Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

Ordinals’ long-term impact on BTC & miners

Based on IntoTheBlock’s weekly newsletter. If you enjoy it, and would like to receive it every Friday make sure to sign up here!

This week we dive into what is perhaps one of the most underreported trends taking place in 2023: the resurgence in the Bitcoin mining industry. After a brutal 2022, when several Bitcoin miners going bankrupt, the space has seen an unexpected uptick following the introduction of Ordinals.

We cover Bitcoin mining stocks’ outstanding performance, its drivers and analyze the longer-term outlook for the space.

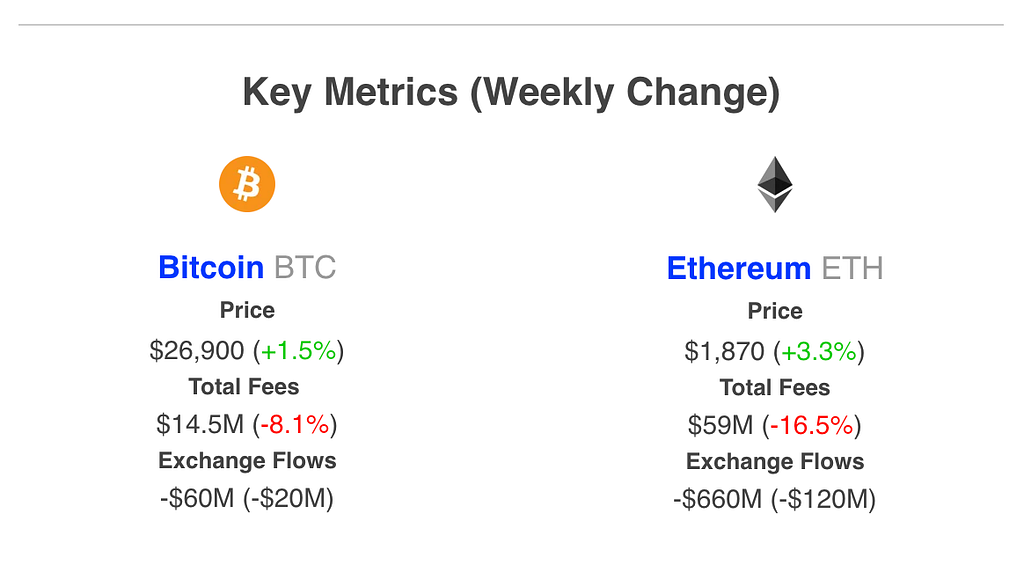

Network Fees — Sum of total fees spent to use a particular blockchain. This tracks the willingness to spend and demand to use Bitcoin or Ether.

- Bitcoin fees declined by 8%, settling at a higher low relative to the beginning of the year

- Ethereum fees dropped by 16.5%, with May’s meme token frenzy seeming a distant memory

Exchanges Netflows — The net amount of inflows minus outflows of a specific crypto-asset going in/out of centralized exchanges

- Bitcoin recorded negligible outflows from CEXs for the second straight week

- Ether continues to see relatively larger outflows from CEXs

Bitcoin Mining’s Resurgence

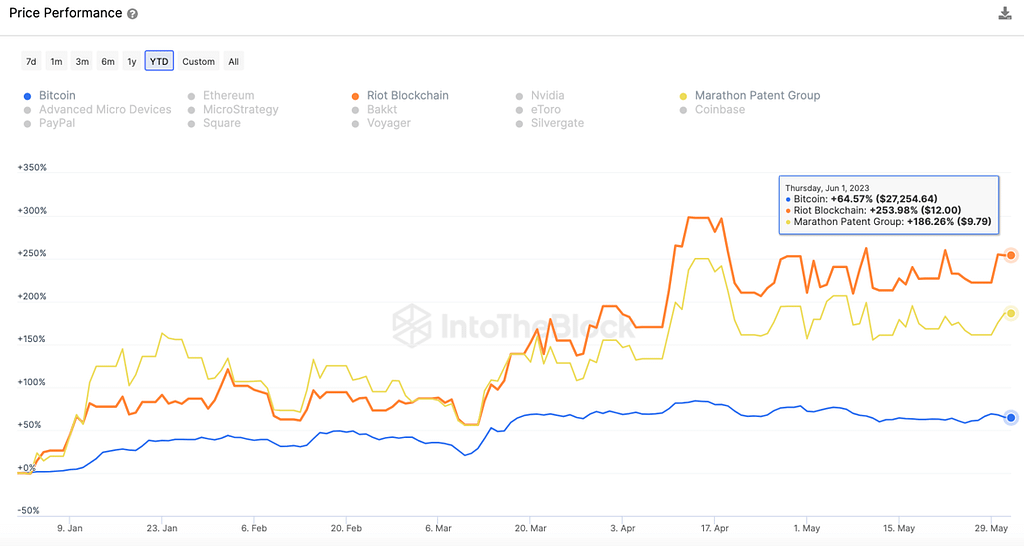

Bitcoin mining companies have seen a strong start to 2023. Riot Blockchain and Marathon Patent Group, two of the largest public mining stocks have significantly outpaced Bitcoin returns this year.

Via IntoTheBlock’s free capital markets insights

Understanding the Outperformance — Miners’ returns are likely driven by a combination of mean-reversion and higher revenues

- In 2022, Riot and Marathon stocks dropped by 86% and 90%, respectively

- Lower Bitcoin prices and increased hash rate crushed miners’ margins and led them to be one of the worst performing assets last year

- Being small cap stocks correlated to Bitcoin, as crypto rebounded these companies reverted their 2022 significantly by doubling in price in 2023

- But this is not just due to Bitcoin’s price, revenues generated by miners have increased sharply in Q2 2023 due to growing transaction fees

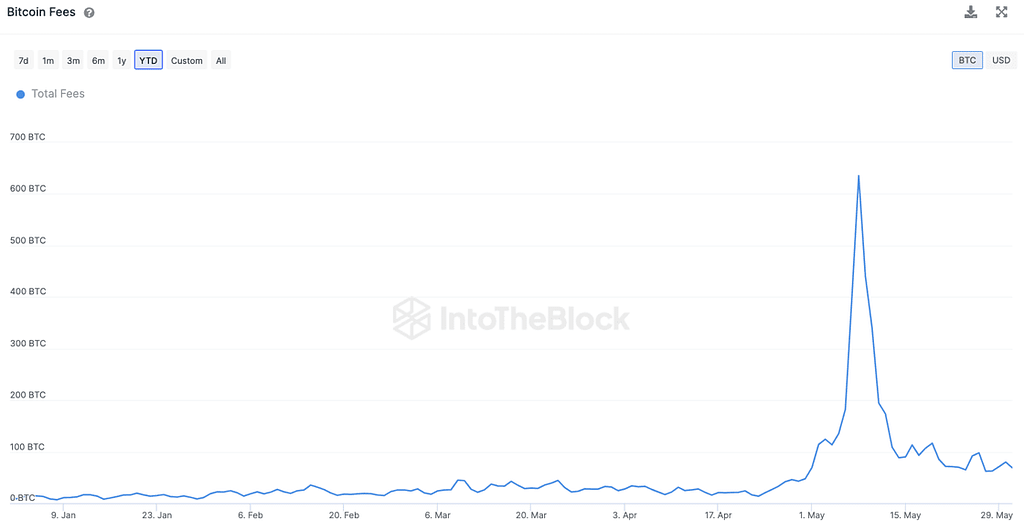

Via IntoTheBlock’s Bitcoin fees indicators

5-Year High on Fees — Bitcoin fees reached their highest since 2017 this May

- Speculation surrounding Ordinals inscriptions, NFT-like artifacts on Bitcoin, began the demand for Bitcoin blockspace around February

- Then BRC-20 tokens, Bitcoin-native tokens tied to individual Satoshis, led to even greater fees

- While fees have since come down, they remain approximately 10x larger than they were on average in January

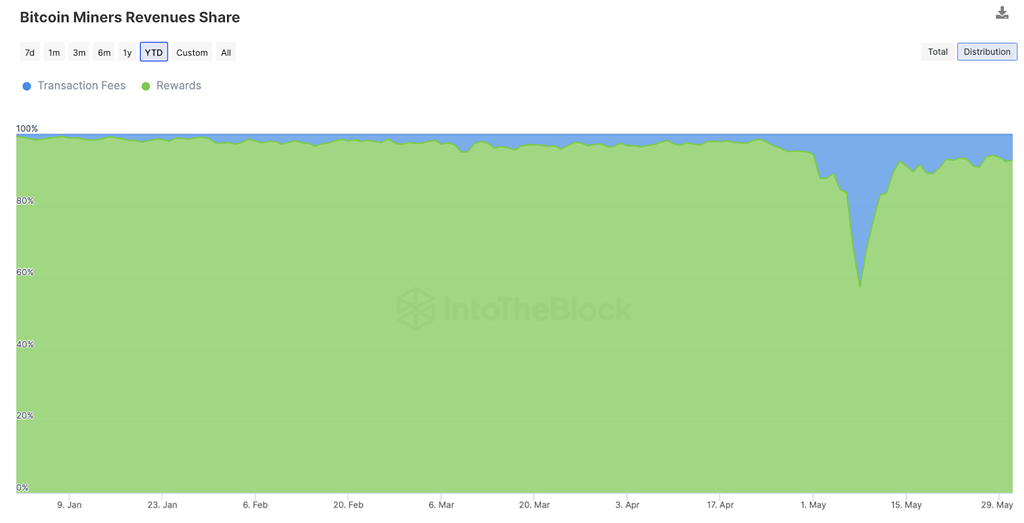

Based on ITB’s Bitcoin miner indicators

New Normal? Rising transaction fees have made miners slightly less reliant on inflationary rewards

- The percentage fees make up out of total miner revenues have increased also approximately 10x in 2023

- This is more sustainable revenue for miners as supply rewards decrease by 50% every four years, and are set to halve less than a year from now

- With infrastructure just being built to trade BRC-20s, Ordinals and other use-cases being experimented on top of Bitcoin, it seems likely that transaction fees will play an increasingly large role for Bitcoin miners

Though some maximalists may be disappointed with sh*tcoins being traded on Bitcoin, the reality is that speculative demand has been one of the few constants in crypto, and having that result in greater miner revenue is positive for the network’s security. Ultimately, the recent rise in Bitcoin blockchain demand likely signals a longer-term improvement in conditions for the mining space and Bitcoin as a whole.

Bitcoin Miners’ Resurgence was originally published in IntoTheBlock on Medium, where people are continuing the conversation by highlighting and responding to this story.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.