Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

Inside crypto’s credit crisis

Based on IntoTheBlock’s weekly newsletter. If you enjoy it, and would like to receive it every Friday make sure to sign up here!

Yesterday we wrapped up one of the most chaotic quarters in crypto’s history. The bear market started to unravel as the macro environment continued to worsen, diminishing risk appetite across the board. However, the crash was exacerbated by factors endogenous to crypto, with the space experiencing its first large-scale credit crisis.

While a significant amount of the debt behind this crisis was settled through opaque centralized lenders, repercussions were felt on-chain throughout the crypto space. This week we analyze the causes of this credit crisis, how it has unwound and the effects it has had specifically on Bitcoin and Ethereum.

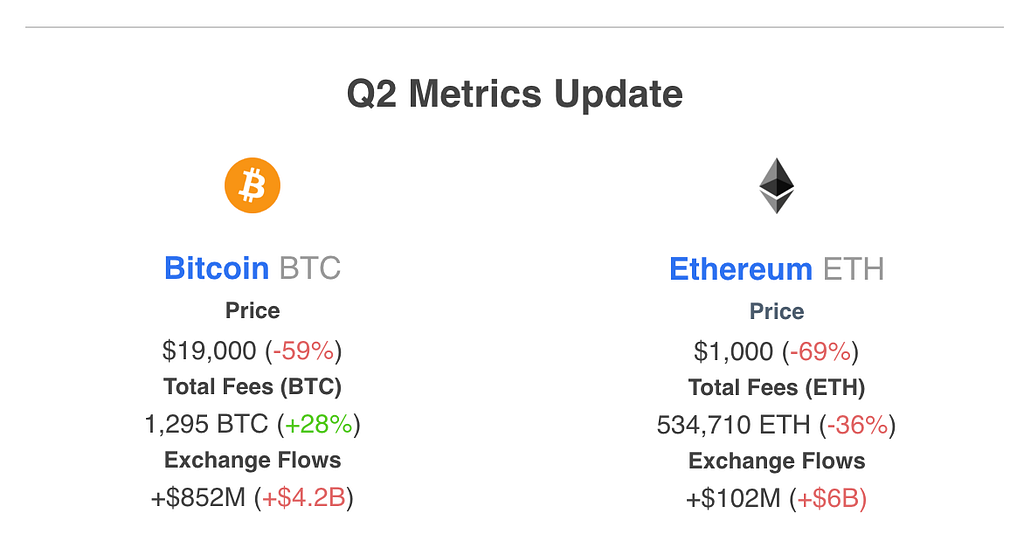

Fees — Sum of total fees spent to use a particular blockchain. This tracks the willingness to spend and demand to use Bitcoin or Ether.

- Bitcoin fees increased in Q2 driven by higher demand during volatile periods

- In spite of the volatility and brief periods of very high fees, Ethereum recorded roughly one third the amount it did last quarter as speculation in NFTs and tokens dwindled

Exchanges Netflows — The net amount of inflows minus outflows of a specific crypto-asset going in/out of centralized exchanges. Crypto going into exchanges may signal selling pressure, while withdrawals potentially point to accumulation.

- Throughout the course of Q2, a net amount of $852 million worth of Bitcoin was deposited into centralized exchanges, compared to a $3.3B outflow in Q1

- CEX’s ETH reserve increased by approximately $102 million in stark contrast to previous quarter’s $6.3 billion outflow

Q2: Crypto’s Credit Crisis

“Only when the tide goes out do you discover who’s been swimming naked” — Warren Buffett

Via IntoTheBlock’s Capital Markets Insights

Turns out too many people were swimming naked after all.

As prices started crashing, unsustainable practices became increasingly apparent. This started with Terra’s UST and its now-infamous 20% APY.

For over one year, Terra’s team subsidized remarkably high rates to depositors of the Anchor product through a “yield reserve” supplied by its Luna Foundation Guard (LFG). Both institutional and retail participants deposited capital into Anchor, which at one point amassed over $20 billion in total value locked (TVL).

How the Credit Crisis Began — competition for unsustainable returns

- Many centralized lenders such as Celsius offered depositors high yields on stablecoins in the 8–12% range, using part of those deposits to yield farm in DeFi chasing higher returns for them to profit from the spread

- While yields above this range were widely available during the bull market in 2021, they became scarce in 2022, causing lenders to pursue riskier options in order to compete with others still offering customers high rates

- This fuelled Terra and UST, leading lenders and funds such as Three Arrows Capital (3AC) to realize massive losses following their collapse

- UST’s backing of over $1 billion in Bitcoin led to further pressure as they became a forced seller

Via IntoTheBlock and Blockchair

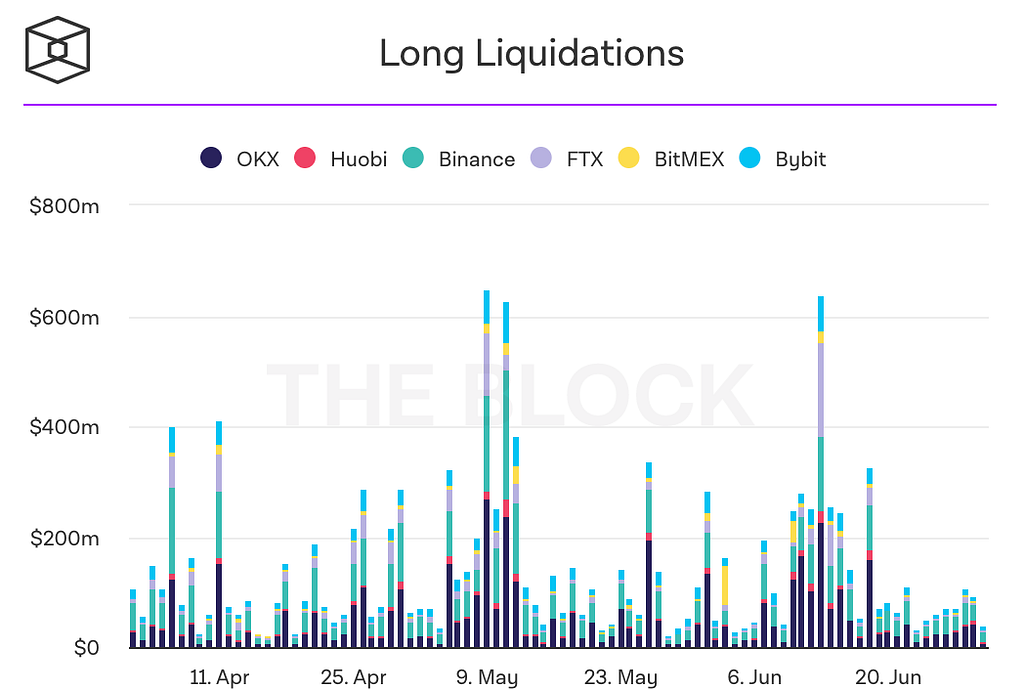

Forced Deleveraging — As stocks continued to crash, crypto followed but was hit harder due to high leverage in the system

- In a now deleted tweet 3AC’s CIO Su Zhu had suggested Michael Saylor to get yield on his Bitcoin by borrowing stablecoins and swapping them to UST for the 20% APY

- As UST imploded, 3ACs excessive leverage was exposed, as they were unable to repay loans to BlockFi, Genesis, Voyager and possibly others through the subsequent weeks

- The insolvencies of institutions like Celsius and 3AC, both which managed over $10 billion according to several sources, led to forced selling and broad-scale liquidations in their largest holdings, Bitcoin and Ethereum

Via The Block’s data dashboard

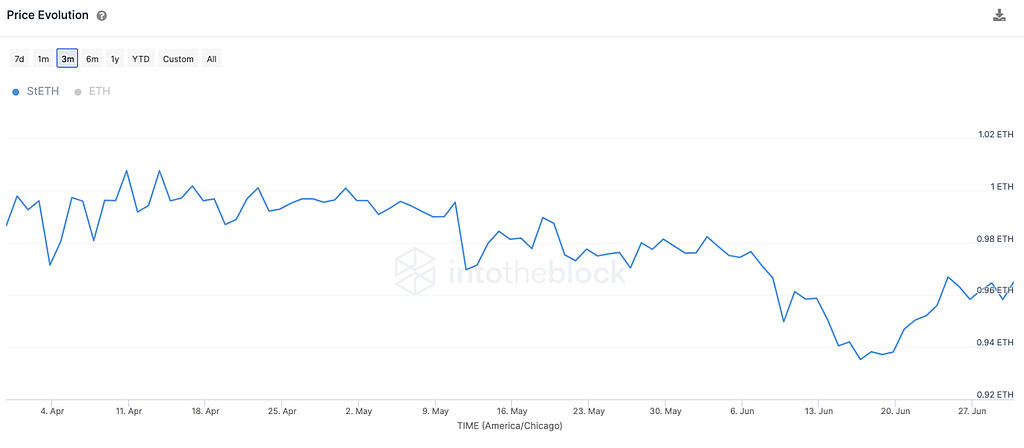

The stETH Debacle — Asides from UST, another of the most crowded trades institutions were doing propelled by leverage involved Lido’s staked Ether token (stETH). Billions worth of ETH were staked in return for stETH at a price of 1-to-1, which earns a passive 4%-5% yield.

This worked out well, until the market’s demand for liquidity grew sharply as the deleveraging took place. Then stETH’s price dropped to as low as 0.93 ETH as institutions were forced to sell in order to cover other positions.

Via IntoTheBlock’s DeFi Insights

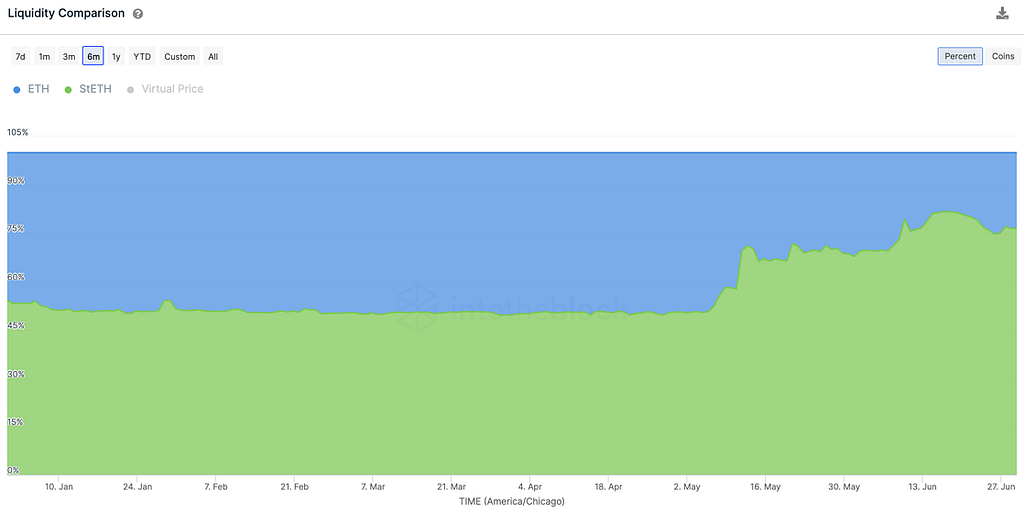

Negative Feedback Loop — deleveraging led to liquidity imbalance and further deleveraging

- Millions of ETH were borrowed against stETH collateral to get leveraged staking yields close to 10%

- As stETH’s price dropped, borrowers were forced to sell it for ETH to cover their collateral

- This further dropped the price and led liquidity providers in the Curve pool to withdraw their ETH to avoid too much exposure to stETH

- stETH’s liquidity dropped and the pool ended up with only 20% ETH (unlike it’s intended 50/5p split), making slippage from selling even worse

Via IntoTheBlock’s DeFi Insights

The stETH trade had gotten crowded and with leverage behind it, the situation quickly got worse. However, we might be starting to see light at the end of the tunnel as the merge approaches and the stETH price recovers.

The same cannot be said for Terra, Celsius or Three Arrows Capital, all which have low chances of survival. These institutions led by their risky practices thrived during the bull market, but were exposed as prices crashed and took down the rest of the crypto space with them. Ultimately, as an industry crypto ended up learning the same lessons from traditional finance from its first debt crisis.

While Q2 comes to a close on a grim note, there are still many aspects of crypto that showed resilience when they were needed the most. Next week we will cover the most relevant of these and key factors to watch out for in Q3.

Upcoming Webinar

Sign up for our next webinar. Limited amount of free seats available.

As crypto has evolved throughout the years, derivatives have become increasingly relevant, at times trading over $100 billion per day. So far most of this growth has come from centralized exchanges, but their decentralized counterparts also provide interesting opportunities.

In this webinar we go from the basics in derivatives to more practical examples of how you can use them. We evaluate potential strategies to hedge or increase returns through the use of derivatives. As well, we will provide some analysis on future opportunities as the derivatives market continues to expand.

Sign up here

Crypto’s Q2 On-Chain was originally published in IntoTheBlock on Medium, where people are continuing the conversation by highlighting and responding to this story.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.