Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

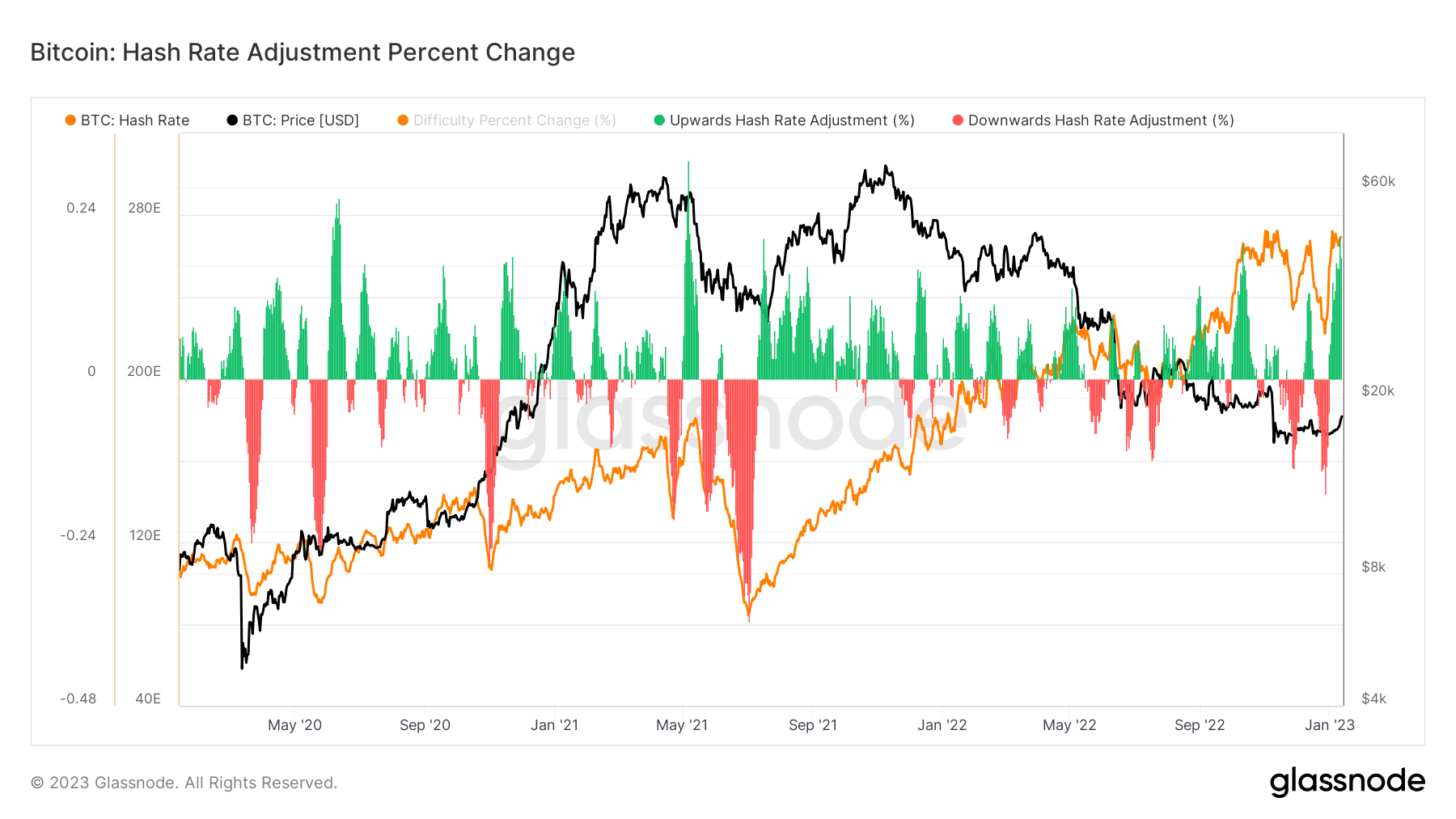

Bitcoin (BTC) hashrate rose 20% to a new all-time high on Jan. 12 — the second time the hashrate increased to a new ATH in the last seven days.

It has since retraced to 251.79 EH/s as of press time.

Source: Glassnode

Crypto investor Asher Hopp pointed out that Bitcoin’s hashrate rose to an all-time high despite bankrupt miner Core Scientific turning off 9,000 ASICs in December. According to Hopp:

“Hash is moving from weak hands to strong hands.”

BTC’s increased hashrate is expected to lead to a 9% rise in mining difficulty, according to bitrawr.

Crypto lenders moonlighting as miners

With several Bitcoin miners using their mining rigs as collateral for over $4 billion in debt, crypto lenders are repossessing machines for their own benefit, Bloomberg News reported on Jan. 12.

While some lenders are storing the rigs, others, like New York Digital Investment Group (NYDIG), have seized the opportunity to venture into crypto mining.

For context, a debt restructuring agreement between NYDIG and Greenidge Generation turned the lender into a Bitcoin miner. According to the agreement, NYDIG would acquire mining equipment of 2.8 EH/s that Greenidge would host.

Bloomberg reported that other lenders with mining experience are favoring this route.

The head of research at TheMinerMag, Wolfie Zhao, reportedly said:

“Lenders are flooded with mining rigs. One way for the lenders to prevent further losses from the defaulted loans is to keep the collateralized machines running and generate some income.”

Meanwhile, reports showed that Bitcoin’s mining profitability declined due to the declining value of the asset and the rising mining difficulty and hashrate metrics.

The post BTC hashrate hits ATH second time in 7 days, difficulty expected to grow 9% appeared first on CryptoSlate.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.