Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

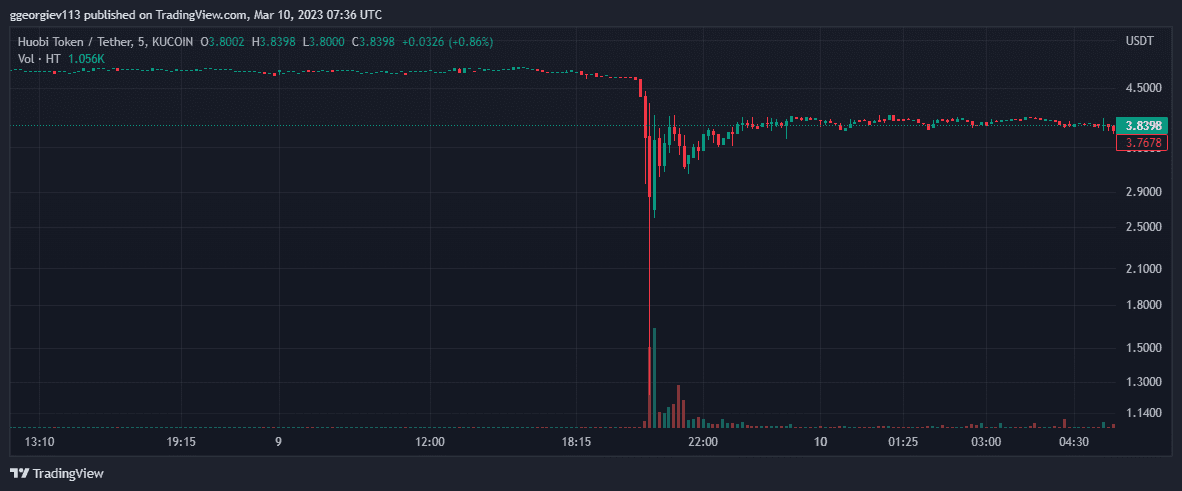

HT – the native token of Huobi Exchange – crashed by 90% on Thursday, dropping from $4.6 to $0.31 in a span of 10 minutes. The price has since recovered, but HT was still down by nearly 20% over the past day and was currently trading at $3.81.

Source: TradingView

Other crypto-assets tied to Tron’s founder, Justin Sun, also tumbled. TRX, for one, fell by over 12% in the past 24 hours from $0.066 to $0.057.

- Despite this, the exec assured that Huobi’s operations are safe and dismissed the incident as normal market behavior.

- Sun, who happens to be the biggest holder of the HT token, apologized for the market fluctuation caused by a “few users triggering a cascade of forced liquidations in the spot and HT contract markets.”

- The exec intends to set up a liquidity fund with an investment of $100 million for those impacted by the leveraged liquidation on the market. He also confirmed a transfer of $100 million in USDC stablecoin to Huobi.

“We will continue to improve the liquidity depth of main cryptocurrencies and HT token, strengthen leverage risk warnings and liquidity capabilities.”

- In an update, Sun also revealed that Huobi is tasked with bearing all leverage-through position losses on the crypto exchange that transpired from this market volatility event of HT.

- Strengthening leverage risk warnings and liquidity capabilities are some of the areas that require attention, according to the exec, who also serves as an advisor to the crypto exchange.

- In the minutes leading up to the crash, more than $2 million of HT tokens were sold on Huobi, according to the transaction data provided by Kaiko’s research analyst, Riyad Carey.

- Besides, Sun was reported to have moved $60 million in USDT from Huobi to Aave, which Nansen said could be unrelated to the event.

The post Huobi Token Flash Crashes by 90% in Minutes: Here’s Everything You Need to Know appeared first on CryptoPotato.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.