Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

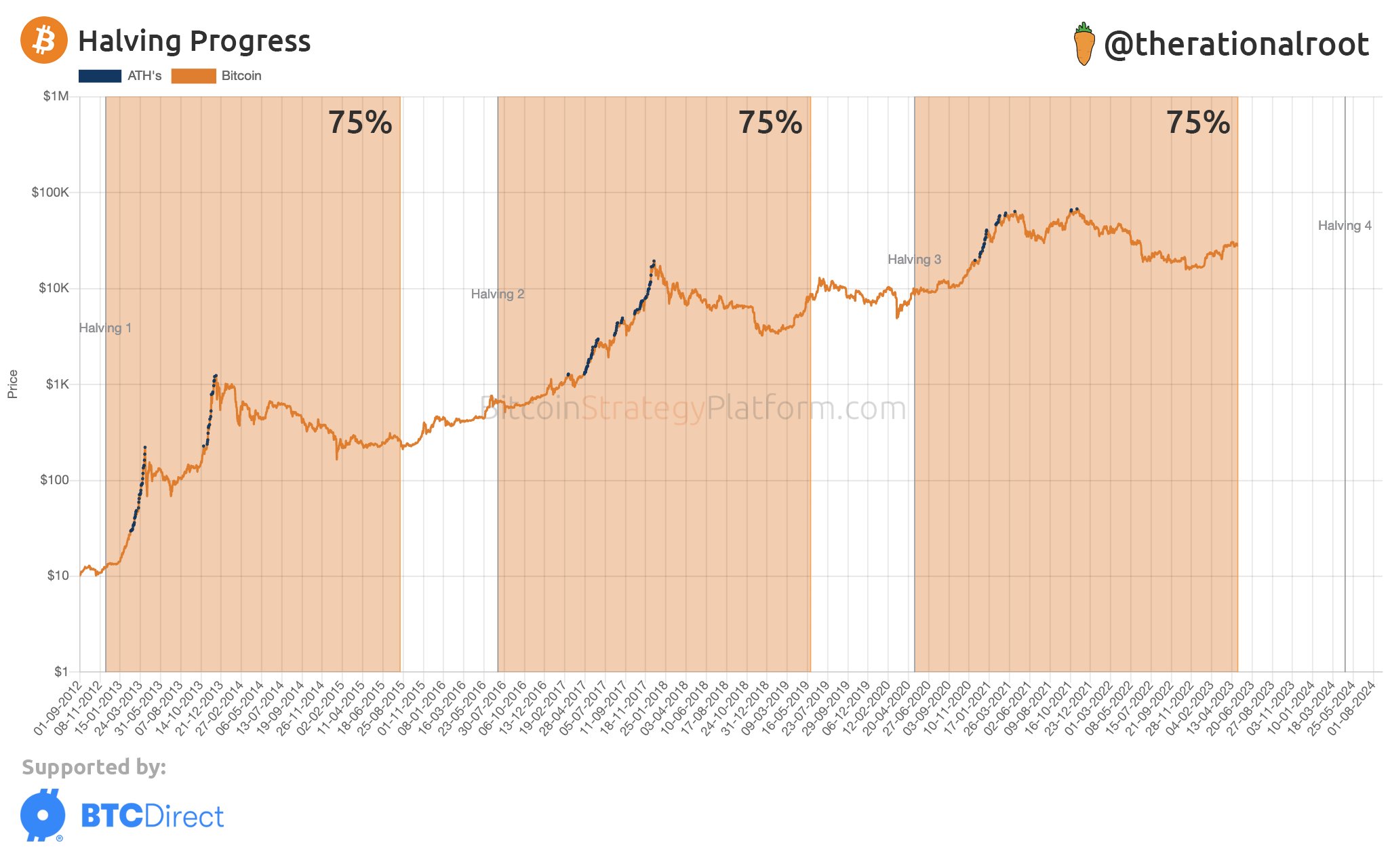

The current Bitcoin cycle is now 75% on the way to the next halving. Here’s what previous cycles looked like at similar stages in their timeline.

Current Bitcoin Halving Cycle Has Hit The 75% Milestone

The “halving” refers to a periodic event where the cryptocurrency’s block rewards are permanently cut in half. The “block rewards” are what miners receive as compensation for mining blocks on the network.

The BTC that these chain validators receive in these rewards is the only way to introduce fresh coins into the asset’s circulating supply, meaning that the block rewards can be considered the equivalent of BTC’s “production.”

The reason that the halving exists as a concept is to restrain the supply of the cryptocurrency and make it more scarce with time since fewer and fewer coins are produced with each halving.

Since the halving has these wide-reaching consequences for the supply-demand dynamics of the asset, such an event has historically had an impact on the cryptocurrency’s price. More specifically, as the supply is tightened following it, the value of BTC has observed a bullish trend.

Halvings occur after every 210,000 blocks or approximately every four years. Because of this periodicity and their important place in the market, these events serve as a popular way of defining the start and end points of a BTC “cycle.”

An analyst on Twitter has put together a chart that shows the status of the current Bitcoin cycle, as well as how it compares with the past ones at similar stages.

As you can see in the above graph, the Bitcoin bull runs have historically taken place following halving events, showing how powerful the narrative around them has been.

From the chart, it’s visible that the latest BTC halving cycle is currently around 75% done, meaning that the miners have mined about 157,500 blocks in this cycle so far.

While the trends that the past two cycles followed after similar milestones were hit differed between the two, they still observed bullish momentum for at least some time after this point.

In the case of the 2012 cycle, the asset’s price continued to climb following the 75% mark and built up to the next bull run. The 2016 cycle reached this milestone while the price was in the middle of the April 2019 rally.

The price continued to rise for a while after the mark was hit, but eventually, the rally hit its top and the cryptocurrency declined after that. The proper buildup to the bull run didn’t happen until the 2020 halving took place (at which point a new cycle had started).

The April 2019 rally shares a lot of similarities with the current one in terms of various on-chain indicators, so it’s interesting that their placement in the timelines of the respective cycles is also quite similar.

It now remains to be seen where the current rally goes from here, and if the pattern of bullish momentum following the 75% halving milestone will hold true in this cycle as well.

BTC Price

At the time of writing, Bitcoin is trading around $29,100, up 1% in the last week.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.