Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

This week, we take a closer look at Ethereum, Ripple, Cardano, Binance Coin, and Solana

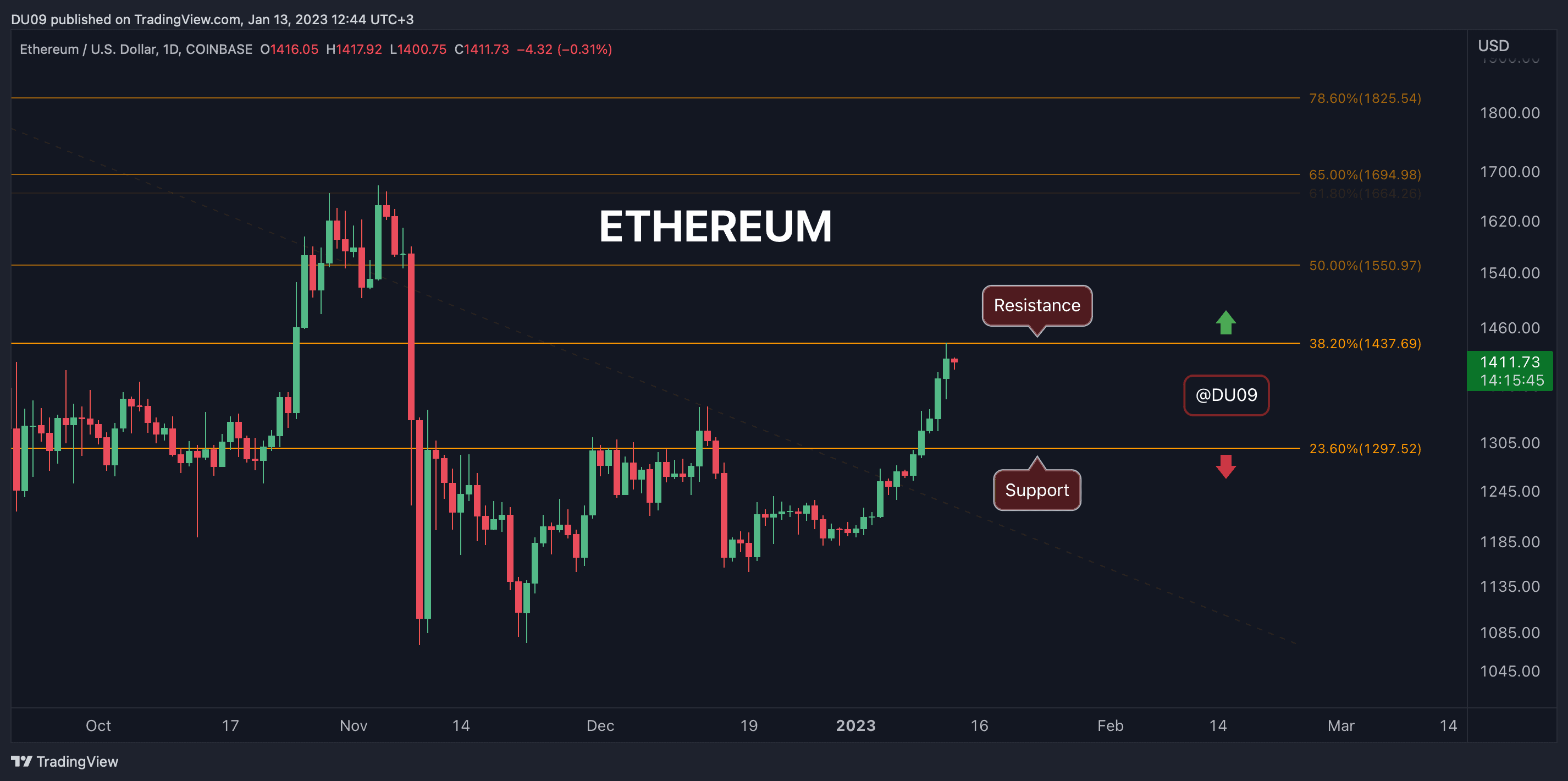

Ethereum (ETH)

With a spectacular start in 2023, Ethereum continued its rally and booked a 12.7% increase in the past seven days. This brings the price closer to $1,500, which is also going to act as a key resistance.

The bulls are in full control of the price action, but they may run out of steam at this rate. It is very hard to know when this rally will take a break, but a pullback becomes more likely the higher the price moves. The current support is found at $1,300.

Looking ahead, ETH remains bullish, and if the buying volume continues to increase, then we could see it move even higher in the coming week.

Chart by TradingView

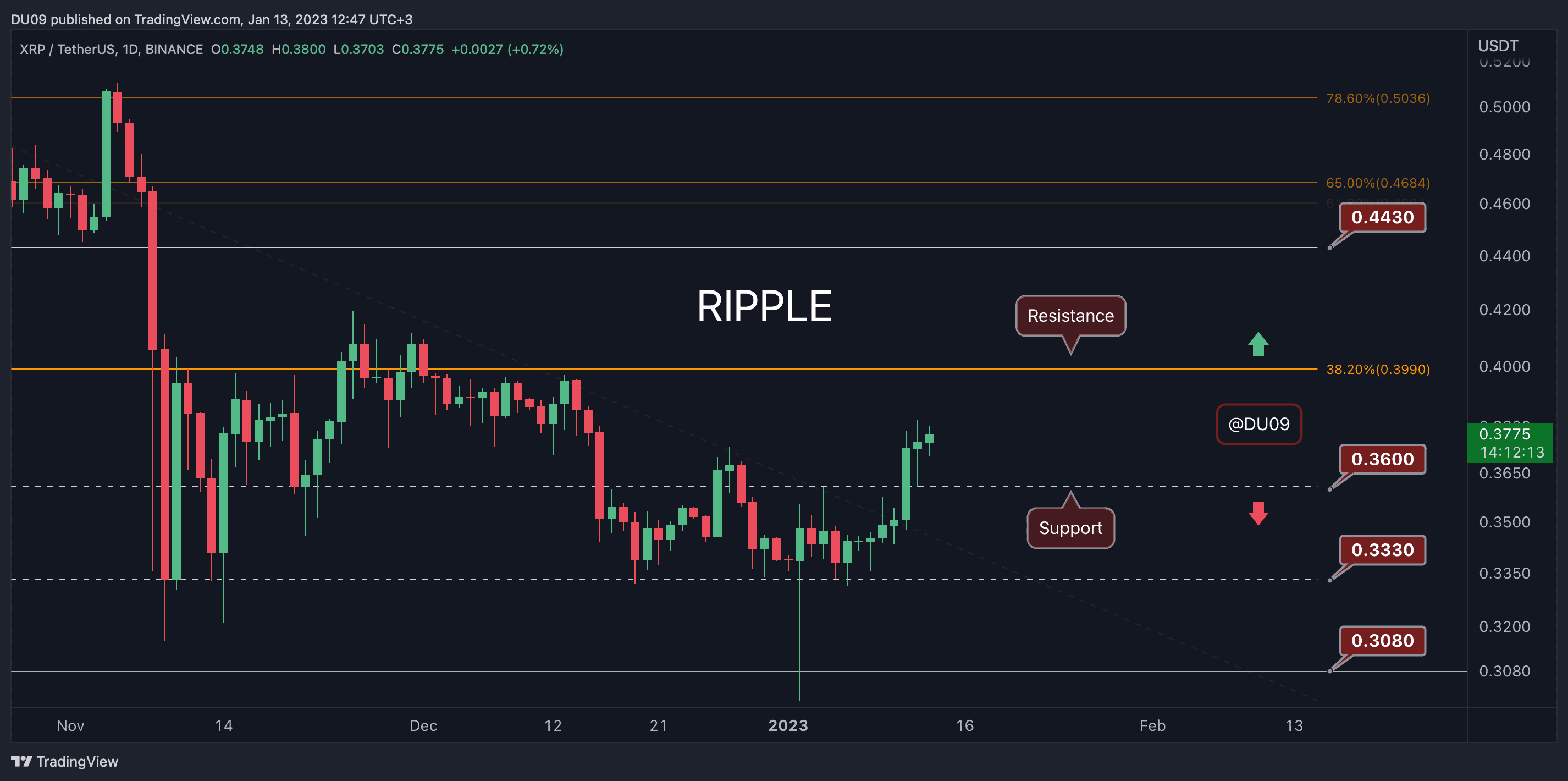

Ripple (XRP)

XRP is not far behind Ethereum, with a 10% price increase in the past week. This uptrend looks solid, and there is still space until the key resistance at $0.40. This gives the bulls room to maneuver in the coming days.

The current support is found at $0.36, and with the price making higher highs, optimism is building up in the market. The RSI indicator is not yet overbought on the daily timeframe, which supports further increases in the price.

Having managed to narrowly avoid a lower low in early January compared to June 2022, this cryptocurrency could end up forming a double bottom. To confirm this scenario, the price would have to move above 42 cents. The current outlook is positive, but XRP may struggle as it approaches the key resistance.

Chart by TradingView

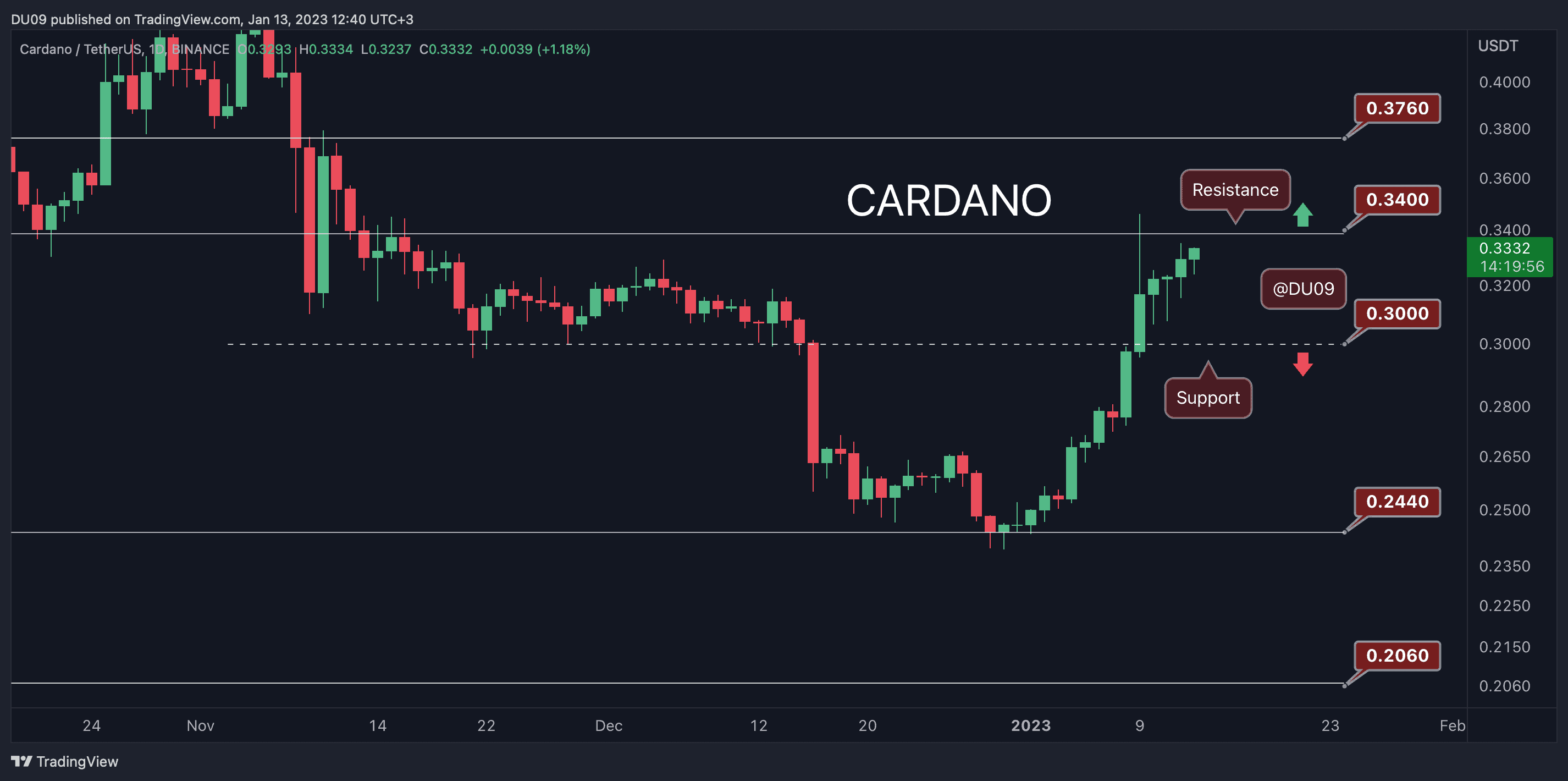

Cardano (ADA)

Cardano’s rally gives no signs of weakness since it started in early 2023. On the contrary, its bullish momentum has intensified and managed to register a 21.8% increase in the past week. This is an impressive recovery.

After the price broke above the 30 cents level (now turned into support), ADA’s price exploded and quickly reached the 34 cents resistance before a pullback followed. Since then, the price returned on the uptrend, with the key resistance now being put under pressure again.

Looking ahead, ADA seems determined to push higher. Buyers continue to dominate the chart, with only two red daily candles in the past two weeks.

Chart by TradingView

Binance Coin (BNB)

Binance Coin has managed to book an 11.6% price increase in the past seven days. In doing so, BNB is quickly approaching the key resistance at $300. This is an impressive recovery considering that, not long ago, the price was closer to $200.

With good support at $260, BNB is well-positioned to challenge the current resistance, and a break above it would open the way for a higher valuation that could see this cryptocurrency approach $360.

Considering its performance, Binance Coin continues to consolidate its position as the third largest cryptocurrency by market cap after Bitcoin and Ethereum (excluding stablecoins). This is unlikely to change in the future since XRP (4th place) has less than half of BNB’s market cap.

Chart by TradingView

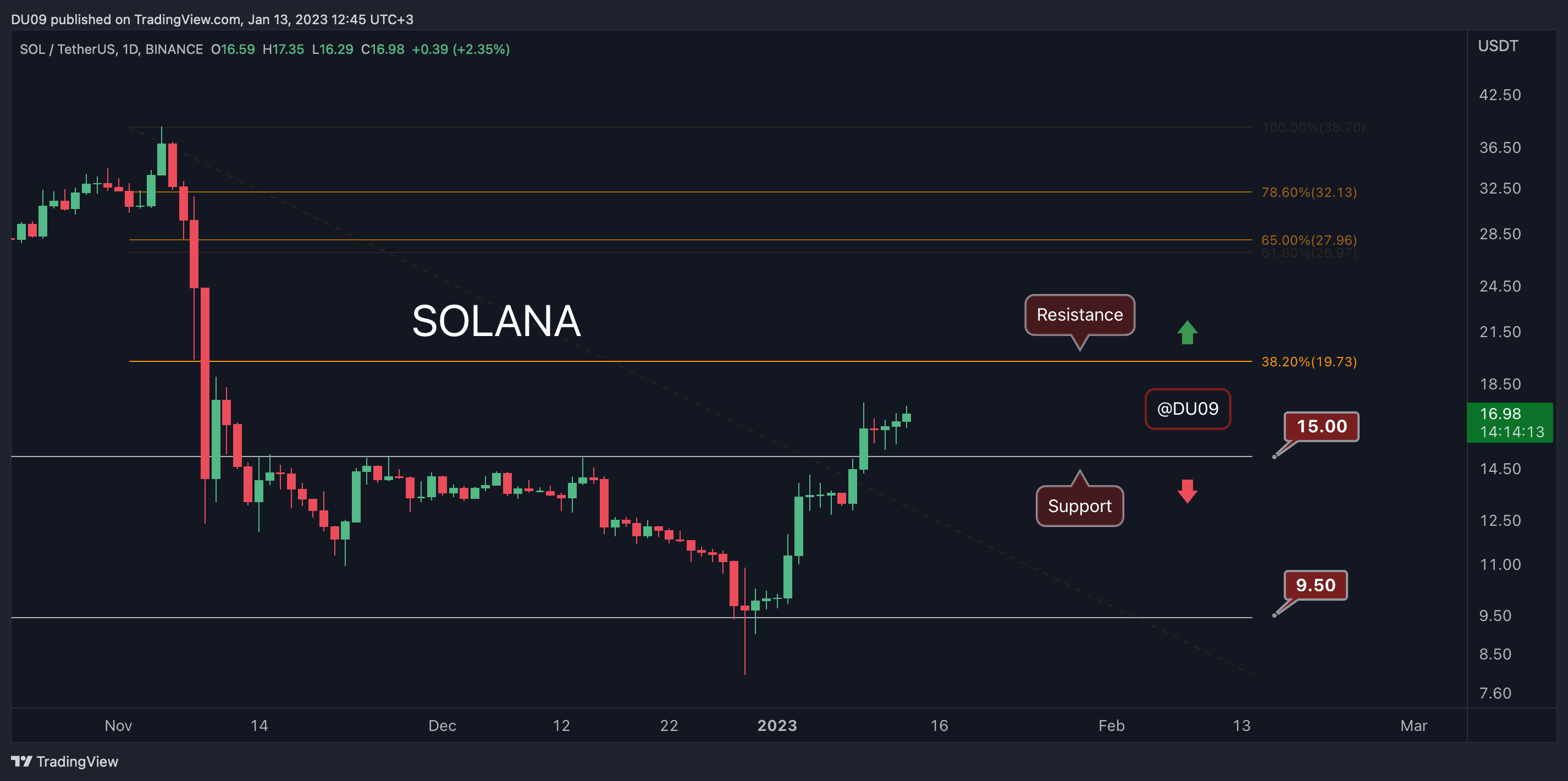

Solana (SOL)

Solana is another example of an impressive recovery, similar to ADA. It booked a 23.7% price increase in the past seven days, making it the best-performing coin on our list for the second week in a row.

With good support at $15, SOL gives no signs of slowing down. Its sight is firmly set on the current resistance at just under $20.

While the price action remains bullish, it is important to note that the RSI on the daily timeframe has reached overbought levels. At the same time, the daily MACD histogram has started to make lower highs. These are early signals that Solana’s rally may approach a pause soon.

Chart by TradingView

The post Crypto Price Analysis Jan-13: ETH, XRP, ADA, BNB, and SOL appeared first on CryptoPotato.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.