Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

As SEC breaks the silence about its outlook on Initial Coin Offerings (token sales), understanding of a token role in blockchain projects is more relevant than ever.

As SEC breaks the silence about its outlook on Initial Coin Offerings (token sales), understanding of a token role in blockchain projects is more relevant than ever.

Not all tokens are born equal. Tokens backed by chicken and geese are different from tokens issued by a VC fund investing in blockchain startups or tokens compensating participants for a network maintenance. The ability of tokens to be a tool for non-dilutive fundraising is making the headlines. Attract millions of dollars without giving away any equity with a 30 page text document and a few lines of code — who does not want that? However, it is the token’s functional (utility) role in a project’s ecosystem that largely determines the viability of that project as a decentralized distributed entity.

This dual role (fundraising and utility) of a token causes a weird twist in relationships between the token holders. As Marcin Rudolf described it well in his article, the “investors” in tokens wish for the token price to go up, while the network users wish for it to stay stable. The former simply want to get some capital gains, while the latter need a token to transact on the platform. They would prefer it to cost the same today as it did yesterday.

Entangled nature of token economics may lead to contradicting interests of token holders

Entangled nature of token economics may lead to contradicting interests of token holders

Now the utility function of a token can take two different faces. Some tokens are spendable. A token holder would use them in a specific transaction (think of it as a movie ticket) or over the course of time (like a gym membership fee). Other tokens are like an access card. Simply holding a token entitles a holder to certain rights. It may or may not require depositing, or locking in, of a token. In the latter case, the amount of token you lock in would determine the amount of rights you will get an access to. And when you are done, you get your tokens back.

As mentioned before, tokens incentivize the participants of the project’s ecosystem to transact so that the ecosystem evolves and does not need a centralized authority. In order for the tokens to do that, they need to power the processes integral to what a platform does. In his article Tokenomics — A Business Guide to Token Usage, Utility and Value, William Mougayar laid out the roles, purposes and functions of tokens in blockchain projects.

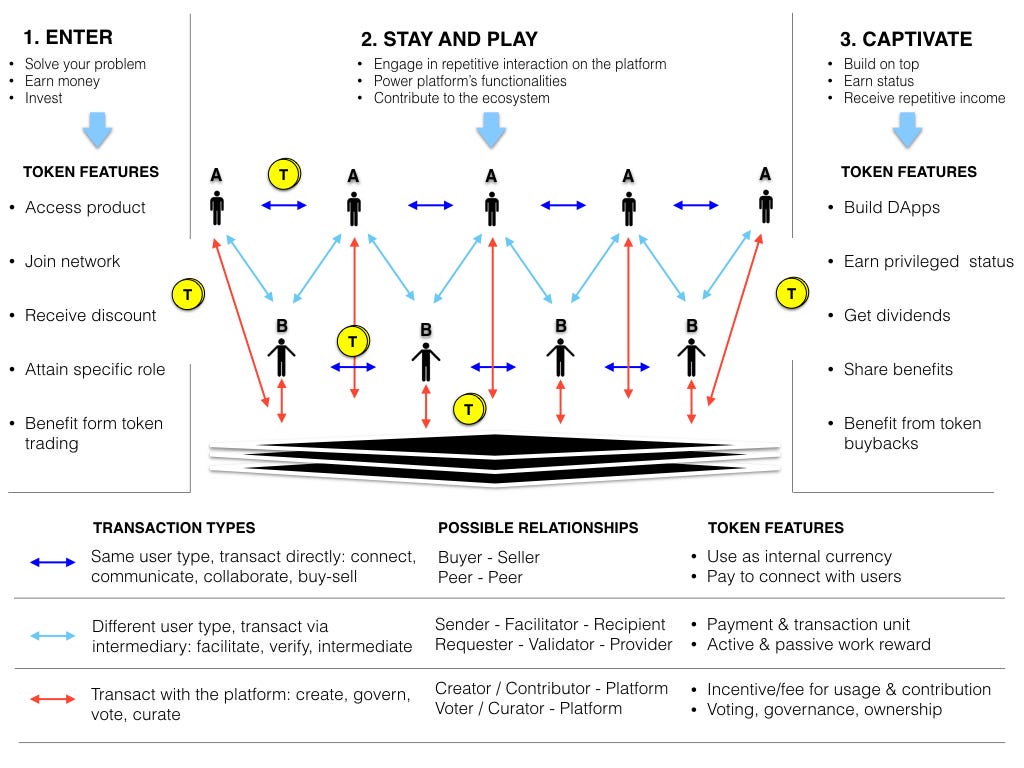

These functions generally fall within three incentive groups, important to a blockchain project: 1) incentives to enter the platform (Enter); 2) incentives to use the platform (Stay and Play); 3) incentives to stay long-term (Captivate).

As an incentive to Enter the platform, tokens may grant the right to access a product or a network, to attain a specific role, or to get in a position to benefit from token trading.

Incentives to Stay and Play on the platform may include various fees for transacting with other users or with the platform itself.

Incentives that Captivate users for a long-term may involve giving users the rights to influence the platform’s evolution, to earn a valuable status, or to benefit from the distribution of the value created by the platform.

Variety of token rights are based on the type of incentive they provide in a blockchain project

Variety of token rights are based on the type of incentive they provide in a blockchain project

Tokens usually carry a combination of rights. But for them to be relevant in the first place, these tokens need to be in hands of users who will actually utilize these rights. As the results of many ICOs showed, however, a big portion of tokens ends up in hands of large purchasers, mainly interested in capital gains. Moreover, for an organization to truly live up to the decentralized nature, it needs not thousands or even hundreds of thousands of token holders, but millions. No token sale has yet achieved that (feel free to correct if you know of one!). Can the secondary market be a good mechanism to provide a true distribution of tokens among a sufficient number of users that would lead to the network effect? This is a whole different story.

But for now, the points to remember:

- Though fascinating as a new fundraising instrument, tokens need to carry utility rights integral to the platform they power, first and foremost.

- Duality of the token role (fundraising and utility) may lead to misalignment of interests of token holders.

- In their utility role, tokens can be spendable in transactions or over time or represent entitlement to rights from a simple fact of holding a token.

- In general, as an incentive mechanism, token need to compel a user to enter the platform, to use the platform, and to stay there long-term.

- Despite the variety of token rights, to be relevant, tokens need to be in hands of people who are interested in such rights.

And finally, the number of live projects powered by tokens is still small (does anyone know of a good source for the stat, aside from here: https://dapps.ethercasts.com/?). For better or worse, the reality often plays itself out differently than the theory. What happens when things get real, we are yet to see!

Follow this blog for more blockchain project overviews, analyses, and observations. We explain complex blockchain stuff in simple language.

What are you token about? Blockchain token economics and rights. was originally published in Hacker Noon on Medium, where people are continuing the conversation by highlighting and responding to this story.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.