Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

Abstract

This week, we focus on the following events: 1) Aptos Debuts Its Blockchain, Putting Millions in VC Dollars to the Test; 2) Crypto Asset Manager Valkyrie Lost the Biggest Investor in Its $11M Funding Round; 3) Liz Truss Steps Down as UK Prime Minister.

Project Analysis: Last week, a company with a valuation of tens of billions of dollars collapsed in just three days, which was still the second largest cryptocurrency exchange in the world, shocking the entire cryptocurrency industry. The FTX incident is commensurate to the “Lehman Moment” of the traditional financial world. This article mainly sorts out the development of this incident and analyzes it.

1. Industry overview

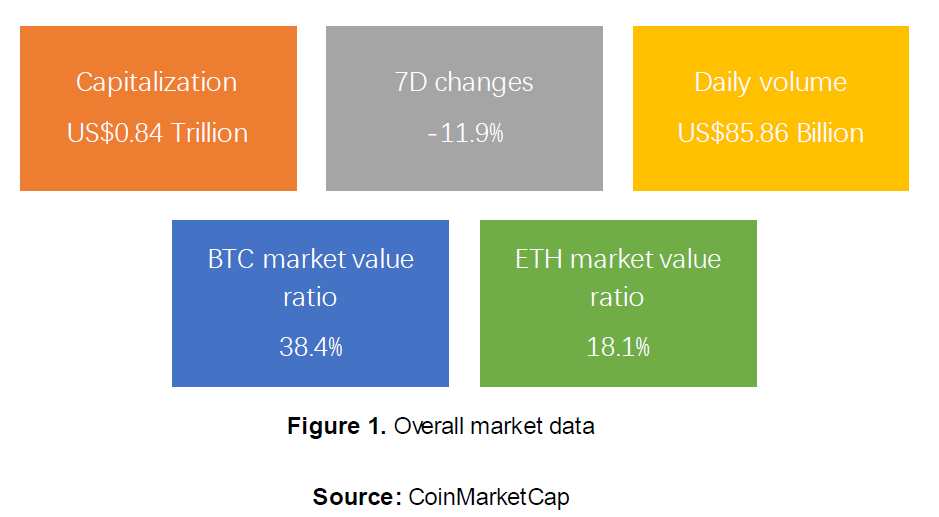

I. Overall market trend

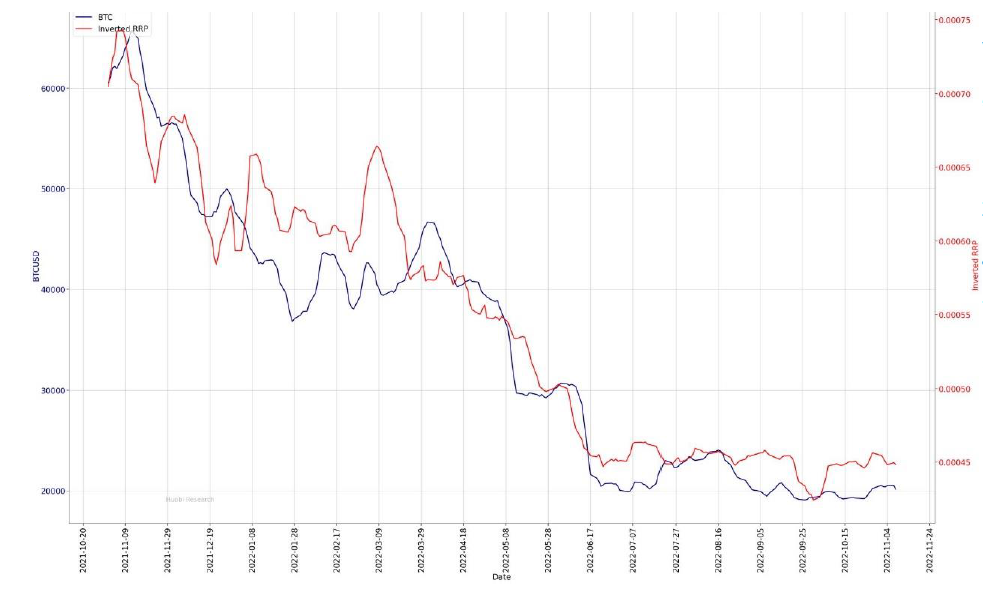

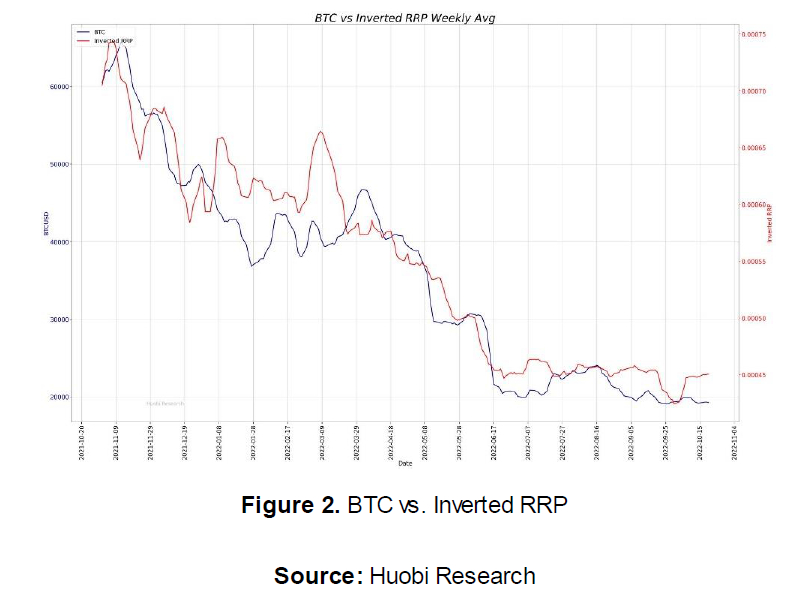

indicate sell-offs in equity markets (SPX/IXIC/Bitcoin) when it decreases, and vice versa.

II.NFT

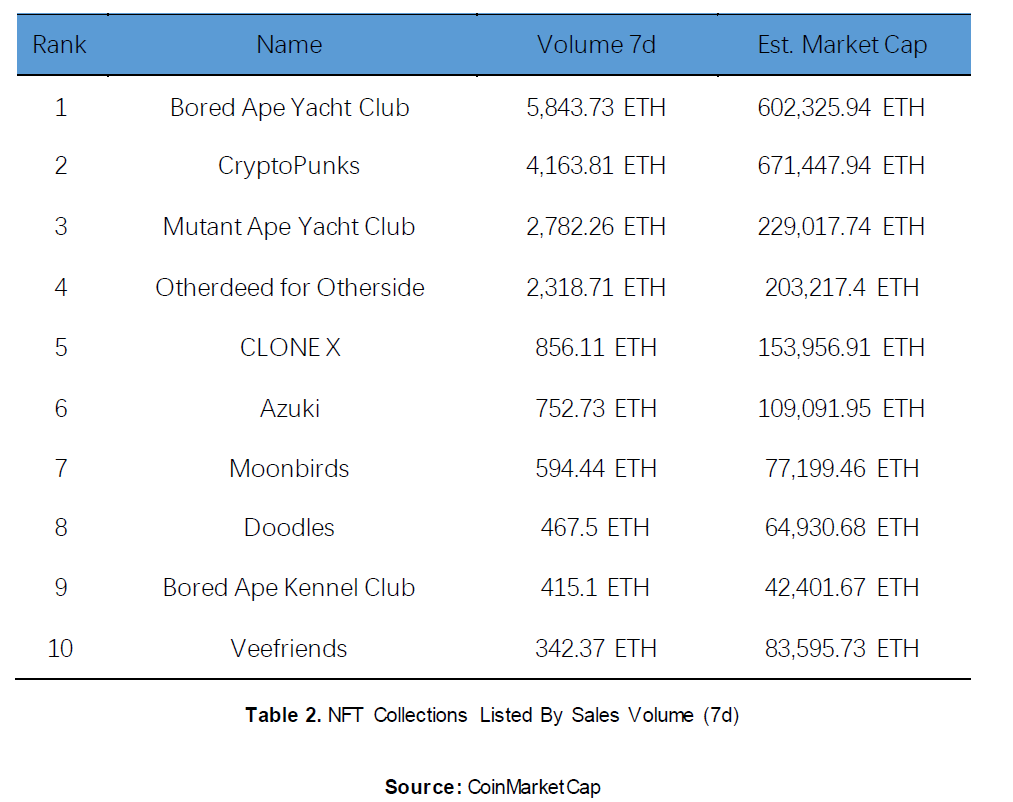

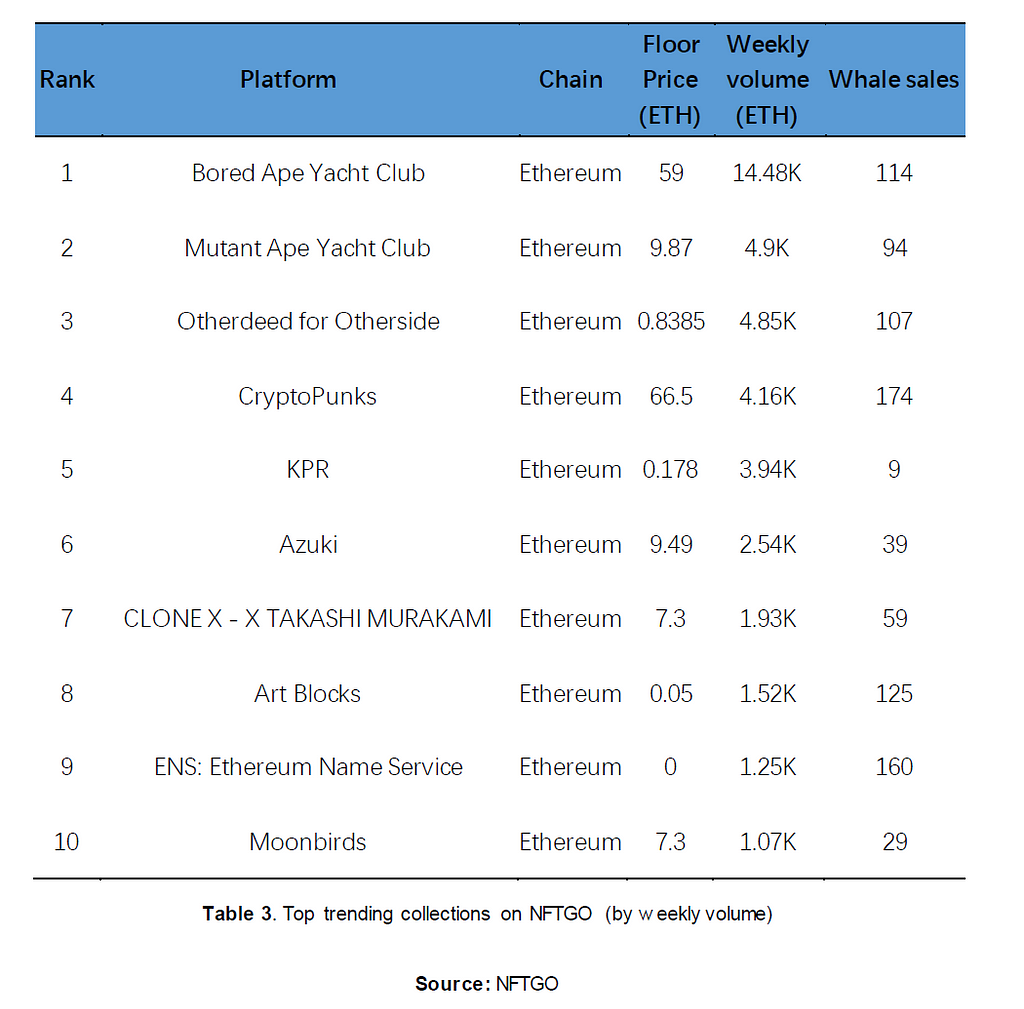

The NFT market last week saw a decrease of 25.47%, with a market cap of US $2,364,918,408.42 this week. However, this week the NFT market had huge fluctuations because the FTX incident heavily influenced the solana NFT market. The 7-day sales volume changed by 1.77% to $31,819,900.95 and total sales did not change very much at 12.98%, to 32,888. This week the top 10 NFT brands on Coinmarketcap are all familiar brands which has entered this list before, all the brands have positive change in volumes, potentially due to the increased selling pressure after FTX collapse.

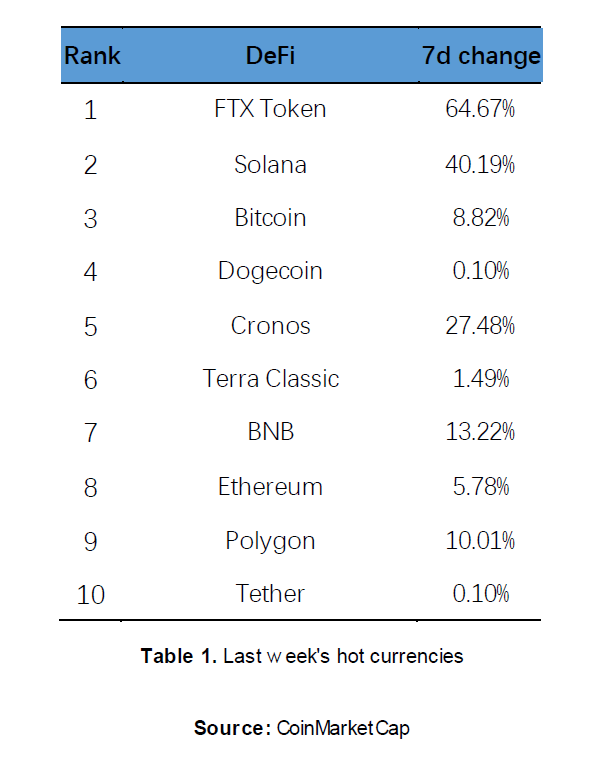

III.DeFi

IV.Layer 2

2. Market news (Source: Coindesk)

I. Industry news

FTX Investment Now Worth Zero, VC Giant Sequoia Says

Venture capital giant Sequoia Capital reassured investors the firm remained largely unaffected by the unraveling of crypto exchange giant FTX and wider decline in digital asset markets even as it marked its investment down to zero.

In a note to Limited Partners posted on the firm’s Twitter page, Sequoia said the exposure it has to FTX is limited, and whatever money it has lost has been offset by billions of dollars in gains.

Sequoia said that it has invested $150 million into FTX.com and FTX.us via its Global Growth III fund and $63.5 million into the exchange and its U.S. division via its SCGE Fund. These investments represent 3% of the Global Growth III fund and less than 1% of the SCGE fund.

“The $150 million loss is offset by the approximately $7.5 billion in realized and unrealized gains in the same fund, so the fund remains in good shape,” Sequoia wrote in a note.

The VC fund noted that in 2021, when it made the investments, FTX generated $1 billion in revenue and $250 million in operating income.

FTX’s investors include Softbank, Temasek Holdings, the Ontario Teachers’ Pension Plan, Race Capital, and Lightspeed Venture Partners, among others.

Huobi Asset Transparency Report Reveals $3.5B in Crypto Holdings

Huobi Global, once China’s top crypto exchange, published an asset transparency report on Sunday to reassure users that its funds remain safe.

As of Nov. 12, there were 191.84 million Huobi token, or HT, ($900 million) on the platform along with 9.7 billion TRX, 820 million USDT, 274,000 ETH and 32,000 BTC, and several other coins, including ATOM, ADA, BCH, DOGE, DOT, MATIC, SHIB and ETC.

The total estimated value of reserves was $3.5 billion, the report said.

Huobi said HT tokens are not only held by the Huobi Global, but some of them are also held by Huobi Global’s users.

The revelation came days after FTX, formerly the third largest digital assets exchange by volume, imploded in response to a CoinDesk report that showed the exchange’s sister company Alameda Research’s balance sheet, was primarily made up of FTX’s native token, FTT.

Solana Blockchain Hit by FTX Tremors as Nearly $800M SOL Tokens Set to Be Unstaked

The epic comedown of Sam Bankman-Fried’s FTX crypto exchange and Alameda Research trading firm is making waves in the market for the Solana blockchain’s SOL token — to the point where some investors have apparently become so nervous that they’re demanding back tokens they had “staked” or deposited into the blockchain’s underlying security protocol.

Earlier this week, when concerns started to grow over the state of the two businesses’ finances, crypto market analysts began to speculate that Alameda might need to sell some of its SOL tokens to raise liquidity. The fears sent the SOL price tumbling — as traders rushed to get ahead of the selling pressure.

Now, apparently, the dynamic has risen to another level: Solana validators who provide security to the blockchain are set to unlock nearly $800 million worth of their SOL holdings as the end of the token lock-in period known as “Epoch 370” approaches — in fewer than 13 hours.

II. Investment and Financing

Paxos Ordered by US Officials to Freeze $19M in Crypto Tied to FTX

U.S. federal authorities have ordered cryptocurrency issuer Paxos to freeze $19 million worth of crypto tied to the bankrupt FTX exchange, the company announced on Saturday.

The order comes after the U.S. Justice Department launched an investigation into the rapid collapse of Sam Bankman-Fried’s crypto empire last week. The run on the multibillion-dollar exchange occurred over just a few days, culminating in a bankruptcy filing in the U.S. on Friday.

By last Thursday, U.S. regulators and the Justice Department had already contacted rival crypto exchange Binance for information about its interactions with FTX. Binance had previously announced it would possibly acquire the ailing exchange, but less than 24 hours later backtracked on the tentative deal after it examined FTX’s finances.

Ikigai Asset Management Had ‘Large Majority’ of Assets on FTX, Unclear Whether It Will Be Able to Continue

California-based hedge fund Ikigai Asset Management had a “large majority” of its assets on defunct crypto exchange FTX, according to the firm’s founder and chief investment officer Travis Kling.

“Last week Ikigai was caught up in the FTX collapse. We had a large majority of the hedge fund’s total assets on FTX,” Kling said on Twitter on Monday. “By the time we went to withdraw Monday mrng, we got very little out. We’re now stuck alongside everyone else.”

In his Twitter thread, Kling said that in the near term, the company would continue trading the assets it has that are not stuck in FTX, and also make a decision about what to do with its venture fund, which was not affected by FTX.

He noted that there is a lot of uncertainty about the timeline and potential recovery for FTX customers. But at some point, he said “we’ll be able to make a better call on whether Ikigai is going to keep going or just move into winddown mode.”

Bitcoin Mining Firm TeraWulf Raised $17M of Capital in Q3, But Cash Reserves Remain Low

Bitcoin mining company TeraWulf (WULF) raised $17 million in capital in the third quarter, but its liquidity remains at $4.5 million, according to a statement on its third quarter earnings released after the market close on Monday.

The $17 million came from $9.5 million in equity from existing investors and $7.5 million of incremental proceeds under a term loan. The Monday statement said that $138.5 million of principal under the term loan was outstanding at the end of the quarter.

Cash flow has proven to be a key determinant of miners’ ability to navigate the bear market, with some major miners facing liquidity crises that could even lead them to bankruptcy.

TeraWulf’s costs of revenue increased dramatically in the quarter as energy prices in New York State, where it mainly operates, soared while it increased its energy demand with new operations. The miner paid 134% in costs per dollar of revenue, compared to 43% in Q2. The miner is trying to bring costs down for 2023, the statement said.

III. Supervision

Kevin O’Leary Says Comments From Gensler Killed His Attempts to Help Save FTX

Venture capitalist Kevin O’Leary said he was looking to throw FTX a lifeline hours before the crypto exchange filed for bankruptcy, only to be thwarted by comments from U.S. Securities and Exchange Commission Chairman Gary Gensler.

The exchange, which was strapped for cash, was trying to patch the hole on its balance sheet, according to O’Leary, who is a paid spokesman for the beleaguered exchange, a corporate account holder and also a shareholder.

The “Shark Tank” star told CoinDesk TV’s “First Mover” on Monday that he spoke with the now former CEO of FTX, Sam Bankman-Fried, Thursday, a day before the Bahamas-based exchange filed for Chapter 11 bankruptcy protection.

Days before, O’Leary said, he was looking to make sense of the liquidity issue on FTX’s balance sheet. At the time, O’Leary said that he was receiving an influx of “inbound requests” from sovereign wealth and pension funds interested in helping fix FTX’s cash crunch. Bankman-Fried told O’Leary that FTX was looking for $8 billion.

Crypto Industry Participants Field Questions from UK Lawmakers After FTX Collapse

Following the FTX bankruptcy last week, executives from Binance and Ripple, among others, testified in front of the U.K. Parliament Treasury Committee.

Present were committee chair Harriet Baldwin — a conservative member of parliament — along with other members of that committee. Testifying were Daniel Trinder, vice president of government affairs of Europe at Binance, Susan Friedman, head of policy at payments network Ripple, Ian Taylor, executive director of lobby group CryptoUK and Tim Grant, head of Europe at Galaxy Digital.

“This is the exchange collapsing Ian, must feel a bit awkward coming in talking to us after last week,” Baldwin said. She also fired off other questions to the group, such as if the events surrounding FTX undermined confidence in what they do for a living.

“I think it would be very wrong to tar the entire industry by this one bad apple, which happened to be a very big apple,” Grant said.

CFTC Pushes Back Against Amicus Briefs in Ooki DAO Lawsuit

The U.S. Commodity Futures Trading Commission (CFTC) on Monday hit back against four amicus briefs filed on behalf of Ooki DAO, a decentralized autonomous organization (DAO) which the CFTC sued in September for allegedly violating federal commodities laws by illegally offering leveraged and margin crypto trading products to U.S. investors.

The amicus briefs — filed by crypto legal consortium LeXpunK, the DeFi Education Fund, and venture capital firms Paradigm and Andreessen Horowitz — urged Northern California district court Judge William Orrick to reconsider his earlier order granting the CFTC’s motion for alternative service, which approved the CFTC’s unorthodox method of serving notice of the lawsuit on the members of the DAO via a help bot on the DAO’s website and a post on its forum, rather than to a DAO member directly.

In its motion of opposition filed Monday, the CFTC pushed back, arguing that it served the legal papers the only way the DAO made itself available. And, because the DAO was clearly aware of the lawsuit — it was acknowledged in both a tweet from the DAO’s official Twitter account and a discussion between members in a DAO-run forum — the CFTC says the notice was effectively served.

3. Timeline of FTX & Alameda Research

I. Cause of the Incident

I. On November 3, Coindesk threw a smoke bomb:

SBF’s Alameda Research holds $14.6 billion in assets, most of which are FTT tokens.

According to CoinDesk, according to a private financial document obtained by the media, Alameda Research, a subsidiary of FTX CEO Sam Bankman-Fried (SBF), held a total of $14.6 billion in assets as of June 30, including $3.66 billion “ Unlocked FTT” and $2.16 billion in “FTT Collateral.” The $8 billion in liabilities includes $292 million in “locked-in FTT” in addition to the $7.4 billion in loans. Its assets also include $292 million in “unlocked SOL,” $863 million in “locked SOL,” and $41 million in “SOL collateral.” Other tokens mentioned are SRM, MAPS, OXY, and FIDA, as well as $134 million in cash and equivalents and $2 billion in equity investments.

II. On November 4th, Alameda’s financial problems began to gain traction:

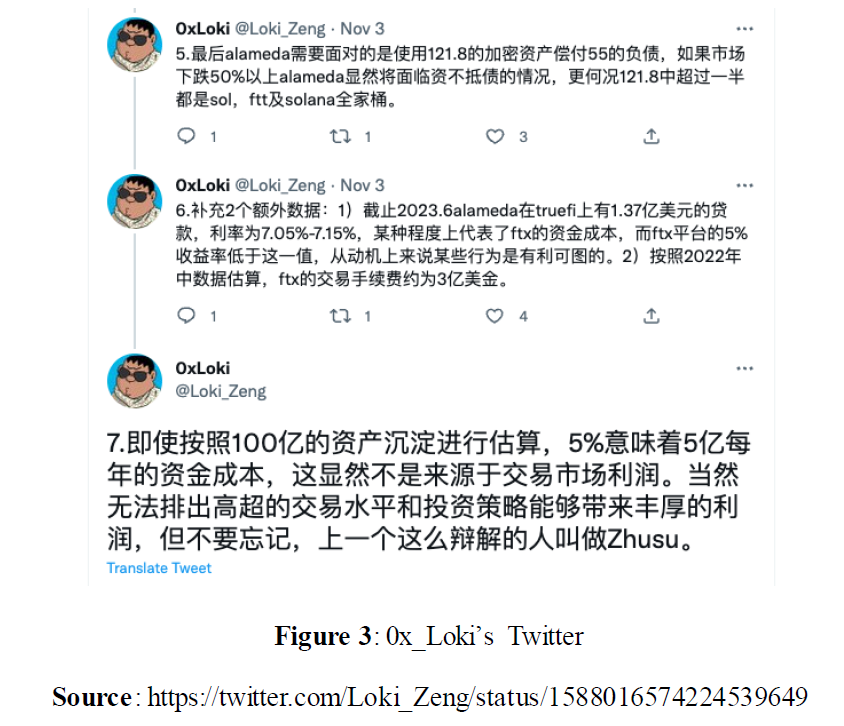

From 0x_Loki, Analyst in Huobi Incubator: Alameda’s balance sheet poses a very dangerous threat, and Alameda faces insolvency if the market falls by more than 50%. (1) Alameda has serious high-leverage operating problems, and its balance sheet is very dangerous. (2) There are many doubts about the source and use of funds of FTX and Alameda. (3) The excessive concentration of SOL/FTT will bring collateral risks to the Defi/Cefi backing them as collateral.

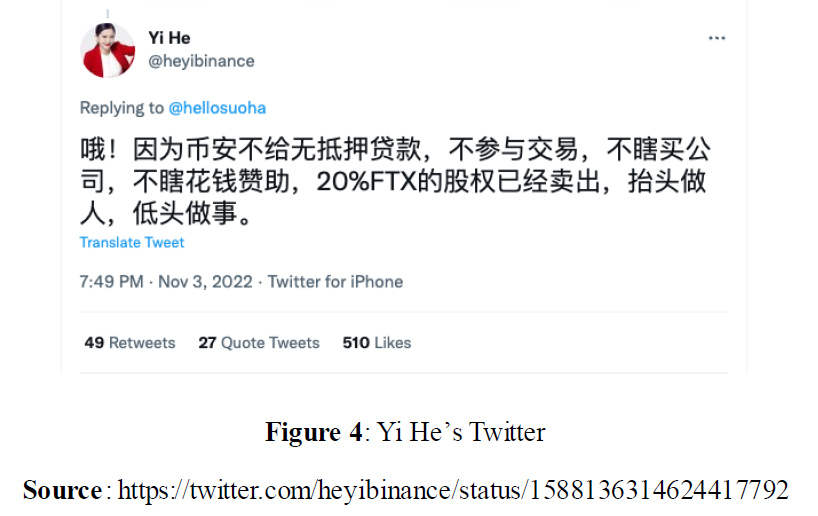

From Yi He, Founder of Binance: Binance does not give unsecured loans, does not participate in transactions, does not buy companies blindly, and does not spend money on sponsorships blindly. 20% of FTX’s equity has been sold.

From Dylan Leclair, co-founder of 21stParadigm: We do not understand how its liabilities are valued. If it’s mostly U.S. dollars, Alameda is in deep trouble because the assets on their balance sheet are completely illiquid. A crypto-denominated loan would be better, but still not much better. FTX/Alameda shines during summer deleveraging, are they just swimming naked?

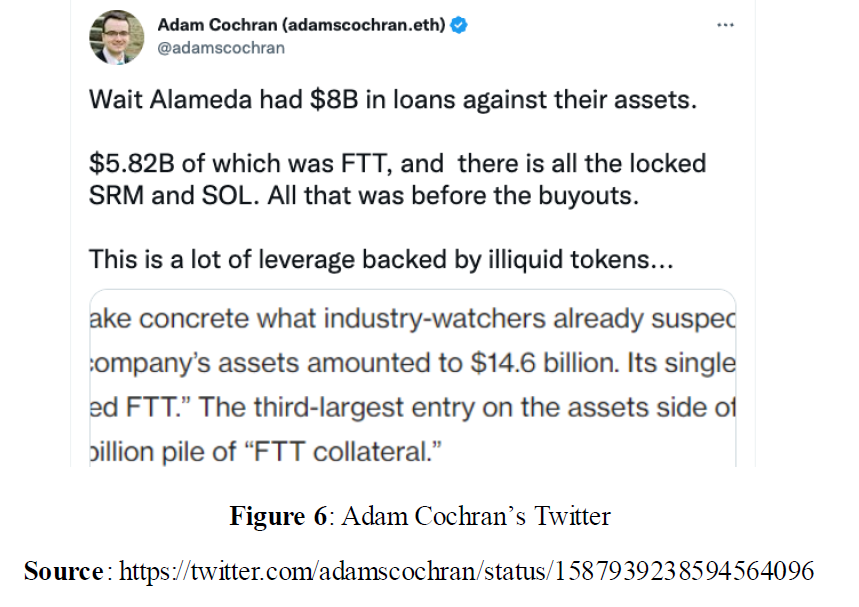

From Adam Cochran, Partner of CEHV: It is impossible to understand who would lend $8 billion to Alameda with collateral such as FTT, SRM, and SOL (high probability is FTX or SBF itself). However, this may explain why SBF has been so aggressive in acquiring bankrupt lending platforms, which would adversely affect Alameda’s lending if the FTTs owned by these bankrupt institutions were liquidated.

III. Co-CEO of Alameda Research responds to online financial documents: only some assets are shown, and most of the loans have been repaid

A few notes on the balance sheet info that has been circulating recently:

- that specific balance sheet is for a subset of our corporate entities, we have > $10b of assets that aren’t reflected there.

- the balance sheet breaks out a few of our biggest long positions; we obviously have hedges that aren’t listed

- given the tightening in the crypto credit space this year we’ve returned most of our loans by now.

II.Process of the Incident

On the evening of November 5th, Changpeng Zhao (CZ), the founder of Binance Exchange, tweeted that “Crypto is high risk.” About 2 hours after the tweet was sent, someone found a transfer record of 23 million FTT tokens on the chain. Some people speculated that it was part of the FTT assets held by Binance.

On the evening of November 6th, Alameda CEO Caroline Ellison tweeted to clarify that the company’s financial situation is good, saying that the balance sheet circulated on the Internet earlier only showed a small part of the company’s assets, and other company assets of more than 10 billion were not included. inside. The “network circulated balance sheet” referred to here originated from an article on Coindesk on November 2, titled “Sam Bankman-Fried’s trading giant Alameda’s balance sheet in the cryptocurrency empire is blurred”, according to a Coindesk quote. According to an internal document, as of June 30, Alameda’s assets reached US$14.6 billion, and its largest single asset was FTT tokens, including US$3.66 billion in unlocked FTT, US$292 million in unlocked FTT, and US$2.16 billion in FTT-related assets. Collateral, other assets are also dominated by cryptocurrencies, and a large number of them are project tokens closely related to Alameda, including SOL, SRM, MAPS, OXY and FIDA, which make people question Alameda’s financial health and worry about the company’s Will be insolvent.

On the evening of November 6th, less than 20 minutes after Caroline Ellison’s tweet was published, CZ directly announced on Twitter that Binance would clear all the FTT tokens in his hand, and said that he would sell them in stages to avoid causing market damage. After the tweet was sent out, the price of FTT fell by about 5%, reaching a minimum of $21. The next day, Caroline tweeted in response, saying she was willing to recycle all FTT tokens in CZ’s hands for $22. CZ is clearly not interested in this suggestion at the moment.

In the early hours of November 7th, while FTX founder SBF introduced the new features of the exchange on Twitter, he did not forget to add a tweet that seemed to be a testimonial at the end: “I have great respect for everything you have done for the industry, whether we use it or not. The same method, including CZ.” Although Caroline and SBF have quickly stated their position on the “Binance Clearing FTT” incident, CZ tweeted again in the early morning of the 7th to reiterate his position that “clearing the FTT in our hands is only after exiting. Risk management, this is learned from the LUNA incident. We will not pretend to be in love after divorce. We are not against anyone. But we will not support those who do small things behind the scenes (to lobby against other industry players) .”

On the evening of November 7, with the emergence of FTT transfer records on various chains and the demand for a large number of asset withdrawals, the market began to worry about the safety and risks of FTX. SBF tweeted on the evening of the 7th that “FTX is fine and all assets are fine.” At the same time, SBF reiterated that “FTX has sufficient funds to protect all client assets. We do not invest client assets. We Has been processing all withdrawals and continues to do so.”

In the early morning of November 8, CZ posted that the media and some people tried to portray the Binance coin sale as a “war”. CZ said, “I’m sorry to disappoint you, because I spend all my energy on how to build this ecology (industry) instead of fighting,” he finally emphasized, “I suggest that others do the same, focus on to build this ecology.”

On November 8, the market still hadn’t fully digested the news. Investors were worried about the risks of the FTX platform, which led to a large number of withdrawals from the FTX platform.

On the afternoon of November 8th, OKX founder Xu Mingxing tweeted, “If FTX unfortunately becomes the next LUNA, then no one, including Binance, will benefit from this incident. The industry has lost confidence. I hope Changpeng Zhao can consider stopping the sale of FTT and reach a new agreement with SBF.”

On November 8, because FTX officials have not made a public and comprehensive explanation on the incident, coupled with the spread of various news on the Internet, the panic among investors and users has gradually expanded, and the continuous large number of withdrawal applications has obviously put pressure on the liquidity of the FTX platform . On the evening of the 8th, FTX has suspended withdrawal requests on Ethereum, Solana, and Tron.

At midnight on November 9th, SBF tweeted that it had reached an agreement with Binance on FTX strategic investment, and that Binance would once again become an investor in FTX. Shortly after SBF posted the post, CZ also confirmed the news on Twitter, saying that he received a request for help from FTX on the afternoon of November 8th, saying that they had liquidity problems. In order to assist users, they reached an investment agreement with FTX, saying that this Two cryptocurrency exchange giants have signed a non-binding letter of intent. At the same time, SBF was found to have deleted his post on the evening of the 7th (“FTX is fine, and all assets are fine.”, “FTX has sufficient funds to protect all client assets. We do not invest client assets. We has been processing all withdrawals and continues to do so”).

In the early hours of November 9th, “Binance’s acquisition of FTX” was instantly spread, and investors cheered. The tokens of the two trading platforms soared instantly. FUD also started to surface. According to media reports, SBF has sought help from billionaires in Wall Street and Silicon Valley to obtain US$1 billion in emergency funds, but it does not seem to be enough to fill the funding gap of US$5 billion or US$6 billion in FTX, and this letter of intent is not binding , Binance can withdraw from trading at any time, and investors suddenly realize the huge potential crisis of FTX. Foreign media obtained news from four investors in FTX that they did not know what the fate of their holdings would be, and they were still trying to figure out what the impact of the acquisition would be. Another investor also said that these institutional investors are worried that the value of the stake will go to zero. At the same time, the news of Binance’s acquisition of FTX has drawn attention from all over the world to whether the transaction complies with antitrust regulations. Regulators everywhere have the power to block the major merger if they fear the acquisition will limit free choice in the market, and there are strict laws against anti-competitive behavior. Suddenly, the market sentiment took a sharp turn from bullish to sharply down. The carnage swept through the cryptocurrency market. Affected by the news, the cryptocurrency market fell as a whole, and mainstream cryptocurrencies such as Bitcoin and Ethereum were not spared.

On the morning of November 9th, Will Clemente, co-founder of Reflexivity Research, tweeted a screenshot titled “SBF Letter to Shareholders” and related content, showing that SBF mentioned to FTX shareholders that the relevant details of the acquisition are still in communication with Binance. During the discussion, it is temporarily unable to provide any substantive content.

On the evening of November 9th, CZ published a memo to his employees on Twitter, in which he responded to the fall of FTX and the acquisition, saying that they did not plan the whole thing in advance. He mentioned that when SBF contacted him that day, He originally thought that SBF wanted to talk to him about OTC, and he didn’t have very accurate information about the internal situation of FTX beforehand, so he could only use Binance’s earnings to compare with it for reference. Therefore, before this phone call, he and Bibi Ann does not have any plans to actively acquire FTX.

At 5 a.m. on November 10, Binance tweeted that based on the results of the company’s due diligence, as well as the latest news reports on improper handling of customer funds and investigations by U.S. agencies, Binance has decided to abandon its acquisition proposal for FTX.com. Binance said, “Initially hoped to support FTX’s customers and provide liquidity, but the problem was beyond the control of Binance’s capabilities. Whenever a heavyweight in an industry falls, retail investors will be hurt. Binance Observing that the cryptocurrency ecosystem has gradually become more resilient over the past few years, the misuse of user funds will be eliminated by the market.” After the announcement, the market panic was triggered, and Bitcoin fell below $16,000, a new low this year. FTX’s native token, FTT, fell to the $2 level.

On November 10, the “Wall Street Journal” reported that SBF asked investors to provide emergency funds in an investor conference call on November 9 local time to make up for the $8 billion gap. The Wall Street Journal quoted sources as saying that SBF made a request to investors. He outlined ways to help FTX solve its financial difficulties and said it was seeking to raise $3 billion to $4 billion in equity to make up for the shortfall. SBF has repeatedly stated to investors in conference calls that “FTX will not be able to solve the withdrawal problem because the value of the collateral has declined and cannot be liquidated.” At the same time, Bloomberg quoted people familiar with the matter as reporting that SBF told investors that if there is no cash For the capital infusion, the company will need to file for bankruptcy.

On the evening of November 10th, SBF issued a series of tweets with 22 replies to explain what happened recently, expressing its apology for not publicly explaining the incident to the public at the first time. As the CEO, he has to take full responsibility for the whole incident. He also admitted that he lacks transparency in public communication work, and the communication process needs to be improved, but he explained that it is inconvenient to disclose too many details because he was negotiating transactions with Binance in the early stage. He emphasized that this tweet was aimed at FTX International ( FTX.com ), not FTX US, and he admitted that he personally miscalculated the liquidity of the exchange, and then unexpected events caused the exchange to have problems , for which he again apologized. He said that the top priority at the moment is to fill the exchange liquidity, so he has started to approach multiple potential investors and is now waiting for the results. As for the status of Alameda Research, he said that Alameda has gradually stopped trading activities and no longer uses FTX for trading. Secondly, he said that he will try his best to keep FTX in operation. The first job is to ensure the transparency of assets and let everyone know what is happening on the exchange. Then he emphasized that only FTX.com has a problem, and FTX US liquidity has no problem at all.

At around midnight on November 11, according to Etherscan, funds were transferred out of the FTX wallet, and it is estimated that the platform is resuming processing withdrawals. Prior to this, the FTX platform has suspended the withdrawal service.

At around 3 a.m. on November 11, FTX official Twitter confirmed that it can only handle withdrawals from Bahamas users.

On November 11, the Securities Commission of the Bahamas issued a statement that it had frozen the assets of FTX Digital Markets Ltd. (FDM) and its related companies on November 10 local time (Taiwan 11) and appointed a provisional liquidator , therefore, FTX cannot transfer its assets without the approval of a liquidator appointed by the local Supreme Court.

On November 11, the FTX Future Fund team, the FTX charity fund, resigned collectively. Various news began to spread in the market, including: FTX US employees are trying to sell the company’s assets, and all employees of Alameda Research have resigned.

On the evening of November 11, FTX announced on Twitter that it had initiated bankruptcy proceedings under Chapter 11 of the United States Bankruptcy Code in the District of Delaware and filed for bankruptcy protection.

On the morning of November 12th, FTX was found to have a large amount of cryptocurrency transferred from its wallet. At present, both FTX and FTX US wallets are affected. The transferred amount is about 300 million US dollars. Most of the assets are transferred to the address 0x59abf3837fa962d6853b4cc0a19513aa031fd32b. At first, the community thought that the liquidator was preparing for bankruptcy, but when the withdrawer started to mix coins on the chain, it was suspected that it was a hacker attack or an FTX insider involved in the money. Shortly after the incident, Ryne Miller, FTX’s legal counsel, tweeted that he did not know why the assets were transferred, which seemed to confirm that this wave of withdrawals was an unusual operation.

On the afternoon of November 12, hackers continued to carry out various currency mixing and asset transfer operations, and the involved encrypted currency assets are currently difficult to estimate. Ryne Miller, FTX’s legal counsel, tweeted that the encrypted assets of FTX and FTX US would be transferred to the cold wallet in accordance with the relevant procedures of Chapter 11 of the Bankruptcy Law to take protective measures in response to the earlier unauthorized transactions. Circumstances in which licensed assets are transferred. Reuters received news that SBF had secretly transferred US$10 billion in funds to Alameda, and at least US$1 billion of client funds were missing. In addition, the more important news pointed out that the FTX legal and financial team discovered that SBF had implanted what the two called a “backdoor” program in FTX’s bookkeeping system, which was built using custom software. This “backdoor” allowed SBF to execute orders that could alter the company’s financial records without alerting others, including external auditors. The whistleblower said the setup meant that moving $10 billion to Alameda did not trigger FTX’s internal compliance or accounting red flags.

At about 3 am on November 13th, FTX legal counsel Ryne Miller quoted the statement of the current FTX CEO John Ray through Twitter, saying that he admitted that there was an unauthorized transfer of assets between FTX and FTX US. Stop FTX’s trading and withdrawal functions, and at the same time try to transfer the remaining encrypted assets to cold wallets, and will cooperate with the legal department to investigate related incidents.

On the morning of November 13, foreign media Cointelegraph quoted people familiar with the matter as saying that SBF has been detained by the Bahamian authorities. In addition to SBF, FTX co-founder Gary Wang and FTX executive Nishad Singh are also under “supervision” by the Bahamian authorities. Plans to travel to Dubai to circumvent the extradition treaty were unsuccessful. People familiar with the matter also revealed that Alameda CEO Caroline Ellison is currently in Hong Kong and is also trying to find a way to escape to Dubai.

III.Reflection of the Incident

With the bankruptcy of FTX, the degree of openness of the financial industry to the entire cryptocurrency field will also go backwards. For a long time in the past, SBF has led FTX and Alameda Research to maintain a good relationship with traditional finance. FTX has also received substantial investment from many well-known groups. SBF also sponsored many world-renowned entertainment events and the US Democratic election. The FTX incident will make it harder for centralized exchanges to gain trust, and it will also make traditional institutions lose confidence in entering the market in the short term, making individual investors less confident and thus wait and see. Next, there will be a high probability that other related centralized finance will trigger a chain reaction.

As an Exchange:

1) The exchange launched the active “transparency” of user fund certification: Exchange assets can be verified within a certain period, and users can also self-check assets at any time, which plays a role of “transparency”. Although evil cannot be completely suppressed, at least they will serve as a warning, perhaps the beginning of a series of changes. In any case, this is a powerful impact on the central culture of the exchange, which has always been strong.

2) Exchanges will be subject to stronger regulatory intervention: For example: further catering to FATF regulation, expanding compliance licenses in different countries, introducing authoritative financial audit companies, etc. In the past, the Crypto industry was popular because of its resistance to censorship, but the FTX thunderstorm incident is a turning point, and reasonable supervision is still meaningful. The underlying protocol of the Crypto industry cannot be regulated, but the upper-level application platform, such as trading, equity financing, and many other aspects, may at least intervene in supervision.

3) The exchange will expand the development of asset management business logic. Due to complex business needs, the exchange’s hot and cold wallet custody, collection, and transfer management assets are all internal ledgers, and users lack participation links. It will be too late after the untrustworthy group runs and withdraws cash. Exchanges should try their best to improve the security and transparency of asset management.

4) Effective intervention of third-party companies such as data security. In fact, on-chain data analysis companies such as Dune, and security companies such as SlowMist are also doing on-chain address labeling. However, the existing public labels are all derived layer by layer. Although they can cover more than 80%, they are not complete and can only play a partial early warning role. What is embarrassing about the current situation is that some address changes and exchange deposit and withdrawal news are not only difficult to deduce a rigorous fact, but will become a weapon to disrupt the market. Follow-up should increase financial audit and supervision.

As a user:

We should put our money in different places. This does not only refer to placing them on different exchanges, but also includes other types of assets. Users should reasonably allocate cash, real estate, stocks and bonds, and cryptocurrencies. Cryptocurrencies can also be kept in different places, such as their own wallets and exchanges. Users should also continue to monitor the exchange and dare to question it. This not only protects your own property safety, but also protects the property safety of others. This is also conducive to the development and progress of the entire industry.

About Huobi Research Institute

Huobi Blockchain Application Research Institute (referred to as “Huobi Research Institute”) was established in April 2016. Since March 2018, it has been committed to comprehensively expanding the research and exploration of various fields of blockchain. As the research object, the research goal is to accelerate the research and development of blockchain technology, promote the application of the blockchain industry, and promote the ecological optimization of the blockchain industry. The main research content includes industry trends, technology paths, application innovations in the blockchain field, Model exploration, etc. Based on the principles of public welfare, rigor and innovation, Huobi Research Institute will carry out extensive and in-depth cooperation with governments, enterprises, universities and other institutions through various forms to build a research platform covering the complete industrial chain of the blockchain. Industry professionals provide a solid theoretical basis and trend judgments to promote the healthy and sustainable development of the entire blockchain industry.

Contact us:

Website:http://research.huobi.com

Email:research@huobi.com

Twitter:https://twitter.com/Huobi_Research

Telegram:https://t.me/HuobiResearchOfficial

Medium:https://medium.com/huobi-research

Disclaimer

1. The author of this report and his organization do not have any relationship that affects the objectivity, independence, and fairness of the report with other third parties involved in this report.

2. The information and data cited in this report are from compliance channels. The sources of the information and data are considered reliable by the author, and necessary verifications have been made for their authenticity, accuracy and completeness, but the author makes no guarantee for their authenticity, accuracy or completeness.

3. The content of the report is for reference only, and the facts and opinions in the report do not constitute business, investment and other related recommendations. The author does not assume any responsibility for the losses caused by the use of the contents of this report, unless clearly stipulated by laws and regulations. Readers should not only make business and investment decisions based on this report, nor should they lose their ability to make independent judgments based on this report.

4. The information, opinions and inferences contained in this report only reflect the judgments of the researchers on the date of finalizing this report. In the future, based on industry changes and data and information updates, there is the possibility of updates of opinions and judgments.

5. The copyright of this report is only owned by Huobi Blockchain Research Institute. If you need to quote the content of this report, please indicate the source. If you need a large amount of references, please inform in advance (see “About Huobi Blockchain Research Institute” for contact information) and use it within the allowed scope. Under no circumstances shall this report be quoted, deleted or modified contrary to the original intent.

Timeline of FTX & Alameda Research Incident was originally published in Huobi Research on Medium, where people are continuing the conversation by highlighting and responding to this story.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.