Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

The Merkle

The Merkle Crypto Bloodbath of March 2018

Crypto Bloodbath of March 2018

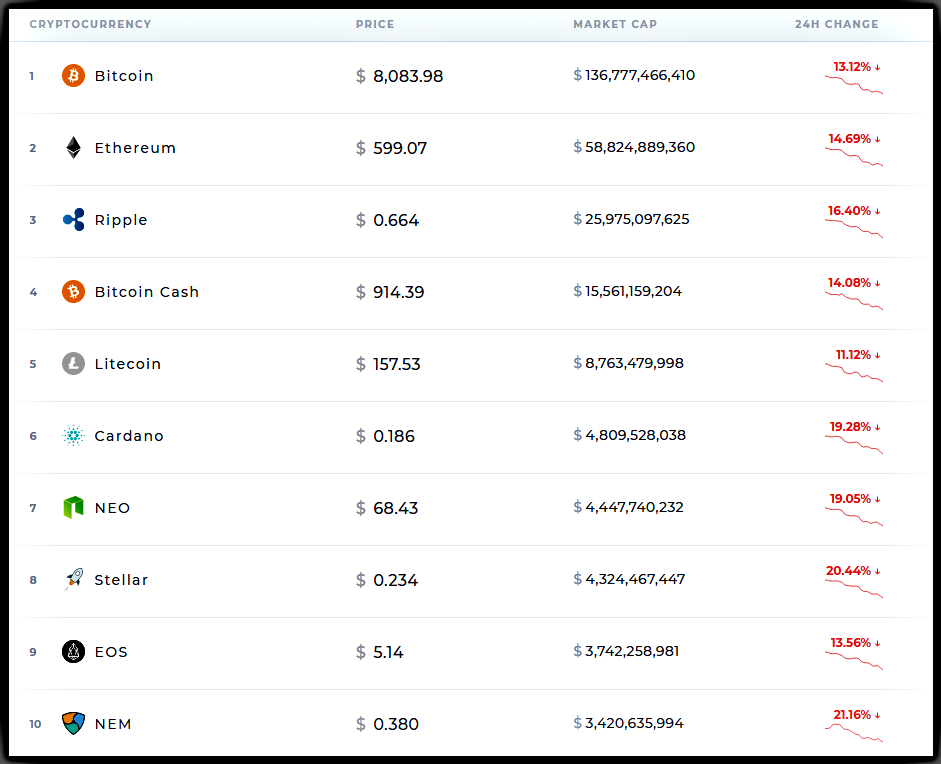

March 14th was not a good day for Bitcoin and the cryptocurrency Market. The cryptocurrency market lost $60 Bn. overnight. Here, take a look for yourself. When was the last time Bitcoin reached $8,000, it feels like ages ago. It was actually just February 11th, according to Coindesk.

Google & One of Europe’s Largest Insurers Beats up Bitcoin

Google & One of Europe’s Largest Insurers Beats up Bitcoin

Google announced that it will be banning all Crypto Ads as of late spring 2018. Meanwhile in Europe, Stefan Hofrichter from Allianz Global Investors, which manages almost 500 billion euro, said bitcoin is a textbook bubble “probably just about to burst”.

It seems there’s a calculated campaign by major institutions to try to discredit the speculative digital gold that seemed so popular in 2017. He went on to say:

“A bitcoin is a claim on nobody — in contrast to, for instance, sovereign bonds, equities or paper money — and it does not generate any income stream.”

Make no mistake Google’s new advertising policies definately kills the enthusiasm of ICOs and some of the momentum cryptocurrencies have made in the last 6 months.

Regulators, National Intelligence and Big Tech Pushing Bitcoin Down

The volatility seen in bitcoin prices this week has been seen in markets for other cryptocurrencies as well. The mainstream financial community continues to vow that digital currencies are risky assets and Bitcoin is likely a bubble.

Altcoins in the red and a Bitcoin blood bath are nothing new, but that Facebook and Google have both decided to ban Crypto related Ads points not just increasing regulation, but a full-on assault from the U.S. establishment on Bitcoin and its blockchain brethren.

Google has bravely stated that it has combated fraud, malware and content scammers for the past 15 years. According to reports, even the FBI was pressuring Google to stop displaying Crypto related Ads. A review of the Twitter account of the POTUS did not find any mentions of this.

Several altcoins including Stellar, NEM and NEO have lost over 20% in the last 24 hours. Bitcoin grew 2,000 percent last year, peaking at around $19,500 in December. Thus far, 2018 has not been kind to the cryptocurrency market, and even Google trends suggest searches on Bitcoin have been in decline since peaking on December 17th, 2017.

As ICOs cannot create digital Ads via Facebook or Google as of June, 2018, blockchain related startups and startups that have been increasingly depending upon ICOs for early stage funding may have more trouble surviving in the latter half of this year.

Did the FBI strong-arm Google?

With the FBI working with Big Tech to cripple and repress ICOs and cryptocurrencies, it remains to be seen if decentralized solutions and blockchain will be adopted faster by enterprise level companies in 2018, as is the case with JD.com adopting blockchain in food tracking. Blockchains use cases remain high as Ripple has has made deals with Japanese banks of late.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.