Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

On-chain data shows the Bitcoin supply on exchanges has hit the lowest value since December 2017 as investors push towards self-custody.

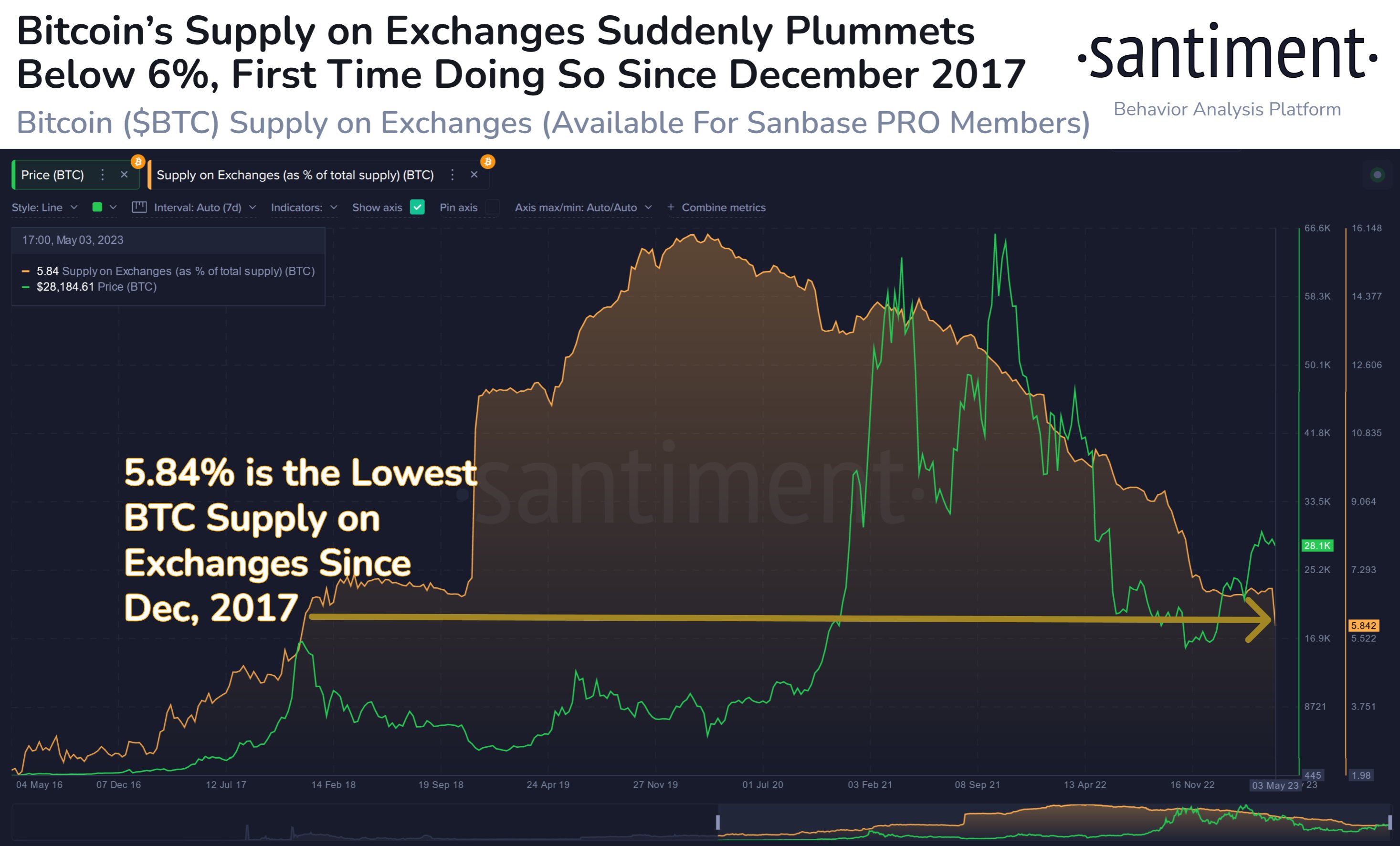

Bitcoin Supply On Exchanges Has Dropped To 5.84% Recently

According to data from the on-chain analytics firm Santiment, this latest plunge in the metric is a good sign for increased interest in self-custody among the holders. The “supply on exchanges” is an indicator that measures the percentage of the total circulating Bitcoin supply that’s currently sitting in the wallets of all centralized exchanges.

When the value of this metric goes down, it means the exchanges are observing the withdrawal of a net number of coins from their wallets right now. This kind of trend, when prolonged, can be a sign that the investors are accumulating the asset currently, and thus, can be bullish for the cryptocurrency’s value.

On the other hand, an increase in the indicator’s value implies the investors are depositing their BTC to these platforms currently. As one of the main reasons why holders may transfer to exchanges is for selling-related purposes, such a trend may have bearish consequences for BTC’s price.

Now, here is a chart that shows the trend in the Bitcoin supply on exchanges over the last few years:

As displayed in the above graph, the Bitcoin supply on exchanges has been going on a downhill trajectory for a few years now, implying that investors have been constantly removing their coins from such platforms.

This decline especially accelerated around the collapse of the cryptocurrency exchange FTX, as a platform like FTX going down put fear into the minds of the investors around keeping their coins in the centralized custody of exchanges.

Since the rally started this year, though, the indicator has mostly moved sideways, as holders have started depositing more of their coins to these platforms for selling to take profits from the price surge.

Things have been different during the past day, however. From the chart, it’s visible that the indicator has seen a very sharp plunge in this period, implying an extreme amount of withdrawals have occurred.

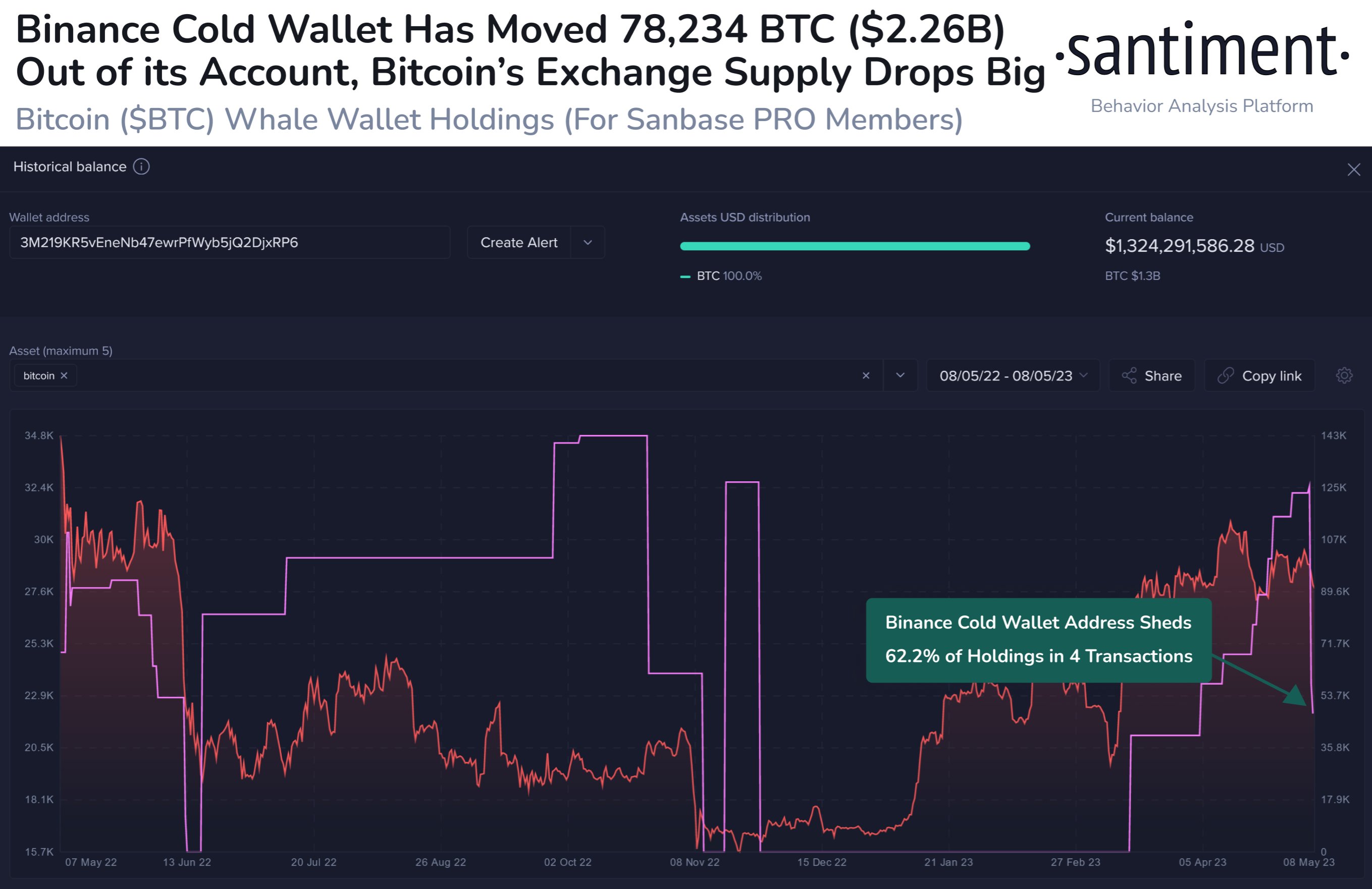

According to on-chain data, this sharp plunge has come because one of the largest whales on the Bitcoin network has moved 78,234 BTC (more than $2.1 billion) out of a Binance wallet.

Following this large move from the whale, the Bitcoin supply on exchanges has now plummeted to only 5.8%. The last time such a low percentage of the total supply was in the custody of these platforms was way back in December 2017.

While this latest sharp drawdown in the supply on exchanges can have bullish effects on the price (as it may be a sign of accumulation from the whale), the long-term decline in the indicator holds bigger significance.

It shows that investors in the Bitcoin market are becoming aware of the risks of keeping their coins on such platforms and are increasingly finding it preferable to keep their coins in self-custodial wallets. This more decentralized BTC supply is a healthy development for the long-term potential of the market.

BTC Price

At the time of writing, Bitcoin is trading around $27,500, down 1% in the last week.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.