Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

With diminishing returns, increased demand, and pre-sales muscling out public sales, profiting from ICOs in 2018 is a tall order. Just to add to investors’ woes, the percentage of tokens allocated for public sale is also on the decline. On average, ICOs now keep more of the pie to themselves and dole out increasingly slender pieces to the public.

Also read: Game of Thrones Bitcoin Hacker Included in Broader Iranian Sanctions

Public Token Allocations Are Down 12% in Three Months

Dfinity, an ICO to create a decentralized world cloud computer, came in for flak this week after details of its public sale were revealed. It was reportedly seeking to raise $350 million from the public in return for 10% of the tokens. This would effectively value the company, which has yet to create a working product, at $3.5 billion. To add insult to injury, the public would be paying 200x the rate that Dfinity had charged their friends and family for tokens during the private sale round.

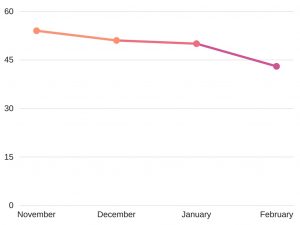

ICO public token allocations dropped from 55% to 43% on average between November and February

ICO public token allocations dropped from 55% to 43% on average between November and February

Dfinity has promised to release an official statement on the matter, presumably in a bid to justify its valuation and deep discounting. If these figures are confirmed to be accurate, they represent an extreme case, but are indicative of a more gradual trend: ICOs are selling less tokens to the public and keeping more to themselves and their advisors. News.Bitcoin.com has tracked average public token allocations since 2017, and found that this figure has dropped steadily since November. In February, the public received just 43% of all tokens issued on average, down from 55% in November.

Less Pie for the People

When the concept of the Initial Coin Offering was born, the notion was that the bulk of the tokens would be sold to the public and the project team would keep a small percentage to themselves to cover their wages for the next couple of years while they set about building the platform. Then, last year, some crowdsales started keeping an additional portion of tokens to incentivize dapp development or as a fund for onboarding new users. Instead of those costs coming out of the money raised by the crowd, they were now being counted as a separate deductible, leaving less tokens for the public.

News.Bitcoin.com examined the token allocation for 105 ICOs, each of which raised over $20 million. ICOs above that threshold tend to have more hype and thus can get away with issuing a lower percentage of tokens to the public. The average public token allocation for all 105 ICOs comes to 49%, a figure which includes pre-sale allocations that were open to the public. The actual percentage offered from project to project differs wildly. Some crowdsales, such as Elastos, 0Chain, and Fusion offered less than 25% of all tokens to the public, while EOS, Crypto20, Polybius, and Envion all sold more than 80%.

Because the average amount raised per ICO has been increasing, prior to November 2017 the sample set (based on crowdsales that raised >$20m) is too small to draw any meaningful conclusions. Between November 2017 and February 2018, however, the data is clear: the public’s average allocation has been dropping every month. Less pie for the people. More pie for the projects.

Do you think ICOs that issue less than 30% of their tokens are being greedy, or are they justified in keeping the majority of tokens back? Let us know in the comments section below.

Images courtesy of Shutterstock.

Need to calculate your bitcoin holdings? Check our tools section.

The post ICOs Are Keeping More of the Pie to Themselves appeared first on Bitcoin News.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.