Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

Abstract

This week, we focus on the following events:

●The Ethereum Merge Is Done, Opening a New Era for the Second-Biggest Blockchain;

● Sky Mavis announces US$2.4 million esports grant for Axie Infinity;

●SEC’s Gensler Signals Extra Scrutiny for Proof-of-Stake Cryptocurrencies.

Project Analysis: With the World Cup approaching and the recent sports football events in Europe, fan tokens of various clubs and countries have shown an upward trend. This research report will analyze fan tokens from the perspective of classification, clubs and value to help you better understand.

1. Industry overview

1.1 Overall market trend

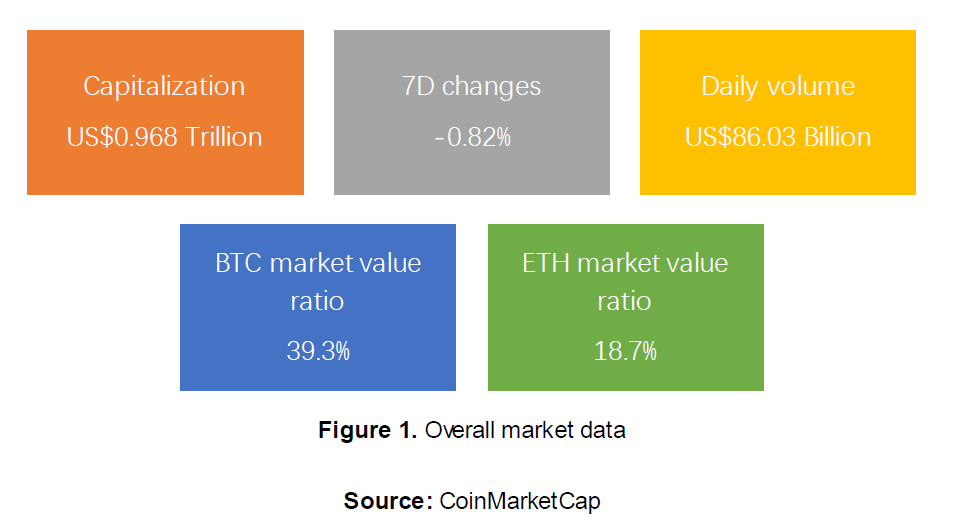

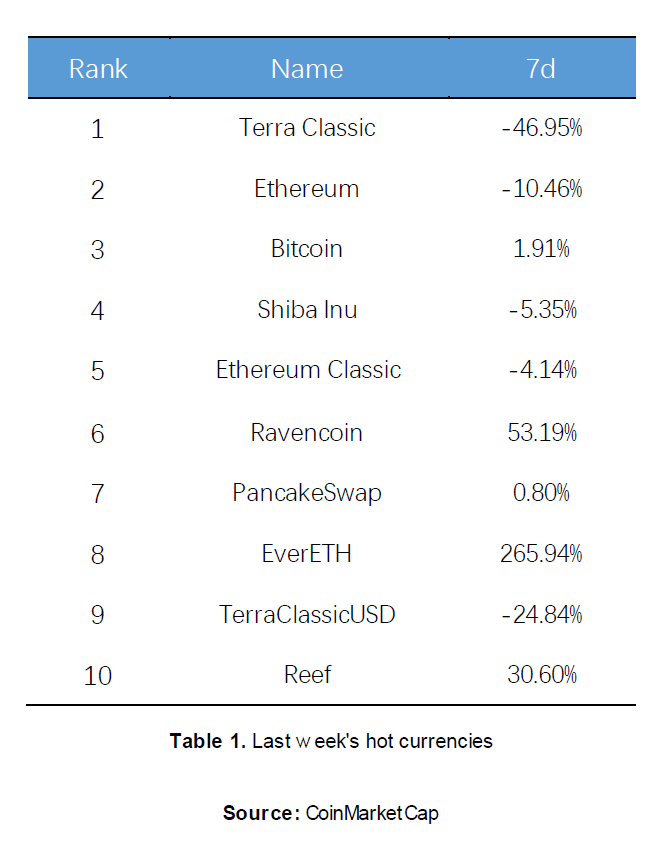

The global cryptocurrency market’s market cap this week saw some fundamental changes. Bitcoin is currently trading at US$19,789, a rather low point within the past few weeks, influenced by Ethereum’s selling pressure. Meanwhile, Ethereum, the second largest cryptocurrency currently trading at US$1,474, has a 7-day price change of -13.53%, due to the post-merge fall after “selling the news”. Terra Classic, the original Terra coin that crashed during May, had a 7-day price change of -43.43%, which basically reversed the speculation-driven rise a few weeks ago. Other coins, affected by CPI data release, post-merge selling pressure and other macro events, also saw decreases.

1.2 NFT

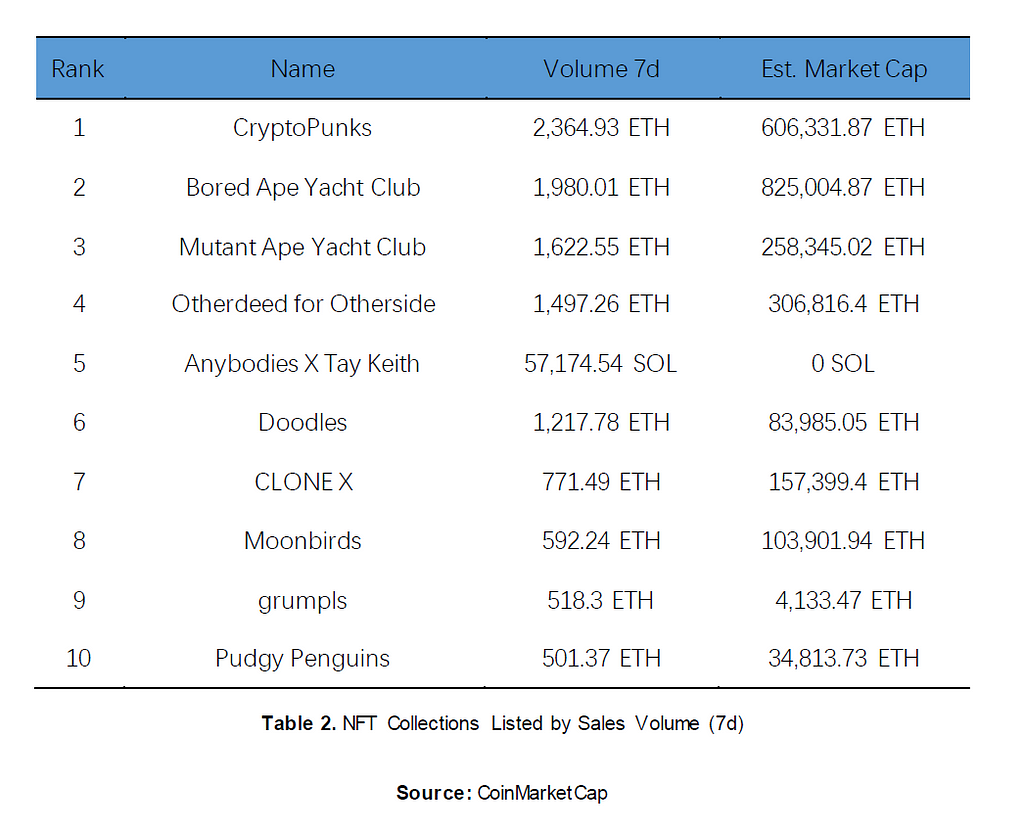

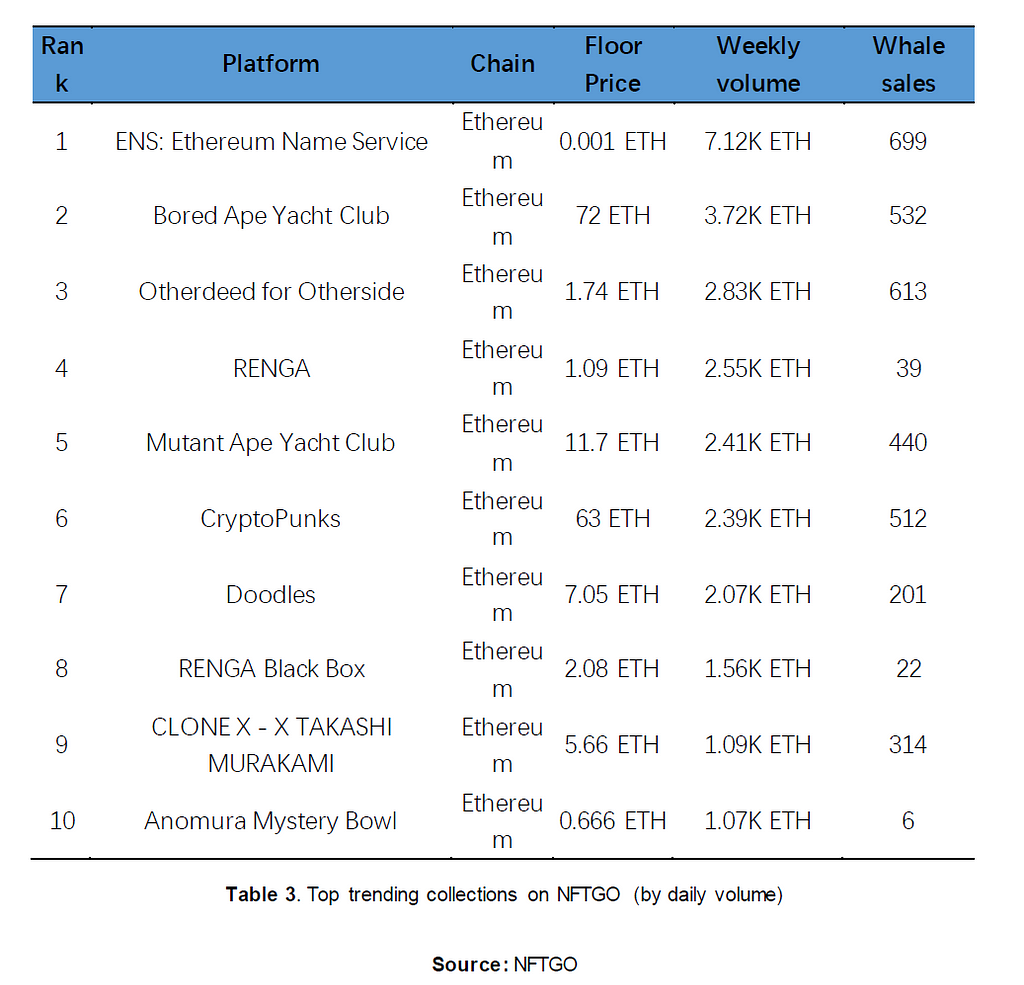

The NFT market last week saw an increase of 59.31%, with a market cap of US$2,313,221,138.01 this week. However, the 7-day sales volume plummeted 82.36% to US$31,234,547.27 and the total sales saw a minor change at 6.51%. Overall, the NFT market had substantive fluctuations this week, with the brand Cryptopunks back among the top 10 NFT brands this week — meanwhile, most of the other brands in the top 10 are no longer familiar names. Doodles (which recently finished a round of financing) and Grumpls are major brands that saw a lot of growth this week and reached the top 10 for the first time. Pudgy Penguins did not see as much growth, but also reached the top 10 for the first time. Other brands such as CLONE X and Moonbirds performed similarly to previous weeks.

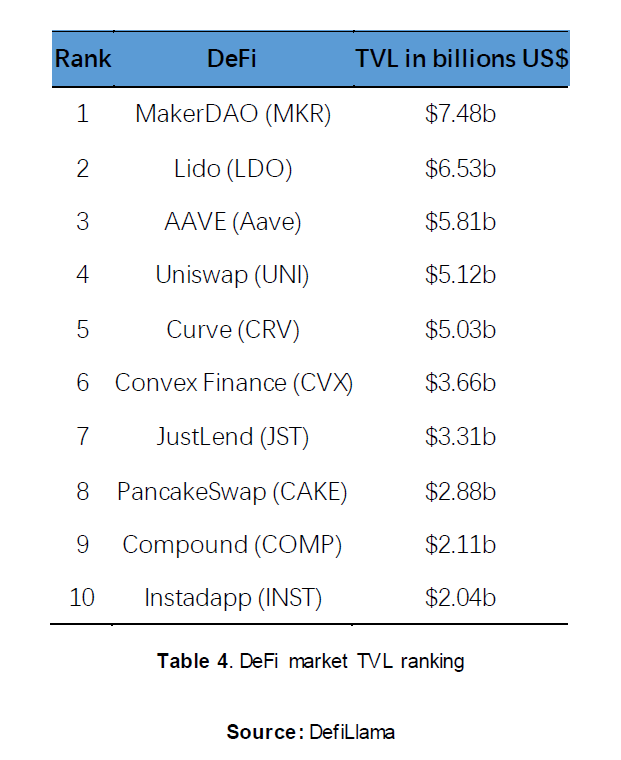

1.3 DeFi

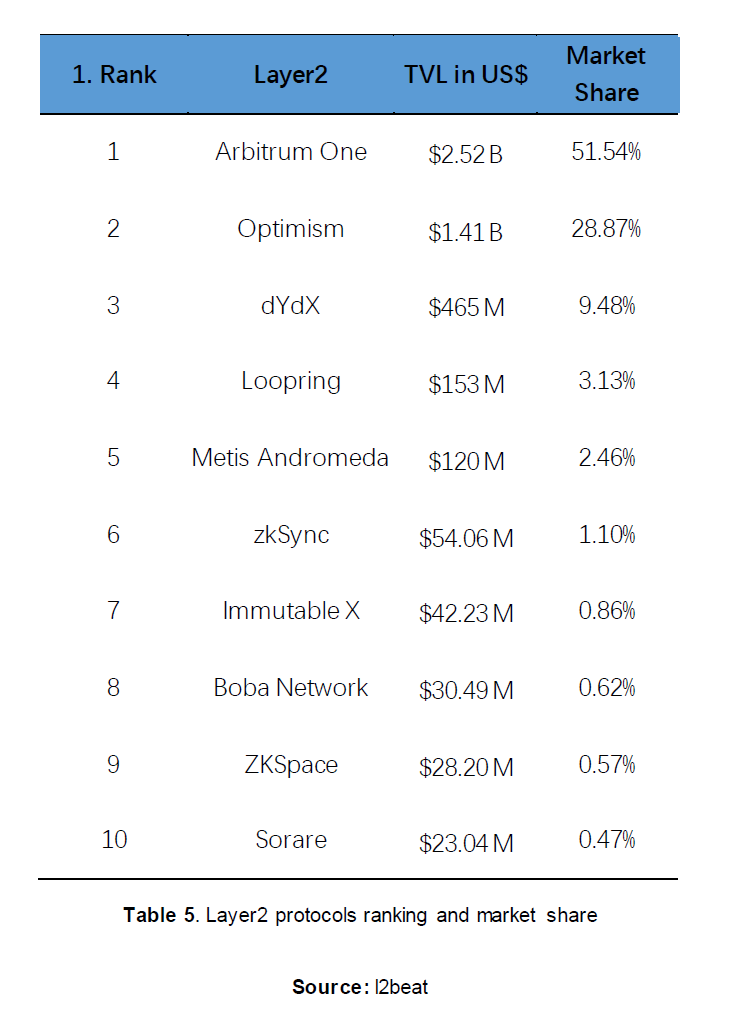

1.4 Layer 2

2. Market news (Source: Coindesk, Odaily)

2.1 Industry news

The Ethereum Merge Is Done, Opening a New Era for the Second-Biggest Blockchain

The massive overhaul of Ethereum known as the Merge has finally happened, moving the digital machinery at the core of the second-largest cryptocurrency by market value to a vastly more energy-efficient system after years of development and delay.

It was no small feat swapping out one way of running a blockchain, known as proof-of-work, for another, called proof-of-stake. “The metaphor that I use is this idea of switching out an engine from a running car,” said Justin Drake, a researcher at the non-profit Ethereum Foundation who spoke to CoinDesk before the Merge happened.

Lido’s Staked Ether Surges Closest to Ether Since Terra Crash

Ether’s (ETH) largest staking derivative token surged toward parity Thursday as traders breathed more easily that the Merge, Ethereum’s technology transition to proof-of-stake, had gone smoothly.

The price of Lido’s staked ether (stETH) token jumped sharply to 0.99 ETH from 0.97 following the Merge earlier Thursday, according to data by CoinMarketCap. This is the smallest price spread between stETH and ETH in four months, and a remarkable comeback from a week ago when the token fell to 0.95.

Lido Finance, the largest Ethereum liquid staking service provider, allows crypto investors to lock up (stake) ETH on Ethereum’s proof-of-stake blockchain to earn rewards. But stakers cannot unlock and redeem their ETH until another software update, the Shanghai upgrade, whose timing is still unknown. So Lido gives investors a tradable variant (stETH) of the locked coins.

2.2 Investment and Financing

Sky Mavis announces US$2.4 million esports grant for Axie Infinity

Sky Mavis’ recent early access release of Axie Infinity: Origins, formerly named Axie Infinity: Origin, has provided an avenue to further develop and expand its esports initiatives.

The company will commit 160,000 AXS (US$2.4 million) to be dispersed between Q4 2022 through Q2 2023. To date, Axie Infinity has enabled 94 tournaments through its grant program, which is designed to help the Axie competitive scene to thrive by spreading AXS across multiple regions and skill levels.

Token Management Platform Magna Raises US$15 million Seed Round at $70 million Valuation

Token management platform Magna closed a US$15 million seed round at a US$70 million valuation led by venture capital firms Tiger Global and Tusk Venture Partners, co-founders Bruno Faviero and Arun Kirubarajan told CoinDesk.

Other participants in the round included Shima Capital, Circle Ventures, Solana Ventures, Polygon Ventures, Avalanche Labs and Galaxy Labs. Individual investors included ex-Coinbase executive Balaji Srinivasan, Messari’s Ryan Selkis and DJ Steve Aoki.

Magna is building token distribution software that makes it easier for protocols, decentralized autonomous organizations (DAO) and crypto funds to send and receive tokens, a process that has so far lacked automation and has been prone to error.

Pantera Capital leads US$4.5 million round for NEAR-based wallet Sender

Cryptocurrency hedge fund and investment firm Pantera Capital led a US$4.5 million investment in Sender, a crypto wallet for the NEAR Protocol ecosystem.

Crypto.com, Jump Crypto, Amber Group, WOO Network, SevenX Ventures, Smrti Labs, D1 Ventures, Puzzle Ventures, Shima Capital, Eniac Ventures, and GFS Ventures also participated in the round, which valued the wallet at US$45 million, according to an announcement Monday. The investment was structured as a token sale.

The deal closed in April 2022 before much of the turbulence faced by the crypto sector in recent months began. Token prices have taken a battering this year, while in the past few months several major crypto outfits — including the Terra blockchain, the hedge fund Three Arrows Capital, and lending firm Celsius — collapsed.

2.3 Supervision

SEC’s Gensler Signals Extra Scrutiny for Proof-of-Stake Cryptocurrencies

U.S. Securities and Exchange Commission (SEC) Chair Gary Gensler on Thursday said that staked cryptocurrencies may be subject to federal securities regulations, repeating a pro-oversight stance in the wake of Ethereum’s transition to just such a method.

According to the Wall Street Journal, Gensler said that proof-of-stake (PoS) blockchains, which generate new coins for inventors who pool their holdings, take on investment contract-like attributes that could bring them under his agency’s purview. He added he was not referring to a specific coin, according to the Journal.

Still, the comments, which came hours after Ethereum completed its PoS transition via the Merge, indicate that the milestone tech upgrade may carry greater ramifications for the second-most popular blockchain than simply cutting its energy usage. As a proof-of-work (Pow) chain, its native ether token was one of only two cryptos — the other being Bitcoin — clearly defined as commodities by federal regulators.

US Treasury Sanctions Russian Paramilitary Group Crowdfunding Ukraine War with Crypto

The U.S. Treasury Department added five crypto addresses to its sanctions blacklist Thursday, all tied to a Russian entity dubbed “Task Force Rusich.”

The addresses — two bitcoin, two ether and one tether — saw thousands of dollars in crypto flow through, sometimes to exchanges such as Binance and KuCoin, according to data from Nansen. Some of the addresses have been active as recently as this week.

Telegram records indicate that at least four of the addresses are linked to a military hardware crowdfunding campaign to help resupply pro-Russian troops that retreated during Ukraine’s offensive in the northeast. The units took heavy casualties during their retreat, one of the posts said.

3. Trending project analysis — Fan Tokens

3.1 What are Fan Tokens?

Fan tokens are cryptocurrencies that permit their holders to access a variety of fan-related membership perks like voting on club decisions, rewards, merchandise designs and unique experiences. They can be used by sports clubs, music fan clubs and other organizations to democratize and organize experiences, establish club leadership and more.

Unlike NFTs, fan tokens are completely “fungible” or interchangeable. This means that, just like fiat or cash, the tokens can be exchanged for sports club merchandise, VIP experiences and more. Additionally, they play an important role in tightening the club community with another team-branded piece of fandom.

Fan tokens are cryptocurrencies that aren’t necessarily backed by underlying value principles of Bitcoin or Ethereum. They receive their worth from how much fans value the ability to participate in the club and earn unique benefits.

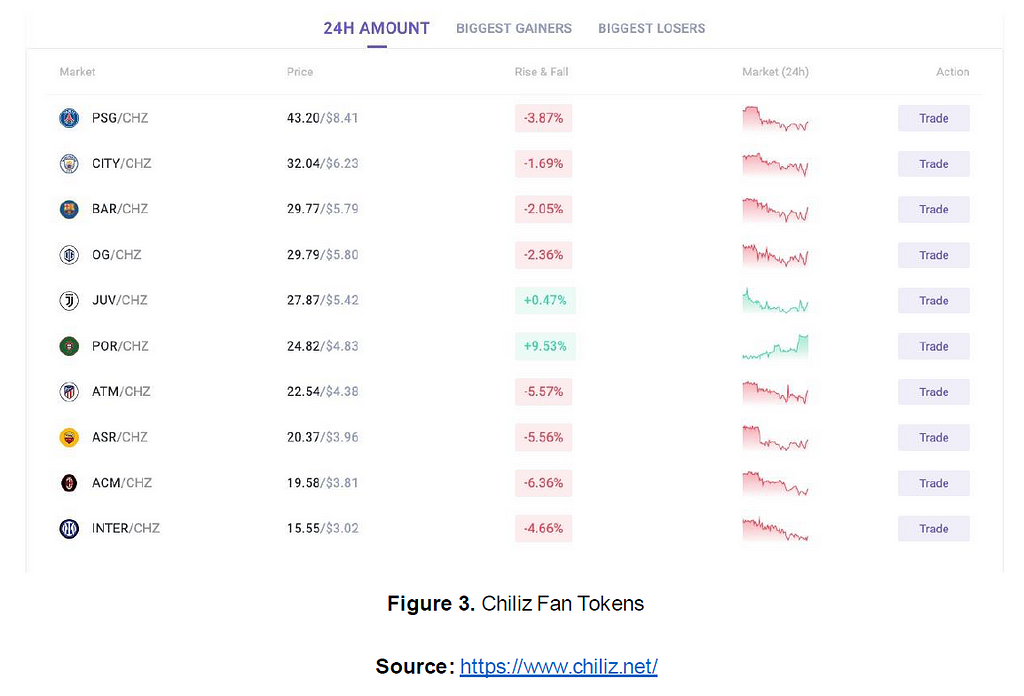

The Chiliz token is the first and most prominent fan token that has prompted an explosion of new tokens like the Manchester City Fan Token, AC Milan Fan Token, the Juventus Fan Token and many more. These currencies are a brand-new use case for crypto as innovation across the blockchain space reaches new highs.

3.2 How do Fan Tokens Work?

Fans can purchase digital tokens and trade them like other cryptocurrencies. When trading, the price of a fan token is generally set by the seller. It is also subject to change according to market movement and how popular the token is at the time.

Once users gain access to a set amount of fan tokens, they are granted the right to vote on a variety of matters concerning their favorite club. These matters that fans can vote on largely depend on the club, but they could include:

- A club’s merch design

- Tour bus designs

- Ticketing matters

- Match locations

- MVP categories

These perks allow fans to feel more involved with the club they already support, and they add an extra level of pride and prestige as their fan tokens will likely increase in value as the club grows over time.

Fan tokens create an exclusive community of the most dedicated fans. They give a new way for fans to take part in an exciting voting and rewards system. The more fan tokens you own, the more influence you have over the club and the more loyalty you show to your team.

3.3 What is Chiliz?

There are two main platform to launch fan tokens. They are Socios and Binance Fan Token Platform.

Chiliz describes itself as “the world’s leading blockchain fintech provider for sports & entertainment.” Chiliz (CHZ) is the most popular fan token platform to date and it has its own blockchain. Chiliz also developed the Socios.com platform for fans to engage with their favorite teams and clubs.

CHZ is the native ERC-20 utility token on the Chiliz network that is secured by the Ethereum blockchain, serving as the digital currency for the Chiliz and Socios.com platform.

Chiliz is generally responsible for the birth of a new form of cryptocurrency — the fan token. Once fans reach the Socios.com platform, club partners host a Fan Token Offering (FTO) — a period where prices of fan tokens are fixed and made available to fans before they reach the marketplace.

Ownership offers fans the ability to vote on a mobile platform, and it acts as a ticket into an exclusive inner circle of fans who share a passion for the team and the sport (or other categories like music). The more tokens a fan holds, the more power their vote holds(with a higher fan ranking), moving them upwards through different reward tiers until they have access to the biggest VIP benefits that are offered.

Football clubs intend to use Socios.com as part of their fan engagement strategy to continue to build their global fan bases, particularly in Asia where the football fan community is experiencing incredible growth. Socios.com connects the clubs to their fan bases, securing additional revenue streams that are digital, secure, transparent and entirely connected to the real fan experience.

- The CHZ Token enables the Socios.com platform — the consumer-facing site where fans can use tokens to participate in polls and surveys and earn rewards with active engagement.

- Users need CHZ tokens to participate in FTO, the initial sale of fan tokens and to access the Socios Locker Room — a space to entice new club entries.

- The CHZ token is highly liquid and traded globally on some of the major exchanges like Huobi Global and Binance.

3.4 What is Binance Fan Token Platform?

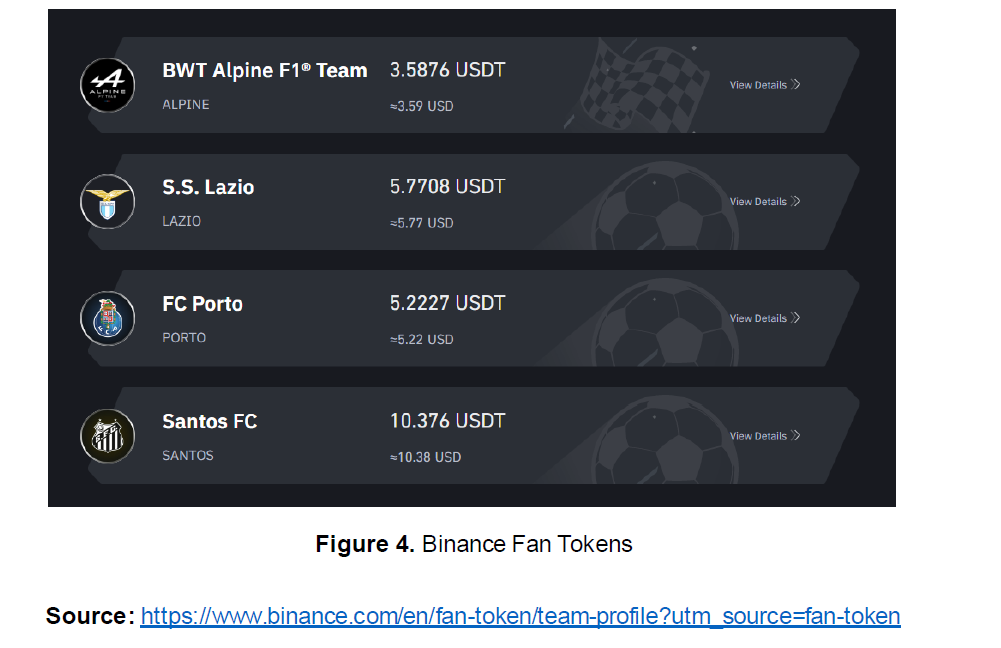

Binance has entered the fan token market by signing exclusive fan token offerings on its platform. They run on the Binance smart chain blockchain network. Currently, they have only 4 team fan tokens and they are purchasable using credit cards and cryptocurrencies. An interesting benefit of Binance fan tokens is that it gives owners access to a limited NFT collection. People can trade Alpine F1 Team, Santos FC, FC Porto, and Lazio fan tokens on Binance Fan Token Platform.

3.5 How to Choose Fan Tokens:

From a club aspect:

If you are a big fan of a certain club, there is no doubt that you can choose the fan token issued by your favorite club. Buying fan tokens will allow users to enjoy the benefits provided by the club, but pay attention to the amount you buy and do not exceed the risk you can afford to take. If you plan to buy Fan Tokens for investment purposes, you need to analyze the value of Fan Tokens from different perspectives.

The World Cup, which occurs once in four years, will be a good time to stir enthusiasm for the soccer sector. This year’s World Cup will be held in November, and there are still two months left before the World Cup begins. At present, the value of some fan tokens have increased by several times.

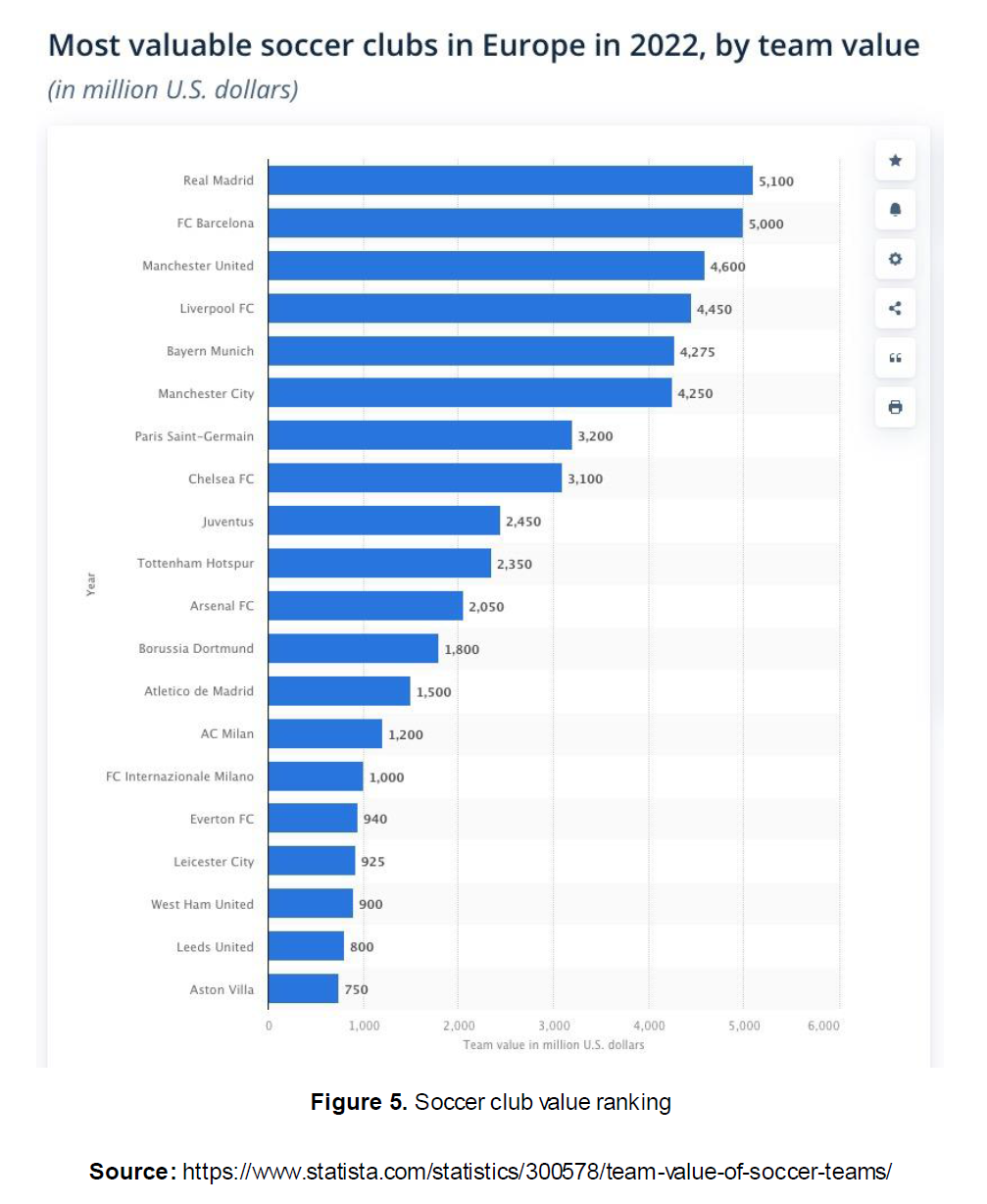

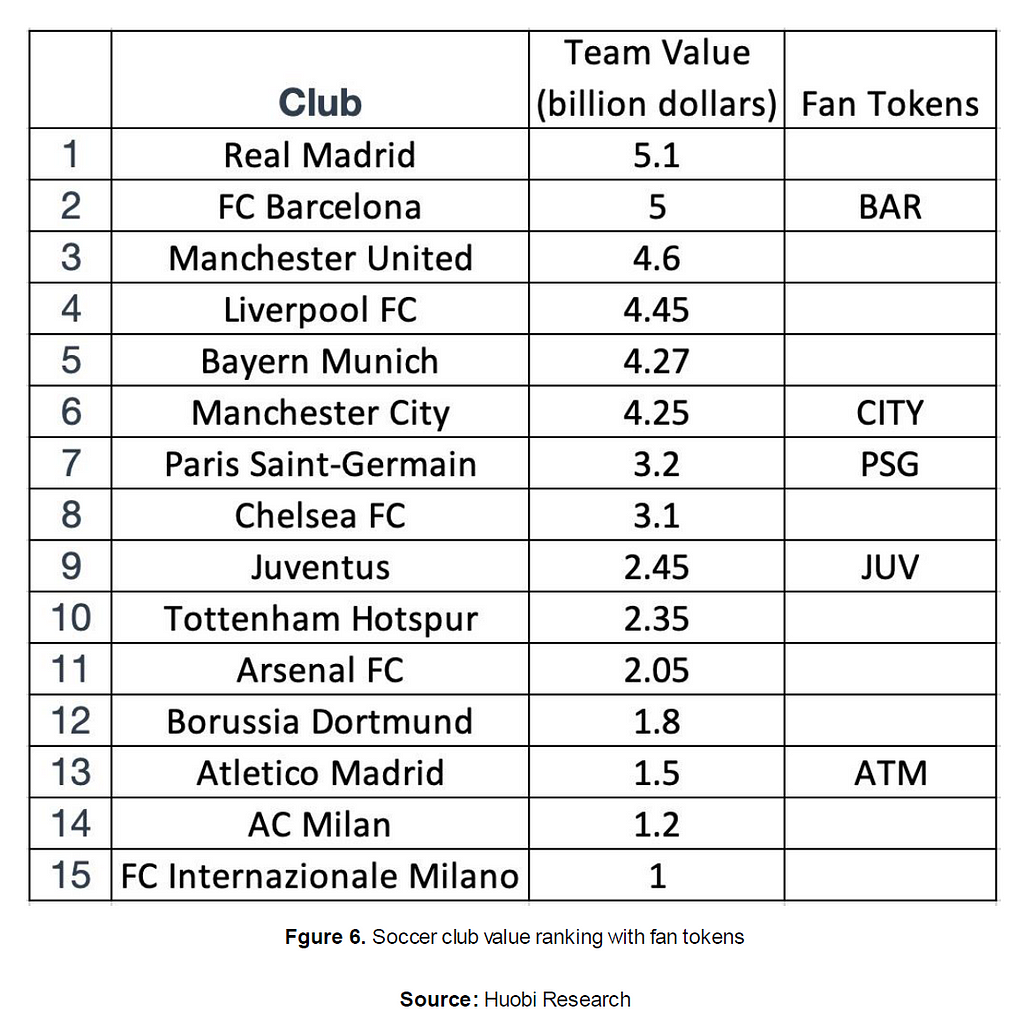

First, let’s look at the value of different clubs:

From this list, we can see which football clubs hold more value. Clubs with higher value and popularity, would correspondingly have a larger fan base. For fan tokens, popularity and fan base are the most important factors.

From tokens’ aspect:

Here we list the top 6 fan tokens with a market value of over US$10 million, and analyze the rights and benefits these tokens can provide, in addition to how they can attract fans.

SANTOS Market Cap: US$54,061,177

Santos FC Fan Token (SANTOS) is a fan token of the eponymous football team that was launched by a partnership between Santos FC and Binance Launchpool. Santos FC, aka Santos Futebol Clube, is a Brazilian sports club in the state of São Paulo, based in Vila Belmiro.

The pandemic hit football clubs hard, and as a result, the concept of a fan token was born. Fans were delighted, and investors picked up on the enthusiasm.

The collaboration between Binance and Santos FC was confirmed in November 2021 with an official statement published on the football club’s social network pages. The agreement of the two parties laid out the conditions for the launch of the fan token. Binance acquired the status of sponsor and licensee, earning the right to operate NFT products. The goal of this alliance is to increase fan engagement, build relationships between the club and fans, and attract the attention of Binance customers.

$SANTOS owners received a number of benefits: participation in the progress of the club and the right to vote in polls. Moreover $SANTOS token holders can gain access to exclusive rewards, privileges, limited & collectible NFTs and to the gamification process.

LAZIO Market Cap: US$41,491,863

Lazio Fan Token (LAZIO) is a fan token by Binance — the world’s biggest and most popular cryptocurrency exchange. So far, fan tokens have only been created by Socios, the company behind fan tokens for several other football clubs, such as PSG, and fan tokens for the UFC and car racing. Binance is leveraging the popularity of fan tokens, which give their holders ownership of the club’s governance and allow them to affect decisions, access exclusive promotions, unlock VIP rewards and gain special recognition with the club. Following the success of other fan tokens, Binance struck a deal with SS Lazio worth over 30 million Euros lasting over two years, with the option to extend it for a third year. The president of Lazio expressed his satisfaction with the following statement:

“We are very satisfied with this new international collaboration. Our partnership with Binance will allow us to extend our digital presence and connect with our fans and followers from all over the world like never before.”

One can expect the success of the fan token to track the performance of the players on the pitch, with wins boosting demand and, therefore, the price.

PSG Market Cap: US$26,533,325

Paris Saint-Germain Football Club commonly referred to as Paris Saint-Germain, PSG, Paris or Paris SG, is a professional football club based in Paris, France. They compete in Ligue 1, the top division of French football. As France’s most successful club, it has won over 40 official honours, including nine league titles and one major European trophy. The club’s home ground is the Parc des Princes.

Founded in 1970, the Parisians won their first major honor, the French Cup, in 1982 and their first Ligue 1 title in 1986. The 1990s was among the most successful periods in PSG’s history; it claimed a second league, three French Cups, two French League Cups, two French Super Cups and the UEFA Cup Winners’ Cup in 1996. After suffering a decline in fortunes during the 2000s, the Red and Blues (PSG’s team nickname) have enjoyed a revival since 2011 with increased financial backing, achieving unparalleled dominance in domestic competitions, winning seven league titles and twenty national cups. PSG has also become a regular feature in the UEFA Champions League, reaching its first final in 2020.

PSG have the most consecutive seasons playing in France’s top flight and is one of two French clubs to have won a major European title. It is the most popular football club in France and one of the most widely supported teams in the world. PSG’s home kit colours are red, blue, and white, and their crest features the Eiffel Tower and a fleur de lys. PSG has a longstanding rivalry with Olympique de Marseille; matches between the two clubs are known as Le Classique and the rivalry is a longstanding fixture in French football.

CITY Market Cap: US$24,021,198

Manchester City Fan Token is a fan token by Socios.com — an app built on the Chiliz (CHZ) blockchain. Fan tokens give holders a stake in the club’s governance by allowing them to influence decisions, unlock VIP rewards, and access to exclusive promotions, games, and special recognition.

Following the massive success of PSG’s launch in January 2020, Manchester City Football Club decided to launch CITY in March 2021. Its success will mainly depend on the club’s success on the pitch and the development of blockchain technology. The token price spiked when Cristiano Ronaldo was rumored to be joining the club, but decreased after the player transfer failed to go through.

BAR Market Cap: US$17,198,625

FC Barcelona Fan Token (BAR) is a utility token created in a collaboration between FC Barcelona and Chiliz. Fan tokens are digital assets that never expire, and provide their holders with an ability to vote in polls and participate in quizzes & contests published on the Socios.com app — a sports fan engagement platform developed by Chiliz and built on Chiliz Chain.

$BAR is the one and only official fan token of Barça that provides fans with a tokenized share of influence in the life of their favorite club. The token was created with the aim of bringing the community closer together and attracting a global audience by making it easier to interact with the soccer team.

The launch of the BAR token took place in June 2020, BAR offered its token owners the right to participate in surveys related to the activities of FC Barcelona, plus the opportunity to earn unique prizes. Token holders vote using a smart contract, and FC Barcelona must take into account the outcome of the poll and implement the poll’s results.

Fan Tokens serve as a membership that allows users to compete for exclusive rewards and team recognition. Rewards include match tickets, exclusive fan experiences, Socios.com bonuses, club NFTs and digital badges. What’s more, through BAR, members can purchase VIP goods / services, VIP access to stadiums and match tickets, and rare collectible items. Users can stake BAR for NFT rewards, and also gain access to the gamified utility.

JUV Market Cap: US$14,918,689

JUV is a utility token that works similarly to most sports fan tokens. JUV functions as a membership key, granting its holders the ability to influence and connect with the team, as well as impact decisions made at the Juventus headquarters. Socios.com, the originator of this fan token in collaboration with Juventus F.C., hosts it on their app. This blockchain-based fan interaction platform allows users to purchase $JUZ tokens in exchange for $CHZ, their in-app (native) token. JUV is created on the Chiliz Chain, an Ethereum-based proof-of-authority sidechain, and is primarily used as a governance token. The token holders can use smart contracts to vote on various contract-binding fan decision polls that are released by Juventus. JUV holders can receive rewards from interactions using the same app, and in the future, JUV can be staked to obtain NFT benefits.

About Huobi Research Institute

Huobi Blockchain Application Research Institute (referred to as “Huobi Research Institute”) was established in April 2016. Since March 2018, it has been committed to comprehensively expanding the research and exploration of various fields of blockchain. As the research object, the research goal is to accelerate the research and development of blockchain technology, promote the application of the blockchain industry, and promote the ecological optimization of the blockchain industry. The main research content includes industry trends, technology paths, application innovations in the blockchain field, Model exploration, etc. Based on the principles of public welfare, rigor and innovation, Huobi Research Institute will carry out extensive and in-depth cooperation with governments, enterprises, universities and other institutions through various forms to build a research platform covering the complete industrial chain of the blockchain. Industry professionals provide a solid theoretical basis and trend judgments to promote the healthy and sustainable development of the entire blockchain industry.

Contact us:

Website:http://research.huobi.com

Email:research@huobi.com

Twitter:https://twitter.com/Huobi_Research

Telegram:https://t.me/HuobiResearchOfficial

Medium:https://medium.com/huobi-research

Disclaimer

1. The author of this report and his organization do not have any relationship that affects the objectivity, independence, and fairness of the report with other third parties involved in this report.

2. The information and data cited in this report are from compliance channels. The sources of the information and data are considered reliable by the author, and necessary verifications have been made for their authenticity, accuracy and completeness, but the author makes no guarantee for their authenticity, accuracy or completeness.

3. The content of the report is for reference only, and the facts and opinions in the report do not constitute business, investment and other related recommendations. The author does not assume any responsibility for the losses caused by the use of the contents of this report, unless clearly stipulated by laws and regulations. Readers should not only make business and investment decisions based on this report, nor should they lose their ability to make independent judgments based on this report.

4. The information, opinions and inferences contained in this report only reflect the judgments of the researchers on the date of finalizing this report. In the future, based on industry changes and data and information updates, there is the possibility of updates of opinions and judgments.

5. The copyright of this report is only owned by Huobi Blockchain Research Institute. If you need to quote the content of this report, please indicate the source. If you need a large amount of references, please inform in advance (see “About Huobi Blockchain Research Institute” for contact information) and use it within the allowed scope. Under no circumstances shall this report be quoted, deleted or modified contrary to the original intent.

Compare Different Fan Tokens was originally published in Huobi Research on Medium, where people are continuing the conversation by highlighting and responding to this story.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.