Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

Even when the market is in an overall downtrend, there are still several ways to emerge profitable. Depending on your level of risk tolerance, you may want to bet on the overall market trend, make guesses on micro-trends, or just hold and make passive income. In each of these methods, there is a tradeoff between risk and reward, and it is up to the individual to manage his or her personal ideal balance between the two.

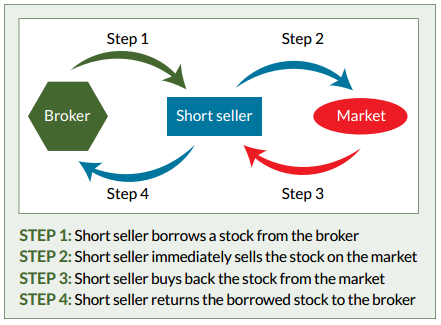

Shorting, or short selling, is effectively the opposite of buying a coin and hoping for the price to increase. In a short sale, you borrow coins from the exchange and sell at the current price. Once you close your short position, you then have to buy back the same number of coins at the current price in order to give the exchange back the same volume of coins. Therefore, in a short sale, the most desirable situation is one in which you initiate the short position at a high price, and close your position at a low price, thus selling high and buying low. This technique is typically used to hedge portfolios and reduce risk, but can be a powerful tool when facing an extended downturn in the market. Shorting is somewhat risky as your losses are uncapped due to the price’s ability to go upward without bound; in a long position, your loss is capped at that of the price going to 0.

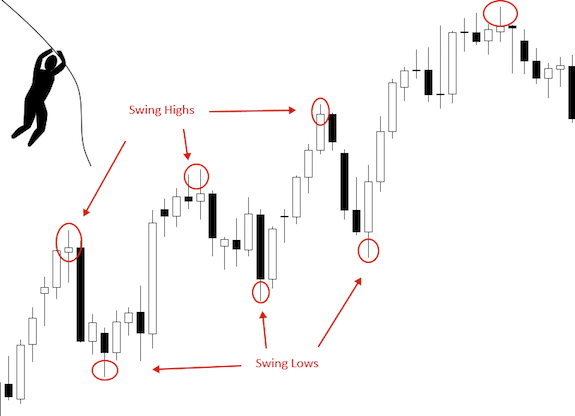

Swing trading takes advantage of the short-term price movements in a coin’s chart rather than looking at the large macro trend. Within a confirmed upward or downward channel of price movement, there will always be small peaks and valleys in the price as it moves in that general direction. Experienced traders can thus make money off of the micro trends, buying the lows and selling the highs during a bear market. In this scenario, market volatility during crashes is the ideal situation as it provides the most number of useful local optima in the chart. In order to swing trade, you must become familiar with the various forms of technical analysis such as pattern formation, and indicators such as RSI. This is only recommended for people with a high risk tolerance and significant experience using technical analysis to analyze short-term movements.

If you have a lower risk tolerance and do not want to use more advanced trading methods, the next best thing is to hold onto coins that generate passive income regardless of market activity. There are many coins that can generate passive income, but the two main types are staking coins and exchange coins. Staking coins, in exchange for governing the network, provide additional coins for each coin used in the staking process. Expect somewhere between a consistent 5% to 10% annual return for staking in most coins. Some proof-of-stake variants, such as Ark’s DPoS, provide higher returns than more decentralized versions of staking. Exchange coins provide various benefits on exchanges such as reduced fees, and some, such as KuCoin’s, provide a form of profit-sharing in which a percent of exchange fees are returned to coin holders. The percent return from these coins is directly tied to volume, which may fluctuate, so it is difficult to ballpark. Staking coins are much more consistent and similar to dividends, whereas exchange coins are still speculative in that you are betting on the success of a particular exchange.

Make sure you give this post 50 claps and my blog a follow if you enjoyed this post and want to see more!

3 Ways to Make Money in a Bear Crypto Market was originally published in Hacker Noon on Medium, where people are continuing the conversation by highlighting and responding to this story.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.