Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

zkSync — Opportunities of Layer-2 Blockchain

Abstract

This week, we focus on the following events: 1) Binance to Sell Rest of FTX Token Holdings as Alameda CEO Defends Firm’s Financial Condition; 2) Helium, Building Out Mobile Network, Plans to Give Free Trials to Solana Phone Users; 3) US Seizes 50K Bitcoins Related to Silk Road Marketplace.

Project Analysis:Some Layer-2 blockchains are popular these days. Some of them will publish mainnets in a few months. Some of the chains announced their airdrop activities and many people want to find airdrop chances on them. This report will tell you about the Layer-2 main blockchain — zkSync, and how to interact with it.

1. Industry overview

I. Overall market trend

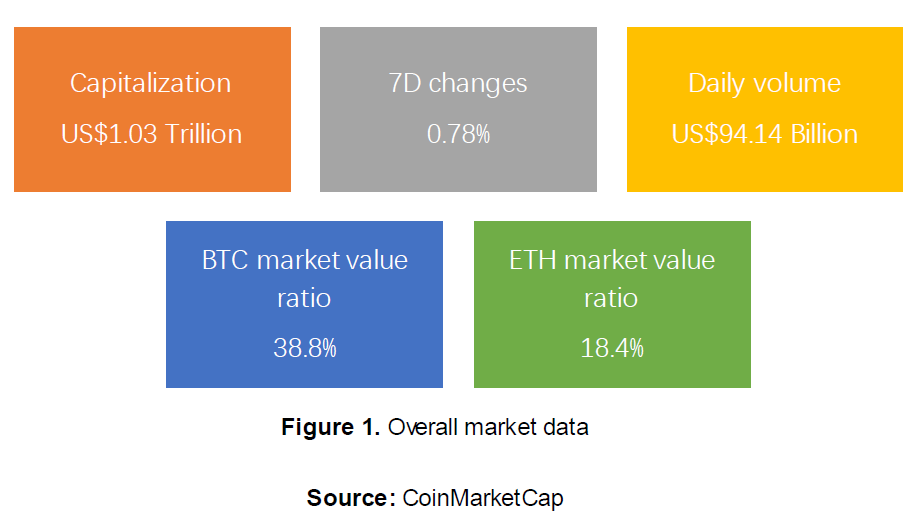

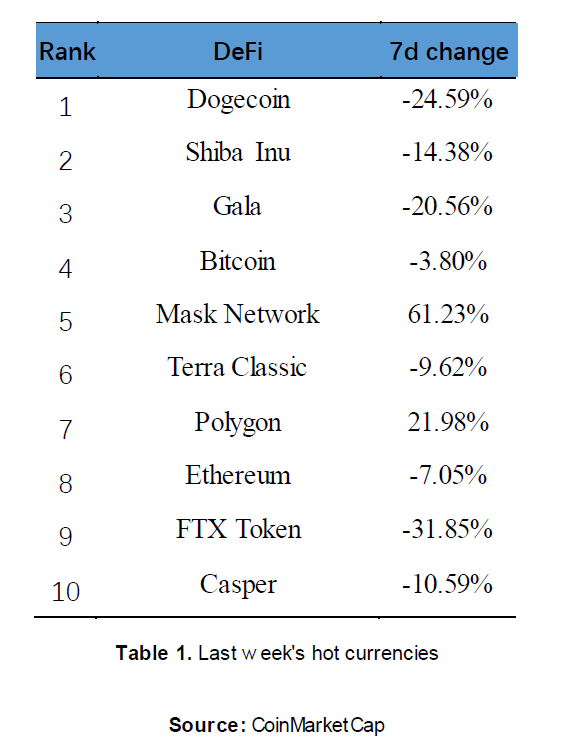

The global cryptocurrency market’s market cap this week changed slightly, currently with a market cap of $1,027,500,019,266. Bitcoin is currently trading at US$19,719, but this week repeatedly at the top of $20,000 or even $21,000. Meanwhile, Ethereum, the second largest cryptocurrency, is currently trading at US$1,473, was slowly increasing. Most of the other top 10 tokens, were tokens that have major news happened this week, like the downfall of Dogecoin, Gala’s hacking event, and FTT’s dumping. Among them, most of them are decreasing, with FTT down by 31.85%. The token with the biggest increase is the Mask Network with 61.23%.

II.NFT

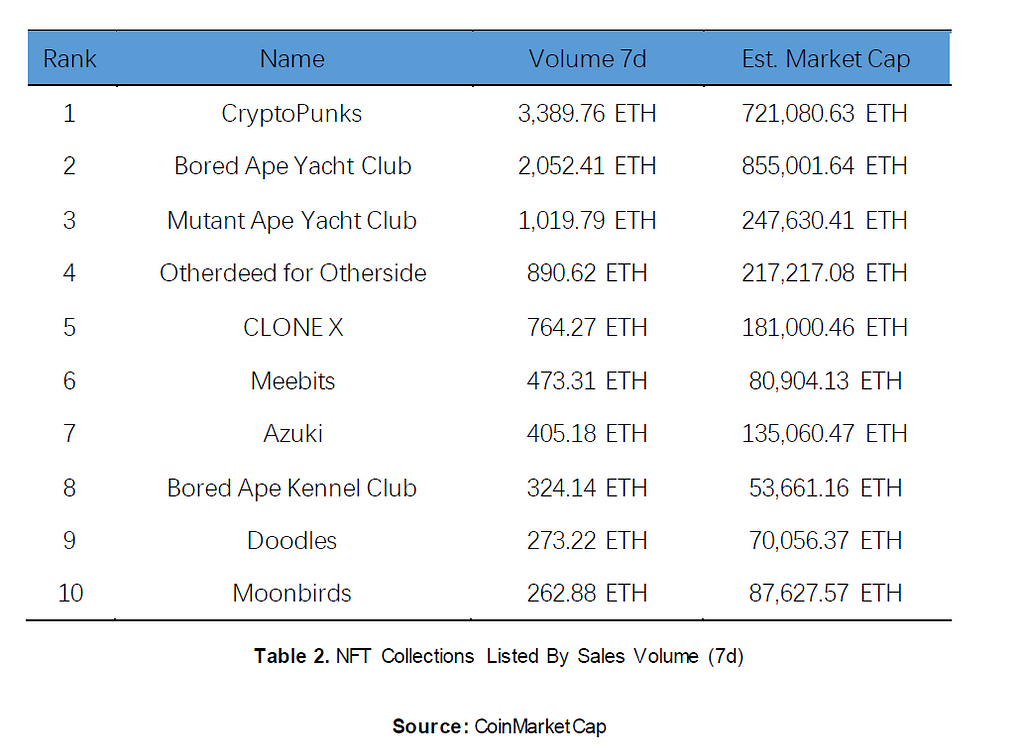

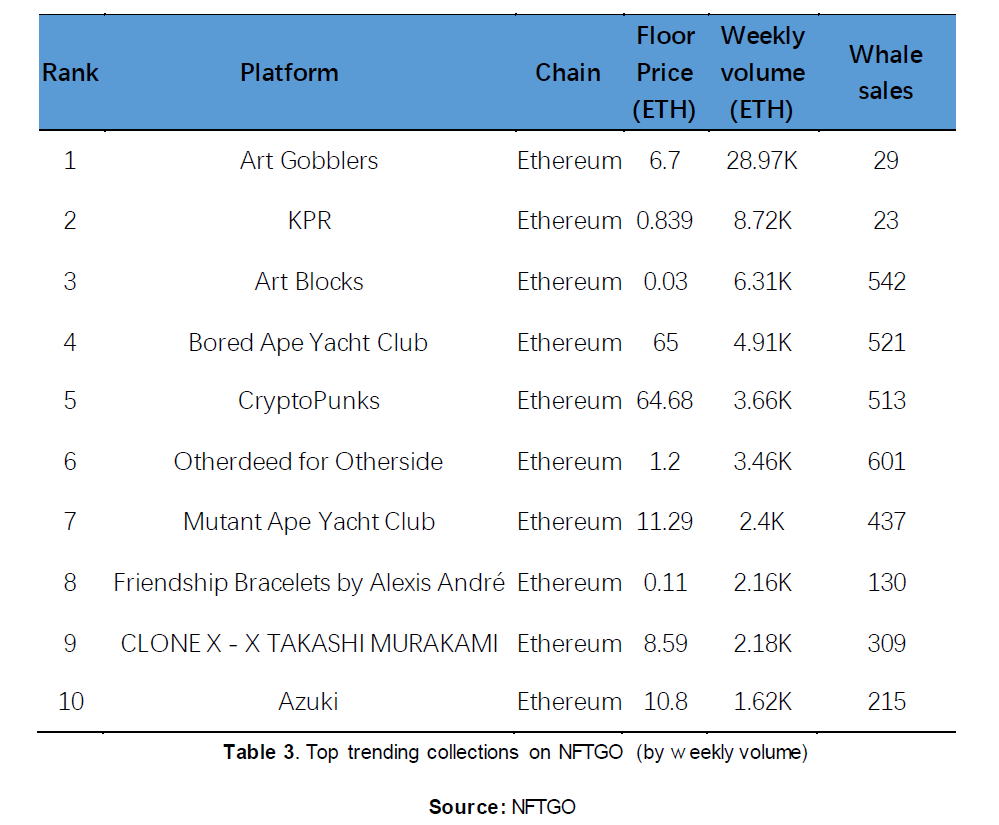

The NFT market last week saw a decrease of 3.31%, with a market cap of US $2,366,955,588.13 this week. This is the fourth consecutive week that the NFT market cap decreased, though slightly. The 7-day sales volume changed by 2.62% to $23,619,806.33 and total sales change by 14.05%, to 36,232. Overall, the sales declined a lot. This week the top 10 NFT brands on Coinmarketcap are all familiar brands which has entered this list before. Meebits has the biggest change at 0.43%, while all the other top 10 brands have a change less than 0.1%. On NFTGO, Art Gobblers has the top position which reflected the heat around this brand this week.

III.DeFi

IV.Layer 2

2. Market news (Source: Coindesk)

I. Industry news

Binance to Sell Rest of FTX Token Holdings as Alameda CEO Defends Firm’s Financial Condition

Binance’s CEO, responding to a CoinDesk scoop about trading firm Alameda Research’s balance sheet, tweeted Sunday that he will sell the remaining FTT tokens held on his books that he took on as part of his exit from Alameda sister company FTX last year.

Binance CEO Changpeng Zhao did not say how much FTT his firm will sell, but that as part of the cryptocurrency exchange’s exit from FTX equity last year, Binance received roughly $2.1 billion worth in the form of BUSD (Binance’s stablecoin) and FTT.

Alameda’s CEO, meanwhile, tweeted that her trading firm’s financial condition is stronger than what was reflected by the balance sheet CoinDesk wrote about. She also offered, in a reply to the Binance CEO’s post, to buy his firm’s FTT token holdings for $22 each.

Open Interest in FTT Futures Doubles as Binance Moves to Liquidate FTX Token Holdings

Traders are scurrying to hedge against a potential slide in crypto exchange FTX’s native token, FTT, in the wake of Binance’s decision to liquidate FTT holdings and controversy surrounding Alameda’s balance sheet.

Open interest, or the dollar amount dedicated to futures and perpetual futures tied to FTT, has more than doubled from $87.56 million to $203 million since early Asian hours, reaching a 12-month high, according to CoinGlass.

The funding rate, or the cost of holding bullish long positions or bearish short positions, has dropped sharply to an annualized -36%, per data provided by Matrixport Technologies. A negative funding rate implies shorts or bears have the upper hand and are willing to pay funding to longs to keep their positions open.

The combination of rising open interest and the negative funding rate suggests traders are taking short positions on FTT.

“FTT’s funding rate has dropped to -36% annualized as opening interest has doubled. Many new shorts seem to have been put on,” Markus Thielen, head of research at Strategy at Matrixport, said. “Trading volumes in the FTT spot market has increased from $58 million to $3 billion.”

Solana Falls and Speculation Centers on Links to Sam Bankman-Fried’s FTX, Alameda

Solana’s SOL token was one of the biggest losers in digital-asset markets on Monday, and crypto analysts speculated there might be a connection to the recent drama surrounding Sam Bankman-Fried’s FTX exchange and his trading firm, Alameda Research.

One theory is that Alameda might try to dump its SOL tokens in a bid to raise fresh liquidity.

“The large amounts of SOL and Solana ecosystem tokens held by Alameda could get sold off in a worst-case scenario and underline the close links between FTX/Alameda and Solana,” said Riyad Carey, research analyst at crypto data firm Kaiko.

The SOL token plunged 4.7% in the past 24 hours.

This week’s kerfuffle in crypto markets has evolved into a full-blown face-off between two of the industry’s biggest titans. It began when Changpeng Zhao, CEO of the rival exchange Binance, tweeted that his firm would sell its holdings of FTX’s exchange token, FTT — a stake reportedly worth more than $500 million. The token happens to be one of the biggest holdings on Alameda’s balance sheet, raising thorny questions about the blurry divisions between Bankman-Fried’s trading firm and the FTX exchange.

II. Investment and Financing

Helium, Building Out Mobile Network, Plans to Give Free Trials to Solana Phone Users

Nova Labs, the company behind Helium Network and a new crypto-powered cellular service called Helium Mobile, said it would provide SIM cards and free trials to customers of Solana Labs’ new Saga phones.

The companies declined to disclose financial details on the plan, which comes after Helium Network community members voted in September to ditch its own blockchain and migrate over to the larger Solana blockchain.

Under the agreement, Saga phones sold in the U.S. will get a 30-day free subscription to Helium Mobile, according to a press release. Saga phones are Solana’s flagship Android device, tightly integrated with the Solana blockchain.

The Helium Network is a decentralized grid of wireless hotspots that aims to provide an alternative to hard-wired internet or mobile data service. The services are powered by cryptocurrencies; people who participate in the network receive rewards for doing so.

$1B Crypto Hack Fears Spur 20% GALA Plunge, but Firm Implies It Attacked Itself as a Safeguard

Chaos ensnared Gala Games late Thursday as fears of a potentially billion-dollar hack — or maybe a rug pull — drove its native GALA token down 20%.

Meanwhile, a firm apparently related to the crypto play-to-earn platform said the platform had actually effectively attacked itself to prevent bad actors from absconding with users’ money.

Concerns developed after a single blockchain address appeared to mint over $1 billion worth of GALA token out of thin air. When crypto watchdogs PeckShield flagged that, pNetwork — which provides routing infrastructure for decentralized finance (DeFi) and gaming tokens, including apparently GALA — seemed to imply that it was behind the mint.

“We noticed pGALA wasn’t to be considered safe anymore and coordinated the white hat attack to prevent pGALA from being maliciously exploited,” the firm said, suggesting the new tokens were printed as a way to help pNetwork drain a faulty PancakeSwap pool.

NFT Platform ImmutableX’s $66M Unlocking Looms, Putting Sell Pressure on IMX Token

ImmutableX, a platform for non-fungible tokens, is set to release $66 million worth of IMX tokens in an unlocking event that will enable early private investors to sell some of their holdings and potentially tank the token’s price.

A total of 110 million IMX, representing more than 5% of the token’s total supply, will be freed from vesting, an ImmutableX spokesperson told CoinDesk.

Vesting stands for a period when investors in a company’s stock or a crypto project’s token cannot sell their assets. As the vesting period expires, the investors are allowed to relinquish their holdings, applying selling pressure to the asset’s price.

The unlocking is scheduled for Saturday, Nov. 5 at 13:00 UTC, according to the firm.

IMX recently has been trading at 60 cents, meaning these private investors may book a 500% profit on their early investment if they decide to sell.

III. Supervision

US Seizes 50K Bitcoins Related to Silk Road Marketplace

Damian Williams, the U.S. Attorney for the Southern District of New York, said Monday that authorities seized 50,676 bitcoins related to the darknet marketplace Silk Road in November.

The bitcoin was valued at $3.36 billion at the time it was discovered. Now it is worth $1.04 billion. In November, it was the largest cryptocurrency seizure to date, but has since been surpassed by the 70,000 bitcoins seized in February in relation to a hack of the Bitfinex crypto exchange.

In the Silk Road case, the coins were found at an address in Georgia connected with James Zhong. The feds also found $661,900 in cash as well as various precious metals. Zhong pleaded guilty to committing wire fraud in 2012, according to a statement from the Justice Department on Monday.

CBDCs May Need Global Regulation, EU Commissioner Says

Central bank digital currencies (CBDCs) may require a network of international deals to stop state-backed money from infringing on other countries’ sovereignty, European Union Commissioner Paolo Gentiloni said on Monday.

The bloc of 27 nations is considering a digital version of the euro, but needs to resolve issues such as how a digital euro will work for cross-border payments.

“How do you avoid the risk of infringing the sovereignty of other jurisdictions through a digital currency … while developing a digital currency with global ambition, as the digital euro will be?” said Gentiloni, who is responsible for economic policy at the European Commission, the EU’s executive arm. Gentiloni was speaking at a conference on the digital euro organized by the Commission and the European Central Bank.

“This, of course, brings the possibility of specific agreements with other jurisdictions regulating this kind of dimension,” he added.

SEC Charges Trade Coin Club Founding Members With Operating a $295 Million Ponzi Scheme

The Securities and Exchange Commission (SEC) said Friday that it’s charging the founding members of a multi-level marketing organization with operating a $295 million crypto Ponzi scheme.

The SEC is charging Douver Torres Braga, Joff Paradise, Keleionalani Akana Taylor and Jonathan Tetreault for their involvement in Trade Coin Club, which raised over 80,000 bitcoin (BTC) from over 100,000 investors.

Braga, who founded the firm, allegedly deceived investors by telling them they could generate daily returns of 0.35% on their crypto through a bot, but instead used these funds to compensate himself, Paradise, Taylor and Tetreault.

“We allege that Braga used Trade Coin Club to steal hundreds of millions from investors around the world and enrich himself by exploiting their interest in investing in digital assets,” said the chief of the Enforcement Division’s Crypto Assets and Cyber Unit, David Hirsch, in a statement.

3. zkSync

I. What is zkSync?

zkSync is a Layer 2 scaling solution for Ethereum based on zk Rollup. It belongs to the Layer 2 track together with Arbitrum and Optimism, but the difference is that both Arbitrum and Optimism, which are currently the largest Layer 2 ecosystems on the market, are based on Optimistic Rollup. the difference:

-zk Rollup — Zero Knowledge Proofs

-Optimistic Rollup — Fraud Proof

Let’s briefly talk about the difference between the two. Fundamentally, the two schemes are logically opposite. For example, zk does not believe all validators at all, and uses zero-knowledge proof to verify the results one by one, while Optimistic It is to use fraud proofs, in principle, choose to trust everyone and wait for others to raise objections, that is to say, Optimistic is a looser verification mechanism, which reduces the complexity of verification and calculation work. If you have a POS asset, this solution is feasible, then from the perspective of stakeholders, this is also true. This is similar to the reason that you have a POS asset, and you naturally don’t want it to go wrong. However, in terms of technical and logical rigor, zk seems to be more rigorous, but the development difficulty and cycle are long, which is why Arbitrum and Optimism are the first to open up the Layer 2 ecosystem.

II. When to issue token?

In the latest official article, zkSync will start decentralization after Q1 2023, which is the closest time to the issuance of coins as predicted by the market.

III. How to interact?

There are currently two network versions of zkSync:

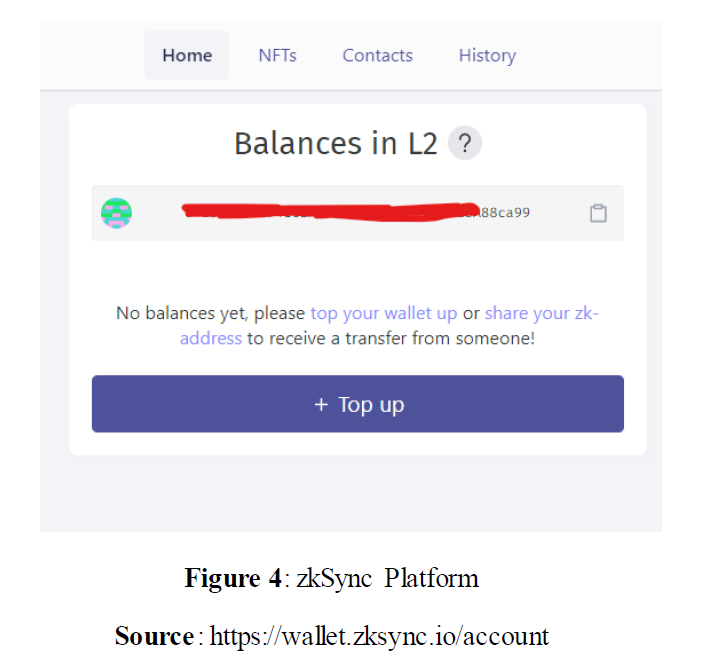

zksync 1.0 mainnet can be used, you need to recharge it with real ETH

zksync 2.0 testnet, leading faucet

The difference between these two networks is that zksync 1.0 is not compatible with EVM, so although the mainnet has been launched, there are not many applications in the ecosystem, while zksync 2.0 and its zkEVM can basically achieve full compatibility with EVM, so the future zksync 2.0 mainnet The ecosystem may directly target Arbitrum and Optimism. Currently, the TVL of these two Layer 2s is around 1B.

Therefore, at the interaction level, zksync 1.0 has been online for a long time, and many people have been interacting continuously since last year. For those who start interacting now, the opportunities for latecomers may not be as many as forerunners, but because 1.0 is already running on the main network and Both interaction and experience require real money, and if there is an airdrop, the probability of this part is very high.

On the other hand, since the zksync 2.0 testnet is free of cost interaction, it is recommended to interact as much as possible, although it will be very convoluted. After the zksync 2.0 mainnet is launched, if no coins are issued, it is also a good time to interact with the mainnet. opportunity.

To sum up, the relationship between interaction and airdrop is simple and simple: do both.

zkSync 1.0 interaction:

1. Top up

After clicking Top up, 4 bridges will be displayed, you can choose 1–2 at will, the official bridge is recommended.

2. Transfer

Here, you can enter your own or a friend’s address for transfer, which is the same as a normal transfer between wallets.

3. Swap

At present, clicking the [Swap] button on the official website will jump to ZigZag, a decentralized exchange. It is recommended to trade several times, because the trading functions that can be used on zksync are very limited. ZigZag is directly linked on the official website in each Aspects and official actions are very close.

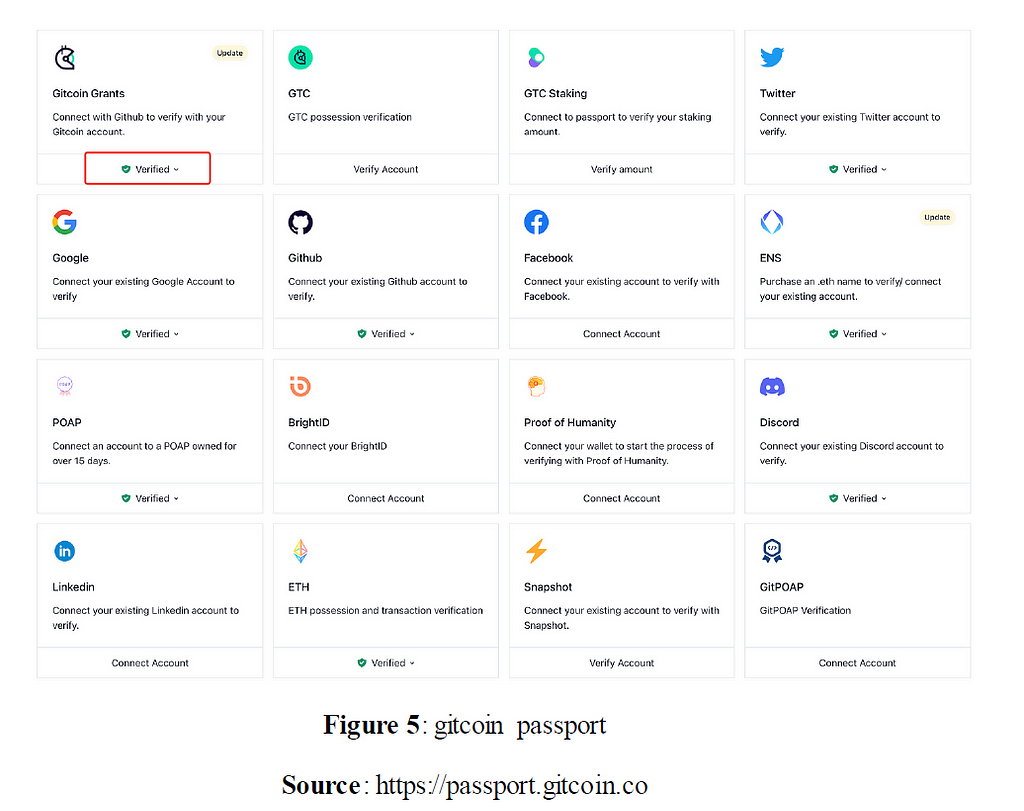

4. Gitcoin Donation & Passport

This is a long-term interaction. Many people have been participating in Gitcoin donations on zkSync since last year. They can continue to follow the conditions. After all, according to the OP, the probability of this part of the airdrop is also very high. Passport is an on-chain passport of Gitcoin, and one of its settings is anti-sybil attack, so try to light up as much as possible.

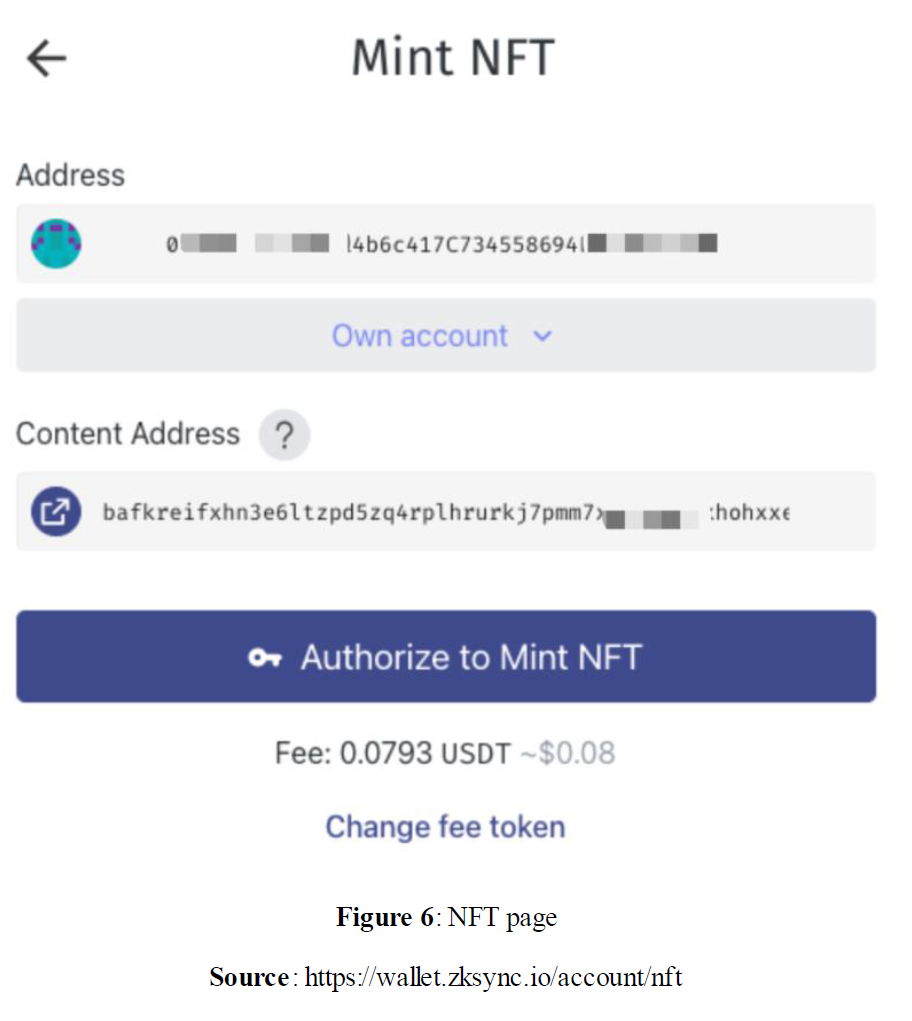

5. Minting NFTs

This step will be a little more troublesome. First of all, the Content Address needs to upload an image to IPFS and get the CID, then fill in the CID code and cast NFT on the zksync official website.

zkSync 2.0 interaction:

Currently zksync 2.0 is a Goerli Testnet, which supports cross-chain deposit and withdrawal with the Goerli Testnet of the Ethereum mainnet on the official website.

1.Add testnet RPC

Open the testnets button on Chainlist, search for zksync, add to Metamask.

2.Get faucet

There are two ways for the testnet of zksync 2.0 to claim faucet:

Official Faucet — Requires Twitter to post, requires an avatar and cannot be a new account

Ethereum mainnet Goerli faucet leader → zksync 2.0 bridge → zksync 2.0 testnet

3.Interactive Swap — SyncSwap & Mute.io

This step is relatively simple. Trading, adding liquidity, and going through all the functions that can be experienced, and more dex may appear in the future, so the same method can continue to interact.

4.Mint NFT & List — MintSquare

Link wallet → click on your avatar in the upper right corner and select mint → upload a picture and fill in the information → submit mint.

The entire transaction and usage experience is very similar to OpenSea. After casting NFT, you will check your own NFT in your profile, select NFT to set the price and list it, and you can buy other people’s NFT if you have the conditions to increase the completed experience.

5.Loan — 1kx

1kx has a set of functions such as dex, stable currency, and lending, so you can experience everything you can experience, and you can do both swap and lending at one time.

These are the steps to interact with zkSync. In fact, no one knows the rules and standards of giving airdrops. These are the experience from getting airdrops in other projects and blockchains, but it cannot promise users can get airdrops by these steps. Users should analyze the costs and decide whether interact with it.

About Huobi Research Institute

Huobi Blockchain Application Research Institute (referred to as “Huobi Research Institute”) was established in April 2016. Since March 2018, it has been committed to comprehensively expanding the research and exploration of various fields of blockchain. As the research object, the research goal is to accelerate the research and development of blockchain technology, promote the application of the blockchain industry, and promote the ecological optimization of the blockchain industry. The main research content includes industry trends, technology paths, application innovations in the blockchain field, Model exploration, etc. Based on the principles of public welfare, rigor and innovation, Huobi Research Institute will carry out extensive and in-depth cooperation with governments, enterprises, universities and other institutions through various forms to build a research platform covering the complete industrial chain of the blockchain. Industry professionals provide a solid theoretical basis and trend judgments to promote the healthy and sustainable development of the entire blockchain industry.

Contact us:

Website:http://research.huobi.com

Email:research@huobi.com

Twitter:https://twitter.com/Huobi_Research

Telegram:https://t.me/HuobiResearchOfficial

Medium:https://medium.com/huobi-research

Disclaimer

1. The author of this report and his organization do not have any relationship that affects the objectivity, independence, and fairness of the report with other third parties involved in this report.

2. The information and data cited in this report are from compliance channels. The sources of the information and data are considered reliable by the author, and necessary verifications have been made for their authenticity, accuracy and completeness, but the author makes no guarantee for their authenticity, accuracy or completeness.

3. The content of the report is for reference only, and the facts and opinions in the report do not constitute business, investment and other related recommendations. The author does not assume any responsibility for the losses caused by the use of the contents of this report, unless clearly stipulated by laws and regulations. Readers should not only make business and investment decisions based on this report, nor should they lose their ability to make independent judgments based on this report.

4. The information, opinions and inferences contained in this report only reflect the judgments of the researchers on the date of finalizing this report. In the future, based on industry changes and data and information updates, there is the possibility of updates of opinions and judgments.

5. The copyright of this report is only owned by Huobi Blockchain Research Institute. If you need to quote the content of this report, please indicate the source. If you need a large amount of references, please inform in advance (see “About Huobi Blockchain Research Institute” for contact information) and use it within the allowed scope. Under no circumstances shall this report be quoted, deleted or modified contrary to the original intent.

zkSync — Opportunities of Layer-2 Blockchain was originally published in Huobi Research on Medium, where people are continuing the conversation by highlighting and responding to this story.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.