Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

Mining is a foundational necessity for Bitcoin (BTC). With a proof of work (PoW) consensus mechanism, miners process all transactions on the network, while providing the security and decentralization vital to its normal functions. For these reasons, the well-being of mining farms around the world is monitored to help analysts understand the overall vitality of the Bitcoin network.

Briefly put, what is mining?

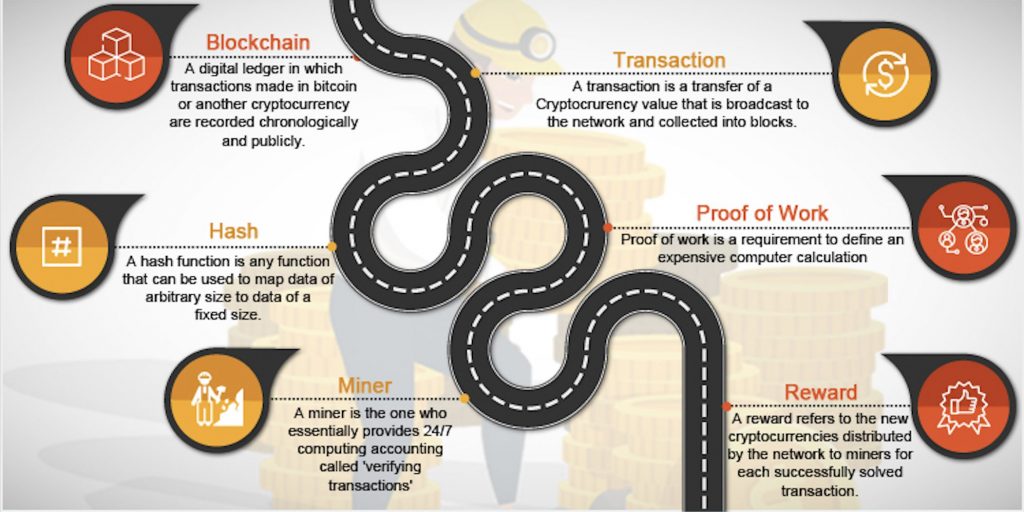

All crypto aficionados should have a baseline understanding of mining. The term cryptocurrency comes from the conjunction of cryptography and currency. This term is ideal because Bitcoin is cryptographically secured and is essentially unhackable. It owes its renowned security to its PoW mining system. Without these security and validation procedures, crypto would be easily exploited through double-spending and other issues.

Miners process and verify transactions on the Bitcoin network. For their efforts, miners are granted rewards in the form of newly minted bitcoin. The mining process involves solving complex cryptographic hash puzzles with the aid of powerful ASIC systems. When solved, these puzzles verify blocks of transactions, and the distributed ledger is updated to reflect the changes in BTC address balances. It’s clear to see that for Bitcoin, mining is not optional, but instead an integral part of the network. Without it, Bitcoin could not exist.

The current status of BTC mining

The entire cryptocurrency space has faced challenges throughout the past year, and mining has also been affected. Revenue is down in the mining industry as a result of several different factors. While many mining farms are operated by true crypto believers, the overhead costs required are prohibitive for many would-be participants.

Competition in the mining industry is also rising, leading to a less profitable environment for everyone involved. Hash power has been steadily dropping throughout the past year to date (YTD). With all these challenges piling up, miner capitulation through selling BTC has been exceptionally strong as a result. Here, we will break down all the different elements impacting BTC mining, what they mean for the health of the network, and what a potential path to recovery could look like for the industry.

Understanding the troubles miners face

Cryptocurrency mining is a complex ecosystem that incorporates many different financial, sociopolitical, environmental, and economic considerations. When you consider the fact that this industry is international, the factors involved increase exponentially. However, at the foundational level, all of these different mining companies are facing the same dilemmas.

Miner revenue

Throughout 2022 thus far, miner revenue has dropped immensely. Two main factors — the drawdown of BTC’s value, and the rising level of competition — bear the brunt of the blame. Miners may choose to hold their BTC for the long-term, but they likely pay for their costs in fiat, meaning liquidating some of their coins is unavoidable.

Source: SCALA Blockchain

It’s clear to see that the value of BTC and other cryptocurrencies has a strong influence on profitability for these miners. Unfortunately, the entirety of 2022 has been more or less a grind for the crypto market as selling pressure has been unrelenting. While some analysts may point to indications that the market is ready to turn around, there is little evidence to suggest that a bull market is starting quite yet.

While BTC price continues to flounder, mining competition is on the rise. This is despite several companies closing their doors. How is this possible? The reason mostly revolves around the network’s built-in counter to inflation: halving events. As of May 11, 2020, there is a fixed number of 900 BTC mined per day. After every halving event, the amount of rewards given gets divided by two, leaving less BTC for every miner on the network.

During periods of excessive selling or even times when the price of BTC remains flat, miners may struggle to stay profitable against their excessive electricity and equipment costs. Throughout 2020 and 2021, the crypto market was generally on the upswing. Now that the price has receded, miners are feeling the pressure of the reduced rewards after the 2020 halving.

At the end of the day, mining is a business. And like with all businesses, revenue is the lifeblood. If the cost of mining ever outweighs the incentives, an untold number of nodes within the ecosystem will face an existential crisis. While some may maintain their crypto loyalty with the hope of exceptional returns, others will be forced to make a tough decision. With rising mining costs, diminished progress in the market, and post-halving supply realities, for some, the choice to continue is removed.

Hash price

To get a greater understanding of a miner’s expected revenue, we can look to the hash price. The hash price is one of the most important metrics used by miners to perform cost vs revenue calculations. Hash price is the measure of expected daily revenue per 1 Th/s of mining power in USD. If a miner has a capability of 10 Th/s, they should expect to earn about $5 in revenue with a hash price of 50 cents. However, throughout the last quarter, hash price has collapsed by about 59.43%.

Source: Hash Rate Index

The growing rate of miner capitulation

As the circumstances surrounding this challenging landscape continue, miner capitulation can be identified through several metrics. While it may be tempting to say we have seen the worst of it, it is arguable that another push under the crucial $20,000 marker for BTC will be too much for a percentage of miners to bear. Let’s take a look at some other illuminating statistics to unpack the situation.

Hash rate

Tying in with the hash price is the hash rate. When using a 14-day moving average (MA), a clear stagnation of the network’s combined mining capabilities comes into view. As of August 2022, the hash rate dropped 7% from recent all-time highs. While July 2021 to July 2022 saw explosive growth, this recent drop is one of the clearest signals that no new miners have joined the network. This means there is no new computing power available to push the hash rate capacity.

Source: Glassnode

Hash ribbon

A hash ribbon combines the 30-day and 60-day MAs of network hash to reflect miner capitulation trends. Oftentimes, moving average crossovers are used by traders to predict an asset’s future moves, and the same concept can be applied here. When the 60-day MA crosses over the 30-day, this is generally a signal that miners have been aggressively capitulating. Conversely, a crossover of the 30-day MA over the 60-day can signal that the worst of the capitulation could potentially be over.

Source: Glassnode

What we have recently discovered is an unfortunate indication that miners are increasingly going offline. The 60-day MA has crossed the 30-day, meaning that we are potentially going to see further capitulation from BTC miners around the world. As this asset becomes increasingly expensive to mine, with margins being squeezed and an uncertain future ahead, it is possible that mining farms could be sidelined. But when more favorable market conditions return to the ecosystem, we could see a show of force as miners come back to the network.

Balance held by miners

When the status of a company’s solvency is in question, we can’t often peer into their bank accounts. Luckily, due to the immutable nature of blockchain technology, we can get a glimpse into the miners’ financial standing by following their wallets. As miners compete every day for a finite number of coins, they are gradually forced to sell some BTC to cover the cost of their expenses.

When the cost of mining greatly exceeds their generated revenue, miners end up selling their reserves to stay in the network for as long as possible. Over time, excessive drops in these reserves can become a “canary in the coal mine” indicator that immense capitulation is underway. Through the second quarter of 2022, the balance held by miners has decreased by 5,488 BTC.

Source: Glassnode

Miner capitulation is a natural occurrence

While it may seem like doom and gloom at times, downturns in the cryptocurrency market are just as vital as bullish times. These periods combine to form the entire market cycle. As such, miner capitulation is also a natural response to the mining difficulty mechanism endemic to Bitcoin’s protocol. As miners face increasing challenges, only the most resilient will be able to continue supporting the network as others are forced to capitulate.

The fact is, the cryptocurrency world will always need miners, and there will always be participants willing to seize the opportunity, regardless of difficulty. Even as other major players like Ethereum transfer to a proof of stake (PoS) system, the security and benefits of PoW are still appreciated. Additionally, as long as mining is a cost-intensive process, a theoretical bottom-value for Bitcoin will always be in play and considered by the market.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.