Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

In 2017, Initial Coin Offerings (ICOs) dominated the cryptocurrency landscape with many crowdfunding projects raising millions of dollars in investor funding. The hype and buzz around ICOs was feverish as developers and investors alike sought to take advantage of the hype. ICOs were touted as a more democratic means of project funding that enabled blockchain-based enterprises to be established without the hassle associated with venture capitalists and banks. However, as ICOs became more popular, fraudulent individuals began to exploit the system. Pump and dump schemes, Ponzi schemes, and a number of ICO scams began to emerge. All of this resulted in a decrease in investor confidence and an increase in government regulations.

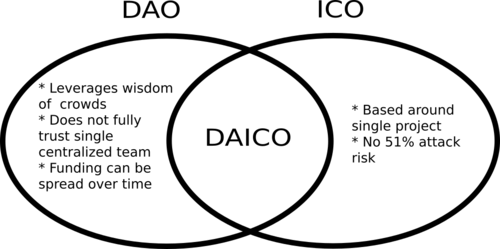

In a bid to stem the tide of fraudsters hijacking the ICO space and negatively affecting the fidelity of the crypto market, a new crowdfunding model has been created. Vitalik Buterin, the creator of the Ethereum blockchain posted an article on the Ethereum Research Forum detailing a new approach to cryptocurrency crowdfunding. The post titled, “Explanation of DAICOs” described a new crowdfunding protocol for blockchain-based enterprises that would combine the features of the Decentralized Autonomous Organization (DAO) and the ICO. According to Buterin, this new model vastly improves upon the shortcomings of the ICO model while at the same time not being too complex.

A Look at the DAICO Model

During an ICO, the blockchain-based enterprise creates a smart contract for the ICO process that governs the collection of investor funds. This contract doesn’t control the utilization of funds or the contribution of investors to the overall actualization of the project. The contract terminates after the fundraising is over and investors wait for the tokens to become listed on exchanges so that they can dump them or trade them. In the DAICO model, this unhealthy trend is done away with completely. In the DAICO, the enterprise and the investors are part of an integrated team with both sides answerable to each other in a fairly balanced digital organizational framework.

The process of the DAICO crowdfunding begins with the creation of a DAICO contract which is designed by the development team of the blockchain-based enterprise. Once created, this contract is published and the DAICO can begin. The DAICO contract serves two major roles and they are:

1. Governing the crowdfunding process

2. Controlling the utilization of the funds raised during the crowdfunding process.

It is this second function that the DAICO contract surpasses most ICO smart contracts. DAICO contracts continue to be operational after the crowdfunding, whereas ICO contracts are only written to govern the crowdfunding process alone. These two main functions of the DAICO contract are based on the two parts of the contract which are the CONTRIBUTION MODE and the TAP MODE.

Image Credit: https://ethresear.ch/t/explanation-of-daicos/465

The Contribution Mode

This mode contains all the information about the mechanisms by which the crowdfunding process will be carried out. Exact specifics concerning how investors will put up equity in the form of fiat money or ether in exchange for the cryptocurrency token of the project are domiciled in this portion of the contract. Different types of contribution modes can be specified depending on the preference of the people in charge of the blockchain-based project. Some of the options available include whitelist, Dutch auction, capped, and uncapped token sales. When the contribution mode portion of the DAICO contract is terminated, an investor will no longer be able to put up equity in the project. The termination of the contribution mode is the signal for the automatic activation of the tap mode. In addition, the tokens become tradable once the contribution mode is terminated and the tap mode is activated.

The Tap Mode

If the contribution mode can be likened to the ICO construct, then the tap mode is the DAO half of the DAICO aggregate. The tap mode of the DAICO contract contains all of the modalities that guide the utilization of investor funds. Investors who are now token holders and the developers of the project enter into a DAO agreement. The investors can vote on how much money is released to the development team. Investors can also vote on which aspect of the project actualization will be given priority by the development team.

The architecture of the tap mode doesn’t just give all the power to investors as the project developers can also prevent the deliberate sabotaging of the project. This is done by reducing the tap amount or deactivating the DAICO and starting a new one.

There are two distinct voting categories contained in the tap mode and they are:

1. Tap Initiation

The token holders (investors) initiate a tap to activate and approve the release of funds to the development team. This then enables the team to work on whatever portion of the project implementation process that has been voted on by the DAICO.

2. DAICO Contract Deactivation

If either party i.e., investors or developers are not happy with the progress of the project development, they can vote to deactivate the DAICO. Whatever unspent ether is left will be returned to the investors based on their proportional investment in the DAICO.

Benefits of the DAICO Model

The ICO model definitely has a number of flaws that undermine what the model hopes to achieve. The DAICO is a fresh take on the concept of decentralized crowdfunding for projects that aims to address these flaws. The following are some of the potential benefits of the DAICO model.

1. Better utilization of investor funds and improved relationship between investors and developers.

2. Elimination of the trend towards centralization of the cryptocurrency crowdfunding process.

3. Improved security for blockchain-based startups during and after crowdfunding.

If the DAICO turns out to be the solution for the cryptocurrency crowdfunding conundrum, then it will be a welcome development. Such a model has the potential to sanitize the cryptocurrency crowdfunding process and improve the confidence of investors in blockchain-based startups.

Keen to find out more about FundYourselfNow? Join our crowdfunding revolution conversation on our Telegram group, or follow us on Twitter.

Overview of the DAICO Crowdfunding Model was originally published in Hacker Noon on Medium, where people are continuing the conversation by highlighting and responding to this story.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.