Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

Analysis of Bitcoin’s Correlations from a Macro Perspective

Bitcoin’s narratives could be evolving based on changing correlations

Traditional finance markets experienced a price rally throughout the last month, following one of the worst first half years in history. Despite macroeconomic uncertainties the Federal Reserve’s last interest hike took the form of market relief. In light of these trends, the behavior of crypto relative to traditional markets has been evolving. This article evaluates Bitcoin’s last month price performance in relation to the decreased correlation to the Nasdaq 100 and the increased correlation to Gold and Silver.

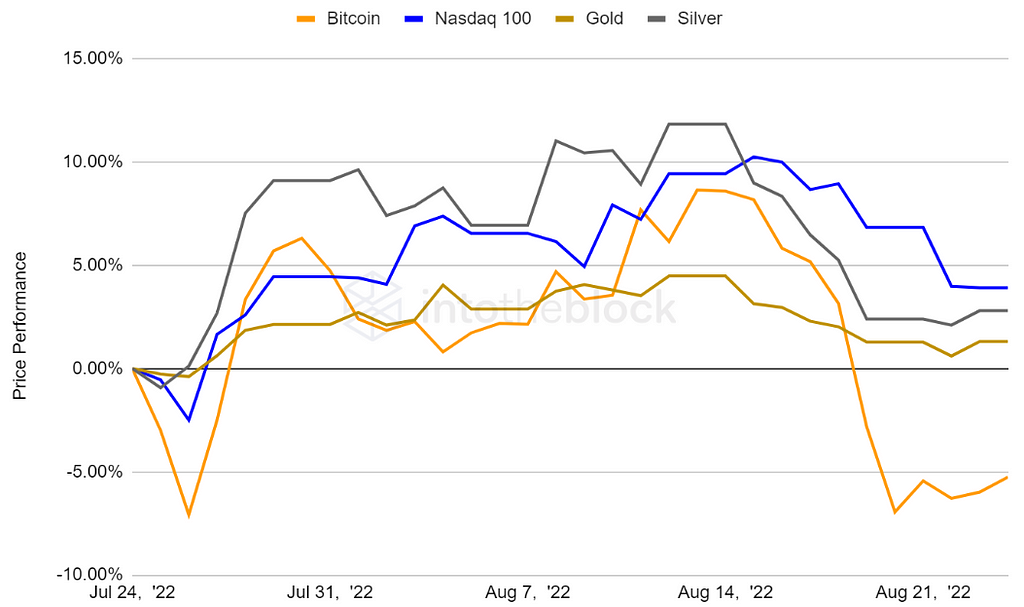

Price performance between different assets lets us gauge the percentage difference accumulated. This is useful to compare the returns generated by crypto relative to traditional assets.

Source: IntoTheBlock’s Capital Markets Insights

The indicator above portrays Bitcoin, Nasdaq 100, Gold and Silver price performance throughout the last month. Recently the US Fed’s 75 basis point interest hike following their July 26–27 meeting provoked positive reactions from the market as they stated that they were approximating “neutral rates”. Here it is visible how the Nasdaq 100 has managed to keep some returns after increasing in price following the FED’s meeting while Bitcoin, Gold and Silver have decreased in price. The Nasdaq 100 has dropped 6% from its last month high on August 15th maintaining returns of 5% throughout the last month, whereas Bitcoin decreased around 14% from its respective last month high concluding in a 2% decrease in price. This difference between price movements has caused correlation between the assets to diminish.

During the past year Bitcoin’s behavior narrative has been that of a high beta stock, these are defined as positively correlated assets with an amplified magnitude. In this sense Bitcoin has portrayed a high correlation to the Nasdaq 100 during the year to date scope. Moreover, during the months of April and May the assets maintained a correlation in the 0.9 level.

Furthermore, the indicator below shows Bitcoin’s 30-day dropping correlation with the Nasdaq 100.

Source: IntoTheBlock’s Capital Markets Insights

The strong positive correlation between the two assets has decreased to a 0.5 correlation. This behavior does not necessarily rule out Bitcoin’s possible future positive strong correlation to the Nasdaq 100, but is important to continuously track how macro markets affect crypto, and how their relationship evolves.

Bitcoin’s most recent behavior has revived the narratives of “digital gold”. This theory claims Bitcoin to be the ultimate store of value; a digital version of gold. This narrative would essentially make Bitcoin an inflation hedge. Proponents of this theory claimed that Bitcoin’s mining difficulty, scarce supply and constant demand could give the asset the characteristics of a better version of gold. Fundamentally it would make Bitcoin more efficient than gold thanks to its provable scarcity and greater accessibility.

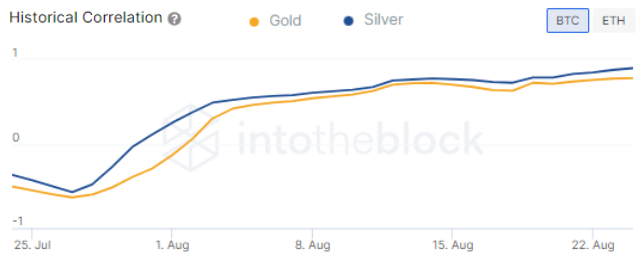

Below we can observe how Bitcoin’s correlation with gold and silver has been increasing throughout the last month and it’s currently at a yearly high.

Source: IntoTheBlock’s Capital Markets Insights

Bitcoin’s current correlation to Gold and Silver stands at 0.89 and 0.74 respectively. Since the beginning of the year this correlation has been negative to non-existent. More recently this correlation has regained a positive strong outlook reaching yearly high levels.

Cryptocurrencies is still a young and growing industry. Correlation and characteristics narratives have changed several times throughout distinct macroeconomics circumstances. Self asset characteristics generally take time to develop and adhere to the asset’s price performance.

Analysis of Bitcoin’s Correlations from a

Macroeconomics Perspective was originally published in IntoTheBlock on Medium, where people are continuing the conversation by highlighting and responding to this story.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.