Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

What is Abra?

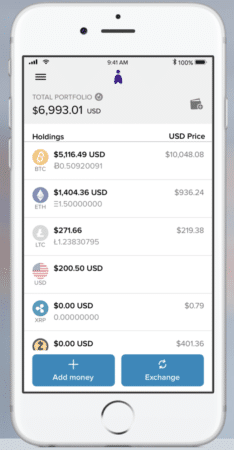

Abra is a cryptocurrency investment platform that enables users to buy, sell, trade, and earn interest on a variety of cryptocurrencies. With as little as $5, users can earn around 10% interest on stablecoins and 4.5% interest on Bitcoin, compounded daily.

Charlie Lee, the creator of Litecoin, has long teased a “huge unexpected surprise” for Litecoin. The surprise has arrived in the form of a new app from Abra. The app allows people to invest in 20 cryptocurrencies and 50 fiat currencies through the use of Bitcoin and Litecoin smart contracts. Not only can you invest in the 70 different assets, but trading between them is feeless and nearly instant.

Merchant processor @CommerceCB

Popular online wallet

Goods trading platform

One huge unexpected surprise @AbraGlobal#PayWithLitecoin https://t.co/bYUPup67G0 https://t.co/bYUPup67G0

— Charlie Lee [LTC

] (@SatoshiLite) March 15, 2018

How does it work?

Here’s an example of how to use Abra. Imagine you deposit $1000 of LTC into the app and want to trade for some exposure to Stellar’s price at $0.25. This creates a transaction on the Litecoin network that requires multiple signatures, like that of a smart contract. You sign the first half of the transaction to Abra and lock up your LTC at the trading price. If Stellar doubles in price relative to LTC, you would now have double the LTC. Then, you can have Abra sign the second half of the transaction. This would unlock your LTC and send your profit, resulting in $2000 of LTC in your wallet.

At no point in this process would you ever own any Stellar coins. It would not be possible to send Stellar from Abra to a Stellar wallet. You are simply providing yourself market exposure to the price changes of altcoins. Abra creates a synthetic currency that follows the price of Stellar, but you are really engaged in Litecoin the whole time. You can invest in 70 different currencies, but never actually own them. You would own synthetic currencies that follow their price via smart contracts on the Litecoin blockchain. “In this way, Abra enables you to invest in multiple cryptocurrencies without creating a separate wallet, managing separate keys, or figuring out how to buy cryptos on an exchange.”

Synthetic Currencies

Liquidity of synthetic currencies won’t be a problem. Abra has successfully run these multi-sig contracts to “manage fiat, Bitcoin, and ether counterparty risk for over a year now with no service interruptions.” You can always trade for Bitcoin or Litecoin and send those coins to whatever wallet you like. In the US, you can also liquidate to fiat currency and send money to your bank account.

Abra can guarantee these smart contracts to their users by hedging their users’ positions. To hedge your trading positions, Abra performs “a combination of buying and selling cryptocurrencies with different exchange partners.” Their hedging provides no risk to the users or Abra. Their profit comes not from hedging but on the difference in price when you perform your trades.

Building on the Litecoin Network

Up until recently, Abra created smart contracts related to synthetic currencies on the Bitcoin network. However, they now plan on using the Litecoin blockchain for the majority of transactions.

“Abra has chosen Litecoin as the primary asset class for our investment platform although we now have the ability to move users between Bitcoin and Litecoin contracts. We chose Litecoin after a long and thorough research process to determine the asset class that met our criterion: secure, safe, scalable on-chain and off-chain, low mining fees, and preferably with adherence to the published Bitcoin core roadmap.”

Abra determined the future of their business can rely entirely upon the Litecoin network. Unlike other coins, Litecoin is free of hard fork drama, network outages, and spikes in transaction fees.

Abra believes that “Bitcoin will always be slightly more secure than Litecoin due mainly to its smaller block size – many refer to Litecoin as digital silver vs Bitcoin’s digital gold. But this small security tradeoff means lower mining fees and more on chain scaling for our users. We believe that Litecoin is the best choice today for these contracts.”

Not only are Litecoin’s fees lower than Bitcoin’s, but the latest Litecoin Core update lowers fees even further. Average transaction costs could potentially be less than 1 cent.

What does this mean for Litecoin?

Abra dramatically reduces the complexity of investing in multiple cryptocurrencies. Users outside of the US interested in the investment platform can get started by first obtaining Litecoin. If Abra is able to attract a significant amount of users, this could drive demand for Litecoin. On the supply side, the numerous smart contracts on Abra will lock Litecoin away reducing the circulating supply of LTC. Finally, Abra’s choice adds credibility to Litecoin. Out of all the competitors such as Ripple, Ethereum, or Bitcoin Cash, Abra’s research showed Litecoin to be the best option.

Abra chose Litecoin over Bitcoin Cash because of Litecoin's better security and its adherence to Bitcoin's scalability roadmap.

#flappening https://t.co/ZtwLUfI1yx

— Charlie Lee [LTC

] (@SatoshiLite) March 16, 2018

How to use Abra?

To get started, first download the app here and write down your private keys. Abra is a non-custodial wallet so you have access to your own funds at all times.

Then using an American or Philippines bank account, American Express card, Bitcoin, Litecoin, or Ethereum, start funding your wallet. Once you add funds to your Abra wallet, you are ready to invest in any of the 20 available cryptocurrencies.

Final Thoughts

Charlie’s ‘big surprise’ might have been somewhat confusing at first, but there is no doubt Abra is nothing but good news for the future of Litecoin and its applications. Most coins are still looking to be added to new exchanges. In the case of Abra, the new exchange is added to Litecoin.

The post What is Abra? | An Investment App on the Litecoin Network appeared first on CoinCentral.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.