Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

Venture capital can often feel riddled with opaqueness, and seems to hold the throne as one the most illiquid asset classes available to investors. However, the proliferation of token sales has brought about an interesting discussion regarding the possible effects on the traditional VC model, which has essentially remained untouched since its inception.

Hence, it would be interesting to lay out a balanced overview of the benefits and drawbacks of tokenizing a VC fund, considered mainly from the perspective of LPs and fund managers.

A small number of funds have already turned to crypto tokens as a means of alleviating some of the shortcomings of an otherwise dynamic and exciting practice. Most recently, the 22nd batch from 500 Startups announced the independently operated 22X Fund, which will offer access to a portfolio of 30 highly vetted startups, through the purchase of a single token.

Historically, the typical fund lifecycle is around 10 years with common provisions against transference of LP interests. This means capital can be locked up for the entire life of a fund. The issuance of an equity based security token could provide a degree of liquidity, and thereby attract more investors to a fund.

Additionally, the current regulatory environment may allow for greater inclusivity by allowing a new demographic of investors to gain exposure to the asset class, drawing on the same principle as crowdfunding sites (e.g SeedInvest) and publicly listed funds (e.g Social Capital, Draper Esprit).

However, crowdfunding sites have proved rather disappointing in terms of dealflow, while IPO-ing a fund is often highly capital intensive. This means money could currently be left on the table by denying some investors participation in funds with access to top tier startups.

Despite the possible benefits of tokenization, many firms may shy away due to the backlash over phony token projects and overall volatility of crypto markets in the past year.

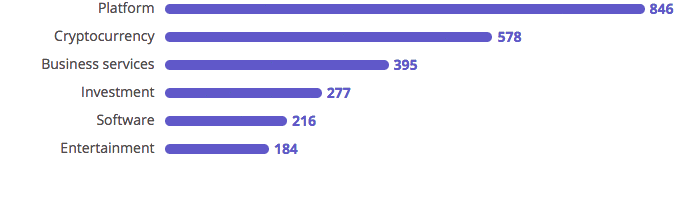

Categories across 2017’s cluster of ICOs, showing 277 fundraisings for investment purposes. Source: ICOBench.com

Categories across 2017’s cluster of ICOs, showing 277 fundraisings for investment purposes. Source: ICOBench.com

I do believe this is a real cause for skepticism and would even argue that some “pump and dump” ICOs have hijacked the functional progress of tokens, so far.

However, a number of platforms have been introduced recently, which focus on security and regulatory compliance (for example, Bancor and tZero). This could provide assurance to firms willing to be the forerunners.

It may be argued that allowing liquidity can also be disadvantageous, as there will be a lack of insulation against external market forces that can require an LP to cash out early. This is an important function of existing PE / VC models, which could be lost through the introduction of full liquidity.

The nature of this asset class requires fund managers to have the ability to operate with a high degree of autonomy from their investors.

There are some sound arguments for why liquidity may not necessarily affect fund autonomy the way one might assume. In fact, the current regulations for tokens, or the lack thereof, may allow firms to lessen some of the potential bureaucracies prescribed in traditional models. This may be entirely dependant on the structural issuance of the token, and to what extent it would be backed by equity in the portfolio companies.

Nevertheless, tokens and crypto markets are still a nascent field, and implementing this technology as a new VC model can prove risky in the face of a highly volatile market. Applying unconventional wisdom, however, is in the essence of venture capital itself.

The potential implications of tokenizing a VC fund, for better or worse, will warrant close attention from all stakeholders in 2018.

What are the benefits and drawbacks of a tokenized fund? was originally published in Hacker Noon on Medium, where people are continuing the conversation by highlighting and responding to this story.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.