Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

Overview of the unstaking process for individuals stakers in the largest liquid staking derivative protocols after the Shanghai fork.

As the Shanghai/Capella fork approaches, there is an increasing focus on how users will be able to withdraw their staked ETH. A couple weeks ago, IntoTheBlock’s Juan Pellicer wrote about the withdrawal process for validators, explaining the types of withdrawals and how long they will take to process.

This post builds on top of that and examines how each of the largest liquid staking derivative (LSD) protocols will process withdrawals from their platforms. Specifically, we will dive into how the withdrawal process will look for individual stakers that are not running a validator. Below we dive into the current information available from Lido, Rocket Pool, StakeWise, and Frax on what their redemption process will be and how the differences could affect holders of each the different LSD tokens.

LSDs Gaining Momentum

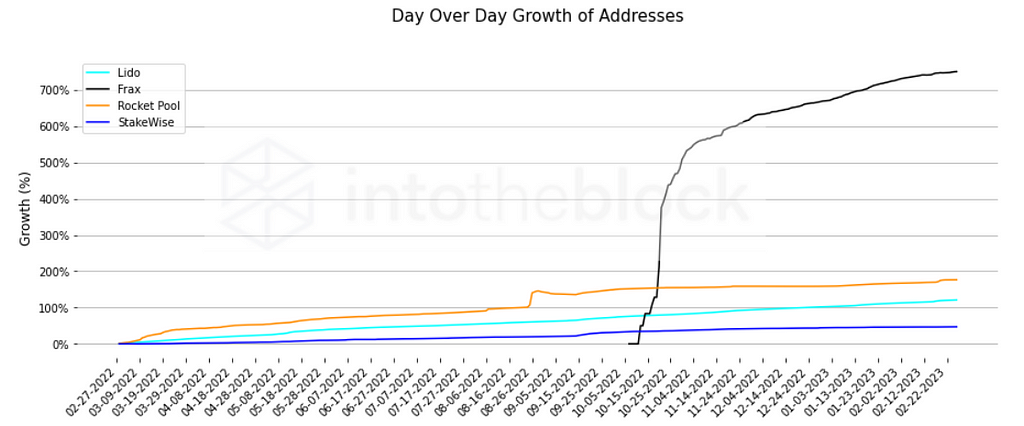

Since Ethereum’s merge to Proof-of-Stake last September, user confidence has been growing in LSD tokens. This has been exemplified by the growth seen in users holding LSD tokens outside of the most well known token, Lido’s stETH. The chart below shows the day over day growth of addresses holding one of the 4 decentralized (excluding cbETH) LSDs with over 100M worth of supply. While they have all been increasing in holders of the course of the past year, we can see the biggest growth in new addresses for Rocket Pool’s rETH and Frax’s sfrxETH tokens. The most notable growth in addresses clearly being for sfrxETH which launched only after the merge, but has seen significant growth due to its high staking APY.

Source: IntoTheBlock Analytics

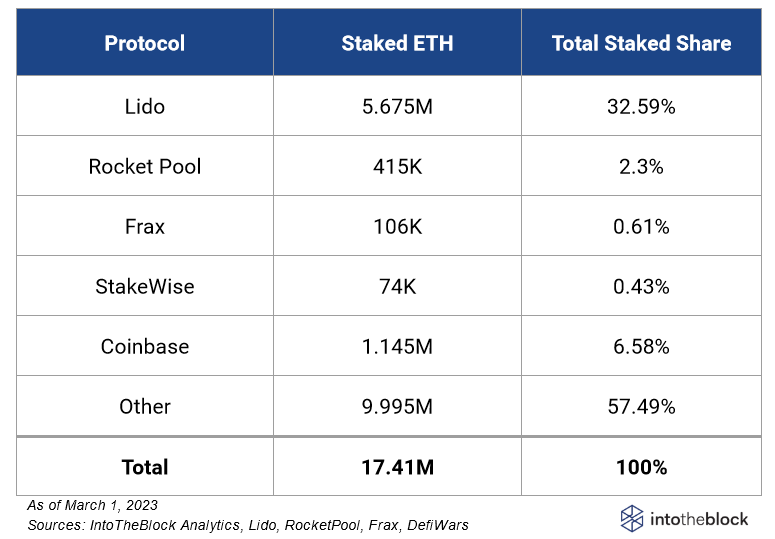

Though there has been substantial user growth in the smaller LSD protocols, the lion’s share of the total staked ETH in LSDs belongs to Lido. The table below breaks down the largest ETH LSDs. With nearly 33% of all staked ETH under its purview, Lido dominates the LSD market. However, this means that there will be more scrutiny on how Lido designs its LSD redemption system to attempt to mitigate long withdrawal queues for their holders. If the queues get to long and DeFi users get anxious to convert their Lido LSD tokens, a run on swapping stETH or wstETH back to ETH in the market could have far reaching consequences in DeFi from drops in ETH prices and impermanent losses to LP holders to liquidations in money markets where Lido’s LSD tokens are used as collateral.

While long queues to redeem ETH from Lido could have a larger impact on DeFi, long redemption times for any of the other LSD tokens could impact holders of those tokens. With this in mind, we will summarize below the current redemption strategies that each of the LSD protocols are proposing to aid users in navigating the upcoming fork.

Lido stETH

Lido has extensive documentation and forum discussions around their withdrawal process. Lido estimates they could have 200,000 ETH available in the week after the fork as a buffer for initial withdrawal requests. This will help mitigate any runs on swapping out stETH to ETH in the market before the withdrawal request volume begins to stabilize. As withdrawal volumes stabilize, the protocol will rely on a two-mode system (Turbo mode and Bunker mode) they have developed to prevent any manipulations to the staking/unstaking process and to minimize any negative impacts to holders.

Turbo Mode

The default mode that Lido will use aims to process withdrawals for stakers as fast as possible. This means that under normal conditions, non-validator stakers wanting to withdraw their ETH will need to wait an estimated 2–7 days to be able to claim. In the first week after the Shanghai fork, wait time might be higher while long-term stakers look to withdraw some of their rewards that have been accruing, but the buffer pool in place should keep the wait time around the regular estimated wait.

Bunker Mode

Under catastrophic scenarios, Lido’s withdrawal process is switched to bunker mode. This mode is enacted if mass slashing events occur across a large portion of Lido’s Validators. The current threshold Lido has set is 600+ validators to be slashed in the same window of time. If this occurs, bunker mode is activated and the protocol waits for all losses from slashes to be calculated so that they can socialize the costs across all stETH/wstETH holders in an even manner. When bunker mode is activated, the amount of time before withdrawal is initialized will be longer than turbo mode. Estimates for withdrawal time will be between 6–18 days, but under a doomsday scenario it could take as long as it takes for a slashed validator to exit (~36 days).

Rocket Pool rETH

Rocket Pool’s core design of partnering individual stakers ETH with validators that only need to deposit a portion (8 or 16 ETH) of the 32 ETH needed to set up a validator. With this design, if validators are slashed, they will normally take the full slash of the cost which is absorbed by the insurance provided upfront by the validator.

To redeem rETH to ETH, there will be a pool where holders can perform the unstaking process. If funds are available in the pool redemptions will be immediate. A recent proposal has passed that will increase the size of this pool giving more capacity for users to unstake. In a worst case scenario, if available ETH runs to be redeemed, demand to swap will move to open markets and create a discount on rETH. This will create an arbitrage opportunity that can incentivize validators to exit their positions, adding more ETH into the pool.

StakeWise sETH2

Full documentation has not been provided yet by the StakeWise team, however initial proposals appear to be that sETH2 holders will be able to make claims against the deposit pool (max 32 ETH) that StakeWise uses for collecting enough ETH to create a new validator. Additionally, as sETH2 holders begin to request redemptions, the protocol will begin the process of having their validators exit to provide sufficient ETH for those who are requesting to redeem. If ETH is available in the deposit pool, redemptions sub 32 ETH could be near immediate. However, if the pool is empty, a validator would need to initiate the exit process which could take around 7–8 days (and up to 36 days if the validator is slashed).

This design could be susceptible to staking/unstaking gaming if there isn’t a robust way, similar to Lido, to socialize slashing costs. I expect that a detailed documentation will be provided in the coming weeks explaining the process.

Frax frxETH

Similar to StakeWise, there isn’t currently any documentation on how Frax will manage withdrawals of frxETH back to ETH. Conversations with team members have indicated that there will be a buffer pool to handle the withdrawals, but it is unclear if there will be a waiting period. Given Frax’s larger treasury and the design on how staking rewards are allocated between frxETH and sfrxETH, it can be assumed that a reallocation will be designed to support frxETH holders redeeming back to ETH. Announcements from the Frax team on how this will be designed should come out in the near future.

To Stake or not to Stake Post Shanghai?

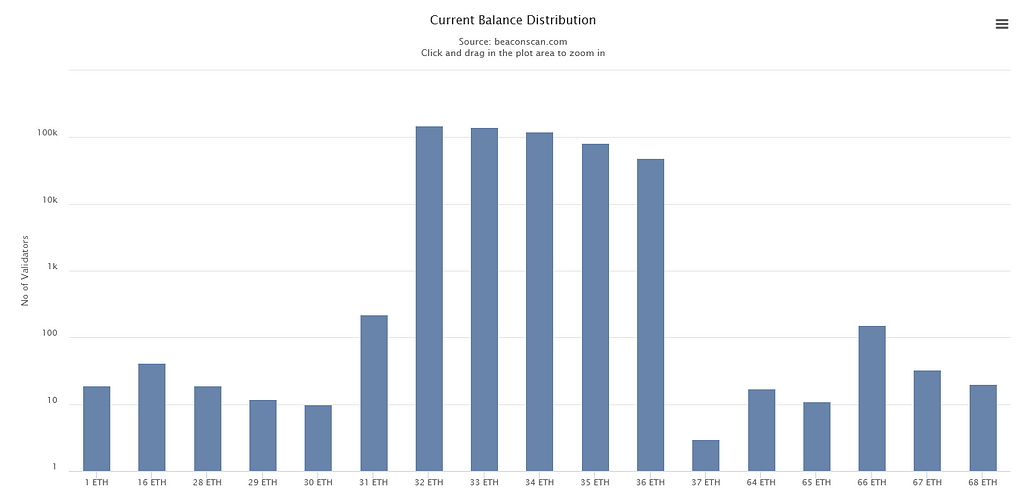

The Shanghai fork prompts the question of what should be the expectations on how much ETH we should expect to be unstaked? This question is hard to answer since it will be significantly dependent on how smooth the fork goes and also the global macro outlook. However, with the Shanghai fork design, rewards accumulated to validators will be automatically distributed through a sweep mechanism that will occur on average once a week. This means we can assume that most validators will initiate a partial withdrawal (withdrawing accumulated rewards) within the first week after the fork. Looking at the distribution of how much ETH validators are holding in the chart below, we can make an estimation that about 834k ETH could begin the partial withdrawal process in the first week. If no validators had been recently slashed, this process could take potentially as little as ~5 days (total validators/(16 withdrawals per block * ~7200 blocks per day). This would amount to less than 5% of all staked ETH being withdrawn.

Source: Beaconscan

The second question is, if all this ETH is withdrawn where will it go? This question will be specific to each individual staker/validator. While some will realize profits on their rewards, others might reinvest into staking by creating new validators or minipools on Rocket Pool.

Another possibility is that this newly unstaked ETH will find its way into other DeFi protocols. A quick calculation of the weighted APY across larger (greater than $5M) ETH-based pools without IL shown on DefiLlama gives us an average APY of 5.25%. This is notably larger than the current average APY for staking in LSDs (4.4%). If this gap in yields drives some of the ETH into DeFi, it will be a substantial boost for LSD protocols since many of the high yield pools are paired with LSD tokens.

Summary

The design and mechanisms of how each of the LSDs will support unstaking vary substantially. Lido is taking a route where all unstakers will need to wait for some period of time, while Rocket Pool redemptions will be immediate if the ETH is available. On top of this, the potential for about 5% of all ETH to be withdrawn in the first days post-fork could cause a lot of volatility with significant opportunities for arbitrage between the different LSD tokens. The general consensus among LSD protocols seems to be that enabling withdrawals will prompt more ETH to be staked. However, the market likes to be contrarian. All of this means that during the immediate window before and after the fork, there could be large price fluctuations in ETH and potential temporary depegs of some of the LSDs. Pools partnered with LSD tokens could be exposed to substantial IL if a liquidity provider removed their position during this time. As a DeFi user, it is important to review the mechanics of each of these protocols and decide in advance of the fork how to position yourself.

Ethereum Withdrawals: Liquid Staking Derivatives Edition was originally published in IntoTheBlock on Medium, where people are continuing the conversation by highlighting and responding to this story.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.