Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

Bank of America recently admitted to doctoring paperwork on over 16 million market orders from institutional clients, claiming to have immediately executed their orders while actually routing these orders to other firms before executing them. This is a form of front running in which brokers can benefit from private knowledge of an upcoming order, and strategically place their own orders in such a way that is profitable for the broker. For example, if you, as a broker, have private knowledge that a large buy order is about to be made, you can make a purchase before the large order is executed and profit from the subsequent increase in price. In centralized systems that rely on brokers, this type of manipulation is likely very common, since, as you can see, the punishment is quite small.

Bank of America 'systematically' misled clients about stock trades

Decentralized exchanges like AirSwap aim to fix the issues that lead to manipulation in traditional centralized exchanges. Decentralization

Decentralization

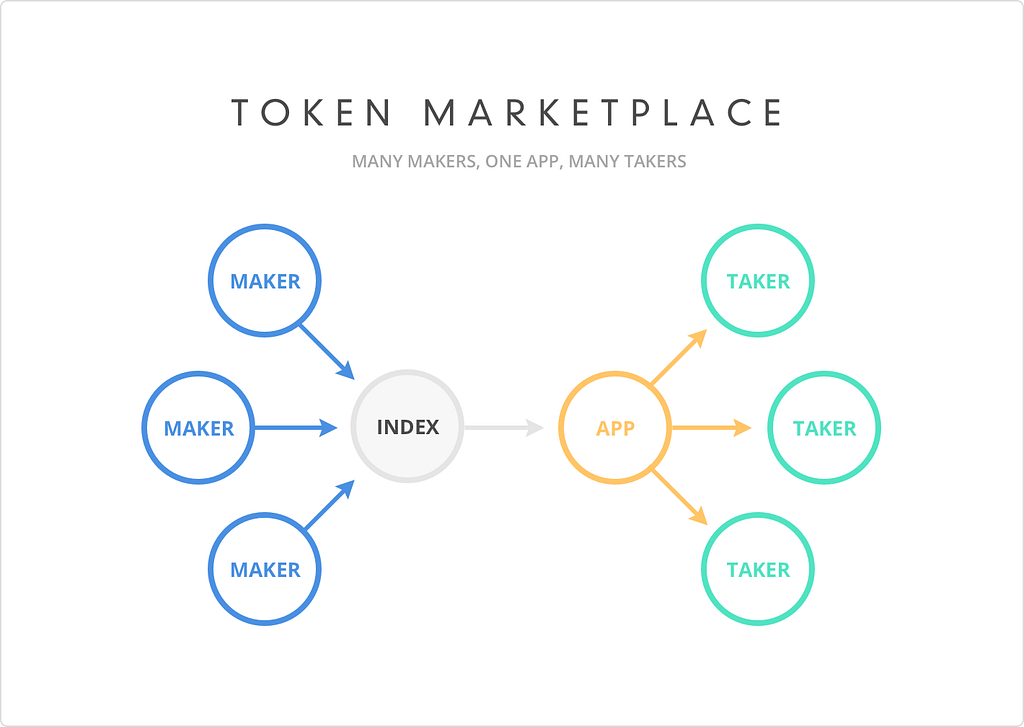

AirSwap is one of the many exchanges in the growing decentralized exchange ecosystem. Decentralized exchanges significantly increase security by not storing customer information or assets on a central server. This means that hackers would be unable to steal anything in the case of a security breach. This is an improvement over centralized exchanges, which, as history has shown, are vulnerable to being hacked. Additionally, since exchanges are conducted via smart contract, a person is not directly handling funds or executing orders, which greatly reduces the risk that front-running would occur on behalf of an exchange operator. For a great overview of the overall decentralized exchange landscape, check out this article written by the AirSwap team.

The Lay of the Land in Decentralized Exchange Protocols

Peer-to-peer Trading

Even with a decentralized exchange, having a traditional public order book still leaves the exchange vulnerable to front-running. AirSwap fixes this by using a peer-to-peer trading process instead of using a public order book. After declaring intent to trade on the platform, traders are able to negotiate with each other privately after AirSwap’s Indexer protocol matches buyers with sellers. Since trading intent is not made public, the risk of front running is greatly reduced, since now both miners and exchange operators cannot front run. This allows large volumes to be traded in private without broadcasting to the public that these deals are going through, making the platform ideal for large institutional investors. However, as is possible with dark pools, I am not sure if there will be any mechanism preventing pinging, in which predatory investors sniff around the list of trading intents in order to plan market moves around orders that have yet to be fulfilled.

Make sure you give this post 50 claps and follow me if you enjoyed this post and want to see more!

Eliminating Front Running with Decentralized Exchanges was originally published in Hacker Noon on Medium, where people are continuing the conversation by highlighting and responding to this story.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.