Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

Aptos — Questions, Clarifications, and Data

Abstract

This week, we focus on the following events: 1) Aptos Debuts Its Blockchain, Putting Millions in VC Dollars to the Test; 2) Crypto Asset Manager Valkyrie Lost the Biggest Investor in Its $11M Funding Round; 3) Liz Truss Steps Down as UK Prime Minister.

Project Analysis: On October 19, 2022, Aptos Mainnet was officially launched. Before the market opened, it was in the spotlight with its ultra-high valuation, high performance and star investors. After the opening, about 20 million APTs were also airdropped to users as testnet rewards. At the same time, due to the fact that it has received a lot of attention before its opening, some false remarks and accusations have appeared. This article will briefly introduce the performance of Aptos Mainnet after its launch and the official team’s clarification of rumors.

1. Industry overview

I. Overall market trend

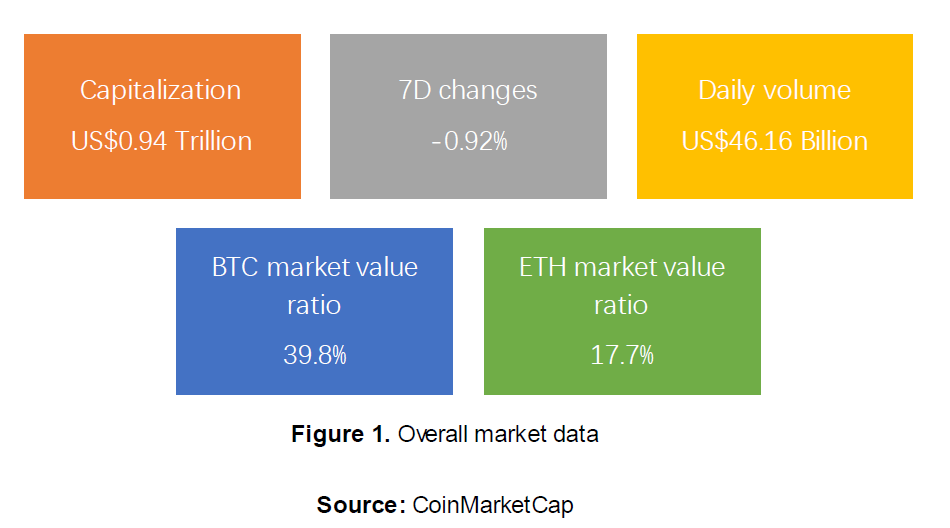

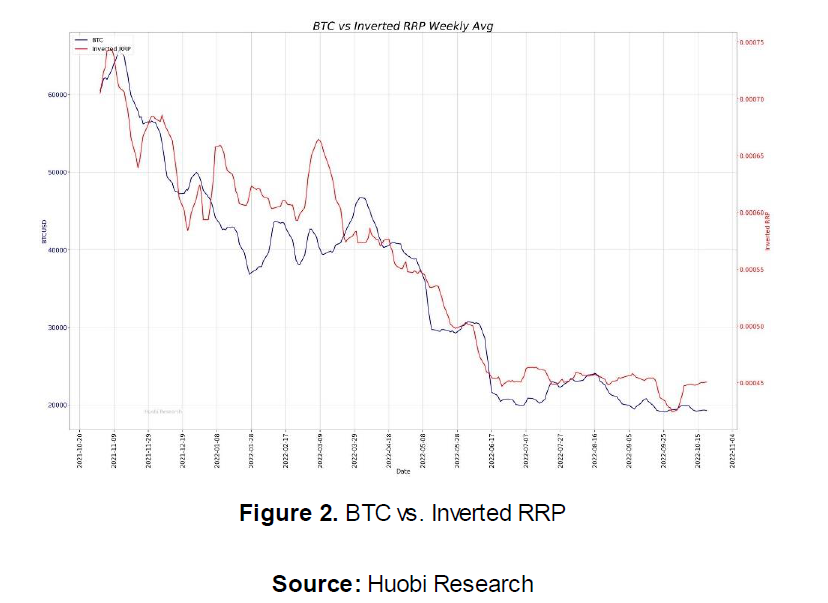

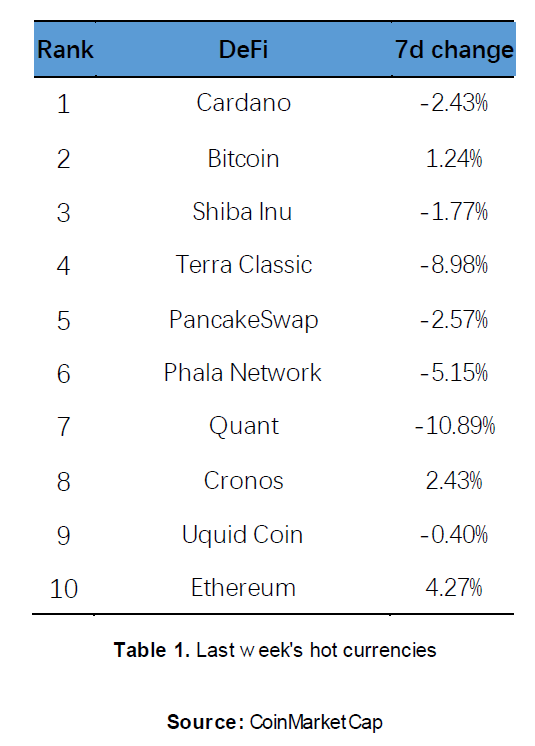

The global cryptocurrency market’s market cap this week changed slightly, currently with a market cap of $936,439,665,685.444. Bitcoin is currently trading at US$19,439, continuing weeks below $20,000, showing no signs of going back to $20,000. Meanwhile, Ethereum, the second largest cryptocurrency, is currently trading at US$1,355, was slowing increasing. Most of the other top 10 tokens, were new tokens that never entered the top 10 before, like PHA QUT CRO and UQC. Among them, most of them are decreasing, with Quant (QUT) decreased the most at 10.89%. Below is a graph for BTC and Inverted RRP, RRP is an instrument used by the Fed to suck out liquidity from the markets by attracting investments from the markets themselves.

The Inverted RRP may indicate sell-offs in equity markets (SPX/IXIC/Bitcoin) when it decreases, and vice versa.

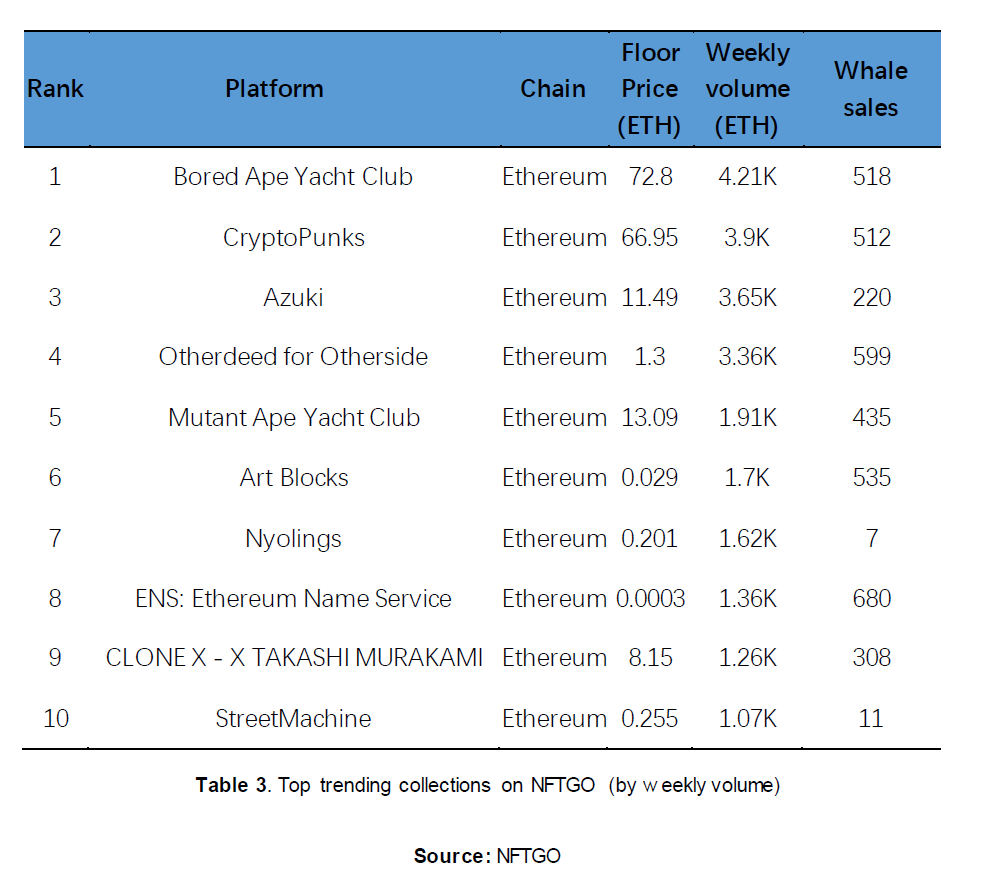

II.NFT

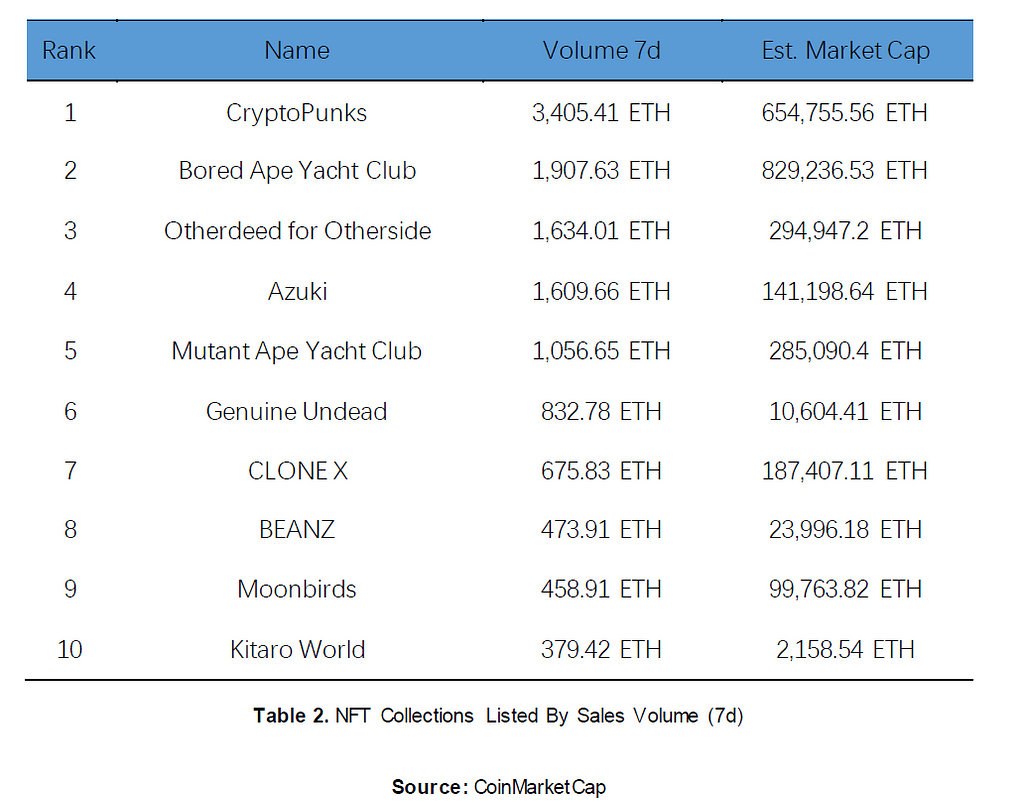

The NFT market last week saw a decrease of 10.22%, with a market cap of US $2,352,905,043.62 this week. This is the third consecutive week that the NFT market cap decreased. The 7-day sales volume changed by 1.56% to $26,818,016.84 and total sales did not change very much at 1.11%, to 43,135. Overall, the sales declined a little bit. This week the top 10 NFT brands on Coinmarketcap are all familiar brands which has entered this list before, except the tenth, Kitaro World with a Market Cap of 2158.54 ETH; it also has the biggest change at 0.07%, while all the other top 10 brands have a change less than 0.1%.

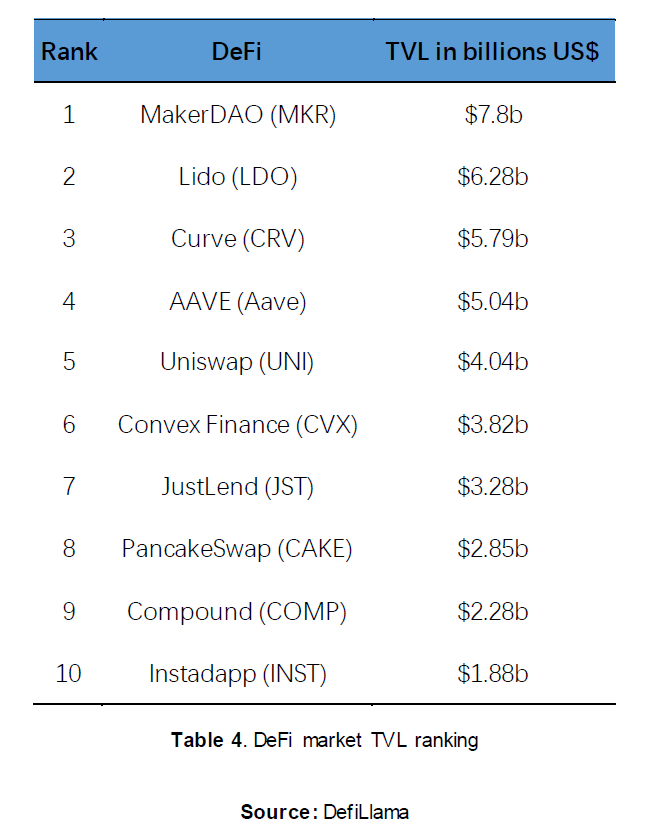

III.DeFi

IV.Layer 2

2. Market news (Source: Coindesk)

I. Industry news

Aptos Debuts Its Blockchain, Putting Millions in VC Dollars to the Test

Aptos Labs blockchain launched its mainnet on Monday, becoming the first of the Facebook spin-off networks to premiere and putting to the test its multibillion-dollar valuation.

Aptos is the brainchild of several ex-Meta employees who pioneered the company’s failed diem stablecoin. The Aptos blockchain’s code is written with Move, the Rust-based programming language favored by Mysten Labs’ Sui blockchain, another upcoming network.

While Aptos Labs has declared its network “live,” its ecosystem is far from completed, with dozens of teams yet to launch the wallets, trading venues and non-fungible token tech essential to decentralized finance (DeFi). Until those — and a token — debut, there won’t be much to do on Aptos.

Furthermore, the vulnerability assessment by the platform alleged that FTX has no restriction on the transfer GAS limit of ETH’s native token. It said FTX used the “estimateGas” method to evaluate the handling fee, resulting in most of the GAS limit being 500,000, which is 24 times higher than the default value of 21,000.

Celo Protocol Moola Market Loses Over $10M in Market Manipulation Attack

Celo-based lending and borrowing protocol Moola Market had over $10 million worth of tokens stolen, and later returned, Wednesday morning after a market manipulation attack.

The exploit was the second of its kind in the last few weeks, with the attackers manipulating the prices of Moola’s native MOO tokens to borrow collateral against their positions — effectively draining the protocol.

Moola developers said the attack started during late Asian hours on Tuesday. “An unknown attacker started manipulating the price of MOO on Ubeswap, allowing the attacker to manipulate the MOO TWAP price oracle used by the Moola protocol,” they wrote. Oracles are third-party services that fetch data from outside a blockchain to within it.

Crypto Wallet BitKeep Hacked for $1M in BNB Chain, Polygon Tokens

Crypto wallet BitKeep was hacked for over $1 million worth of BNB Chain and Polygon-based tokens during early Asian hours on Tuesday, developers said.

BitKeep supports tokens from more than 30 blockchain networks such as Ethereum, Polygon, Solana and BNB Chain and claims to have more than six million users.

The wallet’s Swap product was hacked early on Tuesday.

“Our development team managed to contain the emergency and stopped the hacker,” the team said in a tweet Tuesday morning, adding that it will compensate all user losses.

II. Investment and Financing

Crypto Asset Manager Valkyrie Lost the Biggest Investor in Its $11M Funding Round

Months after announcing it had raised $11.15 million, crypto asset manager Valkyrie Investments earlier this month revealed — quietly — that the biggest participant in the funding round reneged, leaving Valkyrie scrambling to find others to fill the gap.

In a letter that went largely unnoticed until now, Valkyrie CEO Leah Wald wrote that an entity she called CSA Evolution VC Fund was no longer able to contribute $5 million toward the transaction.

“We had a signed subscription doc in-hand, and their [limited partners] were blue chip firms that have impeccable reputations in the business,” she wrote in the letter dated Oct. 7. “In the months that have since passed, though, those LPs backed out and the investor was unable to meet its obligation.” She went on to say that Valkyrie was looking for other investors to step in.

Stealthy Crypto Hedge Fund Edge Capital Raises $66.8M for DeFi Bets

Crypto hedge fund Edge Capital Management, which has very little public information, has raised $66.78 million across two decentralized finance (DeFi)-focused funds, according to regulatory filings on Oct. 19 with the U.S. Securities and Exchange Commission (SEC).

The U.S.-based Edge DeFi Fund LP has raised about $28 million from eight investors since sales opened on Feb. 1 of this year, according to the filing. The firm plans for the offering to last for more than one year for the fund. The other Cayman Islands-based Edge DeFi Offshore Fund has sold about $38.6 million to six investors since opening for sales at the start of October 2021.

The firm is likely planning to raise further for both funds as it didn’t set any limits for their targeted raise, according to the SEC filings.

Pension Fund-Backed Parataxis Digital Yield Fund Targets $500M in Assets in 2023

Multi-strategy crypto investment firm Parataxis Capital expects to triple the assets under management for its $35.6 million digital yield fund by the end of the year, with a further ambitious target of $500 million by the end of 2023, co-founder and CEO Edward Chin told CoinDesk in an interview. Chin said the target is based on conversations with the firm’s allocators, who help institutions decide where to invest money.

Parataxis, which currently has about $116 million in assets under management, primarily focuses on institutional investors such as banks, family offices and pension endowments. The market-neutral Parataxis Digital Yield Fund made headlines in August when Fairfax County, Virginia’s, $6.8 billion pension fund, the Fairfax County Retirement Systems, said it would invest $35 million in the yield farming fund. Fairfax, one of the first U.S. pensions to invest in crypto, made a two-part bet on yield farming, a term that refers to any effort to generate the most returns possible on crypto assets through a variety of methods.

III. Supervision

Liz Truss Steps Down as UK Prime Minister

Liz Truss has resigned as U.K. prime minister on Thursday after serving just six weeks on the job.

Her short time in office was marked by controversies over her fiscal policy and the energy policy known as fracking, and her resignation leaves the fate of bills on stablecoins and crypto seizures hanging in the balance.

“I am resigning as leader of the Conservative Party,” Truss told reporters outside her office on Downing Street, saying a new leadership election will be completed within the next week. “I will remain as prime minister until a successor has been chosen.”

The government’s Financial Services and Markets Bill, which would offer much-needed regulations allowing crypto assets to be used as a means of payment, entered committee stage on Wednesday.

DeFi Exchange Mango’s $114M Exploit Was ‘Market Manipulation,’ Not a Hack, Ex-FBI Special Agent Says

The $114 million in funds siphoned out of decentralized crypto exchange (DEX) Mango Markets wasn’t the result of a hack, according to former FBI Special Agent Chris Tarbell.

Tarbell, who previously worked at the FBI’s cybercrime squad in New York, told CoinDesk TV’s “First Mover” the exploit of Mango Market was “more of a market manipulation.”

“This wasn’t [about] getting into a system and getting unauthorized access,” Tarbell said, referring to the strategy used by the illicit actors.

Hodlonaut Wins Norwegian Lawsuit Against Self-Proclaimed ‘Satoshi’ Craig Wright

Magnus Granath, known on Twitter as “Hodlonaut,” won a lawsuit against Craig Wright on Thursday, a judge in Norway ruled.

Granath sued Wright in Norway to try and preempt a defamation suit Wright planned to bring against Granath in the U.K., where defamation laws are heavily tipped in favor of the plaintiff and monetary damages can be enormous.

At the center of both cases is a series of tweets, written by Granath in March 2019, in which he called Wright — who has long claimed and failed to prove that he is Satoshi Nakamoto, the pseudonymous inventor of Bitcoin — a “fraud” and a “scammer.” Granath asked the Norwegian court to rule that his tweets were protected by the freedom of speech, therefore preventing Wright from pursuing damages in relation to the tweets.

“The result was as expected,” Granath told CoinDesk. “I am very happy and thankful for all the support.”

3. Aptos

I. Data

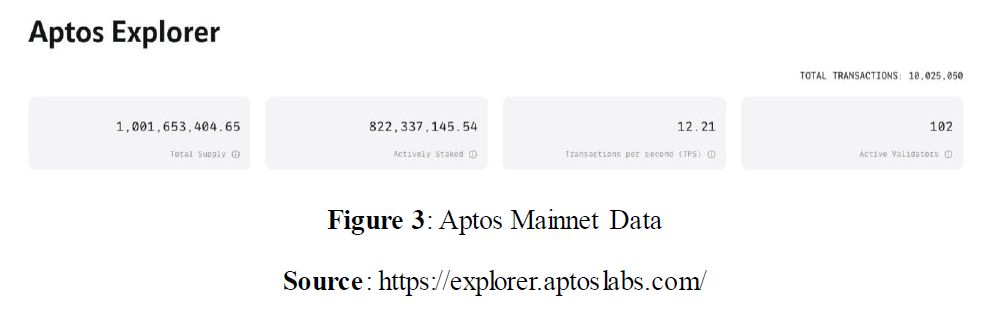

On-chain data

On October 24, 2022, the total supply of Aptos is 1,001,653,404.65. The Actively staked is 822,337,145,54. The TPS of Aptos is 13.51. The Active validators are 102. The total transactions are 10,028,919.

Obviously, the vast majority of tokens are pledged, and this part belongs to institutional investors and project parties. For ordinary users, there are very few tokens at the disposal of the market. Over time, most of the tokens will also be held by project parties and institutional investors. For now, TPS is 12.21. This data is still at a low level so far, unable to meet the requirements of a large number of on-chain ecosystems.

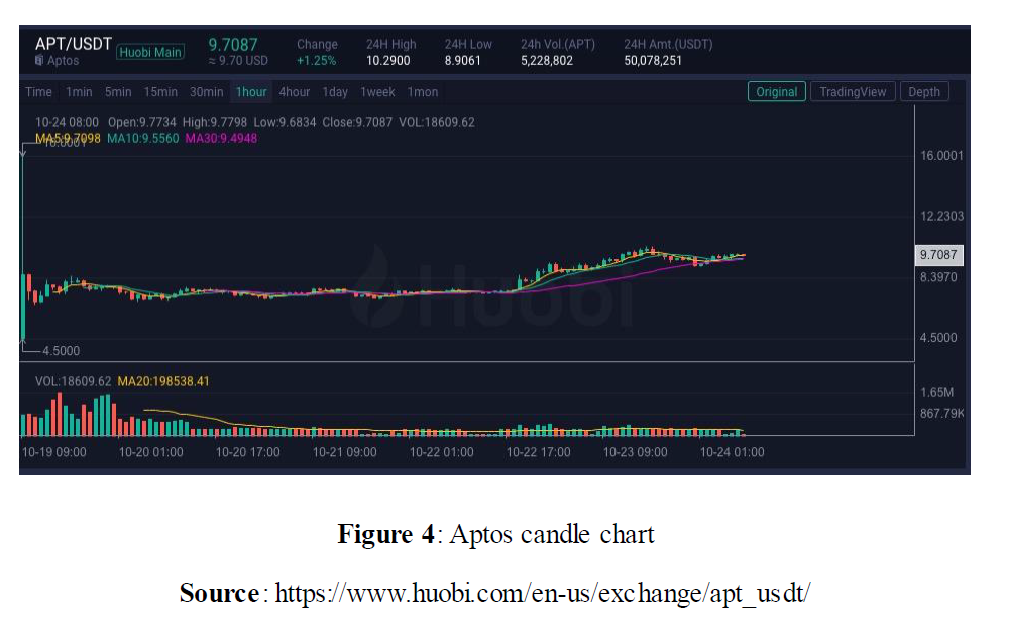

Market Data

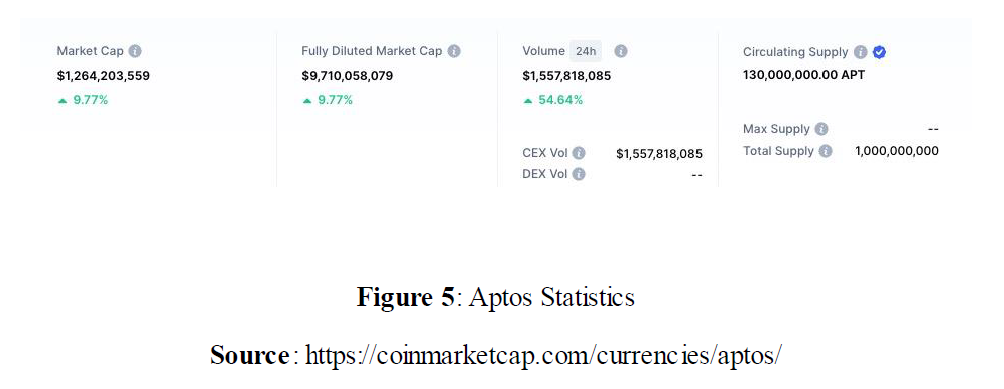

APT’s price peaked at 16u at the opening, and then fell back and fluctuated around 7u. Starting from the 22nd, the price has shown strength, and the current price is around 10u. The live Aptos price today is $9.71 USD with a 24-hour trading volume of $1,557,818,085 USD. We update our APT to USD price in real-time. Aptos is up 9.77% in the last 24 hours. The current market ranking is #42, with a live market cap of $1,262,307,550 USD. It has a circulating supply of 130,000,000 APT coins and the max. supply is not available.

II.Clarifications

Just when Aptos was very popular, a netizen (@ParadigmEng420) questioned. At the same time, Aptos officials also gave clarifications.

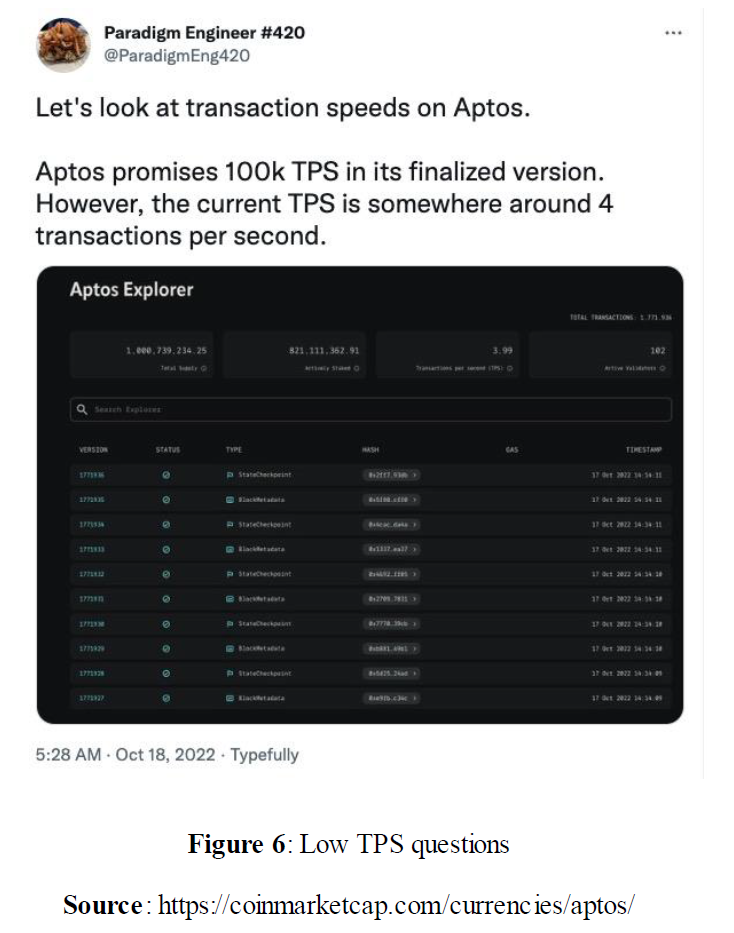

The TPS is very low.

Aptos promises 100k TPS in its finalized version. However, the current TPS is somewhere around 4 transactions per second. Additionally, the majority of these transactions are not actual transactions, they are merely validators communicating and setting block checkpoints and writing metadata to the blockchain.

Clarification:

Although Aptos has officially announced the launch of the main network, the main network is still in the empty running stage (this stage has actually lasted for a week), and most of the ecological project parties plan to complete it within the first day of launch. Therefore, the data of 4 TPS will have a large deviation from the actual situation, because there is no actual user interaction for the time being.

According to Aptos official news, Aptos introduced a large number of stress tests in the testnet phase. In less than 2 weeks, more than 800 million transactions were completed, with an average TPS of over 700, and the team was able to continuously achieve more than 4,000 TPS.

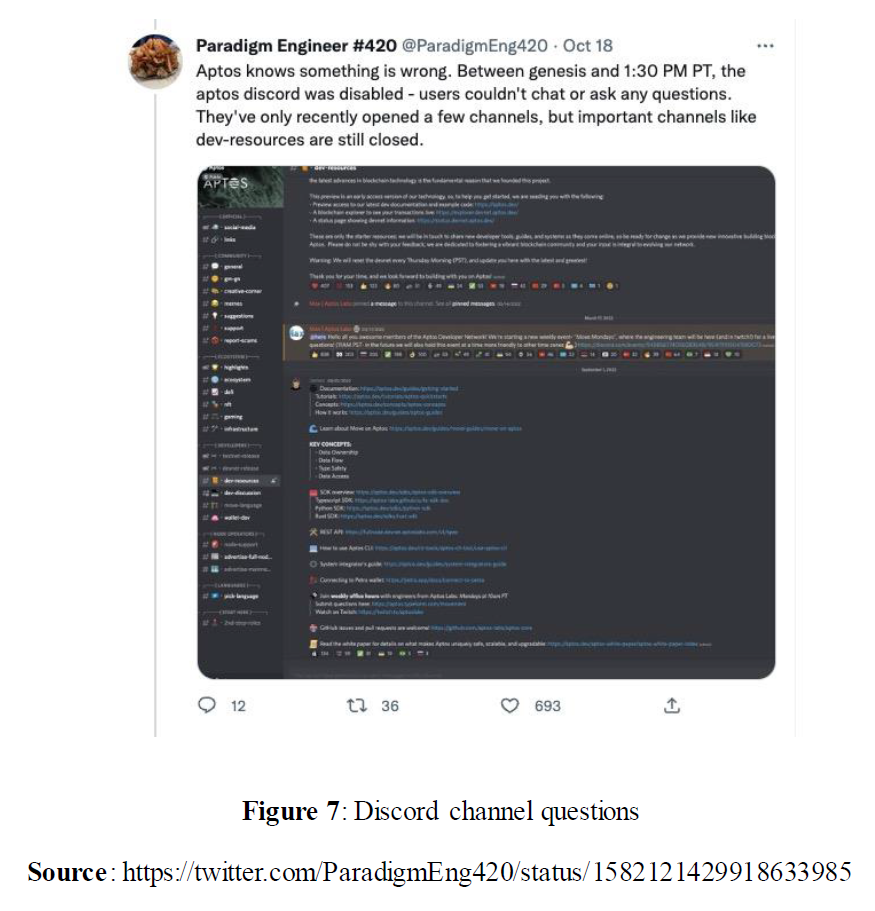

Aptos disabled some main Discord channels

Between genesis and 1:30 PM PT, the aptos discord was disabled — users couldn’t chat or ask any questions. They’ve only recently opened a few channels, but important channels like dev-resources are still closed. Why not announce it publicly instead of shutting down your discord and pretending the launch went smoothly?

Clarification:

Aptos has officially explained the issue — the comment function is turned off to protect the community from scams during this window, the developers are actively monitoring, and the above channels will return to normal in due course.

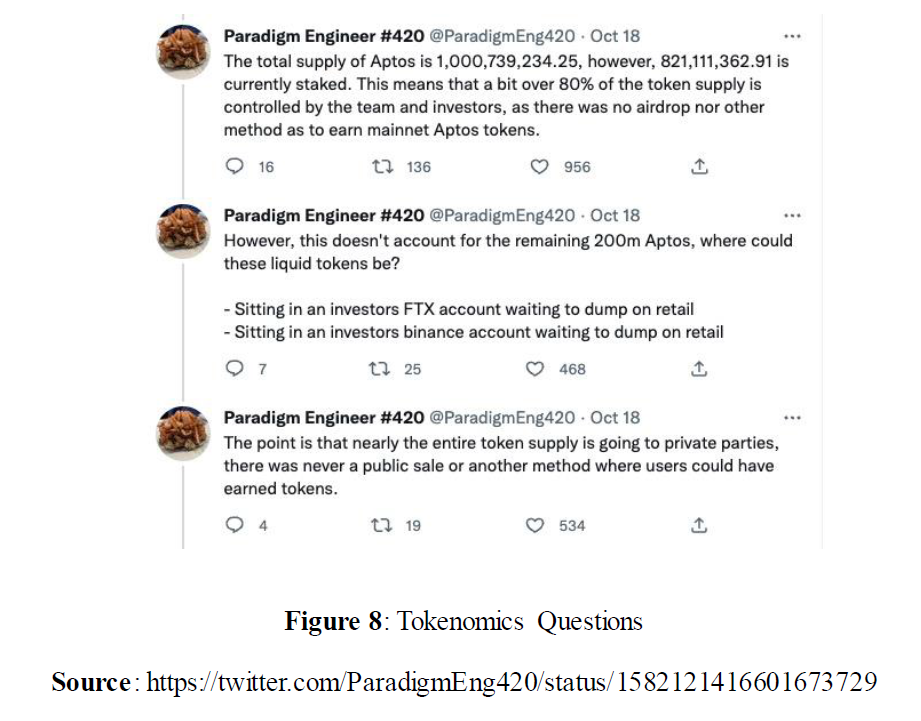

No tokenomics and no airdrop

The total supply of Aptos is about 1 billion, and about 820 million are currently staked, which means that more than 80% of the token supply is controlled by the team and investors, as there is no airdrop or other method to earn APT. Almost all of the token supply goes to institutions, and there has never been a public sale or other channel for users to acquire tokens.

Clarification:

In fact, Aptos announced an airdrop to early-rising test users afterward. Node participants of the testnet can get 300APT, and testnet NFT recipients can get 150APT. In the end, Aptos issued a total of about 20 million APTs for airdrops.

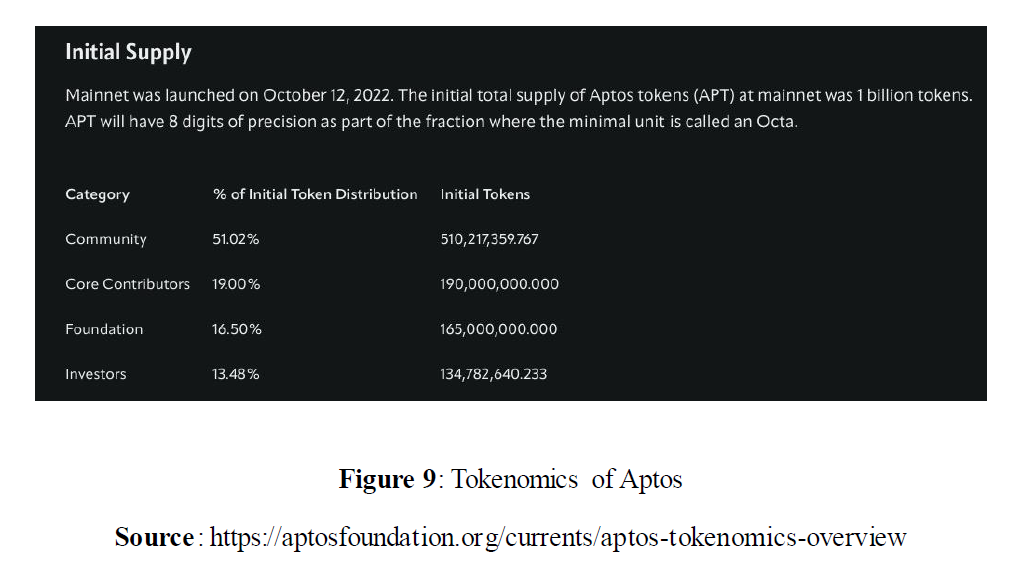

On October 17th, Aptos officially released the tokenomics of Aptos. But this is undoubtedly very late for tokens that have already been launched. According to the official disclosure, Aptos tokens are distributed as follows: 51.02% will be allocated to the community, 16.5% to the foundation, 19% to core contributors, and 13.48% to investors. This allocation seems very reasonable, but if you look closely at the tokens allocated to the community, there are also hidden secrets. As mentioned in the Token Economics document, 410,217,359.767 APTs in 51.02% of APT tokens are held by Aptos Foundation and 100,000,000 APTs are held by Aptos Labs. That is to say, 51.02% of the community share does not really belong to the Aptos community, but is essentially owned by the Aptos official team. The official said that these tokens will be used to promote the growth of the Aptos ecological project.

But this part of the tokens is being used for pledge. Who should the pledge income belong to? The current APT staking reward base is 7%, and the base reward percentage will decrease over time by 1.5% per year until 3.25%. Nearly 80% of the tokens are being staked by the foundation and generate 7% of the rewards, which also creates potential pressure on the market.

About Huobi Research Institute

Huobi Blockchain Application Research Institute (referred to as “Huobi Research Institute”) was established in April 2016. Since March 2018, it has been committed to comprehensively expanding the research and exploration of various fields of blockchain. As the research object, the research goal is to accelerate the research and development of blockchain technology, promote the application of the blockchain industry, and promote the ecological optimization of the blockchain industry. The main research content includes industry trends, technology paths, application innovations in the blockchain field, Model exploration, etc. Based on the principles of public welfare, rigor and innovation, Huobi Research Institute will carry out extensive and in-depth cooperation with governments, enterprises, universities and other institutions through various forms to build a research platform covering the complete industrial chain of the blockchain. Industry professionals provide a solid theoretical basis and trend judgments to promote the healthy and sustainable development of the entire blockchain industry.

Contact us:

Website:http://research.huobi.com

Email:research@huobi.com

Twitter:https://twitter.com/Huobi_Research

Telegram:https://t.me/HuobiResearchOfficial

Medium:https://medium.com/huobi-research

Disclaimer

1. The author of this report and his organization do not have any relationship that affects the objectivity, independence, and fairness of the report with other third parties involved in this report.

2. The information and data cited in this report are from compliance channels. The sources of the information and data are considered reliable by the author, and necessary verifications have been made for their authenticity, accuracy and completeness, but the author makes no guarantee for their authenticity, accuracy or completeness.

3. The content of the report is for reference only, and the facts and opinions in the report do not constitute business, investment and other related recommendations. The author does not assume any responsibility for the losses caused by the use of the contents of this report, unless clearly stipulated by laws and regulations. Readers should not only make business and investment decisions based on this report, nor should they lose their ability to make independent judgments based on this report.

4. The information, opinions and inferences contained in this report only reflect the judgments of the researchers on the date of finalizing this report. In the future, based on industry changes and data and information updates, there is the possibility of updates of opinions and judgments.

5. The copyright of this report is only owned by Huobi Blockchain Research Institute. If you need to quote the content of this report, please indicate the source. If you need a large amount of references, please inform in advance (see “About Huobi Blockchain Research Institute” for contact information) and use it within the allowed scope. Under no circumstances shall this report be quoted, deleted or modified contrary to the original intent.

Aptos — Questions, Clarifications, and Data was originally published in Huobi Research on Medium, where people are continuing the conversation by highlighting and responding to this story.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.