Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

Key Takeaways

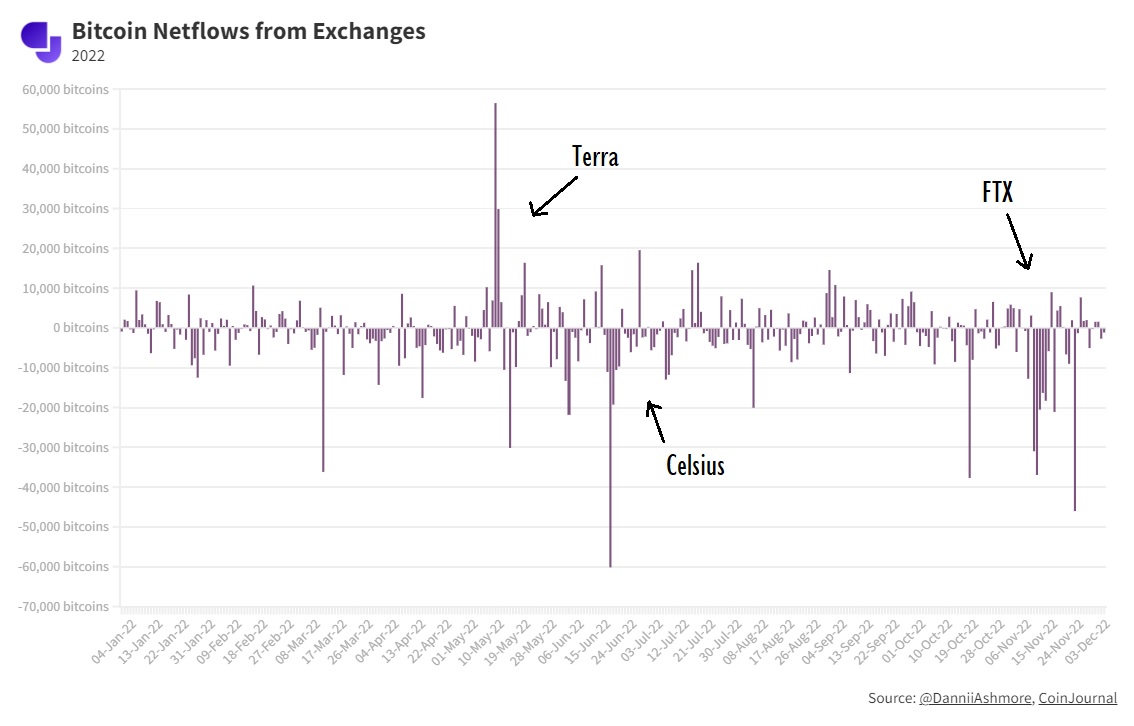

- Exchanges balances are lower by nearly 200,000 bitcoins compared to pre-FTX, as customers have lost all trust in exchanges

- This trumps the Celsius insolvency of June, where 128,000 bitcoins were pulled from exchanges in the month following Celsius’ demise

- Terra collapsed in May, but seeing as it was a DeFi protocol, trust in centralised entities had not yet broken at that point

- Only time will tell how bad the contagion from the FTX bankruptcy is

Trust in cryptocurrency exchanges is at an all-time low. It is not difficult to figure out why, as the collapse of FTX has sent shockwaves through the industry. As of less than a month ago, FTX was considered among the safest exchanges out there.

Customers pull bitcoins from FTX

The numbers back this up. We at CoinJournal.net looked on-chain, where we have seen Bitcoin flow out of exchanges at unprecedented speed in the aftermath of the FTX bankruptcy.

In the 27 days since the FTX story started to break, a net figure of nearly 200,000 bitcoins has been pulled from exchanges. It appears thousands of Bitcoin holders are running for the hills with their Bitcoin, pulling to the safety of cold storage.

“FTX was tier-1 royalty when it came to exchanges. Its collapse has spooked investors, as it should. The transparency of exchanges is incredibly low, and the reality is that it is almost impossible to know what is going on behind the scenes. The movement of Bitcoin off these exchanges shows that customers are realising this”, said Max Coupland, director of CoinJournal.

Unfortunately, the FTX scandal is far from the only one that has rocked crypto this year. So, how does the reaction of customers differ this time round?

Celsius brought similar panic

When Celsius sent an email out to customers on Sunday, 12th June, 2022 that it was suspending withdrawals on its platform, it was a dagger to the heart of any investors who held assets on the platform.

While those assets were obviously inaccessible, customers soon panicked that funds held on other lending platforms could soon come under threat, as contagion continued to ripple through the industry.

The key difference here was that exchanges were not under pressure. Nonetheless, customers still panicked, as the graph below shows. Exchanges balances were reduced by 128,000 bitcoins over the next month, with over 100,000 flowing out in a 5-day period soon after Celsius were declared insolvent.

Terra death spiral was different

The third shocking variable to rock crypto markets this year was the Terra death spiral in May. In fact, this was where everything started. Celsius fell to the ensuing contagion (something I was caught up in too) – alongside Three Arrows Capital,Voyager Digital and a whole load of other firms.

Notably, this was also when trading firm Alameda Research suffered large losses which led to Bankman-Fried allegedly sending customer deposits from FTX to shore up liquidity at the firm. So in one way, it all stemmed from Terra.

But Terra was different in that this was not a centralised firm and proved insolvent. This was a decentralised finance protocol with a flawed model. The reaction from customers was therefore vastly different.

We can see this by looking at the flow of Bitcoins to and from exchanges in the below chart.

Note that the first few days show a massive influx of Bitcoins to exchanges. This was the warchest that the Luna Foundation Guard held, sent to exchanges to be redeemed as Terra desperately floundered to defend the peg.

After that, the activity is quite normal, with no discernible pattern between bitcoins flowing to and from exchanges.

2022 Summary

Trust in exchanges has not been this low since the Mt Gox collapse of 2014. But in looking through the entire year of exchange activity, it is clear that two incidents cratered this trust more than any other: Celsius and FTX.

Regarding the future, only time will tell how badly crypto’s reputation has been dented in the long-term.

If you use our data, then we would appreciate a link back to https://coinjournal.net. Crediting our work with a link helps us to keep providing you with data analysis research.

Research Methodology

Data taken from on-chain. Wallets correspond to known public exchange wallets.

The post A net flow of 200,000 bitcoins leaves exchanges following FTX collapse, as trust broken appeared first on CoinJournal.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.