Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

Investing in crypto can be tricky. The complexities of deciding what to invest in, when to double down, and when to hold cash are often amplified by crypto’s volatility.

To avoid banking on the “perfect” time to buy, beginners, seasoned investors, and even experts often use dollar cost averaging, a popular investment strategy.

In this article, we’ll explain:

- What dollar cost averaging is

- What the benefits and drawbacks are to this approach

- Steps on how you can adopt a dollar cost averaging strategy today

What is dollar cost averaging?

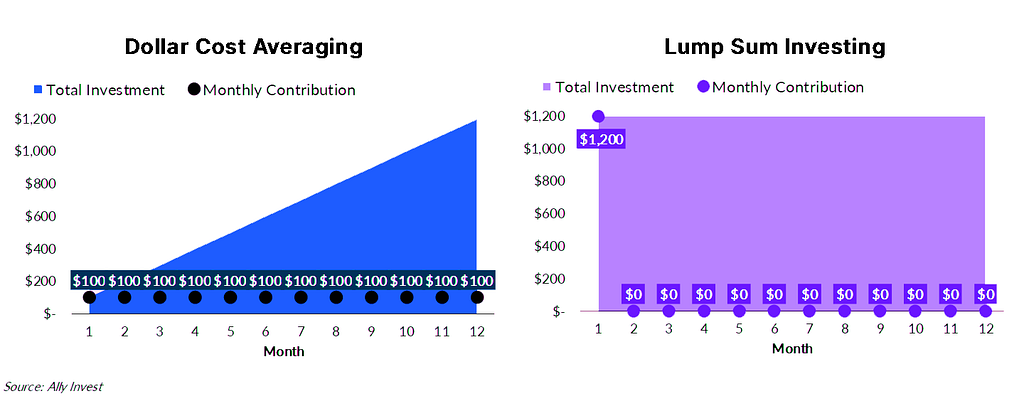

Dollar cost averaging is an investment strategy in which an investor evenly splits their investment into periodic purchases regardless of the asset’s price.

Investing in smaller amounts over time means that you’ll buy both when the price is high and when the price is low.

In turn, this smooths out your average purchase price.

Dollar cost averaging is popular in crypto given how quickly prices go up and down in a short period of time due to volatility. The basic idea is that you spread your investment into equal amounts over regular intervals instead of trying to decide on the “perfect” time to buy.

How does dollar cost averaging work?

It’s important to start off by remembering that when investing in bitcoin, you don’t need to buy a “full” bitcoin, despite what many new investors often think. Instead, investors will often purchase a small amount or fraction of “one” bitcoin.

So, say you have $500 to invest in Bitcoin. Instead of buying $500 worth today which would be worth 0.023035 BTC, if you were to adopt a dollar cost averaging investment strategy you would buy $50 worth of BTC every week for ten weeks to diversify your entry point and spend the same $500.

When the price of bitcoin is high, you’ll only be able to afford a certain amount of bitcoin with your fixed amount of investment. When the price drops, however, you’ll be able to purchase more.

As a result, when the market stabilizes, this evens out your average purchase price and you’ll benefit from having more bitcoin when you buy them at a low price.

Here at Blockchain.com our records indicate that over the last 5 years, buying Bitcoin every week has performed better than timing the market 82% of the time.

What are the main benefits of using dollar cost averaging?

While there are many benefits to this approach, here are some of the key ways dollar cost averaging may help your long-term investment plans.

- Saves time and effort. When trying to “time the market”, constantly refreshing portfolios and reviewing price fluctuations can be time consuming, not to mention nearly impossible l to get right. Dollar cost averaging gives you this time back to focus on other areas of your life, particularly if you set up an automated recurring buy.

- Less emotional. Every investor is prone to acting with the heart and not the head. With crypto’s volatility, the risk of allowing emotion to take over can lead to us neglecting trading plans and potentially investing more than we can afford. Dollar cost averaging advocates wait several years for their assets to appreciate and so can better weather short-term volatility in exchange for long-term gains.

- Potential long term capital gains. In some places, crypto profits from short-term gains get taxed less favorably than long-term gains, playing a significant role in total returns. A long-term approach shields your funds from taxes, and if you wait until you retire before selling your assets you’ll pay even less tax.

To find out more about how crypto taxes work, listen to our recent podcast episode on ‘Your Guide to Crypto Taxes in 2022’

The Blockchain.com Podcast: Your Guide to Crypto Taxes in 2022 on Apple Podcasts

Using dollar cost averaging in a bear market

In a recent article by Wealth Professional, Investment Advisor Graham Priest told Wealth Professional,

“I’m advising clients that dollar-cost averaging over the upcoming time period is one strategy to mitigate risk. Some clients have placed greater amounts in the past few weeks to take advantage of the drop in many stocks. But overall, dollar-cost averaging is prudent.”

While dollar cost averaging can be used in any market, such as in a bull market where prices are rising, and in a bear market where prices are falling, utilizing this strategy during a down market or recession can be particularly powerful.

Does dollar cost averaging really work?

While you should avoid making investment decisions based on what others are doing, many legendary investors embrace a dollar cost averaging approach instead of timing the market.

Warren Buffett believes you should only buy stocks if you have no problem holding onto them for 10 years and buys companies because of their fundamentals and long-term possibilities.

This approach can be applied across a range of assets, including crypto.

Instead of swinging for the fences, strive to build your portfolio incrementally.

If you’re still not convinced, there are plenty of online dollar cost averaging calculators that let you test this strategy out for yourself.

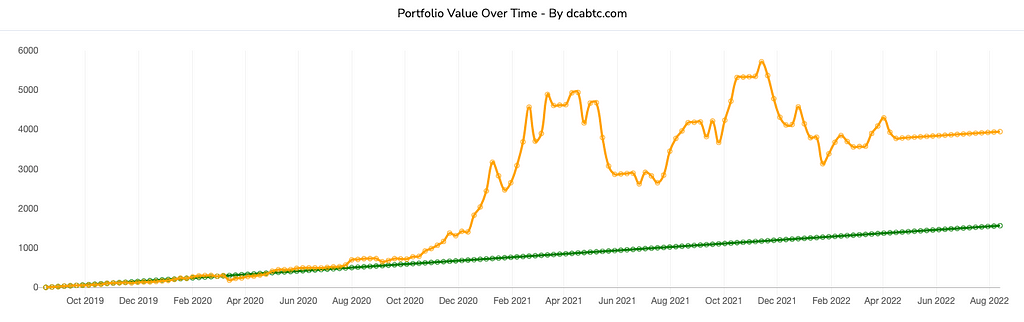

The data below from dcaBTC shows the total value of investment when $10 Bitcoin is purchased weekly for three years, starting in 2019.

The price of bitcoin (orange line) vs the total accumulated amount invested (green line)

What are the disadvantages of using dollar cost averaging?

Adopting a dollar cost averaging approach to investment does not guarantee protection against losses or gains in profit. There are a few disadvantages to consider ahead of determining if this is the right investment strategy for you.

- Time. It can take a long time to build up a position if you’re investing small amounts regularly.

- “Mooning.” If the asset you’re investing in never goes down, you may have been better off just buying all at once.

Remember: Dollar cost averaging does not guarantee that you will make a profit, and as with all crypto investments, your capital is at risk.

How to get started with dollar cost averaging

- Choose an amount to regularly invest. It could be a flat amount, a percentage of your paycheck, or something else. It’s important to choose an amount you can sustain and remember, only invest what you can afford to lose and what you do not need access to in the short term.

- Choose assets. You can choose one or more assets to build a position in.

- Choose a purchase interval. It can be every week, every month, or even every day.

BONUS: Automate your buys. Most apps, including the Blockchain.com Wallet, let you make recurring buys at an interval of your choosing.

Why not put this strategy to work? Setup a recurring buy today.

Dollar Cost Averaging, Explained was originally published in @blockchain on Medium, where people are continuing the conversation by highlighting and responding to this story.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.