Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

5. CEFI

5.1 Status quo of institutional business developments

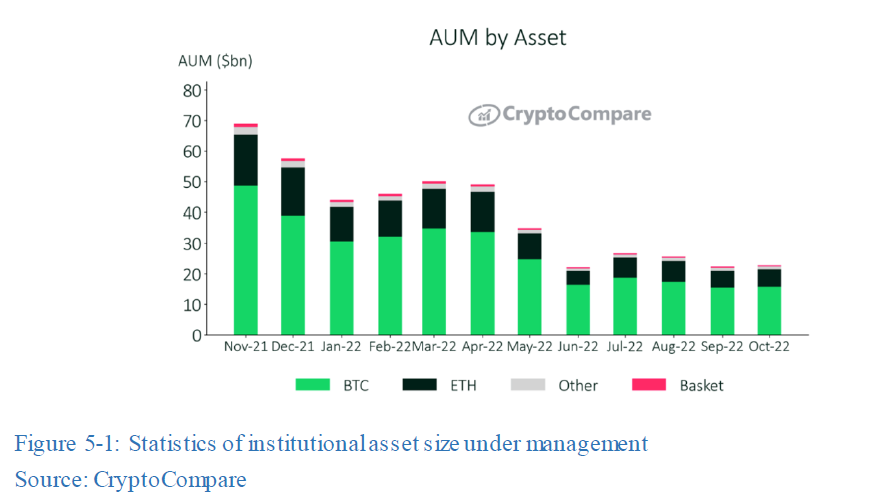

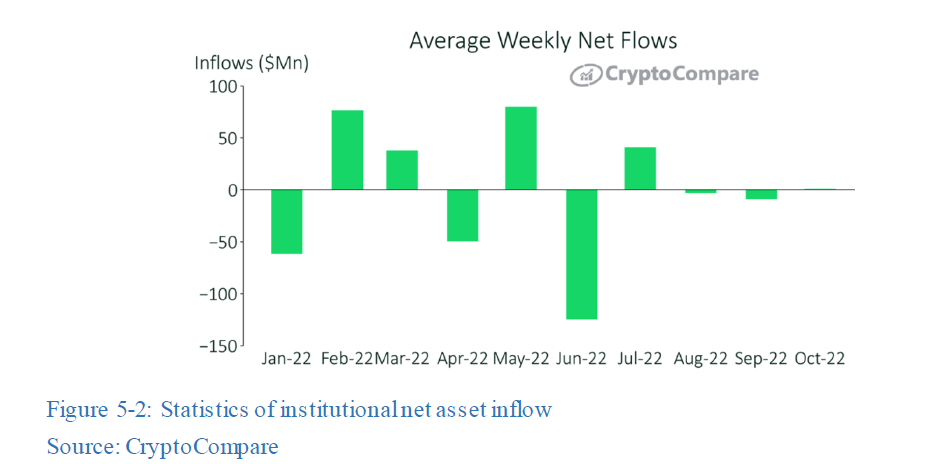

The institutional business portrait of 2022 is highly correlated with the crypto market as a whole. According to CryptoCompare’s data from November 2021 to October 2022, the size of institutional business declined from nearly US$70B at the end of last year to around US$22B. It is encouraging to see a small recovery in October compared to September, an increase about 1.76%, the first rise since July, but still below the peak in March. In terms of net inflows, it went from negative to positive in October, reaching US$730K, compared to negative US$9.2M in September. It reveals the perfect match with the April-June institutional turmoil (see 5.3 in this chapter).

5.2 Custodial business competition/service landscape

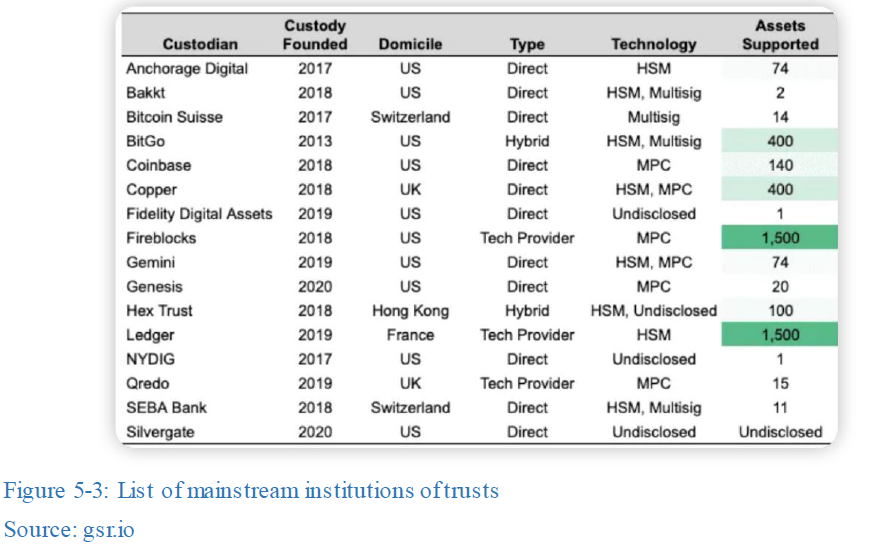

The trust business (crypto asset custody) is the primitive institutional business to be developed. In 2022, there are more than 150 institutions offering custody service. Among the leading ones remain Fireblocks, Coinbase, BitGo, ledger, etc. As demonstrated in the chart below, Fireblocks ventured into the crypto trust market back in 2018, supporting more than 1,500 types of assets in custody. In terms of geographical distribution, most of the leading players are concentrated in the United States; most of the methods are sole-proprietary (only one adopts hybrid custody). From technical point of view, MPC (multi-party computing) technology has been gradually integrated to the past single HSM technology.

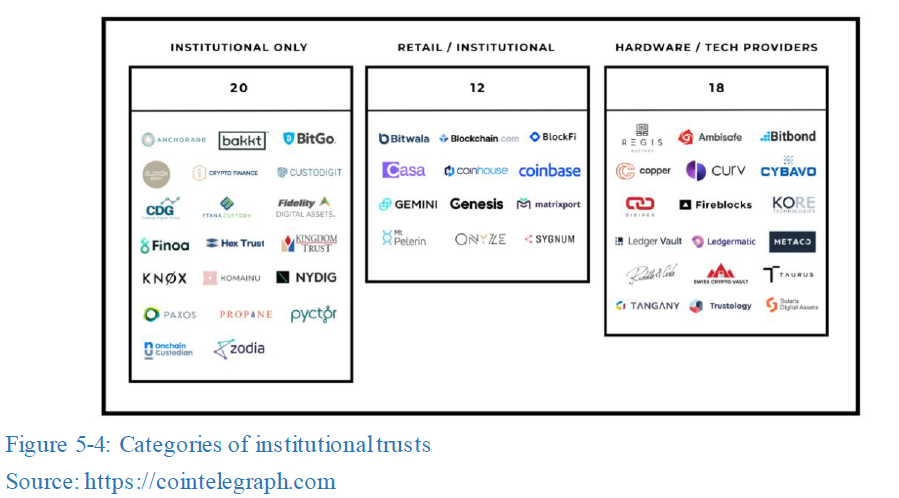

In terms of products offered, they are divided into three categories. The first is to provide services only to institutional customers, represented by BitGo and Hex, while another is to provide services to both institutional customers and retail customers (including high net worth individuals), such as BlockFi, Coinbase, etc. The third category is relatively peculiar, specializing in providing hardware services to the market, such as hot and cold wallets, custodial systems, etc., represented by Fireblocks, Bitbond, etc. These three categories form the current competitive landscape of the custody market.

5.2.1 Lending/Borrowing and Asset Management in CeFi

Institutional lending/borrowing business refers to the provision of crypto asset lending/borrowing services to institutional investors and users, including high net worth individuals (including family offices). Borrowers are usually quant-trading institutions, exchanges, mining pools, project teams, etc. Quant-trading institutions and exchanges usually utilize institutional services for hedging or as part of working capital, while mining pools pay electricity bills and purchase fixed assets such as mining machines with the credit. Correspondingly, lenders of institutional services are usually long-term holders, such as wealth management institutions and family offices.

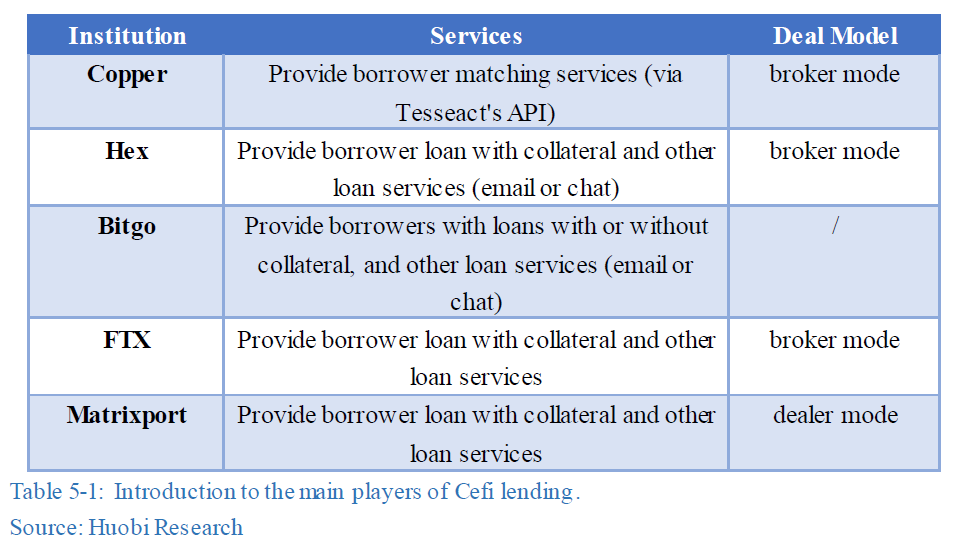

The major players in CeFi lending/borrowing in 2022 are Copper, Hex, Matrixport, BitGo, etc. Their main services and deal models are summarized in the table below.

So far, the faster and more convenient way to match deals is through email or WeChat (in Hex or Bitgo’s model) with broker mode; dealer mode of fund pool is relatively harder to construct due to compliance conditions.

5.3 Statistics and impact of institutional turmoil

After the collapse of Terra, many investors are under severe loss. Three Arrows Capital and its investors are the first on fire. Three Arrows Capital suffered devastating losses in the Terra incident due to undue risk management, with so many investors implicated, the maelstrom has created a giant exposure of funds in the crypto world. As a result, institutions that had financial dealings with Three Arrows Capital were embroiled. The bankruptcy of Three Arrows Capital reflects the huge risk exposure of lending without collateral (credit lending) in the cryptocurrency market, which has led to a spate of institutional meltdowns. Various governments become more cautious after the string of risky bursts in the cryptocurrency market and have decided to impose stricter regulations to prevent similar incidents from repeating.

The other thunderstorm is the FTX incident. It all stems from Alameda, which is the sister company of FTX, that it borrowed funds from FTX for business purpose on the cost of mortgaging SOL and FTT; the funds lent out are all client funds. CoinDesk published an article and warned the general public by indicating the risk on the balance sheet of FTX, and CZ responded to this post by another post, claiming the plan of selling off all FTTs in his holdings; the market was hence in a deep panic that the price of FTT plummeted, triggered a selling climax. FTT suffered from the selling climax and the liquidity was drained; meanwhile, the underlying FTT and SOL lost the buttress of value, pushing FTX to a state of insolvency that led to the bankruptcy in the end. Before all these, FTX was the second largest centralized exchange only to Binance. Despite that the FTX incident is already one of the catastrophes in the financial world, it was hacked merely hours after the declaration of bankruptcy, with assets worth over 600 million dollars in theft, and most of the users cannot withdraw their money back for ever. It is indeed a tsunami for the whole industry, and some of the consequences are still yet to come.

5.3.1 Details of the incidents

1. Terraform Labs

Terraform Labs is the cryptocurrency company carrying out the responsibility of developing and maintaining Terra Network and Anchor. The company created the stablecoin TerraUSD, which later de-pegged from U.S. dollar and led to the collapse of Terra and dumping in the market. The Luna token, once a cryptocurrency worth over $40 billion in market cap, became worthless when TerraUSD lost the peg to U.S. dollar, and losses of Terraform Labs are beyond countable. Terra’s collapse was merely the start of a series of subsequent institutional meltdowns.

2. Three Arrows Capital

Three Arrows Capital is a cryptocurrency hedge fund in Singapore. Until March 2022, Three Arrows Capital had $10 billion in assets under management, known as one of the most prominent cryptocurrency firms in the world. However, the $200 million investment in Luna was one of fuses that lighted the fire of bankruptcy. The company declared bankruptcy on June 29, two days after it received a notice of default on a loan from Voyager Digital; the defaulted amount exceeds more than $650 million as of June 2022. British Virgin Islands court has since ordered Three Arrows Capital to liquidate its assets after the court found the fact of insolvency.

3. Voyager Digital

Voyager Digital is a US-based cryptocurrency lending company operating primarily in the US and Canada. On July 6, Voyager Digital disclosed that it had filed for Chapter 11 bankruptcy protection after losing more than $650 million in bad debt to Three Arrows Capital, plunging it into a financial crisis, suspending trading and freezing customer funds a couple times. Despite a rescue loan from FTX founder Sam Bankman Fried’s trading firm, Alameda Research, to Voyager Digital in June, the bankruptcy is the unavoidable finale of Voyage Digital. The company also claimed in its Chapter 11 filing that it had more than 100,000 creditors at this point, along with liabilities of between $1 billion and $10 billion. FTX has since acquired Voyager Digital for $1.4 billion. After the crash of FTX, CZ has expressed interest in November again on acquiring Voyager Digital.

4. Celsius Network

Celsius Network is an American and Israeli cryptocurrency company. The company was once a leader among cryptocurrency lending platforms. However, in June 2022, trading and withdrawals are halted from the platform, and about $12 billion in user assets were frozen. Celsius Network filed for bankruptcy protection on July 13. The company also fired about a quarter of workers on July 4. Around 354 million worth of assets from Celsius are implicated in the FTX incident.

5. Babel Finance

Babel Finance is a cryptocurrency lender based in Hong Kong. The company stopped all withdrawals from its users in June. After announcing the cessation of user withdrawals, Babel Finance disclosed that it was hit by unprecedented liquidity problems due to volatile cryptocurrency market conditions. Babel Finance was one of the many cryptocurrency companies devastated by Terra and Three Arrows Capital, which triggered mass frozen on billions of dollars of funds.

6. ConFLEX

CoinFLEX is a futures exchange. It temporarily closed all withdrawals in June due to financial distress in light of the recent cryptocurrency downturn. CoinFLEX later announced plans to recover $84 million in funds outstanding. It also partially reopened withdrawals with a cap at 10 percent, leaving 90 percent of user balance as locked funds that users still cannot withdraw or trade. This incident was indeed a liquidity issue that a $47 million security deposit is defaulted by one of CoinFLEX’s borrowers. CoinFLEX’s hole is hence estimated at $84 million.

7. BlockFi

BlockFi is one of the world’s leading cryptocurrency companies, which provides financing services and loans. Nearly 80 million dollars are at loss from the bad debt of 3AC. In June this year, BlockFi announced a plan of layoff for almost 20% of the payroll; the tormented BlockFi was acquired by FTX with 240 million dollars afterwards. In the FTX incident, BlockFi declared on a working proposal for filing bankruptcy by huge risk exposure to FTX, and all withdrawals were suspended.

8. Genesis Trading

Genesis is a famous crypto trading company that provides crypto exchange, lending/borrowing, custodial and brokerage services; the overall scale of assets under management exceeds $10 billion. In the FTX incident, $175 million worth of assets are stuck on FTX. With this risk, an urgent announcement was made on Nov 16 that all new loans and redemptions were suspended. Genesis is currently seeking an emergency loan to be sufficient to pay off the redemption requests of large amount.

9. Vauld

Vauld, a Singapore-based cryptocurrency company that provides cryptocurrency lending and investment services to more than 800,000 customers. On July 4, the company announced all customer withdrawals and deposits are closed. Vauld’s CEO Darshan Bathija claimed that unreliable and unstable market conditions prompt financial distress to the company. Vauld had been operating with powerful appearance in the market for about four years and had raised $27 million through investors such as Coinbase Ventures. Vauld has also faced liquidity problems because of the collapse of the Terra stablecoin UST and other institutional meltdowns; $197.7 million were taken away in the retreat of the customers since June 12.

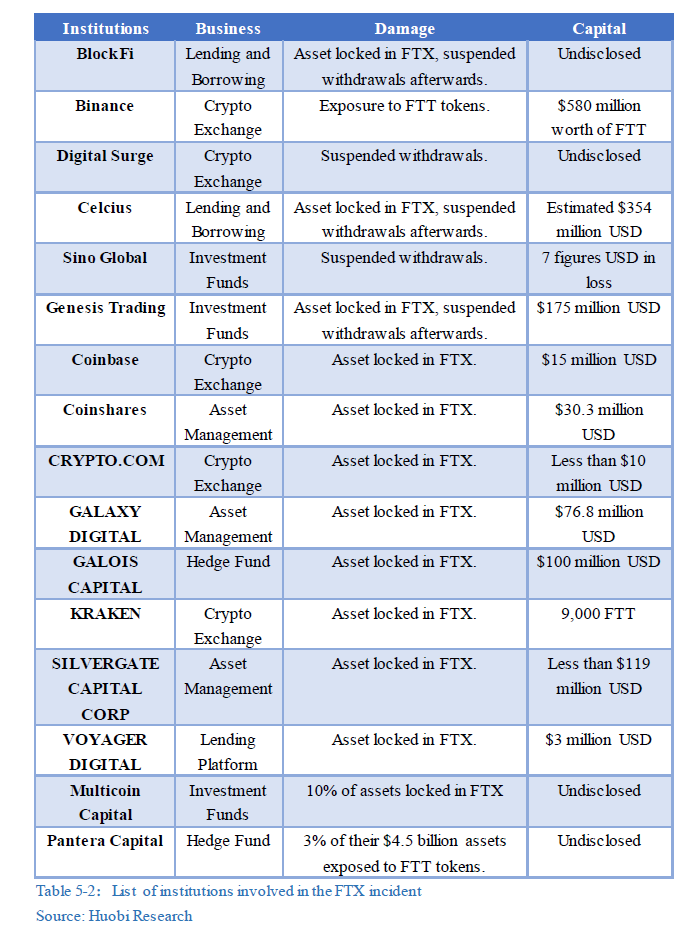

10. Statistics of institutions involved in the FTX incident

The following chart summarizes the known institutions encumbered by FTX so far (not all institutions chose to declare exposure of funds involved in the FTX incident). Most institutions on the list have remaining funds on FTX that cannot be withdrawn, and some of them have suffered from overwhelming holdings of FTT.

6. NFT

6.1 Status quo of NFT market

NFT is a new crypto segment that emerged in 2021 and has received a lot of attention from the market since April 2021. It has continuously heated up and entered the sight of general public since the second half of last year and climaxed at the beginning of 2022. However, the performance demonstrated weakness and lack of momentum amidst the worrisome atmosphere of the crypto industry.

6.1.1 Overall decline in NFT market

Throughout 2022, NFT’s total market cap declined from $31.14B in January to $21.73B in October, a decline of about 42%, and single-day closing declined from $842M in January to $48M in October, a decline of roughly 94%.

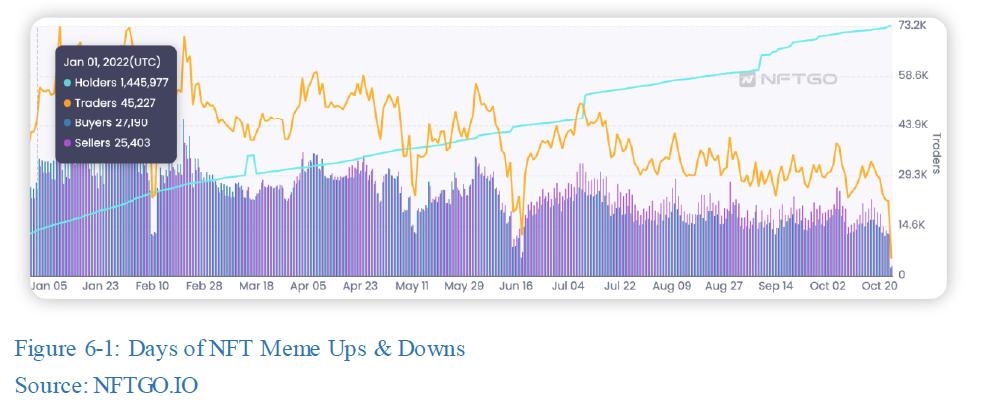

In 2022, the NFT market saw a decline in active traders from 45,000 at the end of 2021 to 5,000, with a correspondingly large decline in both buyers and sellers. Major transactions were spotted in January, April and June, and a rather dismal performance from the second half of the year onwards. In contrast, the cumulative number of NFT users reached 3,426,600 from 1,445,900 at the beginning of the year, a comparative increase of 138% (the NFT market embarked in the second half of 2021). The increase in the total number of users is accompanied by a decrease in the number of active trading users, indicating an increase in the number of price takers, with the majority of users holding at loss.

6.1.2 Interest in NFT remains heated in Asian Markets

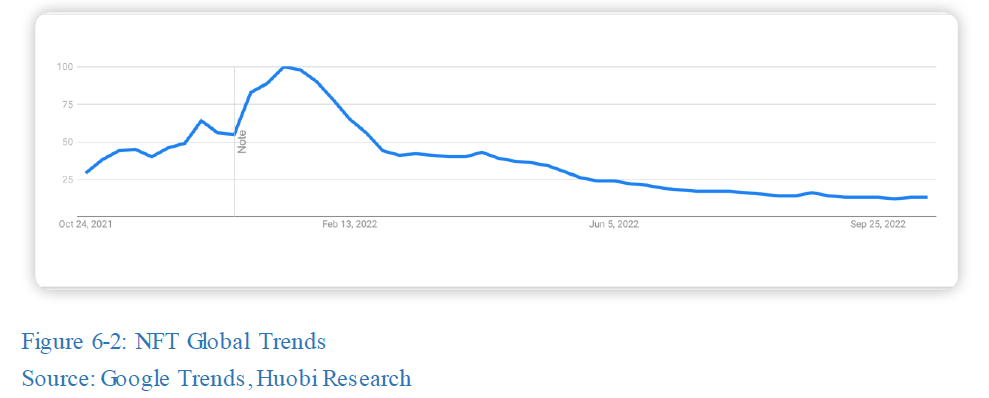

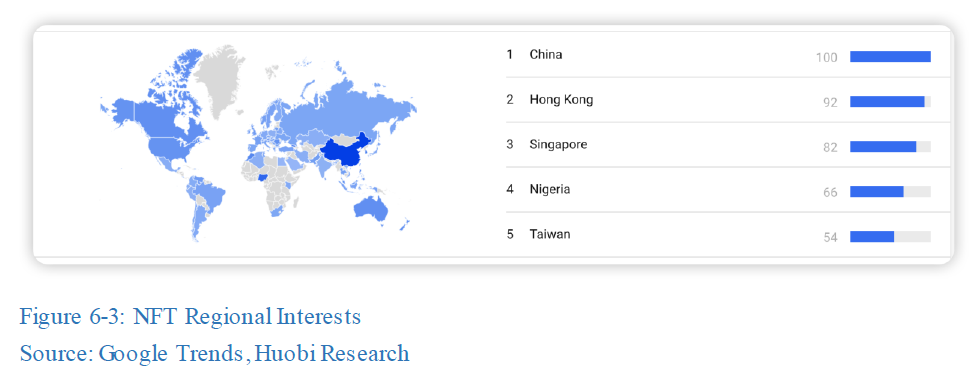

From Google Trend, searches on NFT peaked in mid-January 2022, and started to decline thereafter. With another small recover in April-May, it has been on a diminishing trend since then.

Geographically, Mainland China ranks first in the search index, followed by Hong Kong, and the 3rd-5th are Singapore, Nigeria and Taiwan respectively, while the US ranks 19th. It is still considered high compared to previous year, when the interest in NFT from Mandarin-speaking regions (Mainland China, Hong Kong, Singapore) gradually surpassed that from Europe and the US in the context of the bear market.

6.1.3 Leading players dominate with majority being PFP, cultivating the market of long tail

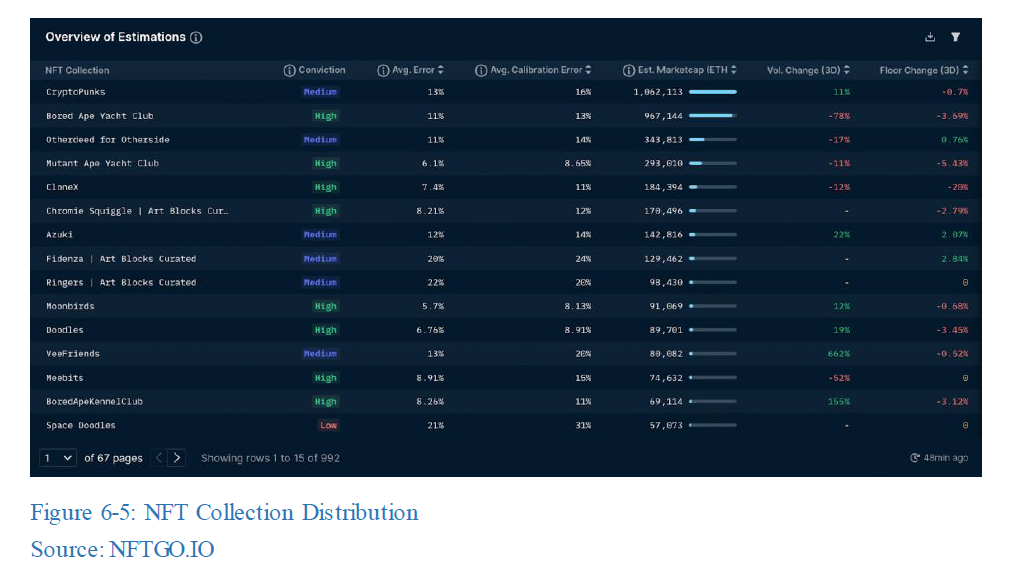

From the classification of NFT, about $12.67B out of $21.73B falls within the PFP category in 2022, accounting for 58%, followed by collectibles and gaming NFT. It indicates that the NFT market is still dominated by avatar series; nothing new in terms of category compared to 2021.

In terms of collections, the top3 are BAYC, CryptoPunks, lands from Otherside. Almost more than half of the top ten (Meebits and CryptoPunks were acquired by Yuga Labs) are occupied by Yuga Labs, revealing the trend of sustainable dominance from leading players.

However, excluding the first ten comparatively famous NFT series, other niche NFT accounted for 62.05%, the long-tail begins to be unveiled, and the NFT market is slowly conforming to the 20/80 principle.

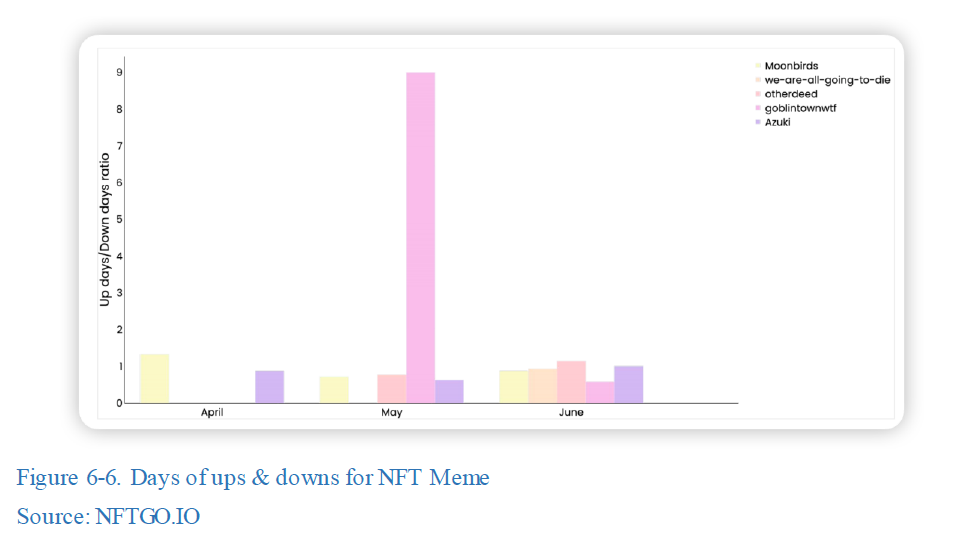

6.2 New trends in NFT –layer upon layer, the Meme bubble popped

Throughout 2022, the NFT market began its downturn in May (marked by the Otherdeed for Otherside offering on May 1) after a honeymoon period from January to April. From May to October, all kinds of Meme NFTs sprung out against the backdrop of the bear market. From the preliminary series of we-are-going-to-die to the pyramid-marketed Mts, along with goblintown.wtf, in the bear market continues to drain the confidence of NFT players. Especially goblintown.wtf, which raised $20m in 1 week with strong pyramid marketing, also being the “ugliest” NFT ever. The subsequent Shit or Shit Beast series was a nesting operation based on this, which also attracted a large number of people out of FOMO. NFT Meme is one of the distinguishments of the NFT market in 2022, even if it prevails first and breaks down at last.

Another innovation for the NFT market in 2022 is the increasingly appealing storytelling relationship and augmented narrative between NFT series. Combined with airdrops and token issuance, a gameplay combo with crypto is discovered and trending. Especially in light of the success in DeFi, a new chapter of NFTfi is on the way.

6.3 NFTfi — The rise continues after a popular debut

NFT (non-fungible token) has become an indispensable part in the crypto world, and now NFT has evolved from pure PFP project to more advanced form combined with games, metaverse, collateralized lending, etc., forming a new model of NFT + decentralized finance. However, inherently, as non-fungible token, the indivisibility results in weaker liquidity compared to FT, such as limited trading precision, higher cost, and lack of price discovery mechanism.

As solutions, financial applications and tools regarding issues on NFT assets have emerged in the market, aiming to add liquidity and increase certainty on pricing of NFT assets, and improving the utilization of funds on NFT by the combination of NFT and finance in order to create better user experience in the NFT market, which we collectively refer to as NFTfi applications.

6.3.1 NFT lending/borrowing — a budding market

NFT lending/borrowing is the most direct way to address the liquidity issue of NFT assets, and the most sought-after demand in current NFT market. Prior to 2022, barely any voices of NFT lending/borrowing were heard, while it gradually started to appear in conversations. There are 2 mainstream modes for NFT lending/borrowing: P2P (peer to peer) and P2Pool (peer to pool), represented by the NFTfi protocol and the BendDAO protocol. They differ in terms of transaction frequency, trial scope and price discovery effectiveness; the overall market is still relatively small compared to that of fungible tokens.

As stated earlier in this report, it is undoubtable that the NFT market in 2022 is in the downturn, thus NFT lending/borrowing does not perform quite well. Current NFT lending/borrowing stays in the scope of blue-chip; for the low-to-medium NFTs, it is not widely recognized in the market for the time being due to high price volatility and the lack of oracles.

Overall, even though NFT lending/borrowing has seen some innovation in 2022, but the development is still relatively slow, and the market size is rather small in compared to FT, let alone the market cap. The market will expand to more NFTs at the bottom, along with the realization of more financial derivatives and application scenarios on current model.

6.3.2 Status quo of NFT liquidity-providing solutions

The entire crypto market contracted in 2022, and NFT liquidity solutions were just in time. Current prevailing NFT liquidity solutions are fractional NFT, crowdfunding protocols, and liquidity pool protocols.

● Fractional NFT enhances both the trading experience and capital utilization: by transforming NFT into fungible tokens with higher transaction precision, it becomes eligible for various financial tools such as collateralization, staking and leverage of fungible tokens or equity.

● Crowdfunding protocols delicately address the excessive threshold for users to hold an NFT from the market demand side, enabling participants to pool their funds and co-manage an NFT in a multi-sig environment.

● Liquidity pool protocols gathers NFTs near the floor price, providing users with a stable platform for market-making.

Overall, liquidity solutions emerged one after another in 2022; some projects (such as PartyBid) successfully caught the eyes of capital funds and investors. More innovated projects are burgeoning.

The above-mentioned liquidity solutions are diverse, all of which can improve funding efficiency to a certain extent. However, limited by pricing difficulties, the liquidity of long tail NFTs as well as rare ones has never been effectively addressed. In the future, with the accumulation of historical trading prices gradually completing the NFT quotation mechanism, the market of NFT would become more liquid than ever.

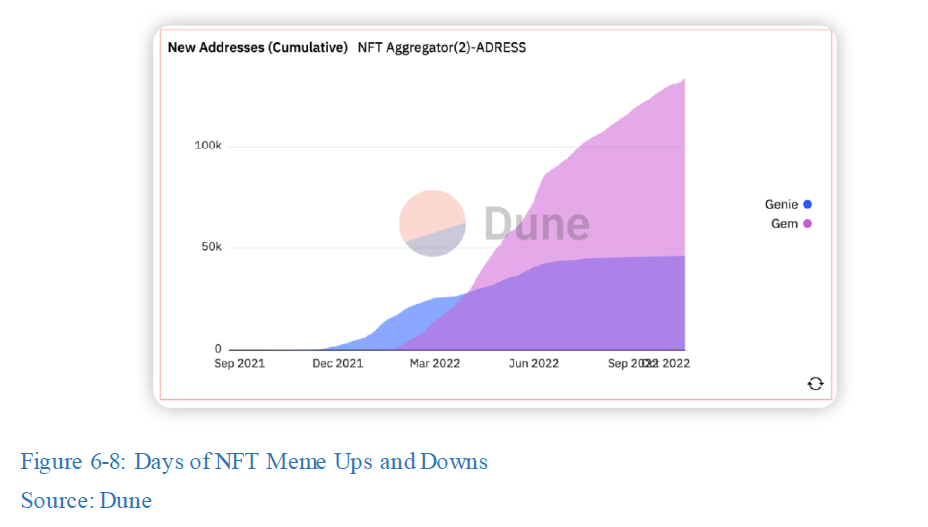

6.3.3 NFT aggregator — Duopoly landscape

On one hand, NFT aggregator is an integrated platform consists of asks and bids from different orderbook trading marketplaces, providing one-stop buying, listing and selling. Current universal aggregators are Genie and Gem, and various segmented aggregators as ENS.vision. NFT aggregators performed extremely well in the first half of 2022; Genie and Gem were acquired by SudoSwap and OpenSea respectively. The entire aggregator track is basically dominated by Gem and Genie, demonstrating sustainable market power of duopoly.

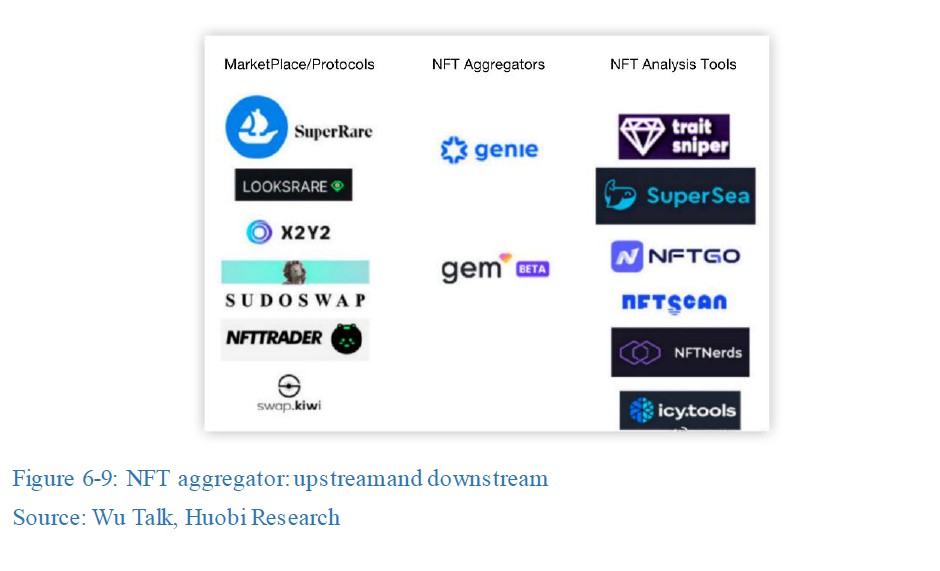

On the other hand, NFT aggregators are capable of meeting demands of information aggregation and trading aggregation. Deep integration with upstream trading marketplaces in the upstream and data analytical tools in the downstream is in progress: trading marketplaces/protocols in the upstream naturally rely on aggregators as channels, while data analytical tools in the downstream provide users with features, ranking, distribution and other services when screening. The first half of 2022 has already seen some acquisitions of aggregators by trading protocols in the upstream, and the integration of aggregators with data analytical tools is in transit; more cases are expected next year. Vertical integration of NFT aggregators with trading marketplaces and data analytical tools is destined to happen.

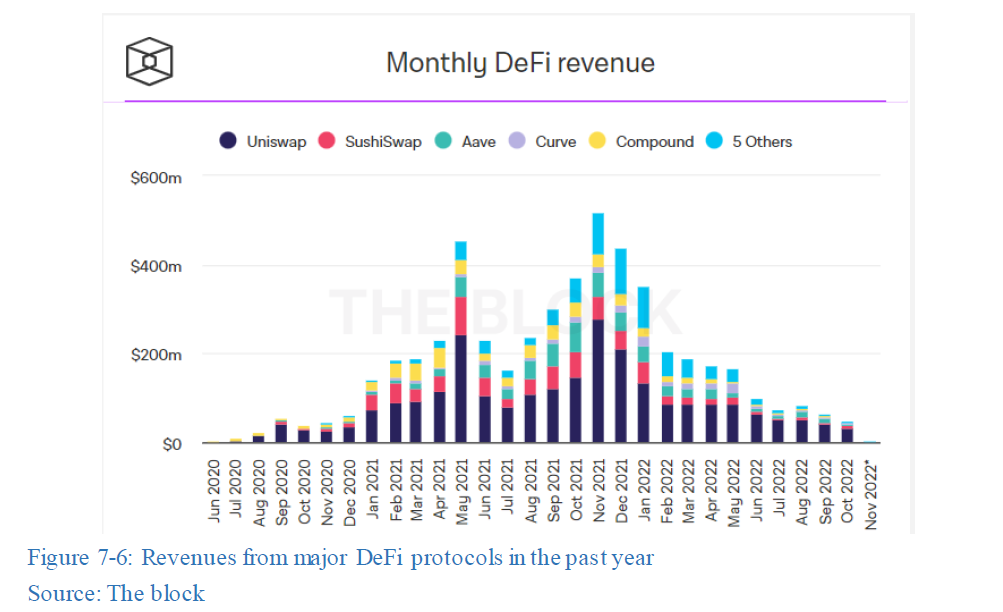

7. DeFi: the darkness before dawn

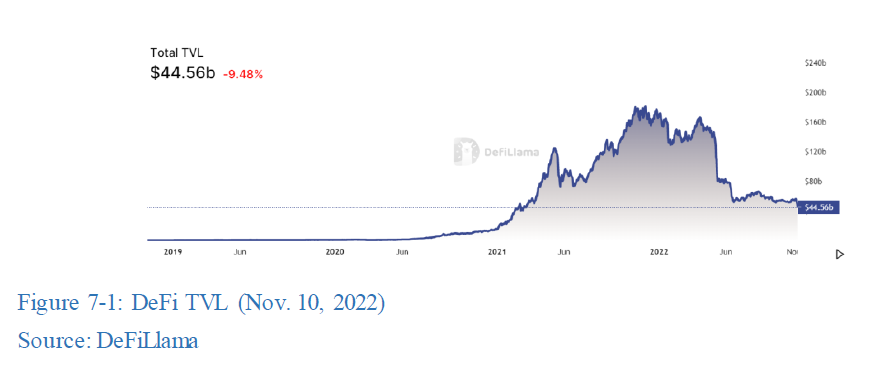

In early days, the development of DeFi had been mediocre: the types of protocols are rather limited, and most of them are but duplicates of traditional finance projected to infrastructures on blockchain. It was not until 2020 that DeFi saw explosive growth with the introduction of the Automated Market Maker (AMM) and liquidity mining, funds started flooding to DeFi. At the end of 2021, DeFi’s Total Value Lock-in (TVL) reached the summit at $182.16 billion.

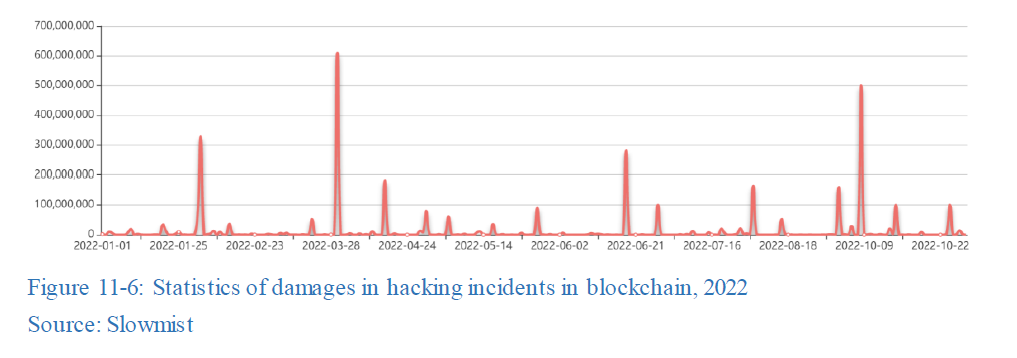

In 2022, DeFi has also been distressed by chain reactions of macroeconomic uncertainty, tensions across borders, black swan events (Terra crash, 3AC, Celsius and FTX incident), increase in DeFi on-chain attacks and vulnerabilities, and general downturn in the crypto market. This chapter aims to reveal the status quo of the DeFi market on different dimensions.

7.1 Status quo of the DeFi in bear market

● TVL

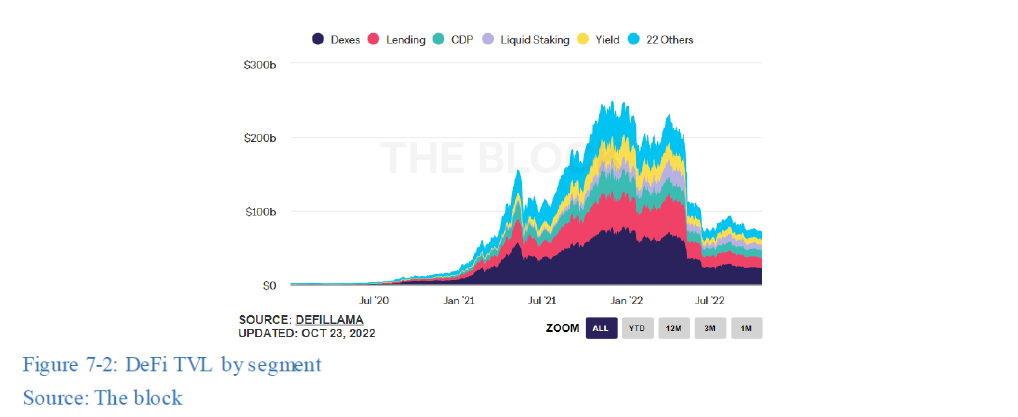

The TVL in DeFi protocols is currently $44.56 billion, which has dropped 75.5% from the all-time high of $182.16 billion, directly reflecting the massive devaluation and withdrawal of capital from the DeFi market. In terms of protocol categories, DEX and lending remain the main battlefield in DeFi, with the sum of the two accounting for approximately 68.1% of TVL, less than that in 2021. In the L1 chain category, Terra has the largest drop in TVL over the past year, mainly due to the collapse of UST, which swept the value of down to almost zero, and in the FTX incident, the Solana ecosystem is devastated again. The rest of the major L1 chains also saw decline in TVL, such as BSC with decrease about 45.1% and Avalance about 59.2%. The bear market only did part of it; according to Beosin’s blockchain security report, over 30 hackings happened in Q3 2022 in DeFi, over $400 million were lost and the whole segment pays the bill.

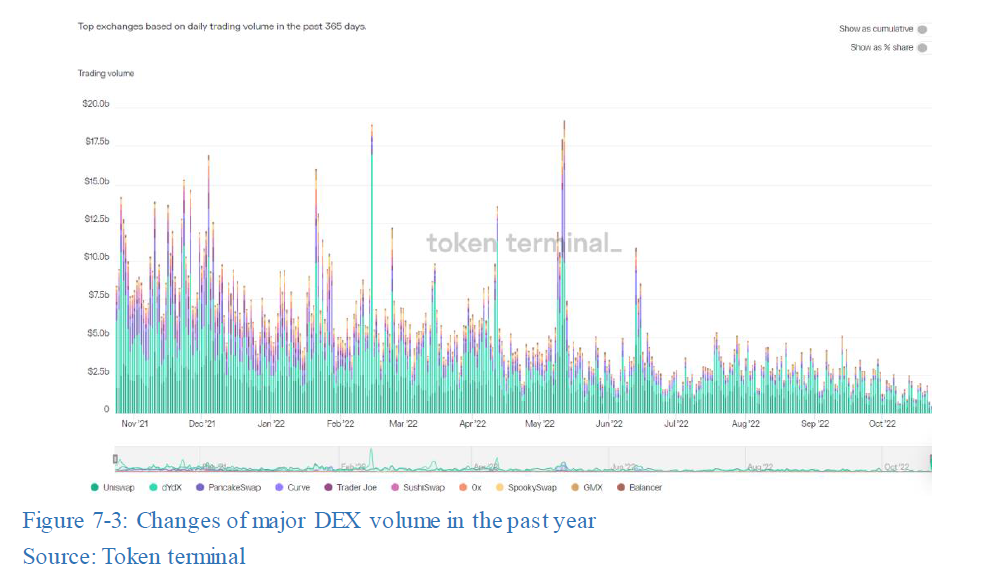

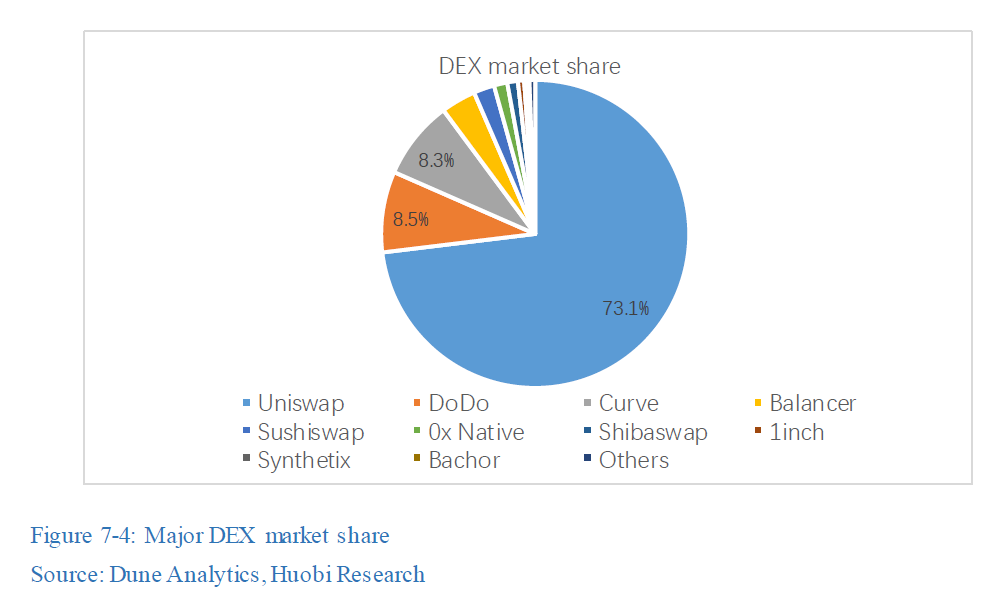

● DEX

DEX is a fundamental infrastructure in DeFi that its trading volume is a direct reflection of market confidence and activeness. Among the top 10 DEXs, the total daily trading volume fell steeply from of $19.19 billion max to as low as only $740 million. However, the DEX segment continues to appear as oligopoly. According to Dune Analytics, Uniswap, DoDo and Curve have ruled the market by nearly 90% of total trading volume. Among them, Uniswap is in a monopoly-like position in the industry with 67.5% of trading volume.

While DEX has not seen a major update as Uniswap V3 in the past year, some minor upgrades were completed by various DEX protocols to pass the winter in crypto.

1. Integration with NFT trading is trending for DEX. On the one hand, the leading DEX, Uniswap, for example, announced at the end of July that NFT trading will be supported after the upcoming integration of the existing NFT trading platform-Sudoswap, and users will be able to access on-chain liquidity provided by sudoAMM in the future. On the other hand, other DEXs, represented by PancakeSwap, have also developed and integrated NFT trading marketplaces on their own platforms, boosting the growth of over 40% in revenue.

2. DEXs are investing in diversification of products to provide one-stop service. Currently, many DEX protocols are no longer monotonic in Swap, but cross-chain, lending/borrowing, staking and wealth management are available as services on the platform to enhance degree of loyalty and attract more funds. In addition, some DEXs based on AMM (SushiSwap, PancakeSwap, etc.) have also derived the traditional limit order mode on the platform for better trading experience.

3. DEXs have started full migration to Layer2 with acceleration in multi-chain deployment. With the diffusion of Layer2, represented by Rollup, many DEXs have announced plans on adopting scaling solutions to reduce transaction costs and improve TPS. At the same time, more and more protocols are being deployed to emerging L1 chains other than Ethereum for incremental user base.

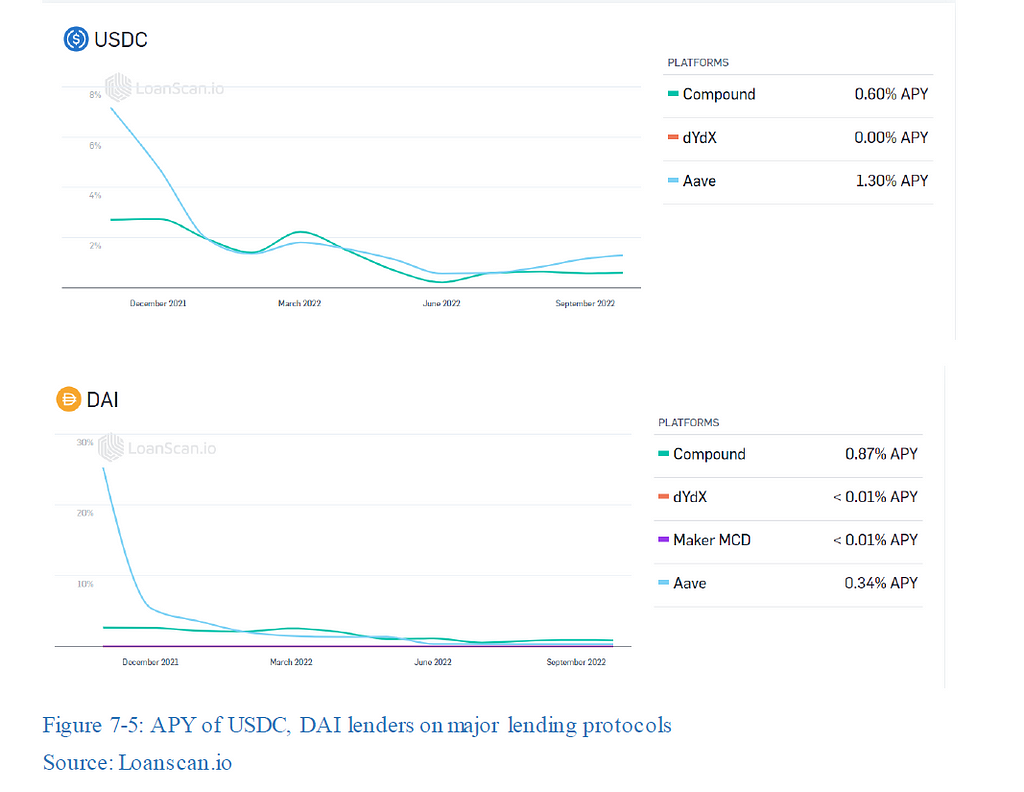

● Lending and borrowing

Lending/borrowing is the second largest in terms of TVL in DeFi. Total borrowings in DeFi fell from $28.4 billion to $16.2 billion at lowest, and total deposits decreased from $78.2 billion to 40.3 billion at lowest. Lending agreement yields are also declining significantly. The yield on mainstream lending platforms, such as Compound, AAVE and MakerDAO, for stablecoin USDC and DAI lenders is only between 0% and 1.5%.

The cheerless market has forced many lending protocols to start actively seeking alternatives in their business. Taking the leading lending application AAVE for example, native stablecoin GHO will be in effective to shield the ecosystem by exploiting the wide spread of stablecoin and amplifying the influence of the platform. On the other hand, with the official launch of ERC-4626 protocol, all interest-bearing certificates, such as Lido’s stETH and cToken on Compound, could be incorporated to various lending protocols through this interface seamlessly. In the future, as more types of interest-bearing certificates enter the list of supported assets for collateral and lending, the capital efficiency of funds can further be elevated.

7.2 Survival and outlook of DeFi

From the data above, we can tell the unfavorable situation DeFi is facing during the bear market. We have the following suggestions for projects hanging in through this round of bear:

(1) Forget about subsidies and build a stable revenue stream. Liquidity mining is the universal ignition for DeFi projects from cold start, and it has become a standard feature for all DeFi projects. However, the nature of liquidity mining is a form of subsidy that some projects coax users into investing in native tokens for seemingly high rate of return on the subsidy out of thin air, while the projects do not have stable liquidity themselves, or even worse: they do not wish to carry on at the very beginning. When a DeFi protocol subsidizes users with tokens and fees for a long time, the loyalty of these users will be attached to liquidity mining. At this point, if the token price were to be diluted by mining and selling, the subsidies will be eroded, the trading volume, liquidity of the pool and trading depth will quickly drain. Therefore, blind excessive returns or subsidies are not sustainable for DeFi in the long run. In other words, only those who could get over with subsidizing day by day and create a bona fide revenue stream will survive till the next boom.

(2) Renovate token economics to a sustainable one. Currently, many DeFi protocols have difficulty accumulating and capturing the value of tokens. Some existing protocols have made attempts on developing sustainable token economics, such as Curve’s VE model: The staking of CRV must not stop as long as users yearn for better governance and corresponding rewards so that whales cannot simply buy in for higher governance authority and rewards in the short term; meanwhile, tokens are endowed with more value and circulating supply is also decreased. As a result, more and more protocols are setting foot on explorations and optimizations in token economics for another growth opportunity by adding more value to tokens.

(3) Explore financial derivatives of DeFi. Each subsidiary in DeFi is almost in equilibrium, and the domination power of leading projects is absolute. There are hardly any new growth opportunities unless disruptive innovations emerge in a bigger picture. Therefore, new projects yet to start could consider something rather mature in traditional finance but almost rare in blockchain, which mostly are derivatives. Although current protocols of derivatives have demonstrated certain competitive advantage, they are at a fairly early stage.

(4) Embrace regulation appropriately. Since the Tornado Cash incident, the crypto industry has officially become the target under severe surveillance of various modern regulatory parties. In addition to the U.S., the EU will also formulate the bill of Markets in Crypto Assets (MiCA) for DeFi next year. In the future, regulation will not only aim at a certain protocol or segment but on the entire blockchain application layer. Therefore, instead of going against traditional financial regulation, it is smarter for DeFi protocols to proactively seek for a balance between blockchain and censorship.

7.3 Stablecoin

7.3.1. A new round of prosperity and crisis for algorithmic stablecoin

Evolution and Collapse

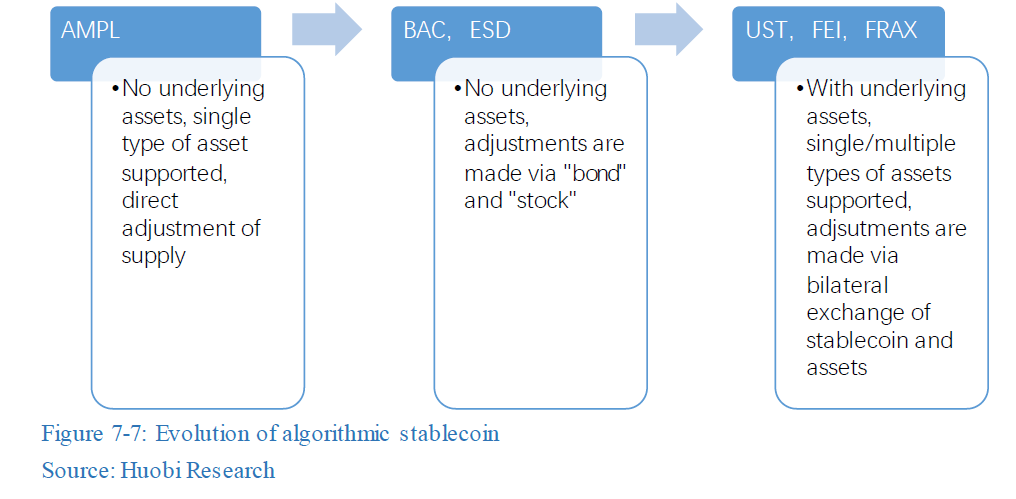

Algorithmic stablecoin was a star back in DeFi Summer 2020, and after two years of development, it has evolved into third generation.

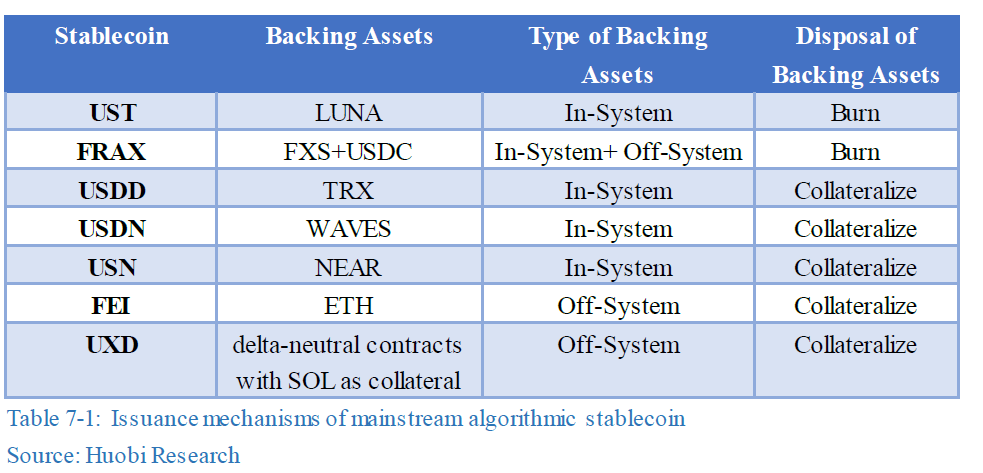

The most notable difference between third generation of algorithmic stablecoin and predecessors is the collateral of sufficient assets to avoid a “death spiral”. In the issuance mechanism, destruction or full collateralization must precede the issuance, which almost fundamentally altered the inherence of algorithmic stablecoin. In this report, we will continue to use the term “algorithmic stablecoin” and define it as a “crypto-asset backed” stablecoin. Only with underlying assets can algorithmic stablecoin withstand the market volatility and decrease in price, thus maintaining the price in peg with the pricing unit in the long run.

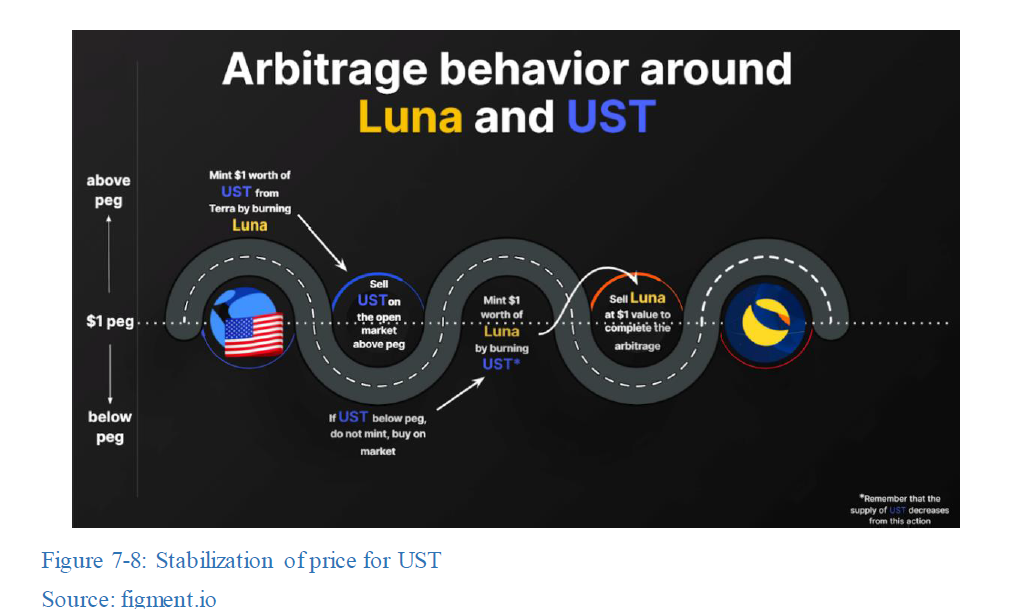

Modifications are also made in terms of the stabilization of price, mostly as the the figure demonstrates below.

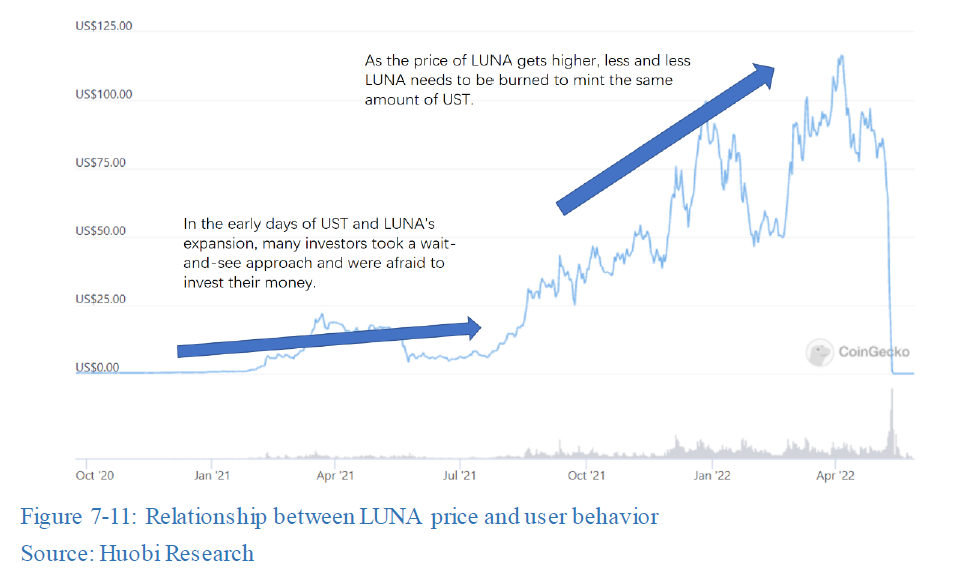

A delicate mechanism design does not guarantee a vast growth of stablecoin. Anchor, a lending protocol on Terra, was the core contributor to the mass growth of UST, where users deposit UST and become eligible for a fixed return of 20% APY. With the influx of users and funds, price of LUNA, issuance amount of UST and TVL of Anchor skyrocketed as a bundle. In March this year, it even passed DAI and became the largest decentralized stablecoin in value.

However, in May this year, price of LUNA has continued to fall first, and a change to floating rate announced by Anchor followed. Meanwhile, the proportion of UST in Curve have lost the balance, and dumped by whales, UST has completely de-pegged from USD and never recovered. Price of LUNA vanished more than 99%, and TVL of Anchor halved within a week. The collapse of UST and Terra has taken the breath of the market. What’s more, some other stablecoin also de-pegged from USD for a rather short period, even being accused as fake.

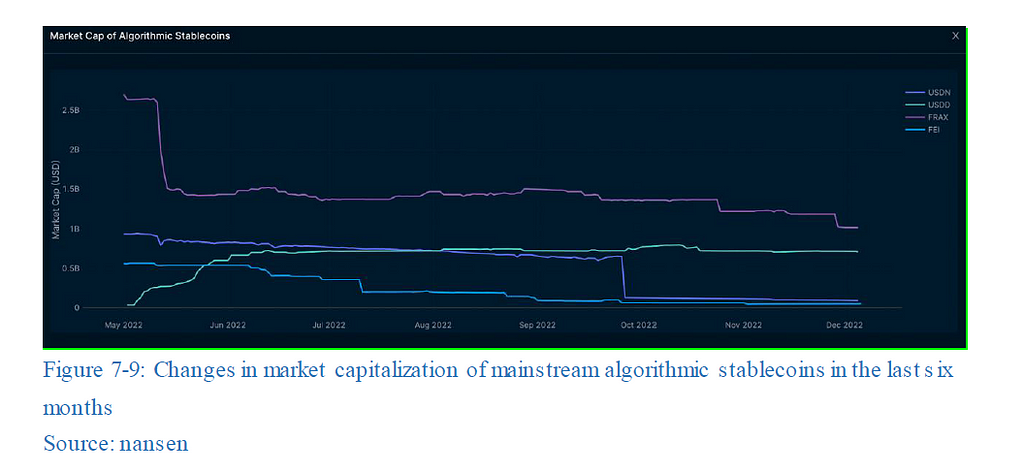

Other projects have also fell off to abyss in light of the consequence. FEI, which used to call itself DeFi 2.0 project on Ethereum, failed to reach consent with the victims and the community on the amount to compensate for the loss and the handling of assets in treasury in the incident of theft on Rari, the lending protocol it merged with. The co-founder resigned before long, and the protocol is therefore completely dissolved. In July, USN on Near claimed that only USDT is accepted for minting as USN, which, in effect, is indeed a nullification of USN as an algorithmic stablecoin; an announced was made in October on the cease of future operations due to insolvency. Although still alive, the circulating supply of USDN on Waves was reduced by nearly 90% after repeated de-pegs, once again seeing the bottom of algorithmic stablecoin. The only one that has managed to withstand the pressure is USDD, which has a collateralization rate of over 300%, supported by a group of CEXs (such as Huobi, Poloniex, Kucoin, Bybit, Gate) and DeFi protocols (such as Sun.io and Ellipsis), and some restrictions apply on redemptions; the issuance instead is almost doubled.

The chart below compares the market capitalization of UST before and after the collapse across current mainstream algorithmic stablecoins. The sum of the market cap of the top 5 algorithmic stablecoins in issue at the time slide from $23 billion on May 8 to less than $4 billion on May 22, a drop of 82.6% in 2 weeks. The total market cap of these 5 algorithmic stablecoins is now just under $2.5 billion, which is about less than 10% from before the UST collapse.

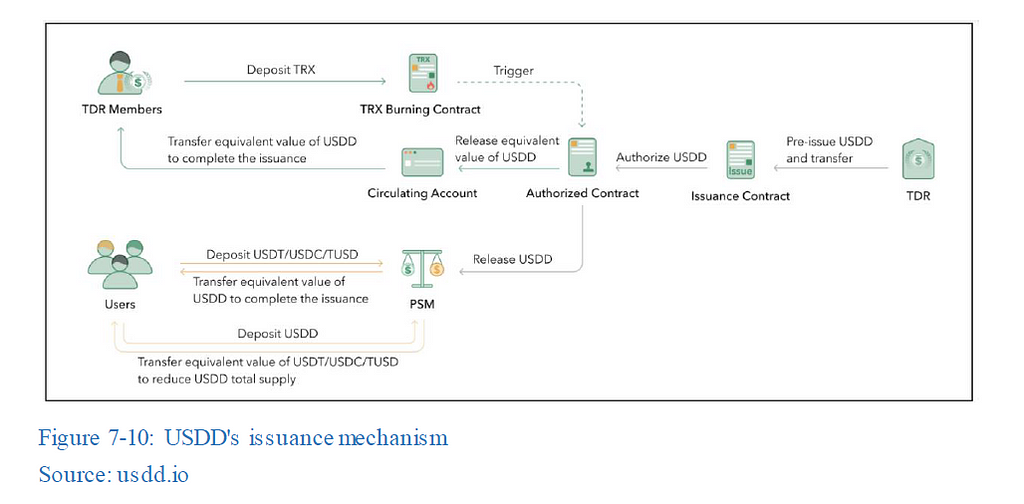

For USDD, the issuance mechanism combines the features of both algorithmic and over-collateralized stablecoin. Only whitelisted institutions by TRON DAO Reverse (TDR) can issue USDD by full collateralization of TRX (as algorithmic stablecoin), for which TDR has a reserve of nearly 200% assets for collateralization (externally considered as over-collateralized) consisting of TRX, BTC, and USDC; only these whitelisted institutions have the right to burn USDD and exchange it for TRX. If any risk is incurred towards the event of de-peg, USDD will not face dumping as it kills the opportunity in the future to do so. USDD is widely adopted by various scenarios, and supported by credible CEXs, such as Huobi, Poloniex, Kucoin, Bybit, Gate and a number of other CEXs, as well as established DeFi protocols, such as Sun.io and Ellipsis. It nearly doubled in issuance despite the almost doom of the whole segment. It was also granted as fiat currency status in the Dominican Republic on October 7, 2022. It is the second cryptocurrency in the world, after Bitcoin, to be granted legal currency status.

Recap and foresights

Why is this generation of algorithmic stablecoin always crashing? What happened to the seemingly flawless mechanisms?

There are two main types of crypto-assets backed stablecoins according to how they are minted: one is destruction of underlying assets while the other is putting assets in collateral. The risk associate with destruction-based algorithmic stablecoins is that the system may overmint the underlying assets when both the price of underlying assets and the stablecoin fall, leading to a steep drop of the price for the underlying asset, and landing a collapse of the entire system.

As what happens to UST, most LUNA are destroyed at high prices and the underlying assets appear to be adequate, but not enough new assets are being added in the unit of crypto. The underlying assets become inadequate when the price of LUNA suddenly drops. As long as the stabilization mechanism is still running, the selling pressure of LUNA will keep climbing, aggravating the decrease of LUNA price, and more LUNA must be in stock to meet the demand of redemption. In the end, it will be difficult to make up the deficit even if all LUNA is resurrected; additional LUNA has to be minted. Within 1 week after the crash, total supply of LUNA has reached nearly 7,000 times than the initial supply; LUNA is just one step away from zero, and UST has become past tense as the foundation is gone once and for all.

Stablecoin with collateralization, similar to stablecoin with destruction of underlying assets, is also subject to a situation where both the price of underlying assets and the stablecoin decrease, and the underlying assets are insufficient. In this case, it is basically “first come, first serve”: users who redeem early are more likely to retrieve full amount of assets, while users who arrive late could receive nothing. As a result, users who are unable to redeem from the official channel will instead turn to the secondary market to sell their stablecoins, thus causing a steep drop in price.

Algorithmic stablecoins were born to improve capital efficiency in a decentralized mechanism. The capital efficiency of centralized stablecoin is to be evaluated by the efficiency of issuance and long-term returns, and only one can be maximized. Over-collateralized stablecoin is sacrificing capital efficiency of issuance in exchange for long-term appreciation of assets; whereas algorithmic stablecoin tends to capture short-term capital efficiency, which in the long run, it depends on how much revenues are generated by the applications accepting the stablecoin.

Algorithmic stablecoins are complementary to over-collateralized stablecoins. For users, if they are more optimistic about the potential of an asset, excessive future returns can be preserved by over-collateralization. If they are confident about the development of one particular ecosystem and desire relatively stable income out of it, algorithmic stablecoins are better.

In the future, if any stablecoin solution could guarantee sufficient collateral assets in reserve, operate under healthy stabilization mechanisms, satisfy various scenarios and adopt flexible asset management strategies, the market will acknowledge.

7.3.2 Reinventing over-collateralized stablecoin

In July, two legacy DeFi protocols, Aave and Curve, both announced plans on issuing stablecoins, rejuvenated the segment from dead silence: the stablecoin from Curve will be named crvUSD without any more details, and GHO, while still a traditional over-collateralized crypto-assets backed stablecoin, introduced some minor innovations, namely the new role of facilitator.

A facilitator is a protocol or entity that has been approved by Aave Governance to exercise the right to mint and burn GHOs. Facilitators can design their minting and burning methods accustomed to the characteristics of their own business. From the perspective of risk management, Aave Governance will set a cap on the amount of GHOs that can be minted per facilitator.

The facilitator will mainly change the game by:

(1) Enhancing the flexibility of the GHO stablecoin system. Multiple institutions are able to issue stablecoins at their own convenience, and a wide range of assets are allowed in the collateral. In addition to the traditional minting methods of staking ETH or AAVE, more minting methods are available as input to collateral, such as real world assets (RWA), Delta mutual positions, credit scores, etc.; liquidity of more assets can be revived in this case.

(2) Performing as the catfish in the Catfish Effect and facilitating the economics of facilitators per se. GHO carries the same functions as a normal stablecoin, but it is bound to the facilitator’s own economic model to drive business operations, incentives, token staking, and other activities. If properly designed, there should be many protocols willing to become facilitators.

The main risk of this move is the increased complexity of the protocol, which could be found exploitable by hackers. The overall risk should be manageable considering the strong technical strength of Aave, and the cap on the issuance of facilitators. It is anticipated that GHO can become an essential asset in the future to meet a wide range of application scenarios.

8. GameFi & Metaverse

8.1 GameFi

8.1.1 Status quo and outlook of GameFi

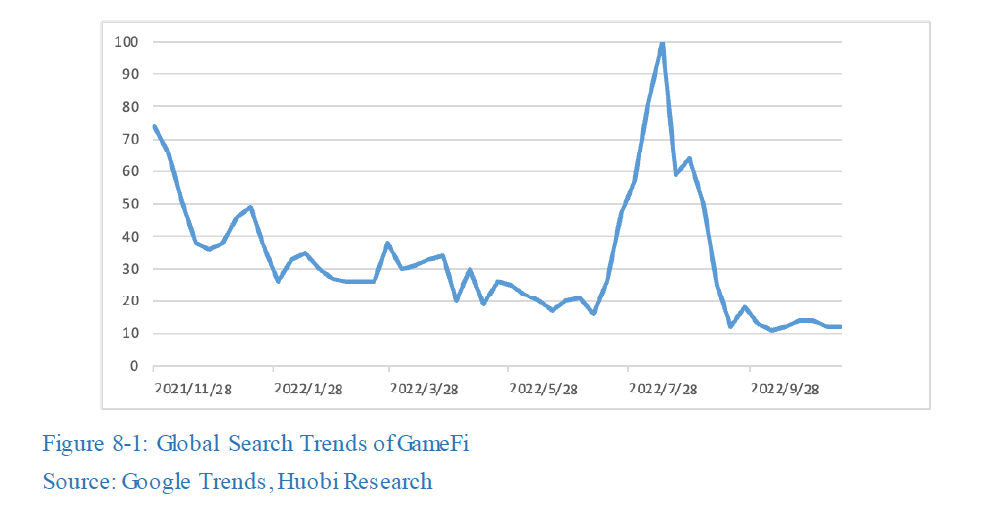

GameFi is a new segment born during the 2020 bull market. GameFi is a unity of gaming and finance: gamers play for fun, while some others profit by financial incentives; games are delicately financialized and incremental traffic was injected and rejuvenated the market. GameFi scored big during last year’s bull market, however, GameFi has seen strong positive correlation with BTC index during the market downturn (Figure 8–1 and Figure 8–2). In the bearish market of this year, projects relied on hype and unsustainable profit models have doomed even worse.

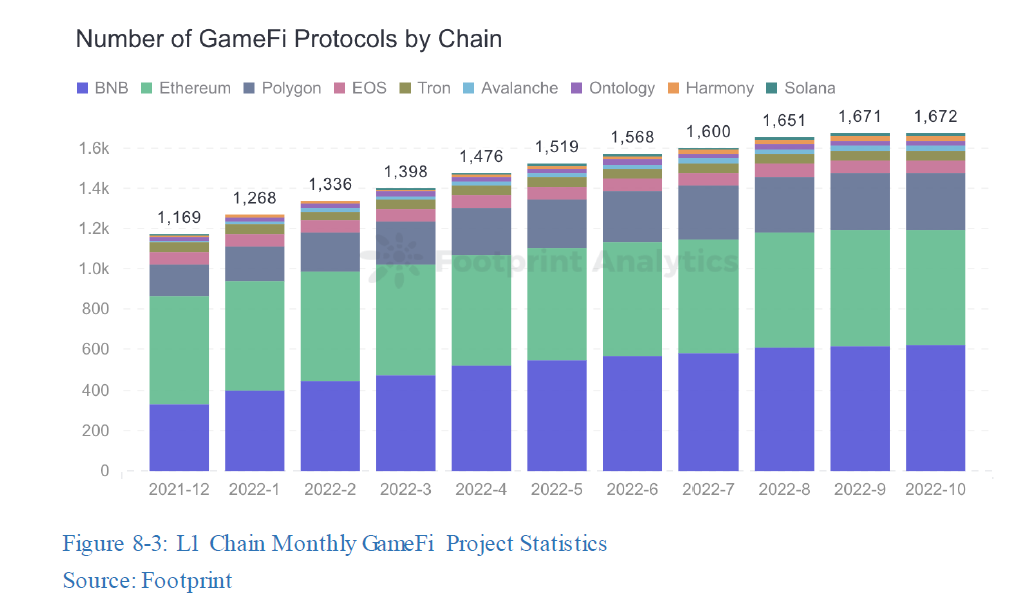

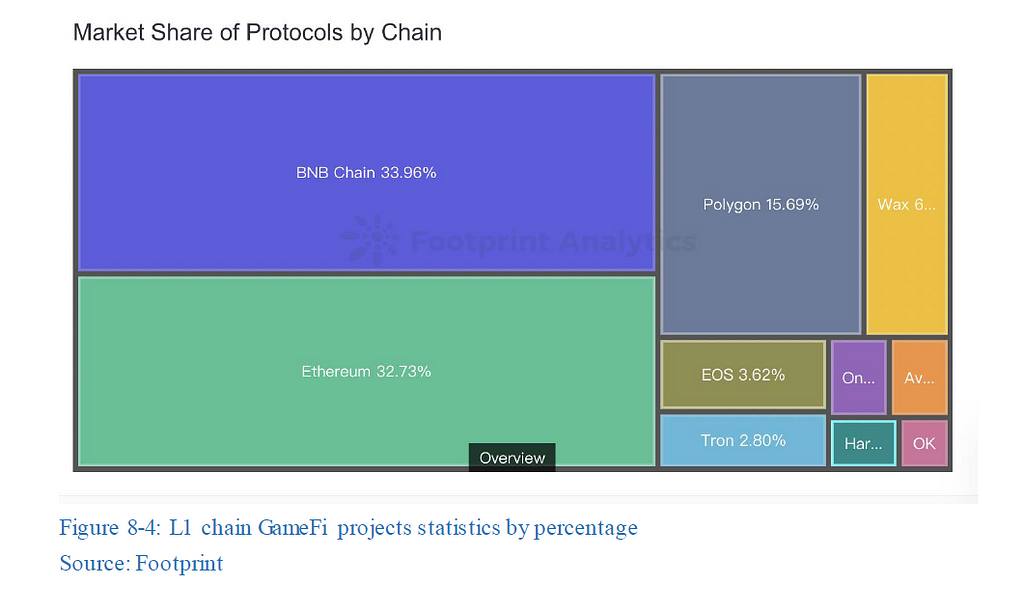

According to Footprint’s on-chain data, the growth of GameFi projects slowed down significantly in May, with only 41 new projects launched during the month, much lower than the number of projects launched in Q1 (Figure 8–3). BSC now has the largest gaming ecosystem after one year of growth in 2022, with over 582 GameFi projects currently (Figure 8–4).

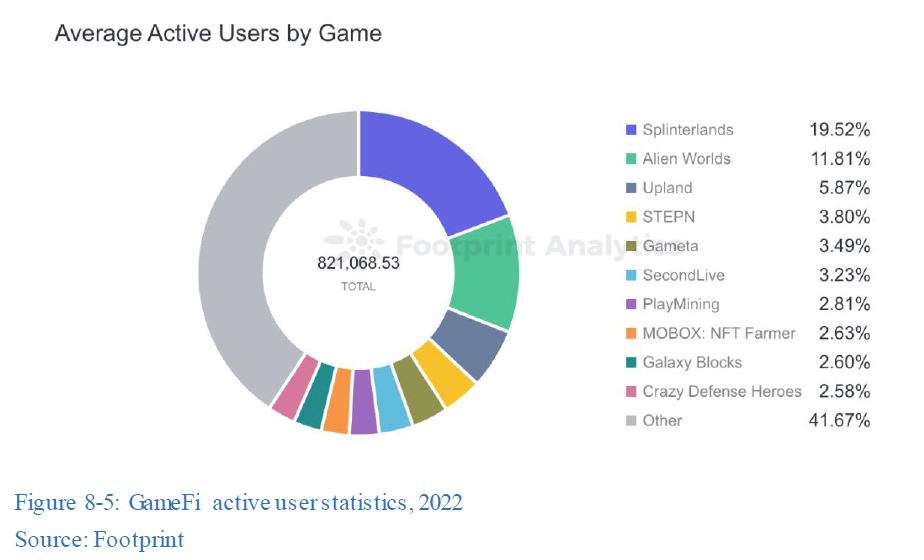

Axie Infinity was the hottest GameFi project for last year and Stepn for this year, but they are no longer in the range of top three in terms of the number of average active users; they have fell way behind the top three blockchain gaming projects, implying that unsustainable gaming economics is not conducive to a project’s growth in the long run (Figure 8–5). On the contrary, Alien Worlds and Splinterlands, two dark horses outside the GameFi scope now rule the market. They are still favored by players even the price of tokens has dropped and the return on investment has decreased. This also suggests that the playability of games can somewhat prevent from falling into asset inflation during a downturn.

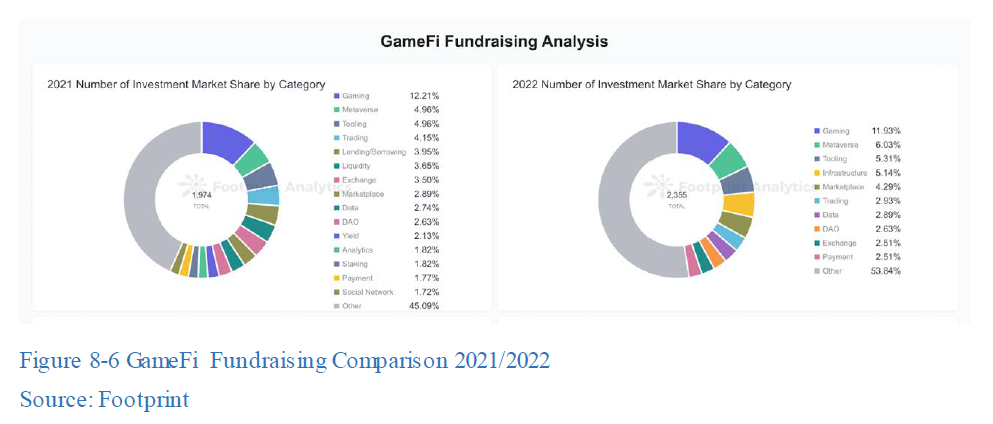

In 2022, capital funds are continuously watching for Web3 investment opportunities, particularly GameFi and Metaverse, as shown in the chart below. For the second year in a row, GameFi and Metaverse exceeded the number of investments under the category of Tooling, Trading and Lending/Borrowing (Figure 8–6). Capital investments in these two categories have surged from $874 million in 2021 to $2.4 billion in 2022.

8.1.2 X 2 Earn brings the pop, what about the next pop?

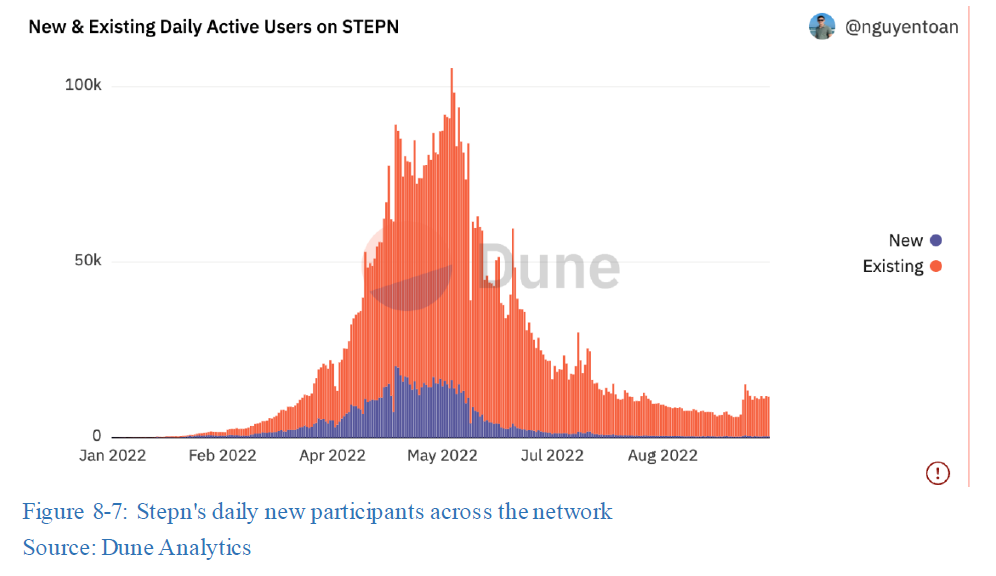

In the first half of this year, Stepn introduced the economic model of Move to Earn to blockchain for the first time, and it literally discovered a treasure island of its own. A large number of Web2 practitioners began to realize that the economic model of Play 2 Earn is not only limited to games; applying token economics to traditional Web2 scenarios will be icing on the cake, and the X to Earn model was born in this context. All kinds of scenarios, including sports, learning, singing or even sleeping, began to be adopted as inputs of the X To Earn model, making attempts to duplicate the token incentive model from online to real life experience. However, with a retrospective view on the development of X To Earn in the past year, the data is somewhat a disappointment. For example, the highest number of daily participants of Stepn reached 100,000 in May, but now it is less than 10,000; new users and investors after the decrease in the number of participants should no longer be able to calculate the return cycle (Figure 8–7).

For the project team, X To Earn introduces more brick-and-mortar scenarios to players compared to Play 2 Earn, which to some extent solves the current problem of poor playability of blockchain game and enhances the level of user loyalty to the game, but it remains controversial whether numerous scenarios are in bona fide need of token economics, and whether it is a sustainable business model that can be justified.

For users, projects with X To Earn sets high threshold to enter as users must hold designated NFT to get in. This marketing strategy is friendly to early adopters: the early holders often purchase at a lower price. In a typical hunger marketing strategy driven by “invitation only” mechanism, users would flock to join. With the increase in the subsequent reproduction of NFT, the value is constantly diluted; in other words, it is almost rare not to see dumping activities by early users in a bear market when no fresh blood is injected to the market. Users with such FOMO mood often buy at overpriced with more risk exposure to loss. The simple swift hand-changing activity from the hand of old to new, in fact, is also the main reason for X 2 Earn being infamous and accused as a Ponzi.

X to Earn inherited the dual token + NFT incentive model first introduced by Axie Infinity, which, if not designed properly, could severely affect the value of token incentives and impede the retention of daily users. So far, neither Play 2 Earn nor X to Earn has been able to effectively control the inflation of in-game tokens.

In the long run, the influx of X to Earn players will naturally escort X to Earn projects out of current dilemma, but the aforementioned issues are urgent, such as how to offset the inflation of game NFTs and game tokens, enhance the ecological construction of the project, reduce the financial attributes of gold farming, and implement business model in brick-and-mortar. Only when all the issues above are deliberately handled could X to Earn stepped out of the mist.

8.2 Status quo and outlook of Metaverse

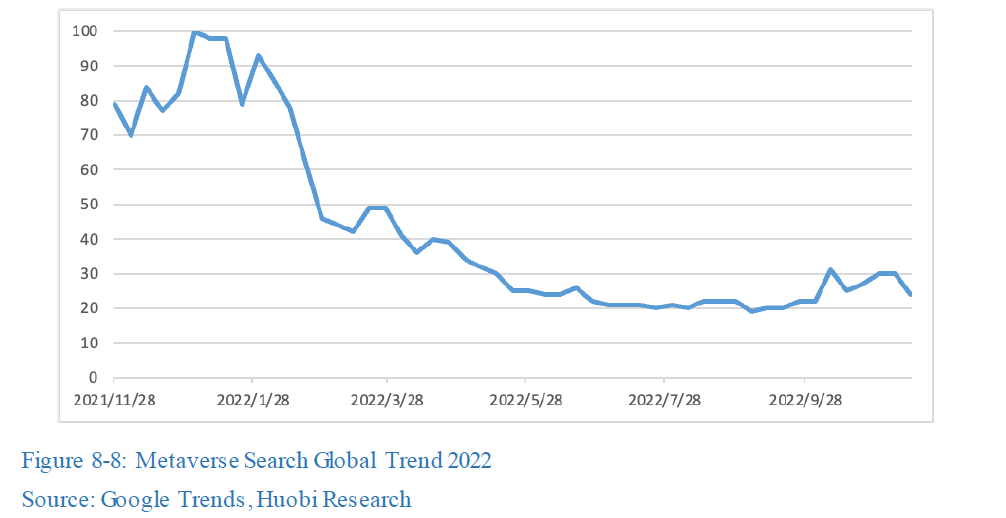

The year of 2021 is the genesis of Metaverse, relevant games such as Roblox, Decentraland and Axie Infinity became more well-known last year. In November of last year, the hype of Metaverse stormed the world. This year, as the market went bearish, Metaverse related segments and projects have cooled down a bit (Figure 8–8).

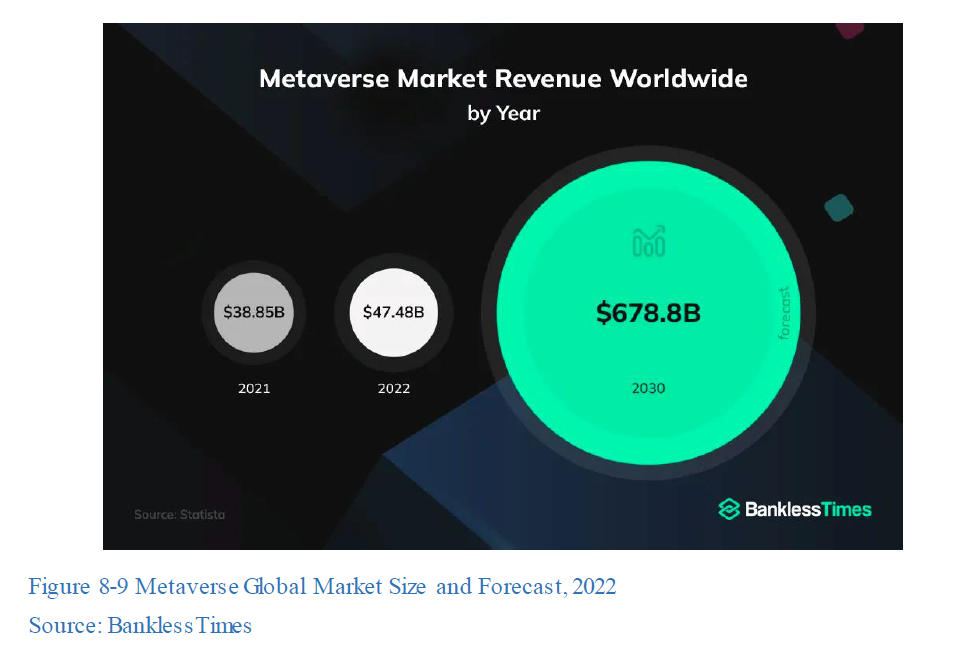

According to Statista, the market size of Metaverse reached $38.5 billion in 2021, $47.48 billion in 2022, and is expected to reach $678.8 billion in 2030 (Figure 8–9). For cryptocurrency, a relatively large variety of assets are throughout the Metaverse segment with a total market capitalization of more than $1.8 billion.

Metaverse is a new type of internet application and social existence combining many innovative technologies that integrates the real world and the virtual world to a whole. Metaverse is powered by virtual reality technology that provides an immersive experience based and projects as a mirror image of the real world based on digital twin technology; an internal economy is operated based on blockchain technology, enriching the virtual world with inputs from the real world, such as economics, social system, and identity system, enabling productive content generation activities to be done by users. On the industrial level, the underlying technologies of Metaverse involve a series of cutting-edge technologies, including but limited to 5G, cloud computing, expanded display, robotics, neural interfaces, artificial intelligence and blockchain.

As for national interest, many governments have already dabbled to joint venture with enterprises in commercial development and institutional design of various versions of Metaverse, striving to be the rule maker, for example:

China: In January this year, officials of Ministry of Industry and Information Technology of China made an announcement at a press release of the development of small-medium-sized enterprises (SMEs) that the government strongly encourages and aims to nurture a number of innovative SMEs to enter into avant-garde technology markets such as Metaverse, blockchain, and artificial intelligence. In addition to the voice at the national level, more than 20 provinces, cities and regions have issued relevant supporting documents to provide soil for related industries to land and prosper.

United States: In March 2022, President Biden signed the Executive Order on Ensuring Responsible Development of Digital Assets, which urges all agencies to conduct research on technological innovations and regulatory policies for cryptocurrencies, digital assets, and other technologies, emphasizing the cementation of the U.S. leadership in the global financial system as well as digital assets [4]. Big social companies represented by Meta are also actively talking with policy makers and industrial experts to provide reference suggestions from a practitioner perspective in order to coordinate with various stakeholders in Metaverse and enforce a code of conduct for the virtual world.

EU: On September 20, 2022, the President of European Commission Ursula von der Leyen claimed the adoption of the Work Programme for 2023. As part of the agenda, the letter of intent proposes an initiative that “continue looking at new digital opportunities and trends, such as the metaverse.” The European Commission desires to ensure safety and equivalent opportunity in Metaverse, and plans to set out a series of specific legislations in 2023.

South Korea: On July 2, 2022, the South Korean government announced that direct investment will be made in Metaverse project from the government. According to a statement by the Minister of MSIT Lim Hyesook, more than $177 million will be invested to state-owned enterprises in this field. South Korea is one of the first countries in the world that makes direct investments. This batch of investment is part of South Korea’s intentions to incorporate latest technology focus into its new ruling regarding digital governance. It is also considered the guidelines the government is following to set industry standards and drive the transition of the society to a fully digital one.

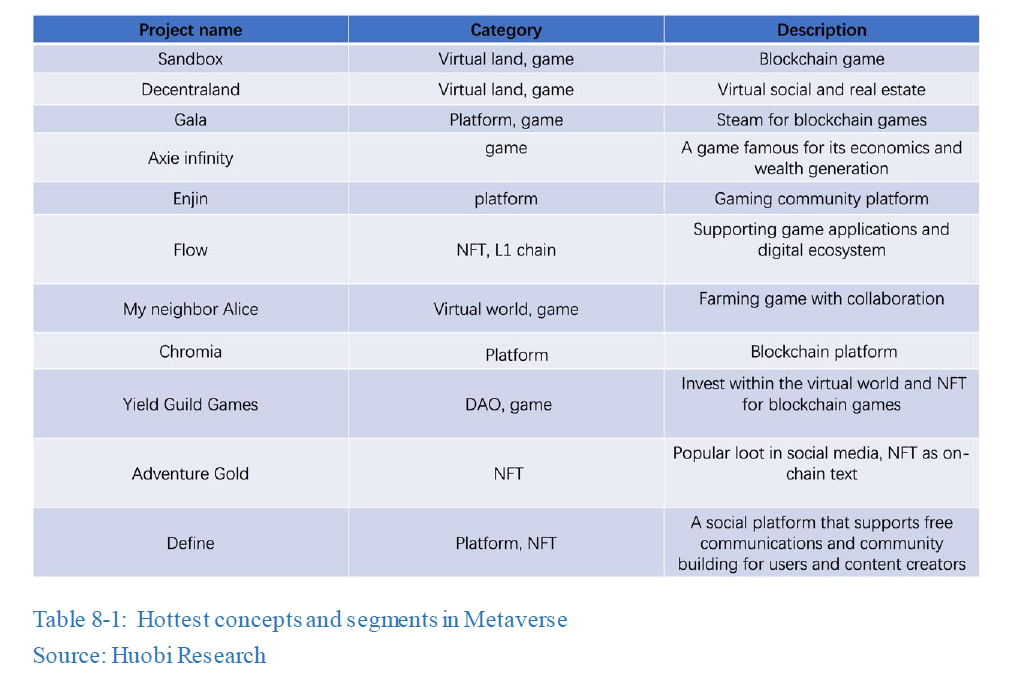

In the blockchain field, Metaverse can be segmented to several specific areas, including: GameFi, NFT, Platform, Web3, Social, and Virtual World.

So far, although an initial sketch of the industry has been shaped, some remain in the phase of concepts merely existing in the hype of capitalists; it takes time for the concepts to materialize. Stories are easier to be told in the context of Metaverse, it is not just more convincing for average investors but also the capitalists; that is how bubbles are generated by storytelling. During last year’s bull market, a large number of projects sprung everywhere, but hardly any of them is active now; it is a perfect example elaborating significance in long-term R&D and input. Nonetheless, we should still be optimistic about the market of Metaverse, for even with the market downturn, the scale of Metaverse still exceeded that of last year, which further depicts the potential of the industry.

In the market of Metaverse, finally blockchain and traditional businesses found something in common, giving birth to countless opportunities. It is evident that traditional technology companies, game companies, internet companies, and others are starting to explicitly step into this field, and this topic has always been the center of the conversation in the primary and secondary markets of traditional financial market. In the future, we believe that Metaverse will be one of the bridges connecting the inside and outside of the blockchain world, becoming an epoch-making existence.

9. Mining: threats and opportunities of POW and POS

POW mining has seen the vicissitude in 2022 influenced by the bear market and the merge of Ethereum. In the bear market, mining costs are rising, and many miners are not able to sustain; Bitcoin are sold at low prices to pay off the debts that less Bitcoin are seen in holdings of crypto mining firms. Meanwhile, the coming merge of Ethereum has shut the door to some POW miners; they instead turn to other POW mining. After the merge of Ethereum, liquidity staking has become prevalent and vital in Ethereum on validations of nodes.

9.1 Status quo and changes in POW mining

POW mining is highly controversial because of the consumption of electricity as the government are concerned on both the environmental effect and regulation. The largest project representing POW consensus is Bitcoin. The changes in the Bitcoin mining this year can be elaborated in terms of (1) the advantageous/disadvantageous policies of various governments, (2) the restructuring of power grid in various countries, and (3) changes in the crypto market. The two cycles must be taken into consideration: the macroeconomic cycle and the halving cycle for block rewards.

In terms of policies, the largest influential event on Bitcoin mining in 2021 must be the expel orders in China: many Bitcoin mining activities are transferred to other nations, with the U.S. becoming the country with the largest share of Bitcoin hashpower; some states in the US enacted specific policies as support to mining firms. For example, Bitcoin mining activities could be conducted with renewable energy in Texas, such as powers from wind turbines, and Oklahoma offers tax incentives for Bitcoin mining firms.

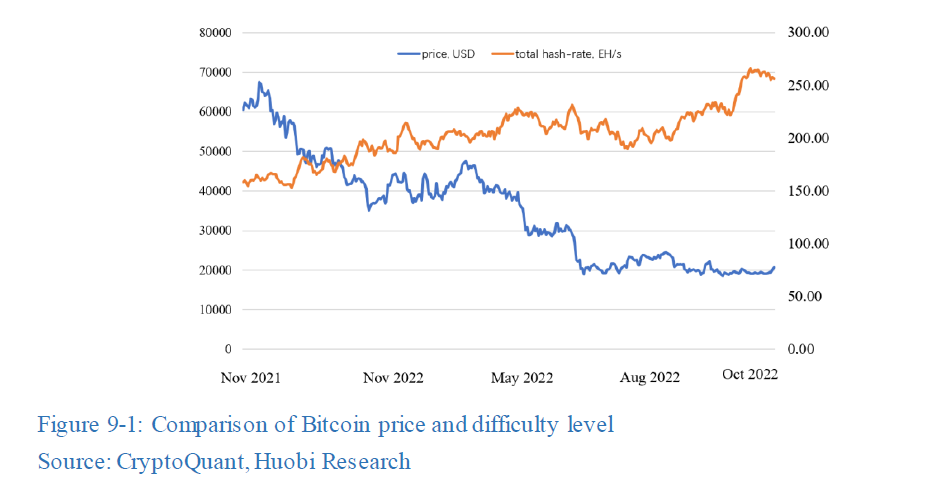

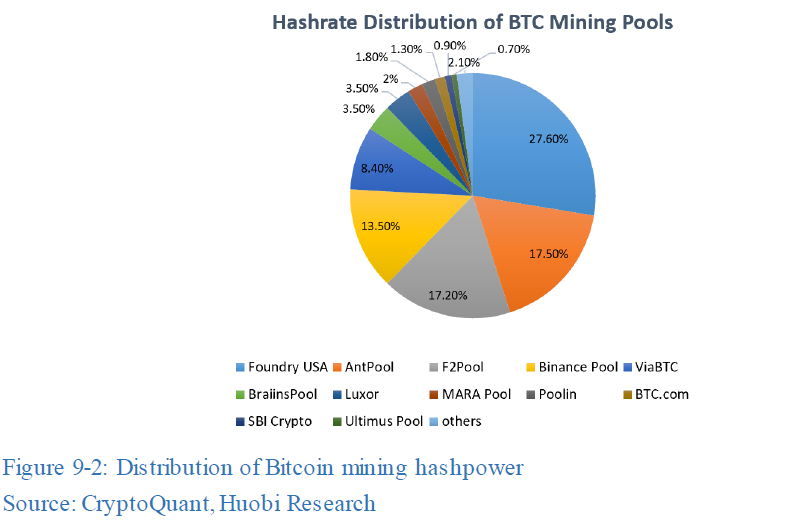

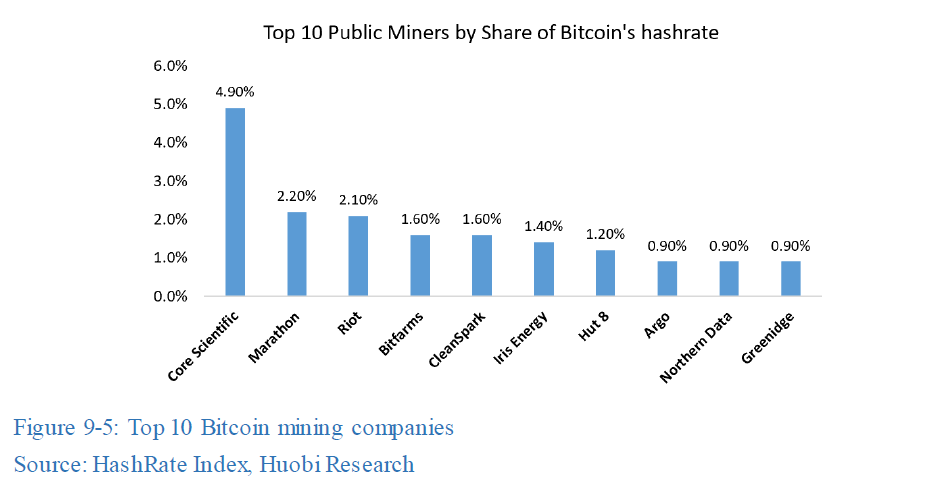

According to HashRate Index, hashpower of Bitcoin mining is dominated by the four major mining pools: Foundry USA, AntPool, F2Pool and Binance Pool, occupying more than 70% of the hashpower. In terms of the market, the efficiency of Bitcoin mining depends on three major factors: hashpower, level of difficulty, and Bitcoin price. In 2022, the accumulated hashpower for Bitcoin network is around 200 EH/s, with mining difficulty has escalated. Moreover, upgrades of mining methods and hardware even accelerated the increase in hashpower as well as the cost of mining, miners are making less profits. Many mining companies faced financial distress this year. Since mid-June, price of Bitcoin has fallen below $25,000, close to the shutdown price for most miners. The “difficulty/price” curve unravels that profit margins are much lower in 2022 as the overall “difficulty/price” curve is higher in 2022 compared to 2021. The difficulty level is growing much faster than the price of Bitcoin, more miners were escaping as revenues for miners hit all-time low for the entire third quarter despite the difficulty/price ratio had a slight decline in August.

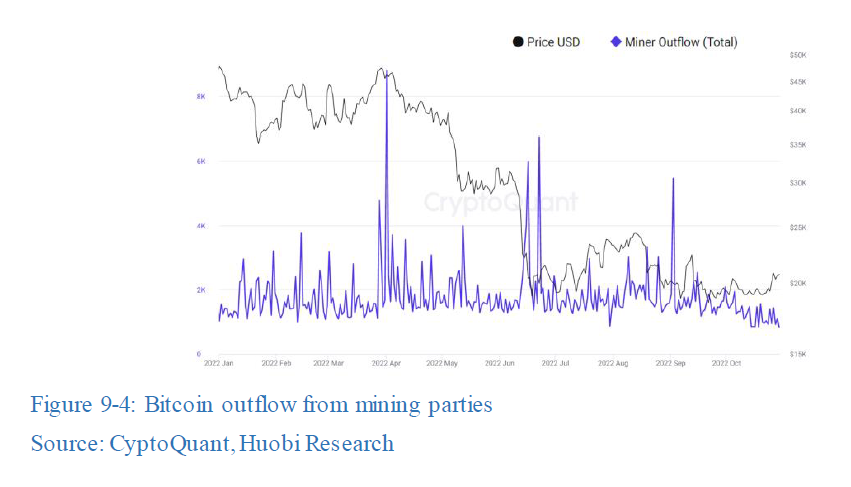

According to CryptoQuant, there were numerous dumping activities of Bitcoins by miners in April, June and September; Bitcoin holdings by miners decreased to 1.91 million, a nearly 12-year low. Core Science (CORZ), the world’s largest Bitcoin mining company, sold 7,202 bitcoins in June, and only 24 Bitcoins are in the wallet; a bankruptcy and liquidation are on the way. Other POW networks are also facing decline in hashpower and token price, specifically, Monero. With the continuity of bear market and global recession, bitcoin prices could fall below the bottom line for mining entities, and with soaring energy costs, more mining firms will face bankruptcy.

9.2 The merge of Ethereum: a different mining landscape

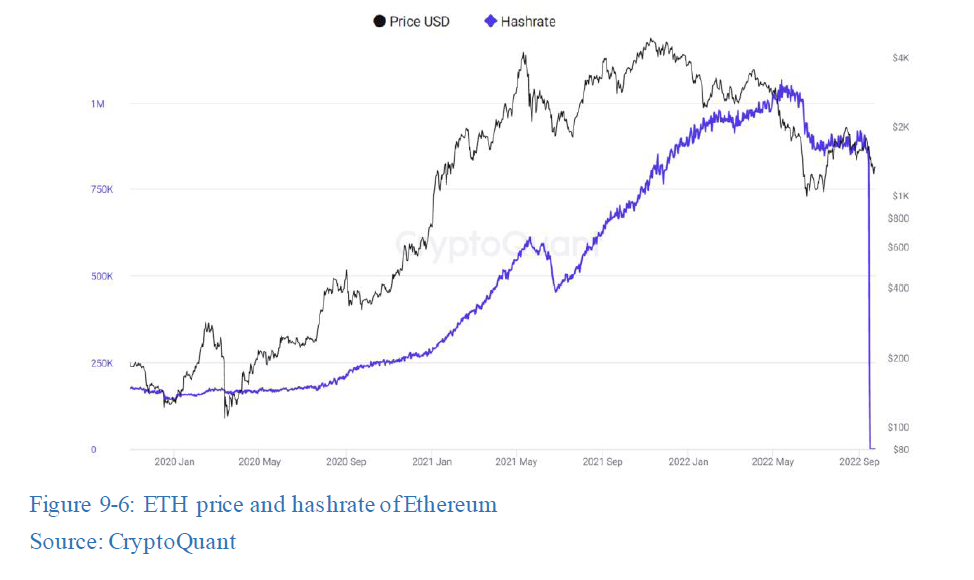

On September 15, 2022, Ethereum completed the merge, stepping into a brand-new era: the consensus mechanism was converted from POW consensus to POS; under POS, block generation will not depend on computing power any more, and the miners will not work under the new scheme, and outdated. In May 2022, the hashrate of the Ethereum network reached an all-time high. Not long after, expectations on the merge started to influence miners that almost all miners started to exit, and the hashrate dropped.

There are two types of Ethereum miners: ASIC miner and GPU miner. An ASIC miner has absolution advantage on performance as it specifically uses ASIC chips as core computing parts for algorithms, whereas a GPU miner is also known as graphics card miner. ASIC could mine Bitcoin, ETH, Ether Classic (ETC), but the ASIC miner for Ethereum can only be functional in ETH and ETC mining; as it cannot be converted to other algorithms, it barely could be sold. L1 chains that supports GPU miners are Ethereum, Litecoin (LTC), Ether Classic (ETC), Dash, Zcash. Besides mining, GPU miners can also provide computing power in Web3 applications, or be deployed in Web2 data centers for hyper computation.

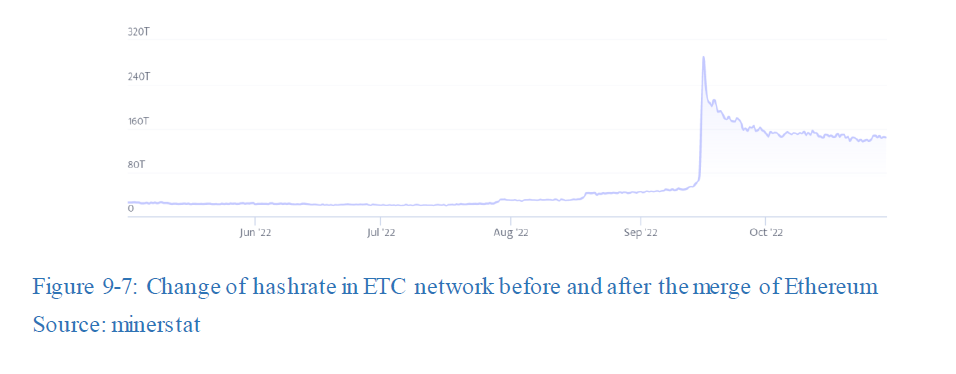

Upon merge, miners had three exits: (1) sell GPU miners; (2) switch to miners on other l1 chains; and (3) adhere to hardfork. As it is not economically feasible to switch to other networks since the risk in a bear market cannot be estimated and the overall return is minimal, most miners chose to sell their GPU miners, resulting in a decline of over 50% in graphics card price since December 2021. The remaining small percentage of miners went to ETC, and the ETC price had a significant increase in July, but the income from ETC mining is still trivial compared to Ethereum; the price increase of ETC was main caused by speculative activities. After the smooth merge of Ethereum, ETC’s hashpower increased by 5 times and now maintained at 141.4571 TH/S, while DASH had some increase of hashpower for rather short time in September.

The third option for miners has sparked a huge controversy in the industry. So far, it seems that hard-forked project from Ethereum, ETHW, is indeed successful. Early supporters are some miners, users and exchanges. The main ETHW mining pools are 2Miners, F2Pool, Nanopool, HeroMiners and Poolin; the whole network has a total of 209 mining entities and the network hash rate is currently 35.11 TH/s. ETH holders also received candies from the hardfork, and the circulating supply of ETHW is 106 million with the price of $7, ranked 63 in terms of market cap. Early ecosystem is established by developers with a sum of 52 projects, including 3 cross-chain bridge projects, 7 wallet projects, 10 DEX projects, and 5 NFT trading markets, etc. Whether ETHW could become a competitive L1 chain in the future depends on future movements of performance improvement and the number of featured projects.

9.3 POS as a service: grand opening of a new era

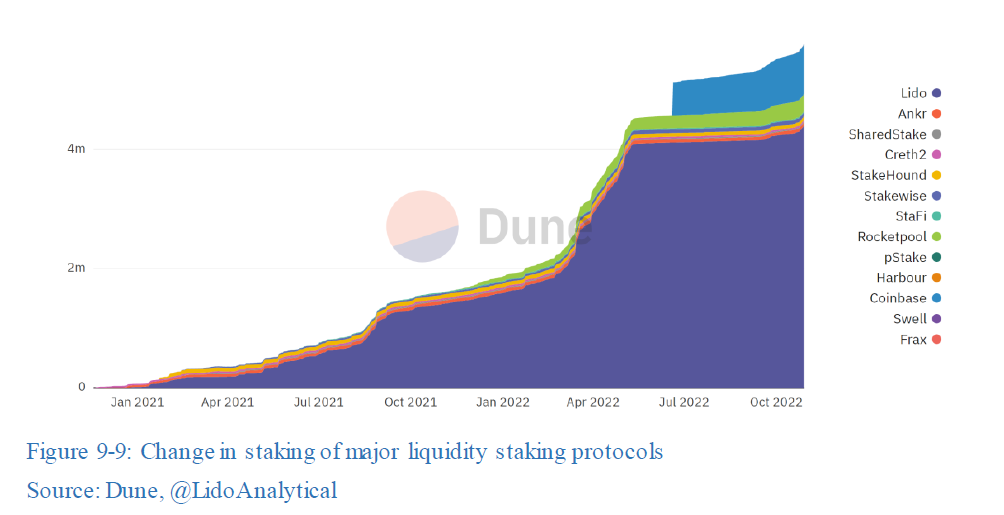

The merge of Ethereum disbanded POW mining by GPU to an end, but also embarked a new opportunity of POS. At least 32 ETH must be in staking to run a validating node as a validator. As of October 2022, about 15 million ETH have been in staking in the network since the launch of staking as a service a year ago, accounting for 12.56% of the total ETH supply; total validators reached 455,066. Validators must stay online or the ETH in staking will be forfeited. Based on current state of the network, the APR for validators is around 4%.

There are 3 ways to participate in network validation and functional nodes even if the criterion of 32 ETH in staking or conditions on hardware is not met: (1) through a node operator, known as an ETH 2.0 staking service provider; (2) a custodian; and (3) liquidity staking. Even with staking service from a node operator, 32 ETH must also be deposited while hardware is not mandated. The operator can act on behalf of validators, for which a service fee is applied. Some CEXs and wallets offer staking services for smaller amount (less than 32 ETH), which users with less than 32 ETH could participate in staking jointly. The first two methods are similar to escrow services, and the credibility of service providers must be verified before action.

The ETH and proceeds from staking will not be available for withdrawal until the next network upgrade, and liquidity staking was born in response to the long period of staking, which is, in fact, a waste of resources for investors. A liquidity staking protocol is a smart contract that creates a staking pool on Ethereum. The protocol supports staking less than 32 ETH; by minting exact same number of dummy tokens as credentials for the actual ones in staking, users are able to interact in other protocols by holding the dummy tokens with the same functionality, resolving the liquidity dilemma for staking.

9.3.1 Analysis of liquidity staking segment

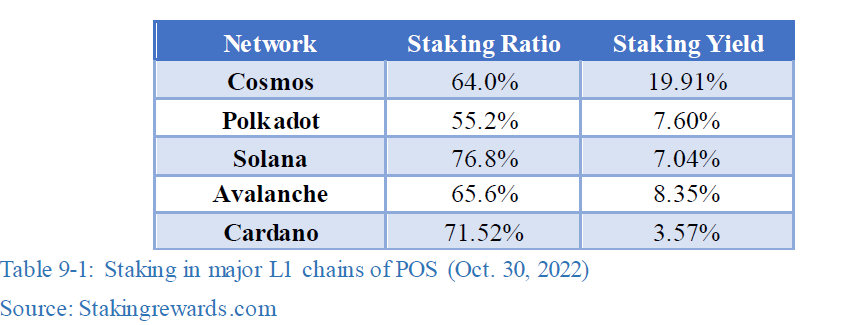

Liquidity staking is worthy of attention: (1) The competition in staking is intense. Except for staking of ETH 2.0, most POS chains provide staking services; besides, more than 40,000 service providers of staking are plotted on each chain. (2) ETH staking has great potential. Compared with the staking rate other POS networks, such as Cosmos, the staking rate of ETH has larger room for growth. Moreover, for the security concerns, official team will invest in bringing more participants into staking. (3) Liquidity staking has demonstrated advantages. Liquidity staking is a derivative entirely from ETH 2.0 and also diffused on other POS networks based on specific scenarios. In terms of staking market share for ETH 2.0, liquidity staking protocols have taken up a significant proportion, with Lido ranked first and other protocols thriving, such as Rocket Pool and Stkr (Ankr).

For users, liquidity staking protocols are appealing in 3 ways: (1) as user-friendly it is, not all 32 ETH must be on hand to participate in network validation and benefit from the profits; it could be deemed as a relatively stable and safe fixed-income type of product; (2) tokens in staking can be withdrawn at any time, and no threshold; (3) the dummy tokens could liberate the liquidity in staking and release it elsewhere in ecological applications, such as DeFi; the capital efficiency is vastly improved; (4) not only earnings from validation can be received, but earnings from governance also become feasible.

Each staking pool differs from each other:

● Lido

The relative replicate of staking on Ethereum is stETH, capable of receiving rewards for staking and transaction fees in ERC-20 tokens. The whitelist of validators is selected by the Lido DAO via governance. Holders of $LDO are endorsed with rights in governance.

● Rocket Pool

The relative proof of staking on Ethereum is rETH, which differs from Lido in that the Rocket Pool does not leave the decision of validator assignment to token holders. Anyone could become a node operator in the network by creating a “minipool”, subject to certain conditions in staking as security measures.

● SSV

SSV is the most anticipated project of liquidity staking. The most notable feature is the complete decentralization of the protocol, which is known as the king of anti-censorship. Security of asset is ensured the adoption of Distributed Validator Technology (DVT) technology.

The risks of liquidity staking protocols have become never more prominent in current bear market:

(1) Certificates from liquidity staking, which are similar to futures, representing the principal and right of collecting return from participation in staking; the price is decided by supply and demand. In the bear market this year, especially when there is a lack of confidence in the merge of Ethereum, de-peg of the price of stETH appeared;

(2) All DeFi protocols are subject to attacks on smart contracts. Although liquidity staking protocols are all secured by multi-signature technology, they are essentially custodial services, which the risk for being the target of attack applies.

(3) Even though each liquidity staking protocol works differently, the tokens in staking would ultimately circulate through validating nodes. That being said, misconducts from nodes may still be an issue regardless of which nodes are on the whitelist of Lido.

(4) Certificates from liquidity staking are flowing everywhere in the DeFi world, but origin of liquidity might drain;

(5) Liquidity staking protocols dominate the validation network of Ethereum, imposing a threat on the level of decentralization to the network; governance tokens may also have influence to the ecosystem somewhat.

Liquidity staking protocols face intense competition from each other, comparative advantages could be found in two ways: (1) cooperating with other Dapps and providing more application scenarios for minted certificates, especially on revenue-bearing products; (2) deploying on more L1 chains; and (3) improving the security level of the protocol, for example, on verifiers. The future of liquidity staking protocol depends on the overall development of the main chain in the long term, incident like the crash of LUNA means doomsday to such protocols. Besides, the capability in the capture of value, construction of the on-chain DeFi ecosystem, and many other factors all have an impact on the protocol. The expectations on deflation of Ethereum and the increase on returns rom staking have brought opportunities on liquidity staking protocols in the bear market.

10. Global crypto regulatory environment

The year of 2022 is a milestone for crypto in terms of regulations.

In August, Tornado Cash was sanctioned by the U.S. Treasury Department, and the launch of regulations on on-chain activities triggered profound discussions in the industry. After the FTX incident in November, the regulation of centralized institutions such as CEX will become stricter; self-discipline of exchanges and transparency on reserve of funds may become the standard.

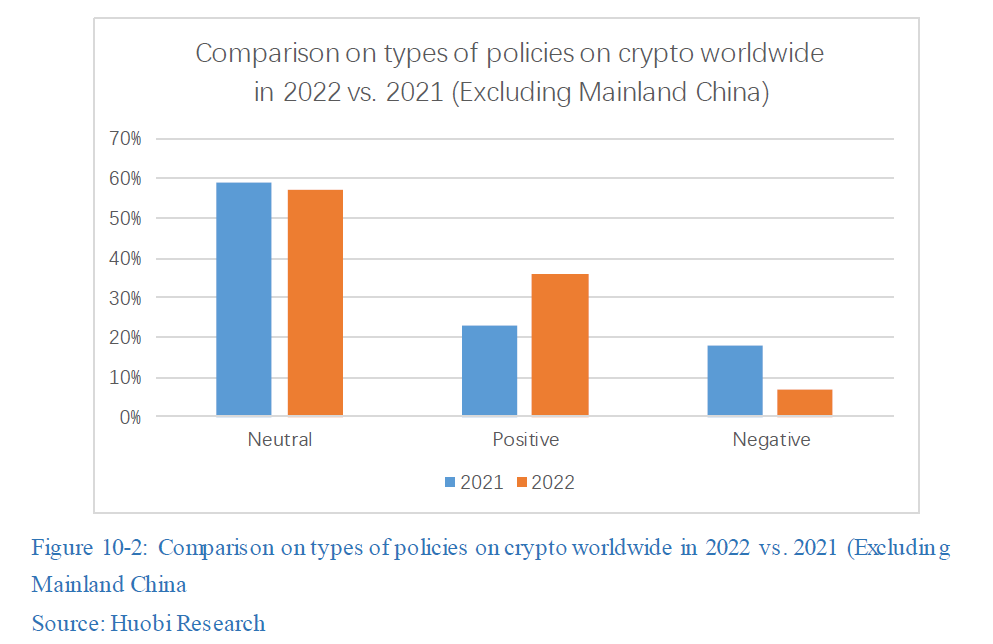

The mainstream countries that support cryptocurrency, represented by the U.S. and Europe, have set the basket of regulations on cryptocurrencies on the agenda from upper-level framework this year. In March, President Biden of the US signed the Executive Order on Ensuring Responsible Development of Digital Assets, which urges all agencies to conduct research on technological innovations and regulatory policies for cryptocurrencies, digital assets, and other technologies, which is the first time the U.S. government enacted full-scale measures to regulate the crypto market. In October, the EU passed MiCA and TFR at large, and a unified crypto regulatory framework will be established internally. Compared to 2021, the number of favorable regulatory policies gradually increased and the number of negative ones were less heard in 2022, and the policies introduced were mostly on cryptocurrency trading and stablecoins.

Thorough analysis on policies of various countries worldwide towards cryptocurrency will be given in this chapter to interpret status quo and trends of global crypto regulation in depth.

10.1 The global crypto regulatory landscape in general

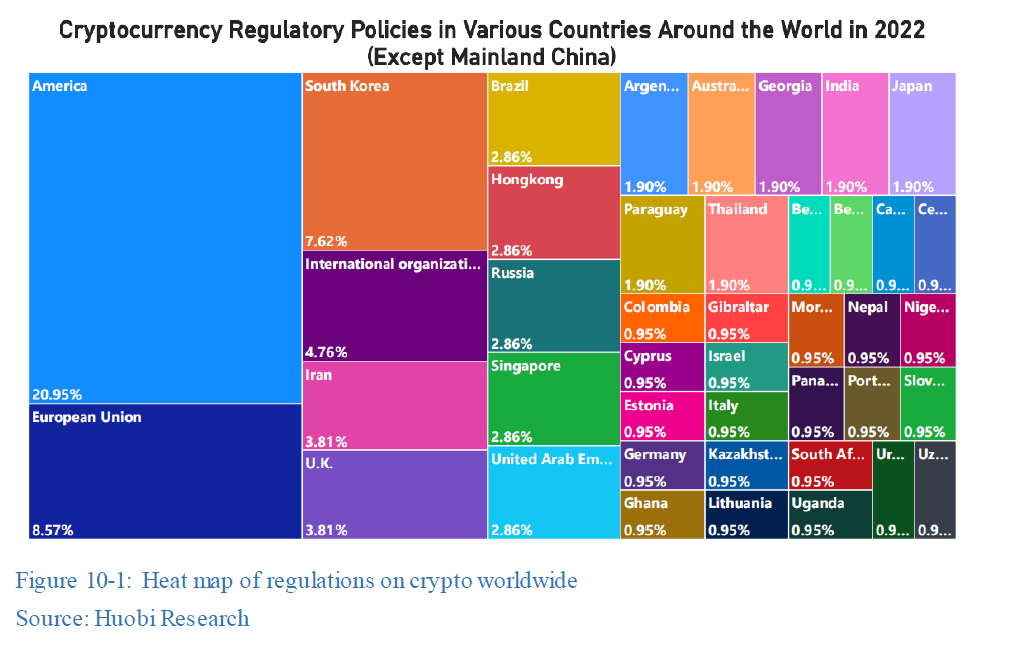

According to statistics on global regulations by Huobi Research, over 42 sovereign countries and regions around the world, excluding mainland China, have issued 105 regulatory measures and guidance for the crypto industry since 2022.

From a regional perspective, the crypto regulatory measures adopted by the US, EU and South Korea are more concentrated and intensive. The US has been the center of attentions from others, with a sum of 22 federal and state regulatory statues, aiming at crypto transactions, crypto regulatory guidance, judicial decisions, stablecoins, etc.; 9 regulatory policies were published by the EU, mainly in crypto regulatory guidance, stable coins, anti-money laundering and other concerns mentioned in MiCA and TFR; South Korea passed 8 related regulations, mostly in judicial decisions, stablecoins, crypto regulatory guidance, crypto transactions, etc.

For further analysis and interpretation on the attitudes from various sovereign countries on crypto, existing policies are categorized as positive, neutral and negative based on the type of policies, where positive policies are those with a positive effect promoting the crypto industry, neutral policies are those standard measures that will not impose either a positive or negative effect on the crypto industry, and negative policies refer to those bans or administrative penalties, etc.

By classification, the percentage of positive, neutral, and negative policies are 36%, 57%, and 7%, respectively, in 2022 compared to 23%, 59%, and 18% in 2021; there were more positive ones and less negative ones in 2022, a symbol indicating a favorable attitude of the overall regulatory environment. In addition, most countries are still inclined to regulate and guide the crypto industry on the basis of modest regulation.

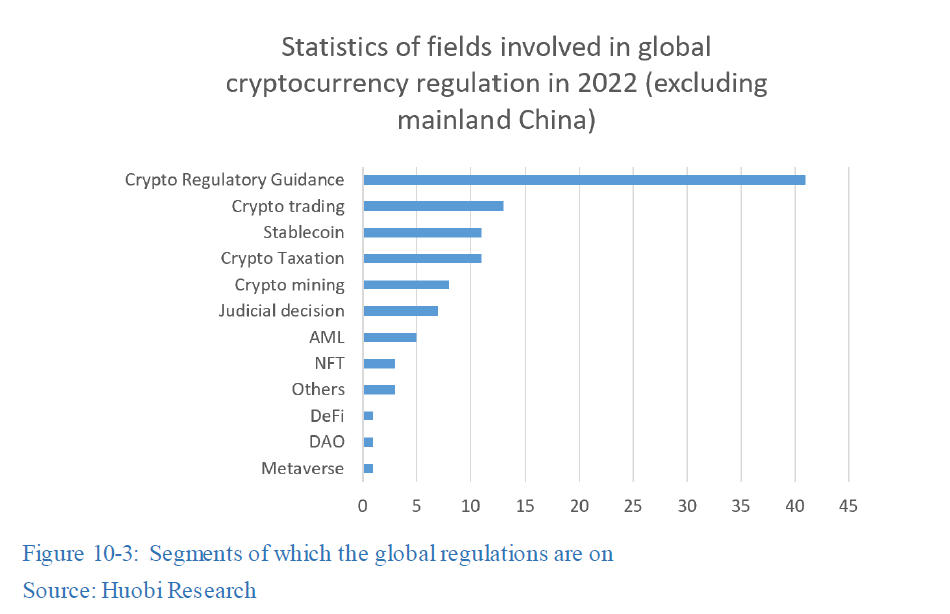

The policies can further be divided to the following categories by segments in crypto: crypto regulatory guidance, crypto trading, stablecoin, DAO, NFT and other 12 categories, among which crypto regulatory guidance, crypto trading and stablecoin are the top three areas of all policies, accounting for about 62% of the total. The number reveals that most countries or regions are actively promoting regulatory frameworks and regulatory guidance for corresponding businesses of crypto in 2022 in order to be competent with the rapid growth of the crypto industry, as well as supplementing gaps in current regulations on crypto trading. In addition, affected by the Terra crash, almost all governments are highly cautious on the regulation of stablecoins.

10.2 Changes in global regulatory environment

The year of 2022 has special meaning to the crypto industry from the perspective of regulations that regulatory frameworks are continuously being developed by various countries, represented by the US and EU; with effectuation of such regulatory policies in the future, the crypto industry will complete the transition from the unregulated wild zone to a civilized legal ear with definitive regulations. The frameworks adopted by the US and EU and iconic cases of regulations will be dissected in this chapter.

10.2.1 The US and EU: upper-level regulatory framework is on schedule

MiCA and TFR were initially passed by the European Parliament on October 10, 2022, and both bills are expected to enter into effect in 2024.

No definitive regulation framework applied in the EU except for the unified AML that the internal of EU is somewhat fragmented as each member enacted regulations to meet their own domestic need. As a result, the overall regulation environment for the EU is relatively conservative and behind. MiCA, once adopted and implemented, will be applied throughout the EU and superior to laws of individual member states, granting additional power of enforcement to various national authorities.

MiCA primarily establishes a regulatory framework for crypto assets that are beyond existing financial laws of the EU, such as security tokens and central bank digital currencies (CBDC). MiCA classifies crypto assets into electronic money tokens (e-money tokens or EMT), asset referenced tokens (ART), and asset reference tokens (‘asset tokens’), depending on whether the value of the token is pegged to other underlying assets.

●EMT is an electronic alternative to coins or banknotes, whose value is pegged to fiat currency. In other words, it is actual money but in digital form, commonly seen in payment processing applications, such as Alipay, WeChat Pay, etc.

●ART is designed to anchor its value by reference to any other things of value or right, or combination of both, including one or more official fiat currencies. ART covers all other crypto assets backed by underlying assets other than EMT. For example, USDT and USDC, stablecoins backed by U.S. dollars, treasury bonds, and Pax Gold backed by physical gold, etc.

● Other Crypto Assets are all other crypto assets that are not ART or EMT. Compared to regulations on ART and EMT, regulations on Other Crypto Assets are relatively flexible that they are deemed as in compliance of the regulations as long as a whitepaper is submitted and approved, and standard rules are met in marketing, organizational code of conduct, and technologies.

MiCA’s limitations on non-euro stablecoins are 1 million in the number of daily transactions and 200 million euros in daily trading volume. USDT, USDC and BUSD have accounted for more than 75% of total trading volume in EU, far more than the limited number of daily transactions and daily trading volume. If regulatory policies regarding non-euro stablecoins were continued to be pursued by the EU in the future, it may harm the competitiveness and hinder the innovative potential of the EU in the crypto market.

DeFi and NFT were not included in MiCA. The European Commission is piloting a trial of “embedded regulation” mechanism for DeFi, and NFT could be subject to the same regulatory scrutiny as cryptocurrencies by rumors prior to the official announcement of MiCA. May be concerned by the possibility of ruining the innovations of NFT, MiCA does not appoint NFT inside.

The voice appeared two-sided from general public in EU regarding TFR (The Transfer of Funds Regulation): supporters argue that it is helpful in clarifying regulatory boundaries and speeding up the regulation of crypto assets, while opponents claim that it violates the right on privacy in Charter of Fundamental Rights of the European Union, and the collection of personal data is not necessarily helpful in eliminating money laundering activities.

The U.S. regulatory framework came out later than that in the EU, consistent with the Executive Order on Ensuring Responsible Development of Digital Assets issued by President Biden, the first draft of regulation framework on crypto was released on September 16 2022, aiming at adopting consumer protections, maintaining financial stability, fighting the illegal use of cryptocurrencies, cementing leadership of the US in global finance, and technical innovations with responsibilities.

10.2.2 Regulations on CEX are tightening, on-chain activities are now regulated

As the crypto market becomes more influential, regulatory frameworks on crypto assets are being constantly developed by various sovereign countries and regions, but there are many influential regulatory events in 2022 during the transition of the old regime to new: one being the collapse of centralized entities, such as FTX and 3AC, reflecting the missing of appropriate regulations to some extent; and the other being the judicial judgements on Tornado Cash, signifying the beginning of regulations on on-chain activities.

The FTX bankruptcy is the third most influential incidents in 2022 after the collapses of Terra and 3AC. The main issues of the FTX case are the misappropriation of funds, affiliate transactions with Alameda Research, etc. At the time, some U.S. regulators expressed that they were investigating or had already started investigating the issues a few months ago. However, the FTX incident will not happen if regulations of crypto assets in various countries are appropriately in place. Traditional financial markets have a clear regulatory system for assets in reserve and clear requirements for affiliate transactions and companies like Alameda Research; most countries currently have either a lack of clarity or a gap in the regulation of crypto markets, For example, The CFTC has jurisdiction over crypto derivatives and crypto assets that qualify as securities under certain rules are subject to approval of the SEC. These two are also responsible overseeing investment companies, but FTX and Alameda Research are apparently not properly regulated. Many in the US have appealed to intensify regulations on crypto assets after the FTX incident.

On-chain activities are also frequently discussed in the industry and among regulatory parties, including: the sanction of Tornado Cash by the U.S. Treasury, the filing of a lawsuit against Ooki DAO members by CFTC, the prosecution of SEC towards Ripple Labs, and whether ETH should be considered as security.

From regulatory motives. Tornado Cash was sanctioned because it helped illegal organizations or individuals, such as the North Korean hacker group, to launder large amounts of money by mix of coins, which could potential undermine national security, financial stability and cyber security, and no countries would tolerate such activities for long. The CFTC’s prosecution of Ooki DAO members, the SEC’s prosecution of Ripple Labs and whether ETH is a security, etc. are nothing more than the discussion on whether crypto assets should be included in the existing regulatory system of securities. Regulators, such as the SEC and CFTC, expressed interest on including more crypto assets into the range of current regulations, while some parties in the crypto world are reluctant to such activities, even searching and exploiting legal loopholes for temporary shelters.

From the approach of regulations, for atypical issues as Tornado Cash, U.S. regulators directly act directly with iron fists: arresting developers, banning U.S. users from accessing Tornado Cash’s official website and restricting third-party cooperations. For the prosecution of Ooki DAO members, economical penalties, namely fines, are applied in this case, The litigation of Ripple Labs by SEC began in December 2020 and prolonged to this year. The merge of Ethereum has completed for some time, SEC and other regulatory agencies have not yet taken any actions so far. Although regulators, such as the SEC and CFTC, have the power to regulate securities, and sometimes even have more power interpreting the securities laws, regulators are currently exercising the power cautiously and restrainedly, and prosecutions can sometimes be dismissed by courts at all levels.

From the consequences and degree of impact by the incident, although sanctions of the US Treasury did tremendously cut the number of users of Tornado Cash, Tornado Cash is still operating as it is a decentralized application deployed on Ethereum, but some DeFi protocols and developers began to worry about their own security and position of compliance. Members from Ooki DAO were fined $250,000, setting a reference for regulators on DAOs: if a DAO commits something that the responsibilities are traced back to itself, then all members are subject to be held accountable; to be more specific, for the multi-signature process, the signers will likely be held accountable, and the proposers and voters for on-chain governance. In SEC’s lawsuit against Ripple late September, the U.S. District Court rejected a motion to withhold documents from former senior officer Bill Hinman’s 2018 speech on cryptocurrency-related presentations; Ripple won the lawsuit from the perspective of litigation.

In the future, there will be more and more regulations on on-chain protocols, and regulators will likely continue to take strong measures, such as sanctions and arrests, for illegal acts that jeopardize national security, financial stability and cyber security. For cases of determining crypto assets are securities, on the one hand, with the introduction of new regulatory policies and more references, the boundaries of regulations will become more accurate that on-chain protocols could come up with preliminary solutions to respond. On the other hand, if prosecutions were charged regarding security, litigations and arguing within the frame current security laws can be adopted as strong responses.

10.3 Trends and characteristics of regulations worldwide

New trends and characteristics of global regulations can be found by sorting out all regulations worldwide in 2022:

● Regulations of on-chain protocols may become regular

As the crypto market continues to expand, on-chain protocols are becoming increasingly influential. Many on-chain protocols and assets are currently outside existing regulatory frames in various countries, and some even have a tendency to challenge existing regimes. Tornado Cash being sanctioned by the US Treasury, Ooki DAO members sued by the CFTC, and discussions on whether ETH is a security are just some examples implying the beginning of on-chain regulations, and more regulatory actions will be seen in the future. While the motto of “Code is law,” is firmly believed by the crypto community, governments will not tolerate anyone or any actions that attempt to bypass the enforcement of laws. Accordingly, demand for compliance is inclined to soar for on-chain protocols.

● Tightened regulations on CEX and other centralized institutions

MiCA and TFR will be effective in the coming years, the US crypto regulatory framework will be perfected and integrated to existing law frame, and more regulatory policies will be landed in more countries. Till then, a clear and unified crypto regulatory system will be formed within each country, and international regulatory cooperation will be strengthened as a grid, which will serve as the fundamental rules for regulations and enforcements on crypto assets.