Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

What is DigixDAO?

DigixDAO plans to create a new cryptocurrency backed by actual bars of gold. DigixDAO is the Digix Decentralized Autonomous Organization, a decentralized group of participants making decisions about how to grow the Digix Global Ecosystem. Participants purchased DGD tokens in the “first ever crowdsale on the Ethereum Blockchain.”

The DGD token holders will make decisions related to any proposals submitted to DigixDAO. As a reward for voting and decision making in the growth of Digix, DGD holders receive rewards related to DGX, a token that represents 1 gram of gold. Their tokenization of gold aims to provide stability and store of value in the cryptocurrency space. Bitcoin is often referred to as digital gold, but in this guide, we’ll look at how DigixDAO digitizes your ownership of actual gold.

Proof of Asset

In order to distribute DGX tokens representing 1g of gold, Digix utilizes Proof of Asset (PoA). The process involves recording possession of an asset on the Ethereum blockchain and the creation of PoA Asset Cards. “The asset cards are certified using sequential digital signatures from the entities in the chain of custody, namely, the Vendor, Custodian, Auditor, which are further validated with proof of purchase and depository receipts provided and uploaded onto the InterPlanetary File System for permanent record.”

The Vendor, ValueMax Singapore, is a publicly listed company that sells London Bullion Market Associate certified gold bullion bars.

The independent Auditor, Bureau Veritas Inspectorate, checks the quality and quantity of the gold every quarter.

The participating Custodian Vault, The Safe House, is located in Singapore. Their vault can store up to 30 tons of gold, but in the future, Digix will look to open more vaults around the world for regulatory redundancy.

In total the Proof of Asset Cards stored on the Ethereum blockchain contain:

- Timestamp of card creation

- SKU of the gold bar

- Bar serial number

- Chain of custody digital signatures (Vendor, Custodian, Auditor)

- Purchase receipt

- Audit documentation

- Depository receipt

- Storage Fees due

DGX Tokens

Now that we know how the gold is secured, it’s time to make the DGX tokens. DGX tokens are created by a smart contract that receives PoA cards and generates DGX tokens for each gram of gold. For example, if a 100g PoA card is sent to the smart contract, 100 DGX tokens are created and sent to an Ethereum wallet. This means Digix doesn’t engage in fractional reserves. Each DGX token always represents 1g of gold and is divisible to 0.001g.

The DGX tokens come with two sets of fees associated with storing and securing gold. There’s a demurrage fee that comes out to be 0.60% annually and also a 0.13% transaction fee when transferring DGX with an Ethereum wallet. However, Digix will wave the storage fees during the first year of operation.

We’ll discuss later how the DGX fees are passed onto DGD holders.

Instead of using the PoA cards to generate DGX tokens, the reverse process is also available. Recasting DGX tokens into PoA cards and then physical gold bars will cost you 1 DGX token. The gold bar you claim must also be a multiple of 100 grams and you can choose to either pick up your gold bar in person or, depending on the country, have it sent to you.

The DGX tokens are the crux of the DigixDAO and aim to solve two problems. They want to make it easier and cheaper to own and liquidate gold assets while also providing much-needed stability to cryptocurrencies. While not available for purchase yet, the DGX tokens are expected to be released in the first quarter of 2018.

DGD Tokens

Holders of DGD can vote on how the DigixDAO funds are allocated. DGD token holders can make “active managerial decisions to any proposals submitted to DigixDAO.”

However, there’s some confusion about the rewards for DGD holders who vet and approve project proposals. The Digix Global FAQ says “each token rewards you with a prorated share of DigixDAO’s transaction fee on Digix Gold, denoted in DGX gold tokens.”

There are also plans to include the “demurrage fees as part of the rebate structure to DGD token holders.”

The FAQ also says for “participation on proposals, there will be a reward with DGX tokens.”

However, in February 2018 the Digix team posted on Medium “we would like to emphasize further that DGD do not provide ‘passive income’, nor ‘dividends’, ‘rights to profits of the commission of DGX traded.’”

The post mentions instead you can receive Digix rewards such as “DGX discounts or rebates.”

It’s unclear at this time how much the rebates will be worth in terms of obtaining DGX. What is clear, regardless of what the rewards end up being, is they are not received passively and must be claimed quarterly. After the DGX tokens are launched, there will be further information on how DGD holders can start voting in the DGD governance and receive their rewards.

History

Digix incorporated in Singapore in December 2014 and the DGD crowdsale took place on March 30th, 2016. It was the first ever crowdsale and major Distributed Autonomous Organization hosted on the Ethereum network. The sale intended to run for 30 days but met its 5.5 million dollars hard cap in just 12 hours, selling 1.7 million DGD tokens and reserving 300,000 for the Digix team. Pledges who sent over 15,000 USD worth of Ether received a special badge which will allow them to submit proposals to the DigixDAO.

For better or worse, when you see the word DAO, you might think of hacking. In July 2017, over 4000 DGD were indeed stolen due to a vulnerability in the crowdsale smart contract. The bug was eventually fixed and the tokens reimbursed to the 35 affected addresses.

In 2018, Digix is approaching a critical moment in its history with the release of tokenized gold in the form of the DGX token. There’s a race to become the most trusted stable coin in cryptocurrency and as a Digix founder said, “if one were to extrapolate… over a longer period of time, the stability of gold as a hedge against geopolitical and economic risks is undisputed.”

Digix Global Team

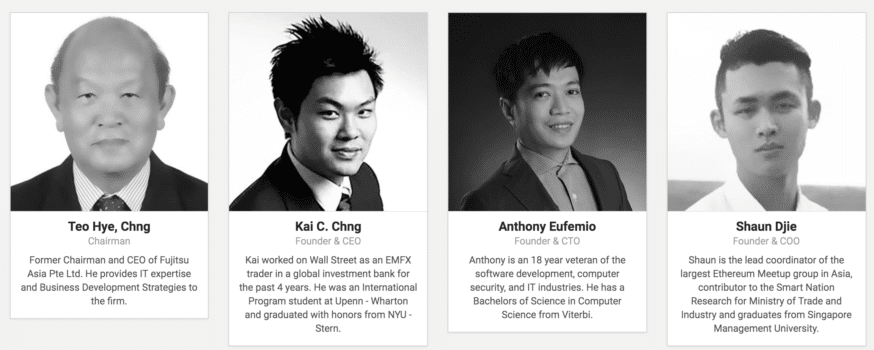

The Digix team based in Singapore is led by three founders: Kai C. Chng, Anthony Eufemio, and Shaun Djie. Kai C. Chng is a graduate of the NYU School of Business a former trader for HSBC. He left his job trading securities due to his strong belief in blockchain technology. Anthony Eufemio graduated from USC Viterbi and has worked in software development for over 18 years. Shaun Djie is the “lead coordinator of the largest Ethereum Meetup group in Asia” and a contributor to “Smart Nation Research” for the Singapore government.

Coin Supply and Sustainability

There are 2 million DGD tokens in existence with 15% allocated to developers. However, if the DigixDAO requires more funding and the majority of participants agree, then another DGD token crowdsale can take place.

The supply of DGX tokens will depend on the demand for gold and the size of their vaults. The first vault Digix is working with can hold about 2 billion USD worth of gold, so if the new DGX gold standard becomes popular, they will need to expand to more vaults.

If the DGX token successfully represents gold, then there are plans to create more tokens for silver and other precious metals too.

The 0.13% transaction fees and one-third of the demurrage fees on DGX go into the rewards for the DigixDAO. As far as the sustainability of the DAO and DGX token, if at least 80% of DGD holders vote to liquidate the DAO, then DGX holders will be reimbursed either in gold bars, fiat, or a cryptocurrency.

Future Projects and Roadmap

The creation of DGX tokens is just the beginning for Digix Global. Once a stable coin is introduced to cryptocurrency, the possibilities are endless.

Wealth Inheritance

Digix plans to provide a dead man’s switch to allow wealth to be passed on to an Ethereum address of your choosing. If you did not access the Digix network for a certain period of time, the smart contract would automatically send your DGX to an heir’s wallet.

Gamification

Instead of using Warcraft gold, Digix would like developers to be able to use real gold as their in-game currency.

Escrow

“DGX tokens can provide a better and less volatile store of value for Escrow services on the blockchain.”

Partnerships with Stable Coins

The Dai Stablecoin will be backed by DGX as collateral. Dai is aiming to “create a decentralized stable coin that is pegged to 1 USD and backed by diversified collateral on-chain.”

Lending and Microfinance

The current volatility of cryptocurrencies makes them less than ideal for lending purposes. However, Digix believes there could be a new industry based on the lending of a more stable DGX token.

Competition

Digix Global has two main competitors. There are the institutions already selling gold, such as GoldMoney, the market leader in digital gold storage, holding 2 billion dollars in assets. They’re also on the Toronto Stock Exchange. GoldMoney provides a type of debit card that allows you to spend your gold. The Canadian based company has regular and independent audits of client holdings but does not use any blockchain technology to store information on individual holdings.

The other main competitor is Tether, the most popular ‘stable’ coin in terms of volume. However, with the recent subpoena of Tether, there’s room in the market for competitors.

Trading History

In January 2018, the vast majority of the cryptocurrency market crashed. DGD was the only coin in the top 100 to rise in value in that time. Perhaps this is an early indicator that people will seek gold as a safe haven during times of market uncertainty. The ICO price of DGD was about 3 dollars, but in 2018, DGD reached an all-time high of over 400 dollars. When Digix finally delivers the DGX tokens and the rewards to DGD participants start rolling in, we might see an even higher demand for DigixDAO.

baseUrl = "https://widgets.cryptocompare.com/";

var scripts = document.getElementsByTagName("script");

var embedder = scripts[ scripts.length - 1 ];

(function (){

var appName = encodeURIComponent(window.location.hostname);

if(appName==""){appName="local";}

var s = document.createElement("script");

s.type = "text/javascript";

s.async = true;

var theUrl = baseUrl+'serve/v3/coin/chart?fsym=DGD&tsyms=USD,EUR,CNY,GBP';

s.src = theUrl + ( theUrl.indexOf("?") >= 0 ? "&" : "?") + "app=" + appName;

embedder.parentNode.appendChild(s);

})();

Where can you buy it?

The vast majority of DGD volume takes place on Binance and Huobi. On Binance the DGD has both BTC and ETH pairs. When DGX goes live, it will be available for purchase with Ether on the Digix marketplace.

Where can you store it?

Any 3rd party wallets that allow custom Ethereum tokens can store DGD and DGX ERC20 tokens. You could use the imToken mobile app or MyEtherWallet.

Final Thoughts

In 1971 America completely severed the link between USD and gold. Almost 50 years later Digix plans to bring back the gold standard. A gold dollar cryptocurrency not only provides stability but can lead to the tokenization other metals and commodities. With stability and store of value on a blockchain, an entire ecosystem of applications is possible. However, it remains to be seen if cryptocurrencies can be considered the gold of the future, or if gold is the gold of the future.

Additional Resources

The post What is DigixDAO? | Beginner’s Guide appeared first on CoinCentral.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.