Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

Banksea Finance — The world’s first NFT pool-based lending platform

Authored by Derrick Chen, Kou Jer Shun, Researchers at Huobi Research Institute

Abstract

This week, we focus on the following events: 1) Scaramucci’s SkyBridge planning new fund for Web3 and crypto; 2) AI-Based startup Optic raises US$11 million with plans to create a public API for Web3 developers and new tools for NFT creators and collectors; 3) Stablecoin firms face tough reserve and capital demands in US Bill; ___________________________________________________________________

Project Analysis: Banksea Finance is the world’s first NFT pool-based lending platform. We explore how Banksea Finance is revolutionizing the way we value NFTs using AI, removing any conscious biasness at play. We also examine their plans to ensure that their users, both borrowers and lenders, be protected, as well as partnerships with other projects.

1. Industry overview

I. Overall market trend

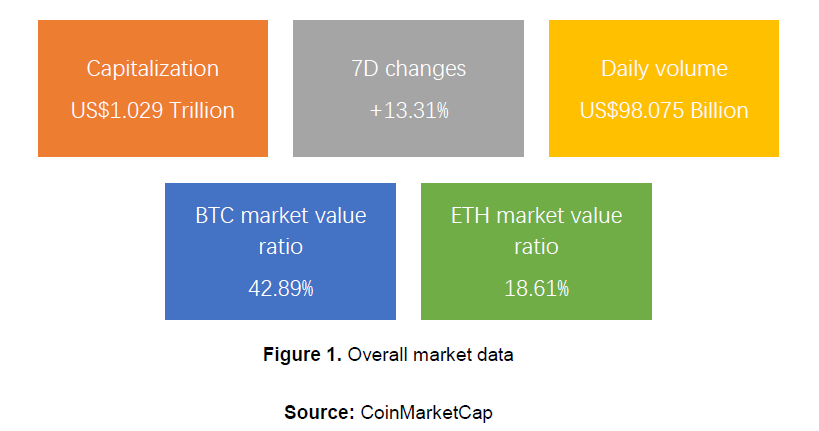

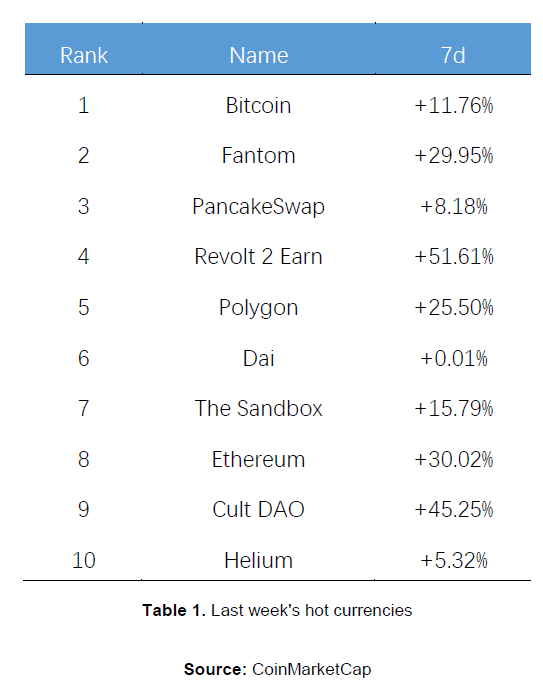

The global cryptocurrency market cap is back above the US$ 1 triliion mark and is currently stands at around US$41.029 trillion. Bitcoin, the world’s largest and most popular cryptocurrency, has declined to US$22,955 after rising above US$24,000 on 20 July for the first time in over a month. This slight rebound in BTC that we witnessed this week has decreased its total loss this year to about 50%. Meanwhile, Ethereum (ETC), the second largest cryptocurrency, has also risen with BTC and is currently trading at US$1,569. Dogecoin (DOGE) and Shiba Inu (SHIB) are currently trading at US$0.07 and US$0.00001209 respectively.

The increase in BTC price is in line with the stock market as investors begin to become more optimistic about the US Federal Reserve’s ability to rein in decades-high inflation. Although the sharp breakout this week is a positive sign, a sustained recovery will depend on strong performance from Wall Street. This recent rally is macro-driven and BTC’s correlation with NASDAQ is still at a historical high of 91%. However, some analysts predict that BTC could in fact hit US$120,000 in 2023 and even US$500,000 in the next 5 years. It does seem that opinions are still divided with regard to short-term expectations. Some are not convinced that the trend has turned and believe the current situation to be a bear market rally, while others expect the upward price movement to continue in the short-term.

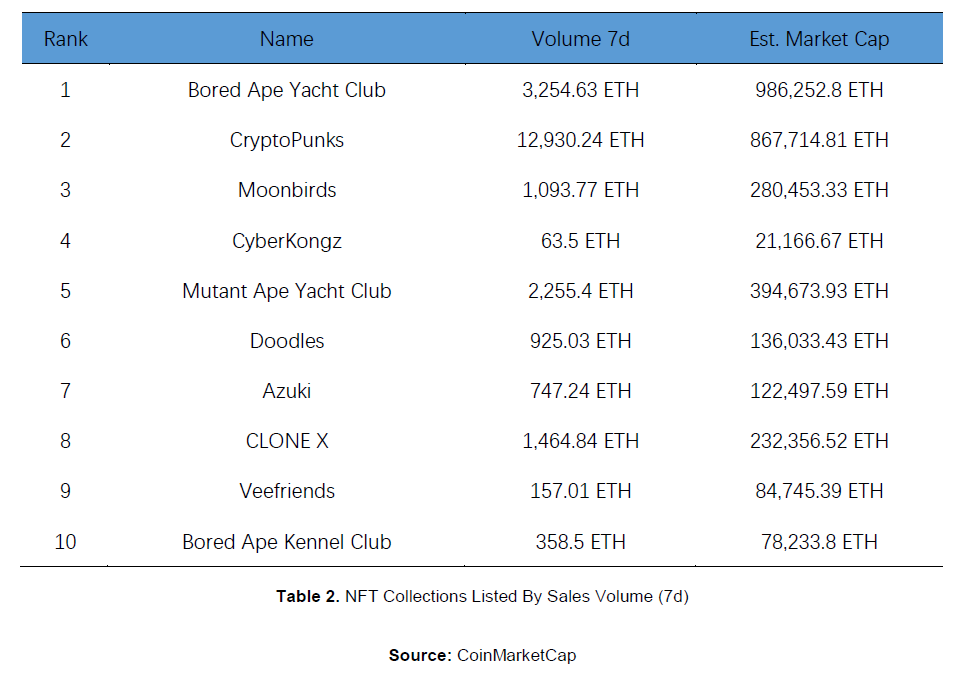

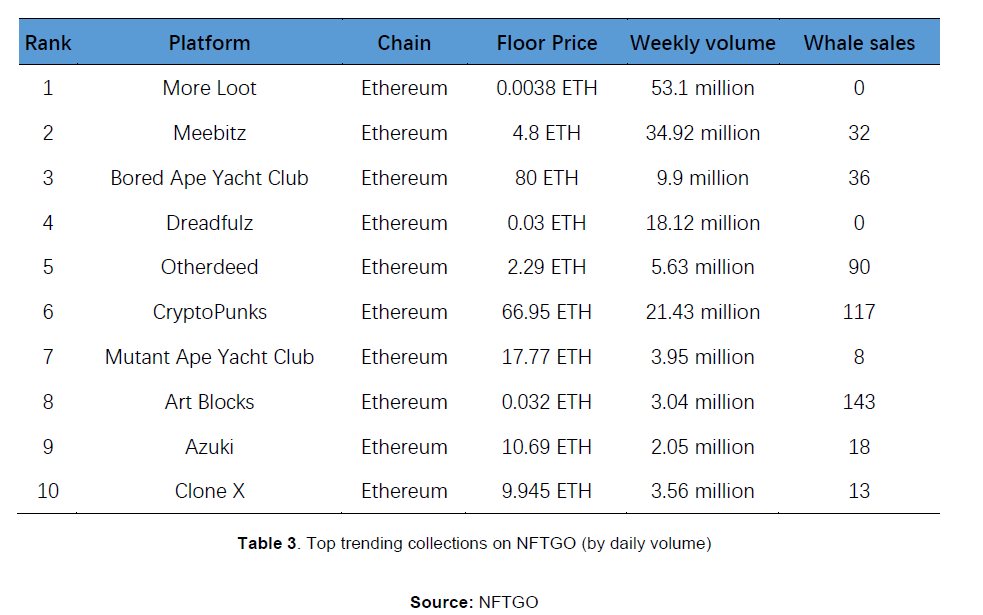

II.NFT

While NFTs were all the rage last year as artists, athletes, celebrities and big retailers used the relatively new and emerging technology to hawk digital versions of their wares. Data seems to suggest that the hype around NFTs is starting to fade. NFT sales have fallen 47% globally during the first three months of 2022 compared to the previous quarter, and a simple check on search volume of the term “NFT” on Google would tell you that the general public seems to be losing interest in NFTs. Some reasons for this slump could be due to the recent cryptocurrency crash as buyers use these cryptocurrencies to purchase NFTs as well as the vasts amounts of thefts and scams on major NFT marketplaces.

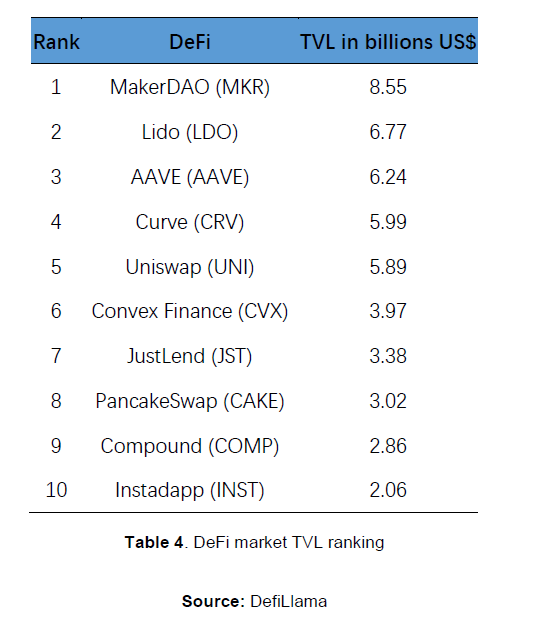

III.DeFi

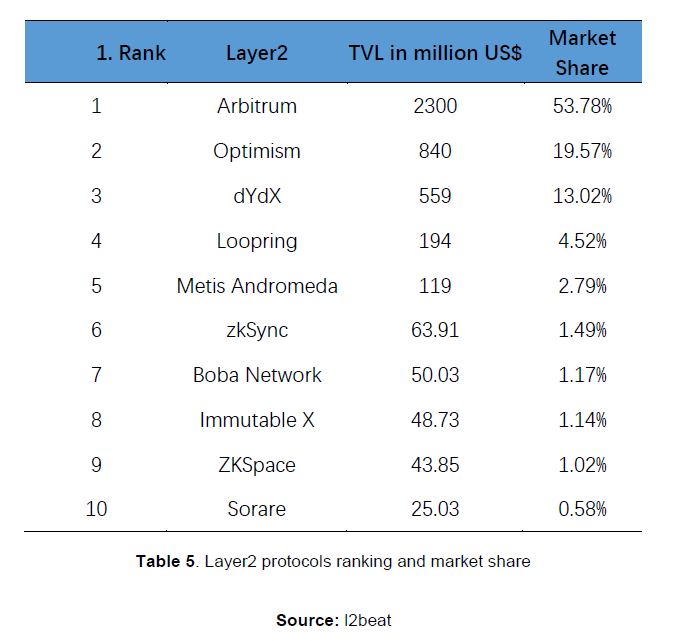

IV.Layer 2

2. Market news

I. Industry news

Scaramucci’s SkyBridge planning new fund for Web3 and crypto

SkyBridge as well as Scaramucci have historically focused on traditional hedge funds but are currently making a huge pivot into crypto alongside the sector’s massive bull run. Scaramucci will reportedly launch the venture and growth equity-style fund to invest in Web3 financial technology companies and late-stage crypto companies. An official announcement is likely to come on September 12 at SkyBridge’s annual Salt conference.

Tesla sold US$936 million worth of Bitcoin in the second quarter

BTC fell roughly 1.7% after the news about Tesla selling its holdings was released but has receovered quickly after Elon Musk mentioned that Tesla is open to boosting its Bitcoin exposure in the future and that this action should not be taken to be a verdict on Bitcoin. He also mentioned that the decision to sell 75% of its Bitcoin holdings was made to maximize Tesla’s cash position. Overall for the second quarter, Tesla reported adjusted earnings per share of US$2.27, beating the consensus of analyst estimates reported to FactSet of US$1.81 a share, on revenue of US$16.9 billion, ahead of a US$16.5 billion estimate.

Prosecutors raid seven Korean exchanges and eight other addresses in connection with the Terraform Labs fraud investigation

According to Yonhap News Agency, sven cryptocurrency exchanges in South Korea have been raided by prosecutors probing a fraud case in connection with the collapse of algorithmic stablecoin TerraUSD(UST) and LUNA. Bithumb, Upbit and Coinone are some the exchanges that have been raided. Investigators seized materials from the raids with the goal of ascertaining whether Terraform Labs founder Do Kwon intentionally caused the collapse of UST and LUNA. In May, Korean police froze Terraform Labs’ assets to prevent the company from embezzeling funds that might possibly be fraudulent.

II. Investment and Financing

AI-Based startup Optic raises US$11 million with plans to create a public API for Web3 developers and new tools for NFT creators and collectors

Optic, a startup that uses artificial intelligence (AI) to authenticate non-fungible tokens (NFTs), unveiled its business on Wednesday and raised US$11 million in a seed round led by Kleiner Perkins and crypto-native investment giant Pantera Capital. The funds will be used to build out the cost-intensive infrastructure and hiring engineering talent. Optic looks for visual similarities, including flipped images, color changes or slight distortions or fuzziness. The monitoring tool informs marketplaces, brands or media companies about potential intellectual property violations and is currently being used by OpenSea.

Dragonfly Capital leads US$13M round for DeFi infrastructure startup XLD Finance

XLD finance offers cross-border DeFi tools for emerging markets and has raised US$13 million in a pre-Series A funding round led by Dragonfly Capital and Infinity Ventures Crypto. XLD Finance was founded in June 2021 and serves customers in the Phillipines, Indonesia, Malaysia, Vietnam, India and Bangladesh. They offer APIs to help Web3 and crypto projecrs include crypto-based payments, disbursements and crypto-to-fiat onramps. They have plans to launch a payment disbursement platform OmniX, a crypto settlement API for merchants, an algorithmic stablecoin and a software development kit (SDK) for cryptocurrency wallets.

Investment firm Valkyrie branches into Venture Capital with focus on Israeli crypto startups

Crypto investment firm Valkyrie is moving into venture capital with a planned US$30 million fund that will bet heavily on early-stage startups in Israel. Lluis Pedragosa, a veteran of Israel’s VC scene, has been hired to lead Valkyrie’s ventures. Pedragosa has stated that despite the country’s surging tech entrepreneur landscape, many have avoided crypto due to the bad taste left by the ICO scams of 2017/2018. However, that has changed in the past 12–18 months and more entrepreneurs are jumping on the blockchain bandwagon. Valkyrie has already invested in a Web3 team called “Bunches” that is building a messaging platform for wallets. Pedragosa said Valkyrie is looking for companies with mass-market potential with projects that help crypto ventures scale into the billions of users. That was his thesis when he embarked on the VC effort with Valkyrie and “the thesis is the same” today, he said.

III. Supervision

Stablecoin firms face tough reserve and capital demands in US Bill

According to a person familiar with the topic, stablecoin issuers may be facing banking-like regulations in the near future and will have to back their tokens with conservative assets under the latest plan for U.S. legislation which is still being negotiated by the leaders of the House Financial Services Committee. The offices of Chairwoman Maxine Waters (D-Calif.) and the panel’s ranking Republican, Patrick McHenry (R-N.C.), have preliminarily agreed that stablecoins should be directly reinforced with assets such as cash and U.S. Treasury bonds that will not be vulnerable during uncertainty.

UK markets Bill extends banking rules to cryptocurrencies

According to a copy of the digital assets legislation published online by the UK Treasury, existing rules for banking and payment systems will be modified and extended to cover digital assets. These rules will largely impact stablecoins and other digital assets that are used for payments or settlements. The regulation also follows a promise from the UK government to turn the nation into a crypto hub before a series of cabinet resignations threatened to put regulatory plans on hold. The Treasury could target a DSA service provider for regulatory action within the UK. using what it called a “recognition order” if the services provided (or disruptions in providing services) are likely to threaten financial stability or have “serious consequences for business or other interests” throughout the country.

SEC’s Chair, Gary Gensler sees plenty of non-compliance across the crypto industry

Gary Gensler mentioned on Bloomberg TV’s “Balance of Power” that the broader cryptocurrency industry contains ‘a lot of noncompliance’ and the US SEC is continuing to develop its regulatory framework. He also mentioned that the SEC is going to do what they can but there are too many platforms that have not properly complied with the law and registered accordingly. There are many crypto tokens out there that have attributes of being promotional while raising money from the public and therefore, the SEC will continue to bring robust enforcement actions, Gensler said.

3. Trending project analysis — Banksea.Finance

What is Banksea Finance?

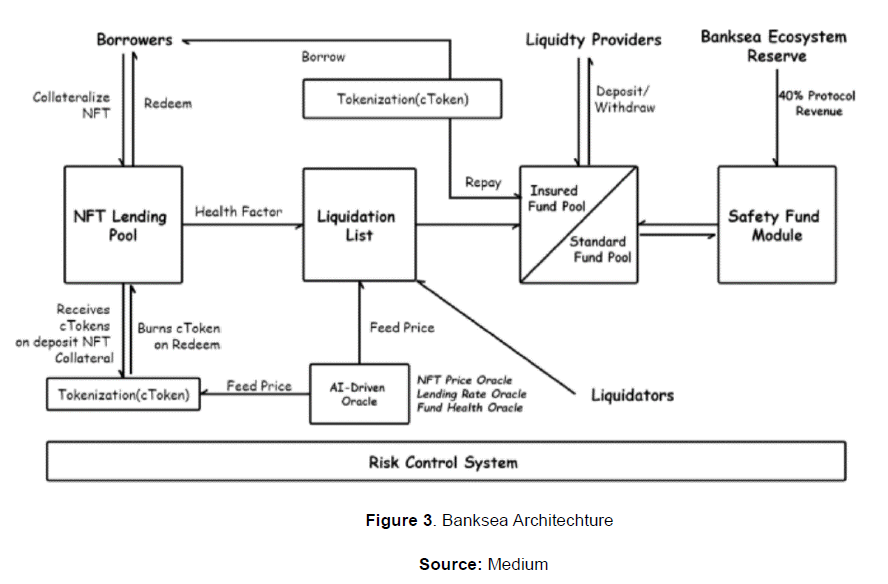

Banksea Finance is commited to building the first NFT AI Oracle protocol and NFT pool-based lending platform. Their aim is to solve many problems that are currently occurring in the NFT market such as the lack of NFT valuation mechanisms, low asset utilization ratio of NFT holders and the lack of guarantee for the safety of lenders’ funds. Banksea Finance is tackling these issues by developing an NFT Valuation mechanism using AI technology thereby providing an NFT pool-based lending solution.

NFT AI Oracle

Banksea NFT Oracle is a decentralized blockchain infrastructure that integrates NFT data analysis, NFT valuation, and NFT comprehensive risk evaluation, providing users and partners with secure, objective, and real-time NFT evaluation. Banksea NFT Oracle will be deployed on Solana, Ethereum, Moonbeam and other ecosystems. Banksea NFT Oracle has three main features — Safety, Objectivity and Real-time.

Safety: It collects large amounts of multi-dimensional data, preventing the risk of a single factor and applies a value aggregation algorithm on-chain to avoud false valuation of nodes.

Objectivity: The AI algorithm directly generates the NFT valuation that guarantees the fairness, openness, and objectivity of the valuation without being affected by subjective consciousness.

Real-time: Banksea NFT Oracle supports minute-level valuation. When the price of NFTs fluctuates significantly, Banksea NFT Oracle can still conduct the NFT valuation instantly in order for users to make informed investment decisions and strategies.

How are they different from other traditional P2P lending models?

Banksea Finance is differentiating itself by creating a brand new NFT-pool based lending model where lenders can put their assets into the fund pool and obtain the corresponding yield while borrowers collateralize their NFT; the platform then evaluates its mortgage rate and interest rate to complete the transaction. During the whole process, NFT valuation will be provided by the AI Oracle.

Banksea adopts a safe, convenient, and reliable lending model to increase NFT liquidity and improve capital utilization. This will undoubtedly greatly improve the integrated development of DeFi + NFT and bring about positive changes to the whole NFT lending market.

How does Banksea Finance protect its users?

Banksea has taken into consideration the risks that both borrowers and lenders will have to bear. It adopts a multi-AI algorithm to build risk control models before, during and after loans to fully guarantee the security of the platform’s funds. Its NFT AI Oracle also will also provide users with price, risk value, and other data in real-time.

To deal with possible bad debts, it has also established an efficient liquidation mechanism. Part of the collateral is sold below market price in way of pre-payment and pre-liquidation and discount auctions. This way, the borrowers can receive principal and interest that are supposed to return to the fund pool, ensuring the fund pool continues to operate in a healthy functional manner.

It has also established a safe fund pool to deal with shortfall events and alleviate the pressure of fund shortage. 40% of the interest rate fees will be deposited into the Safety Fund Pool and used to pay back the bad debt and maintain liquidity in the protocol in the event of a shortfall. In the event where the Safety Fund Pool is exhausted, the backstop module will kick in to sell KSE reserves and pay back the loan. The more quickly the Safety Fund Pool exhausts, the more quickly the backstop module will prepare to activate. A backstop module contains assets pre-deposited that have a priority position in the case of a shortfall event occurrence.

Recent Banksea Finance news and updates

On July 20, Banksea Finance released the Banksea API that enables NFT data analysis and NFT AI Valuation for NFT collections on the Moonriver/Moonbean ecosystem. The API includes top collections on Moonriver/Moonbean such as Exiled Racers-Pilots, Damned Pirates Society, BEANS NFT, Exiled Racers Racecraft, DSP Flagship, GLMR APES, MOONPETS, Neon Crisis V2, etc. It provides the basic information, floor price, transaction data, social media data, multi-dimensional analysis and AI valuation of NFT collections and individual NFTs.

Banksea Finance has also collaborated with Palmare, a move to earn app that aims to redefine the fitness industry. This collaboration is in its early stages but will eventually have huge impact in the SocialFi and SportFi scenes. Palmare will upgrade its platform to have a bridge with the Solana system. Banksea has partnerships with many other projects such as Zebec Protocol, Polychainmoon and Droid Capital.

Banksea is also releasing its very own genesis collection called NFT CitizenOne. Members can participate in the project and community governance, and holders can also enjoy certain privileges including whitelists in IDOs, collaterals for loans, staking for mining $KSE, token airdrops, copyright loyalty and more privileges in the coming days. It has recently completed its first phase of staking and has seen some 770 NFTs staked.

4. Calendar of future popular asset events

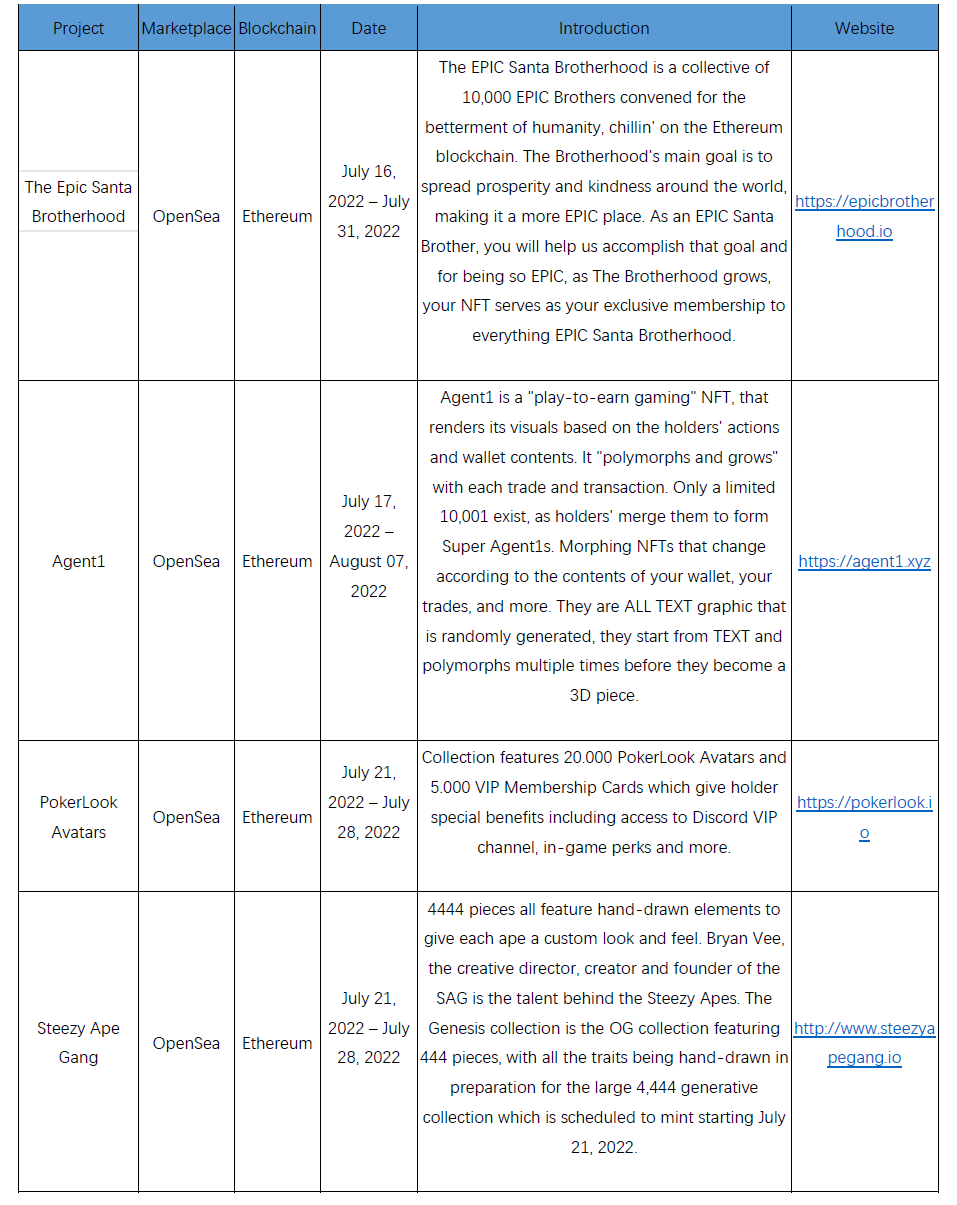

I. NTF mint Calendar

II. Token Airdrops

About Huobi Research Institute

Huobi Blockchain Application Research Institute (referred to as “Huobi Research Institute”) was established in April 2016. Since March 2018, it has been committed to comprehensively expanding the research and exploration of various fields of blockchain. As the research object, the research goal is to accelerate the research and development of blockchain technology, promote the application of blockchain industry, and promote the ecological optimization of the blockchain industry. The main research content includes industry trends, technology paths, application innovations in the blockchain field, Model exploration, etc. Based on the principles of public welfare, rigor and innovation, Huobi Research Institute will carry out extensive and in-depth cooperation with governments, enterprises, universities and other institutions through various forms to build a research platform covering the complete industrial chain of the blockchain. Industry professionals provide a solid theoretical basis and trend judgments to promote the healthy and sustainable development of the entire blockchain industry.

Official website:

Consulting email:

research@huobi.com

Twitter: @Huobi_Research

https://twitter.com/Huobi_Research

Medium: Huobi Research

https://medium.com/huobi-research

Disclaimer

1. The author of this report and his organization do not have any relationship that affects the objectivity, independence, and fairness of the report with other third parties involved in this report.

2. The information and data cited in this report are from compliance channels. The sources of the information and data are considered reliable by the author, and necessary verifications have been made for their authenticity, accuracy and completeness, but the author makes no guarantee for their authenticity, accuracy or completeness.

3. The content of the report is for reference only, and the facts and opinions in the report do not constitute business, investment and other related recommendations. The author does not assume any responsibility for the losses caused by the use of the contents of this report, unless clearly stipulated by laws and regulations. Readers should not only make business and investment decisions based on this report, nor should they lose their ability to make independent judgments based on this report.

4. The information, opinions and inferences contained in this report only reflect the judgments of the researchers on the date of finalizing this report. In the future, based on industry changes and data and information updates, there is the possibility of updates of opinions and judgments.

5. The copyright of this report is only owned by Huobi Blockchain Research Institute. If you need to quote the content of this report, please indicate the source. If you need a large amount of reference, please inform in advance (see “About Huobi Blockchain Research Institute” for contact information) and use it within the allowed scope. Under no circumstances shall this report be quoted, deleted or modified contrary to the original intent.

Banksea Finance — The world’s first NFT pool-based lending platform was originally published in Huobi Research on Medium, where people are continuing the conversation by highlighting and responding to this story.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.