Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

This post is contributed by the Datachain team.

IBC plays an essential role in the enterprise space because of the trust-minimised blockchain interoperability it provides for heterogeneous blockchains and is a proven technology, as discussed in our previous post. The Inter-Blockchain Communication (IBC) protocol is not only for chains built on the Interchain Stack, but for all blockchains, regardless of app building framework, including enterprise (permissioned) blockchains and probabilistic finality chains.

This post is the second part of the IBC and enterprise series and will dive into enterprise use cases in production using the IBC protocol, specifically:

- Delivery Versus Payment (DVP) Settlements between digital assets and digital currency (NTT DATA)

- USDF, a USD-pegged Stable Coin (USDF Consortium)

- Enterprise Blockchain Platform BSN (Bianjie) backed by the Chinese Government

- Atomic Swap Between Digital Currencies (Soramitsu)

DVP Settlements Between Digital Assets and Digital Currency (NTT DATA)

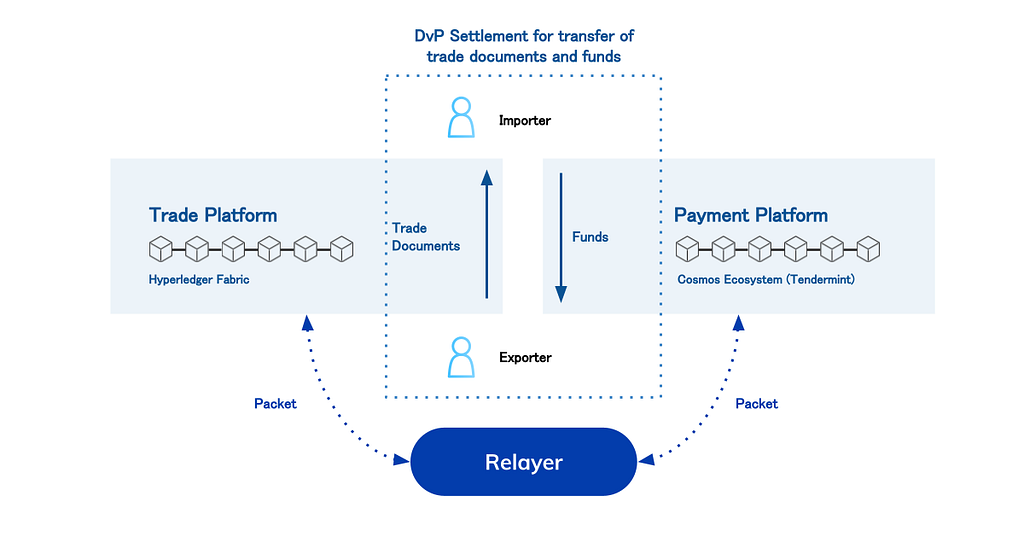

An overview of the DVP settlement system, source: Datachain Teams Up With NTT DATA For Blockchain Interoperability

NTT DATA and Datachain have tested Delivery Versus Payment (DVP) settlements between digital assets on Hyperledger Fabric and digital currency on Tendermint-based blockchains using the IBC protocol. DVP settlement is a settlement method that reduces principal risk by simultaneously delivering securities while making payments. The IBC protocol enables DVP settlements by verifying transactions on the counterparty blockchain without a trusted intermediary. Securities and payments can be received only once both parties have put the transactions on chain and they are verified by the counterparty blockchain.

The experiment resulted in a joint demonstration of a new international trade settlement system by Tokio Marine & Nichido, NTT DATA, STANDAGE and TradeWaltz.The architecture of this demonstration can be applied to other enterprise fields including the settlement of securities transactions. Therefore, as more digital assets become exchangeable on blockchains, there will be increasing demand to transfer digital assets and make settlements simultaneously to minimize the risk.

USDF, USD-pegged Stable Coin (USDF Consortium)

USDF is a USD-pegged stable coin minted by several United States banks at the USDF consortium. The consortium members are: Amerant Bank, Atlantic Union Bank, ConnectOne Bank, FirstBank, NBH Bank, Primis Bank, New York Community Bank, Synovus Bank, Webster Bank, Figure Technologies, Inc., and JAM FINTOP. The primary use-case of USDF is to make money transfers between banks more efficient, and has additional applications such as capital call financing, invoice, and supply chain finance.

USDF runs on the Cosmos SDK based Provenance blockchain with IBC as a primitive. This is why, for example, it is possible for the Provenance blockchain to interoperate with other blockchains to settle payments by USDF.

Enterprise Blockchain Platform BSN (Bianjie) backed by the Chinese Government

Bianjie, the core development team responsible for delivering IRISnet, is also working on Cosmos-based enterprise solutions called IRITA (Inter-Realm Industry Trust Alliance). It is a consortium blockchain product built using the Cosmos/IRIS SDK branching off of the IRISnet project.

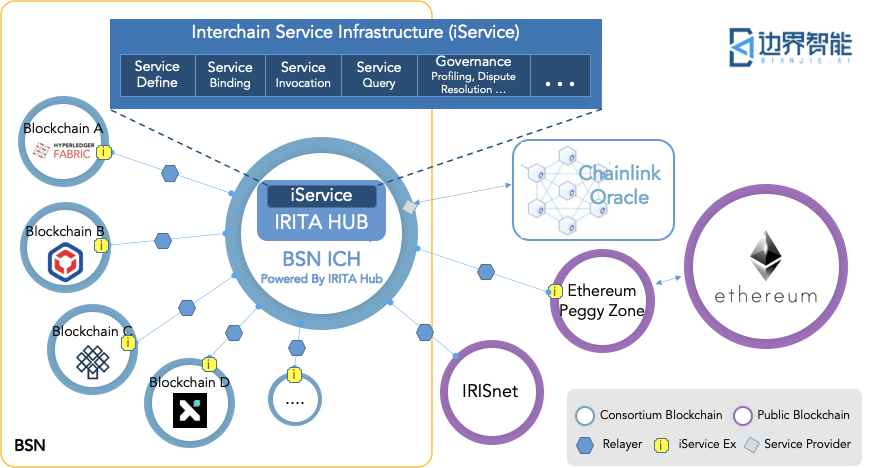

Source: IRITA interchain service, IRITA Hub , has launched at BSN

The Chinese government wants to include multiple blockchain frameworks and make them accessible under one uniform standard on the BSN (Blockchain Service Network) platform. The illustration above highlights the IRITA Hub as a key blockchain platform in the BSN ecosystem with IBC connecting it to other public and private blockchains. Interoperability is supported between consortium and public blockchains such as Ethereum, IRISnet, Hyperledger Fabric and FISCO BCOS.

Atomic Swap Between Digital Currencies (Soramitsu)

Soramitsu, the initial contributor to Hyperledger Iroha and the co-development team behind the Cambodian Central Bank Digital Currency (CBDC) Bakong has started using the IBC protocol to enable simultaneous exchange of digital currencies between different blockchains built on Hyperledger Iroha.

In recent years, the development of digital currencies has accelerated with multiple blockchains (Hyperledger Iroha, Hyperledger Fabric, Corda) employed as the underlying platforms. Therefore, there is a growing need to exchange multiple digital currencies simultaneously, called Payment Versus Payment (PVP) settlements, and this is enabled by connecting multiple heterogeneous blockchains via the IBC protocol. Soramitsu and Datachain have implemented IBC modules for Hyperledger Iroha and completed a demonstration test verifying viability. Soramitsu has also begun to conduct CBDC feasibility studies in the Philippines and Vietnam to expand Enterprise IBC use-cases.

Conclusion

This article covers major enterprise use cases using the IBC protocol. As the use cases illustrate, large enterprise companies such as NTT DATA, US-based Banks, and the Chinese government-backed project BSN have started using the IBC protocol to minimize the risk in processing payments, through DVP settlements and exchanging multiple currencies, PVP settlements. While some projects are in the experimental phase, considering enterprise adoption is generally slower than for public chains, this is not a negative factor and demonstrates the potential of the solution.

If you have not yet done so, reading part one of the IBC protocol for enterprise series will add additional context and is highly recommended to understand why enterprises have chosen to use the IBC protocol.

Datachain is committed to building an interconnected world of public and enterprise blockchains — the Interchain, powered by the IBC Protocol. Our work on the YUI project continues and we look forward to collaborating with the Interchain Foundation and Core Teams to drive adoption of the Cosmos Ecosystem.

Datachain also unveiled LCP, a proxy for light client verification to enable trust-minimized and gas-efficient cross-chain bridges using the IBC protocol.

To learn more about building the Interchain together, Datachain can be found on Twitter and messaged here: contact us.

IBC Use Cases in the Enterprise Space are Coming was originally published in Cosmos Blog on Medium, where people are continuing the conversation by highlighting and responding to this story.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.