Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

Why did Ethereum move to Proof of Stake?

TL;DR

On September 14, 2022 history was made when Ethereum, the second largest Blockchain Network, moved to a proof of stake consensus mechanism. This is a long time in the making, and will change the course of Blockchain technology and its adoption. But why did they do it? Let’s go over their reasons and what proof of stake looks like in a practical sense.

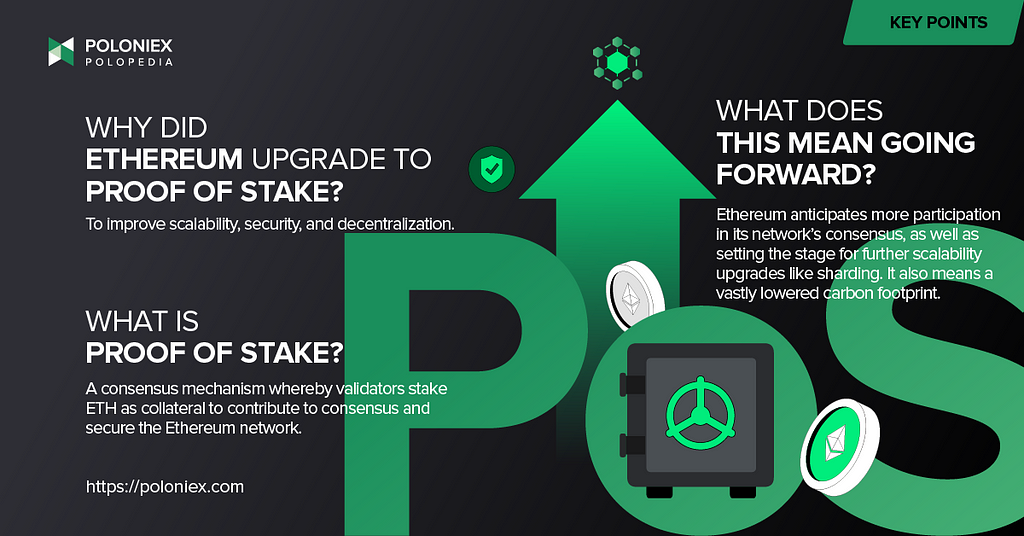

What is Proof-of-Stake?

In order to understand what proof of stake is and what separates it from proof of work, let’s talk a bit about why someone would need to “prove“ something to the Ethereum Network, in order to help secure it.

The way a distributed ledger, a.k.a. a Blockchain, like the one that Ethereum or Bitcoin uses, works is that it distributes the responsibility of verifying the network transactions among a multitude of participants. In a proof of work system, these participants are called miners, whereas, in a proof of stake system, these participants are often called validators.

A validator is an entity that participates in the consensus of a blockchain network

The reason for distributing this responsibility is so that there is no central entity dictating what the truth is. But, of course, one can’t expect that every participant in this process will be diligent or even have the network’s best interests in mind. For example, a malicious node might execute a double spending attack. This is why there needs to be a way that every participant that is responsible for validating network transactions, can make sure the transactions they are verifying are real and correct. Which brings us to different types of consensus mechanisms.

The point of a consensus mechanism is to not only facilitate the network coming to an agreement over its transactions, but to also disincentivize malicious actors from successfully acting dishonestly. In the case of proof of work, a participant proves that it has the network’s best interest in mind by pledging a large amount of computing power. That is, with proof of work, the consensus mechanism functions such that computers solve complex math problems in order to produce new blocks in the blockchain and agree on the entirety of the blockchain’s past transactions. In the case of proof of stake, a participant or validator proves their honesty by staking a stipulated amount of the blockchain’s native cryptocurrency as collateral. Meaning that if they did in fact act maliciously or were lazy, they risk losing their staked crypto.

Proof of stake is often cited as being less energy intensive and less prohibitive to people that want to participate in the securing of a given blockchain network. And because it is less prohibitive and is conducive to more participation and thus more decentralization, it is also more conducive to implementing scaling solutions. This helps make the network more scalable, something that has eluded proof of work systems.

Why did Ethereum move to proof of stake?

In a paper released in 2020 by Ethereum founder Vitalik Buterin, the reasons for Ethereum to move to a proof of stake consensus mechanism were laid out.

An interesting point that was made was the point that attacking a network is more cost-effective when operating on a proof of work consensus mechanism. That is, if the would-be attacker simply spends more on GPU than reliable miners, then they can simply outrun them.

And because proof of work is a hardware game, the barrier to entry becomes prohibitive, contributing to the problem of centralization and single point of failure. Furthermore, hardware, unlike deposited coins, wears and breaks overtime.

Another interesting thing to consider is that an attacker’s cost-of-attack in a proof of work system gradually reduces to zero as honest miners drop out when they have no way to get rewards. Not to mention that in the case of an attack, a community might choose to change their proof of work algorithm. This would render a piece of hardware called an ASIC (a piece of hardware that is designed to perform a very specific task) useless. This comes at a cost to the attacker AND the miner, as the honest miner must replace these pieces of hardware in order to continue mining.

In the case of a proof of stake system, a blockchain can utilize a slashing mechanism, which destroys an attacker’s staked cryptocurrency. This is what happens when you have locked-in tokens as collateral for securing (or in this case attacking) a blockchain network. And this action can be taken quite swiftly by the community, meaning the risk to the attacker is much higher.

There is also Ethereum’s broader future to consider. Now that there is a proof of stake consensus system set up, the network will be much more environmentally friendly. This, becoming ever more important as regulatory scrutiny falls on proof of work blockchains and their associated mining operations. It also sets the stage for further scaling solutions like sharding, which divides the data load of the network and is meant to reduce network congestion.

What do you need to be a validator on Ethereum?

So, how can one become a validator that runs a node on the Ethereum network? Ethereum stipulates that a user has to have 32 ETH and deposit that into a deposit smart contract. Then, they must download an execution client as well as a consensus client. If they are to run a node solo, they must have a computer that meets the minimum hardware requirements and have reliable internet access 24/7.

You should be aware that Ethereum uses an activation queue to select new validators, and thus control the rate of validators joining Ethereum Network. But once activated, a validator can start verifying transactions and producing new blocks.

How does validation work on the Ethereum Network?

On the Beacon Chain, which is Ethereum’s consensus layer, a validator locks their ETH into a smart contract on Ethereum’s blockchain. And like many proof of stake networks, validators are randomly chosen to be block proposers. Furthermore, there is a committee of validators that send what are called attestations, which function as votes, attesting to the validity of the block being proposed by the chosen validator.

As mentioned above, one can become a validator when they deposit 32 ETH. It is worth noting that in the interest of decentralization, there is no advantage to staking more than 32 ETH for one validator.

Currently, since the Beacon Chain is live on the Ethereum mainnet, those who wish to run a node must run a consensus client and an execution client. This is due to the fact that they now have to process transactions as well as sign off on their validity.

How can one stake their Ethereum?

There are several options when it comes to staking your Ethereum:

Solo staking: Solo staking involves an individual depositing 32 ETH via the Ethereum launchpad on a computer that has reliable internet access and is able to stay online 24/7. This method gives the validator full participation awards and contributes the most to decentralization.

To get started as a solo staker, you can visit the Ethereum launchpad here.

Staking-as-a-service: There are providers who run staking-as-a-service businesses through which someone who doesn’t want to deal with the hardware component of staking can participate to earn native block rewards.

Pooled staking: If you don’t have or want to stake your 32 ETH, you may also use a staking pool service via a third-party. In this way you can stake the amount you have or want to as well as exit any time while still earning rewards.

Finally, centralized exchanges: centralized exchanges already provide staking services for various cryptocurrencies. The way this works is that these exchanges have large pools of cryptocurrencies like ETH, and allow users to participate in the security of the network, earning rewards without putting in much effort. One of the main drawbacks of this method is that it creates centralization and heightens the risk of a single point of failure.

Why did Ethereum move to Proof-of-Stake? was originally published in The Poloniex blog on Medium, where people are continuing the conversation by highlighting and responding to this story.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.