Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

.bit — a blockchain-based, open source, and decentralized cross-chain account system

Authored by Derrick Chen, Kou Jer Shun, Lucio Lyu, Researchers at Huobi Research Institute

Abstract

This week, we focus on the following events: 1) Bitcoin Miner Riot Takes US$349M Goodwill Impairment Charge on Acquisitions; 2) Bill Ackman Among Investors as Venture Capital Crypto Firm Shima Capital Raises US$200M Fund; 3) UK Group to Test Stablecoin Payments, Provide Data to Bank of England.

Project Analysis: Starting from May, with some three-digit and brand name ENS sold at high prices, this project, which was launched in 2017, came into the limelight. At the same time, a large number of other DID projects have been launched to compete in the DID space. A good DID project is .bit, which was previously called DAS. This article explains the principle of .bit, its advantages, and compares it with ENS to evaluate the potential and value of this project.

1. Industry overview

I. Overall market trend

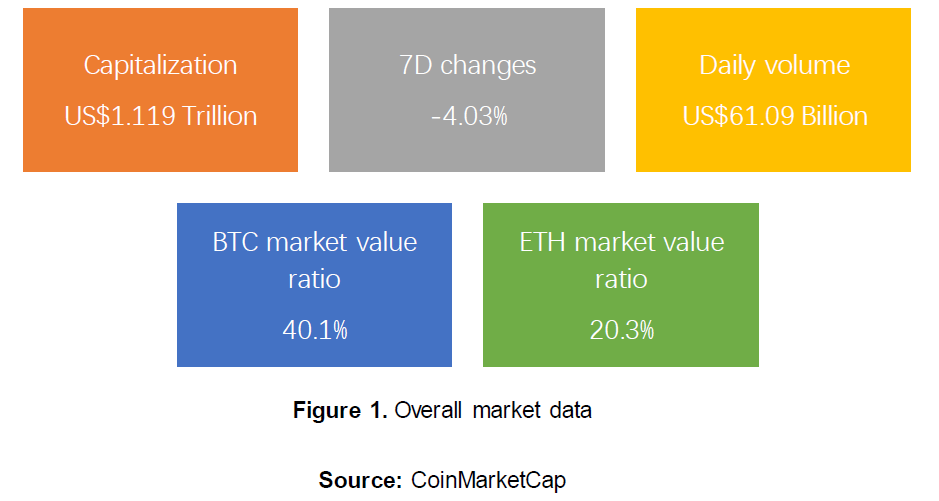

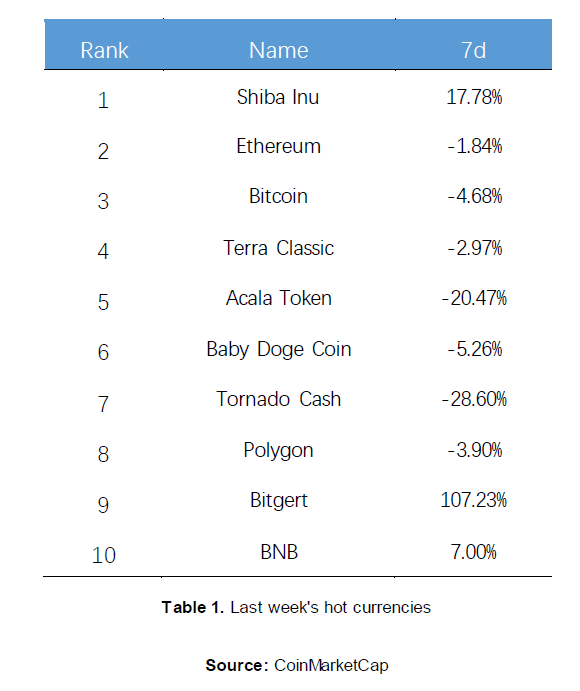

The global cryptocurrency market this week saw a 4.03% decrease to a US$1.119 trillion market cap. Bitcoin is currently at US$23,445, compared to its price a week ago (US$23,923), the change was not significant and should be seen as a normal fluctuation. Meanwhile, Ethereum, the second largest cryptocurrency, currently trading at US$1,883, has a 24-hour change and 7-day price change both below 2%. Tornado Cash, which is currently under the spotlight in the crypto market, shows a 3.19% of recovering over the 24-hour period, but a 28.60% decrease in the 7-day period and 48.37% in the 30-day period. Bitgert has become the new star in the market; with its claimed high TPS and near zero transaction fee — it led a 103.06% rise last week and 86.22% increase over the last month.

II.NFT

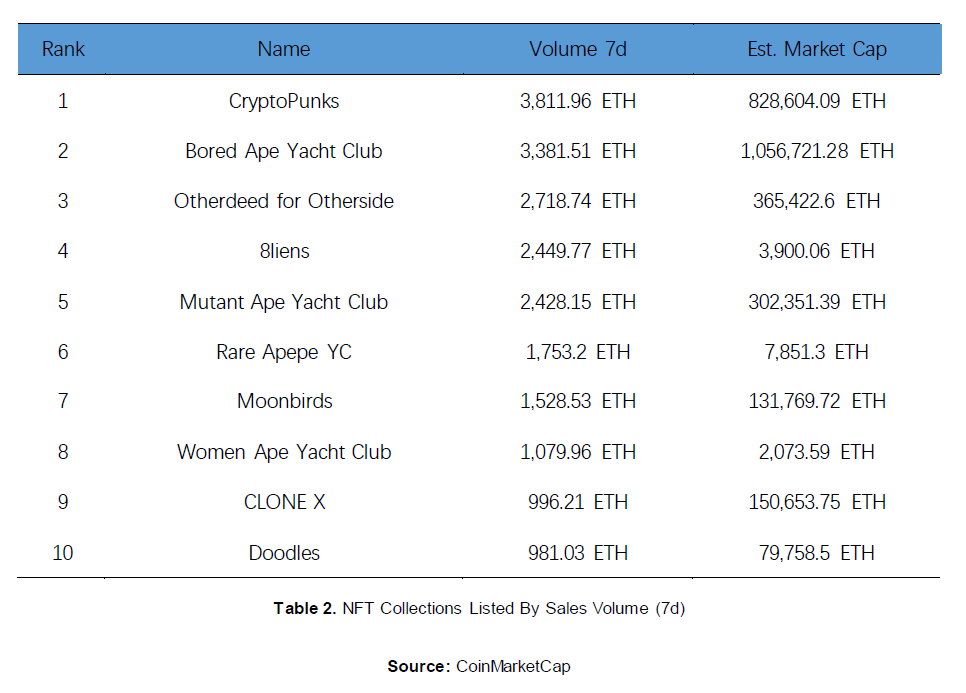

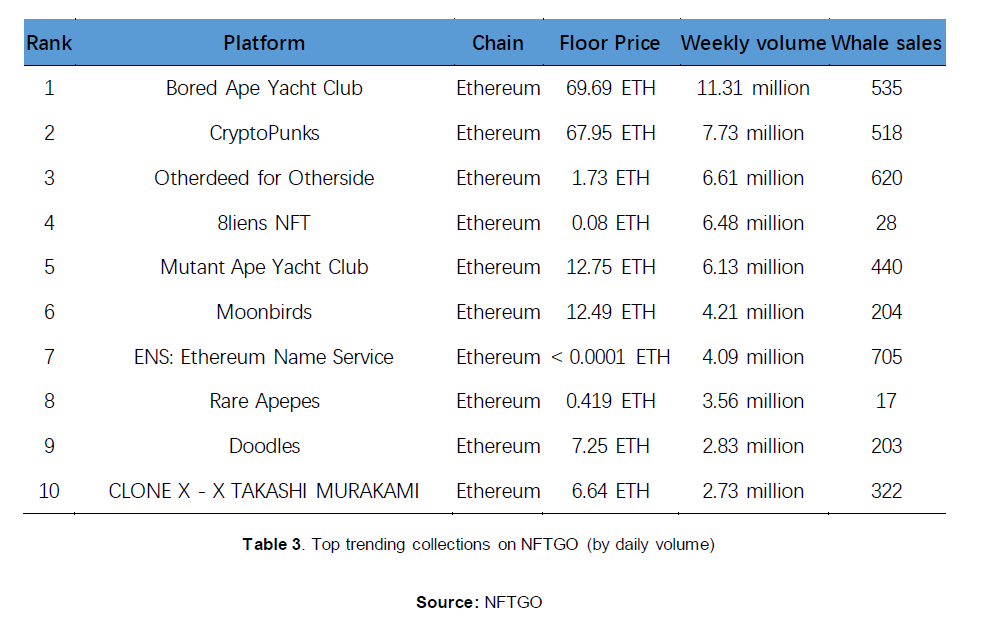

The NFT market last week saw a significant rise of 344.92%, and imarket cap has grown back to US$2,178,158,776.56. However, 7-day sales volume and the total sales remained rather stable: sales volume of 7 days increased by 1.27% and total sales decreased by 2.66% respectively. Overall, it has been a prosperous week for the NFT market; some brands like CLONE X and Doodles made their way into the top 10, competing with traditional top brands like the Ape Yacht Club series. Most of the volume and the average price last week remained stable (below 0.1%) for most of the top 10 brands; except Women Ape Yacht Club, which saw a 0.12% rise in both 7-day volume and 7-day average price.

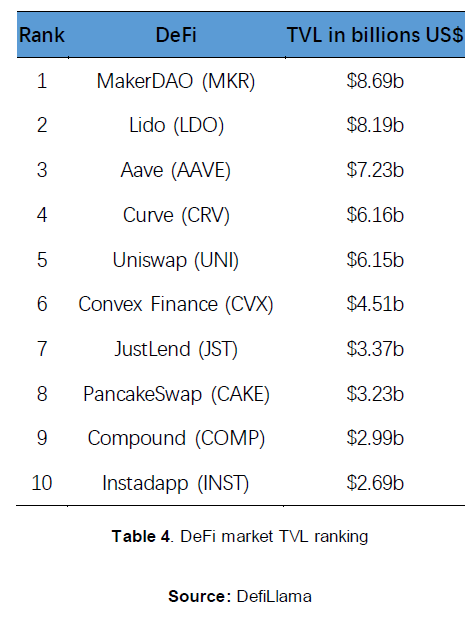

III.DeFi

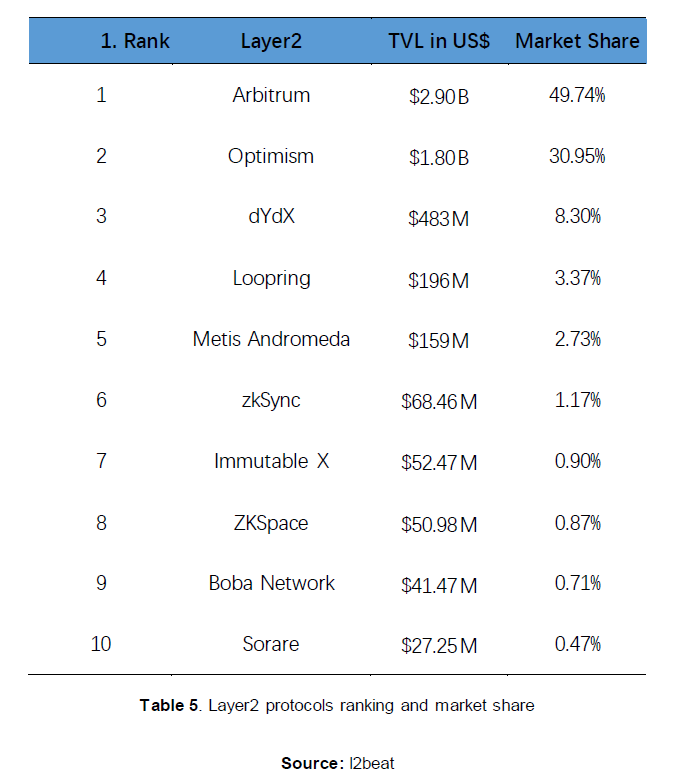

IV.Layer 2

2. Market news

I. Industry news

Bitcoin Miner Riot Takes US$349 Million Goodwill Impairment Charge on Acquisitions

Riot Blockchain (RIOT) is one of the largest publicly traded BTC miners. It recorded a total of US$348.1 million in impairment charges to goodwill in the second quarter of 2022. It also reported an impairment charge of US$99.8 million on its BTC holdings during its second quarter earnings release. The miner was scheduled to report its earnings last week but delayed it due to the complicated nature of calculating how much the cryptocurrency rout and other macroeconomic factors have affected the value of its assets. Riot maintained its hash rate growth guidance of about 12.5 exahash per second (EH/s) by the first quarter of next year, which it first forecast on Aug. 3. Riot shares fell about 6% on Tuesday. Its stock has fallen about 60% this year, in-line with its mining peers, while Bitcoin’s price has been cut nearly in half.

Bitcoin, Ether Drop as Analysts Fear Fed Minutes Will Dash Hopes for 2023 Easing

It’s a risk-off day in financial markets. While Bitcoin (BTC), Ether (ETH) and futures tied to the S&P 500 are trading weak, the safe haven U.S. dollar is gaining against other global currencies. Investors trimming bullish exposure to assets perceived as risky, amid expectations that the U.S. Federal Reserve might use the minutes of its July meeting to push back against hopes of slower rate hikes and eventual liquidity easing. “The question is whether the Fed wants to use these minutes as a communication tool to push back against the view of a 2023 easing cycle,” ING analysts noted in a market update published Tuesday. “Post-meeting rhetoric from the Fed suggests that this is more likely to be the case — especially since the Fed funds futures price the policy rate being cut from 3.60% to 3.20% in the second half of next year.”

II. Investment and Financing

Bill Ackman Among Investors as Venture Capital Crypto Firm Shima Capital Raises US$200 Million Fund

Shima Capital has raised US$200 million for its first venture capital fund to support early stage Web3 start-ups. “There’s been crypto funds that have grown and ballooned in size to billions of dollars of assets under management,” founder and managing partner Yida Gao told CoinDesk in an interview. “It’s hard for them to invest in the earliest stages of Web3 founders … We think that’s an area that we can add the most value.” Investors in the new fund included newly rebranded VC firm Dragonfly, hedge fund billionaire Bill Ackman, blockchain game maker and investment firm Animoca, crypto wallet OKX, Mirana Ventures, Republic Capital, CoinDesk parent Digital Currency Group and entrepreneur and former U.S. presidential candidate Andrew Yang, among others. The fund has a generalist approach that covers a wide range of potential verticals from consumer companies addressing decentralized identity or Web3 social media to gaming to next-generation blockchain technology like zero knowledge rollups, which address Ethereum’s high transaction fees and slow throughput. Check sizes will range from US$500,000 to US$2 million for each company.

Crypto Investing Giant Paradigm Leads US$20 Million Round for Fractional NFT Protocol

Fractional, a protocol that enables collective ownership and governance of non-fungible tokens (NFTs), is rebranding as Tessera, and it also revealed a US$20 million funding round led by crypto-native investment giant Paradigm that closed earlier this summer. Other investors in the Series A funding round included Focus Labs, Uniswap Labs Ventures, eGirl Capital and Yunt Capital. Last year, Paradigm launched a then record-breaking US$2.5 billion crypto-focused venture capital fund, a title that was stripped in May when Andreessen Horowitz started a US$4.5 billion investment vehicle.

Crypto Investment Firm CoinFund Launches $300M Web3 Fund

CoinFund, a crypto-specific investment firm, inaugurated a US$300 million venture capital fund to back early-stage blockchain projects, a sign of investor confidence in an industry plagued by a bear market. The CoinFund Ventures I fund will invest in companies showing commercial traction that also belong to a crypto sector with a large total addressable market, said David Pakman, CoinFund managing partner and venture investing head, in an interview with CoinDesk. Areas of interest include layer 1 blockchains, Web3 infrastructure, non-fungible tokens (NFT), gaming and asset management. Check sizes for CoinFund Ventures I investments will range from US$6 million to US$10 million per company, meaning the fund will likely back 30 to 40 companies. The majority will go to companies CoinFund hasn’t backed before, but a small number of portfolio companies could receive follow-on investments, Pakman said.

III. Supervision

Crypto.com Exchange Registers With UK Financial Regulator

Digital asset exchange Crypto.com registered with the U.K.’s financial regulator, the Financial Conduct Authority. The Singapore-based firm, which serves more than 50 million customers, is now authorized to conduct “certain crypto asset activities” in the U.K., though what exactly those activities entail remains unclear. More details on the approval will come Wednesday. Despite its global growth ambitions, Crypto.com has recently faced several roadblocks. In June, Crypto.com laid off 5% of its workforce, or 260 employees, as it navigated the headwinds of the bear market. On Tuesday, Decrypt reported Crypto.com was undergoing another round of layoffs.

UK Group to Test Stablecoin Payments, Provide Data to Bank of England

The Digital FMI Consortium, a group of private-sector companies, said it plans to test cross-border payments and provide recommendations to the Bank of England using its own sterling-backed stablecoin, dSterling. “The backing of the dSterling will be pounds held in a Bank of England reserve account and it is 100% backed,” a company spokeperson told CoinDesk. The pilot, known as Project New Era, will start in October and run for 12–24 months, it said a press release. Digital FMI, which has 15–20 members, will provide white papers and recommendations to the Bank of England and other regulators. A stablecoin is a cryptocurrency designed to hold its value against another asset, often the U.S. dollar. “Rather than the central bank coming to the private sector and incorporating private sector advice about CBDC development, this is entirely a private sector-led initiative that will provide data and policy recommendations to regulators and the Bank of England,” Casey Larsen, a director at Farrant Group, which handles the consortium’s communications, told CoinDesk

3. Trending project analysis — .bit

I. What is DID?

DID (Decentralized Identifier), is an open-standards based identity framework that uses digital identifiers and verifiable credentials that are self-owned, independent, and enable trusted data exchange. It aims to protect privacy and secure online interactions using blockchains, distributed ledger technology, and private/public key cryptography. The format of the DID is similar to that of an Internet domain name, so it is sometimes called a blockchain domain name.

What exactly is the use of .bit and .eth based on blockchain technology? What is the difference between them and Internet domains like .com? What is the reason behind the hype? To answer these questions, one needs to understand what .com is for.

For the Internet, it is to determine the server through the IP address to login to different websites, for example, Apple’s IP address is 17.253.144.10, and you can remember this string of numbers should you wish to access Apple’s official website. Such addresses tend to be long and messy, making it challenging to remember, which is why there is a .com resolution service. Enter apple.com into the browser, and the backend resolves to an IP address of 17.253.144.10, identifying the server and website. Therefore, it would be easier and faster for uses to enter apple.com to reach Apple’s official website.

And DID services (blockchain domain name) like .eth and .bit, resolve out only an IP address but a string of hash (blockchain address). For example, vitalik.eth will resolve to:0xd8dA6BF26964aF9D7eEd9e03E53415D37aA96045

.com resolves to an IP address to locate a website, but what does vitalik.eth do when it resolves to an ETH address? In the blockchain world, an ETH address (public key) serves as both an identity credential and a payment address.

This serves several purposes.

First, others can transfer funds directly to the address of vitalik.eth, whether it be Bitcoin, Ethereum or other cryptocurrencies (if the wallet address is already bound), whether it is 1 block or 100 million, and the funds can then be received by the address holder. DIDs serve as receiving accounts in the blockchain era.

Second, such DIDs can be used as their own ID, similar to Twitter or Telegram, and can be linked to a user’s account. For content creators, they serve as the perfect IP that is completely under their control with no risk of being blocked.

Third, this DID can also become the domain name system for a new generation of decentralized websites. The traditional .com domain name system based on the Http protocol has major drawbacks, such as centralized storage resulting in easy loss of information (page 404), and is easily blocked by firewalls and susceptible to blacklisting and other behaviors. But the IPFS technology combined with the DID can solve the problem, all the content will be IPFS form of decentralized storage, multi-node preservation, content encryption — the way to search the site will no longer be through the IP address, but a string of hashes, which gives the DID the opportunity to resolve it.

In the future when the IPFS protocol replaces the http protocol, a new generation of domain name system such as .bit or .eth will replace .com and become the norm for network domain names.

II. About .bit

●Introduction

.bit is a blockchain-based, open source, decentralized cross-chain account system that provides a worldwide unique naming system with a .bit suffix that can be used in different scenarios, such as cryptocurrency transfer, domain name resolution, identity authentication, etc.

.bit is the first decentralized account system with broad compatibility, allowing users to register and manage their .bit accounts with any public chain address or even email.

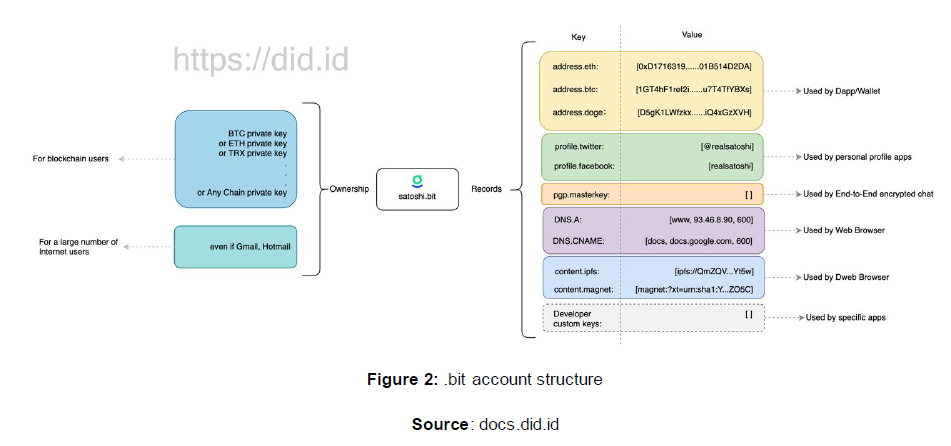

The core elements of a .bit account contain the owner/manager, and the record (i.e. the data associated with). Unlike ENS, the owner/manager of .bit can be any public chain private key or even email; unlike DNS, .bit supports any type of record. (Source: docs.did.id)

●Account Stucture

●Components

Core Protocol

This refers to a series of Lock Scripts and Type Scripts deployed on Nervos CKB. They define .bit accounts and the related operational standards for .bit accounts and are the concrete implementations of the .bit core protocols.

Keeper

Keeper is a set of off-chain programs that can be run by anyone without permission, and is responsible for triggering a series of transactions that conform to the core protocol. Running a Keeper earns .bit system rewards.

Resolution Service

It resolves the global state of .bit based on the transactions on Nervos CKB and provides account resolution service to the public in the form of an interface.

Client SDK

Includes SDKs in various languages to simplify the integration of mobile wallets, web wallets, server wallets and other .bit-related applications.

Dapp UI

Users ultimately use various features of .bit through a variety of application interfaces. These applications can be used directly in the browser or can be integrated into popular wallet software.

● What’s the “cross-chain” in .bit?

This cross-chain differs from others. Traditional cross-chain usually means staking assets on one chain, and getting related assets in another chain. There is no staking asset on any chains in this case as .bit uses Nervos CKB, which is compatible with any public chain’s account (address) system.

Users can install the BTC signature algorithm on Nervos CKB and make sure that the node must invoke the BTC signature algorithm to perform the checksum when packaging the transaction(which is generally a transfer of fungible or non-fungible tokens). After the verification is passed, the transaction is uploaded on chain and the assets transfer is completed, which means users control their Nervos CKB assets with their BTC private keys.

For the same reason, any public chain’s signature algorithms can be installed on Nervos CKB and any public chain address is able to hold assets issued on Nervos CKB.

Users can also cross chains using the Convert Bridge. Users can burn the old one on one chain, and mint on another chain.

III. Comparing .bit and ENS

It is clear that ENS is the most well-known project in the DID circuit and the explosion of this circuit has also been adue to ENS. We shall now compare the advantages and disadvantages of .bit and ENS from several aspects.

●Number of users

As of today, .bit has 118,000 registered accounts and 42,000 users, while ENS has 1.67 million registered accounts and 482,000 users, giving ENS a strong advantage in terms of number of users. ENS has a strong advantage in terms of the number of users, mainly because of its first-mover nature and the hype surrounding the issuance of token airdrops and digital domains for BAYC holders. But while .bit is just about a year old, ENS has been around for four years. It is also impressive that .bit has reached its current number of users.

● Cross-chain capability

Since ENS is issued on the Ethereum chain, registration, management and transaction can only be done on the Ethereum chain. The suffix of ENS is also .eth, which is a project belonging to the Ethereum ecology only. .bit is issued on Nervos CKB, which can provide account resolution service to the public in the form of an interface. .bit can also utilize Convert Bridge, which enables cross-chain. Therefore, .bit is not dependent on any single ecosystem and can interface with every public chain and can be converted to other public chains. This is where .bit excels.

●Residual name availability

Although the number of ENS users is relatively high, its potential to be mined is not high. Besides the need to spend on expensive gas fees, many domain names with investment value have long been grabbed by others, while “.bit” has only released 60% of 4–6 digit accounts so far, and the remaining 40% will be released sometime in the future, and everyone can make reservations for sought-after names, and the allocation process is relatively fair. Secondly, .bit with cross-chain property has an advantage over ENS in the future blockchain industry where multiple chains will co-exist.

●Security of names

As .bit is a common account layer for the whole Web3.0, and accounts are ultimately for human use, it is a necessary design criterion to improve the identifiability of .bit accounts and reduce the occurrence of fraud. To this end, .bit introduces a key design: there are strict restrictions on the characters that can be used to register a .bit account.

Firstly, only lowercase letters, numbers, and a small number of emoji are allowed to be registered as .bit accounts. Secondly, characters from certain languages cannot be mixed with characters from other languages. Fraud is more likely to occur in the Web 3.0 world, and Web 3.0 fraud cases are more immediate and more damaging than the phishing practices of the Web 2.0 world. In the Web 2.0 world, a user who visits a wrong website needs to go through some steps before information or property is stolen. But in the Web 3.0 world, if a user cannot tell the difference between satоshi.bit and satoshi.bit, he will transfer funds to the wrong person and access the wrong contract. Can the average user see the difference between satоshi.bit and satoshi.bit with the naked eye? Likely not. But in fact, the о in the former is a Russian character, while the o in the latter is an English character, and the two are completely different account names. Without any restrictions, it would be simply too easy for someone with ulterior motives to commit fraud. However, under the .bit system, the former will not be deemed legitimate .bit account and will not be registered successfully.

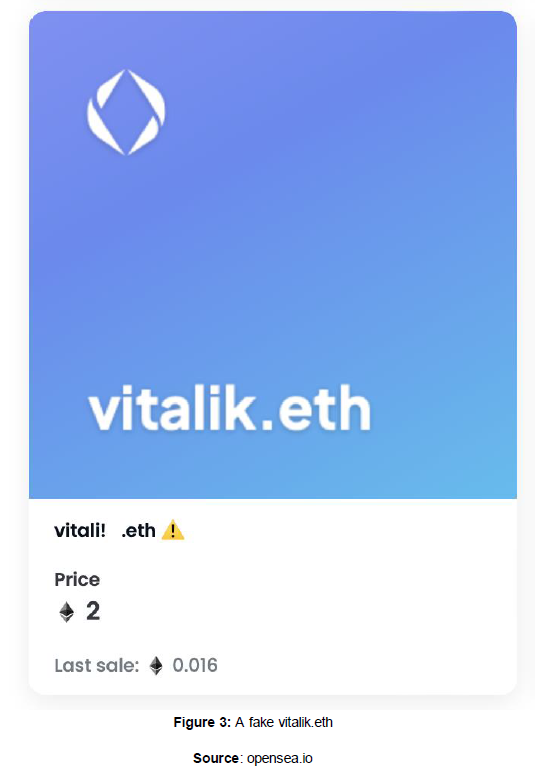

In ENS, the rules and security of the name registration process are not so ideal. Anyone can register a domain name that looks the same as others that already exist by adding zero-width characters (abbreviated as ZWJ, which can be interpreted as spaces with no width). Take vitalik.eth for example, one can add a zero-width hyphen between the English words vitalik, such as vitali%E2%80%8D%E2%80%8Dk, or vital%E2%80%8D%E2%80%8Dik, and ENS will show that the domain name is available for registration. The two domain names will look exactly the same, and no visible difference can be seen. This vulnerability is extremely easy to be exploited by scammers. If a scammer sends you a domain name with a zero-width hyphen at vitalik.eth, you will be led to believe that this is Vitalik’s account, and if a copy/paste function is performed while doing a funds transfer, the funds will go to the scammer. Such a problem was discovered by the ENS team early on, but there is no way to change the rules. ENS is a decentralized product and it would be impossible to delete any of the registered domains.

Therefore, this problem can only be solved by detection and warning.

IV. Summary

.bit, a project that just raised US$13 million in Series A funding, has many advantages:

● .bit is feature-rich.

●.bit can have many users even in the early stage.

● The excellent “cross-chain mechanism” makes .bit not dependent on a single public chain, which is applicable to a wide range of applications.

● There are still many valuable DID names in .bit that have not yet been registered.

●.bit’s name design rules are more secure and reasonable.

At the same time, .bit, as a slightly later project in the DID track, the project teams need to consider how to operate the project to develop rapidly and shorten the gap in scale with ENS, given that ENS has the advantage of the number of users at present.

About Huobi Research Institute

Huobi Blockchain Application Research Institute (referred to as “Huobi Research Institute”) was established in April 2016. Since March 2018, it has been committed to comprehensively expanding the research and exploration of various fields of blockchain. As the research object, the research goal is to accelerate the research and development of blockchain technology, promote the application of blockchain industry, and promote the ecological optimization of the blockchain industry. The main research content includes industry trends, technology paths, application innovations in the blockchain field, Model exploration, etc. Based on the principles of public welfare, rigor and innovation, Huobi Research Institute will carry out extensive and in-depth cooperation with governments, enterprises, universities and other institutions through various forms to build a research platform covering the complete industrial chain of the blockchain. Industry professionals provide a solid theoretical basis and trend judgments to promote the healthy and sustainable development of the entire blockchain industry.

Official website:

Consulting email:

research@huobi.com

Twitter: @Huobi_Research

https://twitter.com/Huobi_Research

Medium: Huobi Research

https://medium.com/huobi-research

Disclaimer

1. The author of this report and his organization do not have any relationship that affects the objectivity, independence, and fairness of the report with other third parties involved in this report.

2. The information and data cited in this report are from compliance channels. The sources of the information and data are considered reliable by the author, and necessary verifications have been made for their authenticity, accuracy and completeness, but the author makes no guarantee for their authenticity, accuracy or completeness.

3. The content of the report is for reference only, and the facts and opinions in the report do not constitute business, investment and other related recommendations. The author does not assume any responsibility for the losses caused by the use of the contents of this report, unless clearly stipulated by laws and regulations. Readers should not only make business and investment decisions based on this report, nor should they lose their ability to make independent judgments based on this report.

4. The information, opinions and inferences contained in this report only reflect the judgments of the researchers on the date of finalizing this report. In the future, based on industry changes and data and information updates, there is the possibility of updates of opinions and judgments.

5. The copyright of this report is only owned by Huobi Blockchain Research Institute. If you need to quote the content of this report, please indicate the source. If you need a large amount of reference, please inform in advance (see “About Huobi Blockchain Research Institute” for contact information) and use it within the allowed scope. Under no circumstances shall this report be quoted, deleted or modified contrary to the original intent.

.bit — a blockchain-based, open source, and decentralized cross-chain account system was originally published in Huobi Research on Medium, where people are continuing the conversation by highlighting and responding to this story.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.