Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

Photo by Hello I’m Nik on Unsplash

Photo by Hello I’m Nik on Unsplash

Consumer companies are the ones that drive the headlines, that generate the most clicks on Techcrunch, and are top of mind for many in the tech industry. So I’d like to celebrate this brief point in time where the enterprise strikes back. While one of the darlings of the last 10 years, Facebook, is getting pummeled, the enterprise market is back in the spotlight.

Look at the Dropbox IPO which priced above its initial value and came out white hot at the end of one of the worst weeks in stock market performance. Couple that with Mulesoft being bought for 21x TTM revenue (see Tomasz Tunguz analysis) at $6.5 billion and Pivotal’s recent S-1 filing and you can see why the enterprise market has everyone’s attention again. However, I’ve been around the markets long enough to know that this too shall pass.

The real story in my mind is about what’s next. It’s true that Salesforce and Workday have created some of the biggest returns in recent enterprise memory. And with that, VC money poured into every category imaginable as every VC and entrepreneur scrambled to create a new system of record…until there were no more new systems of record to be created. My view is that we will see many more of these application layer companies go public in the next couple of years and that will be awesome for sure. There will also still be some amazing companies that raise their Series C, D and beyond funding rounds with scaling metrics. There will also be the few new SaaS app founders who have incredible domain expertise reinventing pieces of the old guard public SaaS companies.

However as a first check investor in enterprise startups, the companies that truly get my attention are more of the infrastructure layer companies like Mulesoft and Pivotal. We are at the beginning stages of one of the biggest IT shifts in history as legacy workloads in the enterprise continue to move to a cloud-native architecture. Being in NYC working with many of the 52 Fortune 500 companies who are undergoing their own migrations and challenges makes us even more excited about what’s ahead. The problem is that as an investor in infrastructure, it’s quite scary to enter a world where AWS commoditizes every bit of infrastructure and elephants like Microsoft and Google are not far behind. Despite that, it’s also hard to ignore the following facts:

- Enormous spend and growth for public cloud and app infrastructure, middleware and developer software of $50b (Gartner, Pivotal S-1)

- Rise of multi-cloud

- Fortune 1000 digital transformation journeys still in early innings

- Most legacy workloads are still locked on-prem and not moved to any cloud infrastructure

- Every large enterprise is a software company which means developer productivity is paramount

- Infrastructure market moves way too fast and more software needed to help manage this chaos

- New architectures = new attack vectors and security needs to be reimagined

- Serverless technologies…

and many more threads which can create new billion dollar outcomes. Key here is tying this all to a business problem to solve and not just having infrastructure for infrastructure’s sake.

SaaS to Infrastructure, Salesforce and Mulesoft

Salesforce clearly sees the future and it’s in moving a layer deeper into the infrastructure stack, and combining the world of application with back-end and cloud with on-prem. The irony is that the company that led the “no software” movement is the one that bought Mulesoft, a company where 1/2 of its revenue is from software installed on-premise. What Salesforce clearly understands is that in the world of enterprise, integration becomes king as organizations constantly look to get disparate applications, databases and other systems to talk to each other.

“Every digital transformation starts and ends with the customer,” Salesforce CEO Marc Benioff said in a statement. “Together, Salesforce and MuleSoft will enable customers to connect all of the information throughout their enterprise across all public and private clouds and data sources — radically enhancing innovation.”

It’s a digital transformation journey, one that every Fortune 1000 is undergoing. In a world where Gartner predicts that 75% of new applications supporting digital businesses will be built not bought by 2020", you can see why Mulesoft’s integration platform helps Salesforce future proof itself and embed itself in a future where developers rule.

The Pivotal Story and Digital Transformation

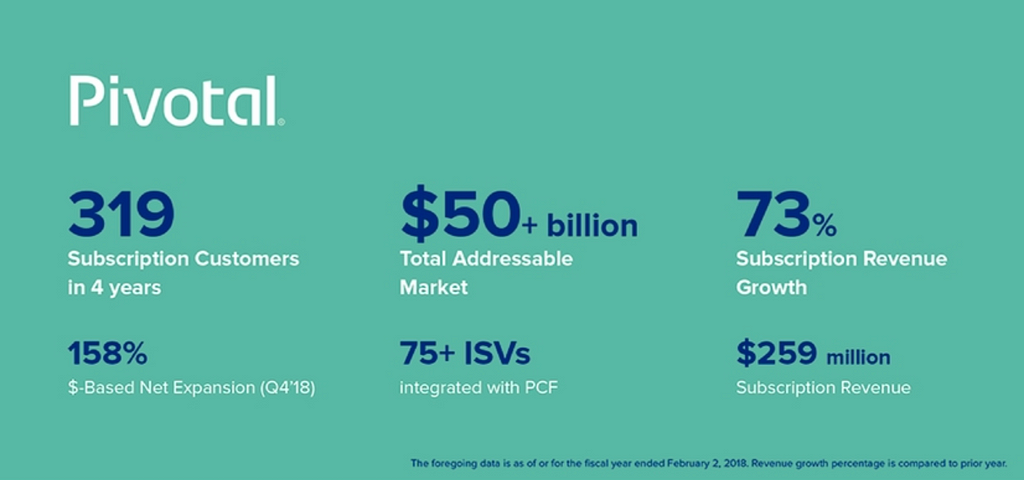

If you are looking for a story about how large enterprises digitally transform themselves into agile software organizations (to the extent they can), then I suggest reading Pivotal’s recently filed S-1 on Friday. Their ascent over the last 5 years mirrors many of the trends we are hearing about on a daily basis; cloud in all forms — public, private, hybrid, and multi; agility; rise of developers; monolithic apps to microservices, containers, continuous integration/deployment, abstraction of ops and infrastructure, and every Fortune 500 is a software company in disguise. Their growth to over $509mm of revenue from $281mm 2 years ago is a case in point. What Pivotal understood early is that there is no digital transformation and agile application development without infrastructure spend. Benioff clearly understands this which is why he paid such a high multiple for Mulesoft.

For those that don’t know what Pivotal does, here is what they do in a nutshell:

PCF accelerates and streamlines software development by reducing the complexity of building, deploying and operating modern applications. PCF integrates an expansive set of critical, modern software technologies to provide a turnkey cloud-native platform. PCF combines leading open-source software with our robust proprietary software to meet the exacting enterprise-grade requirements of large organizations, including the ability to operate and manage software across private and public cloud environments, such as Amazon Web Services, Microsoft Azure, Google Cloud Platform, VMware vSphere and OpenStack. PCF is sold on a subscription basis.

I’ve been fortunate to have a chance to watch closely through my first check into Greenplum many moons ago which ultimately sold to EMC and spun back out as Pivotal (along with some VMWare assets). I also remember the journey the founders were taking on when they decided to sell into P&L units at Fortune 500s charged with making a more agile company. Instead of selling infrastructure to IT, they were able to sell a vision of how P&L units could deliver on their goals faster. Difficult in the beginning, but proved out over time. These P&L units were the one’s charged with creating the bank of the future, the hotel of the future, the insurance company of the future, all centered around a better customer experience driven off of one platform that allowed developers to be more productive and delivered on any cloud.

My only fear about all of this enterprise infrastructure excitement is that like the SaaS markets of yesteryear, this attention will attract way too much venture capital, driving up prices, and reducing opportunities to create meaningful exits. It’s great that enterprise infrastructure is top of mind, but part of me prefers for it to stay in the background, stealthily delivering amazing results.

The Enterprise Strikes Back was originally published in Hacker Noon on Medium, where people are continuing the conversation by highlighting and responding to this story.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.