Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

Many projects introduce a deflationary mechanism in their tokenomics. For a large part, this is usually done through a so-called token burn. Binance is undoubtedly the most famous industry participant in removing chunks of its native cryptocurrency (Binance Coin – BNB), and the way they do it has changed throughout the five years of its existence.

So far, the exchange has burned billions of dollars worth of BNB, pursuing its goal of reducing the token’s total supply by 50%. In this article, we take a deep dive at how the process works, how many burns have been so far, when is the next one, and so forth.

What Is a Coin Burn?

The ‘burning’ of a coin is essentially a process of removing it from circulation by sending it to specifically designated addresses that can only receive cryptocurrency. These addresses are referred to as “burners” or “eaters.”

The closest thing to a coin burn in traditional finance is when a company buys back its own stock from the market in an attempt to reduce the circulating supply and essentially increase the value of the outstanding stock. However, the main difference is that the bought-back stock remains in existence and in ownership of the company, whereas the coins that are burned are essentially destroyed since nobody can ever access them again.

Some notable projects that have introduced burning mechanisms include Shiba Inu (implemented in April this year), Ethereum (started with the EIP-1559 from 2021), and multiple algorithmic stablecoins.

BNB’s Role and How it Started

BNB is the native cryptocurrency of the world’s largest crypto exchange, and the primarily token used in Binance’s entire ecosystem – this includes the BNB Beacon Chain (previously known as Binance Chain) and the BNB Smart Chain (formerly – Binance Smart Chain).

Released in 2017 alongside the exchange, BNB functioned as an ERC-20 token on the Ethereum network before Binance ultimately transitioned it to the BNB chain two years later.

The whitepaper explained that, initially, there was a “strict limit of 200 million BNB” – a number “never to be increased.” Nevertheless, the company laid out the foundations of the burning mechanism in the paper, saying:

“Every quarter, we will use 20% of our profits to buy back BNB and destroy them until we buy 50% of all the BNB (100MM) back. All buy-back transactions will be announced on the blockchain. We eventually will destroy 100MM BNB, leaving 100 BNB remaining.”

BNB Quarterly Auto-Burn

Upon the launch of Binance, the team introduced the original quarterly burning mechanism based on the BNB trading volume and the fees Binance generated from it. However, arguing that it lacks sufficient transparency and predictability, the company switched it to a quarterly auto-burn process.

The new method, incorporated in December 2021, allows on-chain automatic calculations to determine how much of the token has to be burned based on its price and the number of blocks generated on the BNB chain during that quarter. Essentially, if BNB’s price drops, the amount of burned tokens will increase to remain within the supply-demand dynamics.

Binance promises that the quarterly auto-burn is “both objective and verifiable, independent of revenues generated on the Binance CEX through the use of BNB.”

Binance Coin Burned/Circulation. Source: Binance

BEP-95 and Burning BNB Through BNB Chain

While placing a target of 100 million tokens to be burned and the total supply of BNB to be capped at the same number of coins was the initial idea, which has not changed, Binance had to implement several changes along the way to adjust. More specifically, the company outlined new processes (aside from the aforementioned auto-burn) that accelerated the speed at which BNB is being burned.

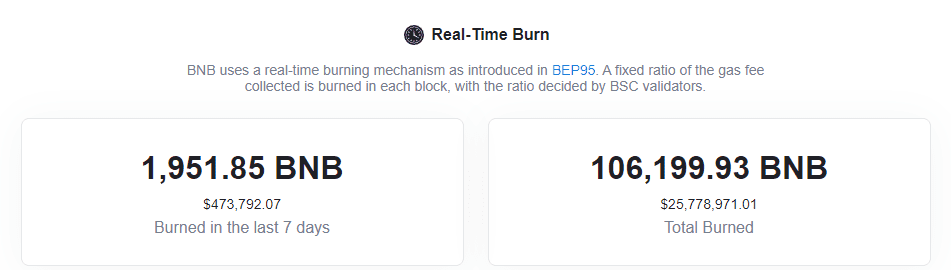

The Binance Evolution Proposal (BEP) 95, implemented in November 2021, saw the addition of a real-time burning mechanism to the BNB Chain. It allows the smart contract to automatically burn a portion of the gas fees collected by validators from each block (produced on an average at every 3 seconds).

This means that the more people use the BNB chain, the more BNB will be burned. A Twitter account that follows the number of BNB burned shows that over 106,000 BNB have been removed from circulations through this mechanism as of the end of July 2022, with an average speed of approximately 285 BNB per day.

It’s worth noting, though, that the BEP-95 burning mechanism will continue even after the 100 million token mark is reached as it depends on the BNB Chain network.

Binance Coin Burned Through Different Burning Mechanisms. Source: BNBinfo

How Many BNB Have Been Burned So Far?

Starting from 200 million BNB in 2017, Binance’s ultimate goal is to decrease the circulating supply by 50%, as mentioned above. Aside from the daily burning mechanism, which has removed 106,000 coins out of circulation by now, the company has completed 20 scheduled quarterly auto-burns.

The latest came earlier in July, based on what transpired on the Binance ecosystem throughout Q2 2022, and saw 1,959,595.29 BNB burned. This amount equaled $444 million calculated at prices on July 13.

As of writing these lines, the total number of BNB burned is just under 39 million (equivalent to $9.3 billion as of today’s prices), meaning that the circulating supply left is still north of 161 million. The next burning event will be after the end of Q3, and so far, the estimations show that more than two million BNB will be removed.

BNB Burns as of July 2022. Source: BNBInfo

The post Binance BNB Burn Explained: How Much is Burnt and When? appeared first on CryptoPotato.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.