Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

On-chain data from Santiment shows that Bitcoin sharks and whales have gone on a 93,000 BTC buying spree since the local top back in April.

Bitcoin Sharks & Whales Have Accumulated Since The April Top

According to data from the on-chain analytics firm Santiment, these holders have become a bit more cautious in the last few weeks. The relevant indicator here is the “Supply Distribution,” which measures the total amount of Bitcoin that each wallet group in the market is holding right now.

The addresses are divided into wallet groups based on the total number of coins that they are carrying in their balances currently. The 1-10 coins cohort, for example, includes all investors that are holding at least 1 and at most 10 BTC.

In the context of the current discussion, there are two investor groups that are of interest: the “sharks” and the “whales.” The former of these is a cohort that includes the investors holding a moderate amount of coins, while the latter includes large holders.

Due to the amount of supply that the combined wallets of these groups hold, they can be quite influential in the market. Naturally, the whales are the more powerful entities, as they hold significantly larger amounts.

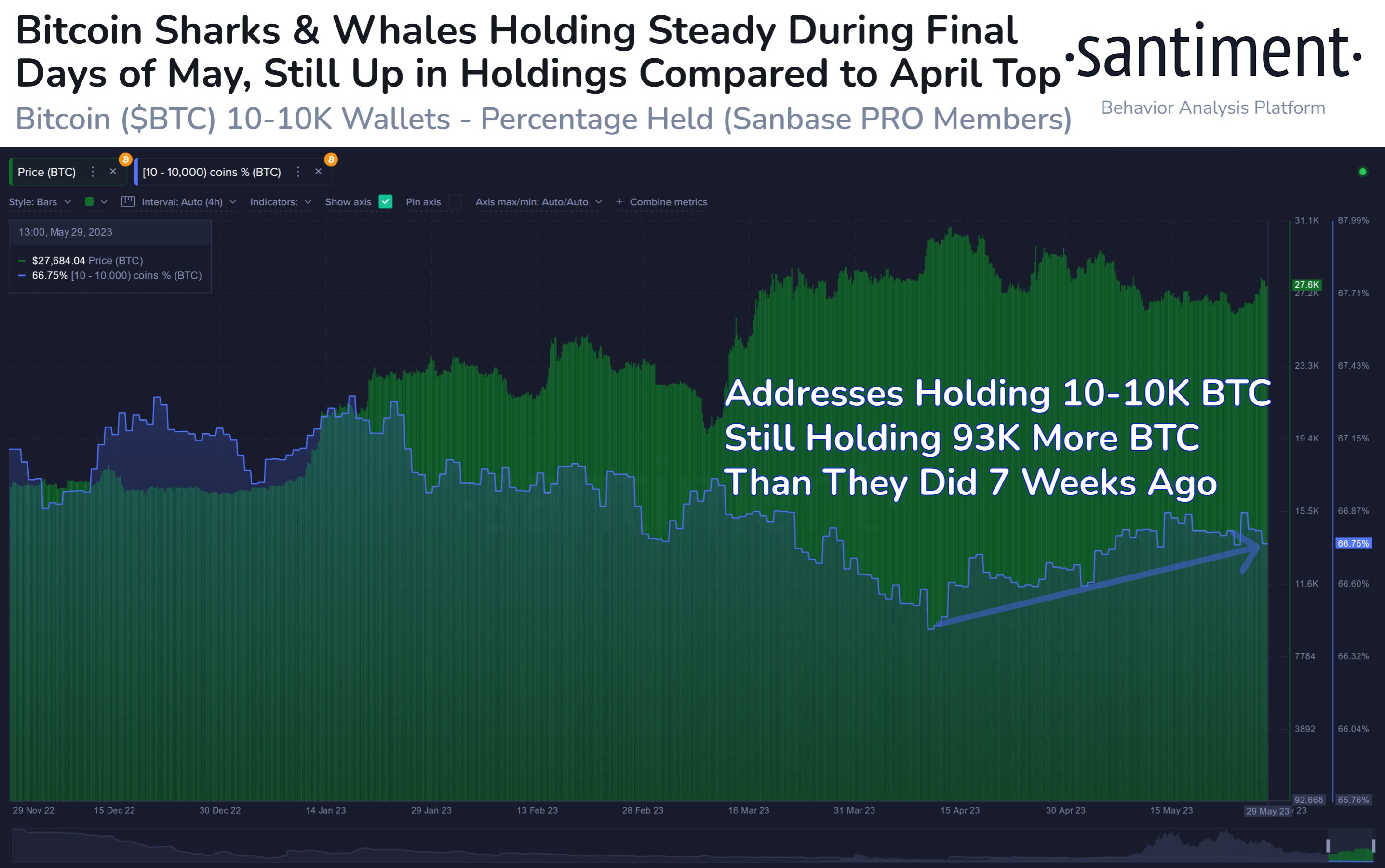

Here, Santiment has defined the combined wallet ranges of these sharks and whales as 10-10,000 BTC. Here is a chart that shows the trend in the Supply Distribution of this address group over the last few months:

From the above graph, it’s visible that the combined holdings of the Bitcoin sharks and whales started observing some decline when the surge took place back in March.

As these investors were distributing, the price moved mostly sideways, implying that it was this selling from these cohorts that may have slowed down the rally. Then, in the middle of April, as the cryptocurrency hit a local top around the $31,000 mark, the supply of the sharks and whales conversely reached a local bottom.

These investors then began to accumulate, as the asset’s price registered a downtrend. This pattern would imply that these holders smartly began to take the opportunity offered by the dips to buy again.

Since this buying started following the local top in April, the Bitcoin sharks and whales have added a total of about 93,000 BTC ($2.6 billion at the current exchange rate) to their wallets.

In recent weeks, however, their supply has gone stagnant as the asset has faced some struggle. This new sideways trend of the indicator may be a sign that these large investors are now cautious in buying more, as they are unsure about where the coin could go next.

Bitcoin has tried to mount together a move in the past couple of days, and so far, these investors haven’t shown any significant reaction to it. Naturally, if they start accumulating again, it would be an indication that they are supportive of the surge.

BTC Price

At the time of writing, Bitcoin is trading around $27,900, up 2% in the last week.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.