Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

If there’s something we’ve all learned since cryptocurrencies starting appearing at every street corner, is that you can easily fail and lose your money if you pick the wrong ones to invest in.

If you are investing in altcoins, fundamental analysis will help you choose the ones with the best long-term potential and the ones that can bring you some profits.

First of all, you should prepare for extreme volatility in this ecosystem. It is often that cryptocurrencies surge up to 40–50% in a single day.

Keep in mind that the cryptocurrency market is also driven by emotions, and the fear of missing out (FOMO for short) is a huge factor when you consider investing in a coin.

Try to master your FOMO and not freak out and sell other assets just to invest in a single coin when you’re seeing big spikes on the charts.

Analyze and decide based on as much information as you can find online before making an investment.

So how do you go on with cryptocurrency research?

The first thing you should know is that all investments will have their pros and cons. Don’t be discouraged if things are harder at the beginning. If you put some effort into it, you will develop skills and observe investment opportunities over time.

Firstly you should take into consideration the deal-breakers. I’ll point them out below, and if they exist, you should not invest any more time in those cryptocurrencies, as they are most probably going to fail.

Finding the right information about cryptocurrencies can be challenging for a few reasons reasons:

- Either the information doesn’t exist yet or it is very hard to find

- Sometimes there aren’t any means of verifying if the source is reliable or not

- Understanding some parts of the information can be beyond your technical abilities

- It can take a lot of time to read, understand and assimilate

There are a lot of platforms out there, that have information for different aspects of every coin. For this article, we’re going to use coincheckup.com because it has a large amount of information on the listed coins and will ease your cryptocurrency research up to the point of just going there and seeing 70–80% of the important information on any single coin.

When researching anything, you should start with a set of questions that need answers. The same happens with crypto. We’ve prepared a list below that should act as a framework for your research.

Save it, print it and use it a checklist whenever you’re researching cryptocurrencies that you’d like to put your money into.

Step1: Take a look at the fundamental analysis data

Knowledge is power, in the investment world as well. In order to assess whether a cryptocurrency is worth investing in or not, we have to first know where can we get the information from.

USC Group Daytrader & Analyst, Zissou (@ZeusZissou) told us what’s the first step when looking at a cryptocurrency.

“Depends on the approach and if you’re a bottoms up or a tops to bottom kinda guy in terms of analysis. If I get excited about macro, I dig deeper.Optimally, you want a fundamentally strong project. Then you just apply Technical Analysis to find good entry points”

Even though Zissou is a Daytrader, he starts his analysis by looking at the fundamentals. In this article we will not get into technical analysis because that’s a whole different subject.

Let’s look instead at how to get our information for fundamental analysis.

Each coin has multiple channels for distributing information. The most important are:

- Its website (most of the information about the team, investments or strategy should be there)

- The whitepaper, being the most important source of information about a coin’s technology and purpose

- Social media accounts such as twitter, facebook or reddit

- Communities built on different applications: Telegram, Discord, bitcointalk, Facebook Groups etc

Touching the following points when checking a coin’s fundamental information, and scoring them as Good or Bad will help you have a good idea whether it has a future or not.

Marked in bold are the ones that in my opinion are deal breakers for any coin. That doesn’t mean the others are not important, but take a look at these first and if if they seem fishy, it’s probably better to stay away from the coin.

- Are the company’s details transparent and easy to find?

- When was the cryptocurrency created?

- What is the organizational structure?

- Is the project transparent enough and has a good clarity of purpose?

- Is there an experienced development team behind the coin?

- Have the people in the advisory board managed successfully these kind of projects before?

- Is the team diverse enough to cover all the needed actions for the coin to succeed?

- Do they have an active social presence? — Facebook, Youtube, Twitter, Reddit, Slack, Telegram, etc.

- Did they have an ICO?

- Do they have a well defined and up to date roadmap?

- How many exchanges can you trade the coin on?

- How much traffic does their website get?

- Is their GitHub activity high enough? We believe software projects should see constant activity

- Who is backing the coin financially or in other ways?

- Are there any upcoming crypto events such as Forks etc that could affect the price?

The cryptocurrency market has evolved at unprecedented speed over the course of its short lifespan (compared to other assets).

Since the release of Bitcoin to the public in January 2009, more than 1,500 cryptocurrencies have been developed, the majority with only a mediocre success.

Here’s a video that will give you an even better understanding of how 4 years look like in terms of new cryptocurrencies and ICO activity.

In order to find out more about any cryptocurrency you have to do hours of research, most people don’t do this and they put themselves in a dangerous situation by investing in cryptocurrencies that simply have no solid fundamentals.

How do we do it?

That’s why here, at CoinCheckup, we want to give more transparency in all the cryptocurrencies on the market.

We started off by looking at the coin’s fundamentals, we created a standardized research process, researched almost all coins and came up with formulas to grade these coins.

The research we’ve done, answering all the questions we’ve listed above about a cryptocurrency’s fundamental data, can be found in its Analysis tab.

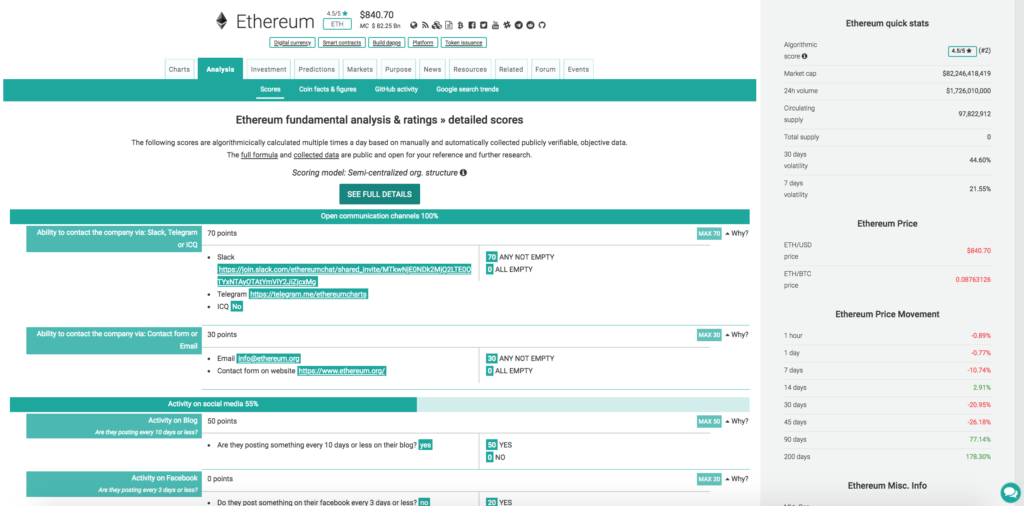

Let’s take the the example of Ethereum’s Fundamental Analysis page.

Instead of researching their website, social media channels and community forums, we’ve created a simple, easy to use interface for all this data.

We even made a scoring algorithm out of it, based on over 100 data points that we research and input into our algorithm.

We don’t want to bore you with the details, but we just want to make it clear that it is available for everyone to look at here and all the information that is considered when scoring is available in each coin’s analysis tab.

You will be able to find there coin infos such as:

- Open communication channels and activity on social media

- Team strength

- Product strength

- Github activity

- Coin strength

- Brand awareness/Buzz

- Advisory board strength

Step2: Check the coin’s economics

You should be able to find answers for the following questions:

- Does the company give insights in its costs?

- Does the company give its financial/growth predictions / predictions for profit and growth?

- How much trading volume is occurring with the coin at the moment and what did the volume look like in the past?

- How volatile is the coin?

- What is the maximum weekly, monthly, annual growth?

- What is their coin emission rate? Is the coin’s inflation under control?

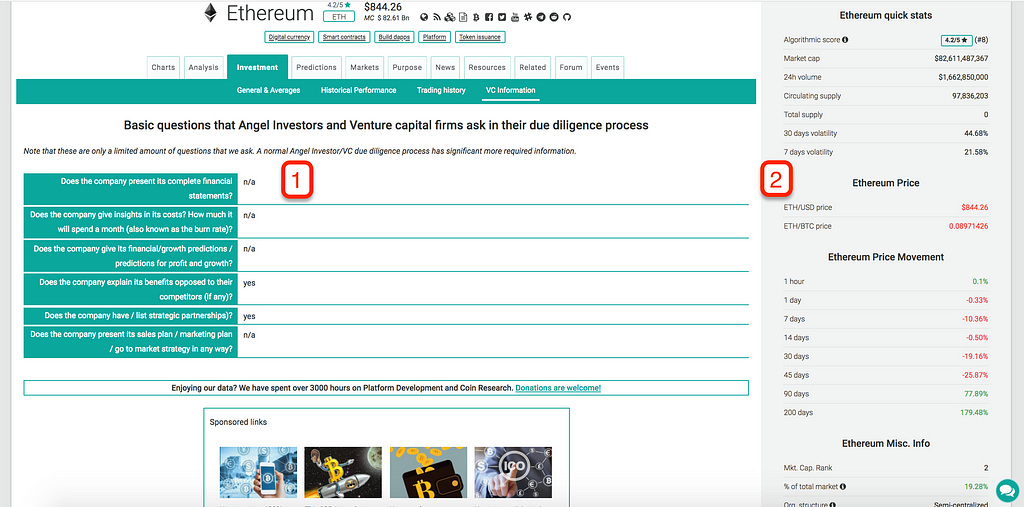

In the case of Ethereum, you can check its Investment tab for answers to some of the questions above.

Another thing you will notice is the sidebar, available on all the pages.

It gives you access to quick stats about a cryptocurrency’s price, volatility, market cap, percentage of total market and a lot of other useful information.

Look over their costs and investment plans

A company looking for investments, no matter the industry it’s in, should be as transparent as possible.

Would you trust a person coming to you and asking for money saying just “Trust me, it is going to work out and you’ll be a trillionaire in no time?”. Most likely you wouldn’t and shouldn’t. The same goes for cryptocurrencies.

Take a look at their website and see if they have a well defined split of their costs and their future investment plans.

Do they invest in marketing more than in development? Get out of there as soon and as fast as possible and forget about it.

Watch out for “pump and dumps”

It is quite common for cryptocurrencies to fall victim to “pump and dumps” due to two very important aspects:

- the speed at which the orders are being processed

- the fact that the crypto market is not yet regulated and trades 24/7

What is a “pump and dump”?

A “pump and dump” is the movement of a coin’s price, when it gets pushed up rapidly or constantly and then down very fast.

These are influenced either by the cryptocurrency’s team or deep pocket investors that want to cash in profits fast and even by organized groups of people.

There is proof of groups of up to 17,000 people on Telegram, chasing “pump and dumps” in order to get profits.

Here are a few reasons to keep an eye on pump and dumps:

- To avoid panicking and selling a coin being dumped that has historically performed well.

- Avoid panicking and buying a coin that is currently being pumped that has historically not performed well.

- To jump on a pumped coin early and to sell quickly (to make a quick profit).

- Or jump off a coin being dumped to take profits or cut losses.

More info about pump and dumps can be found on cryptocurrencyfacts.com

Step3: Check the online community and sentiment

Marketing and branding are an important benchmark for many of the investors out there.

Researching this will help you answer questions like:

- Are they trending on social networks? — This is very important for attracting a large volume of transactions (you can use solume.io to research social trends and sentiment and compare it to the price of a coin)

- Are there any huge negative reviews online about the coin?

- Are they sharing thoughts on their development often enough?

- Does the team interact with people on Social Media?

- What is their total community size? (Facebook + Telegram + Twitter etc.)

- What is their total GitHub community size?

- What is the trend in online searches for the coin? (Check Google Trends to see the trend in searches)

If you already researched the coins fundamentals and economics and everything looks strong, saw that the technology behind it offers unique features that are also applicable in multiple domains, it’s time to see how many people actually know about it.

Without knowing anything about the solution the technology offers, how can that solution be applied to solve problems? That’s where marketing comes in and helps with informing the market about the solution.

Branding

You should also check the coin’s branding and approach they have on it. Check out and see if there were any re-brandings done, because they aren’t uncommon in the crypto space as coins go through different stages in their development and market adoption.

Watch out for frequent re-brandings because these can mean one of two things. Either the coin is changing its strategy or it’s trying to hide something. Frequent re-brandings throughout a cryptocurrency’s life are not a positive point for its future strategic decisions.

Another thing you should look out for is the media coverage the coin is getting and the conversations around subjects related to its brand and technology.

Social proof

Positive mentions in specific cryptocurrency related websites such as cointelegraph.com, coindesk.com or cryptocoinnews.com are very important.

Even more important are mentions by publications outside of the crypto space. Seeing Forbes, Wall Street Journal or Bloomberg giving good signals about a coin’s strength, growth and team means that there is mainstream interest for it.

Coin market cap or the total value of a cryptocurrency is also a form of social proof. The total value of a coin is the result of investors voting with their wallets for the coin or against it.

Social Media

Checking the coin’s social stats is another indicator about their abilities to grow a community and reach even more people.

A very good number to look out for, besides each social channel and forum in particular, is its total community size.

On CoinCheckup, you can see this in the Analysis tab for each of the coins. Just go to the Brand awareness/Buzz section and see the total community size.

Conclusion:

If you’re a very analytical person, another approach to investing in cryptocurrencies is following their momentum and doing the technical analysis on the charts.

If your looking to invest for the short term and focus on investments that show the highest chance of profit in the next few days or up to one month, you can try this. There were people who had different levels of success with such strategies.

On the other hand, if you’re investing for the long term, you’re interested in rock solid fundamentals. This worked in the normal stock market, it has no reason not to work for cryptocurrency as well.

If you’re interested in seeing all the features CoinCheckup has, go to our Market Overview page and start researching the coins you’re interested in.

Originally published at coincheckup.com on February 27, 2018.

The 3 Step Beginner’s Guide to Cryptocurrency Research was originally published in Hacker Noon on Medium, where people are continuing the conversation by highlighting and responding to this story.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.