Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

Ok, hot new ICO discovered on Twitter… Let’s do a quick rundown:

- Flashy Website? Check

- Twitter/Medium/Telegram? Check

- Team and Advisors with slick creds? Check

- Capped crowdsale? Check

- Cool product/idea? Check

No brainer, right? Just toss some money at it, wait for milestone announcements, exchange trading, and product launch, and rake in those sweet, sweet gains!

Except this was the Giza ICO. A total exit scam to the tune of 2100 ETH. The awesome looking hardware wallet to end all hardware wallets is complete vapor. It only exists in 3D renderings and the imaginations of a few hundred “investors”. Head over to CNBC for a rundown of the scam itself.

Before the comment section below gets filled up with “YOU SO STUPID!!!” posts, let me be the first to tell you that yes, I was stupid. But what makes me slightly smarter than the average dumbass, is that I reflect upon my past mistakes and attempt to learn from them. And now I’m sharing those reflections with you, dear reader.

Where Did I Go Wrong?

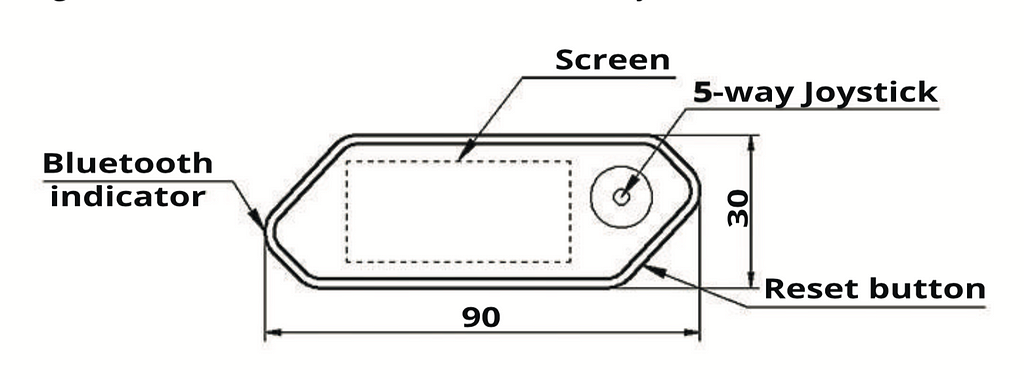

- I didn’t read the whitepaper. There was absolutely NO description of how the device actually worked. Only promises, and a huge section describing the intricacies of the ICO. Seriously, the picture below is the most complicated diagram in the entire document. For a benchmark, take a look at the tech specs of the Ledger Nano. Such complexity. Much tech. Wow.

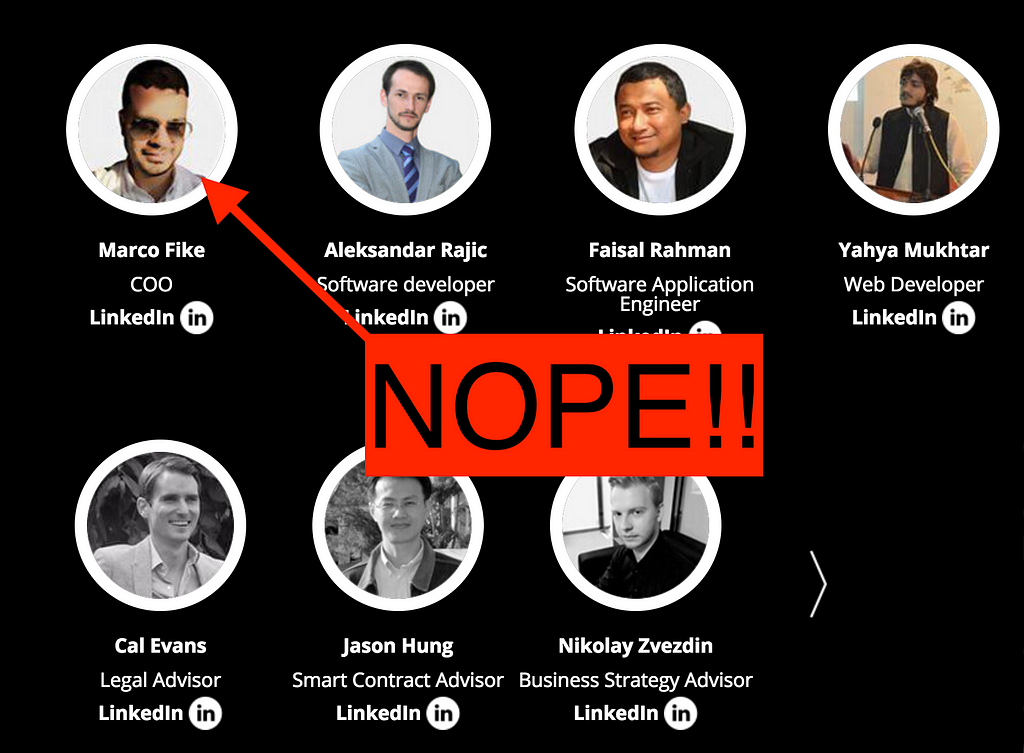

2. I did not stop to think. Caught up in hype, and a quickly diminishing supply before reaching the hard-cap, I made a snap decision to pounce on this fantastic opportunity. Perhaps with a moment’s pause, I might have questioned the fuzzy avatar photo of the CEO and thought maybe, just maybe, this could be fake. But he was on LinkedIn, and LinkedIn never lies!

3. It was an unregulated security with no KYC. It’s no secret that ICOs are frowned upon by most government regulatory agencies. Pretty much any legit ICO ran in the civilized world these days either bans American citizens outright, or requires KYC and accreditation. Giza asked for nothing — just a checkbox basically stating, “you cool, right?”

4. There was no product. Last, but certainly not least, is the fact that Giza is simply an idea. No prototype (even Kickstarter requires a prototype), no GitHub code, no CAD diagrams of the inner workings. Only marketing. Marketing solely crafted to mesmerize cartoon giraffes into parting with some hard earned ETH (only 0.5ETH, but still…).

Remember: Don’t Trust, Verify.

Before you go jumping into that hot new ICO with the clock ticking… make sure the product is real, and verify the identities of the leadership (all of them, especially Ryan Gosling). Look up the code, try out the alpha, read the unintelligible specs in the white paper, check out the dev chatter on gitter.im, and maybe even pepper the founders with questions in Telegram or Twitter (I did this with the Bloom.io founders, and they weren’t salty at all with my incessant peppering).

It Can Wait

Now that the ICO cat is out of the bag, and big money is involved, all the best projects are getting funded before the general public even hears about them — either via pre-sale or traditional private equity agreements. If you find an ICO with time left on the clock and unsold tokens, you have to wonder why Polychain Capital, A16z, Mark Cuban, your rich uncle, and 50 Cent passed on it. If they didn’t think it was worth looking at, maybe, just maybe, you should pass, too.

Like the idea of reading about my embarrassing mistakes so you don’t make them… or feel better about making the same mistakes, too? Give me some claps and a follow on Twitter!

I Got Sloppy. I Got Scammed was originally published in Hacker Noon on Medium, where people are continuing the conversation by highlighting and responding to this story.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.