Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

The industry has always been aware that a time would come when a fee increase would make Bitcoin transactions hugely impractical.

While many assumed the growing cost of transactions would happen with mass adoption, it was the rise of the Ordinals that caused a drastic increase in fees.

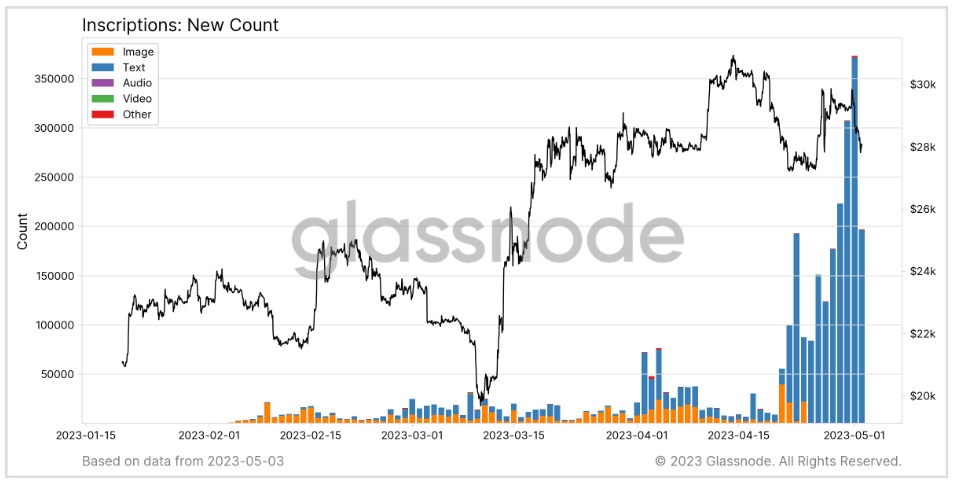

Inscriptions on the Bitcoin blockchain emerged at the beginning of the year and quickly gained popularity. As of May 1, there are over 3.2 million Inscriptions on Bitcoin, with the number continuing to increase as the quarter progresses.

Graph showing the new count of inscriptions on the Bitcoin network (Source: Glassnode)

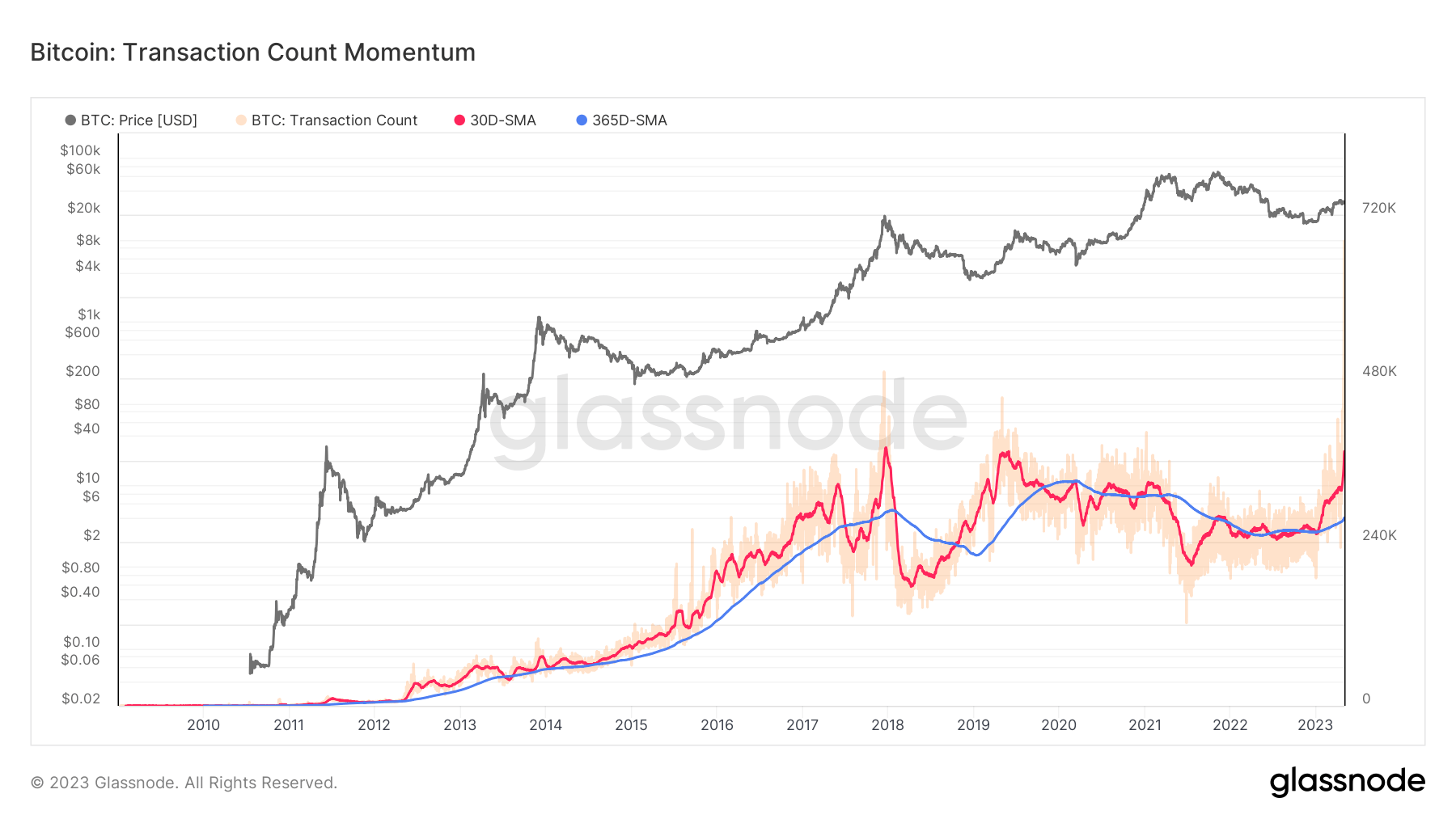

The Ordinal Inscriptions pushed Bitcoin transactions to their all-time high in 2023, with the network seeing over 682,000 transactions in a day.

Graph showing the transaction count momentum on the Bitcoin network from 2010 to 2023 (Source: Glassnode)

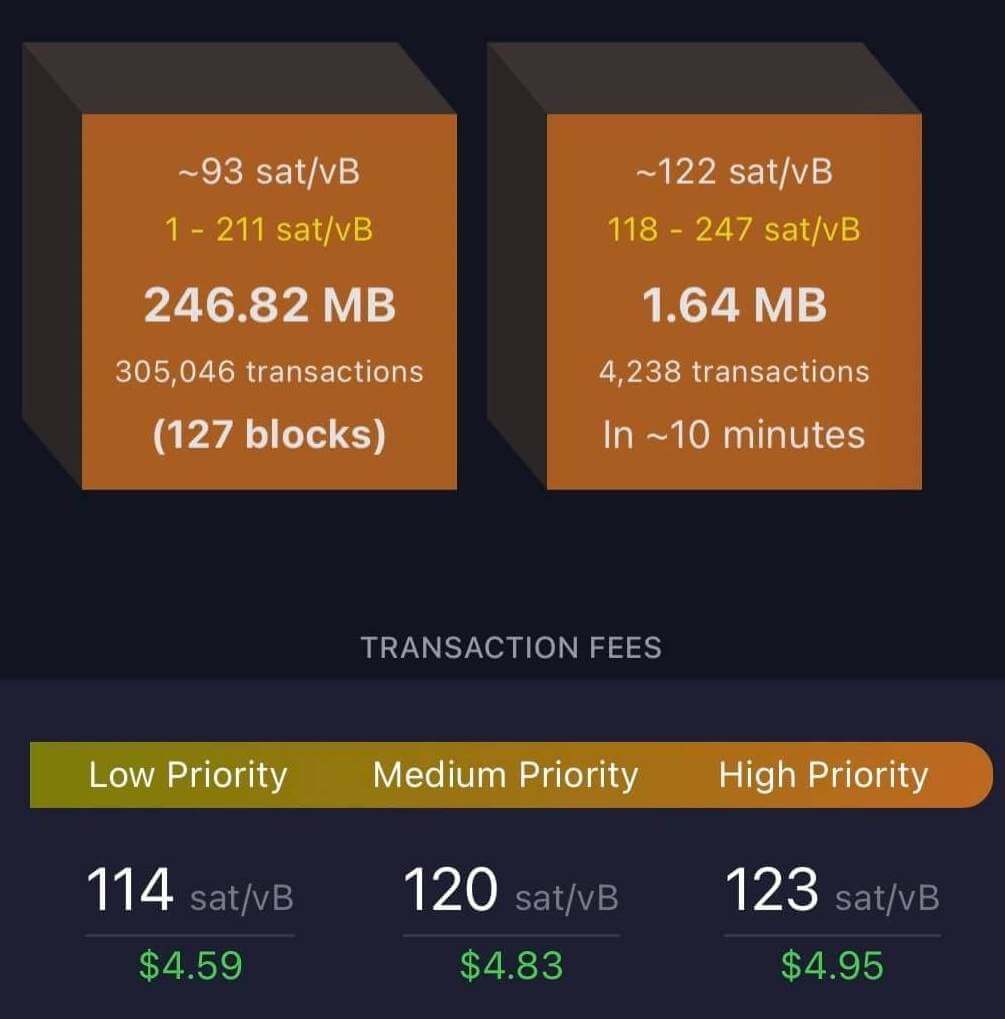

Such a sharp spike in transactions has naturally led to an increase in memory usage, with some blocks being filled up with tens of thousands of transactions. Data from Mempool showed that the average fee for low-priority transactions reached $4.59 on May 2, reducing the difference between the high-priority fee to less than $0.40.

Data showing the average transaction fees and expected block sizes on May 2 (Source: Mempool.space)

The growing popularity of Ordinals and the rise in fees they caused reignited the debate about Bitcoin’s diminishing block rewards. As the cost of mining Bitcoin rises as more miners enter the space, there will come a time when the reward won’t be enough to incentivize block production.

One of the proposed solutions to this issue is an increase in miner fees, which would keep miners incentivized even when block rewards fail to cover the cost of mining. However, for an increase in fees to be feasible, there needs to be significantly more activity on the Bitcoin network.

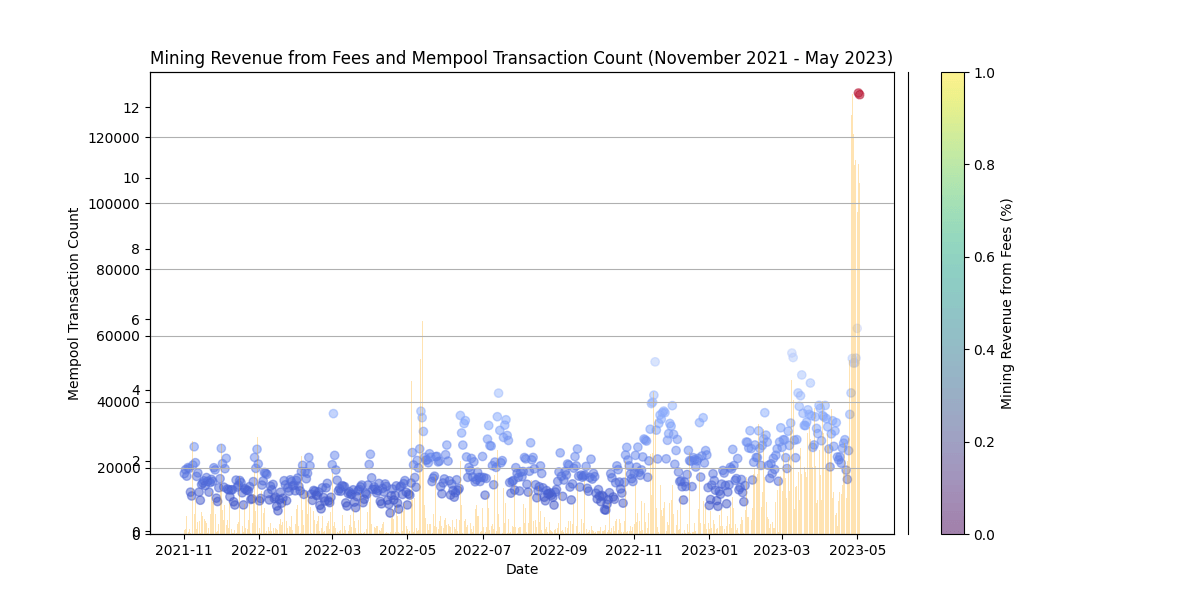

So far, Inscriptions have significantly increased the percentage of miner revenue derived from fees. Data analyzed by CryptoSlate showed that around 12% of miner revenue currently comes from fees, a level previously seen only in bull markets.

Graph showing the mining revenue from fees and mempool transaction count from November 2021 to May 2023 (Source: Glassnode)

Bitcoin inscriptions have been drawing criticism from all corners of the crypto market. However, both sides seem to agree that they have highlighted the need for a high-speed settlement solution for BTC — i.e. the Lightning Network.

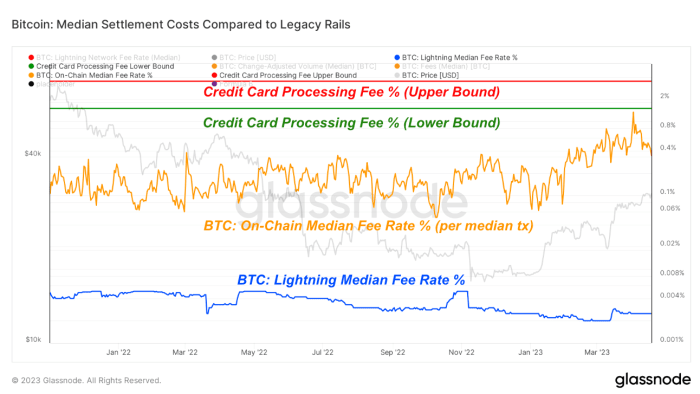

The payment protocol enables fast transactions between participant nodes while keeping the fees incredibly low. Analysis from Bitcoin Magazine showed that the median fee for a Bitcoin lightning transaction was around 0.003%. This is significantly lower than the lower bound for the average credit card processing fee in the U.S., which stands at around 1%.

Graph showing the logarithmic scale of median settlement costs for payment processing of sending the equivalent of 1 BTC (Source: Bitcoin Magazine)

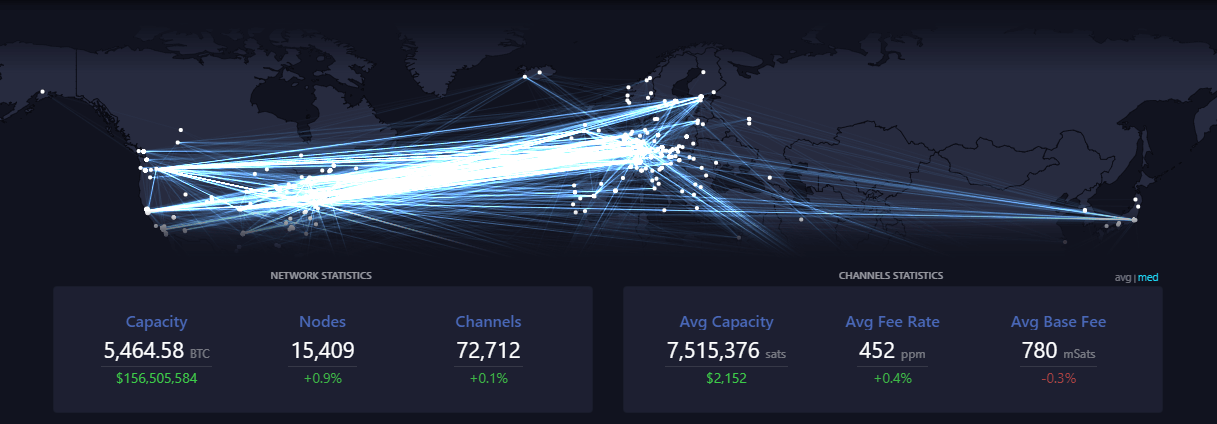

While the popularity of Ordinals will certainly decrease over time, the network is bound to see another project that consumes even more block space. With a capacity of 5,400 BTC, 15,400 nodes, and over 72,700 channels, the Lightning Network presents itself as the perfect solution for Bitcoin payments.

Illustration showing the capacity of the Lightning Network

The post Growing Bitcoin transactions highlight Lightning Network’s importance appeared first on CryptoSlate.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.