Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

Anyone can seem like an investing wizard when markets are going up and up with no end in sight. Where it gets tricky is when they take a dive, especially if values stay depressed over a prolonged period. This unfortunate scenario is known as a bear market, and it’s the bane of investors’ existence in both traditional and digital assets. How long a crypto bear market will last is anybody’s guess, but learning what to do in a bear market can help your portfolio ride out the storm. Ahead we’ll take a look at some strategies for how to survive a crypto bear market.

In this article

- What is a bear market in crypto?

- Bear vs bull markets

- Is crypto in a bear market right now?

- Signs of a crypto bear market

- Other recent bear markets in crypto

- Crypto bear market strategies

What is a bear market in crypto?

Unlike a crypto winter, which is less clearly defined, a bear market must meet precise numeric thresholds to be officially declared. A bear market is said to occur when asset prices drop by 20% or more from recent highs and remain lower for a protracted length of time. This means even during a typical market slump when asset prices have fallen by high-teens percentages, we’re not technically in bear market territory unless it reaches that 20% mark and stays there. Bear markets are no fun for any investor, but they’re a normal part of a healthy market cycle. To be generally pessimistic about the direction of markets is known as a “bearish” outlook.

Bear vs bull markets

A bull market is the opposite of a bear market. Investors are seeing green, and crypto asset prices have shot up from their most recent lows without backsliding. Because cryptocurrency markets often experience much sharper price movements than traditional markets, the threshold for what’s considered a crypto bull market is typically higher. A company’s share price popping 20% in a week would be big news, but it’s not uncommon for a cryptocurrency to jump 50% or more in a single day. Bull markets are typically characterized by prolonged elevated asset values, and a whole lot of high-fiving. When an investor is confident about the overall state of the market, they are often described as being “bullish”. Read full guide to bear vs bull markets.

Is crypto in a bear market right now?

If you’ve checked your crypto portfolio virtually anytime in 2022, you probably already know the answer to this. Yes, we are very much in the grips of a particularly grumpy crypto bear market as of late 2022.

Signs of a crypto bear market

When you look at the symptoms, it becomes readily apparent the bears are in control of the crypto market.

- Asset prices down significantly for prolonged period (way more than 20% in most cases)

- Investor confidence has bottomed out

- Many new investors have fled the market

- Bad news and FUD (fear, uncertainty and doubt) piling up, sending asset prices lower

Other recent crypto bear markets

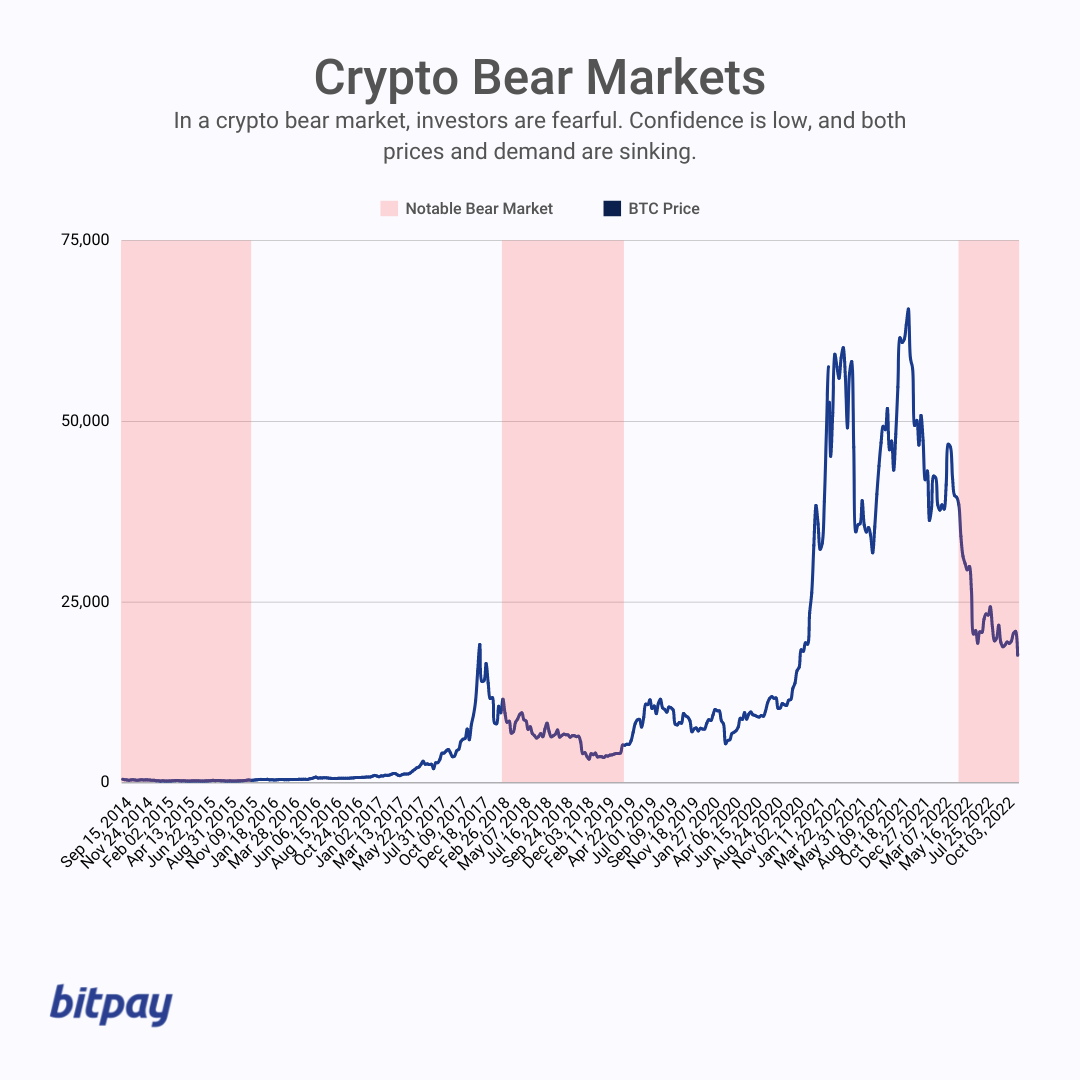

The crypto market has been through bear markets before, and almost certainly will again once the bulls regain control. There have been several other crypto bear markets since cryptocurrency has risen to popularity.

Q4 2017 - Q4 2018 (1 year)

Bitcoin’s stratospheric rise towards the end of 2017 was quickly followed by a yearlong crypto bear market, following the hack of Coincheck and an interest rate hike by the Federal Reserve. Bitcoin peaked at $19,279 at the market’s height, and slid as low as $3,242 over the next 12 months before things picked up again. PayPal enabling crypto use and the NFT boom are said to be the precipitating factors that brought about the end of the 2017-18 bear market.

Q4 2013 - Q4 2015 (2 years)

A series of scandals and bans between 2013-2015 helped knock Bitcoin’s price from a once-unthinkable $1,136 down to just $103 over the two-year bear market. The decline started when the FBI shut down the notorious digital black market platform Silk Road in 2013. That same year, China stepped up its crypto crackdown, announcing a total ban in the country. A year later, the infamous Mt Gox hack shook the crypto world, rattling investor confidence. Some factors believed to be responsible for the turnaround include the launch of Ethereum, Japan allowing crypto trading and the initial coin offering (ICO) boom.

Crypto strategies to consider while in a bear market

Unless you’ve got a crystal ball, incredible luck or an understanding of market dynamics that puts Warren Buffett to shame, you’re probably not going to beat a full-fledged bear market. But there are some strategies you can employ to help ensure your portfolio lives to fight another day.

- Dollar-cost averaging

- Stay focused on long-term goals

- Don’t panic and read too much into the hivemind

- Diversify assets, but be wary of high-risk projects

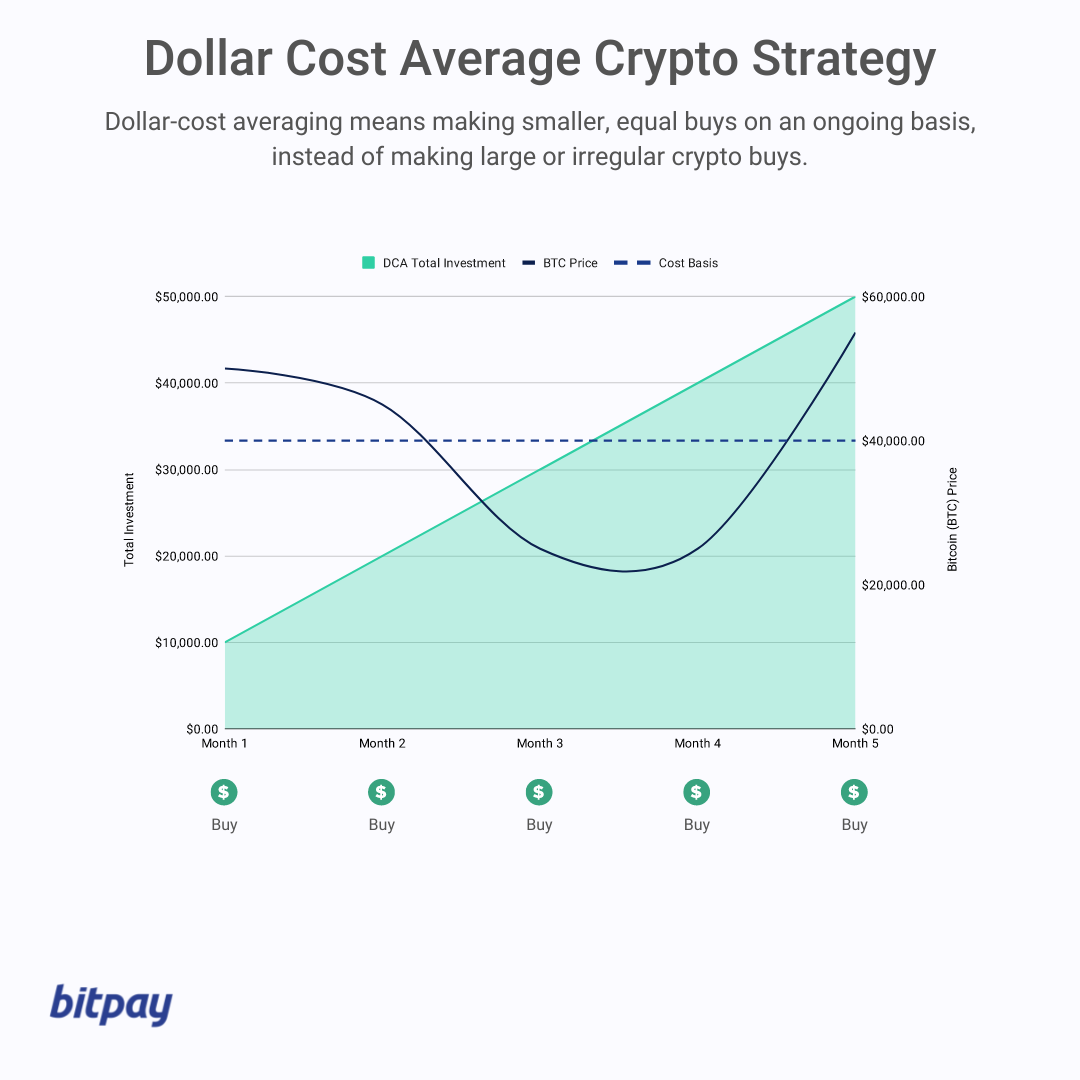

Dollar-cost averaging

Many investors view market downturns as opportunities, and you can improve your chances of taking advantage with a dollar-cost averaging (DCA) strategy. DCA involves purchasing set dollar amounts of assets at regular intervals, no matter what’s happening in the market. The basic idea is that DCA gives you a chance to increase your holdings when prices are lower. Over time, the strategy reduces your cost basis, or the average price you paid for each unit of an asset.

Stay focused on long-term goals

Only you know why you bought crypto in the first place. If you invested with its long-term prospects in mind, big market swings month to month or even year to year don’t necessarily impact that vision. When markets are down, try to remember your reasons for getting involved in digital assets and honestly evaluate whether they still hold.

Don’t panic and read too much into the hivemind

One of the most important rules of investing is to keep a level head. That goes double when market conditions are less-than-favorable. Panicked investors make poor decisions, and sometimes realize big losses they didn’t have to by yanking their holdings out of the market prematurely. Always take crypto news with a grain of salt, but especially in a bear market, when places like Crypto Twitter are flooded with fear, uncertainty and doubt (FUD). Try not to let yourself get carried away with the positivity or negativity you encounter. And please, don’t take crypto investment advice from “some guy on Twitter”.

Diversify assets, but be wary of high-risk projects

Even in a down market, crypto assets are an excellent way to diversify your investment portfolio. But don’t let the promise of outsized gains cloud your better judgment. There are many, many legitimate crypto projects in the market worth your consideration. But there are also plenty of charlatans who will promise the moon and never deliver. Before you put your hard-earned money into any investment, do your homework. And never invest money you can’t afford to lose, whether it’s a bull or a bear market.

Securely buy, swap, store and spend crypto through all market conditions

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.