Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

Did you know around 17% of the US adult population now owns bitcoin? There’s no denying that crypto has gone mainstream.

From mining to the mystery around who invented bitcoin, there’s still confusion around this new and powerful technology despite increased adoption.

This article covers everything you need to know about bitcoin basics, the risks you should be aware of, and how to get started.

What is Bitcoin

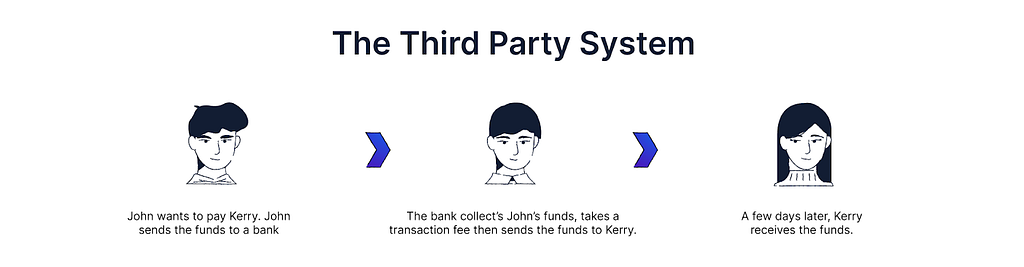

Bitcoin (abbreviated BTC) is digital money that can be used to make secure peer-to-peer transactions on the internet without the need for a third party intermediary (like a bank) to facilitate transactions.

It was created by an open-source community in part due to banks’ detrimental actions during the Great Financial Crisis of 2008, which involved governments printing money and bailing out the financial institutions responsible for the crash.

At its core, Bitcoin allows the user to “be their own bank” eliminating the need to get permission from a company to complete a transaction. On the bitcoin network there are no restrictions on who a user can send money to and how much money can be sent, and operations run around the clock not just during business hours.

Beyond enabling users to “be their own bank” bitcoin also “banks the unbanked”, as financial services cost money to set up and maintain.

From initial deposits, to withdrawal, and membership fees, there are currently over two billion unbanked individuals in the world.

Bitcoin itself can be used as a store of value or medium of exchange that only exists in the digital domain. You cannot hold or see bitcoin.

The Bitcoin network and the bitcoins that power the network were created to be used on the internet, it is not owned by anyone or company — it is a true open payment network that anyone with an internet connection can access.

What can you do with bitcoin?

- Use it like money. Accepted by many companies including Starbucks and Virgin Galactic, Bitcoin can be used to make purchases.

- Transfer funds more quickly and cheaply. Funds can be transferred more efficiently (peer to peer) without high processing fees by the removal of a third party intermediary like a bank or payment processor.

- Use it as a store of value. A store of value should be worth the same or more over time. Bitcoin is often referred to as ‘digital gold’ — it’s limited in supply with specific use-cases. Amidst its volatility — bitcoin has appreciated over 15k% since conception.

How do you “get” bitcoin?

- You can buy bitcoin using fiat currency (e.g. USD, GBP, EUR) through a Brokerage or Exchange like Blockchain.com.

- You can sell something and accept payment in bitcoin.

- You can “mine” bitcoin using specialized computer equipment. (more on this below).

Do I need to buy a “whole” bitcoin?

No. Bitcoin can be bought fractionally.

For example, if bitcoin’s price is $20,000, you can purchase 0.1 Bitcoin for $2,000.

In fact, there’s a special name for the smallest unit of bitcoin that can be traded: satoshi, or sats for short. There are 100 million satoshis in one unit of bitcoin.

With market supply and demand, the price of bitcoin is always changing.

You can check the live price of a whole Bitcoin here.

Who created Bitcoin?

The Bitcoin whitepaper “Bitcoin: A Peer-to-Peer Electronic Cash System”, was published in an email list called the Cryptography Correspondence Group under the pseudonym (fake name) Satoshi Nakamoto on October 31, 2008.

A white paper is an academic document which a project team or company writes to outline the full scope of the product, including the problem that it’s solving.

The problem Satoshi Nakamoto was trying to solve was related to the current financial system and crisis that occurred in 2008.

The Bitcoin white paper explains that:

“The root problem with conventional currencies is all the trust that’s required to make it work.

The central bank must be trusted not to debase the currency, but the history of fiat currencies is full of breaches of that trust.”

In 2009, the software was publicly released and the bitcoin network was launched.

Nakamoto was still active in the project with other developers for an additional year, but in 2010 they stopped contributing and their real identity still remains unknown.

As open source software, hundreds of developers, companies and organizations contribute to Bitcoin’s code.

Bitcoin, bitcoin, or BTC?

Capitalizing or abbreviating bitcoin can be confusing. Here’s what each of these means:

Bitcoin: Bitcoin with an uppercase B is referring to the Bitcoin network and protocol. This is the system that the bitcoin currency runs on.

bitcoin: The lowercase spelling of bitcoin refers only to the cryptocurrency, not the payment network or blockchain protocol.

BTC: BTC is the abbreviated version of bitcoin, and again refers to the cryptocurrency. The use of BTC is similar to a stock ticker symbol and is what you’ll usually see on price charts.

How does it work?

The Bitcoin blockchain can be accessed and managed by any computer, anywhere in the world. The computers that run on the bitcoin blockchain are embedded with a set of rules which makes the data (bitcoins) scarce and valuable.

As a rule, only 21 million bitcoins can be produced, and this scarcity limit ultimately gives bitcoin its value.

Here’s a simple breakdown of what happens when someone wants to send bitcoin using blockchain technology.

- When someone joins the bitcoin network they are given a public key, which you can think of like an email address and a private key which you can think of like a password.

- Every bitcoin transaction made, along with the sender’s public key, is recorded in a public list called the blockchain.

- The main mechanism by which bitcoin transactions are confirmed and validated is called “mining”

- The public full list is then distributed to every computer that is connected to the Bitcoin network.

- As this public list is in chronological order of transactions, it’s possible to trace the history of all bitcoin activity that’s ever occurred. The bitcoin ledger is resistant to both tampering and censorship.

This “open” nature prevents and discourages people or “bad actors” from spending coins that aren’t theirs, making copies of coins or even reversing transactions.

You can check all transactions on the Bitcoin network on the Blockchain.com Explorer.

What is bitcoin “mining”?

Bitcoin mining consists of two processes:

- The verification of new transactions on the blockchain

- The process by which new bitcoin enters into circulation

Recap: only 21 million bitcoins will ever be produced.

Different transactions that have occurred around the same time are bundled together into “blocks” in order to add to the blockchain.

A new block containing all of the transactions that have occurred since the last block is “mined” is added to the blockchain by one “miner” roughly every ten minutes. Once added, the transactions within the block are “confirmed”.

What’s in it for bitcoin miners?

Bitcoin miners are incentivised by bitcoin rewards which they can receive in the following ways:

- If they are the successful miner who adds the new block to the blockchain

- Through transaction fees from all the transactions included in the block

To be the miner who adds the next block to the blockchain, miners must compete to solve an extremely complex mathematical problem based on a cryptographic hash algorithm.

The “answer” to the problem is called the “proof of work” and is included in the new block.

The miner who solves the puzzle fastest adds the new block to the blockchain. Mining is performed by specialized computers with very high processing power.

Listen to our podcast on, What Exactly is Bitcoin Mining? With Jaime Leverton of mining farm Hut 8.

Recap: What is the difference between cryptocurrency, bitcoin and blockchain?

Bitcoin is a cryptocurrency.

In fact, bitcoin was the first ever cryptocurrency developed. Cryptocurrency (including bitcoin) is digital money that is run on a blockchain.

Since bitcoin was created, thousands of new cryptocurrencies have been developed. Bitcoin remains the most popular however in terms of market capitalization and trading volume.

Characteristics of Bitcoin

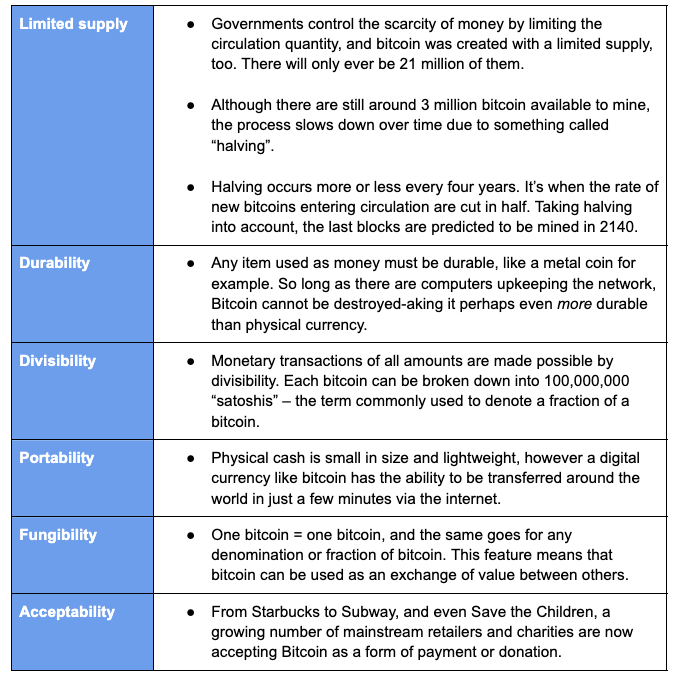

Bitcoin is a fairly new technology, but shares many of the same characteristics of money:

Limited supply, durability, divisibility, portability, fungibility and acceptability.

Is Bitcoin safe?

Bitcoin uses cryptographic technology, which secures the information by transforming it into a format that makes it hard for unintended recipients to understand.

That’s not to say bitcoin does not come without risks, here are some you should be aware of:

- Loss of crypto keys. As with all crypto self-custody, if you lose your keys, you can lose access to your crypto funds.

- A “51% attack”. In theory, this could occur when a single miner or mining group takes majority control of the bitcoin blockchain and essentially “hacks” the network.

- Actions are irreversible. The user is ultimately responsible for what they do. When you click send on a cryptocurrency transaction, it can’t be undone.

- Unclear regulation. Although crypto and bitcoin are regulated in parts of the world such as the US, crypto assets could be subject to stricter regulations in the future.

Is Bitcoin the future?

Economic value is generated when enough people agree that something is valuable. Through this principle, money has taken many forms through the ages: shells, rocks and even cows.

One of the world’s most wealthiest individuals, Elon Musk, famously said:

“Bitcoin’s structure is very ingenious. The paper money disappears, and crypto-currencies are a much better way to transfer values than a piece of paper, that’s for sure.”

From the 20th century onward, we’ve quickly advanced from a cash-based society to plastic cards, to plastic contactless cards.

Who’s to say that bitcoin isn’t just the next iteration of money?

If you’re excited about the benefits of bitcoin and the prospect of a new financial system for the internet, you can purchase bitcoin today on Blockchain.com using the Blockchain.com Wallet.

Bitcoin, Explained was originally published in @blockchain on Medium, where people are continuing the conversation by highlighting and responding to this story.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.