Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

WTH is going on with crypto exchanges?

The current state of the crypto exchange market is unfortunate at best. Many examples exist like Japan’s Coincheck losing over $500 million dollars of their customer’s money via hack or Coinbase’s system glitch accidentally liquidating customer’s bank accounts.

For those of us who have been in the crypto space for a while, these headlines are unsurprising. The long term solution may reside in the interoperability of emerging protocols. But first, let me explain how we will go from 0 to 100.

1.0: Centralized Exchanges (CEXs)

It is believed that almost 99% of all crypto trading volume flows through centralized exchanges like Coinbase, Binance, Kraken, Gemini, etc. This centralization of assets (CEXs take custody of assets being traded) creates a prime target for hackers. Additionally, the relatively young and inexperienced nature of these exchanges has resulted in several service issues such as frozen withdrawals, hacks, unresponsiveness to customers, and limited trade transparency.

Why are people still using 1.0s?

- Fiat On and Off Ramps: 1.0s are typically regulated by local governments which allow traders to connect their bank accounts, i.e. trade in and out of fiat currency. The majority of trading volume is still on fiat pairs, e.g. BTC/USD or BTC/EUR.

- Acceptable User Experience: 1.0’s user experience is more friendly and with less technological hoops, which is more inline with current consumer expectations.

2.0: Decentralized Exchanges (DEXs)

The crypto ecosystem has duly noted the shortcomings involved with 1.0s and thus rushed to address them via decentralized solutions. At time of writing, there more than 53 DEX projects in existence. The competitive advantage that 2.0s offer compared to 1.0s is that decentralized protocols allow for greater security, privacy, and transparency as well as lower fees.

The main disadvantages are scalability, user experience, initial liquidity, and fiat integration. We suspect that the first three will be addressed sooner than later, but fiat integration may be tougher to achieve. This limitation presents a formidable barrier to long term adoption.

Why is fiat integration so important?

The demand for fiat integration will probably grow in the short term as more “fast followers” and “mainstream” consumers begin entering the crypto market. The aforementioned consumers are typically less technology savvy and more risk averse. Furthermore, the bulk of the world’s goods, services, and bills still must be paid in local fiat currencies. For example, you cannot pay your electric bill with XMR.

Fiat on/off ramps are so vital to the crypto ecosystem that the CEO of 0x, Will Warren, envisions centralized exchanges playing a key role within the market for the foreseeable future because of this functionality.

2.5: Hybrids (CEX + DEX)

An exciting entrant into the space is the hybrid exchanges like Legolas Exchange. These hybrids leverage the best features from 1.0 and 2.0 exchanges such as fiat integration, decentralized security, solid user experience, transparency, and minimized front-running. The evolution of 2.5s will be extremely interesting to watch.

3.0: DEXs with Fiat Integration

The holy grail for DEX adoption lies in fiat integration. However, this notion is contrary to the decentralized mantra of the blockchain ethos; especially when it involves commercial banks. Fortunately, the rise of various blockchain projects provide an opportunity to pick some a la carte features that may address this problem.

3.0 Framework

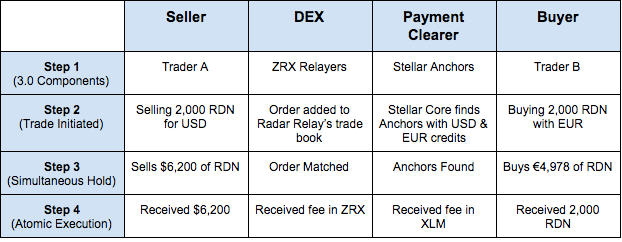

The 3.0 framework enables decentralized fiat integration via the interoperability of blockchains with trades sourced off-chain and executed atomically on-chain instantaneously via Ethereum smart contracts. Early on, the majority of Anchors might be financial institutions, but as peer to peer liquidity grows, that sticking point should be removed.

Conclusion

The short term future of DEXs may hinge critically on the ecosystems ability to creatively incorporate fiat on/off ramps while adhering to decentralization. This may be technically impossible, in which case I expect 2.5s to win. But, I think it is too early to count out 3.0s just yet.

Word of warning: I am not a blockchain engineer nor pretend to be. I would love to hear your thoughts, critiques, or projects working on the 3.0 framework.

— — —

Sources:

- State of Decentralized Exchanges, 2018

- Coinbase Bug Accidentally Drains Users' Bank Accounts - ExtremeTech

- Victims of cryptocurrency hack suing Coincheck for $650 million theft

Disclaimer: Neither the author of this article, nor Pugilist Ventures, provide investment, financial, or legal advice. The content provided is for informational purposes only and should not be construed as any kind of solicitation for investment in any investment opportunity.

The Crypto Market’s Exchange Problem was originally published in Hacker Noon on Medium, where people are continuing the conversation by highlighting and responding to this story.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.