Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

BendDAO — discussing the liquidity risk

Authored by Derrick Chen, Kou Jer Shun, Lucio Lyu, Researchers at Huobi Research Institute

Abstract

This week, we focus on the following events: 1) The Ethereum Merge Has an Official Kick-Off Date; 2) Crypto ATM Operator Bitcoin Depot to List on Nasdaq in US$885 million SPAC Deal; 3) Crypto Exchange Coinbase Faces Class Action Lawsuit Over Alleged Lapses in Security ___________________________________________________________________

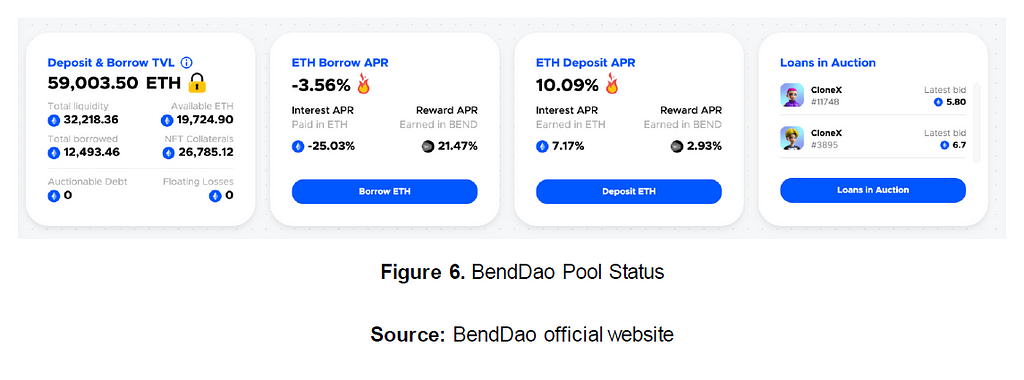

Project Analysis: In the last week, the NFT lending protocol BendDAO has been undergoing a liquidity crisis. A large amount of ETH deposits have been withdrawn over the past week. As of 4 p.m. on August 23, the protocol’s lending utilization rate reached 99.26%, with only 90.03 ETH of liquidity avaible. This means that the vast majority of ETH depositors will be unable to immediately retrieve their assets from the protocol. The worst appears to be over due to the urgent adoption of a new proposal. We analyze BendDao and the series of events.

1. Industry overview

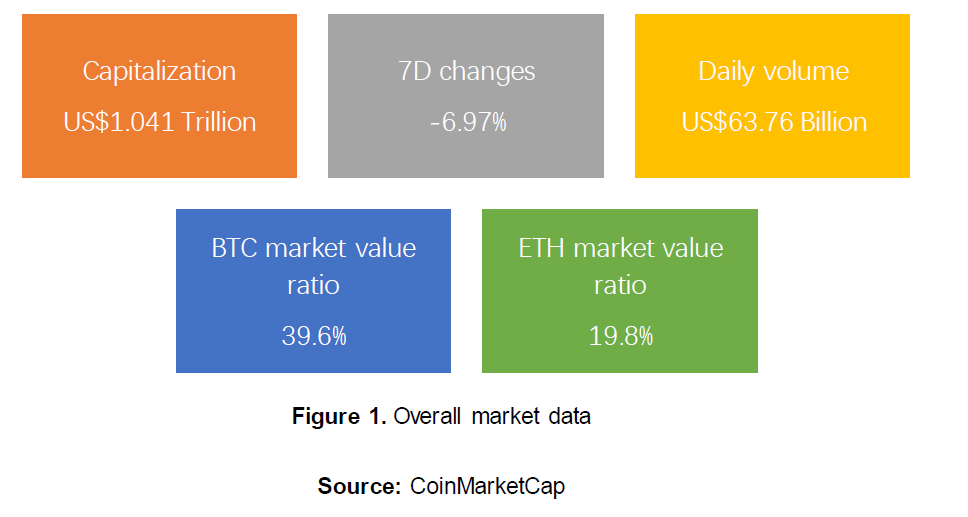

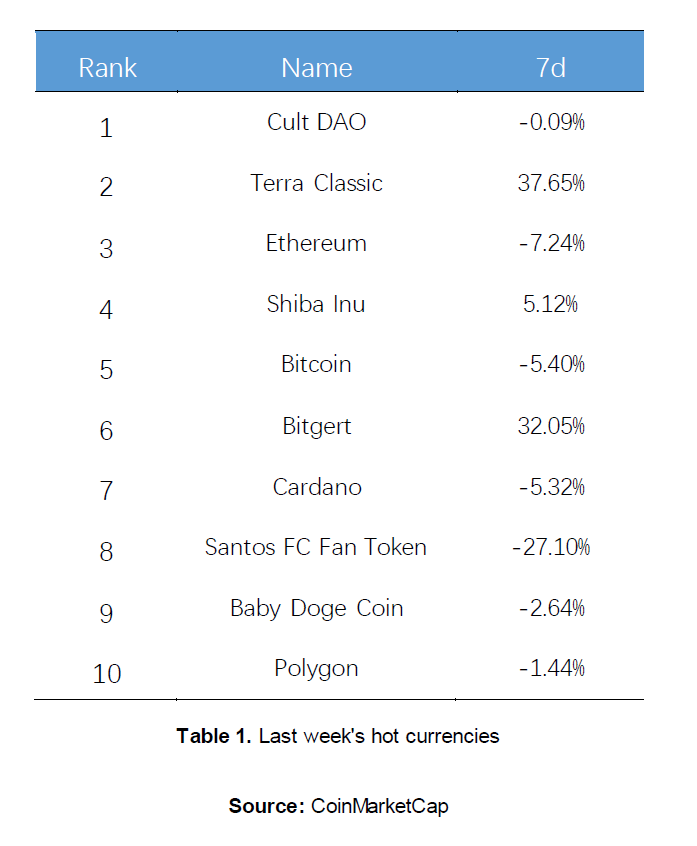

I. Overall market trend

The global cryptocurrency market this week saw a steady increase, with its value at US$1.041 trillion, a 7% decrease from the same time last week. Bitcoin is currently at US$21,562, and compared to its price a week ago, has decreased 5.41%. Meanwhile, Ethereum, the second largest cryptocurrency, currently trading at US$1,686, saw a 7-day price change of -7.28%. Bitgert has continued its uptrend — a 103.06% rise last week and 32% this week. Chiliz is the among the top 11 and its fan token, issued by Santos FC, has ranked in the top 10, albeit with a considerable decrease.

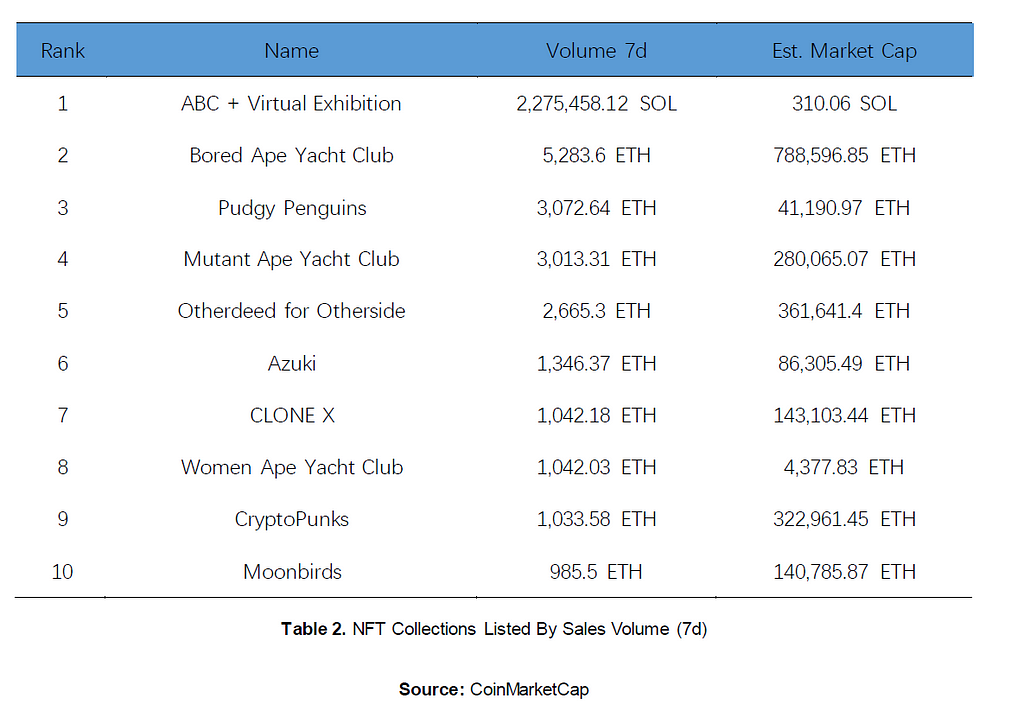

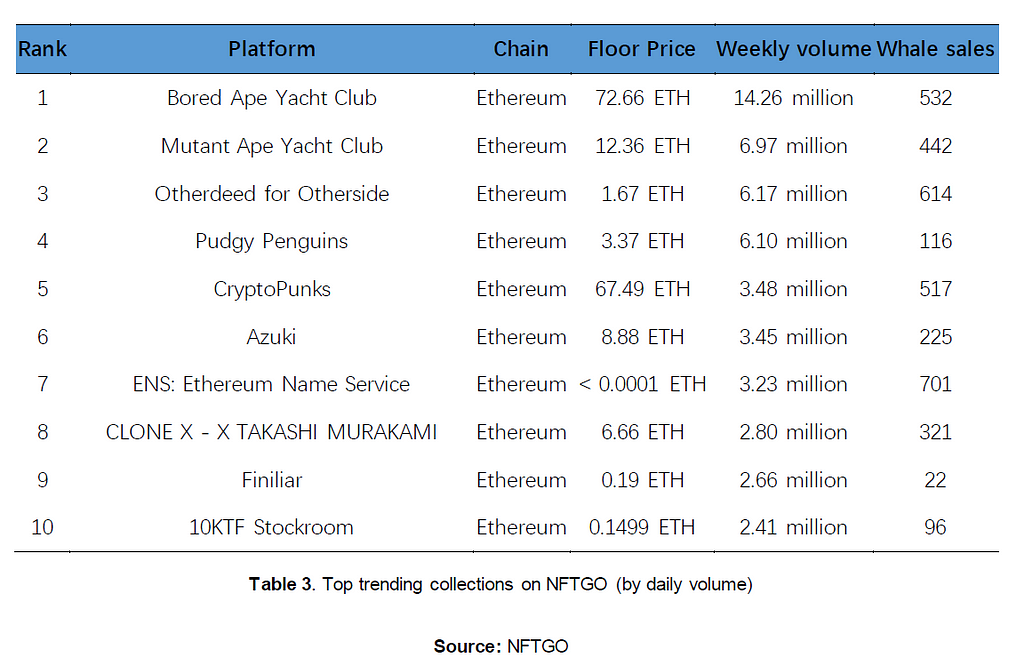

II.NFT

The NFT market last week fell by 73.84%, and the market cap has decreased to US$2,186,948,164.51. However, the 7-day sales volume and total sales both saw a major rise: 7-day sales volume increased by 139.16% to US$134,274,129.76, and total sales increased by 36.46%. We have seen some new names make their way into the ranking of top 10 NFT brands, such as ABC + Virtual Exhibition. Volume and the average price last week remained stable (below 0.1% change) for the majority of the top 10 brands.

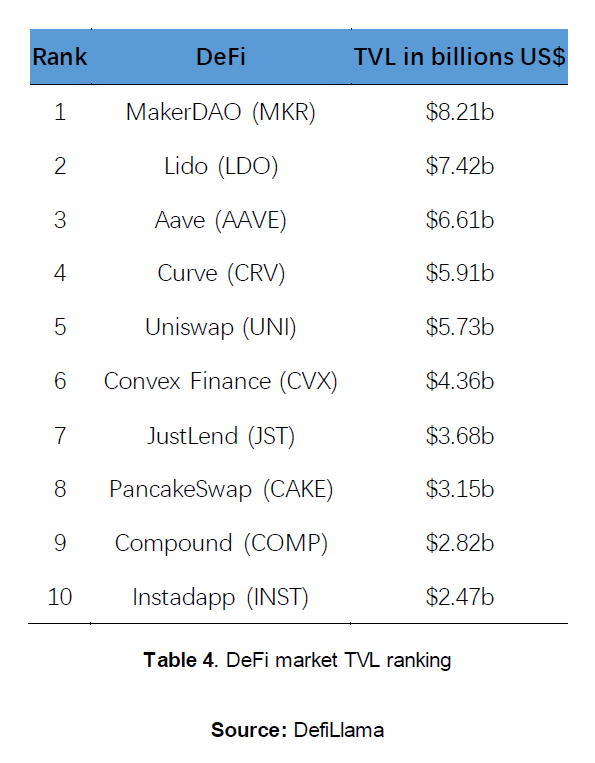

III.DeFi

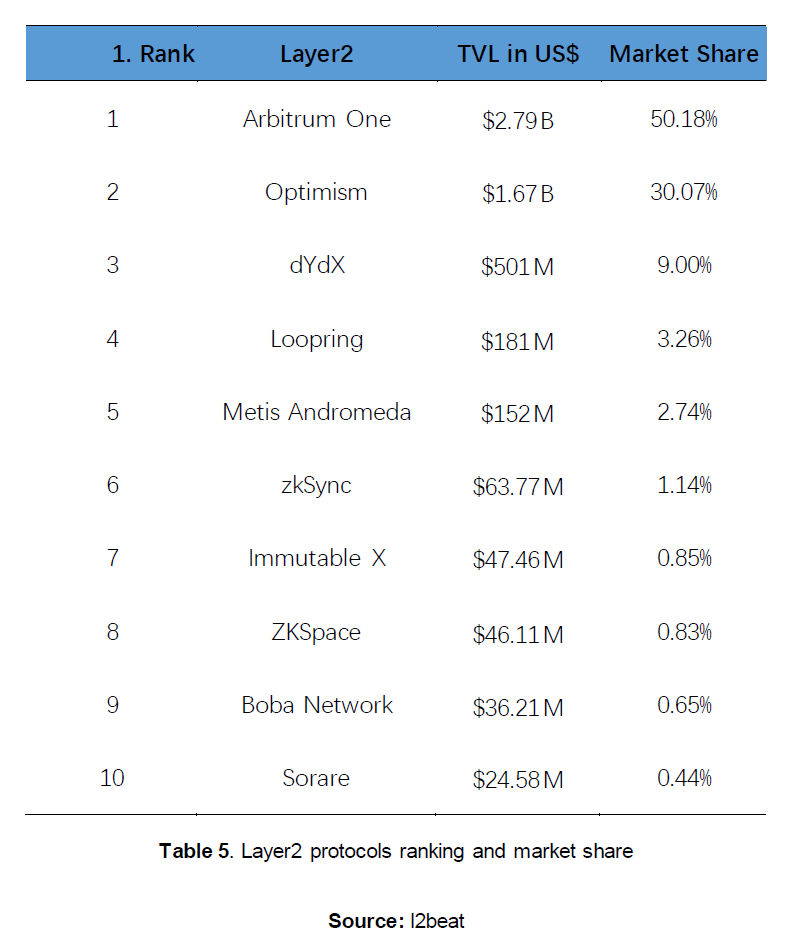

IV.Layer 2

2. Market news

I. Industry news

The Ethereum Merge Has an Official Kick-Off Date

The Ethereum Foundation disclosed Wednesday the official parameters for the long-awaited Merge blockchain upgrade to a proof-of-stake consensus mechanism. The Bellatrix upgrade will activate on the Beacon Chain on September. 6. This upgrade is responsible for setting the rest of the Merge process in motion. The activation is scheduled for epoch 144896 on the Beacon Chain, which should occur at around 11:34:47 UTC. After this, the Terminal Total Difficulty (TTD) value triggering the Merge will be 58,750,000,000,000,000,000,000. This TTD is expected to be reached somewhere between September 10 and September 20. Ethereum developers have hinted in past calls they are aiming for September 15 -16.

Reddit Starts Airdrop of Polygon-Based “Collectible Avatars”

Social media network Reddit has begun airdropping its Polygon-based “Collectible Avatars” as the first step towards a wider push for including blockchain technology. In the past week, some Reddit users were asked to select avatars form the four collections, namely “The Singularity”, “Aww Friends”, “Drip Squad” and “Meme Team”. The collectibles are listed on the NFT marketplace OpenSea. At the time of writing, the collectibles from The Singularity collection are selling for just over US$15, while Drip Squad collectibles are worth over US$42. The avatars can be stored and managed on Reddit’s own blockchain wallet Vault. Vault currently offers users blockchain-based community points, which can be spent on in-app features, such as badges. Reddit has not referred to these avatars as NFTs in its communication to users. The firm, however, had previously stated that blockchain technology remained a part of its long-term plans: “We see blockchain as one way to bring more empowerment and independence to communities on Reddit.”

Crypto Exchange Coinbase Introduces Liquid Staking Token Before Ethereum Merge

Coinbase (COIN) will introduce its own liquid staking token called Coinbase Wrapped Staked ETH (cbETH), ahead of the Ethereum blockchain’s Merge in September, the crypto exchange said in a tweet Wednesday. The token will be Ethereum-based and after the Merge, can be used to stake ether (ETH), the native token of the network, through Coinbase, according to the tweet. Liquid staking allows investors to generate extra yield on top of standard rewards for staking or locking coins in a network. Aside from this liquid token there have been other services that are expected to provide similar services. On July 19, Lido Finance said it will soon offer staked ether on Layer2 networks, which process transactions faster and more cheaply than the Ethereum mainnet. Coinbase is hoping to spur massive adoption of the token, which will have several uses, after the Merge. “Our hope is that cbETH will achieve robust adoption for trade, transfer, and use in DeFi [decentralized finance] applications,” Coinbase said in a white paper. “With cbETH, Coinbase aims to contribute to the broader crypto ecosystem through creating high-utility wrapped tokens and open sourcing smart contracts,” the white paper added.

II. Investment and Financing

Crypto ATM Operator Bitcoin Depot to List on Nasdaq in US$885 million SPAC Deal

Bitcoin Depot, the world’s largest operator of crypto ATMs, plans to go public with a listing on Nasdaq by merging with special purpose acquisition company (SPAC) GSR II Meteora at an estimated value of US$885 million, according to a statement shared with CoinDesk. Atlanta-based Bitcoin Depot says it has a network of over 7,000 locations across the U.S. and Canada, giving it a global market share of 19.1% according to data from Coin ATM Radar. There are more than 38,000 crypto ATMs installed in almost 80 countries, the data show. Mergers with SPACs have been a popular way of going public in recent years accounting for more than half of all initial public offerings in 2020–2021, the U.S. Securities and Exchange Commission (SEC) reported in March. Not all proceed to fruition, however, with some, including the planned US$1.25 billion listing of Bitcoin miner PrimeBlock, being canceled as the crypto market slumped.

Crypto Developer Platform Thirdweb Gets Katie Haun’s Backing at US$160 million Valuation

Thirdweb, a platform for Web3 app developers, raised US$24 million in a Series A round at a US$160 million valuation. The funding was led by Haun Ventures, the investment firm launched earlier this year by former Andreessen Horowitz (a16z) partner Katie Haun. Thirdweb offers pre-built, audited smart contracts that serve as a quick-start guide for developers who want to create and safely deploy applications to blockchains then manage the related analytics. Potential uses include blockchain games and NFT drops. Thirdweb tools have been used by global brands like buy now, pay later platform Afterpay and New York Fashion Week, and the startup has a partnership with Coinbase’s NFT marketplace. In the past nine months, more than 55,000 developers have used Thirdweb tools to build applications, according to the company. “From our standpoint, we haven’t really seen much of an effect on our customers or the developers building these projects,” Thirdweb co-founder and CEO Furqan Rydhan said in an interview with CoinDesk, referring to the rough waters for crypto of late. “It’s really exciting, whether it’s a bear market in terms of price or not, that we’ve continued to see strong growth and have been able to showcase that as part of raising this round.”

III. Supervision

Crypto Exchange Coinbase Faces Class Action Lawsuit Over Alleged Lapses in Security

Coinbase (COIN) failed to properly secure customers’ accounts, leaving them vulnerable to theft and unauthorized transfers, a putative class action lawsuit filed against the crypto exchange last week alleges. The complaint, filed in the U.S. District Court for the Northern District of Georgia, also accuses the company of causing financial harm to users by locking them out of their accounts permanently or for long periods of time, as well as violating federal law by listing securities on its trading platform. Coinbase, which last year became the first cryptocurrency exchange to go public in the U.S., is facing a string of lawsuits from unhappy investors. In addition to another aspiring class action lawsuit filed in New Jersey alleging the company allowed U.S. persons to trade unregistered securities, a Coinbase shareholder earlier this month accused the company of misleading investors about last year’s public listing. The platform is also trying to settle two separate lawsuits filed by investors through arbitration. The Georgia lawsuit represents a class of more than 100 people, including lead plaintiff and Georgia resident George Kattula, though Kattula’s attorneys say there may be more victims.

3. Trending project analysis — BendDAO

I. What is BendDAO?

Bend DAO is a Decentralized Autonomous Organization (DAO) that addresses collateralized lending and borrowing of NFTs. Its purpose is to collateralize NFTs to borrow ETH for working capital or to deposit ETH and receive deposit proceeds. Bend is a decentralized, non-custodial NFT-backed lending protocol in which users can participate as depositors or borrowers. Depositors provide ETH liquidity to the lending pool to earn passive income, while borrowers can borrow ETH instantly through the lending pool using NFT as collateral. It supports instant NFT-backed loans, Collateral Listing, and NFT Down Payment.

NFT Liquidity

This is how bluechip NFT holders are able to get the best liquidity on BendDAO.

Instant NFT-backed Loan

BendDAO is the first decentralized peer-to-pool based NFT liquidity protocol. NFT holders are able to borrow ETH through the lending pool using NFTs as collateral instantly, while depositors provide ETH liquidity to earn interest. The leveraged NFT trading is built on instant NFT-backed loans.

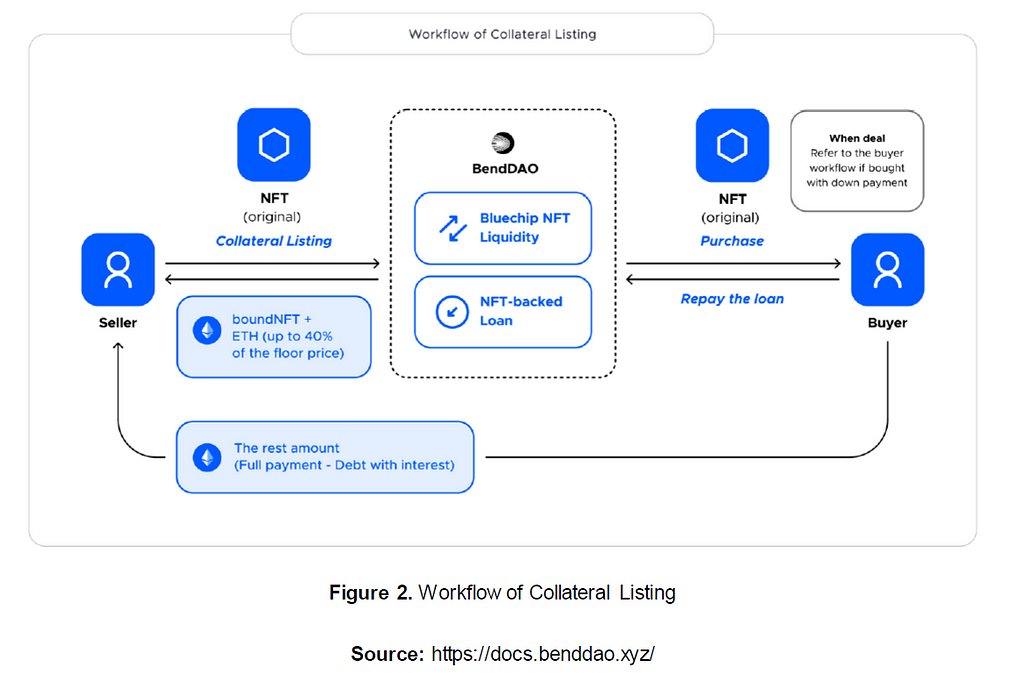

Collateral Listing

NFT holders/sellers can choose to instantly get up to 40% of the floor value of the listing before it even sells. The instant liquidity is provided by the instant NFT-backed loan. The buyer will pay off the loan including interest after the deal. Existing borrowers can list the collateral directly on the BendDAO. The balance after deducting debt with interest will be transferred to the borrower (seller) after the deal.

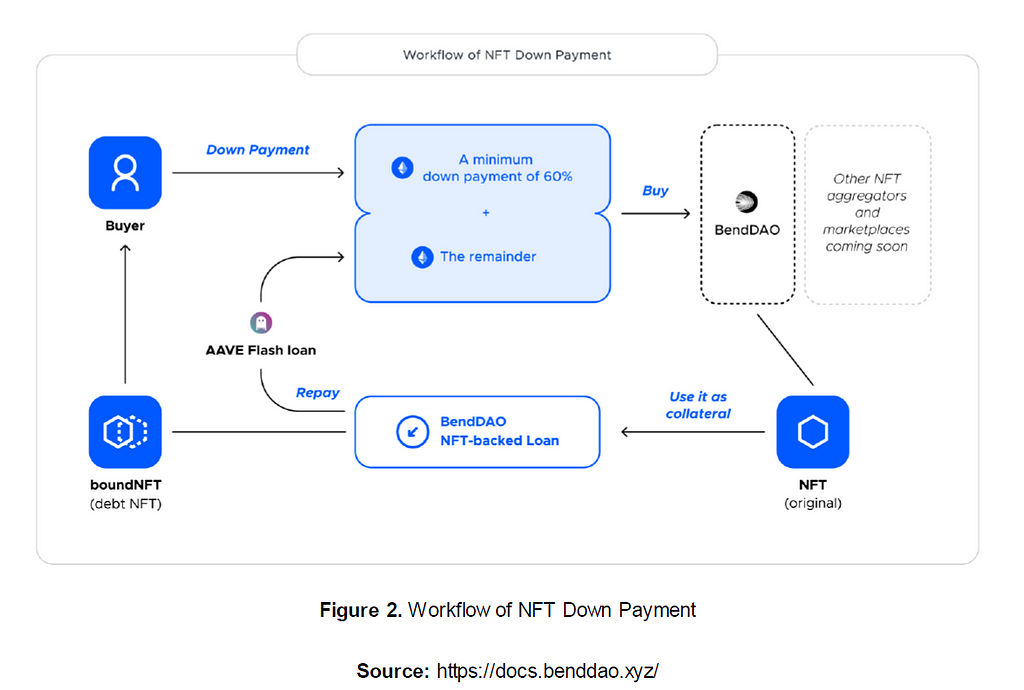

Buy with Down Payment

The buyer may pay a minimum down payment of 60%, depending on the actual price, to buy a bluechip NFT from major NFT marketplaces while initiating a flash loan from AAVE to cover the remainder. The borrowed amount of the flash loan will be repaid through the instant NFT-backed loan on BendDAO. The buyers will automatically become borrowers with the down payment. And borrowers can list their mortgaged NFT for sale as well.

Bend DAO functions like a bank that uses blue chip NFT as a stable asset to give users financial instruments that can be loaned to purchase or used as collateral to borrow. It also opens a pool of interest-bearing deposits to draw in funds to operate the platform.

II. Liquidation and Redeem

●Before the BIP#9

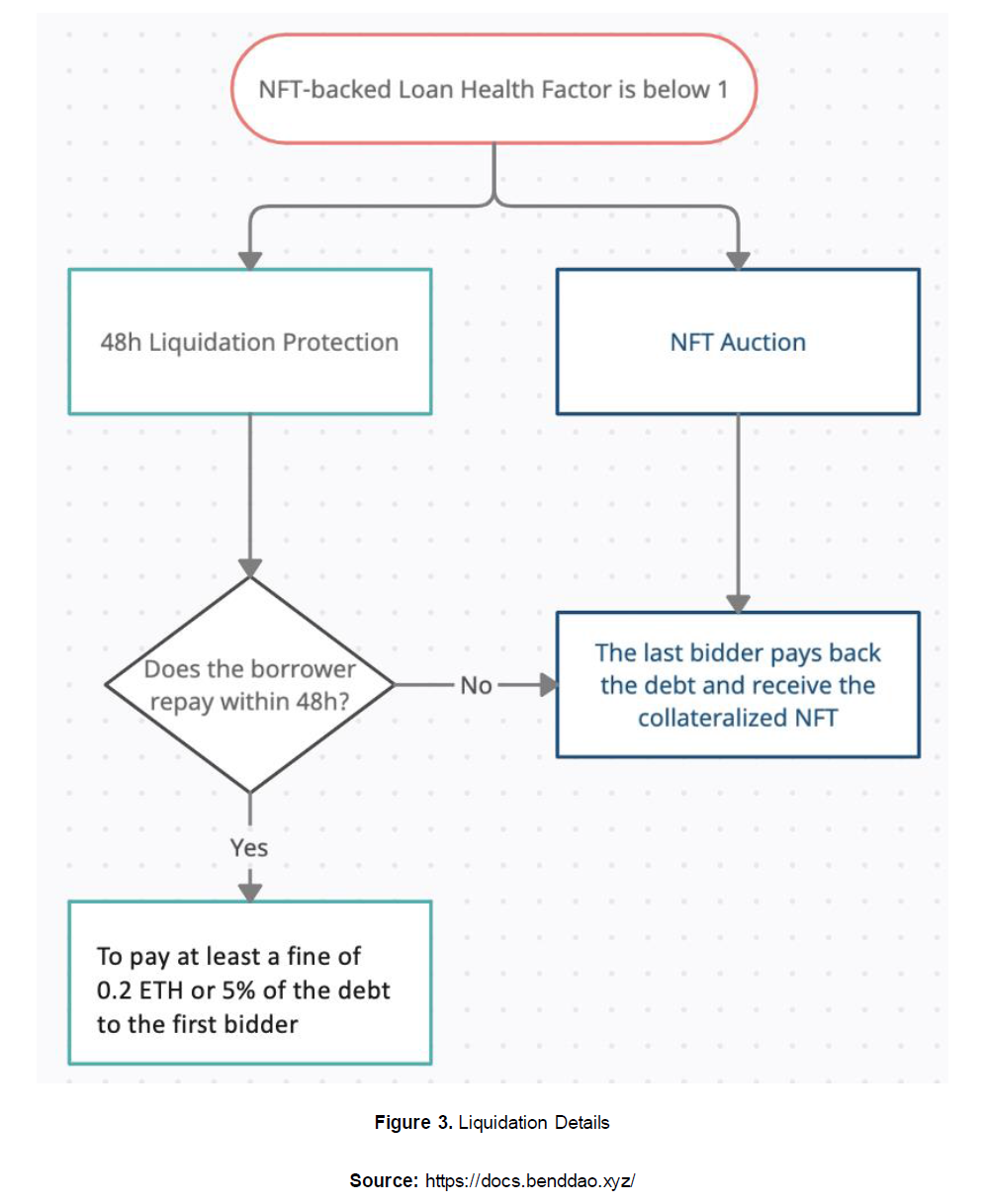

Liquidation is generally caused by a severe drop in the price of NFT. On BendDAO, this limit is represented by a “Health Factor” (HF), and liquidation is triggered when the Health Factor is less than 1.

Health Factor = (44 * 90%) / (40 + interests) <1

Health Factor = (Floor Price * Liquidation Threshold) / Debt with Interests.

What is the health factor?

The health factor is the numeric representation of the safety of your deposited NFT against the borrowed ETH and its underlying value. The higher the value is, the safer the state of your funds are against a liquidation scenario.

If the health factor reaches 1, the liquidation of your deposits can be triggered. A Health Factor below 1 may result in liquidity. For a HF = 2, the collateral value vs borrow can reduce by 1 out of 2 — that is, 50%.

The health factor depends on the liquidation threshold of your collateral against the value of your borrowed funds.

Risk level according to health factor:

- 0.0 < HF < 1.0: Dangerous, borrower maybe lose collateral if the debt is not repaid timely.

- 1.0 <= HF <= 1.5: Risky, borrower should repay partly the debt timely.

- 1.5 < HF < 2.0: Careful, borrower should pay attention and monitor the debt timely.

- 2.0 <= HF: Safe, borrower no need to worry and keep the debt last.

Liquidation will be triggered if the NFT loan’s health factor is below 1.

● Reason for liquidation

The NFT market has recently entered bear territory, with daily trading volume hovering at low levels for a long time and daily trading users flying down. The slump in the NFT market is the main reason for this current crisis involving BendDAO. The main price support for NFT is consensus, and when there is a lack of confidence in the NFT market, mass withdrawals could occur, similar to the reasons behind the instant collapse of Luna in May. However, the NFT market’s liquidity cannot be compared to that of tokens. From the perspective of users pledging blue chip NFTs, a lack of confidence in the NFT market might prove a good way to obtain timely NFT liquidity through a lending agreement, which is also equivalent to obtaining a partial price protection hedge.

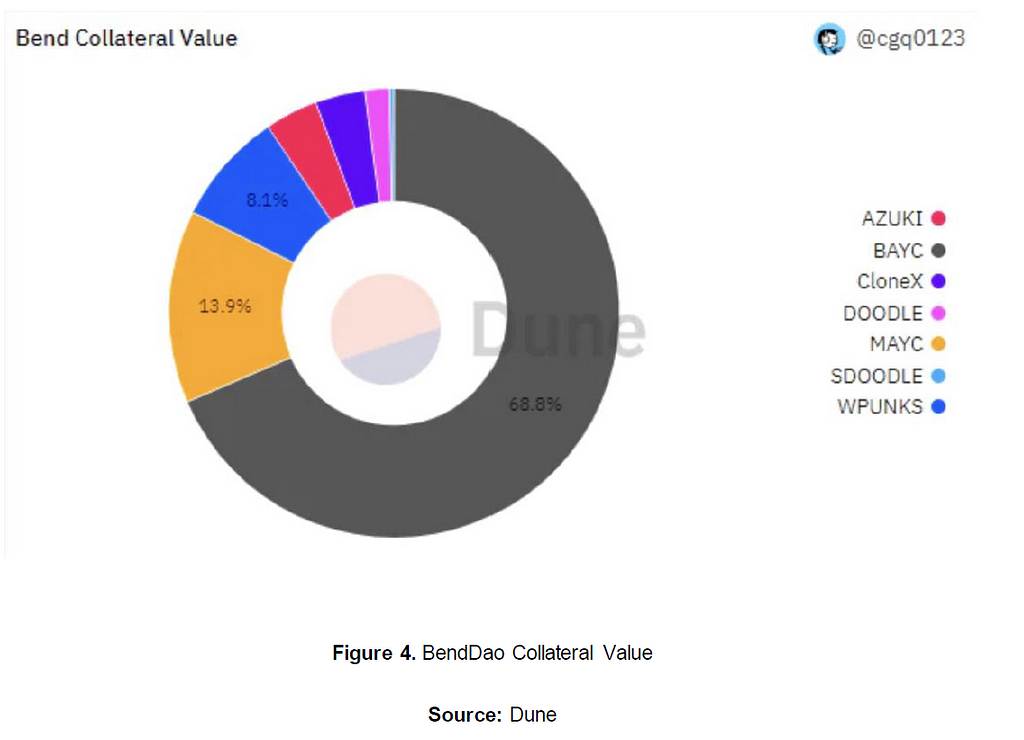

In terms of BendDAO’s business, Bend only provides lending services if certain blue-chip NFTs are used as collateral, namely BAYC, CryptoPunks, MAYC, Doodles, Space Doodles, CloneX and Azuki. Among these blue chip NFTs, Big Monkey BAYC and Little Monkey MAYC form the majority, with over 83% of the collateral value in Bend.

At the time of the crisis, there were 230 BAYCs and 264 MAYCs pledged in Bend, and these BAYCs and MAYCs were most responsible for the creation and resolution of the crisis in BendDAO. Currently there are 22 BAYCs and 34 MAYCs in BendDAO with health factors below 1.1. Even if the price of NFT does not fall, the health factor will continue to fall over time due to the current high borrowing rates.

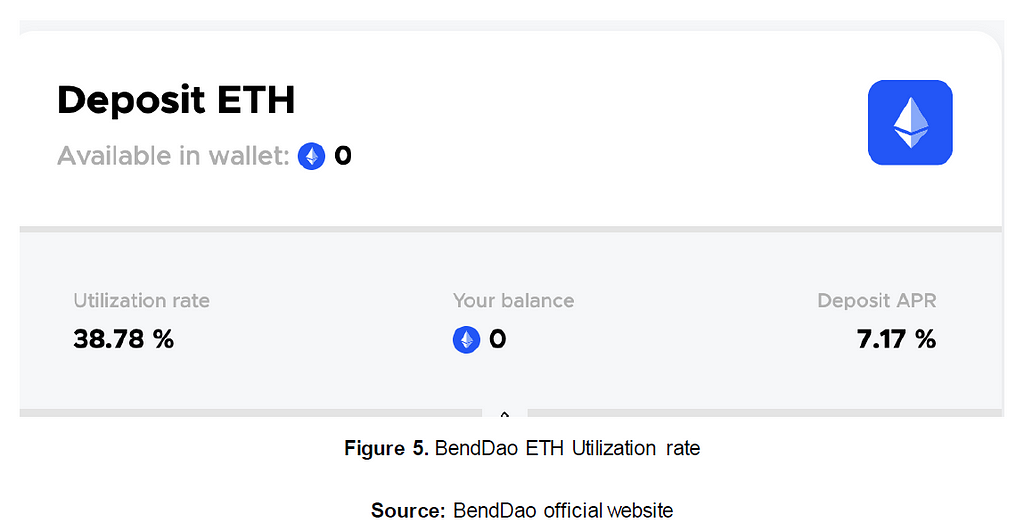

On the other hand, due to the limitations of BendDAO’s deposit and withdrawal mechanism, a large number of users are waiting to withdraw their deposits in BendDAO, and there are no more funds available in BendDAO, resulting in a substantial run on BendDAO. Despite having a high APR, users are not depositing in Bend. BendDAO’s rate regulation mechanism seems to have failed.

● How bendDAO solved the crisis

The BendDAO community has released a new proposal, BIP#9, which aims to address the liquidity crisis by modifying some of the parameters. These include adjusting the liquidation threshold to 70%, adjusting the auction cycle to 4 hours, adjusting the prime interest rate to 20%, and allowing the BendDAO community to vote on how to handle bad debts when they occur. In addition, the number of ETH floating bad debts will be added to the user interface and the total amount of interest will be displayed on the home page. Future protocol level improvements include support for collateral quotes in BendDAO, support for collateral pending orders as much as possible with access to transactions, and attempts to support down payments for auctions.

This proposal would lower the clearing threshold for NFTs and speed up the clearing of NFTs, thereby attracting more arbitrageurs to auction arbitrage. For those who are bullish on blue chip NFT, there will be plenty of opportunities to pick up the slack on BendDAO. On the other hand, however, if the proposal passes, there could be a significant sell-off of NFTs in the market. According to the health factor formula, if the liquidation threshold is set at 70%, collateral with a current health factor below 1.28 will be at risk of liquidation with the NFT floor price unchanged, and even if the floor price increases, the increase will hardly hedge out the impact of the liquidation threshold adjustment on the health factor. a large number of liquidated NFTs could pile up in BendDAO, and the impact on BendDAO may have a large pile of liquidated NFTs and a large impact on market confidence. The unique trading properties of NFTs can cause dramatic floor price swings due to small amounts of selling pressure.

●Current Status

The BendDAO website has been updated to show potential profits in the Available to Auction section to attract arbitrageurs to.

BendDAO has solved this liquidity crisis by passing the proposal quickly and effectively. BendDAO will anticipate risk and respond accordingly further down the line.

About Huobi Research Institute

Huobi Blockchain Application Research Institute (referred to as “Huobi Research Institute”) was established in April 2016. Since March 2018, it has been committed to comprehensively expanding the research and exploration of various fields of blockchain. As the research object, the research goal is to accelerate the research and development of blockchain technology, promote the application of blockchain industry, and promote the ecological optimization of the blockchain industry. The main research content includes industry trends, technology paths, application innovations in the blockchain field, Model exploration, etc. Based on the principles of public welfare, rigor and innovation, Huobi Research Institute will carry out extensive and in-depth cooperation with governments, enterprises, universities and other institutions through various forms to build a research platform covering the complete industrial chain of the blockchain. Industry professionals provide a solid theoretical basis and trend judgments to promote the healthy and sustainable development of the entire blockchain industry.

Official website:

Consulting email:

research@huobi.com

Twitter: @Huobi_Research

https://twitter.com/Huobi_Research

Medium: Huobi Research

https://medium.com/huobi-research

Disclaimer

1. The author of this report and his organization do not have any relationship that affects the objectivity, independence, and fairness of the report with other third parties involved in this report.

2. The information and data cited in this report are from compliance channels. The sources of the information and data are considered reliable by the author, and necessary verifications have been made for their authenticity, accuracy and completeness, but the author makes no guarantee for their authenticity, accuracy or completeness.

3. The content of the report is for reference only, and the facts and opinions in the report do not constitute business, investment and other related recommendations. The author does not assume any responsibility for the losses caused by the use of the contents of this report, unless clearly stipulated by laws and regulations. Readers should not only make business and investment decisions based on this report, nor should they lose their ability to make independent judgments based on this report.

4. The information, opinions and inferences contained in this report only reflect the judgments of the researchers on the date of finalizing this report. In the future, based on industry changes and data and information updates, there is the possibility of updates of opinions and judgments.

5. The copyright of this report is only owned by Huobi Blockchain Research Institute. If you need to quote the content of this report, please indicate the source. If you need a large amount of reference, please inform in advance (see “About Huobi Blockchain Research Institute” for contact information) and use it within the allowed scope. Under no circumstances shall this report be quoted, deleted or modified contrary to the original intent.

BendDAO — discussing the liquidity risk was originally published in Huobi Research on Medium, where people are continuing the conversation by highlighting and responding to this story.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.