Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

Authored by Derrick Chen, Jer Shun Kou, Lucio Lyu, Researchers at Huobi Research Institute

Abstract

This week, we focus on the following events: 1) Ethereum’s Third and Final Testnet Merge Goes Live on Goerli; 2) Blockchain Payments Platform Ansible Labs Raises $7M in Seed Funding Round; 3) Crypto Exchange Bitfinex May Be Facing Criminal Investigation in US; __________________________________________________________________

Project Analysis: With the U.S. Treasury sanctioning Tornado Cash on August 8, the biggest token mixing pool shut down immediately. Tornado Cash is very notorious due to the rise in crypto security incidents — it is viewed as the best place for hackers to launder their stolen funds. We examine Tornado Cash, its mechanisms, ethics, and other investment opportunities in the privacy area.

1. Industry overview

I. Overall market trend

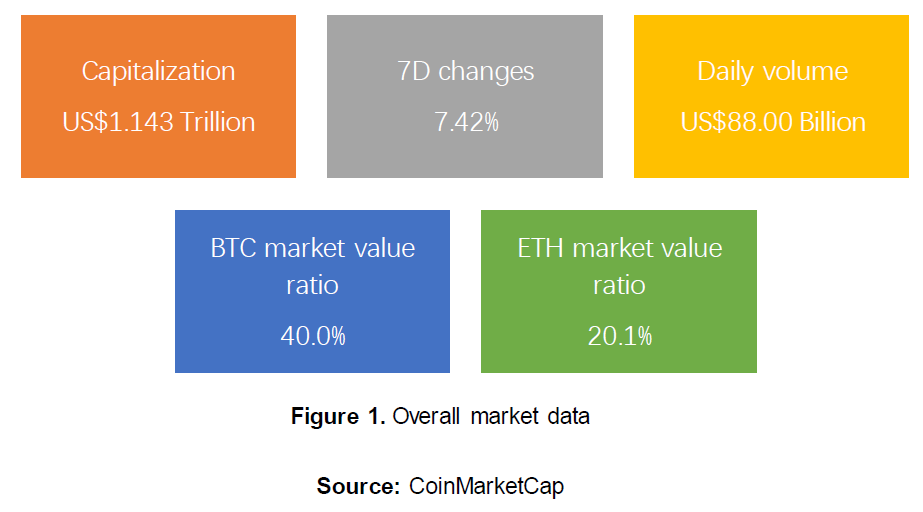

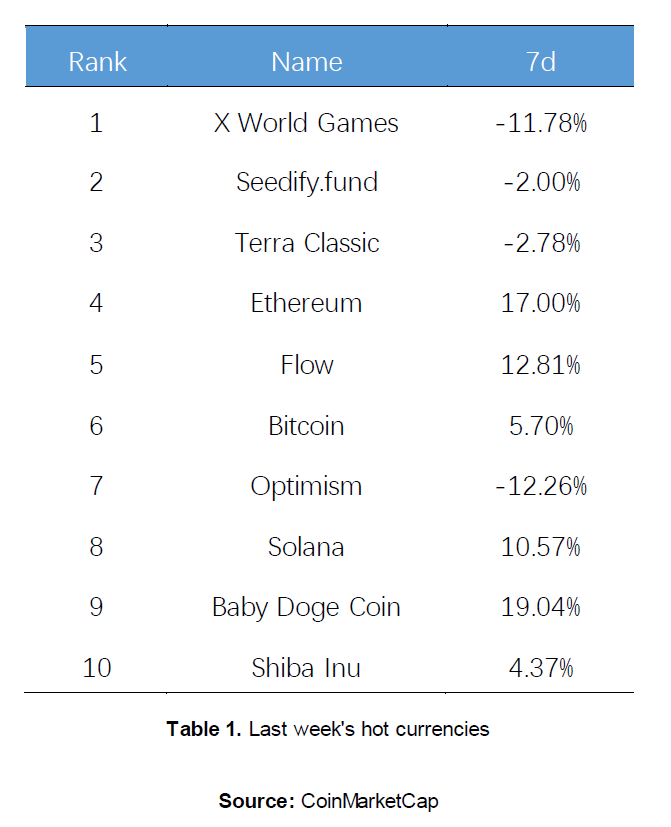

The global cryptocurrency market has been steadily recovering, with a solid increase of 7.42% to hit a market cap of US$1.143 trillion. Bitcoin is currently at US$23,923, close enough to the US$24000 mark that it surpassed a few days ago. The price of SOL is currently US$42.89, which is a signal of recovery after its hacking incident and whichmarks a 10% increase over last week. Baby Doge and Shiba Inu, two famous meme coins, have found their way back to the top 10 with a notable 20% increase over a 30-day period.

II.NFT

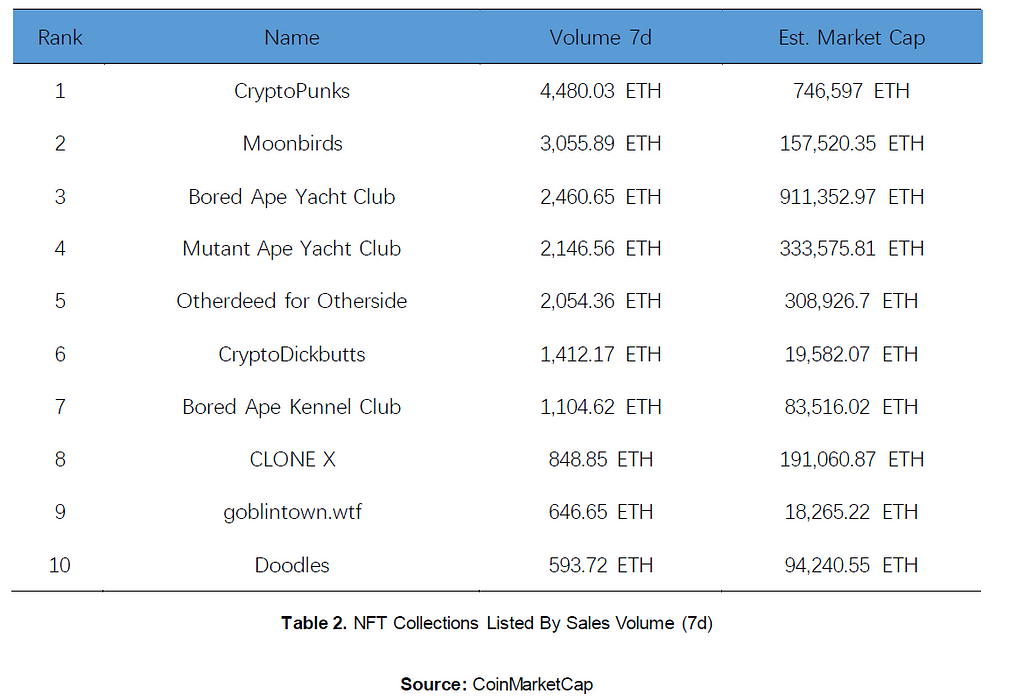

The NFT market last week saw a small amount of increase after dips over the previous weeks; its market cap has grown back to US$1,869,815,111.74, marking a 4.36% increase over last week. However, the 7-day sales volume decreased to US$57,486,532.58, which marks a 2.32% decrease. Total sales, at 64,247 units, saw a 6.06% decrease from last week. Overall, the numbers fluctuated within a safe range; compared to a few weeks before, when there was a decrease of approximately 40%, the NFT market is currently relatively stable.

III.DeFi

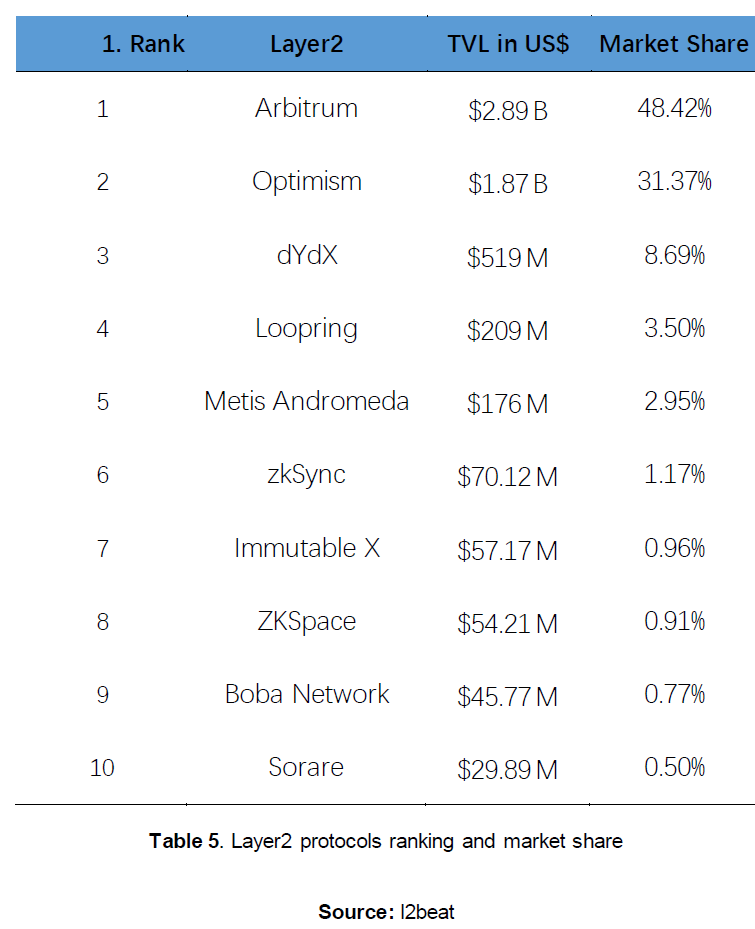

IV.Layer 2

2. Market news

I. Industry news

First Mover Asia: Bitcoin Soars Past US$24K on Favorable CPI; Governments Focus Too Much on Crypto’s Economic Importance, Australia Academics Argue

The July Consumer Price Index (CPI) report in the U.S. was sweet music for crypto investors. The news sent the price of Bitcoin higher minutes after the U.S. Commerce Department published the July inflation reading, which showed prices declining at a slightly lower rate than most analysts expected. Bitcoin was recently trading just at roughly US$23,850, up nearly 3% over the past 24 hours. The largest cryptocurrency by market capitalization had breezed past the US$24,000 threshold earlier in the day and remained in the upper end of the range it’s occupied for the better part of two weeks. Ether cracked the US$1,800 mark for the second time in three days, increasing more than 8% over the previous day. Most other major cryptos also were basking in sunshine, with AAVE rising almost 14% and FTM and STORJ up more than 12% at one point.

Ethereum’s Third and Final Testnet Merge Goes Live on Goerli

The third and final test environment network (testnet) merge before the Ethereum blockchain makes its long-awaited move to proof-of-stake from proof-of-work has successfully been completed. Goerli was the last of three public testnets to run through a “dress rehearsal” for the Merge. Following this, the mainnet Merge is expected to occur sometime at the end of September. The network transitioned to proof-of-stake (PoS) when the Terminal Total Difficulty (TTD) exceeded 10,790,000. That occurred around 1:45 UTC. The testnet merge takes the project one step closer to Ethereum’s mainnet upgrade later this year. The two previous testnet merges, Ropsten and Sepolia, were largely successful as well, heightening Ethereum community confidence that the actual Merge should be able to take place this year.

Bitcoin R&D Center Vinteum Launches in Brazil

Vinteum, a nonprofit Bitcoin research and development center dedicated to supporting Bitcoin developers in Brazil and the wider Latin America region, launched on 11 August this year. Co-founders Lucas Ferreira of Lightning Labs and André Neves of ZEBEDEE will serve as the foundation’s executive director and director of partnerships, respectively. Vinteum’s mission is to train and fund open-source developers across Brazil and Latin America to work on Bitcoin and the Lightning Network, an area that has become critical in recent years as bitcoin matures beyond hobbyist use cases. Brazil experienced an economic crisis when hyperinflation took hold in the early 1990s. As such, bitcoin supporters in Brazil have taken root — given the cryptocurrency’s sound money principles. Likewise, across Latin America, countries including Argentina and Venezuela are in the throes of hyperinflation. On top of that, bitcoin is viewed favorably in Argentina, according to survey data from Block. Vinteum will look to take advantage of these trends to enact meaningful change through a grassroots educational effort.

II. Investment and Financing

Blockchain Payments Platform Ansible Labs Raises US$7 million in Seed Funding Round

Ansible Labs, a startup that is building a payments platform for blockchain accounts, has raised US$7 million in a seed funding round that was led by early-stage crypto venture capital firm Archetype. The capital will go toward hiring, liquidity and operating expenses ahead of the launch of the project’s first product, according to a fundraising deck provided to CoinDesk. The Ansible team has ties to global payments provider Visa — co-founder Daniel Mottice was product lead for Visa Crypto and helped build and launch Visa Direct Payouts, a service that allows financial institutions to push out payments to accounts around the world. Ansible co-founder and Chief Product Officer Matt Vanhouten also worked at Visa Direct and has a background in traditional finance with stints at Wells Fargo and JPMorgan & Chase.

DEX Protocol Injective Raises US$40 million From Jump Crypto, Brevan Howard Unit

Decentralized smart contracts platform Injective raised US$40 million in a funding round that was led by Jump Crypto, the company said on Wednesday. BH Digital, the crypto and digital asset unit of investment firm Brevan Howard, also participated in the round. Injective said it will use the funding to boost utility for its native INJ Token, for liquidity for existing decentralized apps built on Injective and to support new dapps on the platform. Injective sets out to resolve scalability issues and bottlenecks that can mar the user experience on decentralized exchanges (DEXs). The company started trading in tokenized stocks of major public companies in 2020.

III. Supervision

Crypto Exchange Bitfinex May Be Facing Criminal Investigation in US

Crypto exchange Bitfinex is facing a possible criminal investigation in the U.S., according to a Department of Justice (DOJ) reply to a Freedom of Information Act (FOIA) request shared on Twitter late Wednesday. The DOJ denied a request for information pertaining to Tether Holdings Limited, its parent company iFinex Inc. and its subsidiaries., which include Bitfinex, citing Exemption 7(A) of the FOIA Guide. The exemption prevents the disclosure of “records or information compiled for law enforcement purposes, but only to the extent that production of such law enforcement records or information … could reasonably be expected to interfere with enforcement proceedings. Bitfinex has faced several investigations from criminal and civil entities in the U.S. amid questions about whether its sister company, stablecoin issuer Tether, was being truthful about the state of its reserves and whether the company itself allowed U.S. persons to trade on its offshore commodity exchange.

Coinbase Exchange Faces SEC Probe Over Crypto Yield, Staking Products

Publicly traded crypto exchange Coinbase Global (COIN) is under investigation by U.S. securities regulators over its token listing processes as well as its staking programs and yield-generating products, the company disclosed in its most recent quarterly report.The disclosure underscores the heat Coinbase faces as a vocal (and closely regulated) U.S. crypto business. It is under pressure on multiple fronts, including its belief that certain tokens are not securities and therefore exempt from the SEC’s purview. The SEC has taken a different stance in its ongoing case against an ex-Coinbase employee accused of insider trading. Still, Coinbase said in the filing it believes these investigations will not “have a material adverse effect” on Coinbase’s financial condition.

Will the Merge Turn Ether Into a Security?

“After the Merge, there will be a strong case that ether will be a security. The token in any proof-of-stake system is likely to be a security,” tweeted Georgetown Law professor Adam Levitin on 23 July. If Levitin is right, and, more importantly, if the U.S. Securities and Exchange Commission (SEC) shares his view, exchanges that list ether (and that would be nearly all of them) would be subject to more onerous regulatory requirements. Like the Bitcoin (BTC) cryptocurrency, Ether has until now been treated as a commodity, outside the SEC’s jurisdiction.

3. Trending project analysis — Tornado Cash

I. What is Tornado Cash?

Tornado Cash is a fully decentralized protocol. People can deposit tokens in Tornado Cash, and withdraw through different addresses. Tornado Cash can mix all the deposited assets with a pool and generate a private key for users to withdraw assets to different addresses. Before it closed, there was 3.2 million ETH in the service.

Many projects’ stolen tokens were laundered through Tornado Cash before it closed, such as Beanstalk Farms, Ronin Network, Nomad and so on.

II. How did Tornado Cash work?

To make a deposit, a user generates a secret hash and sends this hash (called a commitment) along with the deposit amount to the Tornado smart contract. The contract accepts the deposit and adds the commitment to its list of deposits.

In order to make a withdrawal, the user should provide proof that he or she possesses a secret to an unspent commitment from the smart contract’s list of deposits. zkSnark technology allows for that without revealing which exact deposit corresponds to this secret hash. The smart contract will check the proof, and transfer deposited funds to the address specified for withdrawal. An external observer will be unable to determine which deposit this withdrawal stems from.

In order to prevent transactions from being tracked due to obvious values, Tornado Cash only allows users to withdraw a fixed amount each time, such as 1ETH, 10ETH, etc.

To avoid the risk of being tracked online, users can use VPNs, proxies, or Tor browser to hide their IP address.

III. Can a tool be criminalized?

Is it reasonable to ban Tornado Cash? Legally speaking, it would be deemed unreasonable.

From a legal perspective, “whether an individual has the ability to think and judge independently” is a very important criterion. This is why the conviction criteria for minors and mentally ill people are different from those with full capacity for civil conduct. As an inanimate and unconscious object, the tool would be impossible to condemn. For example, if a person kills a person with a knife, would the knife be considered guilty? The answer is of course not. Because the knife has no self-consciousness, it would be impossible to convict the knife.

Secretary of the Treasury for Terrorism and Financial Intelligence Brian E. Nelson said, “Despite public assurances otherwise, Tornado Cash has repeatedly failed to impose effective controls designed to stop it from laundering funds for malicious cyber actors on a regular basis and without basic measures to address its risks. Treasury will continue to aggressively pursue actions against mixers that launder virtual currency for criminals and those who assist them.”

In fact, such a narrative is illogical. Tornado Cash is a fully decentralized, non-custodial protocol. Tornado Cash should not be viewed as an accomplice that will take centrestage in a crime, it is actually a tool in nature.

This is not simply an unreasonable sanction against Tornado Cash, but the control and suppression of decentralization and privacy by the US government system. Should the US government truly wish to secure citizens’ assets, they should work on how to catch hackers, and how to improve the code of projects and protocols to avoid exploitable vulnerabilities.

Ⅳ. Opportunities in the privacy sector

i. Privacy Protocol

The mechanism behind Tornado Cash is in essence simple but efficient and useful, which deems the service the best choice for money launderers. There are few privacy protocols based on the Ethereum Virtual Machine (EVM), and Tornado Cash has three competitors: Typhoon Cash, Typhoon Network, and Cyclone.

Typhoon Cash is a project endorsed by Licheng Huang. It is built on Ethereum and reuses most of Tornado Cash;s code. The TVL for Typhoon Cash is relatively low — only tens of thousands of dollars. The last deposit occurred three months ago, and it was relayed. The service is entirely provided by the project, and there is a very strong risk of a single point of failure; Typhoon Network is built on the Binance Smart Chain (BSC) and reuses most Tornado Cash’s code, and the total lock-up volume is less than US$40,000. And the relay service is entirely provided by the project, so there is a very strong risk of a single point of failure; Cyclone is developed on the basis of Tornado Cash and deployed on Ethereum, Binance Smart Chain, and IoTeX, which requires additional on-chain base currency (such as ETH, BNB, and IOTX) and the governance token CYC for a deposit to be completed, and users are required to use CYC to pay the annonymous pool fee and relay fee. In addition, all relay facilities are provided directly by the project, which once again poses a strong single point of failure risk.

As can be seen from the above projects, Tornado Cash holds an absolute advantage in the area of privacy. But would the closure of Tornado Cash signal a chance for these similar projects? We doubt it. Should these privacy protocols grow due to the shutdown of Tornado Cash, the U.S. government would still impose sanctions to force their closure.

ii. Privacy Blockchain

Monero and Zcash are two major blockchains operating in the blockchain privacy sector. Monero uses Stealth Address and Ring Confidential Transactions (RingCT) technologies, taking into account both anonymity and transfer efficiency. Zcash is the first blockchain to use zk-SNARK (Zero-Knowledge Succinct Non-Interactive Argument of Knowledge). Tornado Cash also uses this technology as a security guarantee for private transactions.

However, the public chain of privacy coins suffers from the impossibility of adding support for smart contracts on the premise of ensuring full transaction privacy. Liquidity also plays an important part. Low liquidity cannot play a privacy role. The number of users and liquidity are also key indicators. At the policy level, if a privacy blockchain is widely used, will it encounter sanctions from the US government? The future is hard to predict; however, we can still pay attention to the primary market and new privacy blockchains in the quest for investment opportunities.

4. Calendar of future popular asset events

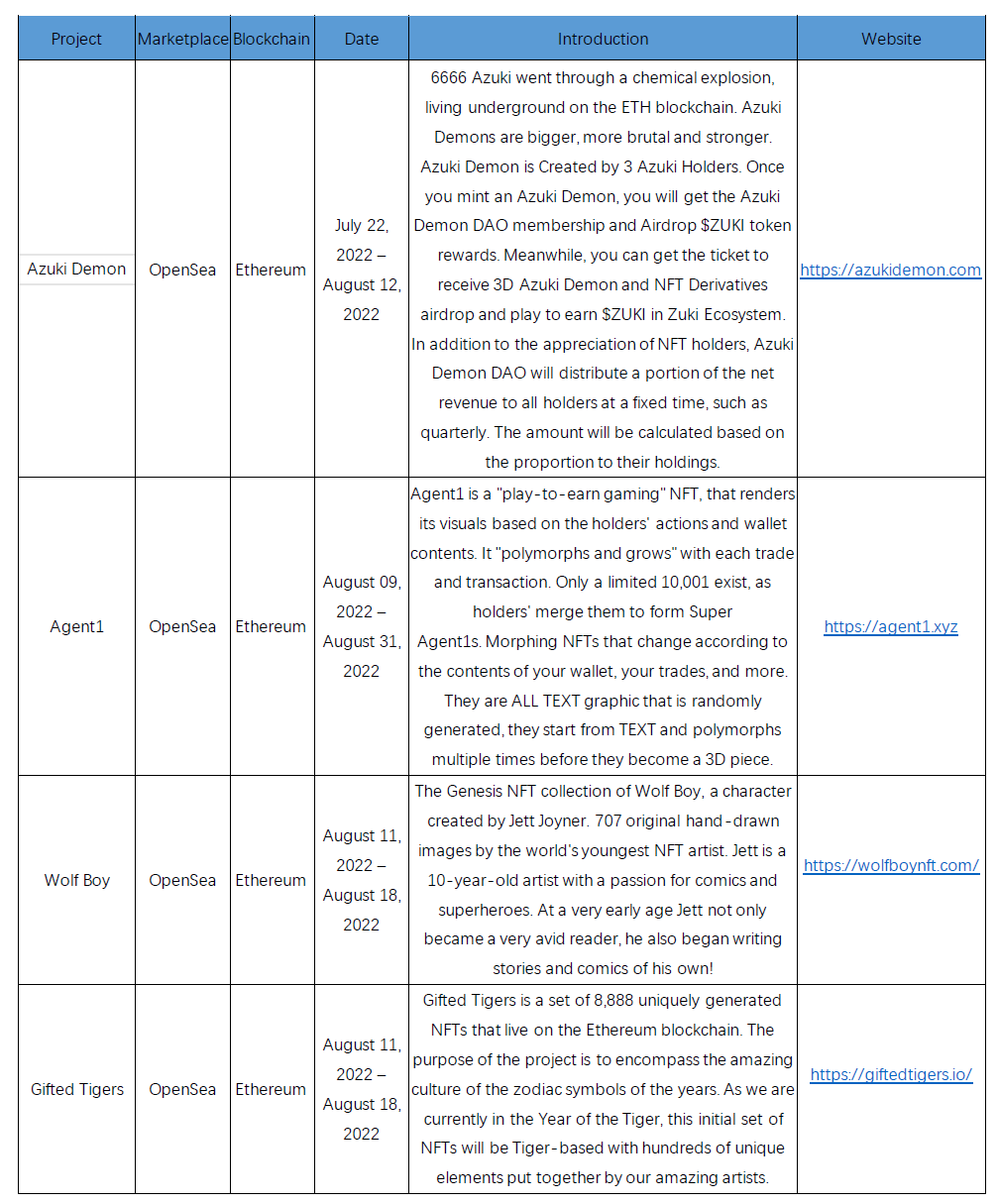

I. NFT mint Calendar

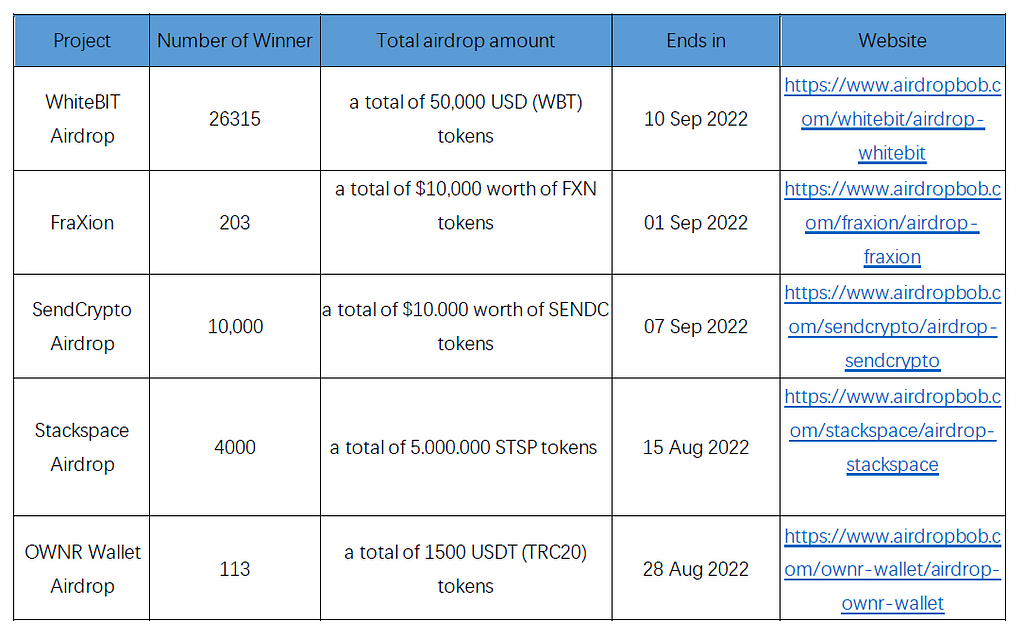

II. Token Airdrops

About Huobi Research Institute

Huobi Blockchain Application Research Institute (referred to as “Huobi Research Institute”) was established in April 2016. Since March 2018, it has been committed to comprehensively expanding the research and exploration of various fields of blockchain. As the research object, the research goal is to accelerate the research and development of blockchain technology, promote the application of blockchain industry, and promote the ecological optimization of the blockchain industry. The main research content includes industry trends, technology paths, application innovations in the blockchain field, Model exploration, etc. Based on the principles of public welfare, rigor and innovation, Huobi Research Institute will carry out extensive and in-depth cooperation with governments, enterprises, universities and other institutions through various forms to build a research platform covering the complete industrial chain of the blockchain. Industry professionals provide a solid theoretical basis and trend judgments to promote the healthy and sustainable development of the entire blockchain industry.

Official website:

Consulting email:

research@huobi.com

Twitter: @Huobi_Research

https://twitter.com/Huobi_Research

Medium: Huobi Research

https://medium.com/huobi-research

Disclaimer

1. The author of this report and his organization do not have any relationship that affects the objectivity, independence, and fairness of the report with other third parties involved in this report.

2. The information and data cited in this report are from compliance channels. The sources of the information and data are considered reliable by the author, and necessary verifications have been made for their authenticity, accuracy and completeness, but the author makes no guarantee for their authenticity, accuracy or completeness.

3. The content of the report is for reference only, and the facts and opinions in the report do not constitute business, investment and other related recommendations. The author does not assume any responsibility for the losses caused by the use of the contents of this report, unless clearly stipulated by laws and regulations. Readers should not only make business and investment decisions based on this report, nor should they lose their ability to make independent judgments based on this report.

4. The information, opinions and inferences contained in this report only reflect the judgments of the researchers on the date of finalizing this report. In the future, based on industry changes and data and information updates, there is the possibility of updates of opinions and judgments.

5. The copyright of this report is only owned by Huobi Blockchain Research Institute. If you need to quote the content of this report, please indicate the source. If you need a large amount of reference, please inform in advance (see “About Huobi Blockchain Research Institute” for contact information) and use it within the allowed scope. Under no circumstances shall this report be quoted, deleted or modified contrary to the original intent.

Can a tool be criminalized? Tornado Cash and other opportunities in the privacy sector was originally published in Huobi Research on Medium, where people are continuing the conversation by highlighting and responding to this story.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.