Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

Aptos — A new layer 1 blockchain with excellent performance, team, and investors

Authored by Derrick Chen, Kou Jer Shun, Lyu Wenze, Researchers at Huobi Research Institute

Abstract

This week, we focus on the following events: 1) Facebook parent Meta loses US$2.8 billion on Metaverse division in Q2; 2) Cybersecurity protocol Naoris Raises US$11.5M to build decentralized Proof-of-Security consensus mechanism; 3) UK Law Commission sees crypto as a new type of property;

___________________________________________________________________

Project Analysis: Aptos has attracted a lot of attention thanks to its massive funding round and star investor lineup. Although the mainnet has yet to be launched, Aptos has attracted many developers. We analyze the performance of Aptos, the programming language Move, and do performance comparison with other public chains. Finally, we also analyze some projects currently under development on the Aptos devnet.

1. Industry overview

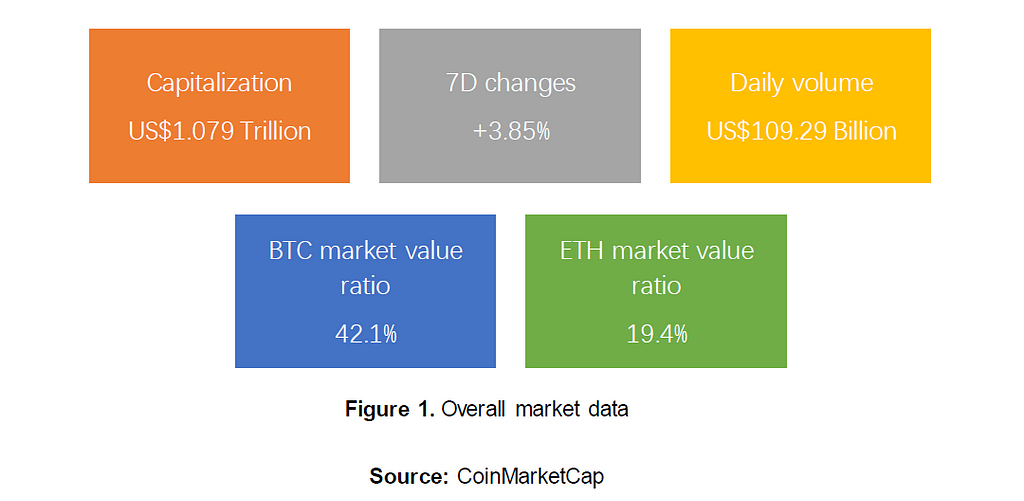

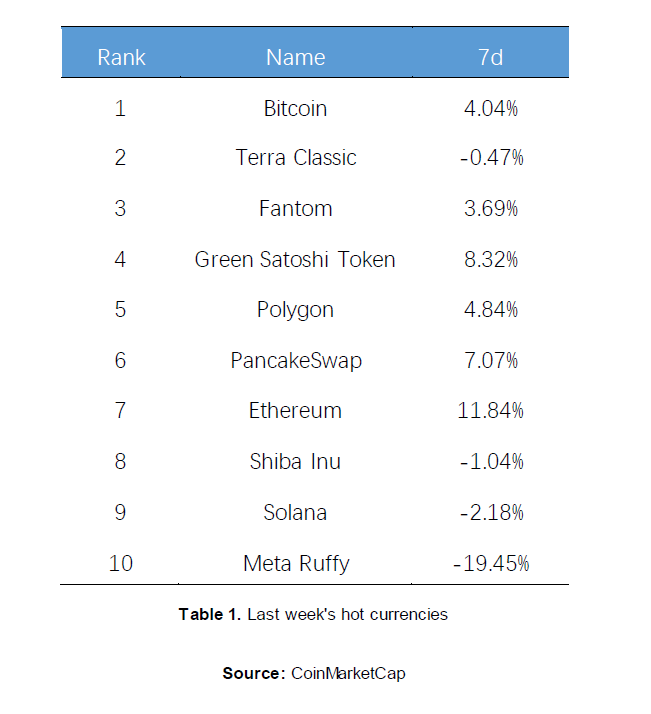

I. Overall market trend

The global cryptocurrency market cap is currently standing at around US$1.079 trillion. Bitcoin (BTC), while remaining steady at around 41% of market share, has risen above US$23,000 over the week. While most of tokens this week took a hit from the interest rate rise from the Fed, market expectations allowed the market to rebound quickly. Meanwhile, Ethereum (ETH), the second largest cryptocurrency, has also risen with BTC and is currently trading at US$1,723. Terra Classic (LUNC) and Green Satoshi Token (GST, the one on SOL chain) are currently priced at U$0.0001004 and US$0.05807 respectively.

Within three days of the Fed announcing the raise in interest rates, the market has rebounded back to its original position, with even a small-scale increase. This outstanding crypto market performance has revealed the market’s full expectation of the Fed’s behavior; so the rise of interest rate reinforced confidence in crypto as a safe haven asset.

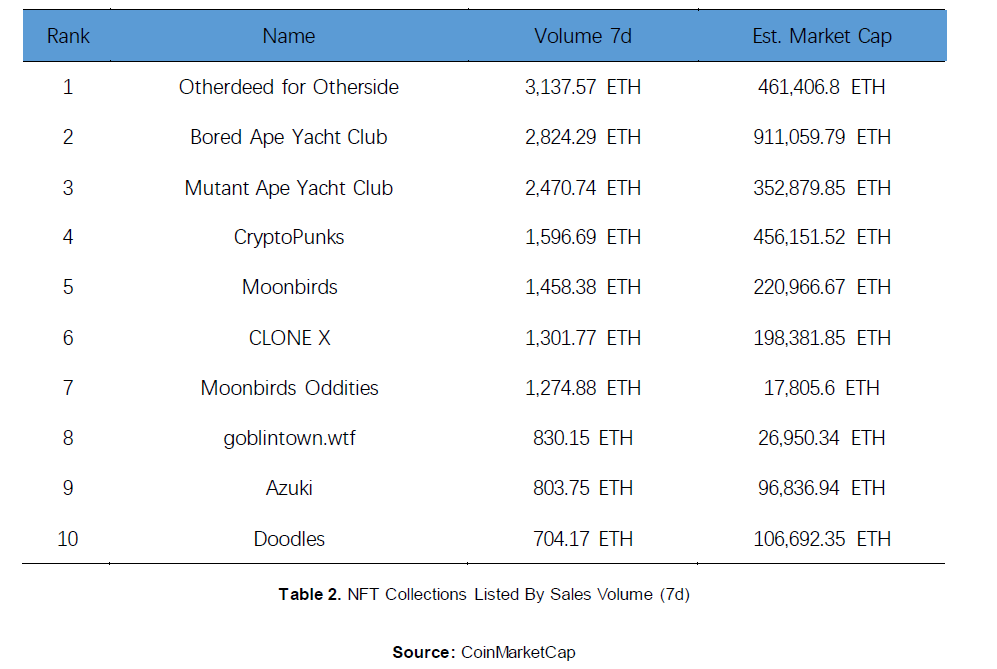

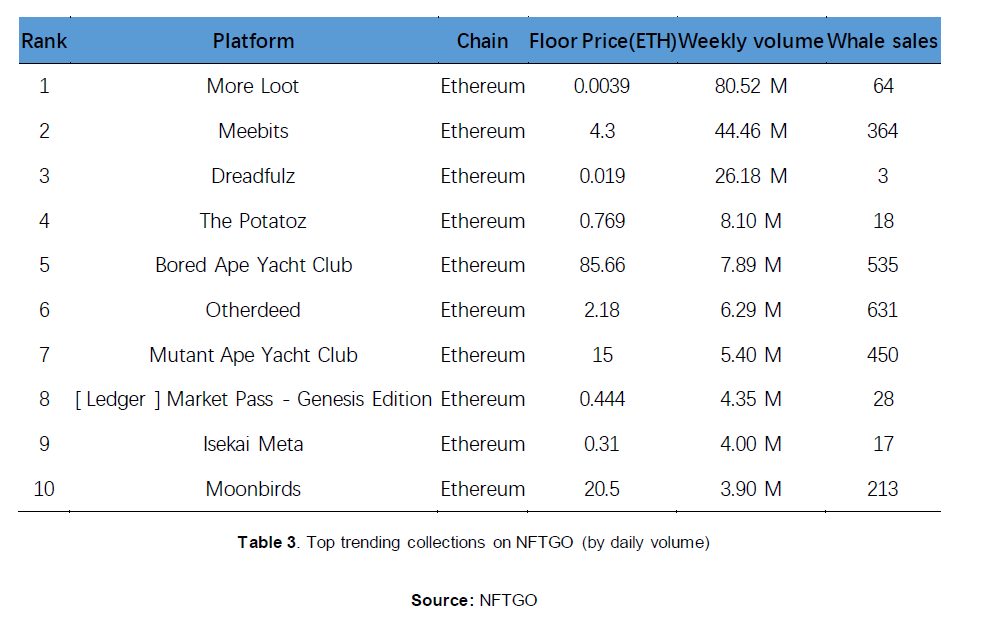

II.NFT

From the data perspective, the NFT market last week was monotonous. With very few of the top collections changing more than 10% in price, most of the top collections experienced little change below 1% in floor price and below 10% in market cap. Most collections experienced a small rise; while some of the brands that are still new to outsiders like Proof Collective enjoyed a rise of more than 10%. Overall, the NFT market this week was still dominated by old-money-ish brands and we witnessed few changes.

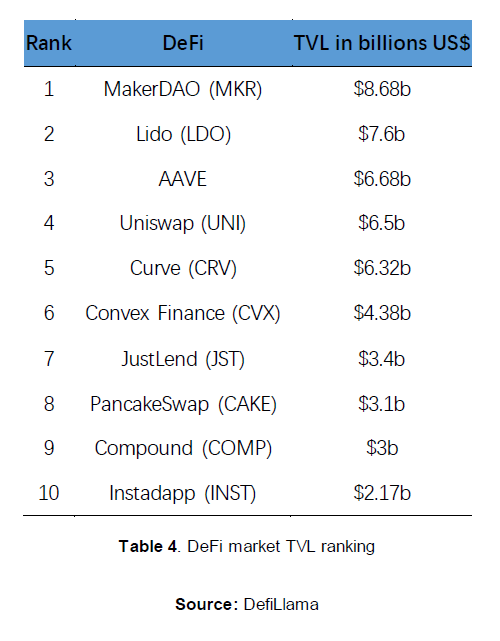

III.DeFi

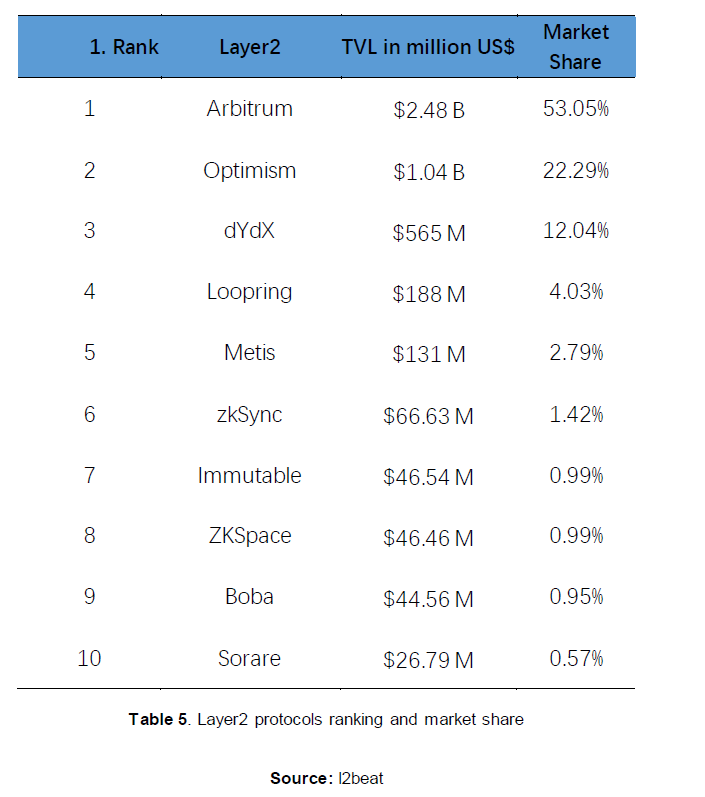

IV.Layer 2

2. Market news

I. Industry news

Facebook Parent Meta Loses US$2.8B on Metaverse Division in Q2

According to Meta’s earnings report released Wednesday, Meta posted a second-quarter loss of US$2.81 billion in its Facebook Reality Labs (FRL) division, which comprises its augmented and virtual reality operators. In 2021, Meta reported a loss of US$10.2 billion on revenue of US$2.3 billion for FRL. However, Mark Zuckerberg says Meta is more focused on its long-term metaverse and reels growth and believes that developing such metaverse plarforms could unlock hundreds of billions or even trillions in revenue over time.

Ethereum’s Mainnet Tenth ‘Shadow Fork’ Goes Live Ahead of September Merge

On July 26, Ethereum successfully completed its tenth “shadow fork”, 26 hours earlier than expected as the network continues to run tests ahead of the much anticipared shift from the energy-intensive Proof of Work (PoW) to the more sustainable Proof of Stake (PoS). This shadow fork brings the project one step closer to the Ethereum’s mainnet upgrade in September. The third and final testnet merge, Goerli, is expected to happen on August 10.

Harmony Proposes Issuing ONE Tokens to Reimburse Victims of US$100M Hack

The horizon bridge incident that occurred in June resulted in the loss of US$99,340,030 worth of digital assets across approximately 65,000 wallets and 14 different asset types. As such, developers behind Harmony are proposing to issue ONE tokens to cover losses. The stolen tokens caused contagion damage in the form of uncollectible loans across a handful of DeFi landing protocols and developers are fearful that these DeFi lending protocols will choose to drop support for Harmony. Thus, the proposal to mint 86 million ONE tokens as part of the reimbursement plan to affected DeFi protocols was born. Users are concerned that the increased token supply will negatively affect ONE’s price.

II. Investment and Financing

Cybersecurity Protocol Naoris Raises US$11.5M to Build Decentralized Proof-of-Security Consensus Mechanism

Naoris raised US$11.5 million in an equity and token sale with investors from Tim Drapers’s Draper Associates, Holt Xchange and others. According to the CEO and founder David Carvalho, the funds raised will be used to expand and scale its operations, creating a decentralized proof-of-security consensus mechanism by the end of 2022. Carvalho, who has worked in cybersecurity for the past two decades, is building a multichain layer 2 and layer 3 protocol, building on security and decentralization. His team is addressing the “points of failure” for Web2 and Web3, helping cybersecurity pivot to blockchain technology.

Alameda Research Leads $3.25M Seed Round for Trustless Media

Trustless Media is a Web3 media company that has recently raised US$3.25 million in a seed round funding that was led by Sam Bankman-Fried’s Alameda Research. Trustless works with different content creators and organizations to help tokenize their content using NFTs. They can use the NFT model to crowdfund productions with holders who receive access to watch the token-gated content and who can participate in productions with on-chain voting. Although some celebrities and companies have begun testing this new business model, the NFT television landscape is still in its infancy.

Unstoppable Domains Hits Unicorn Status With US$65M Series A

Unstoppable Domains is a Web3 digital identity service provider that has recently raised US$65 million in its Series A funding round led by Pantera Capital. Some other investors include CoinGecko, Polygon and CoinDCX. This fundraising has given the firm “unicorn” status and it plans to use the funds to grow its partnerships with Web3 applications and improve its product. The firm provides domains in the form of NFTs in order to give users a digital identity compatible with 150 different Web3 applications. There are currently already 2.5 million domains registered.

III. Supervision

UK Law Commisions Sees Crypto As a New type of Property

The U.K. Law Commision is a statutory independent body tasked with reviewing and updating the law. It wants to extend the country’s property laws to cover crypto as well as NFTs according to a consultation paper published on Thursday. The commission said that this proposal is aimed at helping the government achieve its goal of turning the country into a global crypto hub and that the proposed reforms could make it easier for crypto investors to claim losses in hacks or scams. The paper also mentions that the existing property laws are insufficient to accommodate digital assets due to the many different features and unique qualities. Hence, the law commission is proposing to create a new category called ‘data objects’ that would include anything composed of data in an electronic format.

Stablecoin Issuers May Have to Deal With The Federal Reserve As the Chief Oversight Agency according to a Bill Being Developed in the U.S. House of Representatives

While the industry is desperate for rules and supervision to settle the uncertainties that keep most investors on the sidelines, stablecoin firms would be policed by an agency that devotes much of its time trying to keep Wall Street banks on a short leash. Lawmakers in the House Financial Services Committee have found common ground on a bipartisan effort to establish stablecoin oversight in the U.S. It could mark a first step toward crypto regulation, though a few points remain to be hashed out. Committee leaders initially thought they’d be set to put out the bill this week, but a last-minute intervention from Treasury Secretary Janet Yellen may have delayed it until after the August congressional recess.

3. Trending project analysis — — Aptos

What is Aptos?

Aptos, based in Palo Alto, California, is a public blockchain that aims to solve reliability, scalability, and usability issues that have plagued existing Layer 1s, while possessing security features lacking in EVM-based blockchains. Aptos uses Move, a Rust-based programming language created for Diem, a now abandoned blockchain project by Meta.

The Aptos network can achieve over 130,000 transactions per second thanks to its parallel execution engine (Block-STM). This high throughput naturally results in low transaction costs for users on the network.

MOVE

Move is based on the Rust programming language, which is a well-known and supported programming language. Move was designed for the Diem blockchain by Facebook, which serves the function of implementing smart contracts and custom transactions. The origins of Move largely arise from known problems in the existing blockchain programming languages such as Solidity, which has security and verifiability issues. Any asset in Move can be represented by or stored within resources while scarcity is enforced by default since structs cannot be duplicated.

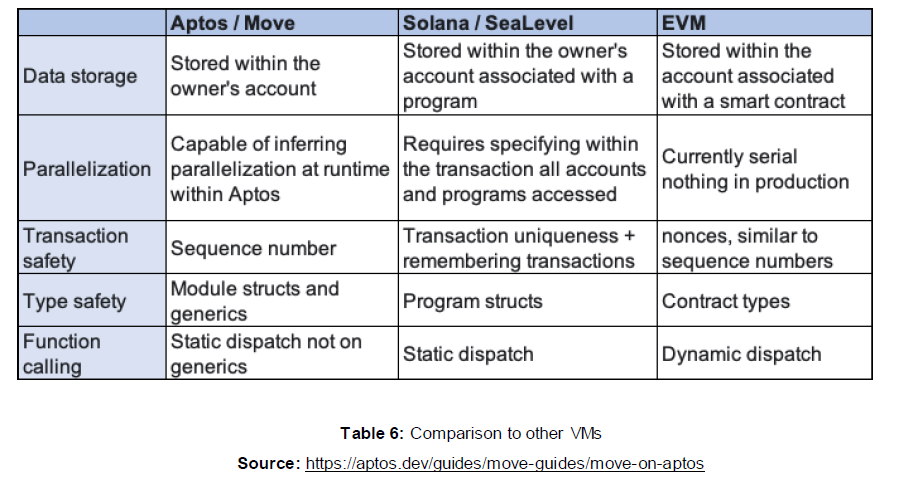

Comparison to other VMs

Team

Aptos is founded by Aptos Labs and co-founded by Mo Shaikh and Avery Ching. Mo Shaikh, Avery Ching, and a few other team members worked together at Meta on the Diem blockchain project previously. They founded Aptos Labs together to continue building on the technology they had originally developed for Diem. Austin(@austinvirts), the former head of marketing at Solana, is currently working as director of the ecosystem at Aptos Labs. The Aptos Team also has many experienced designers, analysts, engineers, and so on. This professional team has the ability to spearhead Aptos’s development.

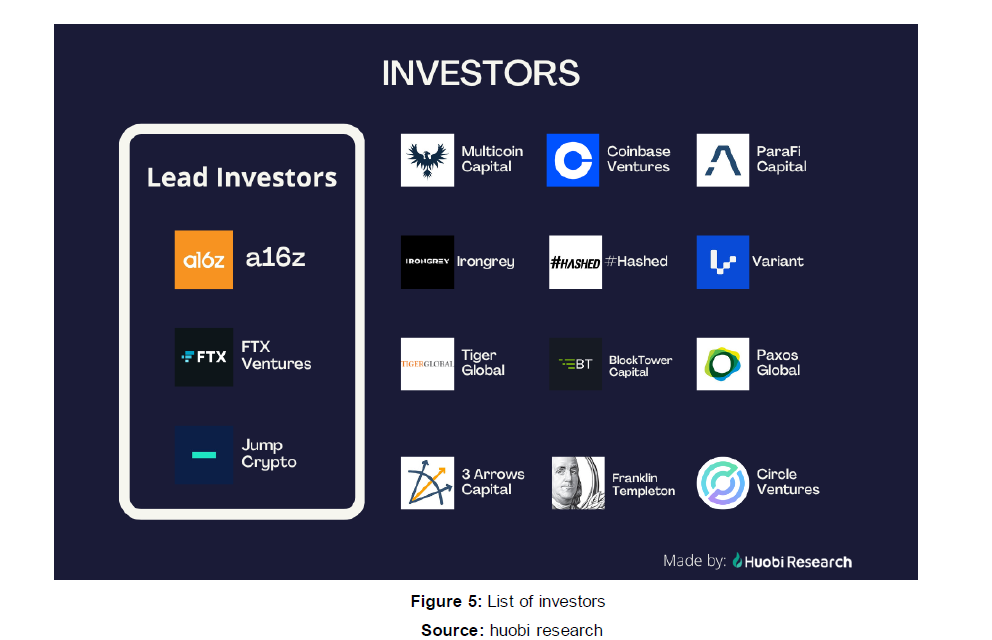

Aptos Investors & Founding Round

Seed Round

Announced Date: Mar 15, 2022

Money Raised: $200M

Pre-Money Valuation: $800M

Lead Investor: a16z

Famous Investors: Multicion capital, Kathryn Haun, Three Arrows Capital, ParaFi Capital, IRONGREY, #Hashed, Variant, Tiger Global, BlockTower Capital, FTX Ventures, Paxos Global, and Coinbase Ventures.

Series A

Announced Date: Jul 25, 2022

Money Raised: $150M

Pre-Money Valuation: $1.9B

Lead Investors: FTX Ventures & Jump Crypto

Famous Investors: Apollo, Griffin Gaming Partners, Franklin Templeton, Circle Ventures, Superscrypt founded by Temasek, and continued support from a16z crypto and Multicoin.

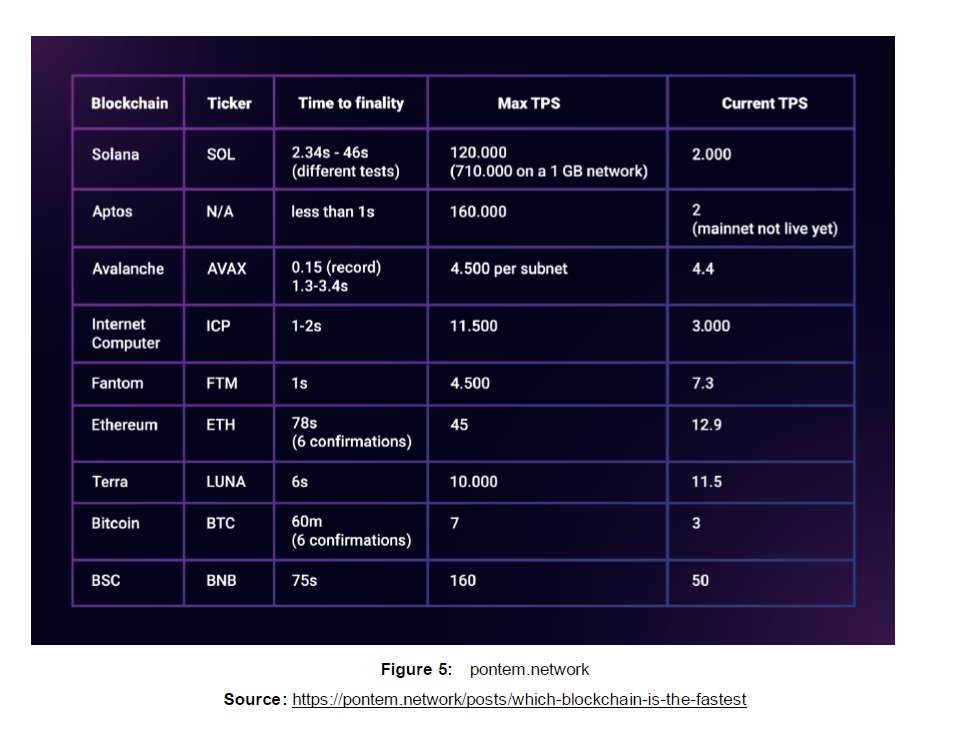

Aptos speed

How does one define the speed of a blockchain? It depends on two aspects: transactions per second (TPS) and time to finality (TTF). For blockchains, transactions per second (TPS) refers to the number of transactions that a network is capable of processing each second.

Here is the equation of TPS:

TPS = (number of tx in a block)/(block time in seconds)

Finality is the assurance or guarantees that cryptocurrency transactions cannot be altered, reversed, or canceled after they are completed. The latency level of a blockchain will ultimately affect the chain’s finality rate. For users, the definition of a blockchain’s speed is time to finality (TTF), the amount of time needed to fully confirm a transaction.

Let’s compare the TPS and TTF between some blockchains:

From these blockchains, Aptos has the shortest time to finality and a very high TPS. The TPS for Aptos can reach at least 130,00, because of the highly efficient, multi-threaded, in-memory parallel execution engine. Aptos blockchain has sub-second finality, which means that a transaction will take less than 1 second to be fully confirmed. Such a fast speed can give users a better experience than other famous blockchains.

Ecosystem Projects

Although the mainnet of Aptos has not been launched, there are many projects have joined the Aptos.

1. Econia

The Econia is a protocol that lets anyone in the world trade a digital asset with anyone else in the world, at whichever price they want. More specifically, Econia is a central limit order book (CLOB), a fundamental financial tool utilized by financial institutions like stock markets, except unlike the New York Stock Exchange or the NASDAQ, Econia is open-source and decentralized.

This version 1 minimum viable prototype (v1 MVP) introduces a key innovation for on-chain trading, Econia’s atomic matching engine, which settles market orders with finality during the transaction in which they were placed.

2. Martian Wallet

The Martian wallet is a crypto wallet that can be used to manage digital assets and access decentralized applications on the Aptos blockchain. Martian wallet is currently available as a Chrome extension and soon will be available as an iOS app.

At its core, Martian wallet works by creating and managing private keys on behalf of its users. These keys can then be used within Martian wallet to store funds and sign transactions.

To interact with web applications, the Martian wallet extension injects an Aptos object into the JavaScript context of every site the user visits. A given web app may then interact with Martian wallet, and ask for the user’s permission to perform transactions, through this injected object.

3. Liquidswap Dex

Liquidswap is the first AMM for Aptos — the most performant & reliable L1 built with Move VM. Liquidswap is a product developed by Pontem, which is a studio working toward global financial inclusion powered by blockchains. Pontem team is going to first build the next generation of Dapps with streamlined experiences enabled by Aptos and Move. Starting with the key foundational protocol of an AMM for correlated and uncorrelated pairs. This will enable liquidity and discoverability for protocol tokens in the Aptos ecosystem. Liquidswap is the uniswap on Aptos.

4. Aptos Name Service

The Aptos Name Service is a smart contract that maps a name to an Aptos address. Claiming a name mints you a special NFT Token that gives you the sole power to edit the address of that name. That Token is composable and can be bought, sold, and traded as you see fit. It is a decentralized, composable identity layer of Aptos. ANS is the ENS on Aptos.

5. Topaz

Topaz is an NFT marketplace built on the powerful Aptos blockchain, with a focus on safety and scalability. Topaz can be viewed as the OpenSea of Aptos.

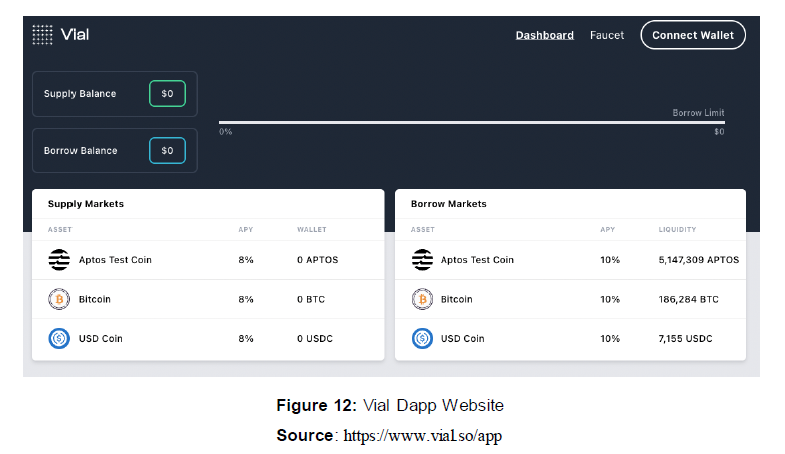

6. Vial

Vial is a pooled interest rate protocol that allows users to lend or borrow assets on Aptos. Interest rates are determined algorithmically based on pool utilization: the ratio of borrowed to supplied assets. Vial is the AAVE on Aptos.

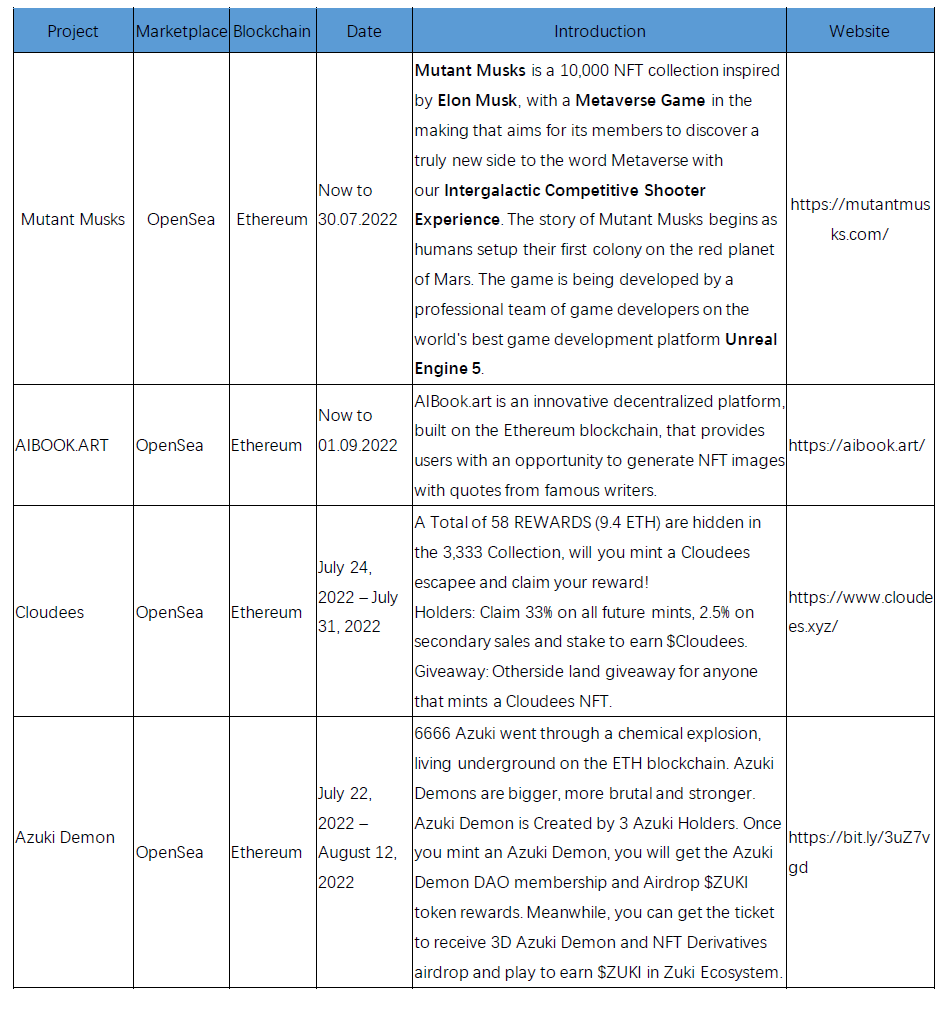

4.Calendar of future popular asset events

I. NTF mint Calendar

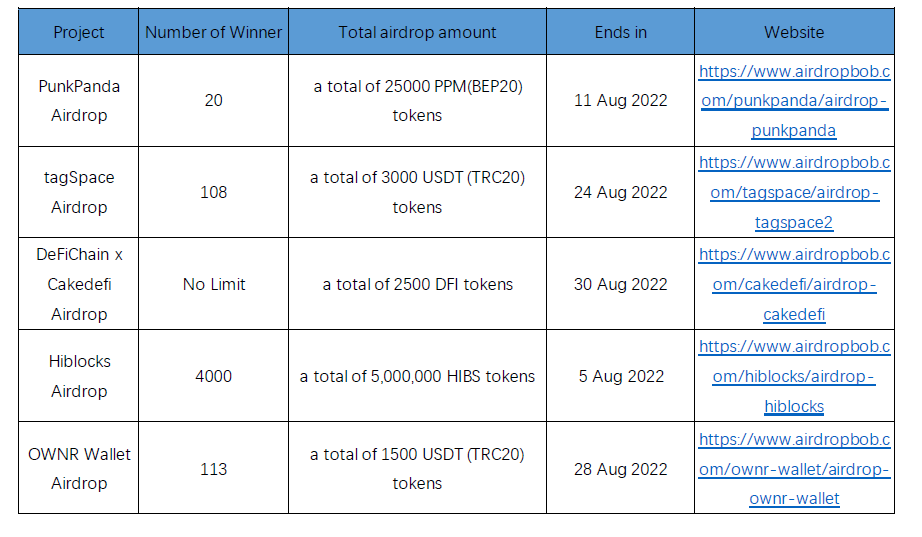

II. Token Airdrops

About Huobi Research Institute

Huobi Blockchain Application Research Institute (referred to as “Huobi Research Institute”) was established in April 2016. Since March 2018, it has been committed to comprehensively expanding the research and exploration of various fields of blockchain. As the research object, the research goal is to accelerate the research and development of blockchain technology, promote the application of blockchain industry, and promote the ecological optimization of the blockchain industry. The main research content includes industry trends, technology paths, application innovations in the blockchain field, Model exploration, etc. Based on the principles of public welfare, rigor and innovation, Huobi Research Institute will carry out extensive and in-depth cooperation with governments, enterprises, universities and other institutions through various forms to build a research platform covering the complete industrial chain of the blockchain. Industry professionals provide a solid theoretical basis and trend judgments to promote the healthy and sustainable development of the entire blockchain industry.

Official website:

Consulting email:

research@huobi.com

Twitter: @Huobi_Research

https://twitter.com/Huobi_Research

Medium: Huobi Research

https://medium.com/huobi-research

Disclaimer

1. The author of this report and his organization do not have any relationship that affects the objectivity, independence, and fairness of the report with other third parties involved in this report.

2. The information and data cited in this report are from compliance channels. The sources of the information and data are considered reliable by the author, and necessary verifications have been made for their authenticity, accuracy and completeness, but the author makes no guarantee for their authenticity, accuracy or completeness.

3. The content of the report is for reference only, and the facts and opinions in the report do not constitute business, investment and other related recommendations. The author does not assume any responsibility for the losses caused by the use of the contents of this report, unless clearly stipulated by laws and regulations. Readers should not only make business and investment decisions based on this report, nor should they lose their ability to make independent judgments based on this report.

4. The information, opinions and inferences contained in this report only reflect the judgments of the researchers on the date of finalizing this report. In the future, based on industry changes and data and information updates, there is the possibility of updates of opinions and judgments.

5. The copyright of this report is only owned by Huobi Blockchain Research Institute. If you need to quote the content of this report, please indicate the source. If you need a large amount of reference, please inform in advance (see “About Huobi Blockchain Research Institute” for contact information) and use it within the allowed scope. Under no circumstances shall this report be quoted, deleted or modified contrary to the original intent.

Aptos — A new layer 1 blockchain with excellent performance, team, and investors was originally published in Huobi Research on Medium, where people are continuing the conversation by highlighting and responding to this story.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.