Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

Now is an exciting time to be alive. Technology has been advancing exponentially and solving problems in every area of life. Can you believe that the first personal computers were just 40 years ago? And now here we are: I can tap on my phone and have shoes, pizza, or a ride show up at my door. My speaker can tell me about the weather and pop culture trivia. Drones fly through the sky and cars can literally drive themselves.

We live in the future — and things are exponentially speeding up.

Among the many products that exist, there is one type that tends to usher in disruptive innovation. Platforms.

Platforms > Products

Before the internet, things were much simpler. Companies made products and sold those to customers for money. Simple.

Then the internet happened and things got crazy. Suddenly people were more interconnected than ever before. This resulted in an entirely new class of products forming. These products empowered their users to create value for each other. This was the rise of the platforms.

Why are platforms so good? Because it literally empowers armies of people. Hundreds, thousands, even millions of people using their talents to solve problems and create value. This allows products to go beyond companies and become communities.

To highlight this point — let’s look at some examples.

Apple vs Nokia

Users had a problem. They wanted a new phone that had the right features to suit their needs. Nokia, a product maker, came out with lots of mobile phones for each bucket of people their marketing team identified. Apple, on the other hand, released the iPhone. They created the app store and equipped developers with the tools to make apps. Each app extended the functionality of the phone in creative new ways. 2.2 millions apps later — Apple has destroyed Nokia.

Users needed a place to stay when traveling. Marriott saw increasing demand and built more hotels. Airbnb redefined accommodations by creating a platform that enabled people to rent out their spare rooms and condos. Fast forward a few years and Airbnb’s has over 4 million listings. This is more than all the rooms from the top 5 hotel chains in the world combined. Suddenly Marriott, Hilton, and other nearly 100 year old businesses are overthrown by the disruptive power of a platform.

Users wanted news. The NY Times was a big publication with its 1,300 staff writers churning out content. But then Twitter came along and redefined journalism. Making it so that everyone with a phone could create and distribute news. The NY Times could hire more writers, but they will never catch the 328 million people that use Twitter.

And platform companies aren’t just big, they’re valuable. Right now, 5 out of 6 of the most valuable companies in the world are platforms. Apple, Alphabet (Google), Microsoft, Amazon and Facebook. Platforms simply make good business models.

Blockchain Platforms

Where the internet enabled a wave of tech platforms to accel, blockchain may usher in the next wave. Bringing in companies looking to solve even harder problems and disrupt industries with heavy competitive advantages.

Among the top 10 cryptocurrencies by market cap, 7 are platforms.

- Ethereum — the world computer

- Ripple — international bank payments

- Cardano — more scientific Ethereum

- Stellar — currency with smart contracts

- NEO — Chinese Ethereum

- EOS — the Ethereum killer

- IOTA — the internet of things payments

Clearly platforms are already off to a good start. If we look further down the list, we can see broad patterns starting to emerge. Let’s dive into some of the key industries that crypto platforms are gearing up to disrupt.

Decentralized Computing

Computers are a critical part of modern life. But while technology is good, it takes a lot of work behind the scenes to connect everything properly.

On this front, Ethereum, Cardano, NEO, and EOS are all competing to become the infrastructure level for decentralized applications. These platforms are like the internet. They hook everything up so that other companies can launch apps on top of them.

https://coinmarketcap.com/tokens/

https://coinmarketcap.com/tokens/

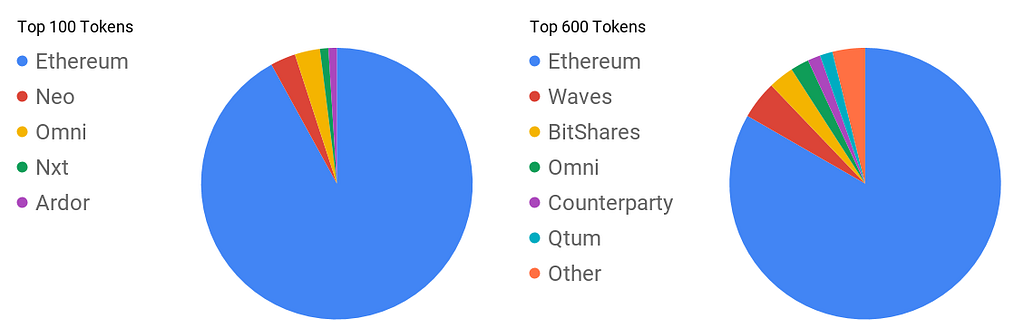

And right now, the race is on. Each organization and technology has strengths and weaknesses. So far, the platform of choice is Ethereum. As shown below — of the top 100 and top 600 tokens, the vast majority are built on the Ethereum platform. Followed by NEO, Omni, Waves, and others.

Ethereum uses blockchain to run programming code for decentralized applications. The primary way Ethereum does this is through smart contracts. A smart contract is the code (similar to a real contract) that executes the exchange of money, content, property, shares, or really anything of value that can be connected digitally. This eliminates the need for a middleman that facilitates the exchange. Things are done automatically and entirely by code using the Ethereum blockchain. Ethereum has seen huge early success as a platform so far, having the vast majority of decentralized applications choosing it over its competitors. It is currently the 2nd most valuable coin by circulating market cap.

NEO is similar to Ethereum but with a few notable differences. It is faster (10,000 transactions per second) and more flexible (can be written in C# and Java). In addition, NEO uses proof-of-stake to reach consensus on the blockchain. This means that instead of having miners burning electricity to keep the system running, with NEO the system is kept running simply by people holding onto their coins. In addition, they receive a reward of GAS (a token on the NEO blockchain) which they can sell on exchanges. Finally, NEO also has greater support from China. OnChain, its founding company, has deals with the Chinese government as well as support from companies like Alibaba.

Banking

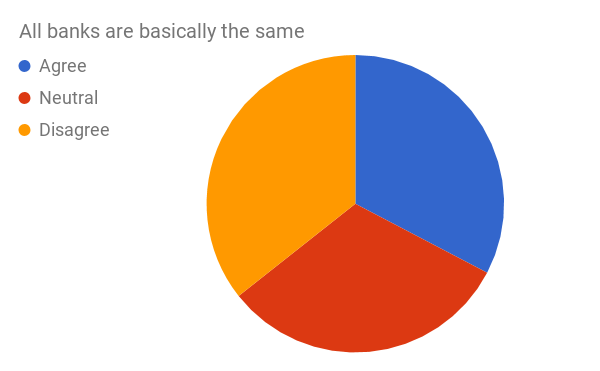

The banking industry is big, slow, and really difficult to change. This can be seen by the commoditization of banks — with one third of customers saying that all banks are basically the same. This speaks volumes considering banking is something that we all do on a regular basis.

FortySeven is creating a platform for the banking industry. Traditionally, opening a bank costs millions of dollars and creating applications is difficult. The amount of bureaucracy and regulation makes it slow moving and prohibitively expensive. FortySeven aims to fix this by creating the infrastructure level. They are currently working with the FCA in the United Kingdom to lay the groundwork so that developers can build applications and disrupt the banking industry. An early product they have in development is the “Multi-Asset Account”, which works in the EU to aggregate all bank accounts, cryptowallets, and investments into one convenient place. FSBT tokens are required to launch applications and smart contracts, which creates demand for them as the platform gains popularity.

Using the Ripple blockchain, banks can send money internationally and use the XRP token to square up balances almost instantly. A process which would typically take days can now be accomplished in 4 seconds. Ripple has so far closed partnerships with over 100 banks and has 75 more in the pipeline. By making their protocol open, Ripple is encouraging developers to build on top of their platform and leverage their blockchain. In addition accelerators focused exclusively on products using the Ripple protocol, such as CrossCoin, have emerged to further accelerate this process. Ripple is currently the 3rd most valuable coin by circulating supply market cap.

Advertising

Statista Digital Marketing Outlook

Statista Digital Marketing Outlook

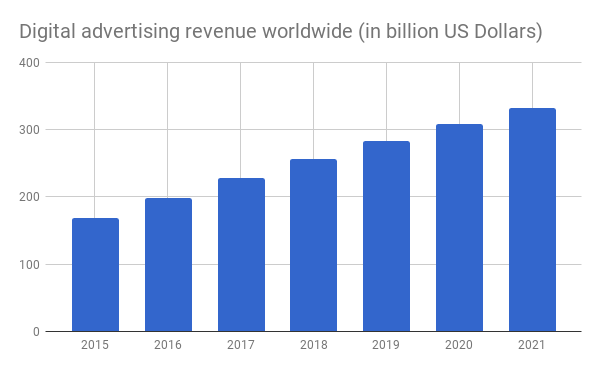

The digital advertising industry has been booming, expected to hit $256 billion this year. Unfortunately, a report from Pivotal estimates Google and Facebook to account for 73% of all digital advertising in the US — up from 63% in 2015. This is a rapidly growing industry dominated by 2 major players. Blockchain could be the way forward.

BAT is a digital advertising platform that connects users, advertisers, and publishers. They aim to reduce expenses for users that spend precious data and battery life on viewing ads. To help publishers stop losing money to Facebook and Google. And to stop bots and fraudulent website from scamming advertisers . BAT does this by measuring a user’s attention and then allocating tokens to the publishers based on what the user actually viewed. Users can choose to view ads and get compensated by tokens. Meaning they get paid to look at ads. BAT is started by the creator of JavaScript and co-founder of Mozilla and Firefox.

Steem is looking to change the way content creators get compensated for their efforts. Instead of relying on advertisements and endorsements, creators can be rewarded by the community itself. Any publishing site can develop their own token on top of Steem and use that to reward people creating and engaging within the community. A popular application already using STEEM is Steemit, where users create long-form content similar to Medium. Until now, nearly $23 million has been paid out through the Steem platform.

Conclusion

Looking back, platforms have proven to be good business models. They have drove innovation and resulted in some of the top companies in the world. The internet ushered in a wave of platforms in areas like technology, hotels, and news. Now blockchain is creating an even more connected world. This opens up new opportunities for platforms to disrupt incumbent companies in areas like decentralized computers, banking, and content monetization. It is an exciting time — what will our world look like in 5 years?

If this article was helpful or interesting, please hit the clap button 👏 and if you know someone that would like it — feel free to share it.

We will be sure to deliver you more analyses of the market in the weeks to come. — writers@coinandcrypto.com

Cryptocurrency Platforms: The key to disruptive innovation was originally published in Hacker Noon on Medium, where people are continuing the conversation by highlighting and responding to this story.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.