Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

XEN Network — A social experiment of crypto

Abstract

This week, we focus on the following events: 1) FTX Loses 100 Million XEN Tokens to GAS Theft Vulnerability; 2) BlockTower Putting $150M Crypto Fund to Work as Valuations Return ‘Down to Earth’; 3) SEC Chairman Says CFTC Should Get More Power to Oversee Stablecoins.

Project Analysis: In the past few days, XEN network was very popular in such a bear market. It burned 1400 ETH for the first 17 hours after it established. As a social experiment, what is the charm of it? This article will analyze the XEN Network in terms of the project mechanism and the vision behind it.

1. Industry overview

I. Overall market trend

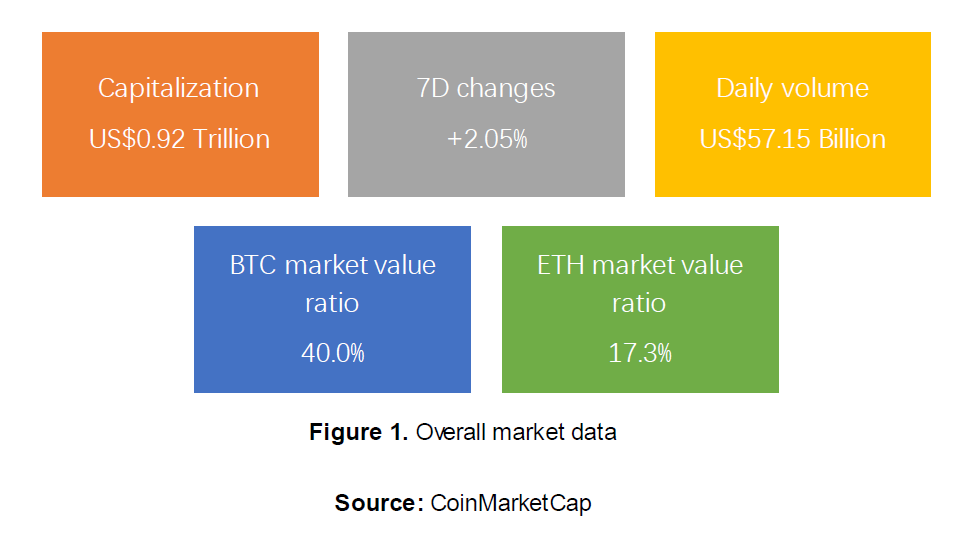

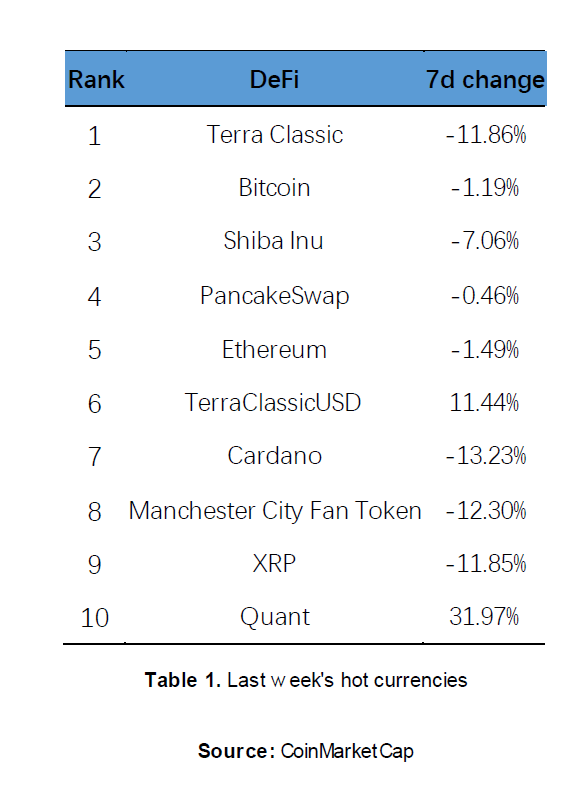

The global cryptocurrency market’s market cap this week changed slightly, currently with a market cap of $921,405,403,413.978. Bitcoin is currently trading at US$19,227, continuing weeks below $20,000, even lower than last week. Meanwhile, Ethereum, the second largest cryptocurrency, is currently trading at US$1,304, still haven’t recover to the point before the Merge. Most of the other top 10 tokens, including Terra Classic, Cardano, XRP, all have a negative 7-day change, as this can potentially be seen as the bottom of crypto market or near.

II.NFT

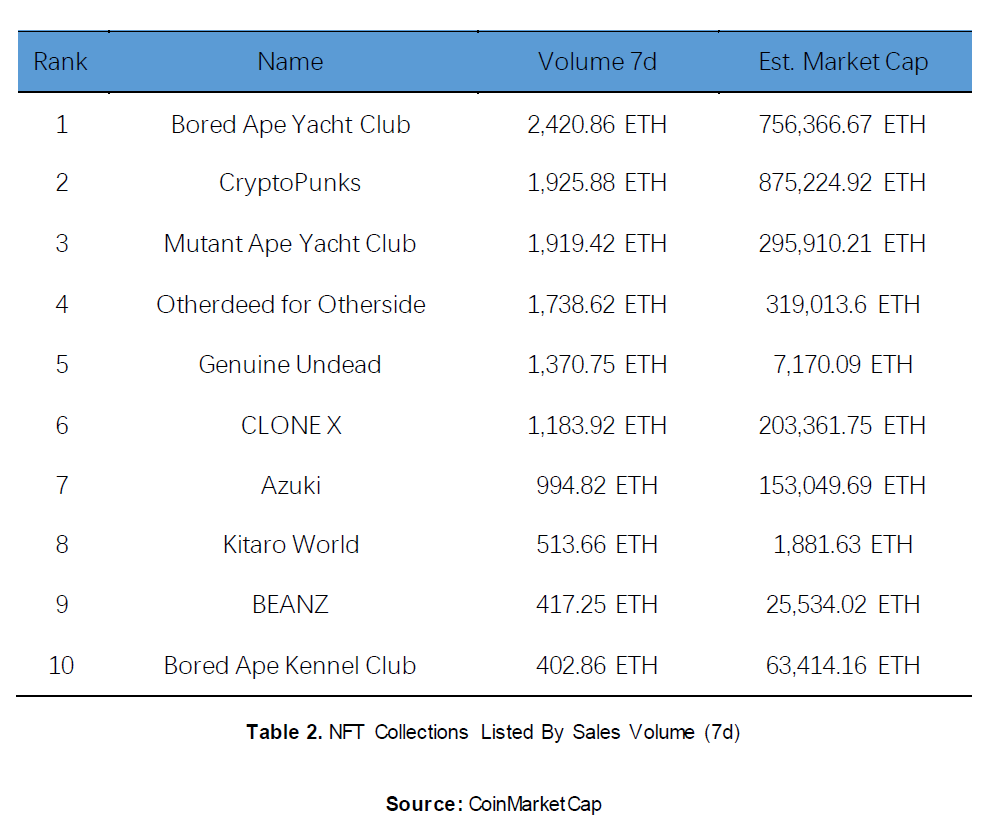

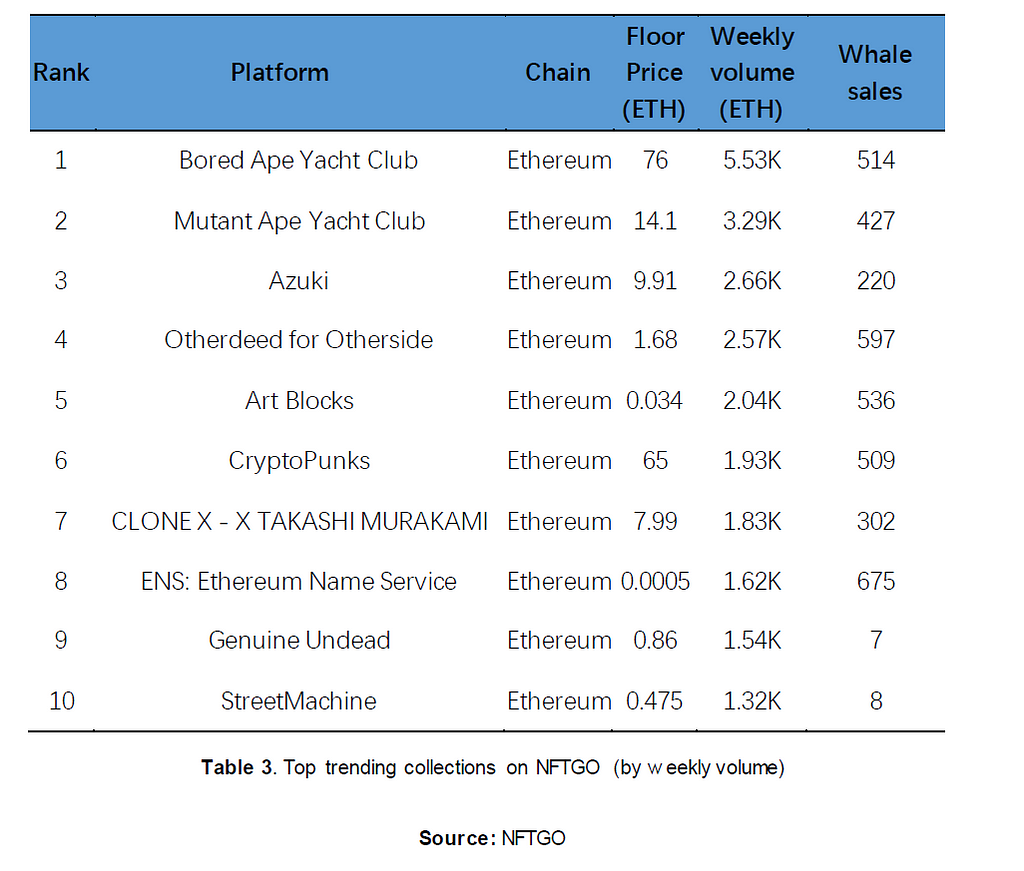

The NFT market last week saw a decrease of 5.97%, with a market cap of US $2,355,639,575.30 this week. This is not a lot compared to last month, with weekly fluctuations over 10% or even 20%. The 7-day sales volume changed by 4.36% to $28,193,656.21 and total sales did not change very much at 12.23%, to 44,607. Overall, the sales declined a little bit. This week the top 10 NFT brands on Coinmarketcap are all familiar brands which has entered this list before; among them, BEANZ has the most change of 0.34% increase, while most of the other brands have volume change less than 0.1%.

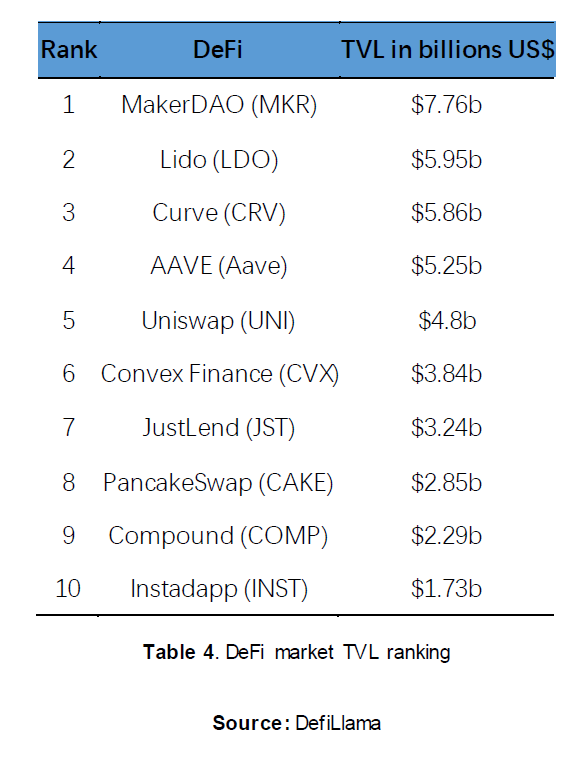

III.DeFi

IV.Layer 2

2. Market news (Source: Coindesk, Investing)

I. Industry news

FTX Loses 100 Million XEN Tokens to GAS Theft Vulnerability

The XEN token, a recently launched Ethereum project mintable by paying gas fees, is the latest tool hackers use to manufacture money out of thin air.

According to a Chinese report, an attacker mints the XEN token for free, while the FTX crypto exchange pays for the gas fees. The report revealed that the hacker placed a bug on a chain for the FTX’s hot wallet to continuously transfer Ethereum (ETH) tokens piecemeal to their address.

So far, the FTX exchange has lost over 81 ETH due to the GAS theft vulnerability, and the hacker’s wallet has obtained more than 100 million XEN Tokens. They have consequently exchanged some XEN tokens for 61 ETH through DoDo, Uniswap, and other decentralized exchanges. Notably, the GAS stealing attack against FTX is still in progress, according to the monitoring platform.

Furthermore, the vulnerability assessment by the platform alleged that FTX has no restriction on the transfer GAS limit of ETH’s native token. It said FTX used the “estimateGas” method to evaluate the handling fee, resulting in most of the GAS limit being 500,000, which is 24 times higher than the default value of 21,000.

Huobi Token Surges 75% as Tron Founder Justin Sun Calls for Empowering the Exchange Token

Investors who bargain-hunted Huobi token (HT) at 21-month lows a week ago may be laughing their way to the bank.

The native coin of China’s once-popular crypto exchange Huobi Global has rallied over 70% since Monday, reaching a four-month high of $7.60, according to data sourced from charting platform TradingView.

Considering the broader market lull and lingering macroeconomic uncertainty, that’s an impressive performance. And it has put HT on the pedestal as the best-performing above $1 billion market cap cryptocurrency of the past seven days.

II. Investment and Financing

BlockTower Putting $150M Crypto Fund to Work as Valuations Return ‘Down to Earth’

Crypto asset manager BlockTower Capital revealed a new venture-capital arm this week and lifted the veil on a $150 million fund that opened in December and was fully subscribed in a matter of weeks. What motivated one of the original crypto-native asset-management brands to enter the VC world, and what will those investments look like amid crypto winter?

BlockTower launched the fund in stealth last winter as part of a “show-don’t-tell” ethos that’s also represented in the firm’s sparse website and corporate Twitter account. Limited partners that invested in the vehicle included insurance giant MassMutual, French-government-backed Bpifrance and the Teachers Retirement System of Texas. Early investments for the fund include layer 1 blockchain Aptos and institutional finance network Maple Finance.

The new venture-capital arm is led by general partner Thomas Klocanas, a veteran of investment firm White Star Capital.

Binance Pool Starts $500 Million Fund to Support Bitcoin Mining

Crypto winter is taking a toll on companies that man the virtual mines, which has led to cryptocurrency exchange Binance starting a lending facility for bitcoin (BTC) miners.

Binance Pool has started a $500 million lending project for private and public miners. The miners will need to pledge security in the form of physical or digital assets for the loan, which will have a duration of 18–24 months.

Binance Pool recently opened a mining pool for ETHW, the forked version of Ethereum that retains the blockchain’s original proof-of-work (PoW) underpinnings.

Binance isn’t the only firm that is looking to support the struggling crypto mining industry, Jihan Wu, the founder of crypto mining rig-maker Bitmain, is also setting up a $250 million fund to purchase distressed assets from mining firms.

Enterprise Crypto Wallet Startup Pine Street Labs Raises $6M in Polychain-Led Round

Upstart crypto infrastructure company Pine Street Labs is trying to build a better business wallet with $6 million in funding from Polychain Capital and other top crypto venture capital firms.

Pine Street Labs wants to shake up the wallet experience for companies, funds, traders — really any business that needs to store tokens, says CEO Justin Gregorius. A veteran of crypto back offices, he told CoinDesk that enterprise newcomers find themselves in crypto wallet purgatory: They can’t rely on retail wallets like Ethereum’s MetaMask or Solana’s Phantom, but don’t have the know-how to build 10 wallets in-house.

Gregorius says his solution is a non-custodial crypto wallet API to let businesses plug and play across 12 different blockchains. Pine Street Labs’ five-person team takes care of the complex tech tuning — optimizing for staking in the Cosmos ecosystem, perhaps — so its novice clients won’t have to.As part of the investment, Union Square Ventures partner Fred Wilson will join the Blackbird board. Other investors in the round included investment firm Variant, the venture-capital arm of USDC issuer Circle and digital product conglomerate IAC.

III. Supervision

SEC Chairman Says CFTC Should Get More Power to Oversee Stablecoins

U.S. Securities and Exchange Commission Chairman Gary Gensler said Friday the Commodity Futures Trading Commission should be given more authority to police stablecoins, according to a report by Reuters.

Speaking at event in Washington, Gensler argued that stablecoins are very similar to money-market markets and should be regulated accordingly, Reuters wrote.

And while the CFTC has regulatory authority over dollar-backed stablecoin issuers in the areas of fraud and manipulation, it doesn’t have “direct regulatory authorities over the underlying non-security tokens,“ Gensler pointed out.

CFTC’s Behnam Calls FTX Idea a Potential ‘Evolution’ in Market Structure

FTX’s proposal to cut out the middlemen in U.S. crypto derivatives has shaken traditional financial firms, but the chairman of the Commodity Futures Trading Commission (CFTC) said the idea could mark an “evolution” in the way markets work.

CFTC Chair Rostin Behnam said he couldn’t comment on when the agency may respond to the proposal, nor which way it might lean, but he revealed how impressed he is with the idea on Friday at the Financial Markets Quality Conference at Georgetown University.

“This is a unique intersection of the crypto space and traditional finance,” Behnam said. “I think this is potentially — and I emphasize the ‘potential’ — another phase in the evolution of market structure, innovation and disruption.”

3. Project Analysis

I. What is XEN Network?

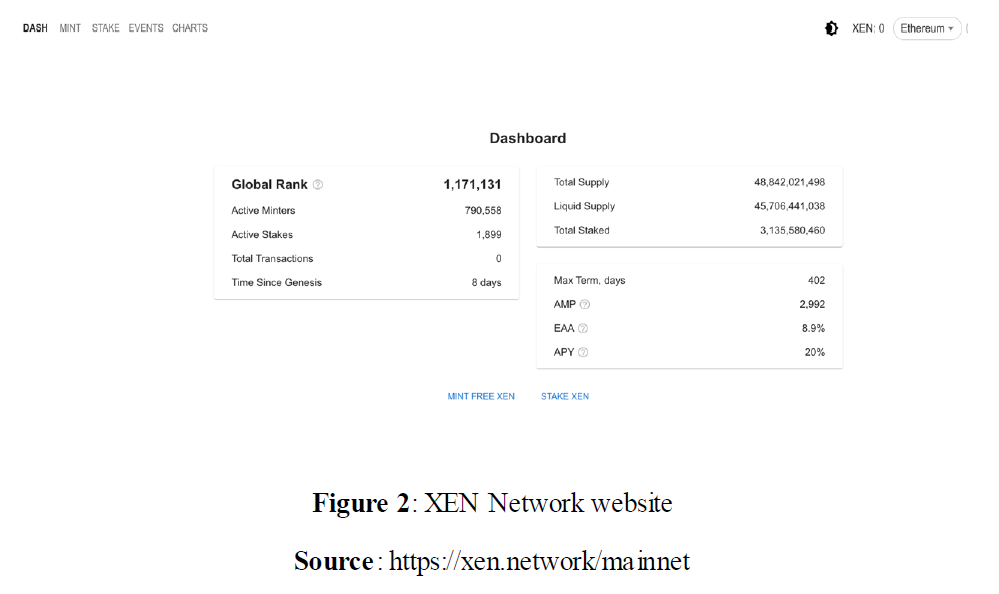

XEN is a virtual mining project mainly built by the whole people. Users only need to interact with the contract to start mining. Its token XEN is an ERC-20 token built on the Ethereum blockchain, based on the fundamental principles of encryption: decentralization, self-regulation, high transparency, and consensus trust. As an encrypted asset created by the community, XEN is committed to bringing together people with the same consensus to build a fully decentralized community. According to XEN’s smart contract, XEN Token cannot be pre-mined, without the administrator’s private key, its contract cannot be changed, and the supply will start from 0. XEN adopts the Proof of Participation mining mechanism, and anyone who participates in XEN mining has the ownership of mining tokens. The supply of the Token itself does not have an upper limit, but as the number of people participating in mining increases, its algorithm will automatically adjust the difficulty of minting coins according to the user’s ranking and the number of people who join the network after him. In other words, the mining difficulty will continue to increase.

II. Functions

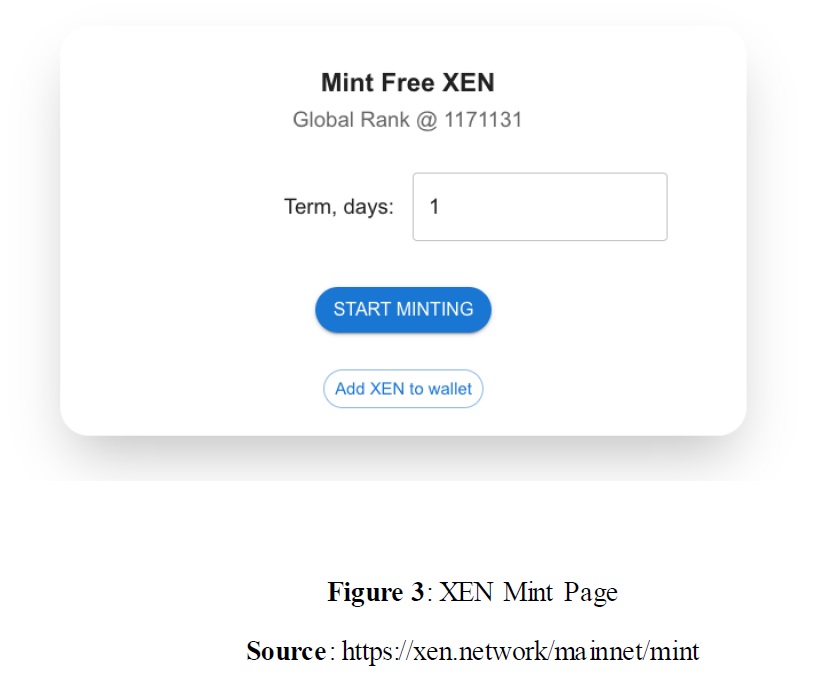

MINT

There is no threshold for the minting of XEN tokens, and everyone can participate for free. The only thing a participant needs is an Ethereum wallet, and some ETH to pay the gas fee. Users need to first connect their wallets to the XEN dApp, indicate the number of days they want to wait on minting XEN, claim cRank, confirm the transaction, and then pay the gas fee. After that, people just have to wait for the end of their waiting period. When the waiting period ends, the user needs to reconnect the wallet, confirm the transaction again and pay the gas fee to mint XEN Token. XEN does not impose a limit on the number of wallets participating in minting. This means that each user can create any number of wallets. However, it should be noted that if a wallet has already claimed cRank and is already in the stage of waiting for tokens to be minted, the wallet cannot claim another cRank again, and the above process cannot be restarted until the end of the waiting period.

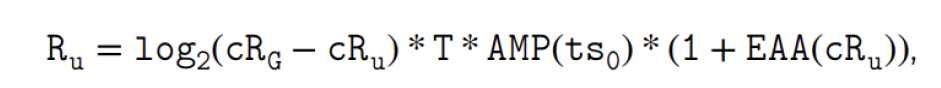

According to XEN’s whitepaper, the number of tokens minted by XEN Token follows a fixed formula:

According to this formula, we can find that the number of coins minted by XEN depends on: Crypto Rank (cRank), waiting time T, AMP (time-dependent Reward Amplifier), EAA (Early Adopter Amplification factor), cRg ( global ranking), cRu (user ranking) and other elements.

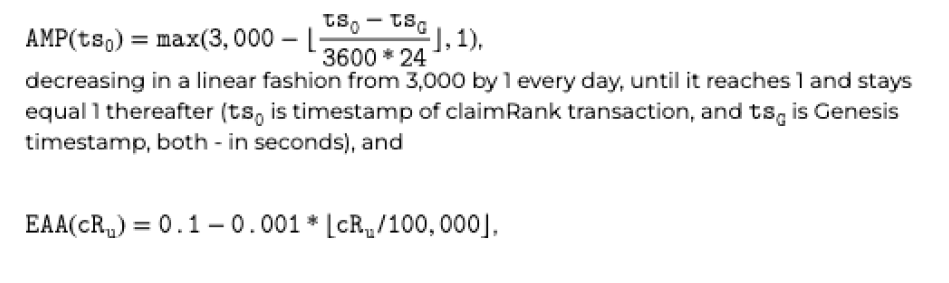

Among them, the calculation method of AMP (time-dependent Reward Amplifier) and the EAA (Early Adopter Amplification factor) is shown in the following figure:

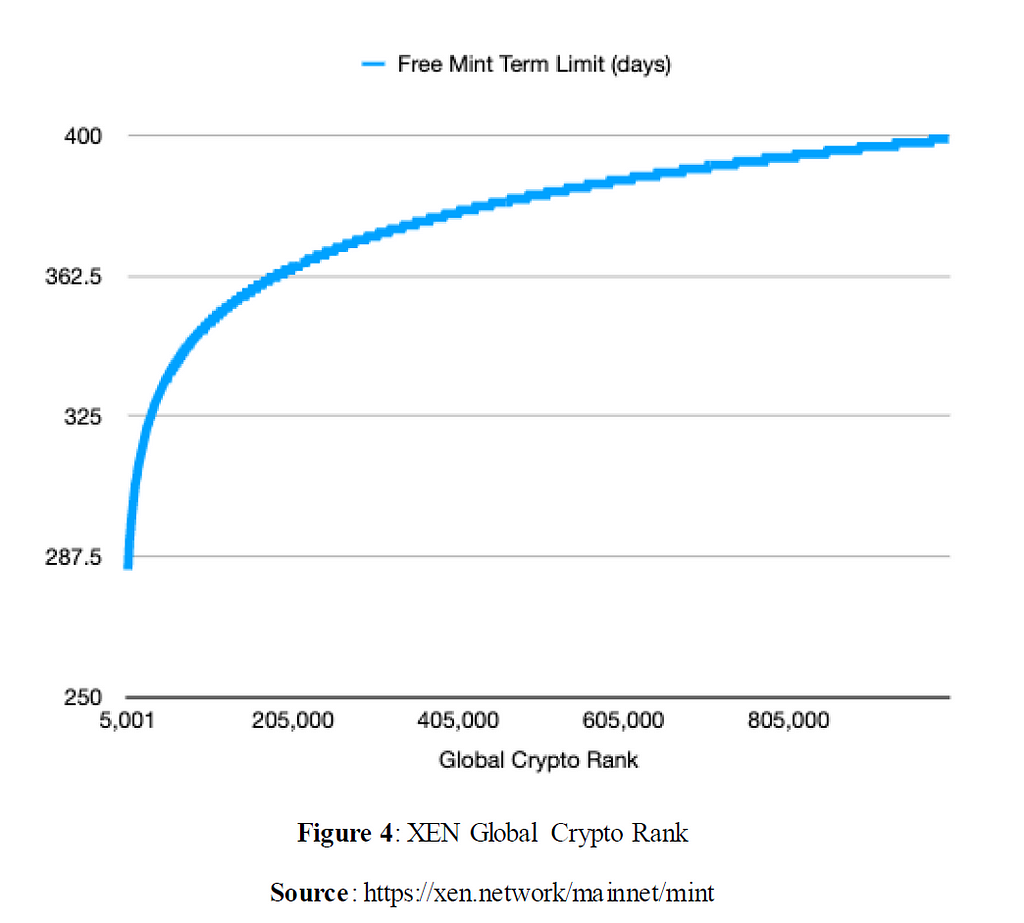

As for the choice of minting time, the initial time XEN can choose is 100 days. After the number of participants exceeds 5,000, more days can be selected. The specific formula: days = 100 + log2 (total number of participating wallets) * 15.

STAKE

The initial staking reward of XEN is 20% APY, which decreases by 1% every 90 days until the APY drops to 2% and remains unchanged. The staking reward setting is not significant for users currently participating in the XEN, because the impact of 20% APY on the total amount of coins obtained can be ignored compared to the waiting time. Therefore, the waiting time should be carefully selected when participating in the XEN project. It should be noted that XEN implements a destruction mechanism for overdue and unclaimed tokens, and 99% of unclaimed tokens will be destroyed within 7 days of overdue.

III. Opportunities of XEN

About its minting rewards

The mathematical model setting of XEN leads to the more people participating, the higher the profit of early users, forming an atmosphere of spontaneous publicity by early participants. At present, the key to the final amount of coins obtained by users participating in XEN interactive mining depends on the ranking and waiting time. The higher the ranking, the longer the waiting time, the higher the amount of coins obtained. The waiting time involves delayed gratification and instant rewards, as well as different users’ judgments on the project and market environment, and no consensus will be formed; however, increasing the number of participants to make their ranking relatively high is the consensus of most participants, which promotes XEN’s rapid fame.

In fact, if you do not use wallets in batches and choose the same lock time, the benefits of early participants and middle and late participants are not much different. We can make inferences by observing the formula. Suppose the number of participants is one million. We compare the rewards of the first one and the middle one.

(log2(1000000–1)-log2(1000000–500000)/log2(1000000–1) = 5%

The difference between the first and the 500,000th at the same time is only 5%.

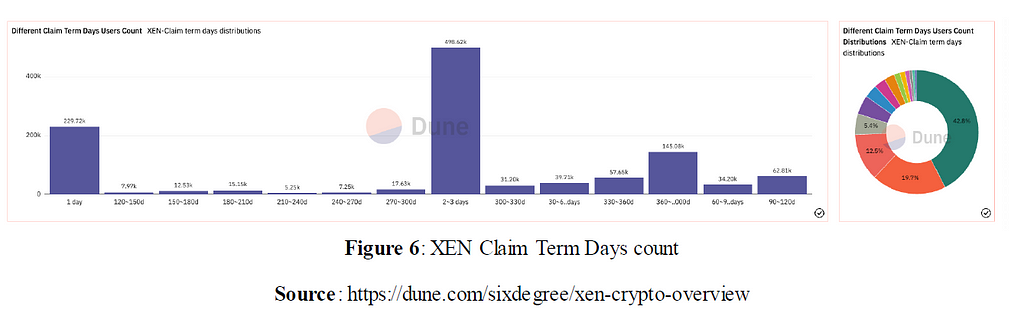

Most people will choose short-term. Because when calculating the income and gas, it is the most important to be able to generate profits as soon as possible. So we can see that almost 60% of people choose 1–3 days.

For users, there is no reason to buy XEN. Because it has no application value. In the market, users who keep unlocking will continue to sell the XEN in their hands, which results in continuous selling. Early buyers may not have a clear understanding of the mechanism of XEN and buy blindly. For early participation and short-term users, they can sell their XEN to make a profit while the market is still hot. However, as the market becomes more rational, the price continues to fall, and the subsequent users almost have no profit.

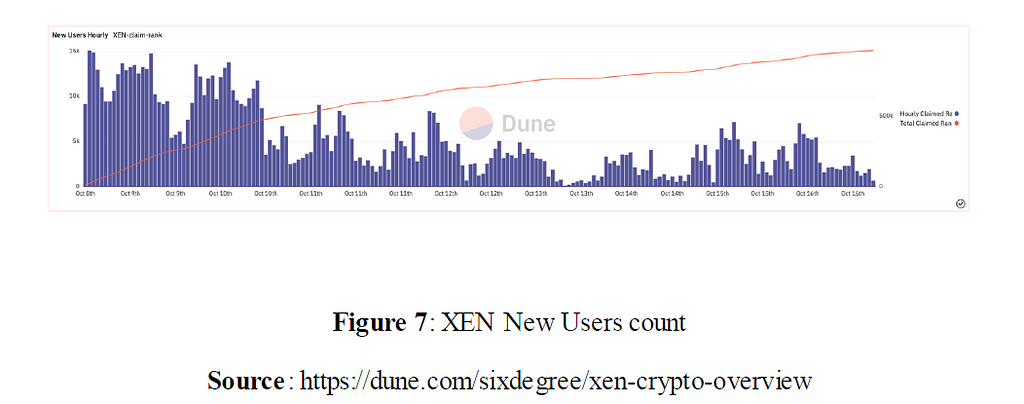

We can also see that since October 10th, the number of participants has decreased rapidly, mainly because the price of XEN is too low to make profits, so the number of participants has become very small.

4. Can XEN be regarded as a Ponzi scheme?

In my opinion, XEN cannot be regarded as a Ponzi scheme. The definition of Ponzi Scheme on Wikipedia is: A Ponzi Scheme is a form of fraud that lures investors and pays profits to earlier invstors with funds from more recent investors. A classic example is Fomo3D. The money from new users flowed to the early users. It set up a pool to incentive people join it. In XEN, The funds from more recent investors do not flow to the early invstrors. Users only need to pay gas to get tokens, and gas is paid to Ethereum miners. XEN does not meet the basic conditions.

XEN is a rather interesting attempt, the essence of which is Ethereum Gas fee mining. However, the novel gameplay, low cost and high popularity make everyone actively participate and promote it, resulting in a large number of users participating in a short period of time. But in fact, XEN Token does not have any value. His popularity is largely due to its novel model and the platform of Jack Levin. Many exchanges are also one of the promoters of this project in order to get new users to preempt the listing of coins.

About Huobi Research Institute

Huobi Blockchain Application Research Institute (referred to as “Huobi Research Institute”) was established in April 2016. Since March 2018, it has been committed to comprehensively expanding the research and exploration of various fields of blockchain. As the research object, the research goal is to accelerate the research and development of blockchain technology, promote the application of the blockchain industry, and promote the ecological optimization of the blockchain industry. The main research content includes industry trends, technology paths, application innovations in the blockchain field, Model exploration, etc. Based on the principles of public welfare, rigor and innovation, Huobi Research Institute will carry out extensive and in-depth cooperation with governments, enterprises, universities and other institutions through various forms to build a research platform covering the complete industrial chain of the blockchain. Industry professionals provide a solid theoretical basis and trend judgments to promote the healthy and sustainable development of the entire blockchain industry.

Contact us:

Website:http://research.huobi.com

Email:research@huobi.com

Twitter:https://twitter.com/Huobi_Research

Telegram:https://t.me/HuobiResearchOfficial

Medium:https://medium.com/huobi-research

Disclaimer

1. The author of this report and his organization do not have any relationship that affects the objectivity, independence, and fairness of the report with other third parties involved in this report.

2. The information and data cited in this report are from compliance channels. The sources of the information and data are considered reliable by the author, and necessary verifications have been made for their authenticity, accuracy and completeness, but the author makes no guarantee for their authenticity, accuracy or completeness.

3. The content of the report is for reference only, and the facts and opinions in the report do not constitute business, investment and other related recommendations. The author does not assume any responsibility for the losses caused by the use of the contents of this report, unless clearly stipulated by laws and regulations. Readers should not only make business and investment decisions based on this report, nor should they lose their ability to make independent judgments based on this report.

4. The information, opinions and inferences contained in this report only reflect the judgments of the researchers on the date of finalizing this report. In the future, based on industry changes and data and information updates, there is the possibility of updates of opinions and judgments.

5. The copyright of this report is only owned by Huobi Blockchain Research Institute. If you need to quote the content of this report, please indicate the source. If you need a large amount of references, please inform in advance (see “About Huobi Blockchain Research Institute” for contact information) and use it within the allowed scope. Under no circumstances shall this report be quoted, deleted or modified contrary to the original intent.

XEN Network — A social experiment of crypto was originally published in Huobi Research on Medium, where people are continuing the conversation by highlighting and responding to this story.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.