Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

Bitcoin has a frequently cited problem–scalability.

The Bitcoin network can only handle a certain number of transactions at once, making it take a long time for transactions to go through and impacting the price of fees.

One of the leading causes of the scalability problem is that each transaction must be verified by every node in the network, which requires a lot of computational power and bandwidth.

Hal Finney was an American software developer and early adopter of Bitcoin who received the first bitcoin transaction from Satoshi Nakamoto

The Bitcoin network, as it exists now, can’t function as a payments system at a large scale, and it was never meant to.

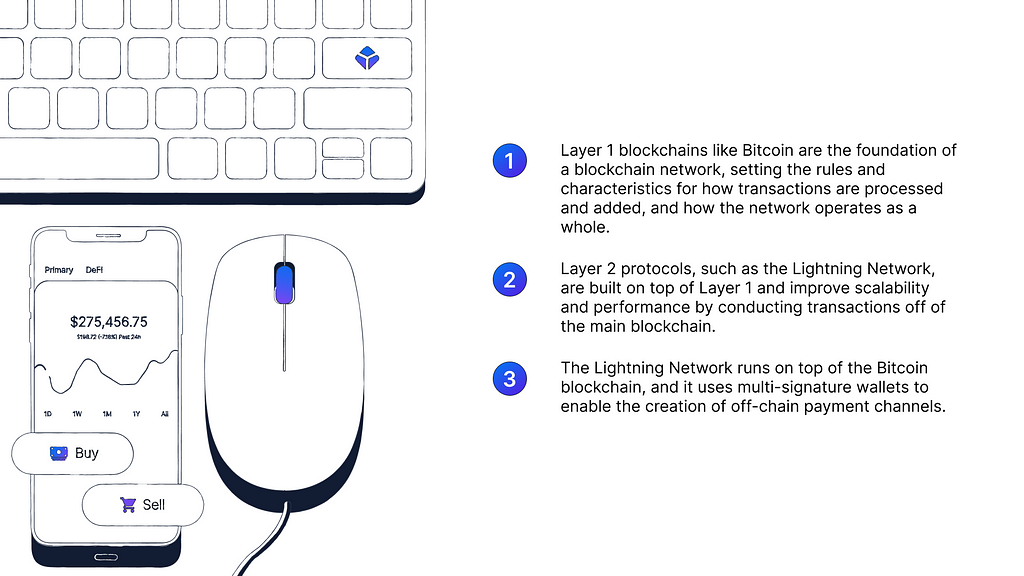

As a Layer 1 system, the core Bitcoin blockchain serves its purpose as intended: it’s a decentralized, immutable ledger system.

Part of Bitcoin’s store of value comes from the energy required from the Proof of Work consensus mechanism it uses, but this doesn’t translate well to being used as a globally adopted medium of exchange.

Enter, the Lightning Network.

What is the Lightning Network?

The Lightning Network was designed to improve the speed and efficiency of transactions on the Bitcoin network by allowing users to make transactions off-chain without the need for block confirmation on the blockchain.

This can help to reduce transaction fees and improve the overall scalability of the network.

The Lightning Network is a Layer 2 protocol that allows users to create payment channels on the Bitcoin network.

The Lightning Network white paper was written in 2016 by Joseph Poon and Thaddeus Dryja, and has been in active development ever since.

The Lightning Network runs on top of the Bitcoin blockchain, and it uses multi-signature wallets to enable the creation of off-chain payment channels.

This allows for faster, cheaper transactions and the ability to make transactions without waiting for block confirmation on the blockchain.

How does the Lightning Network work?

The Lightning Network allows for the creation of payment channels between users on the Bitcoin network.

These channels can be thought of as a way for two users to make an unlimited number of transactions with each other without having to wait for block confirmation on the blockchain.

You might wonder why this is even necessary, and the reason is simple–scalability. If you’ve ever tried to send a small transaction through the Bitcoin network, you know that it can be slow and expensive.

Here’s why:

- Every transaction that occurs is broadcast to every node on the network

- The Bitcoin network processes around seven transactions per second

- Network congestion means that only those paying the highest fees are validated

- Block validation takes ten minutes due to Bitcoins network protocol

As you can see, this limits the ability to use BTC for micro-transactions.

If you tried to use BTC to pay for your $30 dinner, you could potentially pay an equal amount in fees to process that transaction, plus it would take at least ten minutes for the restaurant to process the purchase.

Compare this with a payment processor like Visa, which can handle around 65,000 transactions per second with nominal fees, and it becomes clear that another solution is needed to make BTC a true medium of exchange.

The Lightning Network solves this using payment channels, a way for bitcoin to be exchanged between users off-chain, or outside of the core blockchain. Users can transact with each other as much as they want, and close a payment channel when they’re done transacting.

The only transactions that are added to the Layer 1 blockchain are the opening (funding) transaction and the closing (settlement) transaction.

Because of this, it’s possible that the Lightning Network could process up to 1 million transactions per second.

To create a payment channel, two users must deposit some bitcoin into a multi-signature wallet on the Lightning Network.

This creates a “channel” between the two users, which can be used for any number of transactions.

Once the channel is created, the users can make transactions with each other by updating the smart contract with the new balance. Both parties sign any updates, but they’re only broadcast to the network once the channel is closed.

When the channel closes, the final state of the smart contract is broadcast to the Bitcoin network, and the appropriate amounts of bitcoin are transferred to the users’ wallets. This allows for off-chain transactions to be made quickly and without the need for block confirmation, which can significantly improve the speed and efficiency of the network.

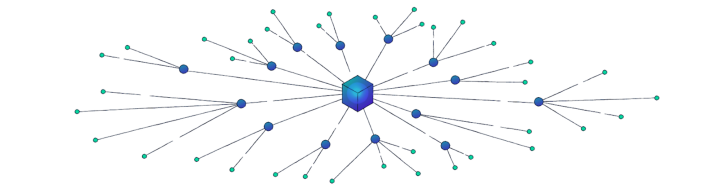

The Lightning Network also allows for the creation of multi-hop payment channels, where a user can make a payment to another user through a series of intermediate channels, which in this case is other users on the network. This can further increase the flexibility and scalability of the network.

Using intermediaries is where the Lightning Network really shines, since it further scales payment options.

Here’s how it works:

In this simplified example, there are three people who all use the Lightning Network.

User A and User B have an open payment channel, and User B also has an open payment channel with User C. Users A and C do not have a payment channel established, but they can transact with each other through User B.

No additional payment channel was needed, and the individual off-chain ledgers were all updated throughout the process.

Is the Lightning Network decentralized?

For the most part, the Lightning Network is a decentralized protocol. This means that the Lightning Network is not controlled by any single entity but relies on a distributed network of users.

The decentralized nature of the Lightning Network allows users to make transactions directly with each other without the need for custodians, like a bank or centralized payment processor. This can help to reduce transaction fees and improve the overall speed and efficiency of the network.

Benefits of the Lightning Network

There are several benefits to using the Lightning Network for transactions on the Bitcoin network, including:

- Faster transactions.

- Lower transaction fees.

- Increased scalability.

- Greater flexibility.

The Lightning Network has the potential to significantly improve the speed, efficiency, and scalability of the Bitcoin network.

While it’s still in the early stages of development, it has the potential to become an influential part of the Bitcoin ecosystem.

Drawbacks the Lightning Network

As a relatively new technology, the Lightning Network may face some challenges and potential problems. Some of the key challenges and potential issues with the Lightning Network include the following:

- Limited adoption.

- Complexity.

- Security risks.

These challenges and risks should be considered before using the Lightning Network.

Is the Lightning Network the future of Bitcoin?

The Lightning Network has the potential to be an indispensable part of the Bitcoin ecosystem, but you don’t need to use the Lightning Network to start buying BTC.

Create a Blockchain.com Account today and make your first bitcoin purchase!

Important Note

This information is provided for informational purposes only and is not intended to substitute for obtaining accounting, tax or financial advice from a professional advisor.

The purchase of crypto entails risk. The value of crypto can fluctuate and capital involved in a crypto transaction is subject to market volatility and loss.

Digital currencies are not bank deposits, are not legal tender, and are not backed by the government. Blockchain.com’s products and services are not subject to any governmental or government-backed deposit protection schemes.

Legislative and regulatory changes or actions in any jurisdiction in which Blockchain.com’s customers are located may adversely affect the use, transfer, exchange, and value of digital currencies.

The Lightning Network, Explained was originally published in @blockchain on Medium, where people are continuing the conversation by highlighting and responding to this story.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.