Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

In the past month, two of the largest unicorns, Dropbox and Spotify, filed for initial public offerings (IPOs). Dropbox followed the traditional route, seeking to raise $756mn on its 23 March IPO, with an expected valuation of $8.2bn. This would make it the largest IPO since Snap, and one of the 10 largest venture capital-backed exits since 2009. Meanwhile, Spotify — which could potentially debut at double the size of Dropbox — initiated a direct listing of its shares on 3 April. Rather than raise capital for the company, the direct listing will offer liquidity to its current shareholders. How shares for both companies perform once they hit the open market remains to be seen, but the two IPOs combined with a strong first week of performance for fellow unicorn Zscaler, which held its IPO on 16 March, are promising developments for a market that has been relatively quiet in recent years.

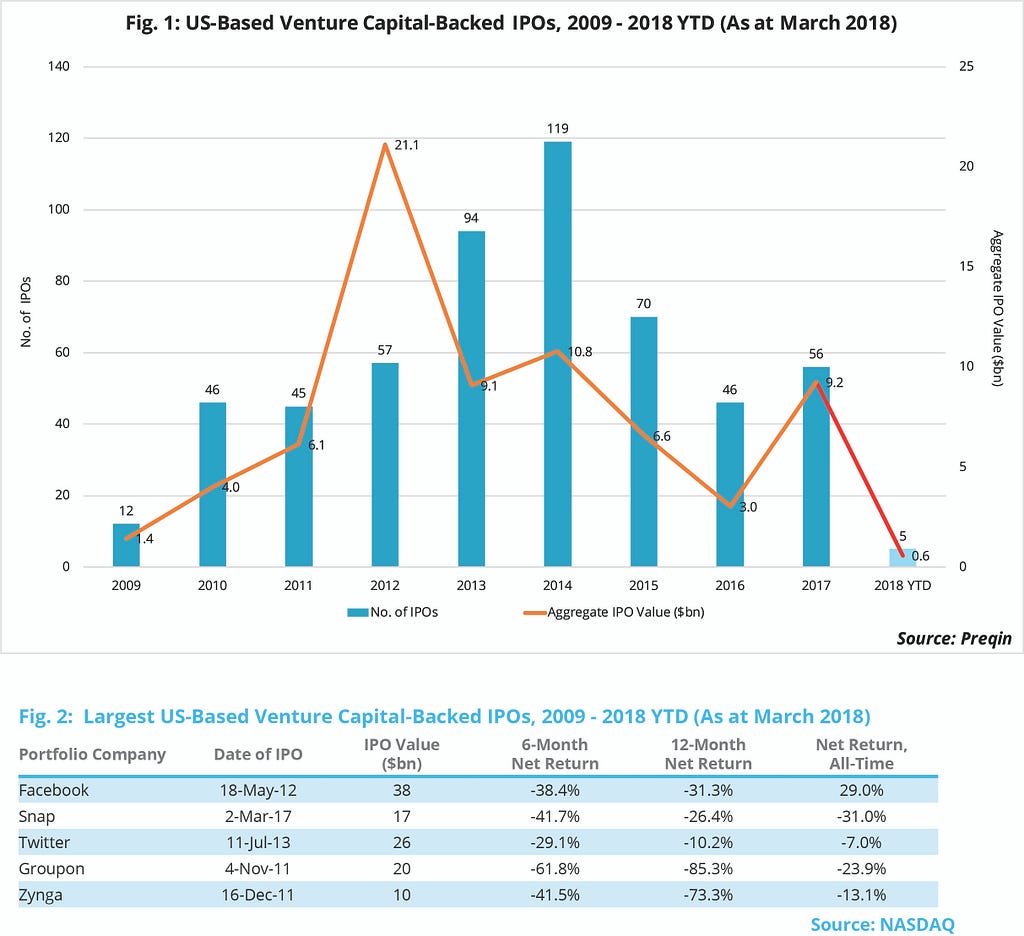

The IPO market has historically been cyclical, moving in pace with the public equity markets. This was demonstrated following the Global Financial Crisis, when US IPO activity dropped off sharply, only to slowly rebuild itself and hit a post dot-com boom with 119 US venture capital-backed companies holding an IPO in 2014. However, despite strong performance for the S&P 500 Index since then, IPO activity has tapered off over the past three years, as seen in Fig. 1. This is a trend among current unicorns, which have chosen to remain private for longer periods as they wait for the perfect market conditions to file for IPO. Since 2009, the only venture capital-backed US-based companies to file for IPO with a valuation over $7bn are Facebook, Snap, Twitter, Groupon and Zynga. Looking at each of their post-IPO performance (Fig. 2) shows why other large unicorns may be hesitant to open themselves up to public markets, as only Facebook has experienced positive all-time performance.

Investing in companies planning for an IPO exit is generally a long-term investment: of the venture capital-backed companies that have held an IPO in the past 10 years, both the mean and median length of time between their first venture investment and the date of IPO is seven years. These investors are often subject to post-IPO lock-ups, which keeps them from selling for another 3–6 months and opens them up to the risk of publicly traded equities. New Enterprise Associates and OrbiMed Advisors have been the most active investors in companies to file for an IPO over the past five years, and with strong first- or second-quartile performance for their recent vintage funds, lend proof that IPOs can offer viable exit opportunities.

- Special thanks to Jesse Fahy, and Justin Hall for contributing.

- Follow me on twitter @felice_egidio

Can Dropbox and Spotify Jump-Start the Venture Capital IPO Market? was originally published in Hacker Noon on Medium, where people are continuing the conversation by highlighting and responding to this story.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.