Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

Put a cumulative ICO funding number in your presentation, and it will most likely be grossly outdated the next day. So many ICOs, and one is not like the other. Why Basic Attention Token ICO completes in seconds, while EOS’s runs for a year? Why there is a token price in one crowdsale and none in the other? You guessed it well, this is not just a random outcome but rather a strategic setup for every ICO to achieve certain goals.

In this post, we wanted to explore the variety of ICO metrics and mechanics to better understand why teams are using them and what results they lead to.

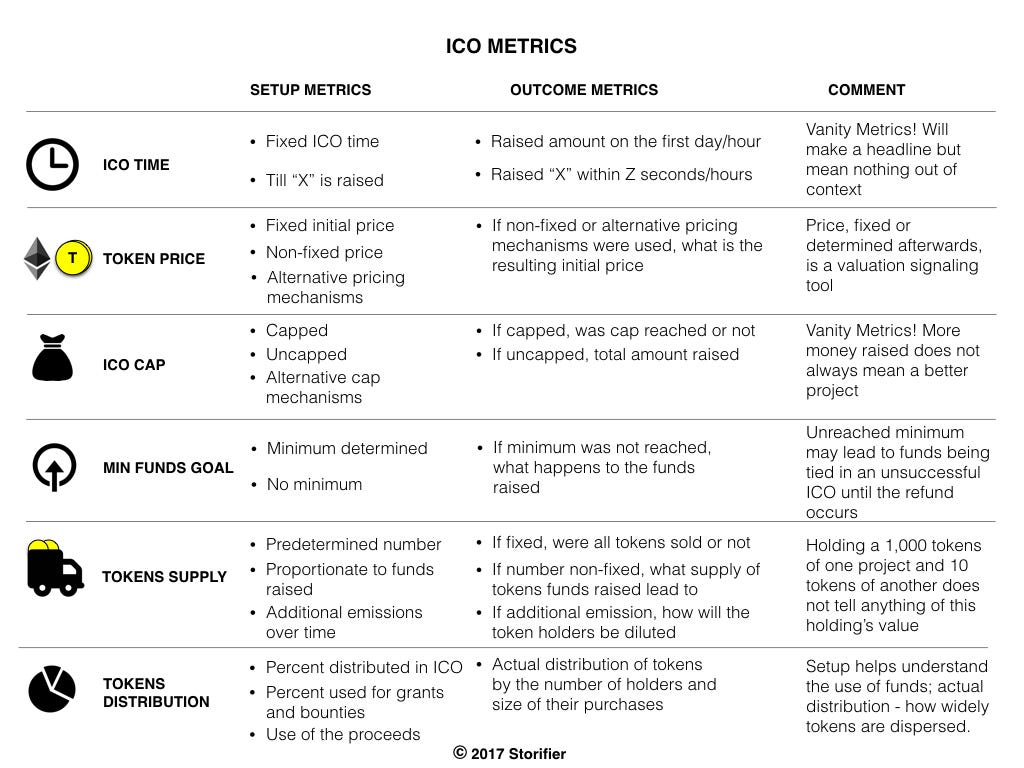

Every ICO team should spend a considerable amount of time to figure the characteristics of their token sale. And the choice is between setting all the metrics in stone prior to the token sale start or letting the market handle the majority of them during the token sale. These metrics include:

- how much time an ICO will run,

- whether a token will have a pre-determined price,

- whether there is a fundraising goal minimum or cap,

- how many tokens will be issued, and

- how funds will be distributed.

The outcome of the ICO campaign also has a number of metrics, helpful to evaluate its success. Bear in mind, however, that while the media loves certain vanity metrics, like funds raised and the time required to raise those funds, they may not be the most important ones. How many investors got to participate in an ICO and the size of their investments, for example, could be a crucial indicator if a project really succeeded in creating a distributed community of supporters or not.

The table below shows the variety of the Setup and the Outcome Metrics in an ICO. Every one of them is important for evaluation of the project.

As metrics show, the way a team sets up the initial token sale impacts the results of a campaign, both for the team and for the project supporters. To understand the connection between the token sale setup metrics and the crowdsale outcome, it’s worth looking at the mechanics behind these metrics, specifically at the token price and the investment cap.

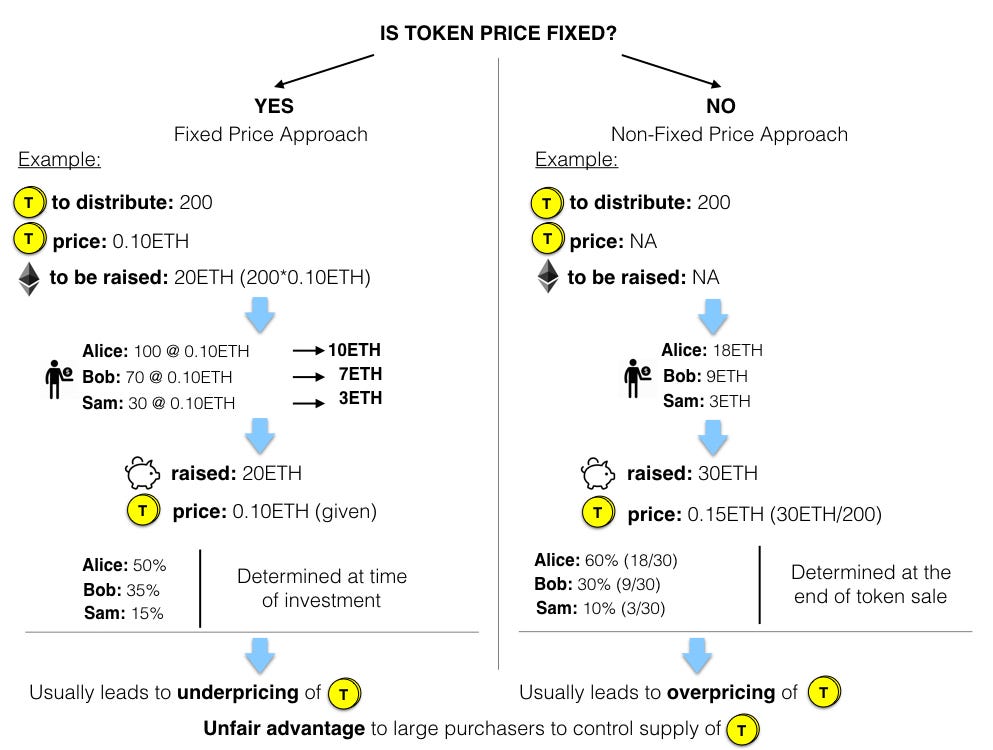

Is token price fixed?

For a token purchaser, this question determines the certainty of tokens number he will receive and the token share he will own, given his contribution and a predefined number of tokens for sale. With a non-fixed price, not knowing how many tokens he will receive and what it means in terms of the token supply, he may be inclined to put more money in hopes to get more tokens. Without the knowledge of the price (we assume that the number of tokens for sale is known), the only way to “outsmart” other purchasers is to invest more.

For the project itself, fixing the token price may result in leaving some money on the table and underpricing of the token, if the demand is high. Having a non-fixed price, on the other hand, may lead to the opposite effect.

The graphics below explains the mechanics of Fixed Price and Non-Fixed Price approaches in an ICO:

With either an underpriced or an overpriced token, choosing between fixed and non-fixed price may seem like choosing between the two evils. Both options carry significant disadvantages, either for a team or for the token holders.

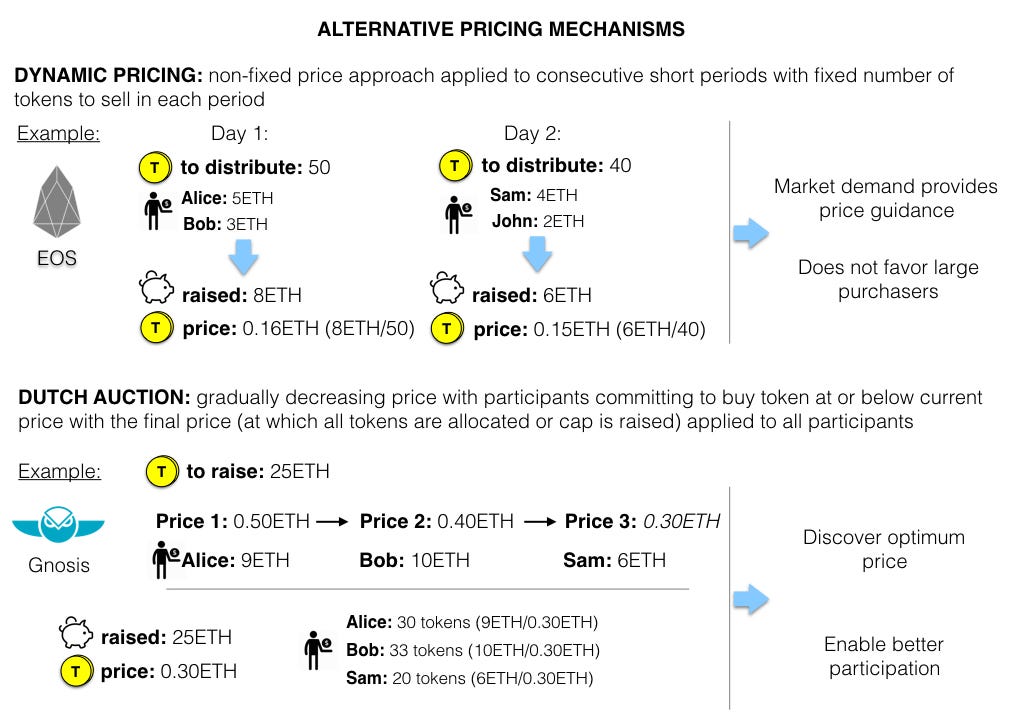

Trying to resolve these disadvantages, teams have developed Alternative Pricing Mechanisms, where purchase price changes as the token sale progresses. The ICO supporters buy tokens at a certain price at a given time or at the final price determined at the end of the campaign. In both cases, a purchaser gets some level of understanding how the market perceives the project, before making a purchase.

Here are two Alternative Pricing Mechanisms used in the token sales by EOS and Gnosis:

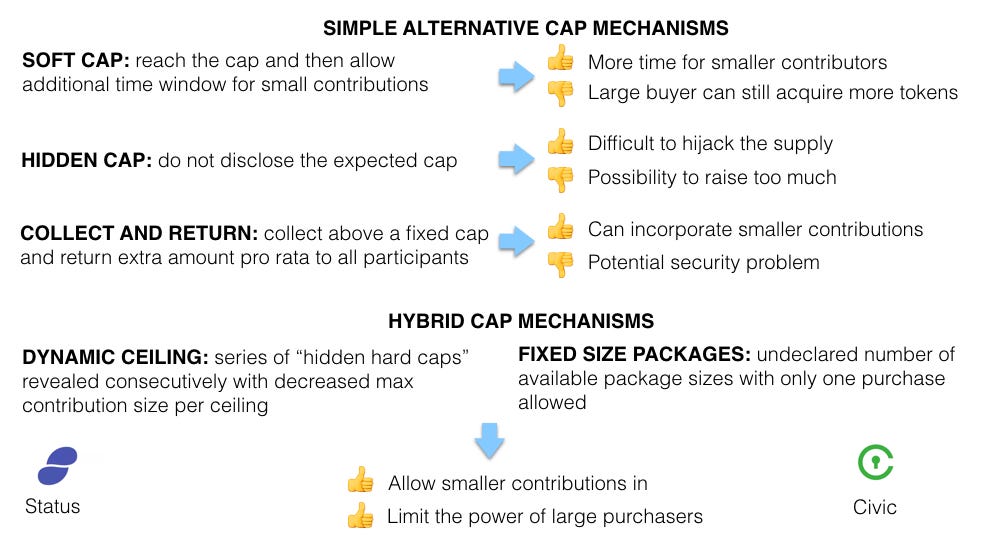

Now price is only one part of the equation. The decision on investment cap has important implications on the project’s valuation too. Successfully raising an amount determined by cap shows the market’s confidence and the team’s discipline. Not setting a cap, on the other hand, protects the project from the shame of not raising a lot, in a pessimistic scenario, and, vice versa, lets all funds in, in case of high demand.

By their nature, decentralized projects assume a wide distribution of token holders that will use the product. However, capped ICOs have resulted in a significant concentration of tokens in hands of large buyers. This contradicts the whole decentralization idea of the blockchain ecosystem. Uncapped ICOs, letting more participants in, still put large purchasers at an advantage.

To counter that, teams came up with the alternative capping mechanisms. Their substance is in 1) letting extra time for smaller investors to get in, 2) making a cap hard to figure out, or 3) slicing the cap in smaller lots. As Alternative Cap Mechanisms may take various forms, some of them do result in a broader token distribution:

With more ICOs coming into pipeline, we would expect that more of them implement both price and cap mechanisms ensuring wide participation. Otherwise, no matter how you call it, if a crowd sale results in 30% of tokens in one third-party address, it is rather a club sale. And that is not the ecosystem we are building.

If you enjoyed reading this article, please take a moment to recommend it and share it with your friends. 🚀

Untangling the ICO mechanics was originally published in Hacker Noon on Medium, where people are continuing the conversation by highlighting and responding to this story.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.