Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

It’s been a crazy couple of weeks since Breakpoint. The crypto world imploded with FTX declaring bankruptcy and the resultant contagion effect affecting markets and projects across the entire Web3 ecosystem. Solana has announced that they have ~30 months of runway (2.5 years) and a lot of projects in the ecosystem have stated they are strong and will keep building. Let’s explore what has been happening since SBF nuked the markets.

Solana Isn’t Going Anywhere

Solana is here to stay. The founder of Solana stated on Twitter, that Solana Labs didn’t have any assets on FTX and still have 30 months of runway at current burn rate.

Solana has 30 months of runway at current burn rate

Solana re-affirmed this with official Solana ecosystem fact releases:

- Official statements regarding the FTX Bankruptcy.

- Official statements regarding Solana Network Health.

To see the Dune Dashboard stats that goes into the Solana Network Health Report, check it out here.

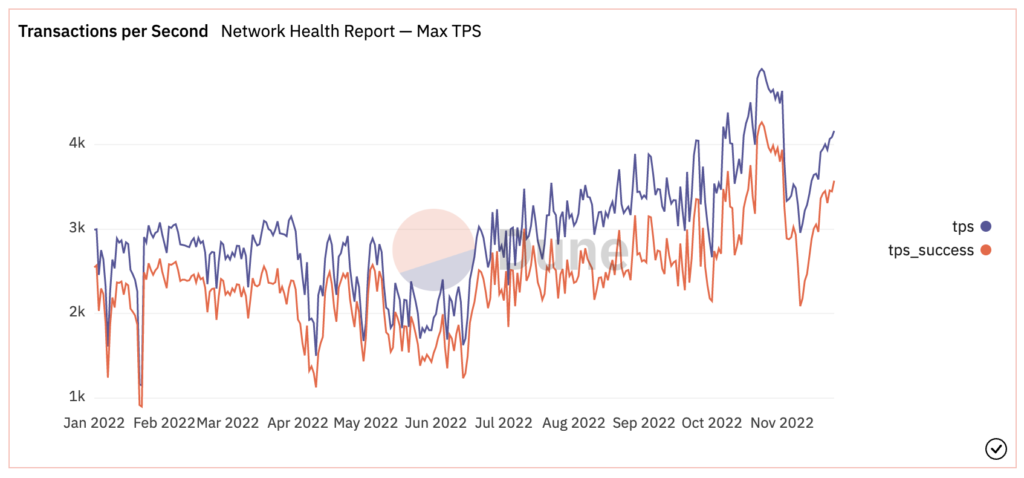

So the network is still running without any hiccups and Solana Labs/Foundation aren’t going anywhere. During times of massive bear market sell-offs there are normally spikes of transactions on the Solana network. Solana network has had issues with these massive tx volumes in the past but over the last couple of weeks it has been very stable. This is thanks to all the great work completed such as QUIC, Stake-weighted QoS, Fee Markets, Transaction Size Increases & Compact Vote States. See their latest status over at Solana Upgrades!

So what’s the major impact of this whole FTX fiasco?

- Solana Defi has taken a massive hit

- Early investors in Solana Ecosystem are disappearing

- Trust has been Shaken

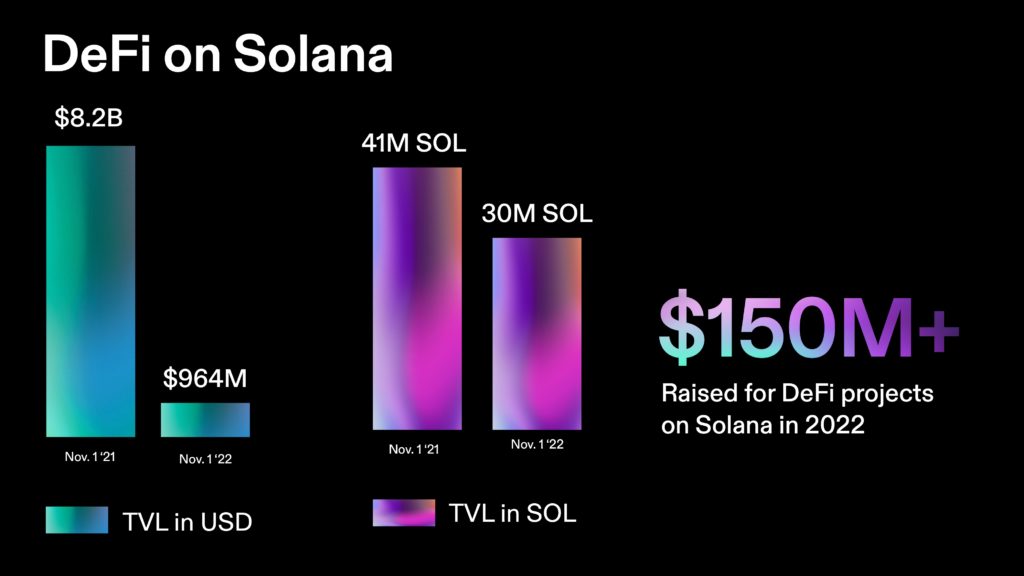

Solana Defi has taken a Massive Hit

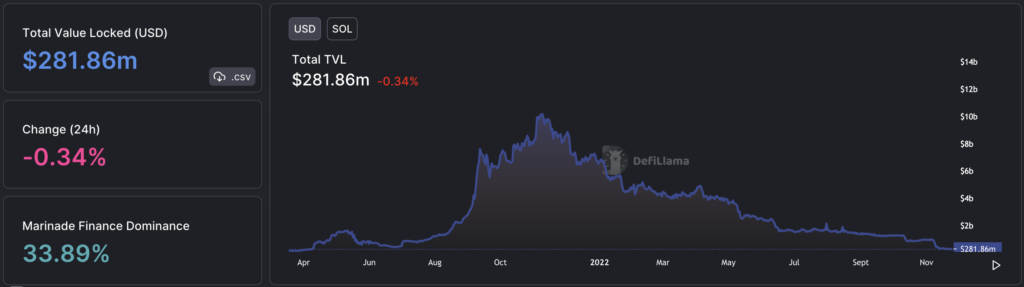

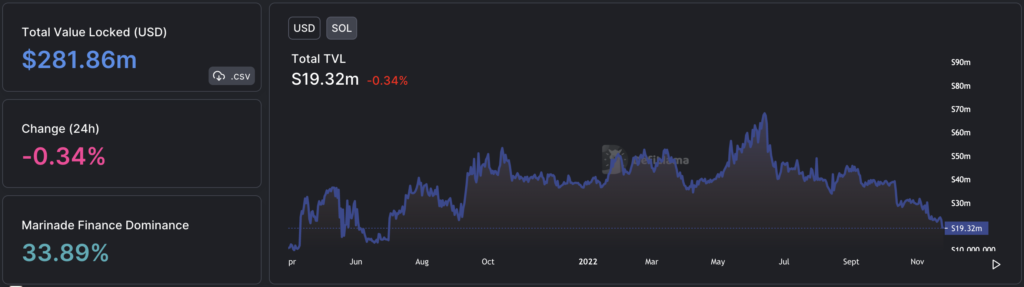

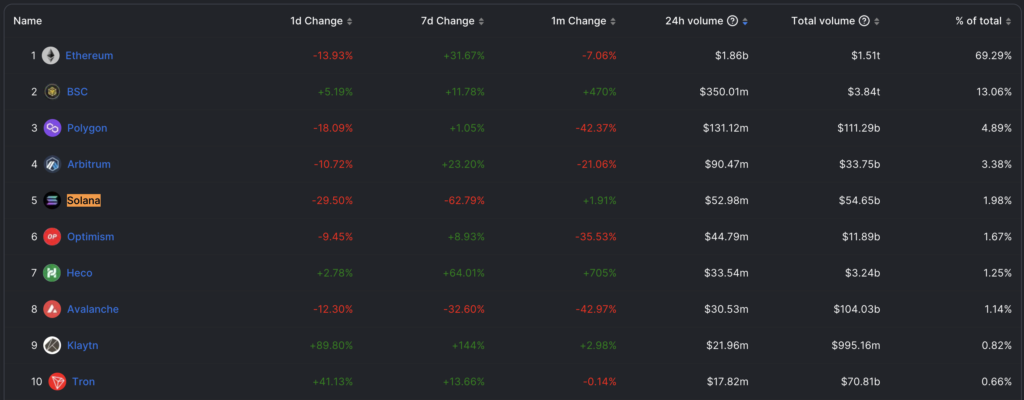

The year on year trends are way down. Part of this is due to the bear market. Recently a lot is due to the ongoing FTX news.

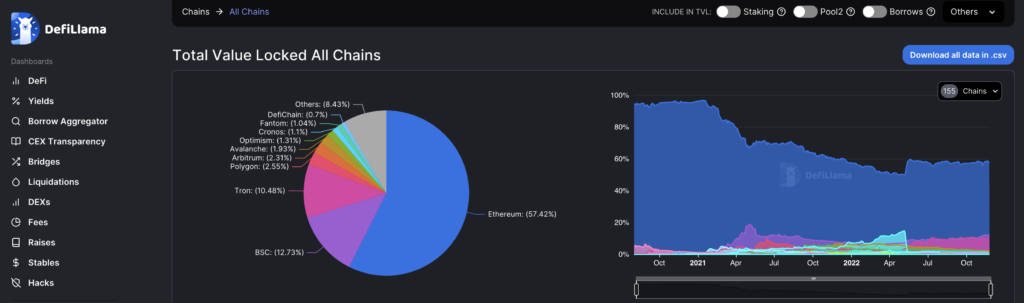

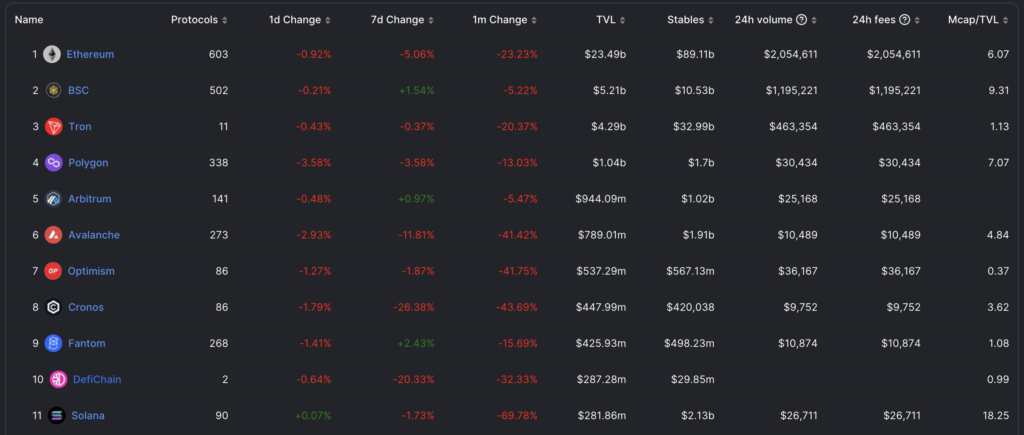

A good comparison is Defillama which compares Total Value Locked across the majority of blockchains. Solana has descended into the ‘other’ category representing <10% of TVL.

https://defillama.com/chains

Solana TVL rankings compared to other chains have been sad…

https://defillama.com/chains

Solana has a TVL of $0.3 million USD versus the market leader Ethereum of $23 billion. This ratio has drastically decreased over the past bear market year, so looking to the Solana Defi Projects making a resurrection in this space.

https://defillama.com/chain/Solana?currency=USD

https://defillama.com/chain/Solana?currency=SOL

https://defillama.com/chain/Solana

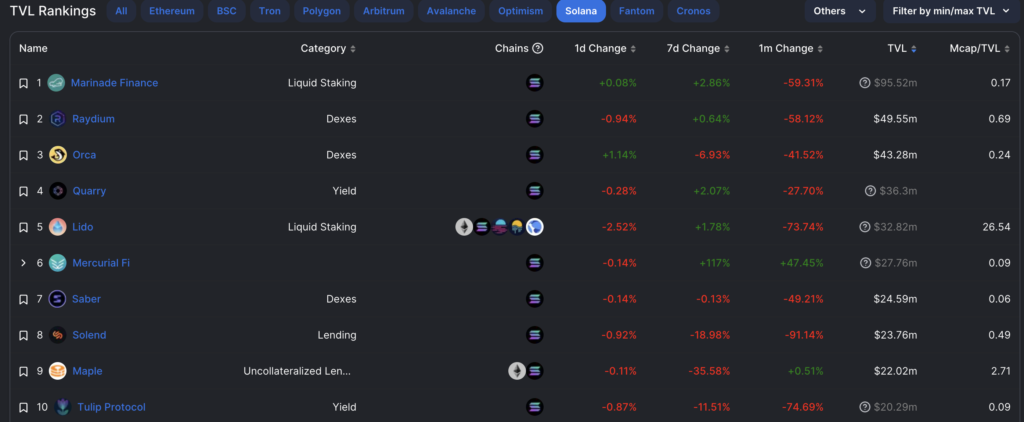

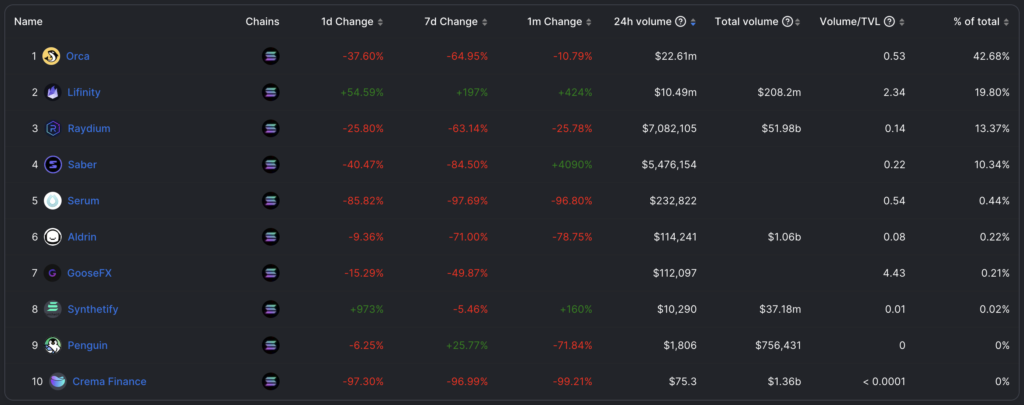

Over the past month Solana Defi apps have seen a massive drop-off in TVL if you look at the Defi apps ranked individually.

Serum Forked – Replaced by Community-led OpenBook DEX

One of the cool things to come out of this whole FTX drama is seeing the Solana community come together and fork the Serum repo to build their own DEX. No longer is the smart contract running one of the big DEX’s potentially compromised (as Serum was made my FTX team) it is now community led with a multi-sig wallet with a variety of Solana Defi Projects holding the keys. Ultimately, this means a stronger, more resilient and decentralised Solana Defi ecosystem. To rebuild will be tough and will take time to grow trust and Defi TVL over coming months & years.

https://twitter.com/openbookdex/status/1593637820408614912?s=20&t=KRyzIckO9tZktS9j8S1XKQ

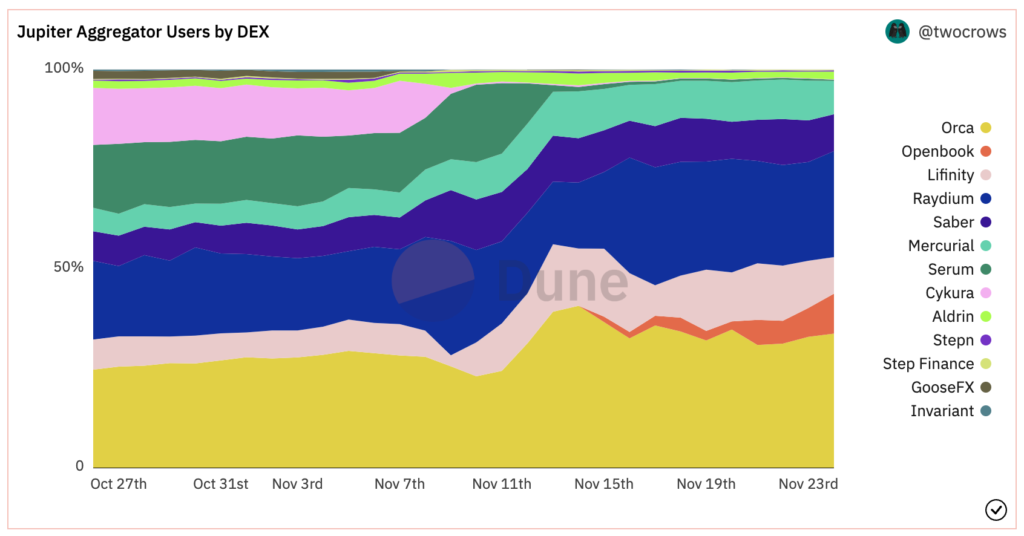

As you can see from the orange section of this graph the Openbook DEX is growing in marketshare.

https://dune.com/twocrows/solana-dex

https://defillama.com/dexs/chains

62% drop in Solana DEX trading volumes

https://defillama.com/dexs/chains/solana

Most DEX’s across Solana have taken a huge hit…

NFTS

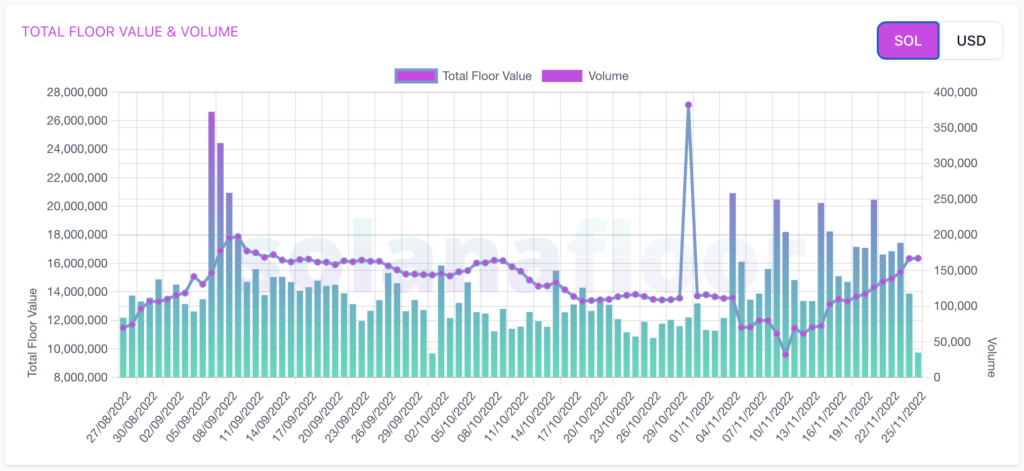

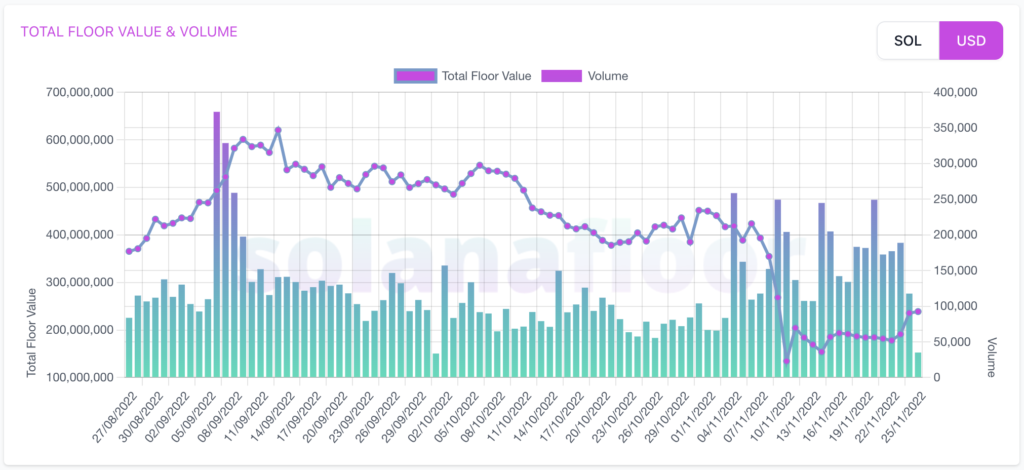

Solana over the past year have gone from strength to strength with total primary NFT mints selling over $1.1B USD and $2.5USD in secondary sales.

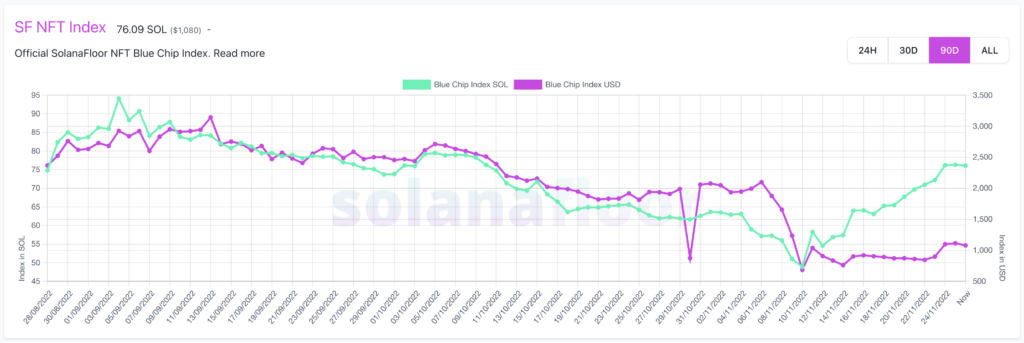

However, with the recent bear market and industry spectacles like the FTX collapse, when looked at in USD value NFT sales have dropped and appear to have stabilised.

https://solanafloor.com/

https://solanafloor.com/

Decentralisation was going well, then Hetzner happened

Solana still have a very positive Nakamoto Coefficient at around 30 putting it higher than the majority of blockchains. Recently

With the recent policy change by Hetzner about 20% of Solana validators had to move to other datacentre providers. This will take time for validators to setup their infrastructure and come online again. Even with all this the Nakamoto Coefficient is very high! You can see in detail the Superminority validator list and all validators at Solana Beach Validator page.

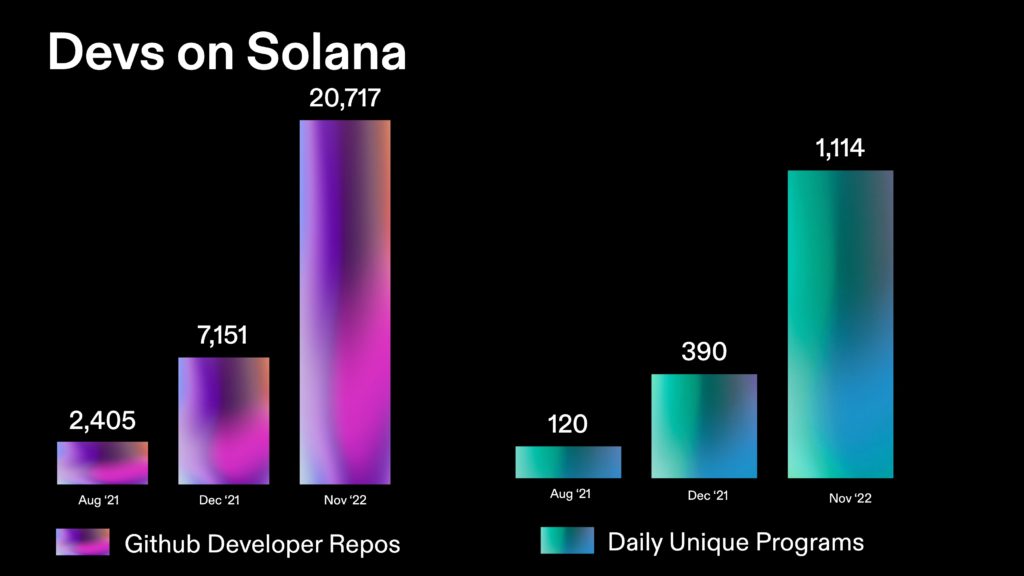

Developer activity is trending down

Even though the overall trend for the past year is going up for Solana Github & Solana Program activity, looking at Santiment Github data since the FTX drama has really trended down.

Good News – Breakpoint Buildooors still Building

At Solana Breakpoint there was a ton of awesome & exciting announcements from lots of projects across the Solana ecosystem.

Upcoming Games

There are 37 games expected to be launched by March 2023 running on Solana! Let’s see how that plays out.

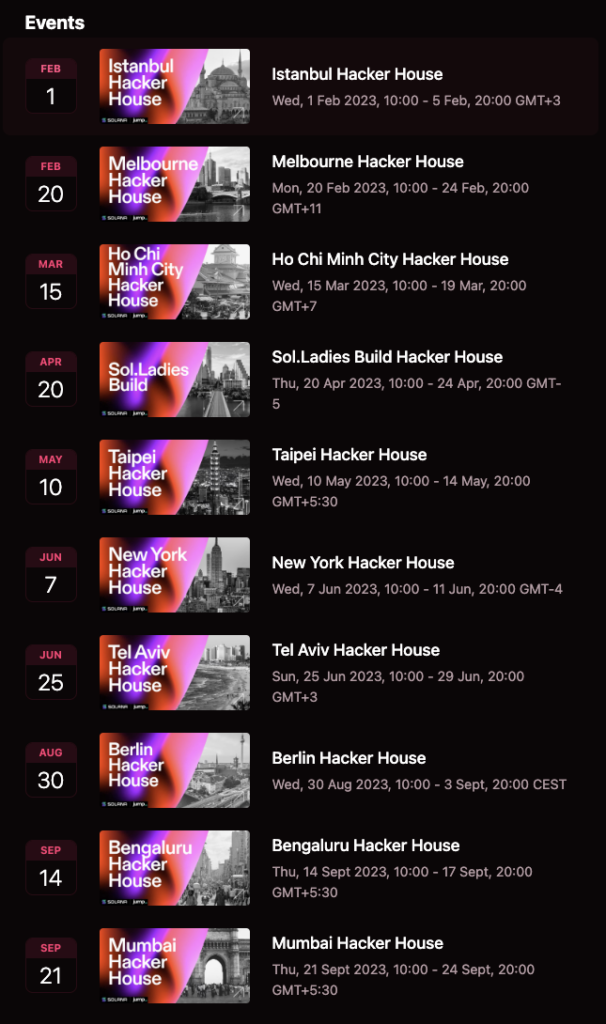

Upcoming Hacker Houses

You can see all the upcoming Solana Hacker Houses over at the LUMA Solana Foundation events page!

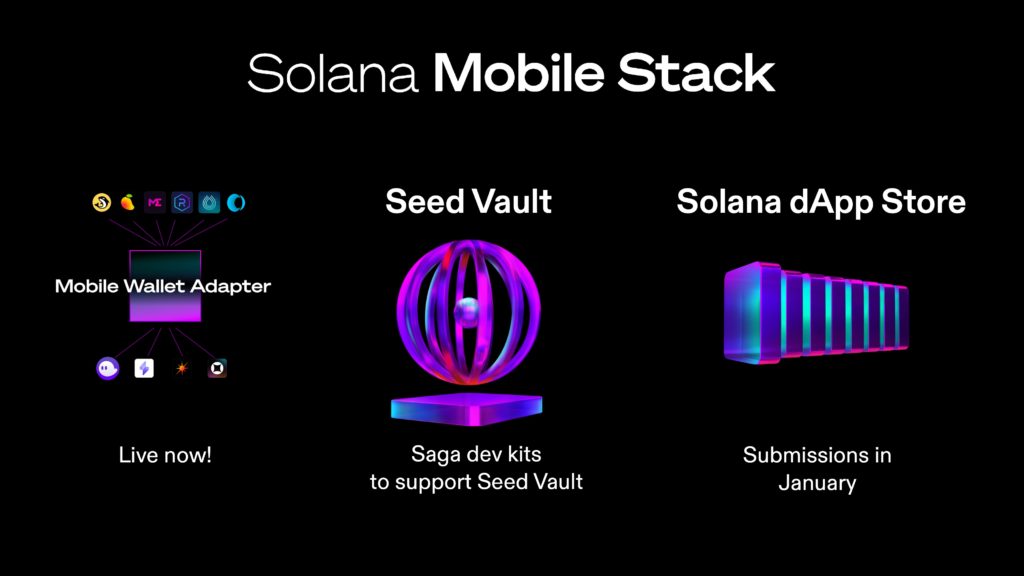

Upcoming Saga Phone!

At Breakpoint they even hinted which dapps will be shipped with the mobile!

Coming on Solana Saga Mobile one day 1 will be:

- Orca

- Backpack

- Solflare

- Phantom

- Defi Land

- Mango

- Laddercaster

- Magic Eden

- Tulip

- Dialect

- Audius

- Hubble

- Jupiter

- Zeta

- Marinade

- Solana FM

- Hyperspace

- Solana’s Dapp Store!

- More to come …

Lessons Learnt

- VC’s shouldnt own 10% of anything. Flush them out to be more decentralised in the event of bad / mismanaged actors

- Watch out for stable coins backed by non-transparent organisations

- Build a supportive ecosystem of investors rather than rely on whales

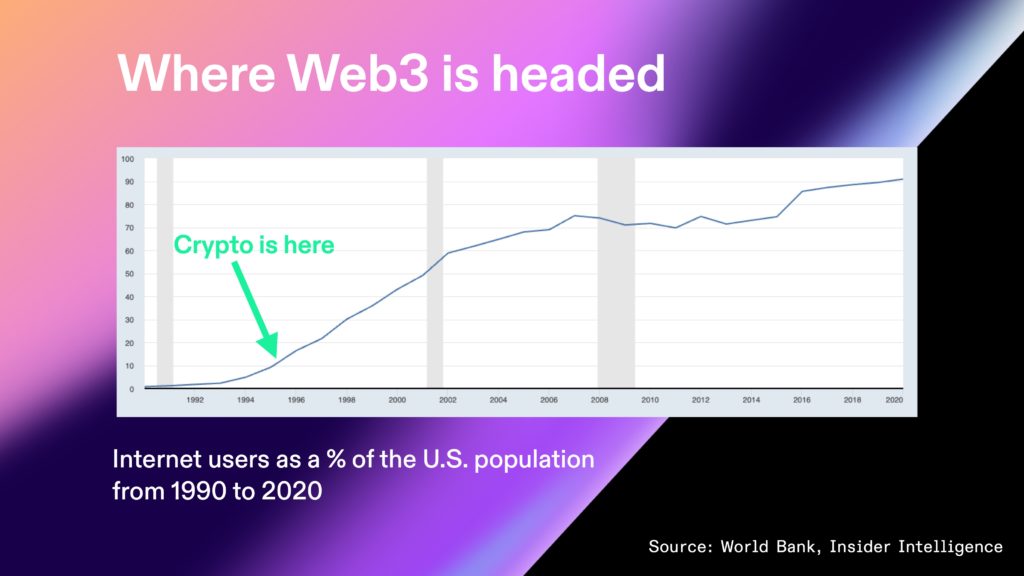

- Remember, we are still early…

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.