Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

We explore Aave’s newly proposed stablecoin GHO, how it works and the impact it would have on DeFi and other stablecoins.

On July 7, the Aave team submitted an Aave Request for Comment (ARC) that proposes to develop a new stablecoin called GHO. The ARC was generally well received in social media and by developers from other protocols. However, we have recently seen several deployments or proposals to create new stablecoins, such as the new money market Interest Protocol. This prompts the question of what will be the outcome if Aave, one of the top 10 protocols by Total Value Locked (TVL) in crypto, moves forward on developing GHO.

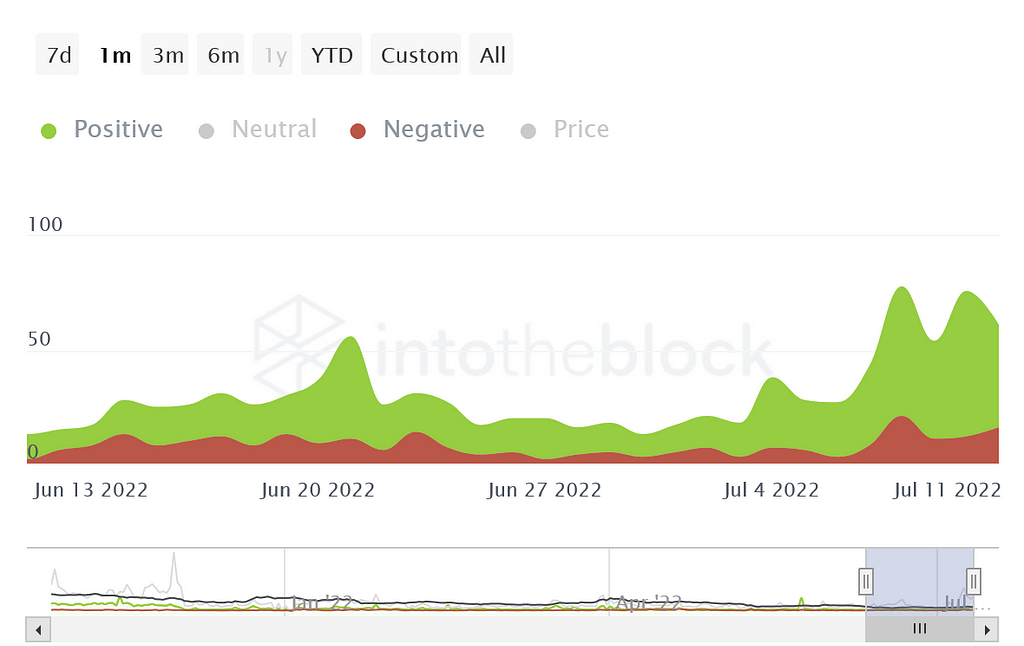

Twitter sentiment from our Analytics App on Aave spiked after the GHO proposal

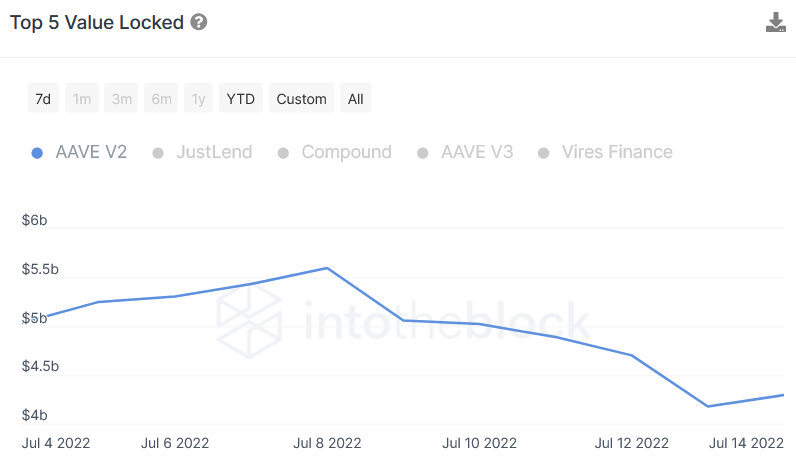

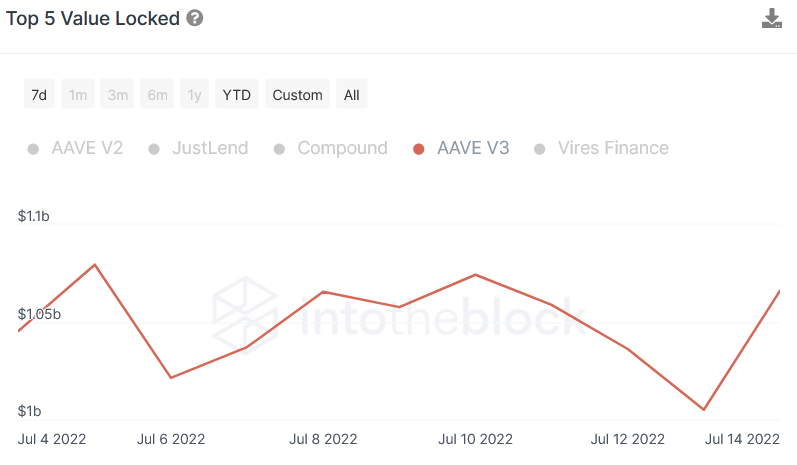

As one of the largest lending protocols in the crypto space, it is rational to see why Aave would want to develop a stablecoin. It has over $5 billion in TVL combined in its V2 and V3 platforms across 7 chains that is ready to be utilized to mint a new stable. Furthermore, with the success of other collateralized debt position (CDP) models such as MakerDAO/DAI and the hole left by the collapse UST, it could be the right time for a battle-tested protocol to inject liquidity into the stablecoin market.

Total Value Locked (TVL) in Aave v2 and v3

GHO’s Design and Innovations

The core design of GHO will be similar to other CDP models. Users will supply collateral and then be able to mint GHO up to a certain ratio depending on the collateral supplied. If the user then gets liquidated or decides to repay their borrowed position, the GHO is subsequently burned. Interest payments generated by the minting of GHO goes directly to the AaveDAO treasury.

With regards to maintaining the GHO’s peg to USD, if GHO goes over the peg, collateral suppliers can arbitrage the peg back to 1:1 by minting more GHO and selling it on the market. In a depeg to the downside scenario, it is profitable for GHO holders to pay back their debts, thus burning GHO and reducing the supply to drive the price back up to peg. Additionally, GHO is overcollateralized by the assets supplied when minted which helps provide stability in the case of increased volatility in the market.

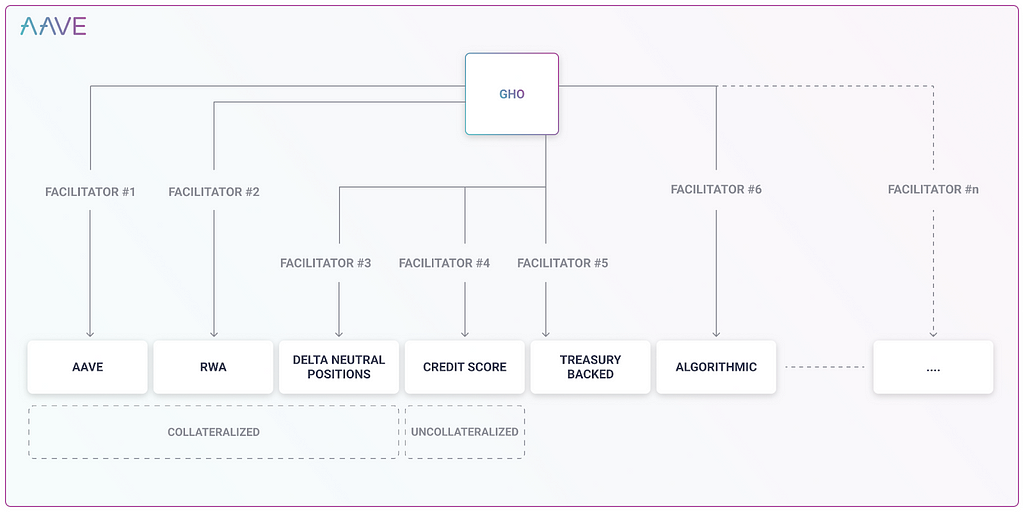

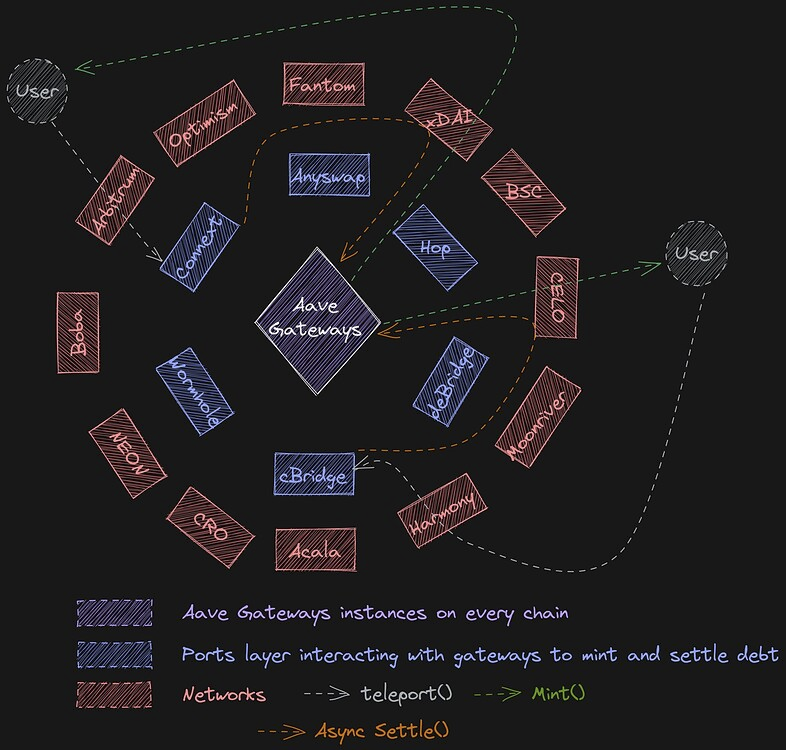

Aave’s design does however differ from other CDP models through its more innovative components. The main differentiation in the GHO model is the introduction of facilitators. Each facilitator that is approved through Aave Governance operates a bucket where they can trustlessly generate and burn GHO tokens. Any protocol, Dapp, or other autonomous entity can become a facilitator and is able to apply different strategies to generate GHO (examples of strategies in the image below). This design opens up endless possibilities on how GHO can be utilized across DeFi. Examples of implementation could be options protocols stables as a hedge or a protocol like Balancer using a facilitator bucket to mint GHO that would be used to bootstrap liquidity for a new token.

Source: Aave team’s ARC proposal

Aave has also designed the GHO model to be enhanced by some of the innovations implemented on Aave V3. Users can maximize the use of their collateral by enabling E-mode and isolation mode. Additionally, if approved by governance, GHO can be deployed across chains through Aave’s Portal messaging system. Portals allows users to instantly (time it takes to confirm tx) “teleport” funds from one chain to another by allowing temporarily unbacked assets to be minted on the destination chain. In the background, whitelisted entities perform batch transactions of multiple users teleports to back the previously unbacked assets on the chain.

Source: Aave’s ARC on Portals

GHO compared to other stablecoins

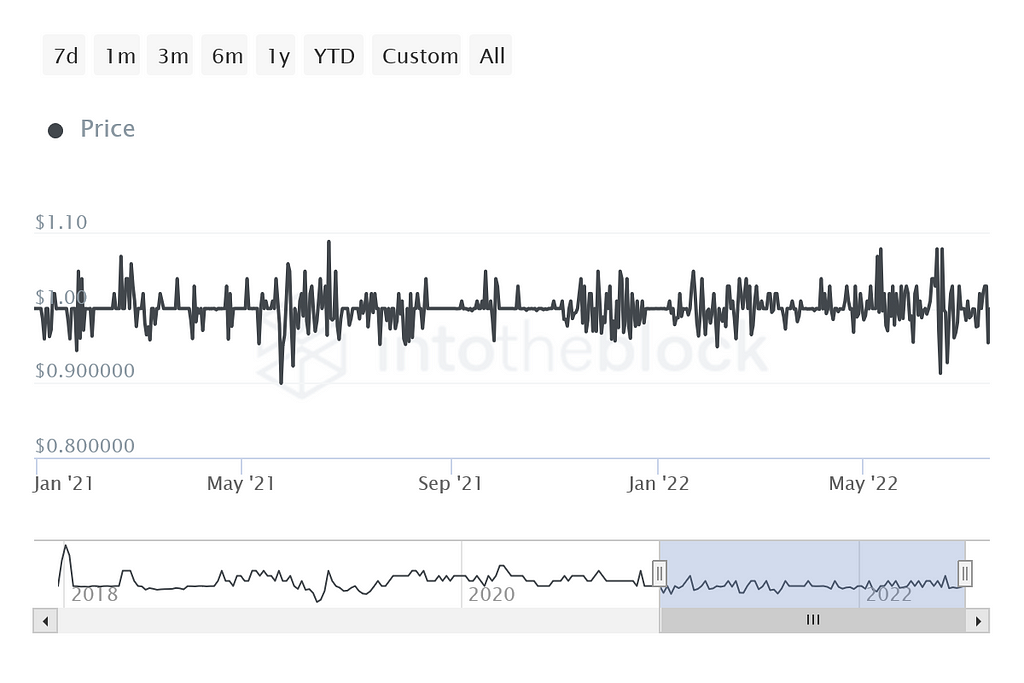

Aave’s GHO token is following the current trend towards CDP style decentralized stablecoins over algorithmic stablecoins. New CDP stables have been popping up on multiple chains such as MAI (multichain), Interest Protocol (Ethereum), aUSD (Dotsama), and IST (coming to Cosmos ecosystem). The current consensus appears to be that CDP stablecoins have a strong ability to maintain their peg. This is demonstrated by DAI’s ability to quickly revert toits peg (seen below) even during moments of capitulation like May and November last year.

Source: ITB DAI price analytics

The question is: how will GHO compare to other established CDP stables on ethereum such as MakerDAO’s DAI and Abracadabra’s MIM tokens? In the case of MakerDao, the main item that differentiates the two is that MakerDAO as of right now, it can only be minted on Ethereum, while Aave is already well established on three chains with the possibility to expand. This gives Aave access to a larger pool of liquidity. The facilitator role will also distinguish Aave’s design from MakerDao. Letting facilitators manage the minting and burning process of GHO with strategies that they are specialized in, will improve liquidity efficiency.

Compared to Abracadabra, a key difference between the two protocols is the way they incentivize their native token holders (SPELL and AAVE). Stakers of SPELL receive part of the fees generated by the protocol and can either have these fees issued in more SPELL (for sSPELL stakers) or in MIM for (mSPELL) stakers. For Abracadabra, mSPELL staking creates a potential leak in the protocol because the MIM being paid will not necessarily be reinvested in the protocol.

For Aave, stkAAVE holders are incentivized by receiving a lower borrow rate on GHO. This helps strengthen the protocol by encouraging more AAVE to be bought and staked in the safety module. Aave has provided a borrowing interest rate tool to demonstrate how it could work. This creates a positive feedback loop. Lower borrowing rates mean more GHO lent out producing larger revenues. This in turn will increase demand for stkAAVE, increasing the protocol’s security. Subsequently, users that increase their stkAAVE positions will continue to decrease their borrow rates, making it attractive to borrow more GHO.

GHO’s Potential Impact Moving Forward

With the introduction of GHO, Aave is clearly stating its goal is to grow and expand the services offered in its application. More importantly, with the facilitator design, it is signaling its desire to grow by integrating other applications and protocols into its own application. When different applications and entities become facilitators in the GHO minting model, they are users of GHO and their users potentially are also using GHO, thus generating more revenues and capturing a larger share of existing liquidity as collateral to mint GHO for Aave.

Of course, it is not only Aave that will benefit from this system. Since the facilitators will design their own strategies, they will be able to mint GHO with the approach that suits them the most. Becoming a facilitator gives entities access to what would most likely become a trusted stablecoin. This can help them increase liquidity and stability to the TVL in their application. Outside of crypto, the facilitator role can potentially provide an entry point for non-crypto native companies to integrate into the blockchain. An example of this could be a facilitator creating a strategy that uses GHO as an on-ramp and off-ramp into real world assets.

A Point for the Fat Application Thesis

Aave makes a strong case for validating the fat application thesis. The fat protocol thesis argues that in crypto the base layer technology (like the ethereum blockchain) will capture a larger amount of the total created value compared to the applications built on top of the protocol layer. The fat application thesis on the other hand, maintains the status quo of how value is generally distributed in web2 (Google has is valued high while HTTP much less).

GHO has the potential to generate large amounts of additional revenue for Aave. Crypto users are hungry for additional decentralized CDP stables and with Aave being a trusted name in the space, adoption of GHO could happen rapidly. Aave has already successfully deployed across 7 L1s and L2s and with the potential implementation of their Portal messaging system, they could deploy across more chains with liquidity easily moving between. How the Portal system is designed, users won’t have to leave Aave’s app to move their assets between chains, which can help keep liquidity from exiting the protocol. Above all else, the facilitator proposition makes other apps users of the Aave system. An app that has other apps as active users is a strong indicator of the fat application thesis being confirmed.

Possible Drawbacks of Design

GHO will most likely be a net positive for stables and the entire crypto ecosystem. It could easily gain traction and other stablecoins by becoming another strong stable to be added to new and existing stable pools. However, there is a chance it might have a negative impact on smaller CDP style stablecoins or those who don’t get a role as a facilitator. Examples such as MIM or MAI whose competitive advantage against MakerDAO/DAI is that they use collateral to mint on multiple chains. Aave’s design and security could lure large amounts of liquidity away from protocols such as these, subsequently reducing their supply. This could potentially cause consolidation among decentralized stables to one or two tokens (e.g. DAI, GHO). The debate on if stablecoin consolidation would result in a positive or negative outcome for crypto is still ongoing, but if GHO does move forward, it will be something for token holders and collateral suppliers of other protocols to watch closely.

Final Thoughts

The GHO ARC proposed by the Aave team, is one of the biggest proposed changes to the Aave recently. The token’s design appears to be sound and if mass adoption of GHO occurs, adding a stablecoin to their ecosystem should be profitable. The crash of UST opened up a lot of room for new entrants into the decentralized stablecoin market and Aave is looking to capitalize on this. As our sentiment metrics shown above indicate, the community’s sentiment for an Aave created stablecoin is positive. It is worth following the discussion on the GHO ARC to see how the conversation unfolds and to watch when it will move forward to a snapshot vote.

How Aave’s GHO Fits into the Stablecoin Landscape was originally published in IntoTheBlock on Medium, where people are continuing the conversation by highlighting and responding to this story.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.