Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

Summary of the stablecoin market after recent events and what the current trends are in the DeFi space

The last several months have been some of the most volatile for what is supposed to be the most stable part of the DeFi space. Stablecoinshave faced much adversity recently, with the complete collapse of UST in May and the subsequent supply crunch for DAI after several large liquidations on MakerDAO. This has prompted many questions from the community about what the best direction forward for stablecoins is and if the gap left by UST in the decentralized stablecoin field can be filled.

In this post we at IntoTheBlock (ITB) aim to provide a brief summary of the three overarching types of stablecoins currently in the market and their primary risks, highlight new and rumored stables, and finish with some thoughts on the market and current trends in the space.

Stablecoin Pegging Mechanisms

The three dominant types of stablecoins that currently exist in the market can be categorized by the method in which they maintain their peg to a non-crypto native asset. The assets can be either fiat currencies, precious metals, or other assets, but here, we will focus on stables pegged to the dollar. The three pegging mechanisms used are fiat-backed, crypto-backed, and algorithmic. Each of these mechanisms has some inherent risk and therefore below, we will briefly summarize how the dynamics work and their associated risks

Fiat-backed

The simplest to understand of the three mechanisms, fiat-backed stables are backed 1:1 by real-world assets. The largest share is usually backed by the currency that it is pegged to (USD for this example), but can also be backed by other assets such as bonds, treasury bills, and gold. This makes scaling the supply of the stable relatively easy since the liquidity in assets backing the stable are readily available.

The largest exogenous risk for fiat-backed stables is the centralized aspect of the assets and the issuing entity. While there is a debate on if this is a risk or a benefit, the entities that are issuing fiat-backed stables are more centralized than their other stablecoin peers. These entities have control over the supply of the token and are able to freeze assets when it is deemed necessary. Furthermore, as a centralized entity that often holds assets that are regulated by government entities, they face more regulatory pressure that can push them to take action that is detrimental to some of their stablecoin holders.

Crypto-backed

Similar to fiat-backed, these stables are instead backed with crypto native assets. Since most crypto currencies are volatile in nature, the most common mechanism used to assure a 1:1 peg are collateralized debt positions (CDP). The CDP mechanism enables individuals to deposit and lock a crypto asset in exchange for minting stables. Most commonly the CDPs are overcollateralized, meaning that a user can only mint a percentage of the total value of the deposited asset. If the asset depreciates in value near or below the value of the minted stables, the depositor will be at risk of having their CDP liquidated. This ensures that there is always enough collateral to back a 1:1 exchange for the stable.

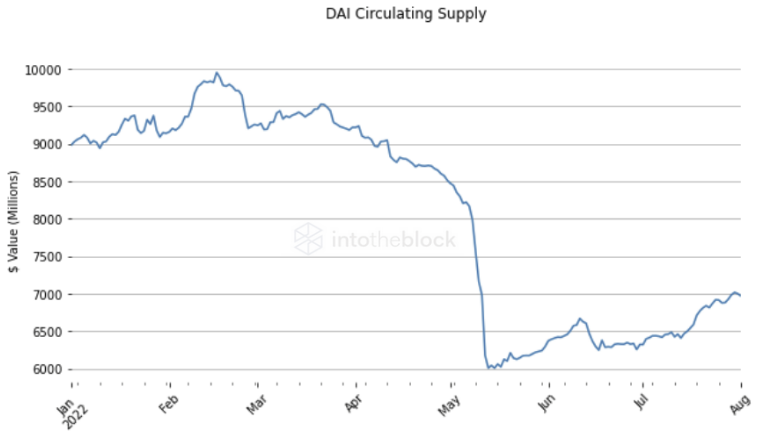

One of the main risks for crypto-backed assets and specifically those with a CDP mechanism is the volatility of the crypto market. If prices drop sharply on the assets being used as collateral in the CDPs, then people need to pay back their loans (thus burning the stable). This can cause a sharp drawdown in the circulating supply of the stablecoin which can cause liquidity problems and high costs for users that want to move their money into or out of that token. If costs are too high to use the stablecoin as a means of exchange between other assets, users will migrate to other tokens. This can inevitably lead to a slow death for the stable as it loses popularity.

DAI in circulation shrinking as large liquidations occur on MakerDAO

Sources: IntoTheBlock, DefiLlama

Algorithmic

As the name suggests, this pegging mechanism uses an algorithm to maintain the stablecoins 1:1 peg to USD. The most popular algorithm used has been the seigniorage model that uses a second token with a floating price to stabilize the stablecoin by providing arbitrage opportunities. This is accomplished by being able to exchange the stable and the second token at a 1:1 USD ratio through a burning process. Therefore, if the stable deviates up or down from the peg, it is profitable to burn one token to redeem the other. Eventually bringing the stablecoin price back to the peg.

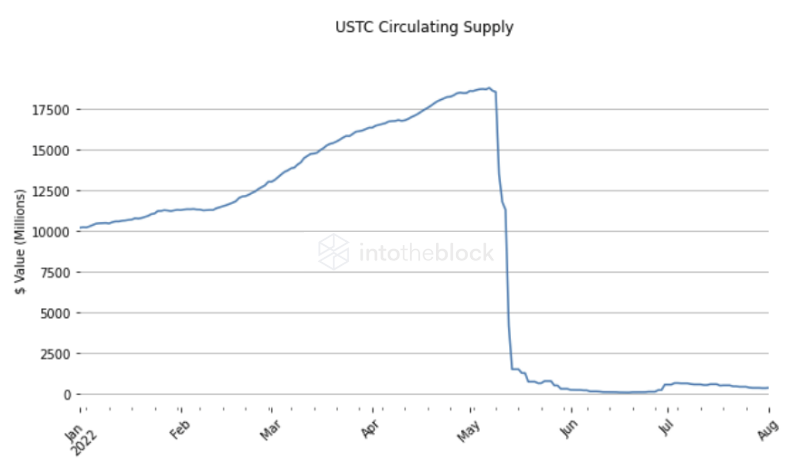

The risk for algorithmic coin is the doomed death spiral that happened to UST. In short, this occurs when the stablecoin depegs and can’t regain the peg. This creates a loop where the people lose confidence in the stablecoin regaining peg and trade for the second token used in the seigniorage model. This can eventually lead to faith being lost in the system and users trading to other tokens outside the system, causing a complete collapse.

The infamous graph of the UST collapse

Sources: IntoTheBlock, DefiLlama

The Current Landscape and New Directions

Strength of stables

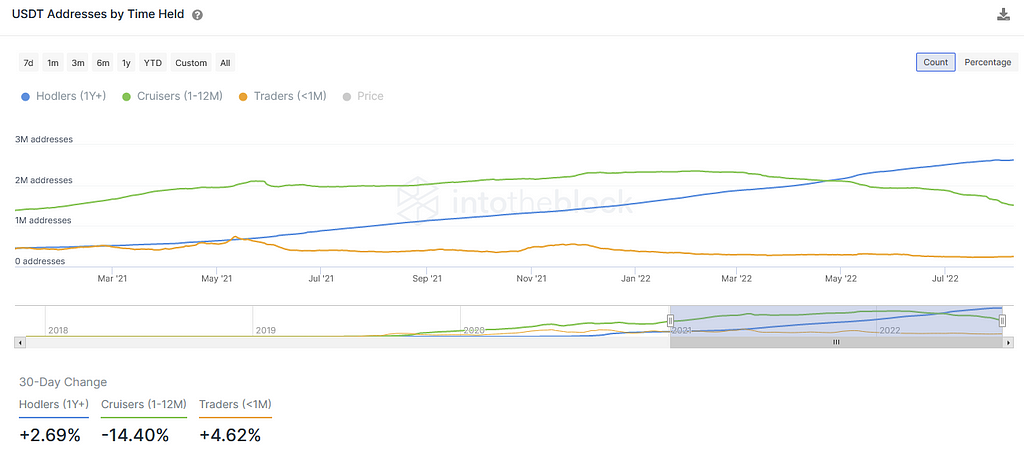

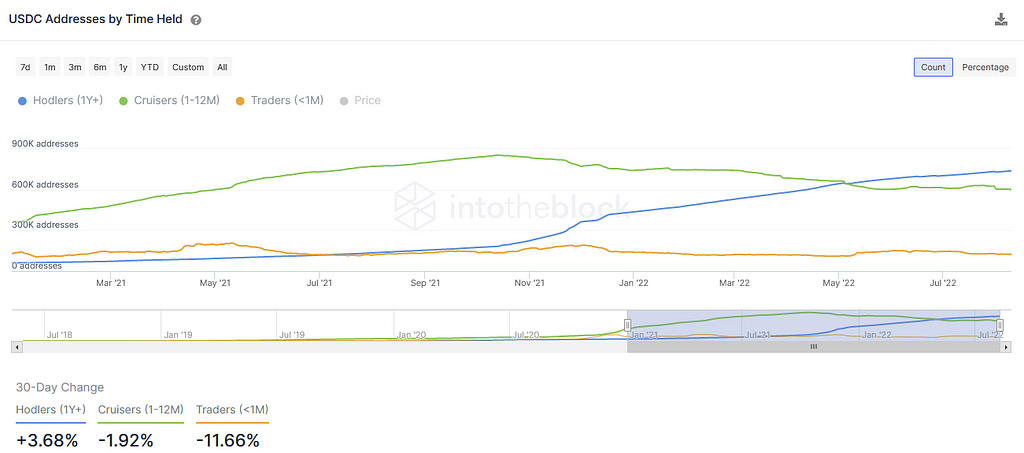

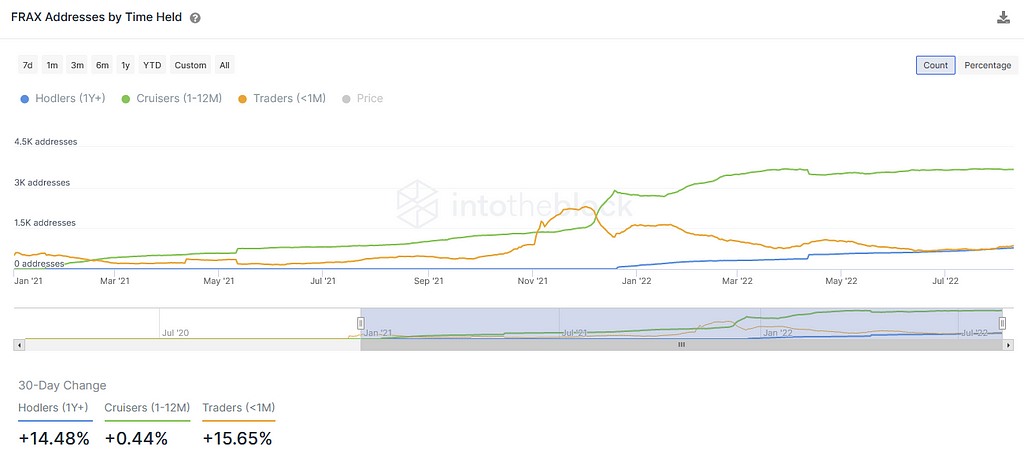

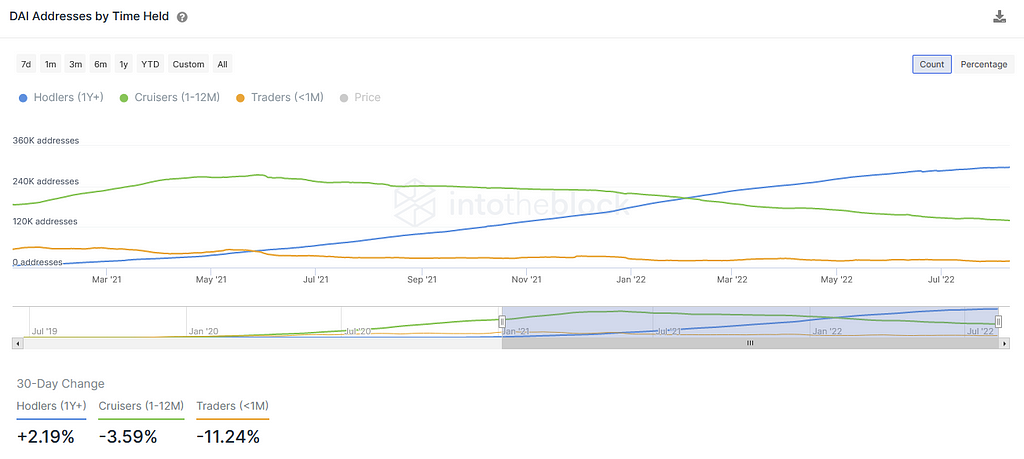

The prevalence of stablecoins has been one of the most important developments in this crypto cycle compared to past cycles. Looking at four of the largest stablecoins (graphs below) with one from each pegging mechanism category, we can see the growth of users since January of last year. Users are not only growing, but also more users (in terms of addresses) are holding onto their stablecoin assets longer.

Via IntoTheBlock USDT Analytics

Via IntoTheBlock USDC Analytics

Via IntoTheBlock FRAX Analytics

Via IntoTheBlock DAI Analytics

The continuing increase in hodler addresses among USDT, USDC, FRAX, and DAI suggests that users are seeing stablecoins as a way to store value rather than transferring assets back to traditional finance (TradFi) markets. This would be a bullish scenario for crypto as it would mean that more assets are remaining on-chain rather than paying on-ramp and off-ramp fees to move between TradFi and DeFi. Users leaving their assets on-chain indicates a higher trust for the space and more conviction that cryptocurrencies will find a permanent place among the financial markets.

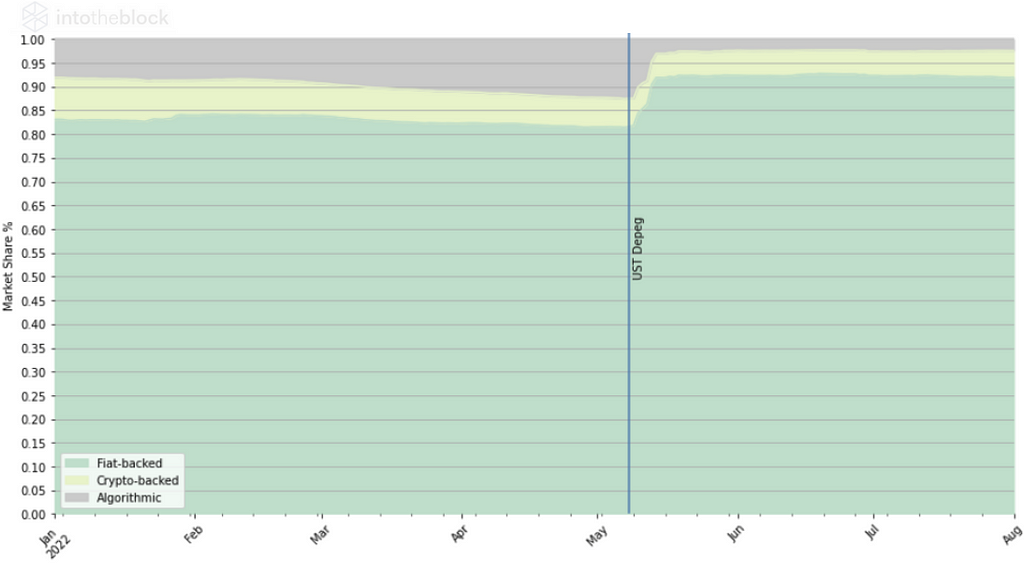

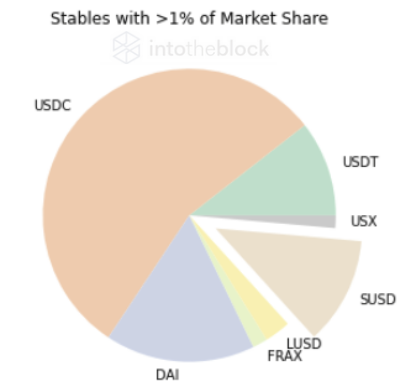

Coming back to Fiat

However, with the turmoil that has happened with stablecoins these past months, it might not be a surprise that users are reverting back to the stables that closest resemble what they are most familiar with in TradFi markets. Fiat-backed stables have increased their market share dominance since May and absorbed nearly all of the UST collapse. Crypto-backed stables even lost market share against their fiat-backed counterparts briefly before bouncing back to near their pre-UST collapse levels. This indicates that when major crisis events occur in crypto, most of the money will move back towards the TradFi side of the asset spectrum. This suggests either that these fiat-backed stables are deemed the least risky of all stablecoins, or that users are looking to be best positioned to exit the crypto space if everything collapses.

Market Share of Stables by Pegging Mechanism

Sources: IntoTheBlock, DefiLlama

New Directions

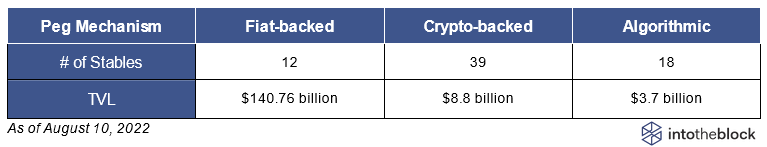

Fiat-backed stables have had a great amount of success while algorithmic stables (aside from FRAX) have retreated to the shadows. Where does this leave new entrants into the market? The table below shows the popular choice is the crypto-backed CDP mechanism. Crypto-backed stables account for nearly 60% of the USD-pegged stables and have the second highest total value locked (TVL) between the three pegging mechanisms.

Sources: IntoTheBlock, DefiLlama

he main reasons for the popularity are pretty clear. The barrier to entry for creating a fiat-backed stable is high. There are hurdles in creating an entity that will be able to buy the assets used, such as government and jurisdictional regulations. This on top of the fact that new entrants into the market will have to go up against the well-established USDC and USDT duopoly, implying a new entrant will need to be well-funded to have a chance of snagging some market share.

Developing and deploying a CDP protocol is far cheaper and more decentralized than the fiat-backed stables. As stated in the risks above for fiat-backed stables, these tokens are inherently more centralized. Entities wanting to create decentralized stablecoins will naturally avoid this direction. Additionally, as per Coingecko the total market cap of the crypto market is $1.21 trillion. Subtracting the $141 billion in stablecoins reported by DefiLlama, still leaves $1.069 trillion billion in crypto assets. This means there is still a lot of untapped potential for CDPs to grow.

The Rise of the CDP Stablecoin

As previously written about, Aave plans to launch GHO, their own stablecoin. This only seems to be the tip of the iceberg as well when it comes to newly launched or potential CDP stablecoins. Interest Protocol has recently launched USDi on the Ethereum mainnet. Additionally, other chains are launching their own versions as well. aUSD has recently been launched on Acala and aims to be the premier stable for the entire dotsama system. Agoric, an upcoming chain in the cosmos ecosystem plans to launch the IST token.

Other Trends

Stables appear to become more chain specific

One trend that might only be temporary during this bear market is that many stablecoins seem to be becoming chain specific. The reasons aren’t entirely clear, but two possibilities could be helping drive this trend. One could be the continuing problem of bridge hacks. With the NOMAD hack still fresh in mind, it appears that some chains are wanting to try and foster chain-native stablecoins to at least allow users another alternative if and when bridges get compromised to and from their chain. The other possible reason we are seeing this is that new chains are the one of the easiest ways for a new stable to establish and grow its TVL and overall stablecoin market share. SUSD from Synthetix is an example of a stablecoin that is only on two chains. on Ethereum mainnet it has less than 0.5% market share, but has made a big push on Optimism and has so far captured 11% of the market and is now the fourth largest stablecoin on the chain.

SUSD’s Market Share on Optimism

Sources: IntoTheBlock, DefiLlama

Variations and Innovations

With a strong desire for stability and security among users, innovation in pegging mechanisms and stablecoins has been slow recently. However, there are some existing stablecoins that have interesting variations to their mechanisms.

- Rebasing Stables: USDi (Interest Protocol), OUSD (Origin Dollar), and USD+ (Overnight Finance) all have a rebasing mechanism incorporated into them. When you deposit other stablecoins (and for some other assets) into the protocol you mint their stablecoin. The protocols then deploy the deposited assets into various yield bearing pools among other protocols and pass on the yield to depositors in the form of more stablecoins. The rebasing stable can further be used in other yield generating ventures, allowing you base (deposited) asset to generate yield twice.

- Hedged Stables: USDL from Lemma Finance is a stable that is hedged by a short position. This works by users depositing other stables (USDC, USDT) or ETH into Lemma Finance to mint USDL. Lemma then trades the assets for ETH and opens a short against the ETH on a decentralized derivatives exchange. Users then can use the USDL as a regular stablecoin or deposit it into their basis trading vault to earn yield.

Conclusions

Observed trends are sending mixed bullish and bearish signals for the future of stables in DeFi. On the bearish side, when a crisis comes, the natural instinct is still to move into the more centralized fiat-backed stables, demonstrating a wariness of their more decentralized counterparts. Liquidity remains fragmented as smaller stablecoins focus growing market shares on only one or two chains. Appetite for innovation appears to be muted with growth being slow for smaller innovative stables and only small variations being introduced on existing pegging mechanisms.

However, the bullish signals are present and appear to be more long-term oriented. Many chains that have not had much access to stables are growing or creating their own. As interconnectivity between these chains and Ethereum grow and the chains evolve, their stables should follow suit. Growth in new stablecoin tokens is leaning towards crypto-backed pegging mechanisms. There is an untapped potential for CDP style stables and there is still lots of room for a “new” DAI to emerge.

The thread between the bullish and bearish signals and the crux of continued growth in the crypto space continues to be the question of how to move assets securely between chains and L2s. Bridges continue to be the weak point, but a secure method is needed to make the existing fragmented liquidity whole.

The Present State of Stablecoins in DeFi in 2022 was originally published in IntoTheBlock on Medium, where people are continuing the conversation by highlighting and responding to this story.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.